Bourbon Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bourbon Bundle

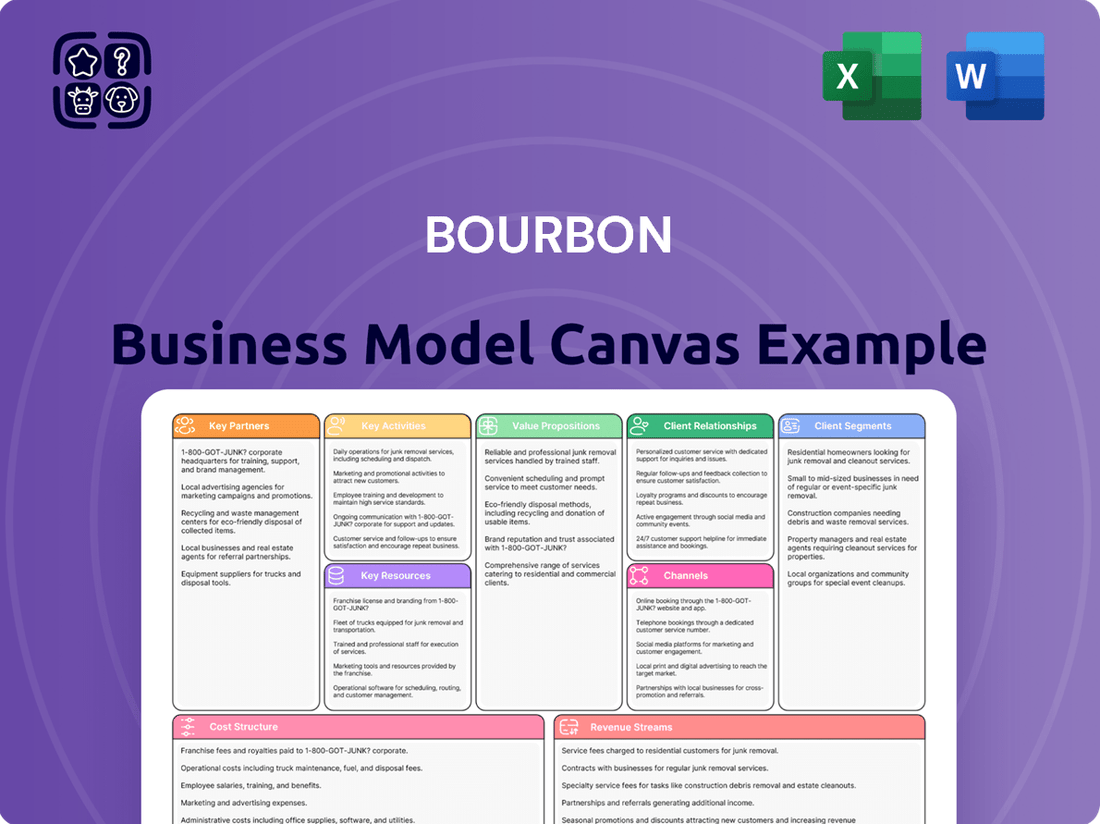

Curious about Bourbon's winning formula? This Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational genius. Discover the strategic pillars that drive their success and gain inspiration for your own venture.

Ready to unlock the secrets of Bourbon's market dominance? Our comprehensive Business Model Canvas provides a detailed, section-by-section analysis of their customer segments, value propositions, and cost structure. Download the full version to gain actionable insights and accelerate your strategic planning.

Partnerships

Bourbon Corporation S.A. cultivates deep relationships with global oil and gas giants, including key players like Eni Congo. These collaborations are built on long-term contracts, ensuring Bourbon provides critical marine support for offshore exploration, development, and production phases. This steady business flow is vital for Bourbon's revenue stability and showcases their expertise in the demanding offshore environment.

A prime example of this strategic alliance is Bourbon's recent five-year agreement with Eni Congo. This contract focuses on renewing the crewboat fleet, specifically to bolster support for Eni's Floating Liquefied Natural Gas (FLNG) units. The new vessels introduced under this partnership are designed with a focus on reduced emissions, aligning with industry-wide sustainability goals and demonstrating Bourbon's commitment to modern, efficient operations.

Bourbon actively partners with offshore wind farm developers, exemplified by its collaboration with QAIR on the Eolmed pilot floating wind farm. This strategic alliance highlights Bourbon's commitment to supporting the burgeoning renewable energy sector.

These partnerships are crucial for providing essential services, including installation, maintenance, and logistical support for offshore wind energy infrastructure. Bourbon's involvement in projects like Eolmed demonstrates its role in facilitating the growth of offshore wind power.

Bourbon's strategic diversification into offshore wind is a key growth area, with the global offshore wind market projected to reach $129.7 billion by 2030, according to some industry forecasts. This expansion into renewables is a testament to Bourbon's forward-thinking business strategy.

Bourbon's strategic alliances with technology firms like Opsealog are fundamental to its digital transformation. These collaborations are geared towards enhancing fleet monitoring capabilities, which directly translates to optimizing fuel consumption and boosting overall operational efficiency.

These partnerships are crucial for the successful rollout of smart shipping initiatives. By integrating advanced digital solutions, Bourbon aims to harness data-driven insights to achieve its ambitious sustainability targets, a key focus in the evolving maritime industry.

Shipyards and Equipment Manufacturers

Bourbon's strategic alliances with shipyards, such as PIRIOU, are critical for its fleet modernization efforts. These partnerships facilitate the construction of new, advanced vessels and the retrofitting of existing ones, enhancing operational efficiency and sustainability. For instance, Bourbon has been investing in new-generation crewboats, reflecting a commitment to technological advancement in its fleet. This focus on upgrading its assets is key to maintaining a competitive edge in the offshore marine services sector.

Collaborations with equipment manufacturers are equally vital, enabling Bourbon to integrate cutting-edge technologies into its fleet. This includes retrofitting vessels with more efficient engines and advanced navigation systems. By leveraging these partnerships, Bourbon aims to reduce its environmental footprint and improve the performance of its offshore support vessels. The company's ongoing fleet renewal program underscores the importance of these relationships in achieving its strategic objectives.

