B. Riley Financial SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B. Riley Financial Bundle

B. Riley Financial leverages its diversified business model and strong financial advisory expertise, but faces challenges in market volatility and regulatory scrutiny. Understanding these dynamics is crucial for any investor or strategist.

Want the full story behind B. Riley Financial's competitive advantages, potential threats, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment decisions and strategic planning.

Strengths

B. Riley Financial's strength lies in its exceptionally diversified financial services platform. This includes robust investment banking, comprehensive financial advisory, dedicated wealth management, and strategic business advisory services.

This broad spectrum of offerings enables B. Riley to serve a wide client base, from large corporations and institutions to individual high-net-worth clients. For instance, in the first quarter of 2024, the company reported significant revenue contributions from its diverse segments, with wealth management alone generating over $100 million in revenue, showcasing the breadth of its operations.

The company's ability to provide a full suite of financial solutions creates a resilient business model. This diversification helps to mitigate risks associated with downturns in any single market segment, allowing B. Riley to maintain stability and capture opportunities across various economic conditions.

B. Riley Financial actively deploys its own capital into proprietary investments, aiming to generate robust free cash flow and recurring revenue. This strategy underscores their confidence in identifying and capitalizing on strategic opportunities.

The company's in-house operational expertise is a key differentiator, allowing them to effectively manage and enhance the value of these investments. This includes majority stakes in established brands, which contribute to their diversified revenue streams and operational synergies.

B. Riley Financial's strength lies in its cross-platform expertise, allowing it to offer comprehensive, collaborative solutions. This integrated approach addresses a wide range of client needs, from strategic planning to capital acquisition, across all business stages.

The company effectively harnesses its diverse business units, including investment banking, wealth management, and financial advisory, to create synergistic offerings. This allows B. Riley to tackle complex challenges and provide end-to-end support for its clientele.

Active Debt Reduction and Capital Structure Management

B. Riley Financial has actively worked to strengthen its balance sheet by reducing outstanding debt. A key move was the full redemption of its 6.75% senior notes due in 2026, which totaled $300 million, completed in early 2024. This proactive deleveraging aims to improve the company's financial flexibility and reduce interest expenses.

These efforts extend to managing its capital structure more efficiently. The company has also engaged in private bond exchanges, further optimizing its debt profile. Such actions are designed to lower near-term liabilities and create a more robust financial foundation.

- Debt Reduction Initiatives: Completed $300 million redemption of 6.75% senior notes due 2026 in Q1 2024.

- Capital Structure Optimization: Engaged in private bond exchanges to refine debt maturity and cost.

- Financial Flexibility: Proactive measures enhance the company's ability to pursue growth opportunities and manage economic fluctuations.

- Reduced Interest Expense: Deleveraging directly contributes to lower ongoing financing costs.

Resilience in Core Advisory and Wealth Management Segments

B. Riley Financial's core advisory and wealth management operations are proving to be remarkably resilient, even amidst broader economic headwinds. These segments are the bedrock of the company's consistent revenue generation.

Notably, the Advisory Services division achieved record results in the first quarter of 2024. This strong performance underscores the inherent operational strength and reliable income streams these key business areas provide.

- Advisory Services record Q1 2024 results.

- Consistent revenue generation from core segments.

- Demonstrated resilience despite market challenges.

B. Riley Financial's diversified business model is a significant strength, allowing it to generate consistent revenue across various economic conditions. The company's ability to integrate its diverse units, such as investment banking, wealth management, and financial advisory, creates synergistic offerings that cater to a broad client base. This integrated approach enables B. Riley to provide comprehensive, end-to-end support for clients, addressing a wide range of financial needs.

