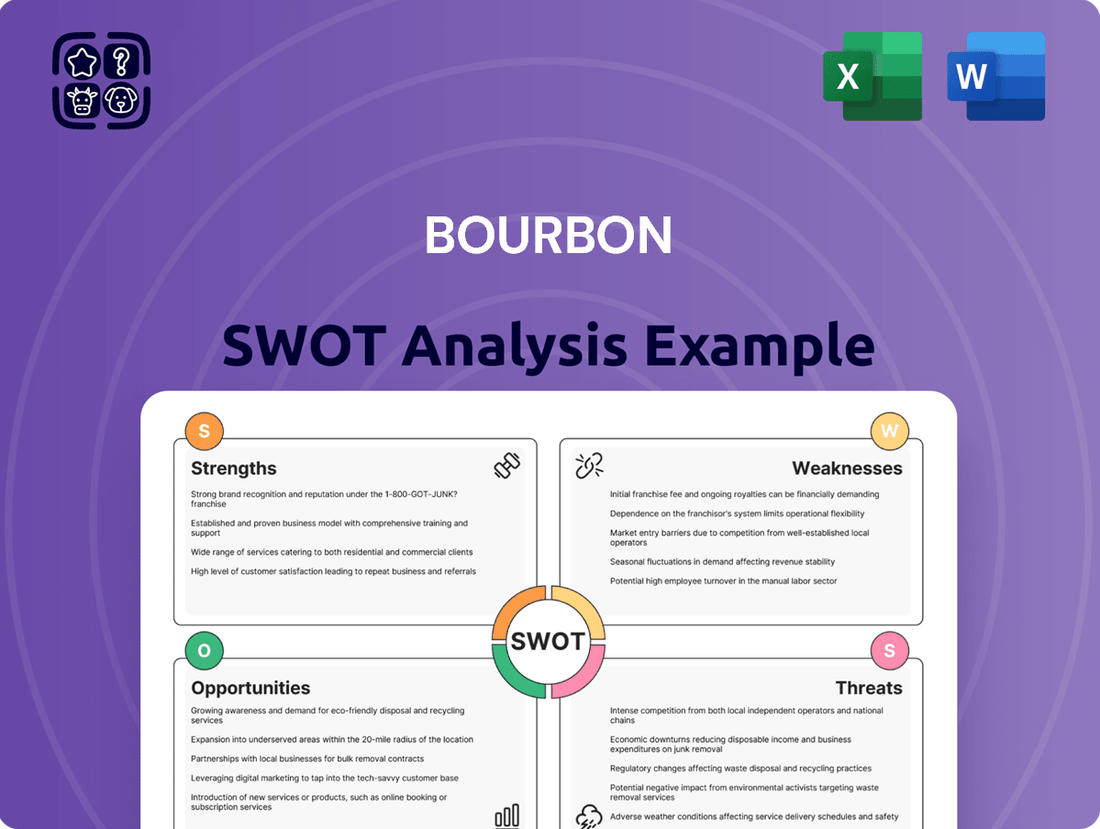

Bourbon SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bourbon Bundle

The Bourbon industry boasts a rich heritage and a passionate consumer base, presenting significant Strengths in brand loyalty and premiumization opportunities. However, it also faces Threats from fluctuating raw material costs and evolving consumer preferences.

Want the full story behind bourbon's market position, including its unique competitive advantages and potential vulnerabilities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Bourbon Corporation boasts a remarkably diverse fleet, encompassing over 100 vessels as of early 2024. This extensive range includes supply vessels, anchor handling tugs, and dive support vessels, enabling them to offer a comprehensive suite of marine services. Their ability to cater to various segments of the offshore energy sector, from traditional oil and gas to emerging offshore wind projects, positions them as a versatile partner.