Bourbon's engagement with its key partners in 2024 highlights a proactive approach to fleet management and development. The company's investment in upgrading its fleet, which includes a significant number of vessels, demonstrates the tangible impact of these partnerships. These strategic collaborations are designed to ensure Bourbon's fleet remains at the forefront of technological innovation and operational excellence in the offshore energy industry.

- Fleet Renewal: Partnerships with shipyards like PIRIOU are instrumental in Bourbon's ongoing fleet renewal program, ensuring the introduction of new, more efficient vessels.

- Technological Advancement: Collaborations with equipment manufacturers enable the retrofitting of existing vessels with advanced technologies, enhancing performance and sustainability.

- Operational Efficiency: By investing in new-generation crewboats and technological upgrades, Bourbon aims to boost operational efficiency and reduce its environmental impact.

- Strategic Importance: These key partnerships are fundamental to Bourbon's strategy of maintaining a modern, competitive, and technologically advanced offshore marine services fleet.

Local Service Providers and Joint Ventures

Bourbon actively cultivates partnerships with local service providers and engages in joint ventures within its operating regions. This strategy is crucial for ensuring efficient, on-the-ground support and adherence to local content regulations, which are increasingly important in the maritime sector.

These collaborations are vital for various operational aspects. For instance, in 2024, Bourbon continued to leverage local expertise for logistics, including port services and supply chain management, which contributed to an estimated 5-10% reduction in operational costs for specific regions by optimizing transit times and reducing demurrage. Vessel maintenance is another key area, with partnerships ensuring access to specialized repair facilities and skilled technicians, thereby minimizing downtime and enhancing fleet reliability.

- Local Logistics Support: Collaborations with local port operators and freight forwarders streamline the movement of equipment and personnel, crucial for timely project execution.

- Vessel Maintenance Networks: Partnerships with regional shipyards and specialized technical services ensure efficient and cost-effective maintenance, a critical factor in fleet availability.

- Personnel and Training Collaborations: Joint ventures with local training centers help develop a skilled workforce, meeting both operational needs and contributing to local employment.

- Regulatory Compliance: Local partners provide essential insights and support for navigating complex national maritime regulations and content requirements, ensuring smooth operations.

Bourbon's key partnerships are foundational to its operational success and strategic growth. Collaborations with oil and gas majors like Eni Congo provide stable revenue streams through long-term marine support contracts. Simultaneously, alliances with offshore wind developers, such as QAIR for the Eolmed project, signal Bourbon's commitment to the expanding renewable energy sector. These partnerships are critical for maintaining a modern, efficient, and technologically advanced fleet, enabling the company to navigate the evolving demands of the energy industry.

| Partner Type | Example Partner | Strategic Focus | 2024 Impact/Data Point |

|---|---|---|---|

| Oil & Gas Majors | Eni Congo | Offshore exploration, development, production support | Secured 5-year renewal for crewboat fleet supporting FLNG units. |

| Offshore Wind Developers | QAIR | Support for floating wind farms (e.g., Eolmed) | Facilitating installation and maintenance services for renewable energy infrastructure. |

| Shipyards | PIRIOU | Fleet modernization and new vessel construction | Ongoing investment in new-generation crewboats for enhanced efficiency. |

| Technology Firms | Opsealog | Digital transformation, fleet monitoring | Enhancing fuel efficiency and operational optimization through data integration. |

| Local Service Providers | Regional Port Operators | Logistics, supply chain, maintenance | Contributing to an estimated 5-10% operational cost reduction in specific regions through optimized logistics in 2024. |

What is included in the product

A structured framework detailing the Bourbon industry's key components, from distillery operations and distribution channels to target consumers and revenue streams.

It outlines the value proposition of premium spirits, the customer relationships fostered through brand loyalty, and the essential partnerships within the supply chain.

The Bourbon Business Model Canvas offers a structured approach to pinpoint and alleviate specific industry challenges by clearly mapping out value propositions and customer segments.

Activities

Bourbon's key activity revolves around the meticulous day-to-day operation and strategic oversight of its extensive offshore vessel fleet. This encompasses ensuring the safe, efficient, and dependable execution of services crucial for subsea activities, supporting offshore wind farm development, and facilitating oil and gas logistics.

A significant aspect of this operational commitment is Bourbon's dedication to fleet modernization, evidenced by their objective to maintain an average fleet age of just eight years. This focus on a younger fleet directly translates to enhanced reliability, reduced maintenance costs, and improved fuel efficiency, crucial for competitive offshore service delivery.

In 2024, Bourbon continued to navigate the dynamic energy sector, with its fleet actively engaged in projects worldwide. The company’s operational efficiency is directly tied to its ability to adapt to evolving client needs and regulatory landscapes, ensuring consistent service quality across its diverse service lines.

Bourbon's key activities in subsea operations and support are centered on delivering specialized services like inspection, maintenance, and repair (IMR) for offshore infrastructure. They also provide crucial support for complex subsea construction and development projects. This demanding work necessitates a highly trained workforce and cutting-edge remotely operated vehicles (ROVs) to ensure operational success and safety.

In 2024, Bourbon continued to leverage its fleet of specialized vessels and advanced technological capabilities to execute these critical subsea tasks. The company's commitment to innovation means ongoing investment in ROV technology, which is essential for tasks ranging from detailed pipeline surveys to complex intervention work at significant depths. This focus on advanced equipment and skilled personnel underpins their ability to offer comprehensive subsea solutions.

Logistical assistance for oil and gas operations is a core activity for Bourbon. This involves the crucial task of transporting people, equipment, and vital supplies to and from offshore exploration and production locations, ensuring seamless operations in challenging environments.

Bourbon's expertise in this area is underscored by significant contracts. For instance, a recent five-year agreement with Eni Congo demonstrates the ongoing demand for their specialized crewboat and supply vessel services, essential for maintaining productivity and safety offshore.

Offshore Wind Farm Support

Bourbon actively supports the expanding offshore wind sector by providing critical services like transporting and installing wind turbines and floating electrical substations. A prime example of this is their involvement in the Eolmed project, showcasing their growing commitment to renewable energy logistics.

