B. Riley Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B. Riley Financial Bundle

Navigate the complex external environment impacting B. Riley Financial. Our PESTLE analysis dives deep into political, economic, social, technological, legal, and environmental factors, revealing critical insights for your strategic planning. Don't guess; know. Download the full PESTLE analysis now and gain a decisive advantage.

Political factors

The upcoming US elections in late 2024 could signal a shift towards deregulation in the financial services sector by 2025. This potential policy change might ease certain compliance burdens for firms like B. Riley Financial, potentially impacting operational costs and strategic flexibility.

Leadership changes within federal agencies, a common outcome of US elections, could introduce new regulatory priorities. For instance, a shift in focus from stringent oversight to market-driven growth could alter the enforcement landscape, requiring B. Riley Financial to adapt its compliance strategies.

This evolving political environment introduces an element of uncertainty. Proactive engagement with regulatory bodies and robust scenario planning will be crucial for B. Riley Financial to navigate potential policy shifts effectively and maintain its competitive edge.

Geopolitical friction, particularly between major economies like the US and China, is a significant factor. This ongoing tension is expected to persist, potentially leading to new trade barriers and shifts in global economic alliances. For B. Riley Financial, this means a need to closely watch how these changes affect international investment flows and the revenue generated from its cross-border advisory and investment banking services.

Governments worldwide are increasingly leveraging the financial sector to drive national economic and social agendas. For instance, in 2024, many nations are implementing policies aimed at stimulating green finance and sustainable investments, potentially directing capital flows towards environmentally conscious projects. B. Riley Financial, like its peers, must navigate these evolving priorities, which could influence its investment strategies and the types of financial services it offers to align with government initiatives.

Fiscal Policy and Government Spending

Changes in fiscal policy and government spending significantly influence market liquidity and investment prospects. For example, increased government spending can potentially drive inflation and shape interest rate movements, thereby impacting B. Riley Financial's investment banking and wealth management divisions, as well as the performance of various asset classes.

In 2024, the U.S. federal deficit is projected to be around $1.9 trillion, a slight decrease from 2023 but still substantial. This level of fiscal activity directly affects the availability of capital for private sector investment and can influence borrowing costs for companies that B. Riley Financial serves.

- Government Spending Impact: Increased fiscal stimulus, like infrastructure spending initiatives, can boost economic activity and create opportunities in sectors where B. Riley Financial has expertise.

- Interest Rate Sensitivity: Higher government borrowing can contribute to upward pressure on interest rates, affecting the valuation of fixed-income assets and the cost of capital for clients.

- Inflationary Pressures: Expansive fiscal policies can contribute to inflation, which influences investment strategies and the attractiveness of different asset classes for wealth management clients.

State-Level Regulatory Activity

While federal regulatory changes often capture national attention, state legislatures are increasingly influential in shaping policy, particularly concerning emerging technologies like artificial intelligence. B. Riley Financial needs to closely track and adapt to this evolving, potentially fragmented, regulatory landscape across the various states where it conducts business or advises clients.

This state-level activity can introduce complexities, requiring tailored compliance strategies. For instance, as of early 2024, several states have introduced or are considering legislation related to data privacy and AI governance, creating a patchwork of rules that differ significantly from one jurisdiction to another.

- Fragmented AI Governance: States are proactively addressing AI, leading to diverse regulatory approaches.

- Data Privacy Variations: State-specific data privacy laws, such as those in California, New York, and Illinois, impact how financial data can be handled.

- Compliance Challenges: Navigating these differing state regulations presents a significant compliance hurdle for financial services firms.

The political landscape in 2024 and heading into 2025 presents a dynamic environment for financial services. Upcoming US elections could lead to deregulation, potentially easing compliance for firms like B. Riley Financial, while shifts in federal agency leadership may alter regulatory priorities. Geopolitical tensions, particularly between the US and China, are expected to persist, impacting global investment flows and B. Riley's cross-border operations.

Governments are increasingly directing capital towards national economic and social agendas, with a growing emphasis on green finance and sustainable investments as of 2024. Fiscal policies, including government spending and deficit levels, directly influence market liquidity and borrowing costs. For instance, the projected US federal deficit of around $1.9 trillion in 2024 affects capital availability and interest rates.

