B. Riley Financial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B. Riley Financial Bundle

B. Riley Financial operates within a dynamic financial services landscape, where the intensity of competition and the influence of various market forces significantly shape its strategic positioning. Understanding these pressures is crucial for any stakeholder looking to navigate this complex industry.

The complete report reveals the real forces shaping B. Riley Financial’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

For B. Riley Financial, the bargaining power of suppliers is significantly influenced by the concentration and uniqueness of those providing essential services. Key suppliers could include providers of specialized financial data, advanced technology platforms, and critically, highly skilled human capital like experienced investment bankers and financial advisors.

When these suppliers are few in number, or their offerings are unique and not easily replicated, their leverage grows. This concentration means B. Riley might face higher costs to secure these vital resources, impacting its operational expenses and profitability. For instance, access to proprietary deal-making databases or specialized regulatory compliance software, if controlled by a limited number of vendors, can command premium pricing.

B. Riley's switching costs are a key factor in understanding the bargaining power of its suppliers. If it's difficult or expensive for B. Riley to change providers, suppliers gain leverage. For instance, migrating from a specialized financial data analytics platform to a new one could incur substantial costs in terms of data integration, system compatibility, and employee training.

Consider the scenario of switching a core operational software system. The financial outlay for new licenses, implementation services, and the disruption to ongoing business operations can be significant. In 2024, many financial firms reported that the cost of migrating complex legacy systems could range from hundreds of thousands to millions of dollars, depending on the scale and sophistication of the software.

Similarly, if B. Riley relies on a team of highly specialized consultants or outsourced professionals with unique industry knowledge, replacing them would involve considerable time and expense in recruitment, onboarding, and knowledge transfer. This makes it harder for B. Riley to push back on pricing or terms from these specialized suppliers.

The threat of suppliers integrating forward into B. Riley's financial services market could significantly enhance their bargaining power. While less common for broad service providers, a specialized technology firm developing unique financial advisory software might consider direct market entry. For instance, if a key data analytics provider to the financial sector in 2024 saw substantial market gaps, they might leverage their proprietary technology to offer competing advisory services, thereby increasing their leverage over B. Riley.

Importance of B. Riley to Supplier's Business

The bargaining power of suppliers to B. Riley Financial is influenced by how critical B. Riley is to their overall business. If B. Riley constitutes a substantial portion of a supplier's revenue, that supplier's leverage is reduced because they are more dependent on B. Riley's continued patronage. For instance, a specialized software provider that derives 30% of its annual recurring revenue from B. Riley would have less power to dictate terms compared to a scenario where B. Riley is a minor client.

Conversely, if B. Riley represents a small fraction of a supplier's income, the supplier possesses greater bargaining power. This is particularly true for large, diversified technology or data providers. For example, a major cloud service provider that serves thousands of enterprise clients would find B. Riley's business to be a marginal contributor, thus allowing them to command higher prices or more favorable contract terms.

- Revenue Dependence: A supplier's reliance on B. Riley’s revenue directly impacts their bargaining power. High dependence weakens their position.

- Client Diversification: Suppliers with a broad client base, like large tech firms, have more power as B. Riley is less critical to their overall financial health.

- Supplier Market Share: If B. Riley relies on a unique or niche supplier, that supplier's power increases due to limited alternatives.

- B. Riley's Spending: The absolute dollar amount B. Riley spends with a supplier also plays a role; larger contracts can shift leverage.

Availability of Substitute Inputs

The ease with which B. Riley Financial can source alternative inputs significantly influences supplier bargaining power. If numerous providers offer comparable data, technology, or a broad talent pool of financial professionals, suppliers' ability to dictate terms diminishes. For instance, in 2024, the financial services sector saw a continued expansion in FinTech solutions, offering a wider array of data analytics platforms, potentially reducing reliance on any single provider.

However, this dynamic shifts when specialized expertise is required. For highly niche financial advisory services or proprietary trading algorithms, the availability of substitutes can be severely limited. This scarcity grants such specialized suppliers greater leverage. In 2023, the demand for AI-driven investment strategies outpaced the supply of deeply experienced professionals in that specific area, allowing those with such skills to command higher fees.