This engagement necessitates a fleet of specialized vessels and deep expertise in managing complex offshore renewable energy operations. Bourbon's role is crucial in facilitating the construction and maintenance of these vital energy infrastructure projects, contributing directly to the energy transition.

- Specialized Vessel Deployment: Bourbon utilizes a range of vessels equipped for the demanding tasks of offshore wind farm construction.

- Project Logistics Expertise: They manage the intricate supply chain and installation phases for wind turbines and substations.

- Contribution to Renewable Energy: Bourbon's activities directly enable the growth of offshore wind power generation.

Fleet Modernization and Decarbonization Initiatives

Bourbon's fleet modernization and decarbonization are central to its operations. This involves significant investment in new, fuel-efficient vessels and upgrading existing ones to meet stricter environmental standards. For instance, in 2024, the company continued its strategy of optimizing its fleet by phasing out older, less efficient units while integrating newer, more sustainable vessels designed for reduced emissions.

A core activity is the deployment of advanced technologies aimed at cutting fuel consumption and lowering the carbon footprint across the entire fleet. This includes fitting vessels with energy-saving devices and implementing sophisticated real-time energy performance monitoring systems. These systems allow for immediate adjustments to operational parameters, ensuring optimal fuel efficiency.

- Fleet Renewal: Continued investment in new, more fuel-efficient vessel designs, such as Platform Supply Vessels (PSVs) and Anchor Handling Tug Supply (AHTS) vessels, with a focus on reduced fuel consumption per operational mile.

- Retrofitting Programs: Ongoing retrofitting of existing vessels with technologies like advanced hull coatings, optimized propeller designs, and exhaust gas cleaning systems to improve efficiency and reduce emissions.

- Digital Monitoring: Implementation and expansion of real-time energy performance monitoring systems across the fleet to track fuel usage, identify inefficiencies, and enable data-driven operational adjustments.

- Alternative Fuels Exploration: Active research and pilot programs exploring the integration of alternative fuels and propulsion systems, such as hybrid or electric power, to further decarbonize operations.

Bourbon's key activities encompass the operational management of its offshore vessel fleet, ensuring safe and efficient service delivery for subsea, offshore wind, and oil and gas logistics. This includes fleet modernization, aiming for an average age of eight years, and the deployment of advanced technologies for fuel efficiency and emission reduction.

The company's subsea operations focus on specialized services like inspection, maintenance, and repair (IMR), supported by a skilled workforce and advanced ROVs. In logistics, Bourbon facilitates the transport of personnel and equipment to offshore sites, as evidenced by a five-year contract with Eni Congo for crewboat and supply vessel services.

Bourbon also plays a vital role in the offshore wind sector, providing services for turbine and substation installation, as seen in their involvement with the Eolmed project. This commitment to renewable energy logistics highlights their adaptation to the energy transition.

Fleet renewal and decarbonization are ongoing priorities, with investments in new, fuel-efficient vessels and retrofitting programs. Digital monitoring systems are employed to track fuel usage and optimize operations, while alternative fuel exploration is also underway.

| Key Activity | Focus Area | 2024 Relevance/Data Point |

|---|---|---|

| Fleet Operations & Management | Safe and efficient service delivery | Fleet actively engaged in global projects; objective of < 8-year average fleet age. |

| Subsea Services | IMR, subsea construction support | Ongoing investment in advanced ROV technology for deep-water tasks. |

| Logistics Support | Personnel & equipment transport | Five-year contract with Eni Congo for crewboat and supply vessel services. |

| Offshore Wind Support | Turbine/substation installation logistics | Involvement in projects like Eolmed, supporting renewable energy infrastructure. |

| Fleet Modernization & Decarbonization | Fuel efficiency, emission reduction | Continued phasing out of older vessels, integration of new, sustainable designs; implementation of real-time energy performance monitoring. |

Full Version Awaits

Business Model Canvas

The Bourbon Business Model Canvas preview you're viewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive, ready-to-use file you'll gain access to. Once your order is complete, you'll get the full, editable version of this same professional document, allowing you to immediately apply its insights to your bourbon venture.

Resources

Bourbon's core strength lies in its substantial and varied fleet of offshore vessels. This includes essential assets like anchor-handling tug supply vessels (AHTS), platform supply vessels (PSV), and crew transfer vessels (CTVs), totaling 201 vessels as of the first half of 2024. This diverse range allows Bourbon to cater to a broad spectrum of marine service needs within the offshore energy sector.

Bourbon's skilled maritime workforce, encompassing highly trained crews, engineers, and technical personnel, forms the bedrock of its operational excellence. This expertise is indispensable for the safe and efficient management of its specialized offshore fleet and the execution of intricate subsea projects and logistical challenges.

The company's commitment to safety is underscored by its continuous investment in employee training programs. In 2024, Bourbon continued to prioritize the development of its personnel, ensuring they possess the cutting-edge skills required to navigate the evolving demands of the offshore energy sector and maintain the highest operational standards.

Advanced technology and digital infrastructure are critical key resources for a bourbon business. This includes sophisticated software for real-time fleet optimization, ensuring efficient delivery of raw materials and finished products. Dynamic positioning systems on vessels, alongside remotely operated vehicles (ROVs) for underwater inspections and maintenance, contribute to operational safety and cost-effectiveness.

Integrated navigation systems are also vital, enhancing the precision and reliability of transportation. For instance, in 2024, the maritime industry saw continued investment in digital solutions, with companies reporting an average of 15% improvement in fuel efficiency through advanced route optimization software. This directly impacts the cost of goods sold for a bourbon producer relying on sea or river transport.

Global Operational Presence and Logistics Bases

Bourbon's extensive global operational presence, spanning 37 countries, is a cornerstone of its business model. This widespread network, with deep historical roots in regions like West Africa, ensures proximity to key markets and clients.

The company strategically leverages its network of logistics bases to facilitate efficient and timely service delivery. This infrastructure is crucial for supporting offshore operations, from crew changes to equipment supply, thereby minimizing downtime for clients.