State-level legislative activity is also becoming more critical, especially concerning emerging technologies like AI. As of early 2024, differing state approaches to data privacy and AI governance create a complex regulatory patchwork that B. Riley Financial must navigate, requiring tailored compliance strategies across jurisdictions.

| Political Factor | Description | Impact on B. Riley Financial | Relevant Data/Trend (2024-2025) |

| Election Outcomes | Potential shifts in regulatory approach and economic policy. | Could influence compliance costs and strategic flexibility. | US Presidential Election scheduled for November 2024. |

| Geopolitical Tensions | Trade friction and evolving global alliances. | Affects international investment flows and cross-border revenue. | Ongoing US-China trade relations and potential tariffs. |

| Fiscal Policy | Government spending, deficits, and interest rate impacts. | Influences market liquidity, borrowing costs, and investment performance. | US Federal Deficit projected at $1.9 trillion for 2024. |

| State-Level Regulation | Fragmented rules on AI and data privacy. | Creates compliance complexities and requires localized strategies. | Multiple states introducing AI and data privacy legislation in 2024. |

What is included in the product

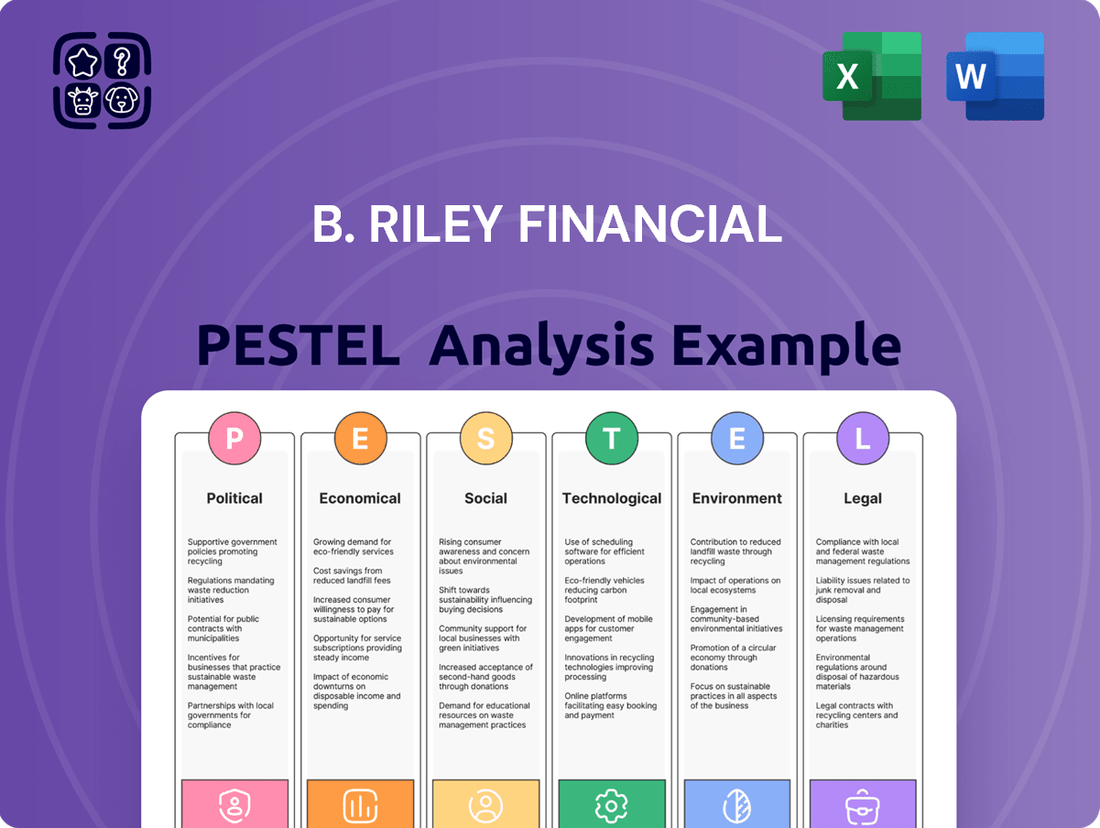

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting B. Riley Financial, providing actionable insights for strategic decision-making.

It offers a comprehensive view of external forces, enabling B. Riley Financial to identify and capitalize on opportunities while mitigating potential risks.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining discussions on external risks and market positioning for B. Riley Financial.

Economic factors

The financial services sector anticipates a subdued growth and interest rate landscape in 2025, with projections indicating a decline in rates. This environment presents both opportunities and challenges for firms like B. Riley Financial.

While inflation is expected to moderate, ongoing fiscal spending could sustain inflationary pressures. This might constrain central banks' ability to implement significant rate cuts, potentially leading to market uncertainty and impacting investment performance throughout 2024 and into 2025.