- Limited Substitutes for Specialized Expertise: B. Riley may face higher supplier power when inputs require unique, hard-to-replicate skills or proprietary technology.

- Abundant Substitutes for Standard Inputs: The availability of multiple vendors for common services like IT infrastructure or general administrative support dilutes supplier influence.

- Impact of FinTech Growth: The increasing number of FinTech solutions in 2024 provides B. Riley with more choices for data and analytics, thereby reducing the bargaining power of traditional data providers.

- Talent Pool Availability: A deep and diverse pool of qualified financial professionals in 2023-2024 generally limits the power of individual recruitment agencies or specialized consulting firms.

The bargaining power of suppliers for B. Riley Financial is generally moderate, leaning towards lower for standard services and higher for specialized inputs. The company benefits from a diverse market for many of its needs, particularly in technology and general professional services, which limits individual supplier leverage. However, the unique nature of some financial data, proprietary software, and highly specialized talent can give certain suppliers significant pricing power.

In 2024, B. Riley, like many financial firms, likely experienced increased costs for advanced data analytics and cybersecurity solutions due to high demand and limited specialized providers. For example, a report from Gartner in late 2023 indicated that spending on financial analytics software was projected to grow by 12% in 2024, driven by the need for sophisticated data interpretation and regulatory compliance tools. This suggests that suppliers in this niche could command premium pricing.

Conversely, B. Riley's ability to switch providers for less critical services, such as general IT support or cloud infrastructure, remains relatively easy due to the competitive landscape. The availability of numerous cloud service providers, for instance, means that B. Riley can negotiate favorable terms by leveraging competition, thus keeping the bargaining power of these suppliers in check.

The critical factor remains the uniqueness and indispensability of the supplier's offering. If a supplier provides a service or data that is fundamental to B. Riley's core operations and lacks readily available substitutes, their bargaining power is amplified. This is particularly relevant for proprietary research platforms or specialized compliance software that are essential for navigating complex financial regulations.

| Factor | Impact on B. Riley's Supplier Bargaining Power | Example Scenario |

| Supplier Concentration | Higher power for few, unique providers | Limited providers of specialized financial data feeds |

| Switching Costs | Higher power with high switching costs for B. Riley | Migrating complex financial modeling software |

| Availability of Substitutes | Lower power with many substitutes | Multiple cloud service providers |

| Supplier Dependence on B. Riley | Lower power if B. Riley is a major client | A niche software vendor relying heavily on B. Riley's contract |