The company's commitment to strengthening its balance sheet is evident in its debt reduction initiatives. In the first quarter of 2024, B. Riley completed the redemption of $300 million in senior notes due in 2026. This proactive deleveraging enhances financial flexibility and reduces interest expenses, creating a more robust financial foundation.

| Segment | Q1 2024 Revenue (Approx.) | Key Strength |

|---|---|---|

| Wealth Management | >$100 million | Broad client base and consistent income |

| Advisory Services | Record results | Resilience and operational strength |

| Proprietary Investments | Contributes to free cash flow | In-house expertise and value enhancement |

What is included in the product

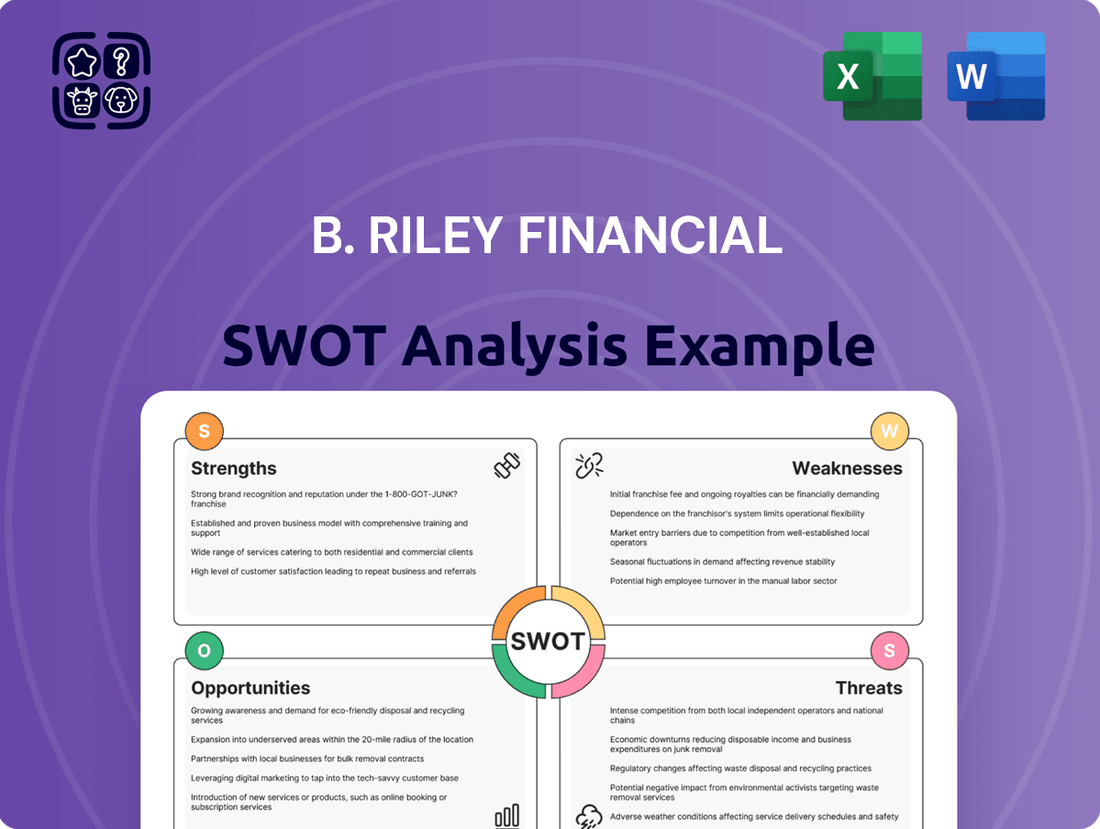

Delivers a strategic overview of B. Riley Financial’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats to understand its market position and future prospects.

Offers a clear, actionable framework to address B. Riley Financial's strategic challenges by identifying and leveraging key strengths and opportunities.

Weaknesses

B. Riley Financial is grappling with significant regulatory compliance hurdles. The company has received multiple delinquency notices from Nasdaq for failing to file its 2024 annual report (10-K) and its first quarter 2025 quarterly report (10-Q) on time. This situation puts B. Riley Financial in a precarious position as it faces a critical September 29, 2025 deadline to rectify these filings and regain compliance with Nasdaq listing rules. Failure to meet this deadline could result in the company's shares being delisted from the exchange, potentially impacting its liquidity and investor confidence.

B. Riley Financial's preliminary Q4 2024 results revealed a significant net loss, largely due to substantial impairment charges on goodwill and intangible assets. These charges highlight considerable pressure on the company's balance sheet and suggest underlying financial challenges.