The United States economy is anticipated to see a slowdown in its Gross Domestic Product (GDP) growth throughout 2025, with projections indicating only modest expansion. This deceleration is a key economic factor to consider.

This anticipated economic cooling could translate into a more subdued environment for corporate deal-making, potentially reducing merger and acquisition (M&A) volumes. Consequently, B. Riley Financial's investment banking and business advisory services, which thrive on robust economic activity and transaction volumes, may experience a direct impact from this trend.

For instance, if the US GDP growth rate moderates to around 2.0% in 2025, as some forecasts suggest, this contrasts with the stronger growth seen in prior periods and could temper client appetite for large-scale advisory services or capital raises.

Consumer spending showed signs of moderation in late 2024 and early 2025. For instance, retail sales growth, a key indicator, slowed from an annualized rate of 3.5% in Q3 2024 to an estimated 1.8% in Q1 2025, reflecting cautious consumer behavior.

This trend is exacerbated by rising unemployment, which reached 4.2% by February 2025, up from 3.8% a year prior. Simultaneously, total household debt in the U.S. surpassed $17.5 trillion in Q4 2024, with credit card balances alone increasing by 15% year-over-year, signaling potential strain on economic expansion.

These conditions could impact the demand for wealth management services. As consumers and institutions navigate tighter financial conditions and potential economic slowdowns, investment strategies may shift towards more conservative approaches, influencing asset allocation and the uptake of advisory services.

Market Volatility and Investment Trends

Market expectations for 2025 are notably uncertain, with geopolitical shifts and policy adjustments poised to create significant volatility. This environment presents both challenges and opportunities for B. Riley Financial, demanding astute navigation to identify robust investment prospects amidst fluctuating conditions.

The firm's success in proprietary investments and client portfolio management will hinge on its capacity to adapt to these dynamic market movements. For instance, the S&P 500 experienced a notable increase in its realized volatility in early 2024 compared to the prior year, underscoring the potential for rapid price swings.

- Anticipated market volatility in 2025 due to geopolitical and policy uncertainty.

- B. Riley Financial's need to identify resilient investment opportunities.

- Impact on proprietary investments and client portfolio performance.

- Historical data showing increased market volatility in early 2024.

Wealth Management Growth Expectations

The wealth management industry is poised for robust growth, with projections indicating a substantial increase in assets under management (AUM) throughout 2025, even amidst prevailing economic uncertainties. This expansion is fueled by a dual engine: favorable market performance and proactive client acquisition and retention strategies implemented by financial firms.

B. Riley Financial's wealth management segment is well-positioned to capitalize on these trends. The sector's anticipated growth presents a clear opportunity for the firm to enhance its service offerings and client engagement, thereby expanding its market share.

- Projected AUM Growth: Industry forecasts suggest a healthy uptick in wealth management AUM for 2025, building on momentum from previous years.

- Client-Centric Strategies: Firms are increasingly focusing on personalized advice and digital solutions to attract and retain clients.

- Market Performance Impact: Positive market trends, when they occur, directly contribute to increased AUM and revenue for wealth managers.

Economic factors present a mixed outlook for B. Riley Financial in 2025. While a slowdown in GDP growth is anticipated, potentially impacting deal volumes, the firm's wealth management division is positioned for growth driven by increasing assets under management.

Consumer spending moderation and rising unemployment in early 2025, with retail sales growth slowing and unemployment reaching 4.2%, could affect demand for advisory services. This is compounded by a significant increase in household debt, exceeding $17.5 trillion by late 2024.

Market volatility, fueled by geopolitical uncertainty, is a key concern for 2025. For instance, the S&P 500's realized volatility saw an uptick in early 2024, highlighting the need for B. Riley Financial to identify resilient investment opportunities for both proprietary investments and client portfolios.

| Economic Indicator | Late 2024 / Early 2025 Projection | Impact on B. Riley Financial |

| US GDP Growth | Modest expansion (e.g., ~2.0%) | Potential slowdown in M&A and advisory services |

| Retail Sales Growth | Moderating (e.g., 1.8% annualized in Q1 2025) | Reduced consumer spending, impacting wealth management services |

| Unemployment Rate | Rising (e.g., 4.2% by Feb 2025) | Increased caution in investment decisions, potential impact on AUM |

| Household Debt | Exceeding $17.5 trillion (Q4 2024) | Potential strain on economic expansion and consumer financial health |

| Market Volatility | Anticipated increase due to geopolitical/policy shifts | Need for strategic navigation and identification of resilient investments |

Preview Before You Purchase

B. Riley Financial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of B. Riley Financial offers valuable insights into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a detailed understanding of the external forces shaping B. Riley Financial's strategic landscape.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a thorough examination of the opportunities and threats B. Riley Financial faces in its operating environment.

