B. Riley Financial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B. Riley Financial Bundle

Unlock the strategic blueprint behind B. Riley Financial's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their diverse revenue streams, key partnerships, and customer relationships, offering a clear view of their operational excellence. Discover how they effectively deliver value across their financial services spectrum.

Partnerships

B. Riley Financial cultivates strategic alliances with other financial firms to broaden its service portfolio and access new markets without the commitment of a full acquisition. These collaborations are vital for delivering integrated solutions, especially in financial advisory and capital raising, effectively extending the company's reach and capabilities.

These alliances allow B. Riley to offer a more comprehensive suite of services to its clients, enhancing its competitive edge. For instance, in 2024, B. Riley expanded its wealth management services through a strategic partnership, aiming to capture a larger share of the growing independent advisor market.

B. Riley Financial cultivates crucial relationships with financial institutions and lenders to facilitate capital provision and the syndication of deals. These partnerships are essential for securing financing for both the company's operations and its clients' transactions, underpinning its investment banking and direct lending endeavors.

In 2024, B. Riley continued to leverage its network of senior lenders to manage existing debt facilities and actively explore opportunities for optimizing its capital structure. This strategic engagement ensures access to diverse funding sources, critical for executing complex financial transactions and supporting client growth initiatives.

B. Riley strategically partners with professional service firms, including leading legal, accounting, and consulting entities. These collaborations are crucial for delivering comprehensive solutions, particularly in intricate situations such as corporate restructuring, litigation support, and forensic accounting. For instance, B. Riley's investment banking division often works alongside law firms on distressed debt advisory mandates, leveraging specialized legal expertise to navigate complex bankruptcies and out-of-court restructurings.

These alliances enable B. Riley to offer clients a more integrated and complete service, especially when they are navigating critical business challenges that span various stages of their lifecycle. By tapping into the specialized knowledge of these external partners, B. Riley effectively augments its own robust in-house capabilities, ensuring clients receive end-to-end support for multifaceted financial and operational needs.

Acquired Entities and Subsidiaries

B. Riley Financial strategically expands its capabilities through the acquisition of complementary businesses. For instance, the acquisition of FocalPoint Financial, a middle-market M&A advisory firm, bolstered its investment banking services. Similarly, acquiring GlassRatner enhanced its restructuring and financial advisory offerings.

These integrations are crucial for diversifying revenue streams and bringing in specialized expertise. While some acquired assets might be monetized, the core value lies in the expanded platform and client reach. This approach fuels B. Riley's growth and strengthens its market position across various financial services sectors.

- Strategic Acquisitions: B. Riley has integrated companies like FocalPoint and GlassRatner to enhance its M&A and restructuring advisory services.

- Platform Expansion: These acquisitions broaden B. Riley's service offerings and client base.

- Diversified Revenue: The integration of acquired entities contributes to a more diversified revenue model.

- Growth Strategy: Acquisitions are a cornerstone of B. Riley's overall growth and diversification strategy.

Private Equity Firms and Investment Funds

B. Riley Financial cultivates strategic alliances with private equity firms and diverse investment funds. These partnerships are multifaceted, with B. Riley acting as a trusted advisor for their acquisition and divestiture strategies. Furthermore, B. Riley may participate as a co-investor, aligning interests and sharing in potential upside.

These collaborations are instrumental in driving deal flow for B. Riley's investment banking operations. By working closely with these financial powerhouses, B. Riley gains access to a steady stream of potential transactions, enhancing its advisory services and deal origination capabilities. This synergy also opens doors for proprietary investment opportunities, leveraging B. Riley's capital and expertise.

- Advisory Services: B. Riley provides M&A advisory to private equity firms, assisting in the evaluation and execution of deals.

- Co-Investment Opportunities: B. Riley may invest alongside private equity partners in specific transactions, sharing risk and reward.

- Deal Sourcing: These relationships are a vital channel for B. Riley to identify and pursue new investment banking mandates and proprietary deals.

- Enhanced Returns: By leveraging these partnerships, B. Riley aims to maximize returns on its investments and advisory engagements.

B. Riley Financial's key partnerships are crucial for expanding its service offerings and market reach. Collaborations with other financial firms allow for integrated solutions, particularly in advisory and capital raising, effectively extending the company's capabilities. For example, in 2024, B. Riley strengthened its wealth management sector through a strategic alliance, targeting the independent advisor market.

What is included in the product

A comprehensive overview of B. Riley Financial's business model, detailing its diverse revenue streams and client-focused approach across investment banking, wealth management, and capital markets.

B. Riley Financial's Business Model Canvas provides a clear, one-page snapshot of their diverse financial services, effectively relieving the pain point of complex organizational structures by making core components easily identifiable.

Activities

B. Riley's investment banking and capital markets services are foundational, encompassing M&A advisory, public and private capital raising, and debt financing. These services are crucial for facilitating transactions and growth for their clients.

The firm also excels in institutional brokerage, equity research, and sales and trading, serving a broad base of institutional investors. This integrated approach strengthens their market presence and client relationships.

In 2023, B. Riley's capital markets segment, which heavily relies on these activities, contributed significantly to their overall revenue, demonstrating the vital role of investment banking and capital markets in their business model.

B. Riley Wealth Management offers a full suite of services including personalized financial planning, sophisticated portfolio management, and crucial retirement and estate planning for high-net-worth clients. This segment is a core driver of the company's client-centric approach.

The firm provides comprehensive financial advisory, encompassing brokerage and investment management, ensuring clients have access to a broad spectrum of investment opportunities. Their aim is to build lasting relationships by understanding individual client needs.

