Broadridge Financial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Broadridge Financial Bundle

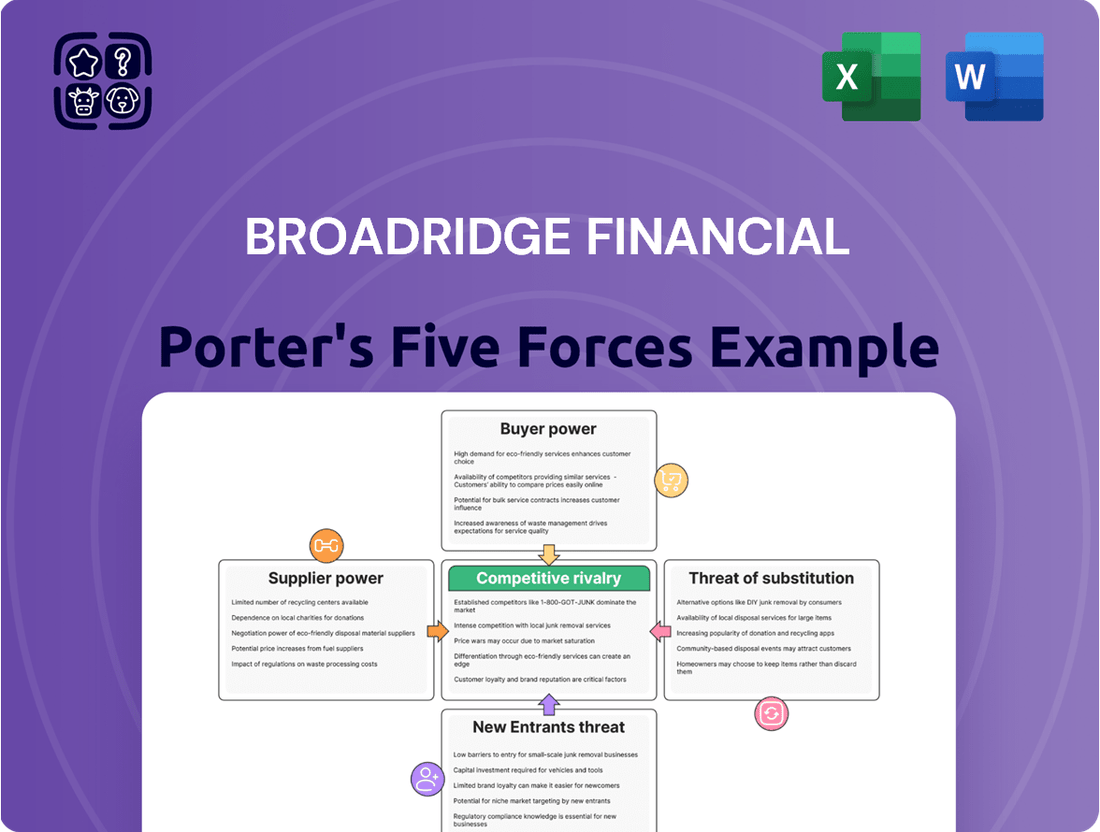

Understanding Broadridge Financial's competitive landscape through Porter's Five Forces reveals the intense rivalry, significant buyer power, and the constant threat of substitutes that shape its market. The influence of suppliers and the potential for new entrants also play crucial roles in its strategic positioning.

The complete report reveals the real forces shaping Broadridge Financial’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Broadridge's reliance on specialized technology and data providers grants these suppliers significant bargaining power. For instance, the financial data sector, crucial for Broadridge's market intelligence services, often features a few dominant players. In 2024, the global financial data market was valued at over $30 billion, with a concentrated landscape where key providers of real-time market data and analytics hold substantial sway.

The fintech sector, including companies like Broadridge, relies heavily on specialized skills. Think software engineers, cybersecurity gurus, and data scientists. Finding these top-notch professionals is tough, and many companies are vying for them. This scarcity means these skilled workers have a lot of say in their pay and conditions.

This situation can directly affect Broadridge. When demand for talent outstrips supply, wages tend to climb. Reports from 2024 indicate a persistent shortage in key tech roles, with some specialized IT positions seeing salary increases of 10-15% year-over-year. This increased labor cost can squeeze profit margins and slow down development.