Sociological factors

Global demographic shifts are profoundly reshaping how people invest. In many Western nations, populations are aging, increasing demand for retirement-focused investments and healthcare services. For instance, by 2030, it's projected that 1 in 6 people globally will be over 65, a significant increase from 1 in 11 in 2015.

Conversely, other regions are experiencing a youth bulge, presenting different investment needs and economic challenges. This younger demographic often grapples with issues like student debt and the gig economy, requiring wealth management solutions that address financial instability and long-term savings goals.

B. Riley Financial, like other wealth management firms, must tailor its strategies to these evolving client needs. This means developing robust retirement planning tools for older clients while also offering accessible, flexible investment options for younger generations navigating economic uncertainty.

Societal demand for personalized financial services is surging, fueled by the widespread availability of big data and sophisticated analytics. This trend means clients increasingly expect financial solutions crafted specifically for their unique circumstances and aspirations. For instance, a 2024 survey indicated that 72% of consumers would switch financial providers for a more personalized experience.

B. Riley Financial is well-positioned to capitalize on this, leveraging advanced technologies to deliver bespoke investment strategies and financial guidance. By offering tailored advice that resonates with individual client goals, the firm can significantly boost customer engagement and satisfaction, differentiating itself in a competitive market.

The United States is experiencing a monumental intergenerational wealth transfer, with an estimated $84 trillion expected to pass from one generation to the next over the next two decades, according to Cerulli Associates. This seismic shift in asset ownership creates a significant opportunity for wealth management firms like B. Riley Financial.

This transfer will bring new affluent clients who will require specialized advice on estate planning, inheritance management, and sophisticated investment strategies. Firms that can effectively cater to the evolving needs and preferences of these younger, often more digitally inclined, inheritors are poised for substantial growth.

Growing Focus on Sustainable Business Models

Societal preferences are strongly shifting towards sustainability. Consumers and investors alike are increasingly favoring businesses that demonstrate a commitment to environmental, social, and governance (ESG) principles. This trend is not just a passing fad; it's reshaping market dynamics and investment strategies.

B. Riley Financial is well-positioned to capitalize on this shift. By emphasizing its own ESG initiatives and offering advisory services in sustainable finance, the company can bolster its reputation. This alignment with evolving societal values can attract capital from a growing pool of ESG-conscious investors.

- Investor Demand: Global sustainable investment assets reached $37.8 trillion in 2024, according to Morningstar data, indicating robust investor appetite for ESG-aligned opportunities.

- Consumer Preference: A 2024 Deloitte survey found that 73% of consumers consider sustainability a key factor when making purchasing decisions.

- B. Riley's Role: B. Riley's advisory services can guide clients through the complexities of ESG integration and sustainable finance, creating new revenue streams and reinforcing its market position.

Digital Adoption in Financial Interactions

The ongoing digital transformation is profoundly altering how people engage with financial services. By the end of 2024, it's estimated that over 80% of banking transactions will occur digitally. This trend necessitates that B. Riley Financial prioritizes robust and user-friendly digital platforms to cater to a client base that increasingly expects instant, online access to their financial needs.

This shift is not just about convenience; it's about meeting evolving client expectations. A significant portion of consumers, particularly younger demographics, now consider digital accessibility a primary factor when choosing a financial provider. For instance, a 2024 survey indicated that 75% of millennials and Gen Z prioritize mobile banking capabilities.

- Digital Engagement: Over 80% of banking transactions expected to be digital by end of 2024.

- Client Preference: 75% of millennials and Gen Z prioritize mobile banking.

- Service Delivery: B. Riley Financial must align its service models with these digital-first expectations.

- Competitive Landscape: Failure to adapt digitally could impact B. Riley Financial's market position.

Societal expectations for ethical business practices are growing, with a significant emphasis on Environmental, Social, and Governance (ESG) criteria. By 2024, global sustainable investment assets reached $37.8 trillion, demonstrating a strong investor preference for companies demonstrating social responsibility. B. Riley Financial can leverage this by integrating ESG principles into its advisory services and investment offerings, attracting a broader base of socially conscious investors and enhancing its corporate image.

