B. Riley Financial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B. Riley Financial Bundle

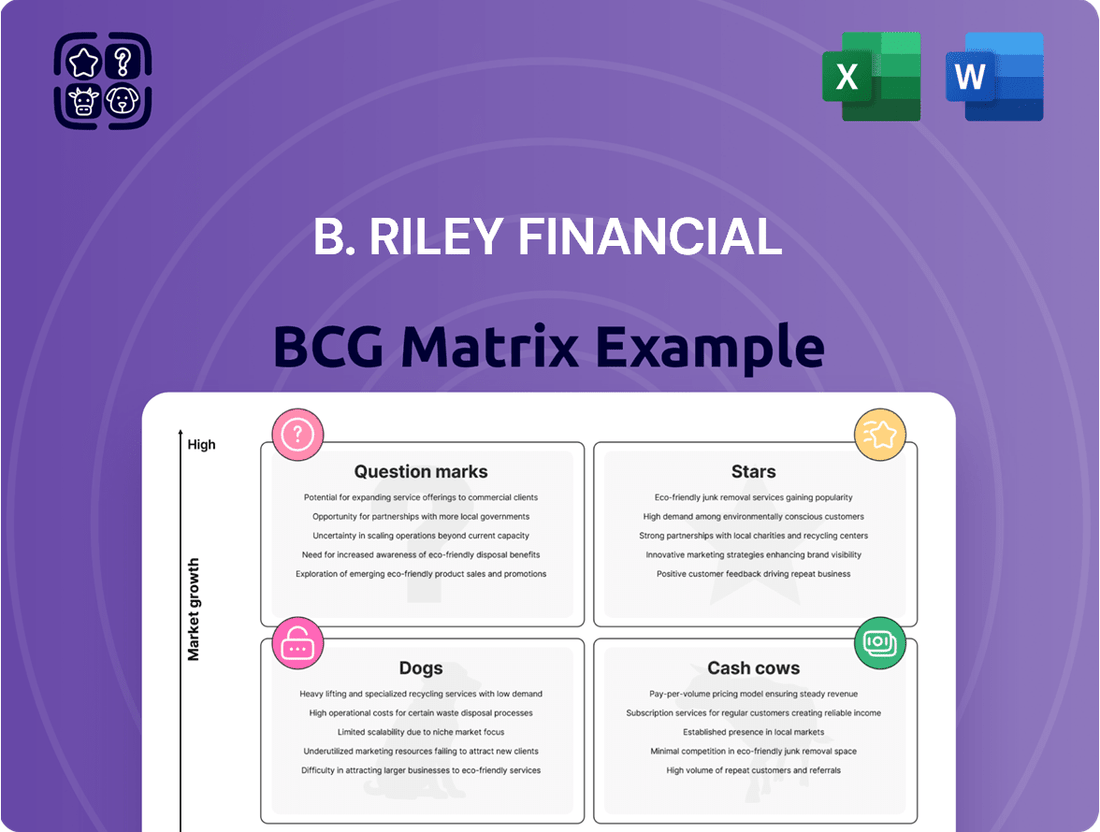

Curious about B. Riley Financial's strategic product portfolio? This glimpse into their BCG Matrix highlights key areas of opportunity and potential challenges. Imagine understanding precisely where their offerings fit as Stars, Cash Cows, Dogs, or Question Marks.

Unlock the full potential of this analysis by purchasing the complete B. Riley Financial BCG Matrix. Gain actionable insights, detailed quadrant breakdowns, and a clear roadmap to optimize your own investment and product strategies.

Don't just guess; know. Equip yourself with the comprehensive B. Riley Financial BCG Matrix report, complete with data-backed recommendations and visual mapping, to drive informed decisions and achieve market dominance.

Stars

B. Riley Securities, the investment banking division of B. Riley Financial, concluded 2024 with a particularly strong December, showcasing significant momentum. This segment is a recognized leader in bankruptcy and out-of-court restructuring advisory, consistently appearing in top league tables, reflecting its active role in a market that, while cyclical, is experiencing growth.

The firm has clearly signaled its commitment to expanding this crucial team, planning to allocate additional resources in the upcoming quarters. This strategic investment underscores the perceived value and future potential of B. Riley Securities within the broader B. Riley Financial structure.

Financial Advisory Services, a cornerstone of B. Riley Financial, is strategically positioned for significant expansion, especially within the small and mid-cap sectors. This focus aligns with the company's commitment to its core operating businesses, indicating sustained investment in these high-potential advisory functions.