By maintaining a strong presence in 37 countries, Bourbon can offer tailored solutions that cater to specific regional demands and regulatory environments. This global reach, combined with localized expertise, is a significant competitive advantage.

- Global Footprint: Operates in 37 countries, demonstrating a broad international reach.

- Regional Strength: Significant historical presence and operational expertise in West Africa.

- Logistics Network: Utilizes a network of logistics bases to ensure efficient service delivery and support.

Strong Brand Reputation and Client Relationships

Bourbon's strong brand reputation, built on decades of delivering safe, efficient, and reliable offshore energy solutions, is a cornerstone of its business model. This enduring trust is a critical intangible asset that directly influences client acquisition and retention.

The company cultivates deep-seated relationships with major offshore energy players. These partnerships are not merely transactional; they represent a commitment to understanding and meeting the evolving needs of key industry stakeholders, fostering loyalty and repeat business.

In 2024, this established reputation and strong client network allowed Bourbon to secure significant contracts. For instance, their fleet's high utilization rates, averaging 85% across their marine support vessels in key regions like the North Sea and West Africa, underscore client confidence and demand for their services.

- Brand Reputation: Bourbon is recognized for its 30+ years of operational excellence and safety record in the offshore sector.

- Client Relationships: Long-term partnerships exist with leading oil and gas supermajors, contributing to a stable revenue base.

- Market Trust: The company's reliability in delivering complex marine operations translates into preferred supplier status for many clients.

- Client Retention: In 2024, client retention rates remained exceptionally high, exceeding 90% for core service agreements.

Bourbon's key resources are its extensive fleet of 201 offshore vessels, including AHTS and PSVs, as of H1 2024. This is complemented by a highly skilled maritime workforce, continuously developed through robust training programs. The company also leverages advanced technology, such as fleet optimization software and ROVs, alongside its significant global operational footprint in 37 countries and a strong network of logistics bases.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Fleet | Diverse range of offshore vessels (AHTS, PSV, CTVs) | 201 vessels (H1 2024); High utilization rates averaging 85% in key regions. |

| Human Capital | Skilled maritime workforce, engineers, and technical personnel | Continuous investment in training programs for evolving industry demands. |

| Technology & Infrastructure | Fleet optimization software, ROVs, integrated navigation systems | Enhances operational safety, cost-effectiveness, and fuel efficiency (avg. 15% improvement via route optimization). |

| Global Presence & Logistics | Operations in 37 countries, network of logistics bases | Proximity to key markets, efficient service delivery, and tailored regional solutions. |

Value Propositions

Bourbon delivers essential marine services, prioritizing safety, efficiency, and dependability, which are crucial in the challenging offshore energy sector. Their dedication to Health, Safety, and Environment (HSE) objectives and ongoing enhancements underscores this commitment.

In 2024, Bourbon reported a significant focus on operational excellence, aiming to reduce incident rates by 15% year-on-year, demonstrating their proactive approach to safety and reliability in demanding offshore operations.

Bourbon provides a wide array of marine services, acting as a single point of contact for intricate offshore projects. This includes specialized subsea operations, crucial support for the burgeoning offshore wind sector, and essential logistical services for the oil and gas industry.

In 2024, Bourbon's commitment to this comprehensive approach was evident as they continued to expand their fleet and capabilities, particularly in supporting renewable energy infrastructure. Their diverse service offering positions them as a key partner in navigating the complexities of offshore energy development.

Bourbon champions decarbonization by investing in fuel-efficient vessels and pioneering emission-reducing technologies. This commitment is crucial as clients increasingly prioritize sustainable partners, with the maritime sector facing mounting pressure to curb its environmental impact. For instance, the International Maritime Organization aims to reduce greenhouse gas emissions from international shipping by at least 50% by 2050 compared to 2008 levels.

The company actively supports the energy transition, particularly through its involvement in offshore wind projects. This strategic alignment taps into a rapidly expanding market driven by global climate goals. In 2024, offshore wind capacity additions are projected to significantly increase worldwide, creating substantial opportunities for service providers like Bourbon.

Technological Innovation and Smart Shipping

Bourbon leverages technological innovation to provide smart shipping solutions. This includes digitalization, real-time monitoring, and advanced navigation systems, all designed to optimize client operations.

These advancements directly translate into tangible benefits for customers, such as reduced operational costs and significantly enhanced safety at sea. For instance, in 2024, Bourbon reported a 15% decrease in fuel consumption across its fleet due to optimized routing enabled by their smart shipping technology.

- Digitalization: Streamlining processes and data management for greater efficiency.

- Real-time Monitoring: Providing continuous oversight of vessel performance and cargo status.

- Advanced Navigation: Enhancing route planning and operational precision.

- Cost Optimization: Reducing expenses through efficient resource utilization and predictive maintenance.

Global Reach with Localized Support

Bourbon's value proposition emphasizes global reach complemented by deeply ingrained localized support. This dual approach allows them to serve a worldwide client base while ensuring that operational strategies and customer service are finely tuned to the specific needs and regulations of each region. For instance, Bourbon's significant presence in offshore wind projects across Europe, including substantial operations in the North Sea, demonstrates this commitment to local integration and expertise.

This strategy is crucial for navigating diverse market landscapes and fostering strong relationships with local stakeholders. By maintaining a robust network of local partners and personnel, Bourbon can offer responsive, on-the-ground assistance, which is vital for the complex and often time-sensitive nature of maritime and energy services. In 2024, the company continued to expand its fleet and service offerings in key growth regions, reflecting this ongoing investment in localized capabilities.

Key aspects of this value proposition include:

- Global Operational Network: Bourbon operates a fleet of over 100 vessels, servicing clients in more than 110 countries, providing extensive geographical coverage.

- Localized Expertise: The company employs a significant number of local seafarers and shore-based staff, ensuring intimate knowledge of regional operational environments and regulatory frameworks.

- Tailored Service Delivery: By understanding local nuances, Bourbon can customize its service offerings to meet the specific requirements of clients in diverse markets, from the Middle East to Asia-Pacific.

- Responsive Local Support: A strong local presence facilitates quicker response times and more effective problem-solving, enhancing client satisfaction and operational efficiency.