What is included in the product

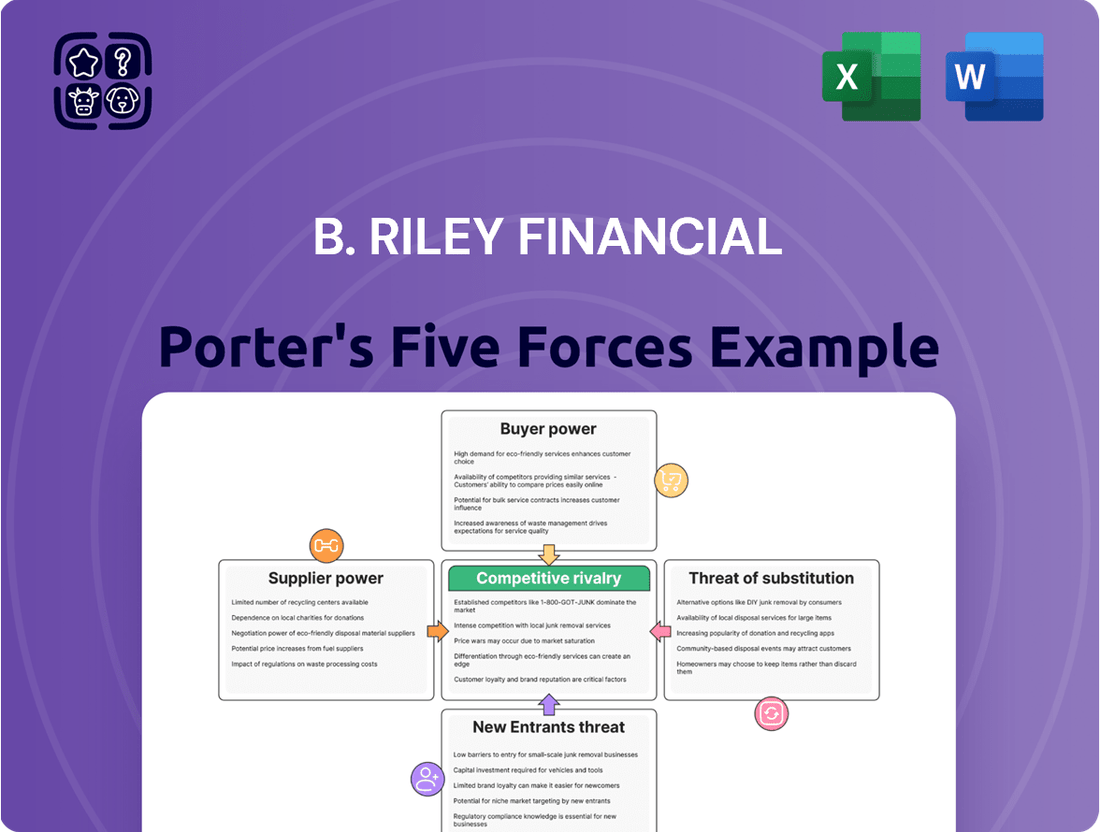

This analysis dissects the competitive landscape for B. Riley Financial, examining the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Effortlessly identify and mitigate competitive threats with a visual representation of each force, allowing for proactive strategy adjustments.

Customers Bargaining Power

B. Riley Financial serves a clientele of corporations, institutions, and high-net-worth individuals. If a few major clients represent a disproportionately large share of the company's income, those clients could wield significant influence, potentially negotiating for reduced service fees or more advantageous contract conditions.

The ease and cost for B. Riley’s clients to switch to another financial services provider directly influence customer bargaining power. For intricate investment banking engagements or long-standing wealth management partnerships, the barriers to switching can be substantial, thereby diminishing customer leverage.

However, for services that are more transactional in nature, clients may find it simpler and less costly to move to a competitor. In 2023, B. Riley reported that its wealth management segment, which often involves deeper client relationships, contributed significantly to its revenue, suggesting that for a portion of its client base, switching costs are indeed a factor.

Customers armed with detailed information about pricing, service quality, and competitor offerings hold significant sway. In the financial services arena, enhanced transparency and readily available data empower clients to shop around and negotiate terms more effectively, directly impacting B. Riley Financial's pricing power and service differentiation.

Threat of Backward Integration by Customers

Customers’ threat of backward integration is a key consideration for B. Riley Financial. This means clients could potentially perform financial services themselves, lessening their need for B. Riley’s expertise.

While most individual investors might not have the resources or inclination, large corporations or institutional clients could develop in-house capabilities for specific advisory or investment functions. This would directly increase their bargaining power, allowing them to negotiate better terms or even bypass B. Riley for certain services.

For instance, a large corporation might build out an internal M&A advisory team or a treasury department capable of managing its own investment portfolio. This shift reduces B. Riley’s revenue streams from those specific clients.

- Potential for In-House Capabilities: Large corporations and institutional investors may possess the scale and resources to develop internal financial advisory and investment management functions.

- Increased Client Bargaining Power: Successful backward integration by customers directly enhances their leverage in negotiations with financial service providers like B. Riley.

- Reduced Reliance on External Services: As clients build internal expertise, their dependence on B. Riley for specific services diminishes, impacting revenue.

- Market Trends: While specific data for B. Riley's clients pursuing backward integration isn't publicly detailed, the broader trend of corporate treasury departments expanding capabilities suggests this is a relevant threat.

Price Sensitivity of Customers

The degree to which B. Riley’s customers are sensitive to price changes directly impacts their bargaining power. Customers who can easily switch to competitors if prices rise have more leverage.

For instance, high-net-worth individuals often seek tailored, specialized advice, making them potentially less price-sensitive than institutional clients who might prioritize cost-effectiveness for more standardized services. This difference in sensitivity shapes how B. Riley structures its offerings and pricing.

- Price Sensitivity Varies by Client Segment: High-net-worth clients may prioritize bespoke solutions over minor price differences, while institutional clients might focus more on competitive pricing for scalable services.