Broadridge's reliance on a limited number of major cloud infrastructure providers, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform, grants these suppliers significant bargaining power. In 2024, the global cloud computing market was valued at approximately $600 billion, with these three providers holding a substantial majority of the market share, underscoring their dominance and ability to influence pricing and terms.

The high switching costs involved in migrating complex, data-intensive operations like those managed by Broadridge further solidify the suppliers' leverage. These costs can encompass not only the technical challenges of data transfer and system re-configuration but also potential downtime and the need for extensive retraining of personnel, making it difficult for Broadridge to easily change providers.

Regulatory and Compliance Software Vendors

Regulatory and compliance software vendors hold considerable bargaining power over Broadridge. The financial services sector is intensely regulated, making these specialized software solutions a necessity, not a luxury. Failure to comply with evolving financial laws can result in severe penalties, making the suppliers' expertise and certified products indispensable.

The high cost of non-compliance for Broadridge's clients, and by extension for Broadridge itself, significantly amplifies the suppliers' leverage. These vendors offer critical, often proprietary, solutions that are difficult to replicate or substitute. For instance, in 2024, the global regulatory technology market was valued at approximately $13.5 billion and is projected to grow substantially, underscoring the critical nature and demand for such specialized software.

- High Switching Costs: Integrating and validating new compliance software is time-consuming and expensive, creating high switching costs for Broadridge.

- Specialized Expertise: Vendors possess unique knowledge of complex and ever-changing financial regulations, a capability not easily found elsewhere.

- Mandatory Adoption: Regulatory requirements often mandate the use of specific types of software, giving vendors a captive audience.

- Limited Supplier Pool: The market for highly specialized and certified financial compliance software is often concentrated among a few key players.

Hardware and Network Equipment Providers

Broadridge's reliance on specialized, high-performance hardware and network equipment from a select group of vendors can lead to significant supplier bargaining power. The need for robust servers, advanced networking gear, and critical security devices to manage its vast data operations means that if only a few providers can meet these stringent requirements, their leverage increases. For instance, in 2024, the global market for data center hardware saw continued consolidation, with major players like Dell Technologies and Hewlett Packard Enterprise holding substantial market share, potentially limiting Broadridge's options for certain critical components.

Long-term contracts and ongoing maintenance agreements further solidify the bargaining power of these hardware and network equipment providers. These commitments can create switching costs for Broadridge, making it difficult or expensive to change suppliers even if more competitive options emerge. This dependency ensures that suppliers can often dictate terms, pricing, and service levels, especially for proprietary or highly integrated systems essential for Broadridge's service delivery.

- Vendor Concentration: The global server market, a key area for Broadridge, was estimated to be worth over $100 billion in 2024, with a significant portion dominated by a few large vendors, increasing their pricing power.

- Specialized Equipment Needs: Broadridge's requirement for high-throughput networking and advanced cybersecurity solutions often necessitates equipment with specific functionalities, narrowing the pool of suitable suppliers.

- Switching Costs: The integration of specialized hardware into Broadridge's existing infrastructure creates substantial costs and operational risks associated with changing vendors, strengthening supplier leverage.

- Service Level Agreements (SLAs): Critical SLAs tied to hardware uptime and performance mean Broadridge may be locked into contracts with providers who offer the most reliable, albeit potentially more expensive, solutions.

The bargaining power of suppliers for Broadridge is significant, particularly concerning specialized financial data and technology platforms. Key providers in these areas often operate in concentrated markets, allowing them to command higher prices and dictate terms. For example, the global financial data market, valued at over $30 billion in 2024, is dominated by a few major players, giving them considerable leverage over firms like Broadridge that rely on their services for market intelligence.

The scarcity of highly skilled tech talent, such as data scientists and cybersecurity experts, also empowers suppliers in the form of labor. In 2024, salary increases for specialized IT roles ranged from 10-15% year-over-year due to persistent shortages, directly impacting Broadridge's operational costs.