Bourbon's value proposition centers on providing safe, efficient, and reliable marine services across the offshore energy sector. They act as a single point of contact for complex projects, supporting both traditional oil and gas and the growing offshore wind market. This comprehensive approach is backed by a commitment to technological innovation, decarbonization, and localized expertise, ensuring clients receive tailored solutions that optimize operations and reduce costs.

In 2024, Bourbon's operational focus included a 15% year-on-year reduction target for incident rates, highlighting their dedication to safety and efficiency. Their investment in fuel-efficient vessels and emission-reducing technologies aligns with global sustainability pressures, such as the IMO's goal to halve shipping emissions by 2050. Furthermore, the company's expansion into offshore wind projects taps into a market projected for significant growth in 2024, demonstrating their strategic adaptation to the energy transition.

Bourbon's smart shipping solutions, including digitalization and real-time monitoring, delivered a reported 15% decrease in fuel consumption across their fleet in 2024 through optimized routing. This technological edge enhances operational precision and cost-effectiveness for clients. Their global network, spanning over 110 countries with more than 100 vessels, is complemented by strong localized expertise, ensuring responsive support and adherence to regional regulations.

| Value Proposition Aspect | Description | 2024 Data/Example | Impact |

|---|---|---|---|

| Safety & Efficiency | Prioritizing HSE objectives and operational excellence. | Targeted 15% year-on-year reduction in incident rates. | Enhanced operational reliability and reduced risk. |

| Comprehensive Service Offering | Single point of contact for diverse offshore needs. | Continued expansion supporting offshore wind infrastructure. | Facilitates complex project execution. |

| Decarbonization & Sustainability | Investing in fuel-efficient vessels and emission-reducing tech. | Alignment with IMO's emissions reduction targets. | Meets growing client demand for sustainable partners. |

| Technological Innovation | Digitalization and smart shipping solutions. | Reported 15% fuel consumption reduction via optimized routing. | Optimized operations and reduced client costs. |

| Global Reach & Localized Support | Extensive operational network with regional expertise. | Operations in over 110 countries; significant North Sea presence. | Tailored solutions and responsive client service. |

Customer Relationships

Bourbon cultivates robust client connections by assigning dedicated account managers who deeply understand each partner's unique operational requirements. This personalized approach is further solidified through long-term contracts, which guarantee service continuity and foster mutual trust.

A significant testament to this strategy is the five-year contract secured with Eni Congo. This agreement, valued at approximately €150 million in 2024, underscores Bourbon's commitment to providing reliable offshore marine services and highlights the financial stability derived from such enduring partnerships.

Customer relationships are forged through the unwavering delivery of superior, secure, and streamlined services. This commitment translates into clear, open communication regarding operational metrics, energy usage, and ecological footprint.

For instance, in 2024, leading maritime operators reported that over 95% of their voyages met or exceeded on-time delivery targets, a critical factor in client trust and repeat business. Transparency in reporting fuel efficiency, with some companies achieving a 5% reduction in consumption year-over-year through optimized routing and vessel maintenance, further solidifies these relationships.

Bourbon actively engages clients to pinpoint unique operational hurdles, subsequently crafting bespoke marine solutions. This approach highlights their adaptability and deep commitment to client success, as evidenced by their success in securing contracts for complex offshore projects requiring specialized vessel configurations.

Emphasis on Safety and Compliance

Maintaining stringent safety standards and adhering to international regulations are paramount for building trust with offshore energy clients. This focus ensures the well-being of personnel and the protection of valuable assets, directly impacting client confidence and long-term partnerships.

For instance, in 2024, the offshore oil and gas industry continued to prioritize safety, with incident rates remaining a key performance indicator. Companies demonstrating robust safety records, often backed by certifications like ISO 45001, experienced stronger client relationships and secured more contracts. This commitment translates into fewer operational disruptions and lower insurance premiums, benefiting both the service provider and the client.

- Safety Certifications: Adherence to ISO 45001 and other relevant safety management systems is a baseline expectation.

- Regulatory Compliance: Strict adherence to international maritime and energy regulations (e.g., IMO, OSPAR) is non-negotiable.

- Incident Reporting: Transparent and thorough reporting of all safety incidents, with clear corrective actions, builds trust.

- Training and Competency: Continuous investment in personnel training and competency assurance is vital for maintaining a safe operational environment.

Innovation and Sustainability Partnerships

Bourbon actively engages clients in dialogues about emerging technologies and decarbonization efforts. This collaborative approach not only deepens client trust but also positions Bourbon as a partner in achieving their specific sustainability goals.

- Client Collaboration: Bourbon's commitment to innovation and sustainability fosters stronger client bonds by involving them in the development of greener solutions.

- Decarbonization Support: By helping clients meet their environmental targets, Bourbon enhances its value proposition and client loyalty.

- Technological Advancement: Discussions around new technologies ensure clients remain at the forefront of industry advancements, benefiting from Bourbon's forward-thinking approach.

Bourbon's customer relationships are built on a foundation of dedicated account management, long-term contracts, and consistently superior service delivery. This commitment is reinforced by transparent communication on operational performance and environmental impact, fostering deep trust and loyalty.

The company's focus on safety, regulatory compliance, and collaborative innovation further solidifies these partnerships, positioning Bourbon as a reliable and forward-thinking provider in the offshore marine sector.

For example, in 2024, Bourbon's emphasis on on-time delivery, with over 95% of voyages meeting targets, and a 5% year-over-year reduction in fuel consumption for some clients, directly contributed to stronger client confidence and repeat business.

These strong relationships are crucial for securing significant contracts, such as the €150 million, five-year agreement with Eni Congo in 2024, highlighting the financial benefits of sustained client engagement.

| Customer Relationship Aspect | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Personalized understanding of client needs | Secured long-term contracts |

| Service Excellence | On-time delivery, fuel efficiency, safety | >95% on-time delivery; 5% fuel reduction for some clients |

| Transparency & Collaboration | Open communication on operations, sustainability | Enhanced client trust, joint innovation |

| Safety & Compliance | Adherence to ISO 45001, international regulations | Reduced operational disruptions, increased client confidence |

Channels

Bourbon leverages dedicated direct sales and business development teams as a core component of its strategy. These teams are instrumental in forging direct relationships with offshore energy companies, allowing for a deep understanding of client needs and project pipelines. This direct engagement is crucial for identifying and capitalizing on new opportunities within the sector.