This broad service offering is a significant strength, allowing Bourbon to adapt to market shifts and client demands. For instance, their expansion into supporting offshore wind installations demonstrates their strategic foresight. In 2023, the company reported a notable increase in activity within the offshore wind sector, highlighting the growing importance of this segment in their service portfolio.

Bourbon's unwavering commitment to safety and efficiency is a significant strength. In 2024, they reported achieving key Health, Safety, and Environment (HSE) objectives, underscoring their dedication to operational excellence. This focus is expected to continue into 2025, bolstering their reputation and client confidence in delivering reliable maritime solutions.

Bourbon is strategically investing in its fleet's future, with significant capital allocated to modernizing its vessels. This includes the development of new crew transfer vessels (CTVs) and passenger transport craft, specifically engineered for enhanced fuel efficiency. For instance, in 2024, Bourbon announced plans to expand its fleet with several new, more sustainable vessels, reflecting a commitment to operational excellence and environmental stewardship.

This forward-thinking investment ensures Bourbon's fleet remains at the forefront of technological advancement and meets increasingly stringent environmental regulations. The company's proactive stance in upgrading its assets, including retrofitting existing ships, directly supports its broader transition towards more sustainable maritime operations, a critical factor for competitiveness in the evolving energy sector.

Growing Presence in Offshore Wind Sector

Bourbon is actively expanding its footprint in the offshore wind sector, a strategic pivot recognizing the global energy transition. They've established Bourbon Wind to capitalize on their extensive marine capabilities, offering services across the entire offshore wind value chain, from initial studies to ongoing maintenance. This includes crucial personnel transport and specialized vessel operations. Bourbon's commitment is underscored by their significant experience with floating wind farm prototypes, positioning them for future growth in this evolving market.

Bourbon Wind's strategic focus is on becoming a key enabler for the offshore wind industry. Their expertise in marine operations, honed over years in the oil and gas sector, is directly transferable to the demands of wind farm development and operation. This includes specialized vessels and skilled crews adept at working in challenging marine environments. The company is well-positioned to benefit from the projected growth in offshore wind capacity, with global installations expected to reach over 300 GW by 2030, according to industry forecasts.

- Dedicated Offshore Wind Division: Bourbon Wind established to focus on the renewable energy sector.

- Full Value Chain Services: Offering expertise in pre-studies, transport, installation, and maintenance.

- Leveraging Marine Expertise: Transferring extensive experience from oil and gas to offshore wind.

- Floating Wind Experience: Proven track record with floating wind farm prototypes, a key growth area.

Global Clientele and Integrated Contracts

Bourbon's strength lies in its extensive global clientele, demonstrating a robust international presence and operational capacity. This broad market reach is complemented by its success in securing integrated logistics contracts, a testament to its ability to offer comprehensive solutions and foster enduring client partnerships.

Recent contract wins, such as the significant agreement in Namibia, highlight Bourbon's capability to deliver end-to-end services. These integrated contracts are crucial for establishing a stable and predictable revenue stream, reinforcing the company's market position.

- Global Reach: Bourbon serves clients across numerous continents, showcasing its established international footprint.

- Integrated Contracts: The company excels at securing complex, multi-faceted contracts that bundle various services.

- Namibia Contract: A key example of their strength is the recent major integrated logistics contract secured in Namibia.

- Revenue Stability: These global operations and integrated contracts contribute significantly to a stable revenue base.

Bourbon's extensive and diverse fleet is a cornerstone of its operational capability, allowing it to serve a wide array of maritime needs. Their commitment to fleet modernization, including investments in fuel-efficient vessels, ensures they remain competitive and compliant with evolving environmental standards through 2024 and into 2025.

The company's strategic focus on the burgeoning offshore wind sector, spearheaded by Bourbon Wind, leverages their deep marine expertise to capture growth opportunities. This division is poised to benefit from the significant projected expansion of global offshore wind capacity, with industry forecasts indicating substantial market growth by 2030.