Broadridge's dependence on a limited number of cloud infrastructure providers, which held a substantial majority of the approximately $600 billion global cloud computing market in 2024, further amplifies supplier power. High switching costs associated with migrating complex data operations reinforce this leverage, making it challenging for Broadridge to change providers easily.

| Supplier Category | Market Context (2024) | Supplier Leverage Factors |

|---|---|---|

| Financial Data Providers | Global market > $30 billion; Concentrated landscape | Dominant players; Essential for market intelligence |

| Specialized Tech Talent | High demand for data scientists, cybersecurity experts | Scarcity of skills; Significant salary increases (10-15% YoY) |

| Cloud Infrastructure Providers | Global market ~ $600 billion; Dominated by a few providers | High market share; High switching costs |

What is included in the product

This analysis meticulously examines the five forces shaping Broadridge Financial's competitive environment, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Effortlessly visualize competitive intensity across all five forces, enabling rapid identification of strategic vulnerabilities and opportunities.

Customers Bargaining Power

Broadridge's core offerings, such as securities processing and investor communications, are intricately woven into the daily operations and IT systems of its clients. This deep integration means that switching to a competitor isn't a simple task.

The process of moving away from Broadridge involves substantial investments in time, money, and potential operational disruptions. Clients would face significant hurdles in data migration, integrating new systems, and retraining their staff, all of which contribute to elevated switching costs.

These high switching costs effectively limit the bargaining power of individual customers. Once a client is established on Broadridge's platforms, their ability to negotiate better terms or switch providers is considerably diminished, reinforcing Broadridge's strong market position.

Broadridge's services are deeply embedded in the critical daily functions of financial institutions, making them indispensable. For instance, their trade processing and regulatory reporting solutions are not mere conveniences but essential components for banks and broker-dealers to operate legally and efficiently. A disruption in these services could lead to immediate and substantial financial losses and severe reputational damage, significantly reducing a client's leverage in negotiations.

Broadridge's client base is characterized by large, sophisticated financial institutions. These clients, often major banks and investment firms, have substantial internal resources and a deep understanding of the services they require. This sophistication means they are well-equipped to negotiate terms effectively.

While these large clients can exert pressure due to their size, Broadridge's specialized solutions and the significant costs associated with switching providers often neutralize this bargaining power. For instance, the average cost for a financial institution to migrate its core processing systems can run into millions of dollars, making such transitions rare and costly.

Consequently, these clients tend to prioritize long-term, strategic partnerships that offer reliable and integrated solutions over seeking minor, short-term price reductions. Broadridge's ability to provide end-to-end processing and data management solutions fosters this client loyalty, as evidenced by its high client retention rates, which have consistently been in the high 90s.

Consolidation in the Financial Services Industry

Ongoing consolidation within the financial services sector, impacting banks, broker-dealers, and asset managers, could result in larger, more influential clients for Broadridge. As these entities expand their market presence, their individual purchasing power and strategic significance to Broadridge may escalate, potentially amplifying their collective bargaining leverage.

For instance, the U.S. banking sector saw a decrease in the number of FDIC-insured institutions from 4,868 at the end of 2020 to 4,720 by the end of 2023, illustrating a trend towards fewer, larger players. This consolidation means that a smaller number of clients could represent a larger portion of Broadridge's revenue, giving them more sway.

- Increased Purchasing Volume: Larger financial institutions tend to execute more transactions, requiring a greater volume of Broadridge's services, which can be leveraged in price negotiations.

- Strategic Importance: As clients grow, their business becomes more critical to Broadridge's overall success, making the company more amenable to client demands to retain that business.

- Potential for Switching Costs: While consolidation can increase client power, the high switching costs associated with Broadridge's deeply integrated solutions can still mitigate some of this influence.

Customization and Integration Demands

Clients frequently demand highly customized solutions and deep integration with their current systems, driven by unique operational needs and regulatory landscapes. This initial customization can grant customers leverage during contract discussions.

However, Broadridge's substantial investment in developing these bespoke solutions creates a strong lock-in effect for the client. This mutual dependency, stemming from the tailored integration, ultimately diminishes the client's bargaining power for subsequent ongoing services.

- Customization Drives Lock-in: Clients requiring bespoke integrations, a common theme in financial services, face higher switching costs.

- Integration Investment: Broadridge's expenditure on integrating with client systems strengthens the client relationship, reducing future leverage.

- Reduced Switching Costs: As clients invest in and rely on integrated Broadridge solutions, the cost and complexity of switching to a competitor increase significantly.