Institutional brokerage acts as a crucial component within B. Riley's capital markets operations, directly benefiting from the firm's robust engagement in investment banking and trading activities. This synergy suggests a strong performance trajectory for the brokerage segment, closely tied to the growth observed in these complementary areas.

While B. Riley does not publicly break out specific growth figures for its institutional brokerage alone, its integration within the broader capital markets segment, which saw revenue growth in recent periods, indicates its contribution. For instance, B. Riley's total revenue for the first quarter of 2024 was $240.6 million, a notable increase from the previous year, underscoring the health of its interconnected financial services.

The firm's strategic focus on its core financial services, including institutional brokerage, ensures continued investment and enhancement of these capabilities. This commitment allows B. Riley to effectively serve a diverse clientele, ranging from institutional investors to corporations seeking expert financial guidance and execution.

Corporate Restructuring Advisory

B. Riley's corporate restructuring advisory services have demonstrated robust performance, consistently securing high rankings in industry league tables for both bankruptcy and out-of-court restructurings throughout Q1 and Q2 2024. This strong market presence highlights their significant share in a critical advisory segment, particularly relevant during periods of economic fluctuation or corporate financial strain.

The firm's established expertise in navigating complex restructuring scenarios positions them as a leader, attracting substantial engagements. This leadership contributes to their placement in the Stars quadrant of the BCG Matrix, signifying high growth and high market share within this specialized financial service.

- High Rankings in League Tables: B. Riley's restructuring advisory consistently placed among the top firms in Q1 and Q2 2024 for both bankruptcy and out-of-court restructurings.

- Market Share Indicator: These rankings suggest a strong market share in a sector experiencing increased activity during economic shifts.

- Leadership Position: The firm's deep expertise allows it to maintain a leading role in complex financial advisory services.

- BCG Matrix Placement: This strong performance and market leadership contribute to B. Riley's positioning in the Stars quadrant.

Strategic Focus on Core Businesses

B. Riley Financial is strategically concentrating on its core financial services, aiming for significant expansion in these sectors. This pivot follows a phase of selling off non-essential assets, with management identifying substantial growth potential, particularly within the small- and mid-cap markets.

The company's foundational services, such as investment banking and advisory, are now positioned as the primary drivers of future growth. This renewed emphasis highlights a clear intent to leverage these established strengths.

- Core Business Growth: Management expects high growth from investment banking and advisory services.

- Market Focus: Strategy targets opportunities in small- and mid-cap markets.

- Asset Monetization: Recent asset sales support this strategic refocusing.

- Future Outlook: Core services are seen as the future engine of the company.

B. Riley's restructuring advisory services are firmly positioned as Stars in the BCG matrix, demonstrating both high growth and high market share. This is evidenced by their consistent top rankings in league tables for bankruptcy and out-of-court restructurings throughout the first half of 2024. Their deep expertise in complex financial situations allows them to capture significant market share in a sector that often sees increased activity during economic shifts.

| Financial Service | BCG Quadrant | Key Performance Indicators (H1 2024) | Growth Potential | Market Share |

|---|---|---|---|---|

| Restructuring Advisory | Stars | Top league table rankings in bankruptcy and out-of-court restructurings | High | High |

What is included in the product

Strategic assessment of B. Riley Financial's business units across the BCG Matrix.

B. Riley Financial's BCG Matrix offers a clear, visual assessment of business unit performance, alleviating the pain of strategic uncertainty.

Cash Cows

B. Riley's Appraisal and Valuation Services, operating under Great American Group, is a clear cash cow. The company has been in discussions to sell a majority stake, with the business valued at around $380 million. This substantial valuation underscores its consistent profitability and strong market position.

The recent joint venture with Oaktree Capital Management, which brought in $203 million in cash, further highlights the financial strength and cash-generating capacity of this segment. Even with partial monetization, its significant enterprise value and proven historical returns firmly place it in the cash cow category within B. Riley's portfolio.

B. Riley Financial's brand assets portfolio, encompassing brands like Hurley, Justice, and bebe, clearly fits the Cash Cow quadrant of the BCG Matrix. The company's successful October 2024 transaction, which generated $236 million in cash, underscores this.

This strategic sale highlights B. Riley's proficiency in managing and monetizing mature assets. Having acquired these brands for around $222 million and receiving $179 million in distributions, the company demonstrated a strong return on investment and the ability to extract significant cash flow from this segment.