B. Riley Financial's total debt burden remains a significant concern, standing at approximately $1.78 billion as of December 2024, despite some recent efforts to reduce it. This substantial leverage can restrict the company's ability to pursue new opportunities or weather economic downturns. The ongoing interest expenses associated with this debt also impact profitability and could pose a risk to the company's long-term financial health.

Deterioration of Reputation and Potential Employee Exodus

B. Riley Financial faced significant reputational damage in 2024 due to a series of adverse events. These included substantial write-downs, particularly impacting its investment banking and wealth management divisions, and ongoing regulatory probes. For instance, the company recorded significant impairment charges related to its investments, contributing to a challenging financial performance in early 2024.

This tarnished image directly affects client confidence, a critical asset in financial services. A loss of trust can translate into decreased business volumes and client attrition. For example, in the competitive wealth management sector, a strong reputation is paramount for attracting and retaining high-net-worth individuals and their assets.

Furthermore, the negative publicity and perceived instability can trigger an exodus of key talent. Skilled professionals, especially in investment banking and advisory roles, often seek environments with stable leadership and a positive market perception. The potential departure of experienced employees could further weaken B. Riley's operational capabilities and competitive standing.

- Reputational Impact: Write-downs and regulatory scrutiny in 2024 have eroded B. Riley's standing, particularly in investment banking and wealth management.

- Client Trust Erosion: A damaged reputation risks alienating existing clients and deterring new ones, impacting revenue streams.

- Talent Retention Challenges: Negative perceptions can lead to key employees seeking opportunities at firms with stronger reputations, impacting service delivery and growth.

Suspension of Preferred Stock Dividends

B. Riley Financial's temporary suspension of cash dividends on its preferred stock in January 2025 highlights a significant weakness. This move, aimed at conserving cash, signals underlying financial strain and can erode investor confidence, especially among those relying on preferred dividends for income. The company's financial health is being scrutinized more closely following this development.

The suspension of preferred stock dividends can have a ripple effect on investor sentiment and the company's cost of capital. For instance, as of Q1 2025, B. Riley's preferred stock was trading at a discount compared to its par value, reflecting increased perceived risk by the market. This action may also make it more challenging for the company to raise capital through equity issuances in the near future.

- Financial Pressure: The January 2025 dividend suspension indicates a need to preserve liquidity, suggesting potential cash flow challenges.

- Investor Confidence: This action can deter income-seeking investors and negatively impact the perception of the company's financial stability.

- Market Perception: The market's reaction, as seen in the Q1 2025 price performance of preferred shares, reflects increased investor caution.

- Capital Access: Future capital raising efforts may become more costly or difficult due to this perceived financial pressure.

B. Riley Financial's reliance on a few key business segments, particularly its capital markets and asset management divisions, presents a concentration risk. A downturn in these specific areas could disproportionately impact overall financial performance. For instance, a slowdown in M&A activity or a decline in assets under management directly affects fee-based revenues.

What You See Is What You Get

B. Riley Financial SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're getting an accurate look at the B. Riley Financial SWOT analysis, detailing its strengths, weaknesses, opportunities, and threats. Once purchased, the complete, in-depth report becomes immediately accessible.

Opportunities

Separating B. Riley Securities into its own company offers a chance for the investment banking arm to focus on its core strengths and pursue a tailored growth plan. This strategic shift could unlock new avenues for expansion and operational efficiency.

By operating independently, B. Riley Securities can implement a governance structure that better suits its specific needs, potentially leading to more agile decision-making. This could translate into a more focused execution of its business strategy, aiming to boost profitability.

This carve-out allows B. Riley Securities to return to its foundational principles, potentially revitalizing its market position. The company’s investment banking segment generated $198.5 million in revenue in the first nine months of 2024, highlighting its substantial contribution and potential for independent growth.

B. Riley Financial is strategically divesting non-core assets to bolster its financial position. For instance, the company has announced the sale of GlassRatner and Atlantic Coast Recycling. These actions are designed to unlock cash, thereby enhancing liquidity and potentially reducing outstanding debt.

This focus on divestitures allows B. Riley to channel resources more effectively towards its core, high-performing business segments. By streamlining its portfolio, the company aims to improve operational efficiency and concentrate on areas with greater growth potential.