Broadridge's customers, primarily large financial institutions, possess moderate bargaining power. While their significant transaction volumes and the strategic importance of their business to Broadridge could theoretically increase leverage, the exceptionally high switching costs associated with Broadridge's deeply integrated, often customized, solutions significantly dampen this power. This lock-in effect, driven by substantial investments in integration, makes clients hesitant to disrupt operations for minor concessions.

| Factor | Broadridge's Position | Customer Bargaining Power Impact |

|---|---|---|

| Switching Costs | Very High (deep integration, data migration complexity) | Lowers customer power |

| Client Sophistication & Size | High (large financial institutions) | Potentially increases customer power, but offset by switching costs |

| Customization & Lock-in | High (bespoke solutions) | Lowers customer power due to mutual dependency |

| Industry Consolidation | Increasing (fewer, larger clients) | Slightly increases potential customer power, but switching costs remain a barrier |

What You See Is What You Get

Broadridge Financial Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of Broadridge Financial provides an in-depth examination of the competitive landscape, including the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. Understanding these forces is crucial for strategic decision-making and identifying key challenges and opportunities within the financial services technology sector.

Rivalry Among Competitors

Broadridge thrives in highly specialized financial technology niches like investor communications and securities processing. While rivals exist in these areas, few match Broadridge's integrated offering across multiple critical functions. This specialization often means competition is segmented, rather than a direct clash across its entire business. For instance, in investor communications, Broadridge competes with firms like Computershare, but their overall market share and service scope differ.

Financial institutions face considerable costs and operational risks when migrating core technology systems, effectively locking them into existing providers like Broadridge. These switching costs can include data migration, system integration, employee retraining, and potential disruption to client services, making a change a significant undertaking. For instance, in 2024, the average cost for a mid-sized financial firm to switch core banking platforms was estimated to be in the tens of millions of dollars, a substantial barrier.

Broadridge's extensive proprietary technology and decades of deep domain expertise in financial services create a significant barrier to entry. This specialized knowledge and technological infrastructure are incredibly difficult and expensive for new or existing competitors to replicate. This effectively moderates the intensity of rivalry, as it’s not simply a matter of matching features or price.

Fragmented Competition with Niche Players

While Broadridge operates in a landscape with large, diversified fintech competitors like Fiserv and SS&C Technologies, a significant portion of its competitive rivalry stems from numerous smaller, specialized niche players. These smaller firms often concentrate on specific product functionalities or particular geographic markets, creating a fragmented competitive environment.

This fragmentation means Broadridge encounters different sets of rivals depending on the specific service it offers or the client segment it targets. For instance, its investor communications segment might face a different competitive set than its trade processing solutions.

In 2024, the fintech sector continued to see significant investment, with many startups and specialized firms emerging. For example, reports from late 2023 indicated that the wealth management technology market alone was projected to grow substantially, attracting new entrants focused on areas like digital onboarding and personalized financial advice.

- Fragmented Market: Broadridge contends with a broad array of smaller, specialized competitors in addition to larger fintech firms.

- Niche Focus: Many rivals concentrate on specific services or geographic regions, tailoring their offerings to particular market segments.

- Dynamic Rivalry: The competitive landscape shifts based on the specific product or client base, meaning Broadridge faces varied opponents across its business lines.

- Emerging Players: The ongoing growth in fintech, particularly in areas like wealthtech, fuels the emergence of new, agile competitors in 2024.

Regulatory Landscape and Compliance Requirements

The financial services industry operates under a stringent and ever-changing regulatory framework. This complexity serves as a substantial barrier to new entrants, favoring established firms like Broadridge that have demonstrated expertise in compliance and risk management.

Companies adept at navigating these regulations, such as Broadridge, which reported significant investments in compliance and security infrastructure in its 2024 filings, gain a distinct advantage. This regulatory burden naturally curtails the number of potential competitors, intensifying rivalry among those who can effectively manage and offer compliant solutions.

- Regulatory Burden: The cost of compliance with regulations like MiFID II or Dodd-Frank can be substantial, deterring smaller or less capitalized firms.

- Compliance as a Differentiator: Broadridge's ability to offer compliant solutions for areas like trade reporting and data management positions it favorably against less experienced competitors.

- Evolving Landscape: Continuous updates to regulations, such as those anticipated in 2024 concerning data privacy and digital assets, require ongoing investment and adaptation, favoring established players.