- Impact on Service Customization: B. Riley's ability to offer differentiated, high-value services can mitigate customer price sensitivity, thereby reducing their bargaining power.

The bargaining power of customers for B. Riley Financial is influenced by several factors, including client concentration, switching costs, information availability, and the potential for backward integration. High client concentration, where a few clients contribute a significant portion of revenue, grants those clients greater leverage. In 2023, B. Riley's wealth management segment, known for its deeper client relationships, showed its importance, indicating that for some clients, switching costs are substantial.

Customers who are well-informed about market pricing and service offerings can negotiate more effectively. The financial services industry's increasing transparency empowers clients to compare and demand better terms. Furthermore, the threat of backward integration, where clients develop in-house financial capabilities, directly increases their bargaining power by reducing their reliance on external providers like B. Riley.

Client price sensitivity also plays a crucial role. While high-net-worth individuals may be less sensitive to price for specialized advice, institutional clients often prioritize cost-effectiveness for more standardized services. This variation in sensitivity necessitates tailored service offerings and pricing strategies from B. Riley to manage customer leverage.

| Factor | Impact on B. Riley Financial | Example/Data Point |

|---|---|---|

| Client Concentration | High concentration gives large clients more bargaining power. | If a few major clients represent a disproportionately large share of income, they can negotiate reduced fees. |

| Switching Costs | Lower switching costs increase customer leverage. | Transactional services have lower switching costs than intricate investment banking engagements. |

| Information Availability | Informed customers negotiate more effectively. | Enhanced transparency in financial services empowers clients to shop around. |

| Backward Integration Potential | Clients developing in-house capabilities reduce reliance on B. Riley. | Large corporations might build internal M&A teams, diminishing B. Riley's revenue from those clients. |

| Price Sensitivity | High sensitivity gives customers more power to seek lower prices. | Institutional clients may be more price-sensitive than high-net-worth individuals seeking specialized advice. |

Preview the Actual Deliverable

B. Riley Financial Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. Our B. Riley Financial Porter's Five Forces Analysis meticulously details the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the financial services industry, providing actionable insights for strategic decision-making.

Rivalry Among Competitors

B. Riley Financial navigates a crowded financial services landscape, facing a broad spectrum of rivals. These include global investment banks, regional players, and specialized boutique firms, each vying for market share in areas like investment banking, wealth management, and corporate advisory services.

The sheer number and varied specializations of these competitors, from large diversified financial institutions to niche advisory outfits, create an intensely competitive environment. For instance, in the middle-market investment banking sector where B. Riley is prominent, hundreds of firms actively compete for deal flow and client mandates.

The financial services sector, especially areas like investment banking and wealth management, is closely tied to economic ups and downs. While the first half of 2024 showed a revenue bump for investment banking, the forecast for 2025 points to a more subdued growth period, influenced by global political uncertainties and shifting interest rates.

When the overall market growth slows, competition among financial firms tends to heat up. They fight harder for each client and deal, as there's less new business to go around. This intensified rivalry can put pressure on fees and profit margins for companies like B. Riley Financial.

B. Riley Financial's ability to differentiate its broad service offerings, from investment banking and financial advisory to wealth and business advisory, significantly impacts the intensity of competitive rivalry. When B. Riley offers unique expertise, fosters a collaborative client approach, or carves out specialized market niches, it can effectively lessen direct competition. However, services that become commoditized are naturally subject to more aggressive, price-driven competition.

Exit Barriers

High exit barriers significantly influence competitive rivalry within B. Riley Financial's operating environment. When firms are locked into the market due to specialized assets, lengthy client contracts, or substantial capital investments, they may continue operating even when unprofitable. This persistence intensifies competition as these companies fight for survival, potentially leading to price wars or aggressive market share grabs.

In the financial services sector, specific exit barriers for companies like B. Riley Financial include the inherent difficulty of unwinding complex operations and the severe reputational damage that can result from a disorderly exit. Maintaining client trust is paramount, making a clean and orderly departure a critical consideration, which often prolongs the operational life of even struggling entities.

- Specialized Assets: Many financial firms invest in proprietary technology platforms or unique data analytics capabilities that have limited resale value, making it costly to divest.