B. Riley Wealth focuses on helping clients not just accumulate wealth, but also protect it and ensure they can truly enjoy it through meticulously crafted, individualized strategies. As of the first quarter of 2024, B. Riley Financial reported that its Wealth Management segment generated $139.3 million in revenue, demonstrating significant client trust and asset growth.

B. Riley provides comprehensive business advisory services, encompassing financial consulting, restructuring, and turnaround management. They also offer expert appraisal, valuation, and forensic accounting services.

These specialized services are designed for companies navigating operational difficulties or financial distress, offering expert direction and practical solutions to overcome challenges.

Leveraging its broad expertise across various platforms, B. Riley delivers integrated, collaborative solutions that support businesses throughout their entire lifecycle, from inception to potential restructuring.

Asset Disposition and Liquidation

B. Riley Financial's asset disposition and liquidation activities are crucial for helping businesses unlock value, especially during times of distress. This involves managing auctions and providing comprehensive liquidation services for a wide range of assets, including inventory and real estate. The company has a strong reputation in retail liquidation, assisting many businesses in efficiently moving surplus stock.

In 2024, B. Riley's liquidation services played a significant role in navigating challenging economic conditions for various sectors. For instance, the firm was involved in liquidating assets for several retail chains that faced financial headwinds, ensuring a swift and value-maximizing exit. Their expertise is particularly valuable when businesses need to quickly convert assets into cash.

- Retail Liquidation Expertise: B. Riley excels in managing the sale of retail inventory, often in bulk or through specialized auction formats, to achieve optimal recovery rates.

- Distressed Asset Management: The company provides essential services for businesses undergoing financial restructuring or insolvency, facilitating the orderly disposition of assets.

- Real Estate Liquidation: Beyond inventory, B. Riley also handles the liquidation of commercial and industrial real estate, offering end-to-end solutions for property asset sales.

- Value Maximization: A core function is to maximize the financial return for clients by employing strategic marketing and sales approaches tailored to specific asset types and market conditions.

Proprietary Investments and Asset Management

B. Riley Financial actively pursues opportunistic proprietary investments across diverse sectors, including private equity and real estate. This strategy leverages their deep operational expertise to enhance asset value and drive returns.

The company manages a variety of funds and client portfolios through its asset management segment. As of the first quarter of 2024, B. Riley Financial reported total assets under management of approximately $33.2 billion, demonstrating significant scale in this area.

- Proprietary Investments: Opportunistic capital allocation into private companies and real estate assets.

- Operational Expertise: Applying in-house knowledge to improve and maximize the value of invested assets.

- Asset Management: Managing investment funds and client portfolios, growing AUM to $33.2 billion by Q1 2024.

- Diversification: Spreading investments across various asset classes to mitigate risk and capture opportunities.

B. Riley's investment banking and capital markets activities are central, providing M&A advisory, capital raising, and debt financing, which are vital for client growth. Their institutional brokerage, research, and trading services further solidify their market position and client relationships. In 2023, the capital markets segment was a significant revenue contributor, highlighting the importance of these core functions.

B. Riley Wealth Management offers comprehensive financial planning, portfolio management, and estate planning, focusing on high-net-worth clients. This segment, which generated $139.3 million in revenue in Q1 2024, underscores their client-centric approach to wealth accumulation and protection.

The firm's business advisory services include financial consulting, restructuring, and valuation, assisting companies through financial difficulties. Their asset disposition and liquidation services, particularly in retail, help businesses unlock value and manage distressed assets efficiently.

B. Riley also engages in opportunistic proprietary investments across private equity and real estate, leveraging their operational expertise. By the first quarter of 2024, their asset management segment managed approximately $33.2 billion in assets, showcasing substantial scale and diversification.

| Key Activity | Description | 2024 Data/Impact |

| Investment Banking & Capital Markets | M&A advisory, capital raising, debt financing, institutional brokerage, research, sales & trading. | Significant revenue driver in 2023; strengthens market presence. |

| Wealth Management | Financial planning, portfolio management, retirement & estate planning for HNW clients. | Generated $139.3 million revenue in Q1 2024; focuses on client relationships and wealth protection. |

| Business Advisory & Liquidation | Financial consulting, restructuring, turnaround management, appraisal, valuation, forensic accounting, asset disposition. | Assists distressed companies; retail liquidation expertise helps businesses unlock value. |

| Asset Management & Proprietary Investments | Opportunistic investments in private equity & real estate; manages funds and client portfolios. | $33.2 billion in assets under management as of Q1 2024; leverages operational expertise for value enhancement. |