- Market Concentration: The high cost and complexity of compliance contribute to a more concentrated market, where a few dominant players can effectively serve the needs of a regulated industry.

Broadridge faces a competitive landscape characterized by both large, established fintech players and a multitude of smaller, specialized firms. This fragmentation means rivalry intensity varies significantly across Broadridge's diverse service offerings, with different competitors emerging in areas like investor communications versus securities processing.

The high switching costs associated with financial technology systems, estimated to cost mid-sized firms tens of millions of dollars in 2024 for core platform migrations, create a sticky customer base. Furthermore, Broadridge's proprietary technology and deep domain expertise act as significant barriers to entry, making it challenging for new entrants to replicate its integrated solutions.

Regulatory compliance, a significant hurdle in financial services, also shapes the competitive environment. Firms like Broadridge, which invest heavily in compliance infrastructure, as evidenced by their 2024 filings, gain a distinct advantage. This regulatory burden, coupled with the dynamic nature of fintech investment in 2024, particularly in wealthtech, fosters a market where established players with robust compliance capabilities often have an edge.

| Competitor Type | Key Characteristics | Impact on Broadridge |

|---|---|---|

| Large Fintech Firms | Broad capabilities, significant market share (e.g., Fiserv, SS&C) | Direct competition across multiple service lines |

| Specialized Niche Players | Focused offerings, agile, often regional (e.g., Computershare in investor comms) | Fragmented rivalry, requires tailored competitive strategies |

| Emerging Startups | Innovative technology, often targeting specific pain points (e.g., wealthtech in 2024) | Potential disruption, necessitates continuous innovation |

SSubstitutes Threaten

Large financial institutions have the financial muscle, with many reporting IT budgets in the hundreds of millions, even billions, of dollars annually. This theoretically allows them to build their own systems for critical functions like trade processing or client reporting, potentially bypassing third-party providers.

However, the reality of developing and maintaining such complex systems in-house is often prohibitive. The sheer cost, coupled with the time and expertise needed to keep pace with evolving technology and stringent regulations, makes it a challenging proposition. For instance, a single system upgrade could cost tens of millions, and the ongoing maintenance and compliance efforts are substantial.

This is where specialized providers like Broadridge shine. They offer scalable, compliant, and constantly updated solutions that are often more cost-effective and less risky than attempting full in-house development. Broadridge's focus allows them to invest heavily in innovation, ensuring their clients benefit from the latest advancements without the burden of internal development.

While manual processes or reliance on outdated legacy systems might exist as a form of 'substitution' in some less sophisticated or smaller financial firms, these are generally highly inefficient, error-prone, and non-compliant compared to Broadridge's automated solutions.

The drive for efficiency, risk reduction, and regulatory adherence pushes clients away from these inferior substitutes. For instance, the global financial services industry continues to invest heavily in digital transformation, with IT spending projected to reach $380 billion in 2024, signaling a clear move away from legacy approaches.

The financial technology landscape is constantly shifting, with innovations like blockchain and artificial intelligence (AI) offering new ways to handle tasks currently managed by established players. These emerging technologies could eventually provide alternative solutions to some of Broadridge's core services.

While these advancements hold significant promise, their widespread adoption within critical financial systems is still in its early stages. Significant challenges remain, including navigating complex regulatory environments and proving scalability, suggesting these are more of a future concern than an immediate threat to Broadridge's current market position.

Outsourcing to Business Process Outsourcing (BPO) Firms

The threat of substitutes for Broadridge’s services from generalist Business Process Outsourcing (BPO) firms is relatively low. While some clients might explore outsourcing non-core financial processes to these firms, Broadridge differentiates itself through specialized, technology-driven solutions rather than simple labor arbitrage. For instance, in 2024, the BPO market continued to grow, with many firms focusing on cost reduction through automation and labor cost savings, but this often overlooks the nuanced requirements of financial services.

Generalist BPO providers typically lack the deep domain expertise, proprietary technology platforms, and robust regulatory compliance frameworks that are critical for areas like investor communications and complex securities processing. Broadridge’s investment in platforms that handle intricate regulatory reporting and secure data management, for example, is a significant barrier to entry for less specialized BPO firms. The financial services industry demands a level of precision and specialized knowledge that generic BPO solutions often cannot meet.