- Long-Term Contracts: Client agreements in areas like wealth management or investment banking often have multi-year terms, obligating firms to continue service delivery.

- Reputational Risk: A poorly managed exit can damage the reputation of the exiting firm and even impact the broader industry, deterring rapid closures.

- Regulatory Hurdles: The financial industry is heavily regulated, and the process of winding down operations often involves extensive approvals and compliance measures.

Switching Costs for Customers

B. Riley Financial faces competitive rivalry influenced by customer switching costs. When these costs are low, clients can readily shift to rival firms, intensifying competitive pressure on B. Riley. This means B. Riley must continuously offer compelling value to retain its customer base.

Conversely, if B. Riley can cultivate high switching costs, perhaps through deeply integrated service offerings or strong client relationships, it gains a degree of insulation from intense rivalry. For example, if a client utilizes B. Riley's wealth management, investment banking, and research services, the effort and potential disruption involved in moving all these functions to another provider can deter them from switching.

- Low switching costs empower customers to easily move to competitors, increasing competitive pressure on B. Riley.

- High switching costs, often built on integrated services and strong client relationships, can provide B. Riley with a competitive advantage.

- In 2023, B. Riley Financial reported total revenue of $1.1 billion, demonstrating its scale within the competitive financial services landscape.

The competitive rivalry for B. Riley Financial is intense, stemming from a vast array of competitors, including large investment banks, regional firms, and specialized boutiques. This rivalry escalates during market slowdowns, as seen with the subdued growth forecast for investment banking in 2025 following a stronger first half of 2024, forcing firms to fight harder for clients and potentially impacting profit margins.

B. Riley's ability to differentiate its services, such as its integrated approach across investment banking, wealth management, and advisory, helps mitigate direct competition. However, commoditized services remain susceptible to price-based competition.

High exit barriers, like specialized assets and regulatory hurdles, can keep less profitable firms in the market, further intensifying competition. For instance, the difficulty in unwinding complex financial operations and the risk to reputation often prevent swift market exits.

Customer switching costs play a crucial role; low costs empower clients to move easily, increasing pressure on B. Riley, while high costs, built on strong relationships and integrated services, offer a competitive buffer. In 2023, B. Riley Financial's $1.1 billion in revenue highlights its significant presence amidst this competitive landscape.

SSubstitutes Threaten

The threat of substitutes for B. Riley Financial's diverse service offerings is significant, as clients can often achieve similar financial objectives through alternative channels. For instance, in the realm of capital raising, companies might bypass traditional investment banking services by opting for direct listings on stock exchanges or pursuing private funding rounds from venture capital firms or private equity funds. This diversification in funding avenues presents a direct substitute for the capital markets advisory B. Riley provides.

The threat of substitutes for B. Riley Financial's services is significant if alternative offerings provide similar or superior results at a lower price point. For example, the rise of robo-advisors presents a compelling, cost-effective alternative to traditional wealth management, potentially drawing away clients who prioritize affordability over personalized human advice.

In 2024, the wealth management industry saw continued growth in digital-first platforms, with assets under management in robo-advisors projected to reach over $3 trillion globally by year-end, highlighting the increasing appeal of these lower-cost substitutes.

B. Riley Financial's target audience, comprising corporations, institutions, and high-net-worth individuals, exhibits a varying propensity to adopt substitute solutions. This willingness is significantly shaped by the industry's reliance on trust and the perceived need for tailored financial advice, which can be harder to replicate with generic alternatives.

The complexity of financial needs for these sophisticated clients often acts as a barrier to simple substitution. For instance, while robo-advisors offer a lower-cost alternative for basic investment management, they often lack the nuanced, relationship-driven approach that B. Riley provides for complex wealth planning and corporate finance needs.

In 2024, the demand for personalized financial guidance remained robust, with surveys indicating that over 70% of affluent investors still prefer working with a human advisor for complex financial decisions, underscoring the challenge for pure digital substitutes in capturing B. Riley's core clientele.

Technological Advancements Enabling Substitutes

The increasing sophistication of financial technology (FinTech) and artificial intelligence (AI) is a major catalyst for substitutes in the financial services sector. These advancements allow for the automation of numerous tasks and sophisticated data analysis, directly challenging traditional service models.