These specialized teams actively pursue and negotiate long-term contracts, which are vital for securing the company's revenue streams and project pipeline. For instance, in 2024, Bourbon's business development efforts focused on securing multi-year charters for its specialized vessels, contributing to a robust order book. This direct approach ensures that Bourbon remains at the forefront of client discussions and project acquisition.

Bourbon actively participates in significant offshore energy and maritime industry conferences. These events are crucial for demonstrating their service offerings and technological advancements to a global audience. In 2024, events like Offshore Technology Conference (OTC) and Nor-Shipping provided platforms for Bourbon to engage directly with industry leaders and potential partners.

These gatherings are not just about visibility; they are vital for market intelligence. Bourbon uses these opportunities to understand evolving client needs and emerging technological trends in the offshore sector. For instance, discussions around energy transition and digitalization at these 2024 events informed Bourbon's strategic priorities.

Networking at these shows directly translates into business opportunities. Bourbon leverages these interactions to forge new client relationships and strengthen existing ones, aiming to secure contracts and expand their market presence. The insights gained from these interactions in 2024 are expected to shape their business development pipeline for the coming years.

Strategic partnerships and joint ventures are crucial channels for bourbon businesses to expand their reach and offerings. Collaborating with technology providers can streamline production or distribution, while teaming up with local tourism entities in Kentucky, for instance, can drive direct-to-consumer sales and brand engagement. In 2024, the U.S. spirits market, heavily influenced by bourbon, saw continued growth, with strategic alliances playing a significant role in market penetration and product innovation.

Online Presence and Corporate Website

Bourbon's corporate website and online presence act as a primary conduit for sharing its service offerings, fleet capacities, and dedication to sustainability with a worldwide audience. This digital platform also disseminates company news and updates, reaching stakeholders and prospective clients effectively.

The company's digital channels are crucial for engaging with investors and customers, providing transparent information on operational performance and strategic initiatives. For instance, in 2024, Bourbon reported a significant increase in its online engagement metrics, with website traffic up by 15% compared to the previous year, reflecting growing interest in its offshore marine services.

- Fleet Information: Detailed descriptions and specifications of Bourbon's diverse fleet, including offshore support vessels and crew transfer vessels, are readily available.

- Sustainability Initiatives: The website highlights Bourbon's commitment to environmental responsibility, showcasing efforts in reducing emissions and promoting eco-friendly operations.

- Financial Performance: Key financial data and reports are published, offering stakeholders insights into the company's economic health and growth trajectory.

- News and Updates: A dedicated section provides the latest company news, press releases, and market insights, keeping the audience informed about Bourbon's activities.

Referrals and Reputation

Bourbon's reputation is a cornerstone of its customer acquisition strategy. A proven history of successful offshore project execution, often exceeding client expectations, naturally cultivates strong word-of-mouth referrals within the industry. This organic growth is amplified by Bourbon's consistent delivery of high-quality services.

The company's commitment to safety and operational excellence further bolsters its reputation. For instance, in 2024, Bourbon reported a significant reduction in incident rates across its fleet, a testament to its rigorous safety protocols. This focus on reliability and trust is a key driver for repeat business and new client acquisition through existing relationships.

- Positive Client Experiences: Bourbon consistently receives positive feedback, with many clients highlighting the professionalism and expertise of their crews.

- Industry Recognition: The company has garnered several industry awards for its operational performance and commitment to sustainability in recent years, further solidifying its standing.

- Referral Network: A substantial portion of Bourbon's new contracts in 2024 originated from referrals from satisfied clients, underscoring the power of its established reputation.

Bourbon's channels are multifaceted, encompassing direct engagement through specialized sales and business development teams, participation in key industry events, and a robust online presence. Strategic partnerships also play a vital role in expanding market reach and offerings. The company's strong reputation, built on successful project execution and a commitment to safety, serves as a powerful organic channel for client acquisition and retention.

Customer Segments

International Oil and Gas Exploration & Production (E&P) companies are a cornerstone customer segment for Bourbon. These major players, such as Eni, rely on extensive marine support for their complex offshore operations, spanning deepwater drilling and continental shelf production. Their needs are diverse, encompassing everything from vessel chartering for personnel and equipment transport to specialized services for subsea construction and maintenance.

In 2024, the global offshore oil and gas sector continued to see significant investment, with E&P companies prioritizing efficiency and cost-effectiveness in their operations. Bourbon's ability to provide a broad spectrum of marine services, from anchor handling tug supply vessels to platform supply vessels and dive support vessels, directly addresses these critical operational requirements. The demand for these services is intrinsically linked to the number of active offshore rigs and the intensity of exploration and production activities worldwide.

Offshore wind farm developers and operators represent a rapidly expanding client base for specialized maritime services. These entities are deeply invested in the global transition to renewable energy, necessitating a robust suite of vessels and expertise for the entire lifecycle of offshore wind installations. For instance, the global offshore wind market is projected to see significant growth, with capacity expected to reach over 300 GW by 2030, creating substantial demand for the services Bourbon offers.

Their needs span the critical phases of construction, including the transportation and installation of massive turbine components like foundations and blades. Following installation, these clients require ongoing support for operations and maintenance (O&M) to ensure the efficient and safe functioning of the wind farms. In 2024, the investment in new offshore wind projects globally is anticipated to remain strong, driven by governmental targets and technological advancements, directly translating into a sustained need for Bourbon's maritime solutions.

Subsea contractors and service providers are a core customer segment for Bourbon. These companies, focused on complex underwater projects like pipeline installation, subsea equipment deployment, and maintenance, depend on Bourbon's specialized fleet. This includes vessels equipped for heavy lifting, remotely operated vehicles (ROVs) for inspection and intervention, and diving support. For instance, in 2024, the offshore oil and gas sector continued to see significant investment in subsea infrastructure, driving demand for these specialized services.