B. Riley Financial is strategically prioritizing its core financial services, such as B. Riley Securities and Wealth Management. This focus aims to revitalize growth by bolstering segments already demonstrating robust operational performance.

In the first quarter of 2024, B. Riley Securities reported record revenue of $215.4 million, up 43% year-over-year, highlighting the strength of this core business. Management's commitment to reinvesting in these areas is designed to capitalize on this momentum and unlock further value creation.

Potential for Significant Valuation Rebound

B. Riley Financial's stock has experienced a notable downturn, suggesting that the market may have already priced in many of the company's current challenges. This situation creates a potential contrarian opportunity. If the company effectively navigates and resolves its regulatory compliance concerns and demonstrates operational stability, there's a strong possibility for a significant rebound in its valuation. Investors with a higher risk tolerance might find this period attractive for potential gains.

For instance, as of early 2024, B. Riley's stock traded at a price-to-earnings ratio that was considerably lower than its historical averages and industry peers, indicating market skepticism. A successful turnaround, marked by clear regulatory resolutions and improved financial performance, could see this ratio expand, driving up the stock price.

- Valuation Discount: The current stock price may reflect a 'worst-case scenario' valuation, offering upside potential if risks are mitigated.

- Regulatory Resolution: Successful resolution of ongoing compliance issues is a key catalyst for valuation recovery.

- Operational Stabilization: Demonstrating consistent operational performance and profitability will rebuild investor confidence.

- Contrarian Opportunity: For investors willing to accept higher risk, the current market sentiment presents a chance to invest before a potential recovery is fully recognized.

Strategic Acquisitions and Opportunistic Investments

B. Riley Financial has a proven track record of leveraging strategic acquisitions and opportunistic investments to fuel its growth. This approach allows the company to expand its service offerings and client base efficiently. For instance, in 2024, the company continued its strategy of integrating complementary businesses, aiming to bolster its wealth management and capital markets segments.

Expanding its portfolio through calculated acquisitions is a key opportunity for B. Riley. By identifying and integrating businesses that align with its long-term vision, the company can enhance its competitive standing and create new avenues for revenue generation. This diversification can also mitigate risks associated with over-reliance on any single market segment.

- Acquisition Strategy: B. Riley's history demonstrates a proactive approach to acquiring businesses that fit its strategic objectives, enhancing its market presence.

- Opportunistic Investments: The company actively seeks investment opportunities that promise strong returns and align with its long-term growth trajectory.

- Revenue Diversification: Acquisitions help broaden B. Riley's revenue streams, reducing dependence on specific financial services sectors.

- Market Position Enhancement: Strategic integration of acquired entities strengthens B. Riley's competitive advantage in its core markets.

B. Riley Financial can capitalize on its strong performance in key areas like B. Riley Securities, which saw a remarkable 43% year-over-year revenue increase to $215.4 million in Q1 2024. This robust performance in a core segment presents a clear opportunity for focused growth and reinvestment.

The company's strategic divestiture of non-core assets, such as GlassRatner and Atlantic Coast Recycling, aims to enhance liquidity and reduce debt, freeing up capital. This financial strengthening allows for greater investment in high-potential segments like wealth management and capital markets.

The current market valuation of B. Riley Financial may present a contrarian opportunity, with its stock trading at a discount relative to historical averages and peers as of early 2024. Successful navigation of regulatory issues and operational stabilization could lead to a significant valuation recovery.

B. Riley's established strategy of growth through strategic acquisitions and opportunistic investments offers a pathway to expand its service offerings and client base. Recent integrations in 2024 further underscore this commitment to enhancing its wealth management and capital markets capabilities.

Threats

A significant threat facing B. Riley Financial is the risk of its stock being delisted from the Nasdaq exchange. Failure to submit overdue financial reports and a compliance plan by the September 29, 2025, deadline could trigger this severe consequence.

Delisting would dramatically impact the company's liquidity, making it harder for investors to buy or sell shares. This, in turn, could further erode investor confidence and potentially lead to a significant drop in the stock price, as seen with other companies that have faced similar situations.

B. Riley Financial is currently navigating a landscape marked by significant market skepticism and investor pessimism. This sentiment is clearly reflected in its stock performance, with its share price experiencing a notable downturn. For instance, as of mid-2024, the company's stock has seen a substantial percentage decrease year-over-year, signaling a lack of confidence from the investment community.