The increasing demand for personalized financial advice is a key sociological factor. A 2024 survey revealed that 72% of consumers would switch providers for a more tailored experience. B. Riley Financial can capitalize on this by utilizing data analytics to offer bespoke investment strategies and financial planning, thereby increasing client engagement and loyalty in a competitive market.

The intergenerational wealth transfer in the U.S., estimated at $84 trillion over the next two decades, presents a substantial opportunity for wealth management firms. This shift necessitates specialized advice on estate planning and inheritance management for new affluent clients. Firms adept at serving digitally inclined inheritors are poised for significant growth.

The digital transformation continues to reshape client interaction with financial services, with over 80% of banking transactions expected to be digital by the end of 2024. B. Riley Financial must prioritize user-friendly digital platforms to meet client expectations, particularly among younger demographics who prioritize mobile banking capabilities, as 75% of millennials and Gen Z do.

Technological factors

The financial services sector is rapidly embracing artificial intelligence and automation, promising significant shifts in how firms operate and serve clients. By 2025, it's estimated that AI in financial services could reach a market size of over $25 billion, demonstrating its growing importance.

B. Riley Financial can leverage AI for enhanced deal analysis, personalized client recommendations, and more efficient risk assessment, potentially boosting operational efficiency. For instance, AI-powered tools can sift through vast datasets for investment banking, identifying opportunities that might otherwise be missed.

Strategic integration of these technologies across B. Riley's investment banking, advisory, and wealth management arms could lead to more sophisticated client offerings and streamlined back-office functions. This proactive adoption is crucial for maintaining a competitive edge in the evolving financial landscape.

The financial services industry, including firms like B. Riley Financial, faces escalating cyber threats. In 2024, the global cost of cybercrime is projected to reach $10.5 trillion annually, highlighting the critical need for enhanced cybersecurity investments.

B. Riley Financial must bolster its defenses with advanced threat detection and response systems to safeguard sensitive client data. This focus is crucial for maintaining client trust and ensuring compliance with an ever-growing landscape of data security regulations, which are becoming more stringent globally.

The financial technology (fintech) landscape, encompassing decentralized finance (DeFi), open banking initiatives, and the proliferation of digital-only banks, is fundamentally reshaping traditional financial services. This evolution presents both challenges and opportunities for established players like B. Riley Financial.

By strategically partnering with fintech innovators, B. Riley Financial can gain access to cutting-edge product development, enhance client engagement through streamlined digital interfaces, and bolster its competitive standing. Adapting to new financial infrastructure and data access models is crucial for remaining relevant in this rapidly changing environment. For instance, the global fintech market was projected to reach $332.5 billion in 2023 and is expected to grow significantly, highlighting the scale of this disruption.

Leveraging Big Data for Client Services

Big data analytics is fundamentally changing how financial firms interact with their clients. By processing vast amounts of information, companies like B. Riley Financial can move beyond generic services to highly personalized offerings. This allows for a deeper understanding of individual client needs and preferences, which is key in today's competitive wealth management landscape.

B. Riley Financial can leverage these extensive datasets to segment its client base with greater precision. This granular understanding enables the firm to anticipate client behavior, identify emerging trends, and proactively tailor product and service recommendations. For instance, analyzing transaction history and investment patterns can help in offering customized financial advice or investment vehicles, directly enhancing client satisfaction and retention.

The application of big data in wealth management and advisory services is already showing significant impact. According to industry reports from early 2024, firms effectively utilizing data analytics saw an average increase of 15% in client engagement metrics and a 10% uplift in personalized product adoption rates. This trend is expected to continue as technology advances.

- Enhanced Client Segmentation: Utilizing AI-driven analytics to categorize clients based on financial goals, risk tolerance, and life stages, leading to more relevant product offerings.

- Personalized Financial Solutions: Developing bespoke investment strategies and financial planning advice, informed by individual client data and market trends.

- Proactive Client Engagement: Identifying potential client needs or concerns before they arise through predictive analytics, fostering stronger relationships.

- Improved Customer Experience: Streamlining service delivery and communication channels based on client interaction data, boosting overall satisfaction.

Emerging Technologies: Blockchain and Quantum Computing

Blockchain technology continues to mature, offering enhanced security for data and transactions, which is crucial for financial services. This innovation underpins the growth of cryptocurrency markets and decentralized finance (DeFi) structures, areas B. Riley Financial can leverage for new product development and client services.