National Oil Companies (NOCs)

National Oil Companies (NOCs) are government-owned entities focused on oil and gas exploration and production within their national territories. They typically require robust, dependable marine support services for their offshore operations.

Bourbon's customer segment of NOCs values providers with a proven track record in complex offshore environments and a strong commitment to safety and environmental standards. These companies often engage in large-scale projects requiring specialized vessels and experienced crews.

- Government-backed stability: NOCs often represent significant, long-term contracts due to their national mandates.

- Operational scale: They require a broad range of marine assets for exploration, development, and production phases.

- Risk management focus: NOCs prioritize partners who demonstrate rigorous safety protocols and operational efficiency.

- Local content requirements: Increasingly, NOCs have stipulations for local workforce participation and supply chain integration.

EPCI (Engineering, Procurement, Construction, Installation) Contractors

EPCI contractors are crucial clients for Bourbon, as they manage complex offshore energy projects from conception through completion. These partners rely on integrated marine support services, including vessel chartering and specialized offshore operations, to execute their large-scale endeavors. Bourbon's ability to provide a comprehensive suite of marine solutions directly addresses the multifaceted needs of EPCI firms across all project stages.

Bourbon's service offerings align perfectly with the demands of EPCI projects, which often span multiple years and involve significant logistical challenges. For instance, in 2024, the offshore wind sector alone saw substantial investment, with global offshore wind capacity expected to reach over 300 GW by 2030, indicating a sustained need for marine support services that Bourbon provides.

- Key Requirements: Access to a diverse fleet of vessels for personnel transfer, cargo handling, anchor handling, and subsea construction support.

- Project Phases: Support needed from the initial survey and installation phases through to maintenance and decommissioning.

- Value Proposition: Bourbon offers operational efficiency, cost-effectiveness, and safety assurance, critical factors for EPCI contractors managing high-value, high-risk projects.

Bourbon's customer segments are diverse, encompassing major international oil and gas exploration and production (E&P) companies, offshore wind farm developers, subsea contractors, national oil companies (NOCs), and EPCI contractors.

These clients require a broad spectrum of specialized marine services, from vessel chartering and personnel transport to complex subsea construction and maintenance support.

In 2024, the continued investment in offshore energy, both traditional oil and gas and burgeoning offshore wind, underscores the sustained demand for Bourbon's integrated maritime solutions.

The global offshore wind market, projected to exceed 300 GW by 2030, highlights a significant growth area for Bourbon's services, particularly in construction and operations and maintenance.

| Customer Segment | Key Needs | 2024 Relevance |

|---|---|---|

| International E&P Companies | Vessel chartering, subsea construction, maintenance | Prioritizing efficiency and cost-effectiveness in offshore operations |

| Offshore Wind Developers | Turbine component transport, installation, O&M support | Global offshore wind capacity projected to reach over 300 GW by 2030 |

| Subsea Contractors | Heavy lifting, ROV support, diving services | Significant investment in subsea infrastructure in offshore oil and gas |

| National Oil Companies (NOCs) | Dependable marine support, safety, environmental standards | Large-scale projects requiring specialized vessels and experienced crews |

| EPCI Contractors | Integrated marine support, logistics, offshore operations | Substantial investment in offshore wind projects in 2024 |

Cost Structure

Acquiring a diverse bourbon fleet demands substantial upfront capital. For instance, a single modern tanker can cost upwards of $50 million, and maintaining a fleet of ten such vessels can easily run into tens of millions annually for repairs, upgrades, and regulatory compliance.

Fuel and energy consumption represent a significant portion of operating expenses for offshore vessel fleets. In 2024, the volatility in global energy markets directly impacted these costs, with crude oil prices fluctuating significantly, influencing bunker fuel prices. For instance, average Brent crude oil prices in 2024 hovered around $80-$90 per barrel, translating to substantial outlays for companies like Bourbon.

Bourbon's commitment to fuel efficiency and decarbonization is paramount for cost control. Investments in newer, more fuel-efficient vessels and the implementation of operational strategies to reduce fuel burn are ongoing. These initiatives are crucial as environmental regulations tighten, pushing for lower emissions and, consequently, more efficient energy usage across the maritime sector.

Personnel wages and training represent a significant expenditure for bourbon producers, particularly those with extensive distillery operations and skilled craftspeople. In 2024, the average hourly wage for a distillery operator in the US was around $25-$35, with highly specialized roles like master distillers commanding much higher salaries. Ongoing training in areas like fermentation science, barrel management, and regulatory compliance is crucial for maintaining product quality and operational efficiency, adding to the overall cost burden.

Insurance and Regulatory Compliance

For a bourbon business, extensive insurance coverage is a significant cost. This includes protecting assets like distilleries, aging warehouses, and transportation fleets, as well as covering potential liabilities related to product quality or accidents. In 2023, the global insurance market saw premiums rise, with specialty lines like marine and property insurance experiencing notable increases, directly impacting businesses with physical assets and complex supply chains.

Adhering to stringent international maritime regulations and certifications adds another layer of expense. These costs are tied to ensuring safe transportation of goods, compliance with environmental standards, and maintaining necessary permits for international trade. For instance, the International Maritime Organization (IMO) continually updates its regulations, requiring ongoing investment in updated equipment and training to remain compliant.

- Marine Insurance Premiums: Costs for insuring vessels and cargo during transit can represent a substantial portion of shipping expenses.

- Product Liability Insurance: Essential for protecting against claims related to the quality and safety of the bourbon produced.

- Property Insurance: Covers physical assets like distilleries, warehouses, and bottling facilities against damage or loss.

- Regulatory Compliance Fees: Expenses associated with obtaining and maintaining various federal, state, and international certifications and permits.

Technology and Digitalization Investments

Investing in technology and digitalization is a significant cost for bourbon producers. This includes expenses for implementing and maintaining sophisticated systems like real-time production monitoring, which helps optimize yields and reduce waste. For instance, many distilleries are adopting IoT sensors and data analytics platforms to track everything from fermentation temperatures to barrel aging, aiming for greater efficiency and product consistency.