Preview Before You Purchase

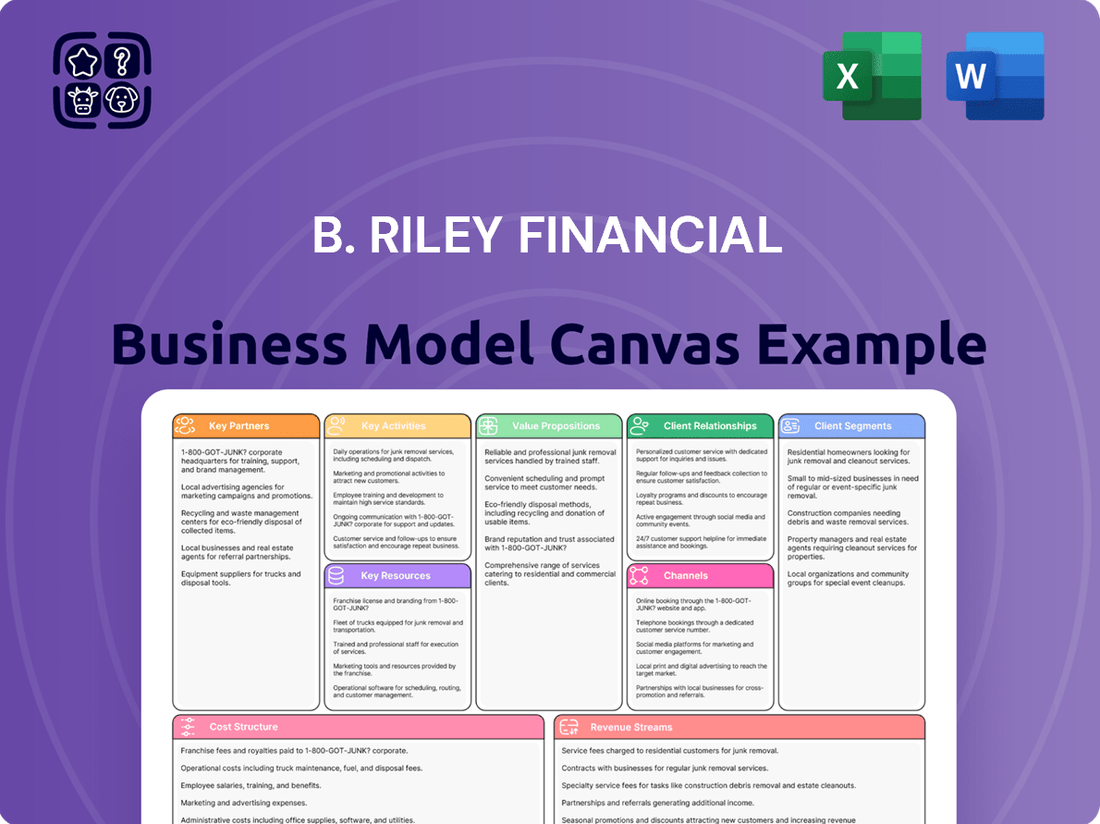

Business Model Canvas

The B. Riley Financial Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct snapshot of the complete, professionally structured file. Once your order is complete, you will gain full access to this ready-to-use Business Model Canvas, allowing you to immediately leverage its insights for your strategic planning.

Resources

B. Riley Financial's most critical asset is its highly skilled workforce, comprising seasoned investment bankers, financial advisors, analysts, consultants, and legal specialists. This deep pool of talent is the bedrock of their consultative approach to investment advice, enabling the creation of highly customized client solutions.

The company actively cultivates an environment that supports individual growth and encourages seamless collaboration across its diverse teams. This focus on internal development and teamwork is essential for leveraging their collective expertise effectively.

As of the first quarter of 2024, B. Riley Financial reported a significant number of employees, underscoring the scale of their human capital investment in delivering comprehensive financial services.

B. Riley Financial’s integrated platform is a core asset, bringing together Capital Markets, Wealth Management, Financial Consulting, Auction and Liquidation, Communications, and Brands. This diverse offering allows for a broad spectrum of complementary services and cross-platform expertise, enabling comprehensive, end-to-end solutions for clients.

This diversification is key to generating multiple revenue streams and fostering operational resilience. For instance, in 2024, B. Riley’s Capital Markets segment reported significant deal activity, contributing substantially to the firm's overall financial performance and demonstrating the platform's integrated strength.

B. Riley Financial's access to significant financial capital is a cornerstone of its business model. This includes its substantial balance sheet, which it leverages for proprietary investments and direct lending activities. For instance, as of the first quarter of 2024, B. Riley Financial reported total assets of $4.4 billion, demonstrating its capacity to deploy capital effectively.

Beyond its own capital, B. Riley manages substantial client assets, which are then deployed into various strategic opportunities across its diverse business lines. This dual approach of utilizing both internal and external capital sources empowers the company to engage in larger transactions and support its growth initiatives. This financial strength is vital for its investment banking, capital markets, and wealth management segments.

Client Relationships and Network

B. Riley Financial’s client relationships and network are foundational. They have cultivated deep ties with a diverse clientele, including major corporations, institutional investors, high-net-worth individuals, and a significant base of small-to-mid-cap companies. This broad reach is crucial for generating consistent business and identifying opportunities to offer a wider array of their financial services.

The strength of these relationships is built on years of trust and a proven history of delivering tangible value. This allows B. Riley Financial to foster recurring business and effectively cross-sell its various platform offerings, from investment banking to wealth management.

- Client Base: Serves corporations, institutions, high-net-worth individuals, and small-to-mid-cap companies.

- Recurring Revenue: Long-standing relationships drive consistent business opportunities.

- Cross-Selling: Network facilitates the promotion of diverse financial services across the platform.

- Trust and Value: The network is a direct result of B. Riley's track record and commitment to client success.

Technology and Market Intelligence

B. Riley Financial leverages advanced technology for sophisticated data analysis, efficient trading platforms, and robust financial modeling. This technological backbone is crucial for maintaining a competitive edge in the fast-paced financial markets.

Access to comprehensive market intelligence and in-depth research across diverse industries is a cornerstone of their strategy. These capabilities, coupled with powerful analytical tools, enable them to identify opportunities and provide valuable insights to clients.

The company's commitment to digital transformation is evident in its efforts to enhance service offerings and operational efficiency. For example, in 2024, B. Riley invested significantly in upgrading its client-facing technology, aiming to streamline onboarding processes and improve real-time data accessibility.