Bourbon's strength is further amplified by its global client base and proven success in securing integrated logistics contracts, which provide revenue stability. The recent significant contract in Namibia exemplifies their ability to deliver comprehensive, end-to-end solutions, reinforcing their market position.

| Strength Area | Key Aspect | Supporting Fact/Data (2024/2025) |

|---|---|---|

| Fleet Diversity & Modernization | Comprehensive Vessel Range | Over 100 vessels (early 2024), including new, fuel-efficient CTVs planned. |

| Offshore Wind Expansion | Dedicated Division & Services | Bourbon Wind offers full value chain services; global offshore wind capacity projected to exceed 300 GW by 2030. |

| Global Operations & Contracts | Integrated Logistics Expertise | Secured significant integrated logistics contract in Namibia; established global clientele. |

| Safety & Efficiency Focus | Operational Excellence | Achieved key HSE objectives in 2024, reinforcing client confidence. |

What is included in the product

Analyzes Bourbon’s competitive position through key internal and external factors, identifying its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address potential challenges, alleviating the stress of uncertainty.

Weaknesses

Bourbon Corporation's history includes significant financial restructuring, notably a debt restructuring program that addressed a substantial debt load. Recent court approvals in early 2024 for finalizing this restructuring underscore past financial vulnerabilities.

These restructuring events, while showing progress, can affect investor confidence and the company's ability to secure future capital, indicating a need for stringent financial oversight.

Bourbon's significant exposure to the traditional oil and gas sector, despite ongoing diversification, remains a key weakness. This reliance means that revenue streams are directly impacted by the inherent volatility of oil and gas prices and the pace of global energy transition initiatives. For instance, a downturn in crude oil prices, such as the fluctuations seen in 2024, can lead to reduced exploration and production activities, directly affecting demand for Bourbon's offshore support services.

The offshore support vessel (OSV) sector, including Bourbon's operational environment, grapples with an aging fleet. This industry-wide issue translates to higher maintenance expenditures and potential operational disruptions. For instance, data from industry reports in late 2024 indicated that a significant percentage of OSVs globally were over 15 years old, increasing the likelihood of unscheduled downtime and repair costs.

While Bourbon has made strides in fleet modernization, the pervasive nature of this challenge means the overall market may experience greater operational risks. This persistent trend necessitates ongoing, substantial capital investment to ensure a competitive and reliable fleet, impacting profitability and strategic planning.

Exposure to High Operational Costs

Bourbon faces significant operational costs due to its extensive fleet of specialized offshore vessels. These costs are driven by essential factors like fuel, regular maintenance, and crew compensation, all of which are subject to market fluctuations. For instance, in 2024, the average daily operating cost for offshore support vessels can range from $5,000 to $20,000 or more, depending on vessel type and services provided.

Global energy prices directly impact fuel expenses, a major component of Bourbon's operating budget. Fluctuations in oil and gas markets, as seen with Brent crude oil prices hovering around $80-$90 per barrel in early 2025, directly translate into higher or lower fuel bills. This volatility makes cost management a constant challenge, directly affecting the company's bottom line.

- Fuel Costs: Directly tied to volatile global energy prices, impacting profitability.

- Maintenance Expenses: Essential for a specialized fleet, requiring significant investment.

- Crewing Costs: Subject to labor market dynamics and specialized skill requirements.

- Supply Chain Disruptions: Can increase the cost of spare parts and essential supplies.

Intense Market Competition

The offshore marine services sector is notoriously crowded, forcing companies like Bourbon to constantly battle for contracts. This competition centers on who offers the broadest services, the most advanced technology, and the most attractive prices. In 2024, the ongoing demand for offshore energy exploration and development, particularly in regions like the North Sea and the Gulf of Mexico, fuels this competitive landscape. For Bourbon, this means a constant pressure to keep day rates competitive, which directly impacts their profit margins.