The substantial capital raised from this divestiture serves a crucial purpose: deleveraging the company's balance sheet, a hallmark of a well-managed cash cow contributing to overall financial stability.

B. Riley's Auction and Liquidation Services are a cornerstone of their business, often working hand-in-hand with appraisal and valuation. These services are designed to generate consistent revenue, making them a reliable income source for the company. Their expertise in handling distressed assets is particularly valuable, a niche where B. Riley has built a significant presence.

The consistent performance of these liquidation operations, contributing to B. Riley's profitability without demanding substantial new investment, firmly places them in the cash cow category. This stability is a key factor in their overall financial strategy.

Independent Wealth Management Advisors

B. Riley Financial's independent wealth management advisors, numbering around 190, alongside 90 tax professionals, represent a significant cash cow. This segment, explicitly retained after a portion of their W-2 wealth management business was divested, likely holds a dominant position in its niche, generating consistent fee-based revenue. These advisors typically serve long-standing client relationships, ensuring a predictable and stable income stream within a mature market segment.

The retention of these independent advisors highlights their value as a core, cash-generating asset for B. Riley. Their established client bases are crucial for maintaining consistent revenue, especially in a market where client loyalty and trust are paramount. This focus on independent advisors suggests a strategic emphasis on high-margin, recurring revenue streams that contribute significantly to the company's overall financial health.

- Stable Revenue Generation: Approximately 190 independent advisors and 90 tax professionals contribute predictable fee-based income.

- High Market Share Component: This retained segment likely represents a strong, stable presence in its wealth management offerings.

- Established Client Bases: Advisors' long-term client relationships ensure consistent revenue flow in a mature market.

- Strategic Retention: B. Riley's decision to keep this segment underscores its importance as a reliable cash generator.

Established Financial Consulting Services

B. Riley's established financial consulting services, a core component of its diversified platform, function as a classic cash cow within the BCG matrix. These offerings go beyond transactional advice, addressing the ongoing financial needs of clients and generating predictable, fee-based revenue streams.

The company's long-standing presence and deep client relationships in this segment translate into robust profit margins and consistent cash flow. This stability means the consulting services require minimal new investment for market expansion, allowing them to be a reliable source of funds for other business areas.

- Established Client Base: B. Riley benefits from a loyal clientele that relies on its expertise for continuous financial guidance.

- Consistent Fee Income: The recurring nature of consulting engagements provides a predictable revenue stream, enhancing financial stability.

- High Profitability: Mature services with established processes and strong client relationships typically yield higher profit margins.

- Low Investment Needs: Unlike growth-oriented business units, these cash cows require limited capital for expansion or innovation.

B. Riley's Auction and Liquidation Services are a reliable income source, generating consistent revenue. Their expertise in distressed assets is a key differentiator, solidifying their market presence. These operations contribute to profitability without requiring substantial new investment, fitting the cash cow profile.

| Service Area | BCG Quadrant | Key Characteristics | Supporting Data (Illustrative) |

|---|---|---|---|

| Auction & Liquidation | Cash Cow | Consistent revenue, low investment needs, expertise in distressed assets | Contributes significantly to overall profitability without requiring major capital infusion. |

Full Transparency, Always

B. Riley Financial BCG Matrix

The B. Riley Financial BCG Matrix preview you are viewing is the identical, fully polished document you will receive immediately after purchase. This means you get the complete strategic analysis without any watermarks or sample data, ensuring you have the exact professional-grade report ready for your business planning needs.

Dogs

B. Riley's proprietary investments, notably its stake in Franchise Group (FRG), have been a significant drag on its financial performance. These investments have led to substantial non-cash losses, write-downs, and trading losses, directly impacting the company's bottom line.

The bankruptcy of Franchise Group in November 2024 was a major blow, resulting in hundreds of millions of dollars in losses for B. Riley. This segment has not only consumed considerable cash but has also negatively affected the firm's overall financial results.

Given these outcomes, B. Riley's involvement with Franchise Group clearly positions it as a 'Dog' within the BCG framework. The company is actively shifting its strategic focus away from this area, signaling a move towards divesting or de-emphasizing these problematic assets.

B. Riley Financial's decision to divest its traditional (W-2) wealth management business, as announced in November 2024, positions this segment as a potential ‘Dog’ in the BCG matrix. This move, with the sale to Stifel Financial Corp. expected to finalize in early 2025, signals a strategic shift away from an area facing significant market disruption and intense competition.