This prevailing negative outlook creates considerable headwinds for B. Riley. Raising new capital becomes a more arduous and expensive process, and managing existing debt obligations is also amplified. Furthermore, attracting fresh investment is a significant hurdle, potentially exacerbating existing financial pressures and limiting strategic flexibility.

B. Riley Financial faces a threat from potentially higher interest rates on new debt, as evidenced by the Federal Reserve's continued stance on monetary policy, which has kept benchmark rates elevated through early 2025. This could mean increased borrowing costs for the company, impacting profitability.

Moreover, any debt restructuring efforts might come with stricter covenants. These tighter terms could limit B. Riley's ability to pursue certain strategic initiatives or require them to maintain specific financial ratios, thereby reducing operational flexibility in a dynamic market.

Intense Competition within Financial Services

The financial services landscape is notoriously crowded, with established institutions and nimble fintech startups constantly vying for market share. B. Riley operates within this intensely competitive environment, facing pressure from a broad spectrum of players offering similar services.

Recent financial and reputational headwinds, such as those experienced in late 2023 and early 2024, can exacerbate these competitive pressures. For instance, a reported 20% decline in revenue for certain segments in Q1 2024 compared to the prior year could impact client confidence and make client retention more challenging. This difficulty in retaining existing clients, attracting new business, and securing top talent is amplified when competing against larger, more stable competitors with stronger balance sheets and more established brand reputations.

- Intense Competition: The financial services sector is characterized by a high number of participants, including large banks, investment firms, and specialized boutique companies.

- Client Retention Challenges: Recent financial performance and any associated reputational concerns can make it harder for B. Riley to keep its current clients engaged and satisfied.

- New Business Acquisition: Competitors with stronger perceived stability may attract clients looking for more secure partnerships, impacting B. Riley's ability to grow its client base.

- Talent Acquisition: Attracting and retaining skilled professionals becomes more difficult when rivals can offer greater job security and potentially more attractive compensation packages due to their stronger financial standing.

Volatility in Proprietary Investment Performance

B. Riley Financial's commitment to proprietary investments, while potentially lucrative, inherently introduces significant exposure to market volatility. When market conditions turn unfavorable or specific investments underperform, the company can face substantial financial repercussions, directly affecting its bottom line. For instance, the company reported significant investment losses in the first quarter of 2024, underscoring this vulnerability.

This volatility can manifest in several ways:

- Market Downturns: Broader economic or sector-specific downturns can negatively impact the value of B. Riley's proprietary investment portfolio.

- Individual Investment Underperformance: Poor strategic decisions or unforeseen challenges within specific companies or assets held by B. Riley can lead to direct losses.

- Impact on Earnings: As demonstrated in Q1 2024, substantial investment losses can significantly reduce reported earnings and profitability for the period.

The potential delisting from the Nasdaq exchange presents a severe threat to B. Riley Financial, particularly if overdue financial reports and a compliance plan are not submitted by the September 29, 2025 deadline. This event would significantly impair liquidity, making share trading difficult and likely leading to a substantial decline in stock value, mirroring outcomes for other delisted entities.

B. Riley faces intense competition within the financial services industry from a wide array of established firms and emerging fintech companies. Recent financial performance, including a reported 20% revenue decline in certain segments during Q1 2024, can hinder client retention and new business acquisition, especially when competing against more financially stable rivals.

The company's reliance on proprietary investments exposes it to considerable market volatility. Significant investment losses, such as those reported in Q1 2024, can directly impact profitability and earnings, highlighting the inherent risks in managing a diverse investment portfolio amidst fluctuating market conditions.

Elevated interest rates, as maintained by the Federal Reserve through early 2025, pose a threat of increased borrowing costs for B. Riley. Any debt restructuring could also involve stricter covenants, potentially limiting strategic flexibility and operational maneuverability.

SWOT Analysis Data Sources

This B. Riley Financial SWOT analysis is built upon a foundation of robust data, including the company's official financial filings, comprehensive market research reports, and insights from industry experts. This multi-faceted approach ensures a thorough and accurate assessment of the firm's strategic position.