AI-powered platforms are increasingly capable of offering personalized financial advice, potentially displacing human advisors in certain capacities. For instance, robo-advisors, powered by algorithms, saw significant growth, with assets under management reaching hundreds of billions of dollars globally by 2024.

This technological shift creates viable alternatives for consumers and businesses seeking financial services. Consider these key impacts:

- Automated Investment Management: Robo-advisors offer low-cost portfolio management, attracting a growing segment of investors.

- Digital Lending Platforms: Online platforms provide faster and often more accessible loan options compared to traditional banks.

- AI-driven Financial Planning Tools: Sophisticated software can now assist with budgeting, tax planning, and retirement forecasting.

- Blockchain and Decentralized Finance (DeFi): These technologies offer alternative avenues for transactions and financial products, bypassing traditional intermediaries.

Regulatory Environment for Substitutes

Changes in the regulatory landscape significantly influence the threat of substitutes for B. Riley Financial's services. A more accommodating regulatory environment for emerging fintech solutions, for instance, could accelerate their adoption and present a greater challenge.

For example, if regulations ease for decentralized finance (DeFi) platforms or alternative investment vehicles, these could draw capital and clients away from traditional financial advisory and brokerage services offered by B. Riley. In 2024, we've seen continued discussions and some initial legislative actions globally aimed at regulating digital assets and fintech innovation, which could impact the competitive dynamics.

- Regulatory Shifts: Evolving regulations can either encourage or obstruct the growth of substitute financial products and services.

- Fintech Permissiveness: A more lenient regulatory approach towards digital financial platforms can amplify the threat of substitution.

- Impact on B. Riley: For B. Riley Financial, this means monitoring how new rules might favor or disadvantage alternative service providers in areas like wealth management, investment banking, and capital markets.

The increasing sophistication of FinTech, particularly AI-driven platforms, presents a significant threat of substitutes for B. Riley Financial. These technologies offer automated investment management and personalized financial planning, directly challenging traditional advisory models. For instance, by 2024, robo-advisors had amassed hundreds of billions in assets under management globally, demonstrating their growing appeal as a lower-cost alternative.

The rise of alternative lending platforms and decentralized finance (DeFi) also offers substitutes by providing faster, more accessible loan options and bypassing traditional intermediaries. Regulatory shifts can further amplify this threat; for example, more permissive rules for digital assets in 2024 could divert capital and clients from B. Riley's core services.

| Substitute Area | Description | 2024 Impact/Trend |

|---|---|---|

| Robo-Advisors | Automated, low-cost portfolio management | Global AUM projected to exceed $3 trillion |

| Digital Lending | Faster, accessible loan options | Continued growth in online origination |

| DeFi | Bypassing traditional financial intermediaries | Ongoing regulatory discussions impacting adoption |

Entrants Threaten

Entering the diversified financial services sector, which includes areas like investment banking and wealth management, demands significant upfront investment. This capital is needed for obtaining necessary licenses, developing robust technological infrastructure, and attracting skilled professionals. For instance, establishing a new brokerage firm in 2024 could easily require millions of dollars just for regulatory compliance and technology alone, creating a formidable barrier.

The financial services industry, including B. Riley Financial's operating environment, is characterized by substantial regulatory hurdles. New entrants must contend with rigorous licensing procedures, extensive compliance mandates, and constant supervision from bodies like the SEC and FINRA. For instance, in 2024, the cost of compliance for financial firms continues to rise, with many reporting significant investments in technology and personnel to meet evolving regulatory demands, making it a formidable barrier.

Established financial services firms like B. Riley Financial leverage significant economies of scale, meaning their large operational footprint allows for lower per-unit costs. For instance, in 2023, B. Riley's diverse business segments, from investment banking to wealth management, likely contributed to cost efficiencies not easily replicated by smaller, newer players.

Furthermore, economies of scope, derived from offering a broad array of integrated services, create a competitive advantage for B. Riley. New entrants often face a substantial hurdle in building the infrastructure and expertise to match this breadth, making it challenging to compete on both price and comprehensive service offerings.