Bourbon faces significant challenges in maintaining its edge. To stay ahead, the company must prioritize continuous innovation and find ways to make its services stand out from those offered by its strong competitors. This isn't just about having the right vessels; it's about offering specialized solutions and superior operational efficiency. For instance, as of early 2025, the market is seeing increased investment in vessels capable of supporting renewable energy projects, a segment where differentiation is key.

- Intense Competition: Numerous global and regional players compete for offshore contracts.

- Price Pressure: High competition often leads to downward pressure on day rates and overall profitability.

- Technological Advancement: Companies must invest in and showcase advanced technological capabilities to win bids.

- Service Differentiation: Offering specialized services, such as those supporting offshore wind farms, is crucial for market positioning.

Bourbon's significant reliance on the volatile oil and gas sector exposes it to price fluctuations and the slow pace of energy transition, impacting revenue. The aging offshore vessel fleet necessitates substantial, ongoing capital investment for maintenance and modernization, increasing operational risks and costs. Intense competition in the offshore marine services sector leads to price pressure on day rates, directly affecting profitability and demanding continuous innovation for differentiation.

| Weakness | Description | Impact | Example/Data Point (2024/2025) |

|---|---|---|---|

| Oil & Gas Dependency | Heavy reliance on the traditional oil and gas industry. | Vulnerability to commodity price swings and energy transition policies. | Brent crude prices fluctuated between $80-$90/barrel in early 2025, directly impacting offshore activity. |

| Aging Fleet | A significant portion of the offshore support vessel (OSV) fleet is aging. | Higher maintenance costs, increased risk of operational downtime, and need for continuous capital expenditure. | Industry reports in late 2024 indicated a high percentage of OSVs globally were over 15 years old. |

| Intense Competition | Highly competitive market for offshore contracts. | Downward pressure on day rates, reduced profit margins, and the need for service differentiation. | Companies must invest in advanced technology and specialized services, like those for offshore wind, to remain competitive. |

Preview the Actual Deliverable

Bourbon SWOT Analysis

This is the actual Bourbon SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine excerpt of the comprehensive report. Once purchased, the full, detailed analysis will be yours to download.

Opportunities

The offshore wind energy sector is a significant growth area, with projections indicating substantial capacity additions and a corresponding rise in demand for specialized vessels. This burgeoning market offers a prime opportunity for Bourbon's offshore wind division to broaden its service offerings across the entire lifecycle of wind farm projects worldwide.

Market forecasts anticipate robust expansion from 2025 through 2034, driven by global decarbonization efforts and government support for renewable energy. For instance, the International Energy Agency (IEA) reported that offshore wind capacity additions in 2023 alone surpassed 10 GW, a trend expected to accelerate.

The offshore support vessel (OSV) fleet is aging, with a significant portion of vessels over 20 years old, creating a robust demand for modern, fuel-efficient replacements. Bourbon's strategic focus on fleet renewal directly addresses this gap, positioning them to secure new contracts and expand market share by offering technologically advanced and environmentally compliant solutions to meet evolving industry standards and client needs.

Global energy demand continues to rise, projected to increase by approximately 25% by 2050 according to the International Energy Agency. This surge, coupled with ongoing decommissioning projects and new exploration in areas like the North Sea and the Gulf of Mexico, directly fuels the need for robust offshore infrastructure. Bourbon's comprehensive fleet, capable of handling supply, cargo, and specialized subsea operations, is well-positioned to capitalize on this sustained demand.

Leveraging Technological Advancements and Digitalization

Bourbon can capitalize on the ongoing digital transformation in the offshore sector by integrating advanced technologies. The adoption of systems like dynamic positioning and automation promises significant gains in operational efficiency and safety. For instance, data-driven optimization can lead to reduced fuel consumption, a critical factor in cost management and environmental compliance. Bourbon's existing partnerships focused on data optimization for emissions reduction highlight a strategic direction that aligns with these technological opportunities.