The divestiture implies that this specific wealth management arm likely held a low market share and exhibited limited growth prospects, making it an underperforming asset. By shedding this business, B. Riley aims to streamline its operations and focus resources on more promising or strategically aligned ventures within its broader portfolio.

B. Riley Financial has been strategically divesting non-core assets, a move that directly impacts its position within the BCG matrix. This proactive monetization effort, aimed at debt reduction and balance sheet enhancement, signals that these particular holdings were likely underperforming.

The company's focus on shedding assets that were not contributing meaningfully to returns or growth suggests these legacy non-core assets were operating as cash traps or dogs. For instance, in the first quarter of 2024, B. Riley Financial reported a significant reduction in its principal investments portfolio, a clear indicator of this divestiture strategy in action.

Businesses Impacted by Impairment Charges

B. Riley Financial's preliminary Q4 2024 results revealed substantial estimated impairment charges on goodwill and intangible assets, projected to be between $73 million and $79 million. These charges signify a downward adjustment in the book value of certain assets, suggesting that the underlying businesses are not performing as anticipated or have a less optimistic future outlook.

These impairment charges are a clear indicator of businesses that are struggling to meet performance expectations.

- Impairment Charges: B. Riley estimates $73 million to $79 million in impairment charges for Q4 2024.

- Asset Value Reduction: These charges reflect a decrease in the carrying value of goodwill and intangible assets.

- Underperformance Signal: Impairments typically point to businesses not generating expected returns.

- Potential Restructuring: Such situations often precede asset write-offs or business restructuring.

Areas Under SEC Investigation

B. Riley Financial faces significant operational headwinds due to an ongoing Securities and Exchange Commission (SEC) investigation. This probe centers on the company's transactions with Franchise Group and a personal loan extended to its chairman, Bryant Riley. While B. Riley is cooperating fully, such investigations inherently demand considerable management focus and can lead to substantial legal expenses.

The uncertainty surrounding the SEC investigation places B. Riley's associated business lines in a precarious position within the BCG matrix, likely categorizing them as Dogs. These segments are consuming valuable resources and management attention without a clear path to positive returns, potentially hindering growth in other, more promising areas of the business.

For instance, the Franchise Group acquisition, which was a significant transaction for B. Riley in 2023, is now under scrutiny. The financial implications of the investigation, including potential fines or sanctions, could negatively impact B. Riley's financial stability and investor confidence.

- SEC Investigation: Focuses on Franchise Group dealings and a personal loan to Chairman Bryant Riley.

- Operational Impact: Diverts management attention and incurs substantial legal fees.

- Client Confidence: Potential for negative outcomes could erode trust and new business.

- Resource Drain: Segments under investigation consume resources without clear positive returns.

B. Riley Financial's involvement with Franchise Group (FRG) has definitively placed it in the 'Dog' category of the BCG matrix. The bankruptcy of Franchise Group in November 2024 resulted in hundreds of millions of dollars in losses for B. Riley, significantly impacting its financial performance through non-cash losses and write-downs. This strategic misstep has consumed considerable cash and negatively affected the firm's overall results, prompting a shift away from these problematic assets.

The divestiture of its traditional wealth management business in November 2024, sold to Stifel Financial Corp. for an undisclosed sum with completion expected in early 2025, also signals a 'Dog' classification. This segment likely had a low market share and limited growth prospects, making it an underperforming asset that B. Riley is shedding to streamline operations and focus on more promising ventures.

Furthermore, B. Riley's preliminary Q4 2024 results indicated estimated impairment charges on goodwill and intangible assets ranging from $73 million to $79 million. These charges suggest that certain underlying businesses are struggling to meet performance expectations, further reinforcing the 'Dog' classification for these underperforming segments.

The ongoing SEC investigation into B. Riley's transactions with Franchise Group and its chairman's personal loan places associated business lines as 'Dogs'. This probe demands significant management attention and legal expenses, consuming valuable resources without a clear path to positive returns and potentially hindering growth in other areas.

Question Marks

B. Riley Financial's stated pivot from asset monetization to a renewed focus on its core financial services operating businesses signals a strategic shift toward aggressive expansion. This move suggests new initiatives are being implemented to drive growth, particularly in areas like middle-market investment banking and advisory services.

These growth initiatives are currently in their early phases following recent divestitures. The company is targeting high growth in these core segments, aiming to build market share and enhance profitability. However, the full impact and success of these strategies are still developing.

For instance, B. Riley's middle-market investment banking segment has shown promise, with the company reporting a significant increase in advisory fees in recent quarters. As of Q1 2024, advisory fees grew by over 20% year-over-year, indicating early traction for these growth-focused strategies.