Brand Loyalty and Differentiation

Brand loyalty is a significant barrier for new entrants in the financial services sector, as established firms like B. Riley Financial leverage existing client relationships and a strong reputation. Building trust in financial services takes time and consistent performance, which newcomers must overcome. For instance, in 2024, the wealth management industry continued to see consolidation, with larger firms retaining a substantial market share due to their established client bases and perceived stability.

New entrants struggle to differentiate themselves in a market where trust and reliability are paramount. B. Riley Financial, with its history and established brand, benefits from this inherent advantage. Many clients remain with their current financial advisors due to comfort and established rapport, making it difficult for new firms to attract significant assets under management. In 2024, studies indicated that over 70% of investors cited trust as the primary factor when choosing a financial advisor, a sentiment that favors incumbents.

- Brand Loyalty: Existing clients of B. Riley Financial are less likely to switch to a new provider, especially if they are satisfied with the service and performance.

- Reputation and Trust: B. Riley Financial's established reputation and years of operation build a foundation of trust that new entrants find challenging to replicate quickly.

- Differentiation Challenge: In a crowded financial services market, new firms must offer a compelling unique selling proposition to attract clients away from established, trusted brands.

- Client Inertia: Many investors exhibit inertia, preferring to stay with their current financial institutions due to convenience and a lack of perceived benefit from switching, particularly in 2024.

Access to Distribution Channels

New players in the financial services sector often struggle to access the established client networks and distribution channels that existing firms have spent years building. For instance, a new wealth management firm might find it challenging to secure partnerships with major employers for their retirement plans or gain traction with independent broker-dealers who already have strong relationships with incumbent providers.

The cost and time involved in replicating these deep-seated relationships can be substantial deterrents. Consider that in 2024, the average cost to acquire a new client in the financial advisory space can range from $1,500 to $5,000, depending on the service model and target demographic. This high acquisition cost, coupled with the need to build trust and credibility, creates a significant barrier for new entrants seeking to compete with established players who benefit from established distribution pipelines.

- Difficulty in accessing established client networks: New firms lack the pre-existing relationships that incumbent financial institutions leverage for client acquisition and retention.

- High cost and time investment for relationship building: Cultivating new client bases and distribution partnerships requires significant financial resources and prolonged effort, often spanning several years.

- Incumbent advantage in distribution channels: Established firms often have exclusive agreements or preferred vendor status with corporate benefit providers, financial platforms, and other distribution intermediaries, limiting access for newcomers.

The threat of new entrants into the diversified financial services sector, where B. Riley Financial operates, is generally low. This is primarily due to the substantial capital requirements for licensing, technology, and talent, alongside stringent regulatory oversight that demands significant compliance investments. For instance, establishing a new investment advisory firm in 2024 typically requires millions in seed capital and ongoing operational expenses to meet regulatory standards.

Economies of scale and scope enjoyed by established players like B. Riley Financial create cost advantages and service breadth that are difficult for newcomers to match. Furthermore, brand loyalty and the inherent trust required in financial services act as significant barriers, with client inertia often favoring incumbent institutions. In 2024, the cost to acquire a new financial client could range from $1,500 to $5,000, highlighting the challenge for new firms.

| Barrier Type | Description | 2024 Impact Example |

|---|---|---|

| Capital Requirements | High upfront investment for licensing, technology, and operations. | Millions required for a new brokerage firm's regulatory compliance and tech infrastructure. |

| Regulatory Hurdles | Complex licensing, compliance, and supervision by bodies like SEC and FINRA. | Rising compliance costs for financial firms, necessitating significant tech and personnel investment. |

| Economies of Scale/Scope | Cost efficiencies from large operations and integrated service offerings. | B. Riley's diverse segments offer cost advantages over smaller, specialized entrants. |

| Brand Loyalty & Trust | Established reputation and client relationships are hard to replicate. | Over 70% of investors cite trust as the primary factor in choosing an advisor, favoring incumbents. |

| Distribution Channels | Accessing established client networks and partnerships is challenging. | New wealth management firms struggle to secure corporate retirement plan partnerships. |

Porter's Five Forces Analysis Data Sources

Our B. Riley Financial Porter's Five Forces analysis is built upon a robust foundation of data, including the company's SEC filings, investor relations materials, and industry-specific market research reports. We also incorporate insights from financial news outlets and analyst commentary to provide a comprehensive view of the competitive landscape.