- Specialized Technology: Broadridge offers proprietary technology solutions, not just labor-based services.

- Domain Expertise: Broadridge possesses deep knowledge in investor communications and securities processing.

- Regulatory Compliance: Broadridge maintains infrastructure for strict financial industry regulations.

- Limited BPO Scope: Generalist BPO firms typically handle simpler back-office tasks, not complex financial operations.

Partial Outsourcing to Multiple Niche Vendors

Clients might choose to piece together solutions from various specialized providers instead of relying solely on Broadridge's comprehensive offerings. This could involve engaging separate vendors for distinct functions like trade processing or regulatory compliance. For example, a firm might use a specialized fintech for its AI-driven analytics while outsourcing its customer communications to a different platform.

While this fragmented approach offers customization, it introduces significant challenges. The need to integrate disparate systems can lead to increased IT complexity and higher operational costs. Managing multiple vendor relationships also demands more resources and attention, potentially diverting focus from core business activities. In 2024, many financial institutions reported increased IT integration costs due to managing a growing number of third-party vendors.

- Increased Integration Complexity: Combining services from multiple niche vendors requires robust API management and data synchronization, which can be technically demanding.

- Higher Vendor Management Overhead: Sourcing, contracting, and overseeing multiple vendors adds administrative burden and increases the risk of miscommunication or service gaps.

- Potential for Data Siloing: When data resides in separate systems managed by different providers, it can hinder a unified view of operations and client interactions, impacting analytics and decision-making.

- Risk of Inconsistent Service Levels: Relying on multiple vendors can lead to variability in service quality and support, potentially impacting the overall client experience.

The threat of substitutes for Broadridge's services is moderate, primarily stemming from the possibility of financial institutions building in-house solutions or adopting fragmented approaches from niche providers. While large institutions possess significant IT budgets, the complexity and ongoing costs of developing and maintaining specialized financial systems often make outsourcing to firms like Broadridge more practical. For example, the global financial services IT spending reached an estimated $380 billion in 2024, reflecting a strong preference for efficient, compliant solutions over the high overhead of in-house development.

Emerging technologies like AI and blockchain present a longer-term substitution risk, though widespread adoption in critical financial infrastructure is still developing. Generalist Business Process Outsourcing (BPO) firms are a low threat due to their lack of specialized domain expertise and regulatory compliance infrastructure, which are crucial for financial services. The trend of financial firms integrating multiple specialized fintech solutions also poses a challenge, increasing IT complexity and vendor management overhead, with many institutions reporting higher integration costs in 2024.

| Substitution Threat | Description | Impact on Broadridge | Key Considerations |

|---|---|---|---|

| In-house Development | Large financial institutions building proprietary systems. | Low to Moderate; High cost and complexity are deterrents. | Annual IT budgets in hundreds of millions to billions. |

| Fragmented Solutions | Clients using multiple niche providers for different functions. | Moderate; Increases IT complexity and vendor management. | Higher integration costs reported by institutions in 2024. |

| Emerging Technologies (AI, Blockchain) | New technologies offering alternative processing methods. | Low in the short-term; Moderate in the long-term. | Adoption challenges include regulation and scalability. |

| Generalist BPO | Outsourcing to non-specialized BPO firms. | Very Low; Lack of domain expertise and compliance. | Focus on labor arbitrage, not specialized financial needs. |

Entrants Threaten

Entering the financial technology sector, especially for critical services like securities processing and investor communications, demands significant capital. In 2024, companies are facing escalating costs for robust IT infrastructure, secure data centers, and advanced cybersecurity, often running into tens of millions of dollars for even mid-sized operations.

This substantial upfront investment acts as a formidable barrier. For instance, establishing a compliant and resilient infrastructure for processing billions of transactions annually, as Broadridge does, requires a level of financial commitment that deters many smaller or less capitalized entities from even attempting to compete.

The financial services sector is a minefield of regulations, with bodies like the SEC and FINRA imposing strict compliance rules. New companies entering this space must contend with intricate licensing procedures, extensive reporting obligations, and robust data security mandates. This necessitates significant investment in legal and compliance talent, a burden that established firms like Broadridge are already equipped to handle.