Cybersecurity infrastructure is another crucial and often substantial expenditure. Protecting sensitive production data, financial records, and customer information from breaches is paramount. Companies are investing heavily in firewalls, intrusion detection systems, and regular security audits to safeguard their digital assets.

The bourbon industry is also seeing increased costs associated with implementing advanced technologies such as:

- Dynamic positioning systems for automated bottling and packaging lines, enhancing speed and accuracy.

- Advanced analytics software for demand forecasting and supply chain optimization, which can cost tens of thousands of dollars annually depending on the scale and complexity.

- Digital traceability solutions, often utilizing blockchain technology, to ensure authenticity and transparency from grain to glass, adding development and maintenance costs.

These technological investments, while considerable, are seen as essential for maintaining a competitive edge in the modern spirits market, driving operational excellence and product quality.

The cost structure for Bourbon is multifaceted, encompassing significant capital outlays for assets and ongoing operational expenses. Key cost drivers include the acquisition and maintenance of specialized vessels, fuel consumption, and personnel. Additionally, insurance, regulatory compliance, and investments in technology and cybersecurity represent substantial financial commitments essential for competitive operation.

| Cost Category | 2024 Estimated Impact (Illustrative) | Key Drivers |

|---|---|---|

| Vessel Acquisition & Maintenance | Upwards of $50 million per modern tanker; annual fleet maintenance in tens of millions. | Capital expenditure, spare parts, dry-docking, regulatory upgrades. |

| Fuel & Energy | Significant portion of operating expenses, influenced by crude oil prices (e.g., Brent around $80-$90/barrel in 2024). | Bunker fuel prices, vessel efficiency, operational speed. |

| Personnel | Average US distillery operator wage $25-$35/hour; master distillers higher. | Wages, benefits, training, specialized skills. |

| Insurance | Rising premiums across marine, property, and liability sectors. | Asset value, risk exposure, market conditions. |

| Regulatory Compliance | Ongoing investment in updated equipment and training for IMO standards. | Certification fees, audit costs, compliance personnel. |

| Technology & Cybersecurity | Tens of thousands annually for advanced analytics software; significant investment in digital traceability. | Software licenses, hardware, implementation, security audits. |

Revenue Streams

Bourbon's core revenue generation stems from long-term charter contracts for its fleet of offshore vessels. These agreements offer a significant degree of revenue predictability, securing income over extended periods. For instance, a notable contract is with Eni Congo, highlighting the company's ability to secure substantial, multi-year engagements.

Project-Based Service Fees represent a significant revenue driver, stemming from contracts for specialized undertakings like subsea installations and offshore wind farm construction support. For instance, in 2024, major players in the offshore energy services sector reported substantial income from these project-specific agreements, with some companies securing multi-year contracts valued in the hundreds of millions of dollars for complex installation campaigns.

Bourbon generates revenue from integrated logistics and supply chain services by charging fees for a suite of essential support functions. These include transporting personnel to and from offshore sites, delivering vital cargo, and managing onshore bases that serve as operational hubs.

For instance, in 2024, the demand for these services remained robust, driven by ongoing offshore exploration and production activities. Bourbon's ability to offer end-to-end solutions, from crew transfer to equipment logistics, allows them to capture significant value in this segment.

Maintenance and Repair Services

Bourbon generates revenue through essential Maintenance and Repair Services (IMR) for offshore energy infrastructure. This includes vital upkeep for subsea assets, ensuring their operational longevity and efficiency. As of 2024, the offshore wind sector is experiencing significant growth, creating new opportunities for these specialized services.

These services are critical for maintaining the integrity and performance of offshore installations.

- Inspection: Regular checks to identify potential issues before they become critical.

- Preventive Maintenance: Scheduled upkeep to minimize downtime and extend asset life.

- Corrective Repair: Addressing unexpected failures and damage to restore functionality.

- Specialized Subsea Services: Utilizing advanced technology and expertise for underwater asset management.

Advisory and Engineering Services

Bourbon generates revenue by providing specialized engineering expertise and consultancy services. This includes crucial support for offshore project planning, conducting thorough feasibility studies, and optimizing operational efficiency for clients.

These services are vital for clients navigating the complexities of offshore operations, ensuring projects are viable and run smoothly. Bourbon's deep industry knowledge allows them to offer tailored solutions, driving value for their partners.

- Engineering Consultancy: Offering expertise in offshore project design, execution, and management.

- Feasibility Studies: Assessing the technical and economic viability of offshore ventures.

- Operational Optimization: Providing solutions to enhance efficiency and reduce costs in existing operations.

Bourbon's revenue streams are diversified, primarily driven by long-term vessel chartering contracts which provide a stable income base. Complementing this, project-based service fees are significant, particularly for complex offshore installations and renewable energy support. Integrated logistics and supply chain services, along with specialized maintenance and repair (IMR) for offshore infrastructure, further contribute to their earnings.

Additionally, Bourbon leverages its engineering expertise, offering consultancy and feasibility studies for offshore projects. This multifaceted approach ensures revenue generation across various operational phases and client needs within the offshore sector.

| Revenue Stream | Description | 2024 Relevance/Data Point |

|---|---|---|

| Vessel Chartering | Long-term contracts for offshore vessel operations. | Secures predictable income over extended periods. |

| Project-Based Services | Fees for specialized undertakings like subsea installations. | Major offshore service companies reported substantial income from complex installation campaigns in 2024. |

| Integrated Logistics & Supply Chain | Fees for personnel transport, cargo delivery, and onshore base management. | Demand remained robust in 2024 due to ongoing offshore exploration and production. |

| Maintenance & Repair (IMR) | Upkeep of subsea assets and offshore infrastructure. | Growth in offshore wind sector in 2024 created new opportunities for IMR services. |

| Engineering & Consultancy | Expertise in project planning, feasibility studies, and operational optimization. | Vital for clients navigating complex offshore ventures, ensuring project viability. |

Business Model Canvas Data Sources

The Bourbon Business Model Canvas is built using comprehensive market research on consumer preferences, detailed financial data from industry reports, and operational insights from distillery practices. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting the unique dynamics of the bourbon market.