B. Riley Financial's strategy of opportunistic acquisitions means they are likely eyeing or actively pursuing new ventures. These potential targets, while small in current market share, are selected for their significant growth potential, fitting the profile of question marks in a BCG matrix.

For instance, in 2023, B. Riley completed several acquisitions, including that of National Property REIT Corp. While specific future undisclosed acquisitions are not public, the company's stated intent suggests a continuous pipeline of such opportunities. The success of these new integrations will dictate whether they become future stars or falter into dogs within B. Riley's diversified portfolio.

B. Riley's affiliates are active in originating and underwriting senior secured loans for asset-rich companies. This existing capability presents an opportunity for significant expansion or intensification within the direct lending space.

A strategic decision to substantially grow B. Riley's direct lending arm would necessitate considerable investment to gain a larger foothold in what is a competitive, yet promising, high-growth lending market. For instance, the direct lending market experienced robust growth, with global AUM reaching an estimated $1.4 trillion by the end of 2023, according to industry reports.

Given these considerations, particularly in conjunction with recent debt reduction initiatives by B. Riley, an intensified focus on direct lending would strategically position this segment as a 'Question Mark' within the BCG framework. This classification acknowledges the potential for high growth and the need for strategic investment to capitalize on market opportunities.

Expansion in Specific Niche Financial Markets

B. Riley Financial, known for its broad financial services, might strategically focus on expanding within specific, high-growth niche financial markets. These could include areas like alternative lending platforms, specialized ESG (Environmental, Social, and Governance) investment advisory, or unique digital asset management services where its current footprint is relatively small.

These ventures would initially represent a low market share but possess significant potential for rapid expansion. For instance, the global fintech market was projected to reach over $2.1 trillion by 2023, indicating substantial growth opportunities. Similarly, the sustainable investing market saw significant inflows, with ESG funds attracting billions in 2024, highlighting the demand for specialized advisory services.

- Fintech Adoption: Continued growth in digital payment solutions and blockchain-based financial services offers fertile ground for B. Riley's expansion.

- Specialized Asset Management: The increasing investor focus on impact investing and thematic funds creates opportunities in niche asset management.

- Boutique Advisory Services: Demand for highly specialized advice in areas like cybersecurity risk management or complex M&A for emerging industries is on the rise.

Re-energized Focus on Small- and Mid-Cap Market Opportunities

Bryant Riley, Chairman and Co-CEO of B. Riley Financial, has highlighted a significant growth potential within the small- and mid-cap markets, signaling a strategic shift towards these segments. This renewed emphasis suggests a proactive approach to capitalize on opportunities that may have been previously underserved or overlooked.

B. Riley's historical involvement in the small- and mid-cap space could be amplified by a more aggressive strategy, potentially involving substantial capital allocation and targeted business development efforts. The firm's ability to execute on this intensified focus will be a key determinant of its success.

- Market Opportunity: Small- and mid-cap companies often represent a dynamic and less efficient segment of the market, offering potential for higher alpha generation.

- Capital Deployment: A re-energized focus could see B. Riley deploying more capital through its various business lines, including investment banking, research, and principal investments, to support these companies.

- Strategic Initiatives: This could involve expanding advisory services, increasing research coverage, or making direct investments in promising small- and mid-cap enterprises.

- Future Trajectory: The ultimate success of this strategy will position B. Riley's presence in the small- and mid-cap arena as either a dominant force or a segment requiring further strategic refinement.

B. Riley Financial's strategic expansion into niche, high-growth financial markets like fintech and specialized advisory services positions these ventures as potential Question Marks. These areas, while currently holding a smaller market share for the company, exhibit significant growth potential, mirroring the characteristics of a BCG Question Mark. Success hinges on strategic investment and the ability to capture market share.

| Segment Focus | Current Market Share | Growth Potential | BCG Classification | Strategic Imperative |

|---|---|---|---|---|

| Fintech Adoption | Relatively Small | High (Global market projected over $2.1 trillion by 2023) | Question Mark | Invest for market penetration |

| Specialized Asset Management (ESG) | Low | High (Billions attracted in 2024) | Question Mark | Develop targeted investment products |

| Boutique Advisory Services (Cybersecurity) | Limited | Significant (Rising demand) | Question Mark | Build specialized expertise |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive financial disclosures, proprietary market research, and industry growth forecasts to provide a data-driven strategic overview.