These advancements enable Bourbon to offer more sophisticated and innovative services to its clients, thereby strengthening its market position. The company can leverage real-time data analytics to predict equipment failures, optimize vessel routes, and enhance crew performance. This proactive approach not only minimizes downtime but also improves overall project execution for clients.

Bourbon's strategic focus on digitalization is evident in its efforts to enhance operational efficiency. By embracing technologies that automate processes and provide data-driven insights, the company can achieve substantial cost savings. For example, optimizing vessel speed and route based on real-time weather and operational data can lead to significant fuel savings, potentially reducing operational expenditures by several percentage points.

Key opportunities include:

- Enhanced operational efficiency through automation and data analytics.

- Reduced fuel consumption and emissions via optimized vessel operations.

- Development of innovative, data-driven service offerings for clients.

- Improved safety records through advanced monitoring and control systems.

Expansion into High-Growth Regional Markets

While Europe remains a core market for Bourbon, the Asia-Pacific region is demonstrating significant growth in the offshore support vessel (OSV) sector. This presents a prime opportunity for strategic expansion. For example, the Asia-Pacific OSV market was projected to reach approximately $10.5 billion in 2024, with a compound annual growth rate (CAGR) of over 4% expected through 2030.

Bourbon can leverage this trend by either establishing new operations or forging strategic partnerships within these burgeoning markets. This approach allows the company to tap into new revenue streams and reduce reliance on established, potentially more mature, markets. Emerging opportunities are also evident in other regions, catering to both traditional offshore oil and gas activities and the rapidly expanding offshore wind sector.

- Asia-Pacific OSV Market Growth: Projected to exceed $10.5 billion in 2024, with a CAGR of over 4% expected through 2030.

- Diversification Strategy: Expanding into high-growth regions like Asia-Pacific can mitigate risks associated with market maturity in Europe.

- Emerging Sector Opportunities: Growth potential exists not only in traditional offshore but also in the burgeoning offshore wind energy sector across various geographies.

Bourbon can capitalize on the increasing demand for specialized vessels in the growing offshore wind market, with capacity additions projected to accelerate. The company is also well-positioned to benefit from the aging OSV fleet, as demand for modern, fuel-efficient replacements is high. Furthermore, Bourbon's digitalization strategy offers opportunities to enhance operational efficiency and develop innovative client services.

Threats

The offshore marine services sector, crucial for Bourbon's operations, is highly susceptible to swings in global oil and gas prices. When crude oil prices, for instance, fall significantly, energy companies often scale back their exploration and production efforts. This directly translates to lower demand for Bourbon's vessels and can drive down the daily rates they can charge, creating a persistent challenge for consistent revenue streams.

Increasing global pressure for decarbonization and more stringent environmental regulations represent a significant threat to the bourbon industry. For instance, the U.S. Environmental Protection Agency (EPA) continues to refine its emissions standards, impacting distilleries' operational processes and waste management. This necessitates substantial investments in greener technologies and potentially leads to higher operational costs as companies adapt to these evolving requirements.

Compliance with new emissions standards and the broader shift towards cleaner energy sources are critical challenges. Bourbon producers may face the need for costly fleet upgrades for transportation and operational adjustments in their distillation processes. For example, the push for renewable energy sources could require significant capital expenditure for distilleries to transition away from traditional fossil fuels, impacting their cost structure and competitive positioning.

Geopolitical instability, including ongoing conflicts and trade disputes, directly impacts global supply chains and can lead to significant cost increases for companies like Bourbon. For instance, the ongoing tensions in Eastern Europe have disrupted energy markets, with oil prices fluctuating significantly, directly affecting the operational costs for offshore service providers. These disruptions can make planning difficult and potentially reduce demand in affected areas.

Supply Chain Constraints and Inflationary Pressures

Bourbon, like many companies reliant on global logistics, faces significant headwinds from ongoing supply chain disruptions. These issues impact the timely delivery and cost of critical components, from new vessel construction materials to essential spare parts, directly affecting operational readiness and expansion plans.