Entering the financial services technology sector, especially as a competitor to established players like Broadridge, demands a deep well of industry expertise. This isn't just about knowing financial products; it's about understanding the intricate workflows of banks, broker-dealers, and asset managers, a knowledge base often built over decades. For instance, navigating the complexities of regulatory reporting or the nuances of trade settlement requires specialized skills that new entrants typically lack.

Furthermore, trust and credibility are paramount when dealing with financial institutions. These entities are inherently risk-averse and are unlikely to entrust critical operations to unproven vendors. Broadridge, having served the industry for years, has cultivated strong relationships and a reputation for reliability. This established trust acts as a significant barrier, as new companies struggle to gain the confidence needed to displace incumbent solutions, especially when large-scale integration and data security are at stake.

Proprietary Technology and Network Effects

Broadridge's formidable proprietary technology, including patented processes, creates a significant barrier to entry. Newcomers would struggle to replicate this complex technological infrastructure, which is deeply integrated into the financial services industry.

The company benefits immensely from strong network effects. As more financial institutions utilize Broadridge's platforms, the value for all participants increases, making it exceptionally difficult for new entrants to gain traction and build a comparable network. For instance, in 2023, Broadridge processed trillions of dollars in transactions, highlighting the scale and interconnectedness of its network.

- Proprietary Technology: Broadridge's patented systems and deep integration are difficult and costly to replicate.

- Network Effects: A vast, established network of financial institutions enhances Broadridge's value proposition, deterring new competitors.

- High Switching Costs: For existing clients, the cost and complexity of migrating away from Broadridge's integrated solutions are substantial.

- Incumbent Advantage: The sheer scale and established relationships of Broadridge make it challenging for any new entrant to achieve critical mass.

High Switching Costs for Prospective Clients

The significant switching costs for financial institutions deeply entrenched with providers like Broadridge present a formidable barrier to new entrants. These costs encompass not only the financial outlay for new system implementation but also the operational disruptions and the inherent risks associated with data migration and retraining staff.

For instance, a financial firm might have years of client data, transaction histories, and regulatory compliance protocols deeply integrated into Broadridge's platform. The process of extracting, cleaning, and migrating this complex data to a new system is both time-consuming and prone to errors, potentially impacting client service and regulatory standing. This complexity makes it challenging for new competitors to offer a compelling value proposition that outweighs the inertia and risk for established clients.

- High Integration Costs: Financial institutions face substantial expenses in integrating new systems with their existing infrastructure.

- Data Migration Complexity: Moving vast amounts of sensitive financial data is a complex and risky undertaking.

- Operational Disruption: Switching providers can lead to temporary service interruptions and reduced productivity.

- Employee Training: New systems require significant investment in training personnel, adding to the overall cost and time commitment.

The threat of new entrants for Broadridge is generally low due to substantial barriers. High capital requirements for technology and compliance, coupled with the need for deep industry expertise and established trust, make it difficult for newcomers. In 2024, the continuous need for advanced cybersecurity and data management further elevates these entry costs, with companies needing to invest millions in compliant infrastructure.

Network effects and high switching costs also significantly protect Broadridge. Financial institutions are reluctant to move from established, integrated systems due to the complexity and risk of data migration and operational disruption. For instance, the sheer volume of transactions processed by Broadridge, reaching trillions annually, reinforces its network's value and the difficulty for new players to gain comparable scale and trust.

| Barrier Category | Description | 2024 Cost Estimate (Illustrative) | Impact on New Entrants |

| Capital Requirements | Robust IT infrastructure, data centers, cybersecurity | $10M - $50M+ | Very High |

| Regulatory Compliance | Licensing, reporting, data security mandates | Significant ongoing investment | High |

| Industry Expertise | Understanding complex workflows, regulatory nuances | Decades of experience | High |

| Brand Reputation & Trust | Credibility with risk-averse financial institutions | Years of relationship building | Very High |

| Proprietary Technology | Patented processes, deep integration | Costly replication | High |

| Network Effects | Value increases with user base | Trillions processed annually | Very High |

| Switching Costs | Data migration, retraining, operational disruption | Substantial financial and operational impact | Very High |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Broadridge Financial leverages a comprehensive suite of data, including proprietary market research, industry-specific financial statements, and regulatory filings to accurately assess competitive pressures.

We integrate insights from financial news outlets, analyst reports, and company investor relations materials to capture the dynamic landscape of the financial services technology sector.