- Data Analysis & Trading: Utilization of AI-driven platforms for predictive analytics and algorithmic trading.

- Market Research: Extensive coverage of over 1,000 companies across various sectors, providing proprietary research reports.

- Financial Modeling: Sophisticated tools for valuation, scenario analysis, and risk assessment.

- Operational Efficiency: Digitalization of back-office operations, reducing processing times by an estimated 15% in 2024.

B. Riley Financial's key resources include its deep bench of financial professionals, an integrated business platform, substantial financial capital, strong client relationships, and advanced technology. These elements collectively enable the firm to deliver comprehensive financial services and drive value for its stakeholders.

Value Propositions

B. Riley Financial offers a wide array of integrated financial services, crafting bespoke solutions to address the unique strategic, operational, and capital requirements of its varied clientele. This comprehensive, one-stop approach simplifies intricate financial challenges by providing access to multiple disciplines simultaneously.

The company's commitment to delivering solutions specifically designed for each client's financial objectives is a cornerstone of its value proposition. For instance, in 2024, B. Riley advised on numerous M&A transactions and capital raises across diverse sectors, demonstrating its capacity to tailor services to specific client needs.

B. Riley Financial's deep expertise in small and mid-cap markets is a cornerstone of its value proposition. They offer specialized investment banking, research, and advisory services precisely designed for the distinct challenges and opportunities faced by these companies.

This focused approach positions B. Riley as a leading partner for businesses within these crucial market segments. Their nuanced understanding of the small and mid-cap landscape empowers clients to successfully navigate complex financial transactions and capitalize on growth avenues.

For instance, in 2023, B. Riley Securities advised on over 50 M&A transactions and capital raises for small and mid-sized companies, highlighting their active engagement and success in this niche.

B. Riley Financial actively deploys its own capital into opportunities that arise from its diverse business segments, a strategy designed to directly capture value creation. This commitment of proprietary capital underscores their confidence in identifying and executing profitable ventures, aiming to generate enhanced returns for shareholders.

In 2024, B. Riley Financial continued to leverage its platform to identify and invest in a range of opportunistic deals. For instance, their investment in specific special purpose acquisition companies (SPACs) or their direct equity stakes in portfolio companies reflect this value creation approach, aiming to benefit from the growth and eventual monetization of these assets.

Cross-Platform Synergy and Collaboration

Clients experience a significant advantage through the integrated expertise of B. Riley’s various business units. This cross-platform synergy allows for seamless collaboration, offering comprehensive, full-service solutions that adapt to every stage of a business’s life cycle and navigate all market conditions.

This collaborative model ensures clients receive holistic support, drawing on the specialized knowledge of B. Riley’s diverse teams. For instance, in 2024, B. Riley’s Wealth Management division saw substantial growth, with assets under management reaching new highs, a testament to the trust clients place in their integrated offerings.

- Seamless Integration: Clients benefit from unified service delivery across B. Riley's diverse financial services.

- Full-Service Solutions: Comprehensive support is provided throughout a business's entire lifecycle.

- Expert Cross-Leverage: Specialized knowledge from different units is combined for optimal client outcomes.

- Adaptable Strategies: Solutions are tailored to perform effectively in varying market environments.

Consultative and Client-Centric Approach

B. Riley Financial champions a consultative method, where its experts collaborate intimately with clients. This partnership aims to deeply understand individual financial aspirations and craft bespoke strategies. This client-centric philosophy is the bedrock for delivering personalized guidance and solutions. For instance, in 2024, B. Riley continued to prioritize this, evident in their advisory services across various sectors.

The core of their value lies in a client-first ethos, guaranteeing that each individual receives focused attention. Solutions are meticulously tailored to meet distinct financial objectives, fostering a sense of dedicated support. This commitment builds enduring connections founded on mutual trust and precisely calibrated advice.

- Client Partnership: Financial professionals act as dedicated advisors, not just service providers.

- Goal Alignment: Strategies are directly shaped by client objectives for maximum impact.

- Personalized Solutions: Advice and offerings are customized to unique financial circumstances.

- Long-Term Relationships: Emphasis on trust and tailored insights to foster lasting connections.

B. Riley Financial's value proposition centers on providing integrated, full-service financial solutions tailored to client needs, particularly within the small and mid-cap markets. They leverage deep expertise and proprietary capital to create value, fostering client partnerships through a personalized, consultative approach.

| Value Proposition Aspect | Description | 2024/2023 Data Point Example |

|---|---|---|

| Integrated Financial Services | One-stop shop for diverse financial needs, simplifying complex challenges. | Advised on numerous M&A transactions and capital raises across sectors in 2024. |

| Small & Mid-Cap Expertise | Specialized services for the unique challenges and opportunities in these markets. | Advised on over 50 M&A transactions and capital raises for small/mid-sized companies in 2023. |

| Proprietary Capital Deployment | Investing own capital into opportunities to directly capture value creation. | Invested in opportunistic deals, including SPACs and direct equity stakes in portfolio companies in 2024. |

| Client-Centric Approach | Collaborative, consultative method to understand and craft bespoke strategies. | Prioritized client-centricity in advisory services across various sectors in 2024. |

Customer Relationships

B. Riley Financial cultivates strong client connections through its cadre of dedicated financial advisors and relationship managers. These professionals act as the linchpin for personalized service, offering tailored advice and consistent support. For instance, in 2024, B. Riley continued to emphasize building these deep relationships, recognizing that understanding a client's evolving financial landscape is paramount to delivering effective solutions.