Quantum computing, though still in its early stages, holds immense potential for the financial sector. Its ability to process complex calculations could revolutionize portfolio optimization, leading to more efficient investment strategies. Furthermore, quantum computing is anticipated to bolster fraud detection capabilities, a critical aspect of risk management for firms like B. Riley Financial.

- Blockchain Adoption: The global blockchain market size was valued at USD 11.19 billion in 2023 and is projected to grow significantly, reaching an estimated USD 120.22 billion by 2030, according to some industry reports.

- DeFi Growth: Total value locked (TVL) in DeFi protocols reached a peak of over $200 billion in late 2021, demonstrating substantial user and capital engagement in these new financial structures.

- Quantum Computing Investment: Global investment in quantum computing research and development is steadily increasing, with significant funding from both governments and private enterprises, indicating a strong future outlook.

- Financial Applications: Early explorations into quantum computing for finance include optimizing trading strategies and improving risk modeling, with potential for substantial efficiency gains.

The rapid advancement of artificial intelligence and machine learning is transforming financial services, with AI in finance projected to exceed $25 billion by 2025, enhancing B. Riley Financial's capabilities in deal analysis and client personalization.

Cybersecurity remains a critical technological factor, as global cybercrime costs are expected to reach $10.5 trillion annually in 2024, necessitating robust defense systems for B. Riley Financial to protect client data and maintain trust.

Fintech innovation, including DeFi and open banking, is reshaping the industry, with the global fintech market reaching $332.5 billion in 2023, presenting opportunities for B. Riley Financial to partner and enhance digital offerings.

Big data analytics enables personalized client experiences, with data-driven firms seeing up to a 15% increase in client engagement, a trend B. Riley Financial can leverage for tailored wealth management solutions.

| Technology | 2024/2025 Projection/Status | Impact on B. Riley Financial |

|---|---|---|

| Artificial Intelligence | Market size over $25 billion by 2025 | Enhanced deal analysis, personalized client recommendations, improved risk assessment |

| Cybersecurity | Global cybercrime costs projected at $10.5 trillion annually in 2024 | Need for advanced threat detection, safeguarding client data, maintaining trust |

| Fintech | Global market size $332.5 billion in 2023 | Opportunities for partnerships, digital interface enhancement, competitive standing |

| Big Data Analytics | Firms using data analytics see up to 15% increase in client engagement | Granular client segmentation, proactive engagement, tailored financial advice |

Legal factors

The financial services sector is characterized by a constantly shifting regulatory landscape, with continuous reforms and new mandates. B. Riley Financial, like its peers, must diligently track and adhere to evolving rules concerning capital adequacy, anti-money laundering, and other financial crime prevention measures. Failure to adapt compliance strategies can lead to significant penalties and jeopardize operational stability.

A key challenge for B. Riley Financial has been maintaining timely submissions to the Securities and Exchange Commission (SEC). The company received extensions from Nasdaq for its 2024 Annual Report and its first quarter 2025 Quarterly Report, highlighting the complexities and pressures of current regulatory compliance timelines.

Regulatory bodies are intensifying scrutiny on Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) programs, with a particular emphasis on modernization. B. Riley Financial must ensure its customer due diligence (CDD) and Know Your Customer (KYC) procedures are exceptionally robust to align with anticipated 2025 regulatory updates aimed at combating financial crimes.

The Financial Crimes Enforcement Network (FinCEN) continues to emphasize the importance of effective AML programs, with a significant portion of enforcement actions in 2024 stemming from deficiencies in these areas. Failure to adapt to evolving regulations could lead to substantial fines and reputational damage for B. Riley Financial.

Data privacy regulations are a significant legal factor for B. Riley Financial. Evolving laws like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) mandate strict protocols for handling customer data. For instance, the GDPR, implemented in 2018, introduced hefty fines, up to 4% of global annual revenue, for non-compliance, setting a precedent for data protection worldwide.

B. Riley Financial must therefore maintain robust data governance. This includes implementing advanced data encryption and secure storage solutions to safeguard sensitive client information. Failure to comply can lead to substantial penalties and reputational damage, impacting client trust and business operations.

Impact of Judicial Decisions and Legal Challenges

Legal challenges against regulatory overreach, particularly concerning capital requirements and fiduciary duties, can significantly shape the operational landscape for financial institutions like B. Riley Financial. For instance, ongoing litigation in 2024 and 2025 related to the interpretation of certain SEC or FINRA rules could lead to revised enforcement priorities or even legislative adjustments, directly impacting compliance costs and business models.