Inflationary pressures are a major concern, driving up the cost of everything from raw materials used in shipbuilding and maintenance to fuel for its fleet and labor wages. For example, the Baltic Dry Index, a key indicator of shipping costs, saw significant volatility in 2024, reflecting these pressures. This escalation in operating expenses and capital expenditure, particularly for fleet modernization, directly squeezes Bourbon's profit margins.

- Supply chain bottlenecks continue to affect the availability and price of new vessels and crucial spare parts.

- Rising material costs, including steel and specialized equipment, increase the expense of fleet maintenance and new builds.

- Elevated fuel prices directly impact operating costs, reducing profitability for offshore support vessel operations.

- Labor shortages and wage inflation add to the overall increase in operational expenditures.

Intense Capital Expenditure for Modernization

Bourbon faces significant financial pressure from the continuous need to invest heavily in modernizing its fleet. Keeping vessels technologically advanced and environmentally compliant demands substantial capital, especially for new builds and retrofits. This ongoing expenditure can strain financial resources, potentially leading to increased debt. For instance, the offshore vessel market in 2024 continues to see owners investing in greener technologies and more efficient designs, driving up newbuild costs. This can divert funds from other crucial strategic areas if market downturns occur.

The imperative for a modern, technologically advanced, and environmentally compliant fleet necessitates continuous and substantial capital expenditure for Bourbon. This ongoing investment, particularly for newbuilds and fleet upgrades, can place a strain on financial resources and increase debt levels. For example, as of early 2025, the cost of a new, eco-friendly offshore support vessel can range from $50 million to over $100 million, depending on size and capabilities. This can divert funds from other strategic initiatives, especially if market conditions are unfavorable.

- High Cost of Newbuilds: Acquiring state-of-the-art vessels, compliant with evolving environmental regulations, represents a significant upfront investment.

- Retrofitting Expenses: Upgrading existing vessels to meet new standards also incurs substantial costs, impacting profitability.

- Financial Leverage: The need for large capital outlays can lead to increased reliance on debt financing, potentially raising financial risk.

- Opportunity Cost: Capital allocated to fleet modernization might otherwise be used for expansion, R&D, or returning value to shareholders.

Bourbon faces significant threats from fluctuating oil prices, with a direct impact on demand for its services. Additionally, stricter environmental regulations necessitate costly upgrades to its fleet and operations, potentially increasing expenditures. Geopolitical instability and supply chain disruptions further exacerbate cost pressures and operational challenges. The company also contends with high capital expenditure requirements for fleet modernization, which can strain financial resources and increase debt. For instance, the average cost of a new offshore support vessel in early 2025 can exceed $50 million, a substantial investment.

| Threat Category | Specific Threat | Impact on Bourbon | Example Data/Context (2024-2025) |

|---|---|---|---|

| Market Volatility | Oil Price Fluctuations | Reduced demand for offshore services, lower day rates | Brent crude oil prices experienced significant volatility in 2024, impacting exploration budgets. |

| Regulatory Environment | Stricter Environmental Standards | Increased CAPEX for fleet upgrades, higher operating costs | Ongoing refinement of EPA emissions standards requires distilleries to invest in greener technologies. |

| Geopolitical & Supply Chain | Geopolitical Instability | Disrupted supply chains, increased operational costs | Tensions in Eastern Europe led to energy market volatility and increased operational costs for service providers in 2024. |

| Capital Expenditure | Fleet Modernization Costs | Strain on financial resources, potential for increased debt | New eco-friendly offshore support vessels can cost $50M-$100M+ as of early 2025. |

SWOT Analysis Data Sources

This Bourbon SWOT analysis is built upon robust data, including financial reports from leading distilleries, comprehensive market research on consumer preferences, and expert commentary from industry analysts to provide a well-rounded perspective.