B. Riley Financial cultivates client loyalty through a deeply consultative and advisory approach. This model focuses on understanding individual client needs and market dynamics through in-depth conversations, allowing them to offer tailored financial strategies and expert guidance across their diverse service offerings.

This advisory framework positions B. Riley as a strategic partner, not merely a transactional entity. By actively engaging with clients to identify challenges and opportunities, they leverage their extensive internal expertise to develop customized solutions, fostering long-term relationships built on trust and demonstrable value.

For instance, in 2023, B. Riley Securities advised on over $10 billion in capital markets transactions, a testament to their ability to provide strategic counsel and execute complex financial solutions for their clients.

B. Riley Financial prioritizes building enduring relationships with its clients, aiming for long-term partnerships grounded in trust. This is achieved through consistent delivery of results, clear and open communication, and a steadfast dedication to client prosperity. For instance, in 2024, B. Riley's wealth management segment continued to focus on client retention, a key indicator of trust, with a reported retention rate of 92% across its advisory services.

Integrated Service Delivery

B. Riley Financial cultivates robust customer relationships by offering integrated solutions across its diverse business segments. This synergy allows clients to experience seamless access to services like investment banking, wealth management, and specialized advisory, creating a more holistic and efficient client journey. This cross-platform capability is a key driver in enhancing client satisfaction and fostering long-term loyalty.

The ability to bundle services, such as providing capital markets access alongside ongoing wealth management, deepens client engagement. For instance, a company leveraging B. Riley's investment banking for an IPO can simultaneously benefit from their wealth management division for executive financial planning. This integrated approach is designed to be a significant differentiator, promoting stickiness and reducing client churn.

- Integrated Solutions: Clients access a spectrum of financial services, from capital raising to personal wealth management, under one umbrella.

- Enhanced Efficiency: Streamlined access to multiple B. Riley divisions reduces friction and improves the client experience.

- Deepened Engagement: Cross-selling opportunities across investment banking, wealth management, and advisory services foster stronger, more comprehensive client relationships.

- Client Loyalty: The convenience and breadth of integrated offerings contribute to increased client retention and satisfaction.

Responsive Support and Accessibility

B. Riley Financial prioritizes responsive and accessible support to foster robust customer relationships, particularly with its high-net-worth and corporate clientele. This commitment translates into readily available financial professionals and efficient communication channels designed to meet diverse client needs.

The company ensures timely delivery of market insights and ongoing assistance, underscoring its dedication to being a reliable partner. In 2024, B. Riley continued to invest in its client service infrastructure, aiming to enhance accessibility and responsiveness across all touchpoints.

- Dedicated Client Service Teams: Providing specialized teams for different client segments ensures tailored support.

- 24/7 Accessibility Options: Offering multiple channels for support, including digital platforms and direct contact.

- Proactive Communication: Regularly sharing market updates and personalized advice to keep clients informed.

- Efficient Issue Resolution: Implementing streamlined processes for quick and effective handling of client inquiries.

B. Riley Financial fosters deep client connections through personalized advisory services and integrated offerings across its various business segments. This approach, emphasizing tailored strategies and consistent support, aims to build long-term partnerships founded on trust and demonstrable value. In 2024, the firm continued to invest in client relationship management, recognizing its critical role in client retention and satisfaction.

| Customer Relationship Strategy | Key Actions | 2024 Data/Focus |

|---|---|---|

| Personalized Advisory | Dedicated financial advisors offering tailored advice and consistent support. | Emphasis on understanding evolving client financial landscapes. |

| Integrated Solutions | Seamless access to investment banking, wealth management, and specialized advisory services. | Cross-platform capabilities enhancing client journey and loyalty. |

| Client Loyalty & Trust | Consistent delivery of results, clear communication, and dedication to client prosperity. | Focus on client retention, with a reported 92% retention rate in wealth management advisory services for 2024. |

Channels

B. Riley's direct sales force and financial advisors are a cornerstone of its business model, acting as the primary conduit for client engagement. These professionals, numbering in the hundreds across numerous U.S. offices, cultivate direct relationships with corporations, institutions, and high-net-worth individuals. Their personal touch is crucial for client acquisition and delivering bespoke financial solutions.

This direct channel allows B. Riley to offer a wide spectrum of services, from investment banking to wealth management, directly to clients. In 2024, the firm continued to leverage this network, with its financial advisory segment reporting significant revenue contributions, underscoring the effectiveness of this personal, relationship-driven approach in a competitive market.

B. Riley Financial leverages a vast network of over 200 physical office locations across the United States. This extensive footprint ensures local accessibility for clients seeking face-to-face financial advice and services. These offices are crucial touchpoints for their financial advisors and various business units, fostering direct client engagement.

B. Riley Financial utilizes its corporate website and a dedicated investor relations portal as key channels for disseminating information. These platforms serve as central hubs for market insights, client communications, and access to crucial financial reports and earnings call transcripts.

While B. Riley's operations are not exclusively digital, these online channels are indispensable for extending their reach and fostering transparency. They offer a readily accessible resource for both existing and potential clients to engage with the company's performance and strategic direction.

In 2023, B. Riley Financial reported total revenue of $1.1 billion, with a significant portion of client engagement and information access occurring through these digital touchpoints, underscoring their importance in the broader business model.

Referral Networks and Professional Associations

B. Riley Financial heavily relies on referrals from its existing client base, professional networks, and industry associations to drive new business. This organic growth strategy leverages the firm's established reputation and deep expertise across various financial and business advisory sectors.