B. Riley Financial must remain acutely aware of these evolving legal precedents. Court decisions, such as those impacting how client assets are managed or how advisory fees are structured, can create ripple effects across the industry. A favorable ruling for a financial firm in one jurisdiction might set a precedent that influences future regulatory interpretations nationwide, potentially reducing B. Riley's compliance burden or, conversely, increasing it if the outcome is less favorable.

- Regulatory Interpretation Shifts: Court rulings in 2024-2025 may redefine the boundaries of existing financial regulations, impacting B. Riley's compliance strategies.

- Impact on Business Practices: Legal challenges could alter how B. Riley conducts its advisory services, underwriting, or asset management operations.

- Future Policy Influence: Outcomes of key legal battles can inform future regulatory proposals and enforcement actions by bodies like the SEC and FINRA.

International Reporting Standards and Digital Signage

The financial industry is navigating significant shifts in international reporting standards, with ISO 20022 for wire transactions becoming a key driver for system upgrades. This global standard mandates enhanced interoperability and data richness, impacting how financial institutions like B. Riley Financial manage cross-border transactions. By 2025, many major payment systems will be fully compliant, necessitating substantial investment in IT infrastructure for seamless data exchange.

Furthermore, regulatory bodies are increasingly focusing on the digital footprint of financial institutions. For instance, rules requiring specific digital signage, such as FDIC signage on online platforms, are now in effect. This means B. Riley Financial must ensure its digital interfaces accurately reflect compliance and regulatory information, a process that began in earnest in 2024 and continues to evolve, demanding constant vigilance in adapting digital presence to meet stringent legal requirements.

- ISO 20022 Adoption: Mandatory compliance for wire transactions is driving significant IT modernization efforts across the global financial sector, with widespread adoption expected by 2025.

- Digital Signage Compliance: Financial institutions are required to update their digital platforms to include necessary regulatory signage, such as FDIC notices, impacting online user experience and compliance protocols.

- Interoperability Gains: New standards aim to improve data robustness and system interoperability, potentially streamlining operations and reducing errors in financial reporting and transactions.

The evolving legal landscape demands constant adaptation from B. Riley Financial, particularly concerning regulatory interpretation shifts and their impact on business practices. Court rulings throughout 2024 and into 2025 are actively reshaping the boundaries of financial regulations, influencing compliance strategies and potentially altering how the firm conducts its core operations.

Environmental factors

Environmental, Social, and Governance (ESG) investing is no longer a niche strategy; it's a significant force shaping corporate decisions, including mergers, acquisitions, and how companies are valued. This shift means B. Riley Financial can leverage its expertise to assist clients in navigating ESG regulations and finding opportunities within the growing sustainable finance sector. Indeed, institutional investments focused on ESG principles are anticipated to experience substantial growth, with some projections indicating global ESG assets could reach $50 trillion by 2025.

Governments and regulatory bodies worldwide, including those in the United States, are increasingly focusing on climate-related financial risk management for major financial institutions. For instance, the Securities and Exchange Commission (SEC) has proposed rules requiring enhanced climate-related disclosures, aiming to provide investors with more consistent and comparable information on climate risks. This regulatory push underscores the growing expectation for firms to proactively manage these evolving financial exposures.

B. Riley Financial, like its peers, must integrate climate risk considerations across its operations. This involves embedding these factors into its governance structures, strategic planning processes, and overall risk management frameworks. By doing so, the firm can better align with regulatory expectations and, crucially, assist its diverse client base in navigating and managing their own environmental risks, thereby enhancing resilience and identifying potential opportunities.

Effective climate risk management for a firm like B. Riley Financial means not only adapting its internal processes but also developing capabilities to advise clients on climate-related financial impacts. This could involve assessing physical risks to assets, transition risks associated with shifting to a lower-carbon economy, and the potential financial implications for various sectors. As of early 2024, the financial services industry is actively exploring new tools and methodologies to quantify and report on these risks, reflecting a significant shift in financial risk assessment.

The EU's Corporate Sustainability Reporting Directive (CSRD) is now coming into effect, mandating extensive reporting on environmental and social risks for large corporations. This directive extends its reach to non-EU parent companies with significant operations or subsidiaries within the European Union, potentially influencing B. Riley Financial's client base and its own international operational footprint.