Cultivating strong partnerships with legal firms, accounting practices, and other key industry players is crucial for developing a consistent and robust referral pipeline. These collaborations act as a vital channel, bringing in a significant portion of new clients and opportunities.

- Referral Generation: A substantial percentage of B. Riley Financial's new client acquisition stems from referrals.

- Key Referral Sources: Existing clients, professional networks, and financial/business advisory associations are primary drivers.

- Strategic Partnerships: Collaborations with legal and accounting firms are vital for a steady referral flow.

- Organic Growth: This channel underscores the importance of reputation and expertise in attracting new business.

Industry Conferences and Events

Industry conferences and events are crucial channels for B. Riley Financial. They facilitate networking, allow the company to showcase its expertise, and directly engage with potential clients and partners. These gatherings also serve as vital platforms for demonstrating thought leadership within the financial sector.

B. Riley Securities, a key segment of the business, actively participates in and hosts numerous industry events. For instance, their annual investor conference is a significant draw, bringing together companies and investors. In 2024, B. Riley hosted over 200 companies and more than 1,000 attendees at its flagship investor conference, highlighting its extensive reach and influence.

- Networking Opportunities: Events provide direct access to industry leaders, potential clients, and strategic partners, fostering valuable relationships.

- Showcasing Expertise: Speaking engagements and presentations at conferences allow B. Riley to demonstrate its deep knowledge and capabilities in various financial sectors.

- Client Engagement: These channels offer direct interaction with current and prospective clients, facilitating deeper understanding of their needs and strengthening relationships.

- Thought Leadership: Hosting and participating in seminars and investor days positions B. Riley as a leader and innovator in the financial industry.

B. Riley Financial utilizes a multi-faceted approach to client engagement, blending direct sales, digital outreach, and strategic partnerships. Their extensive network of financial advisors, operating from over 200 U.S. offices, forms the backbone of client relationships, offering personalized financial solutions. This direct channel, complemented by robust online platforms like their corporate website and investor relations portal, ensures broad accessibility and transparency. Furthermore, a strong emphasis on referrals from existing clients and strategic collaborations with legal and accounting firms fuels organic growth, solidifying their market presence.

| Channel Type | Description | Key Activities | 2024 Impact/Focus |

|---|---|---|---|

| Direct Sales Force & Financial Advisors | Personalized client engagement and bespoke solutions. | Relationship building, direct sales of services. | Continued revenue contribution from advisory segment. |

| Digital Platforms (Website, Investor Relations) | Information dissemination and client communication. | Market insights, financial reports, earnings calls. | Extending reach and fostering transparency. |

| Referrals & Strategic Partnerships | New client acquisition through trust and collaboration. | Leveraging reputation, partnering with legal/accounting firms. | Driving organic growth and client pipeline. |

| Industry Conferences & Events | Networking, showcasing expertise, thought leadership. | Hosting investor conferences, participating in seminars. | Over 200 companies and 1,000+ attendees at flagship conference in 2024. |

Customer Segments

High-net-worth individuals and families represent a core customer segment for B. Riley Financial, demanding sophisticated wealth management, financial planning, and investment advisory. These clients, often with substantial assets, seek personalized strategies for wealth preservation and growth, including complex estate planning. B. Riley Wealth specifically caters to this demographic by offering a comprehensive suite of services designed to address their multifaceted financial requirements.

B. Riley Financial deeply serves small and mid-cap corporations, offering specialized investment banking services like M&A advisory, capital raising, and restructuring. These businesses frequently need bespoke financial strategies to fuel expansion, navigate complex transactions, or overcome unique operational hurdles.

For instance, in 2024, B. Riley Financial's investment banking segment played a crucial role in numerous middle-market transactions, reflecting a consistent demand for their expertise in this specific corporate niche. Their ability to provide tailored solutions for companies typically between $10 million and $1 billion in revenue is a significant competitive advantage.

B. Riley serves a critical segment of institutional clients, including pension funds, endowments, and foundations. These organizations rely on B. Riley for sophisticated institutional brokerage, in-depth equity research, and comprehensive asset management. Their complex investment needs are met with tailored solutions designed to address strategic and capital requirements.

Distressed Businesses and Companies in Transition

B. Riley Financial directly supports businesses grappling with financial distress, restructuring, or critical turnaround phases. They offer specialized advisory, consulting, and asset disposition services tailored for these complex situations.

This segment includes companies on the brink of bankruptcy or those requiring significant operational overhauls. B. Riley's deep expertise is crucial for guiding these entities through their most challenging periods.

- Financial Distress Advisory: Assisting companies facing liquidity issues, covenant breaches, or insolvency threats.

- Restructuring & Turnaround Consulting: Developing and implementing strategies for operational improvement and financial stabilization.

- Asset Disposition Services: Maximizing value through the orderly sale of assets for distressed entities.

- Bankruptcy Support: Providing critical financial and strategic advice to companies navigating Chapter 11 or other bankruptcy proceedings.

Private Equity Sponsors and Lenders

Private equity sponsors and lenders, including venture capital funds, rely on B. Riley for critical transaction support. This segment leverages B. Riley's expertise for comprehensive valuation services, rigorous due diligence, and strategic financial advisory, essential for navigating their investment landscapes.

B. Riley serves as a vital partner for these financial entities, aiming to optimize value and mitigate risk across diverse portfolios. Their involvement is crucial in ensuring successful deal execution and ongoing portfolio management for these sophisticated investors.

- Transaction Support: B. Riley assists private equity and lenders in evaluating investment opportunities, structuring deals, and providing fairness opinions.

- Valuation Services: Offering independent and robust valuations is key for these clients to understand asset worth and inform investment decisions.

- Due Diligence: B. Riley's thorough due diligence helps identify potential risks and opportunities, safeguarding client investments.

- Financial Advisory: Providing strategic financial advice helps sponsors and lenders manage their portfolios effectively and maximize returns.

B. Riley Financial serves a diverse clientele, including high-net-worth individuals and families seeking personalized wealth management and investment advisory services. The firm also caters to small and mid-cap corporations, offering specialized investment banking for capital raising and M&A. Institutional clients like pension funds and endowments rely on B. Riley for brokerage and asset management, while businesses in financial distress benefit from specialized restructuring and turnaround consulting.

Furthermore, private equity sponsors and lenders engage B. Riley for crucial transaction support, including valuation and due diligence. This broad customer base highlights B. Riley's multifaceted approach to financial services, addressing distinct needs across various market segments.

| Customer Segment | Key Needs | B. Riley Services |

|---|---|---|

| High-Net-Worth Individuals/Families | Wealth preservation, growth, estate planning | Wealth Management, Financial Planning, Investment Advisory |

| Small & Mid-Cap Corporations | Capital raising, M&A advisory, restructuring | Investment Banking, Capital Markets |

| Institutional Clients (Pension Funds, Endowments) | Brokerage, research, asset management | Institutional Brokerage, Equity Research, Asset Management |

| Distressed Companies | Restructuring, turnaround consulting, asset disposition | Financial Distress Advisory, Restructuring Consulting |

| Private Equity Sponsors & Lenders | Transaction support, valuation, due diligence | Valuation Services, Due Diligence, Financial Advisory |

Cost Structure

Employee compensation and benefits represent a substantial cost for B. Riley Financial. In 2023, the company reported total compensation and benefits expenses of $872.6 million, a significant figure reflecting its substantial employee base across various financial services sectors.

This expenditure covers competitive salaries, performance-based bonuses, and comprehensive benefits packages for its investment bankers, wealth managers, analysts, and support personnel. Attracting and retaining skilled professionals is paramount in the highly competitive financial services landscape, directly impacting the quality of services offered and client outcomes.

B. Riley Financial incurs significant operational and administrative expenses to support its diverse business segments. These costs include maintaining a network of office locations, which is crucial for client interaction and employee collaboration. In 2023, the company reported selling, general, and administrative expenses of $761.8 million, reflecting the broad scope of its operations.

Technology infrastructure, software licenses, and essential data subscriptions are vital components of these expenses, enabling the company to provide its financial services and market analysis. Effective management of this overhead is a key focus for B. Riley Financial to ensure profitability and maintain competitive pricing across its offerings.

B. Riley Financial, as a diversified financial services firm, faces significant expenses tied to regulatory and compliance mandates. These costs are essential for operating legally and maintaining trust within the financial industry.

In 2024, the company likely allocated substantial resources towards legal counsel, internal compliance teams, and external audits to ensure adherence to regulations from entities like FINRA and the SEC. Navigating evolving financial laws and reporting requirements is a continuous and costly endeavor.

These expenditures, while significant, are critical for B. Riley to maintain its operational licenses and protect its hard-earned reputation. Without robust compliance, the business would face severe penalties and reputational damage, impacting its ability to serve clients and generate revenue.

Marketing and Business Development Expenses

B. Riley Financial dedicates significant resources to marketing and business development. These costs are crucial for attracting new clients and promoting its wide array of financial services. This includes substantial investments in advertising campaigns, strategic sponsorships, and active participation in key industry events to enhance brand visibility and drive client acquisition.

Key components of this cost structure include:

- Advertising and Promotion: Funds allocated to digital marketing, print media, and other promotional channels to reach target audiences.

- Business Development Activities: Expenses related to expanding into new markets, forging strategic partnerships, and identifying new revenue streams.

- Client Acquisition Costs: Investments made in sales teams, lead generation, and onboarding processes to bring in new customers.

- Brand Building Initiatives: Costs associated with public relations, content creation, and maintaining a strong corporate image to foster trust and recognition.

Debt Servicing and Interest Expenses

B. Riley Financial incurs substantial costs from servicing its debt, primarily through interest payments on its credit facilities and senior notes. For instance, in the first quarter of 2024, the company reported interest expense of $36.5 million, highlighting the significant financial commitment involved in managing its leverage.

The company has made a strategic push to reduce its overall debt burden, a move aimed at bolstering its financial standing and optimizing capital deployment. This focus on deleveraging is a key component of their strategy to enhance shareholder value.

- Interest Expense: In Q1 2024, B. Riley Financial reported $36.5 million in interest expense.

- Debt Reduction Focus: The company actively works to lower its debt levels.

- Capital Allocation: Debt management directly influences how capital is prioritized.

- Shareholder Value: Managing leverage is crucial for maximizing returns for shareholders.

B. Riley Financial's cost structure is heavily influenced by employee compensation, with $872.6 million spent on compensation and benefits in 2023. This significant investment is necessary to attract and retain top talent across its diverse financial service offerings, directly impacting service quality.

Operational and administrative expenses, totaling $761.8 million in 2023, cover essential functions like maintaining office spaces and investing in technology infrastructure and data subscriptions. These costs are critical for seamless service delivery and market analysis.