The CSRD's broad scope means that companies, including those B. Riley Financial advises or invests in, will need to disclose detailed information on their sustainability performance. For instance, by 2025, over 50,000 companies will be subject to these new reporting standards, a significant increase from the roughly 11,700 companies covered by previous rules, indicating a substantial shift in disclosure requirements across the global financial landscape.

Demand for Sustainable Finance Solutions

The growing global emphasis on climate change is significantly boosting the demand for sustainable finance solutions. This includes a surge in interest for instruments like green bonds and investments directed towards environmentally conscious projects. For instance, the global sustainable bond market reached an estimated $1.7 trillion in 2023, with projections for continued robust growth through 2025.

B. Riley Financial is well-positioned to capitalize on this trend by acting as a facilitator for these crucial investments. The firm can offer expertise in guiding clients on allocating capital towards sustainable initiatives, thereby meeting both financial objectives and environmental, social, and governance (ESG) mandates.

- Growing Market: The sustainable finance market is expanding rapidly, driven by investor and regulatory pressures.

- Investment Opportunities: Increased demand for green bonds and ESG-focused funds presents new avenues for capital deployment.

- B. Riley's Role: The firm can leverage its financial advisory services to connect investors with sustainable projects and businesses.

Environmental Regulations and Operational Impact

While B. Riley Financial operates in financial services, broader environmental regulations can indirectly affect its business by influencing the industries it invests in or advises. For instance, stricter emissions standards or mandates for sustainable practices can reshape operational costs and investment attractiveness for companies in sectors like energy, manufacturing, or real estate. This necessitates a keen understanding of evolving environmental legislation to accurately gauge the environmental risks and opportunities present within B. Riley's proprietary investment portfolio.

Furthermore, for their business advisory services, staying abreast of these environmental shifts is paramount. As of early 2024, the global push towards net-zero emissions continues to drive significant regulatory changes. For example, the EU's Carbon Border Adjustment Mechanism (CBAM) is set to impact trade for many industries, potentially altering supply chains and investment strategies for companies B. Riley might engage with. This regulatory landscape requires B. Riley to offer comprehensive advice that accounts for these environmental factors.

- Increased Compliance Costs: Companies in B. Riley's portfolio may face higher operational expenses due to new environmental compliance requirements, potentially impacting profitability and investment valuations.

- Shift in Investment Opportunities: The regulatory environment can accelerate the growth of green technologies and sustainable businesses, creating new investment avenues while potentially diminishing returns in traditional, less environmentally friendly sectors.

- Reputational Risk Management: For B. Riley and its clients, failure to address environmental concerns can lead to reputational damage, affecting customer loyalty and investor confidence.

- ESG Integration: Financial institutions, including B. Riley, are increasingly integrating Environmental, Social, and Governance (ESG) factors into their investment analysis and advisory services, reflecting growing investor demand for sustainable investments.

The increasing focus on climate change and sustainability continues to shape financial markets and regulatory landscapes. B. Riley Financial must navigate evolving environmental regulations and capitalize on the growing demand for sustainable finance solutions.

The global sustainable bond market reached an estimated $1.7 trillion in 2023, with projections for continued robust growth through 2025, highlighting significant investment opportunities. As of early 2024, the financial services industry is actively exploring new tools to quantify and report on climate-related financial risks, reflecting a significant shift in risk assessment practices.

The EU's Corporate Sustainability Reporting Directive (CSRD) is expanding disclosure requirements, with over 50,000 companies expected to be subject to its standards by 2025. This regulatory shift necessitates that companies, including those B. Riley advises, integrate environmental factors into their strategies and reporting to manage compliance costs and maintain investor confidence.

| Environmental Factor | Impact on B. Riley Financial | Data/Trend (2024/2025 Focus) |

|---|---|---|

| Sustainable Finance Market Growth | Opportunities for advisory and capital allocation services. | Global sustainable bond market: ~$1.7 trillion in 2023, projected continued growth through 2025. |

| Climate-Related Disclosure Regulations (e.g., SEC, CSRD) | Increased compliance burden for clients; need for advisory on risk management. | Over 50,000 companies to be CSRD-compliant by 2025; SEC proposing enhanced climate disclosures. |

| Shift to Net-Zero Economy | Potential impact on investment valuations in traditional sectors; growth in green technologies. | Global push towards net-zero emissions driving regulatory changes (e.g., EU's CBAM). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for B. Riley Financial is grounded in comprehensive data from leading financial news outlets, regulatory filings, and economic forecasting agencies. We integrate insights from government reports, industry-specific publications, and market research firms to ensure a robust understanding of the macro-environment.