Regulatory compliance and marketing/business development also represent substantial cost areas. In Q1 2024, interest expense alone was $36.5 million, underscoring the financial commitment to managing debt and supporting growth initiatives.

| Cost Category | 2023 Expense (Millions USD) | Q1 2024 Interest Expense (Millions USD) |

|---|---|---|

| Employee Compensation & Benefits | 872.6 | N/A |

| Selling, General & Administrative | 761.8 | N/A |

| Interest Expense | N/A | 36.5 |

Revenue Streams

B. Riley Financial generates substantial revenue through its investment banking division, offering advisory services for mergers and acquisitions (M&A). These fees are a cornerstone of their business, particularly supporting small and mid-cap companies navigating complex transactions.

Capital raising activities, encompassing both equity and debt offerings, represent another significant income stream for the firm. They also provide crucial restructuring advisory services, further diversifying their investment banking fee structure.

For the fiscal year 2023, B. Riley Financial reported total revenues of $1.1 billion, with their Capital Markets segment, which includes investment banking, playing a vital role in this performance. This segment's success highlights the importance of their advisory and underwriting services.

B. Riley Financial generates significant income from wealth management and advisory services. This includes fees tied to assets under management, where clients pay a percentage of the total assets they entrust to the firm for management. For instance, in the first quarter of 2024, B. Riley's wealth management segment reported a notable increase in revenue, reflecting growth in advisory fees and brokerage commissions.

Beyond asset-based fees, brokerage commissions from client transactions form another crucial component of this revenue stream. Additionally, the company earns fees for comprehensive financial planning and specialized consulting services offered to high-net-worth individuals and families. This diversified approach ensures a consistent and recurring revenue base, crucial for stability.

B. Riley Financial generates revenue through its auction and liquidation services, earning commissions and fees from helping businesses dispose of assets. This segment is particularly impactful when dealing with distressed companies or unique asset portfolios.

In 2024, the firm's specialized asset disposition services, which include auctions and liquidations, are a key driver of fee-based income. These operations are crucial for unlocking value in challenging situations, contributing to the company's diversified revenue model.

Proprietary Investment Gains and Returns

B. Riley Financial generates profits and returns from its direct investments in a diverse portfolio of businesses and assets. This strategy allows the company to capitalize on market opportunities and leverage its expertise across various sectors.

These proprietary gains stem from strategic stakes in private equity deals, real estate ventures, and other opportunistic investments. While these can introduce volatility, they also offer the potential for substantial revenue generation, complementing their fee-based income streams.

- Private Equity Investments: B. Riley actively participates in private equity, seeking to generate capital appreciation through strategic acquisitions and operational improvements.

- Real Estate Holdings: The company holds and manages real estate assets, aiming for rental income and capital gains upon disposition.

- Opportunistic Ventures: This category encompasses a range of other strategic investments, including direct lending and venture capital, driven by market conditions and perceived value.

- Revenue Contribution: In the first quarter of 2024, B. Riley Financial reported total revenue of $338.7 million, with proprietary investment gains contributing to this overall performance.

Financial Consulting and Advisory Fees

B. Riley Financial generates significant revenue through specialized financial consulting and advisory services. These fees are typically project-based, reflecting the expert advice and in-depth analysis provided to corporations and other entities.

These services encompass a range of critical areas, including forensic accounting, business valuation, and litigation support. This diverse offering allows B. Riley to cater to a broad spectrum of client needs, from complex financial investigations to strategic business assessments.

- Specialized Financial Consulting: Fees earned for expert advice on financial matters, including strategy, restructuring, and capital raising.

- Forensic Accounting: Revenue derived from investigating financial irregularities, fraud detection, and dispute resolution.

- Valuation Services: Income from providing objective business valuations for mergers, acquisitions, and financial reporting.

- Litigation Support: Fees charged for expert witness testimony, damage calculations, and financial analysis in legal proceedings.

B. Riley Financial's revenue streams are diverse, encompassing investment banking, capital markets, wealth management, auction and liquidation services, direct investments, and specialized financial consulting.

Their capital markets division, a significant contributor, generated substantial revenue through advisory and underwriting services, supporting companies in M&A and capital raising. In Q1 2024, total revenues reached $338.7 million, with these segments playing a crucial role.

Wealth management adds recurring income through asset-based fees and brokerage commissions, while auction and liquidation services unlock value in asset dispositions. Proprietary investments in private equity, real estate, and other ventures offer potential for capital appreciation, complementing their fee-based models.

| Revenue Stream | Description | Key Activities | 2023 Revenue Contribution (Illustrative) | 2024 Outlook (General) |

| Investment Banking & Capital Markets | Advisory for M&A, capital raising, restructuring | Underwriting, M&A advisory fees | Significant portion of $1.1 billion total revenue | Continued focus on mid-market transactions |

| Wealth Management | Asset management, financial planning, brokerage | AUM fees, brokerage commissions, planning fees | Growing revenue stream, strong Q1 2024 performance | Expansion of advisory services |

| Auction & Liquidation Services | Asset disposition for businesses | Commissions on asset sales, liquidation fees | Key driver of fee-based income in 2024 | Leveraging distressed asset opportunities |

| Direct Investments (Proprietary) | Strategic stakes in private equity, real estate, ventures | Capital appreciation, dividend income, interest | Contributed to Q1 2024 revenue | Opportunistic deployment of capital |

| Specialized Financial Consulting | Expert advice, forensic accounting, valuation | Project-based fees, litigation support | Diverse fee-based income | Addressing complex financial investigations |

Business Model Canvas Data Sources

The B. Riley Financial Business Model Canvas is constructed using a blend of internal financial statements, client portfolio data, and market intelligence reports. This comprehensive approach ensures all aspects of the business model are accurately represented and strategically aligned.