Bourbon Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bourbon Bundle

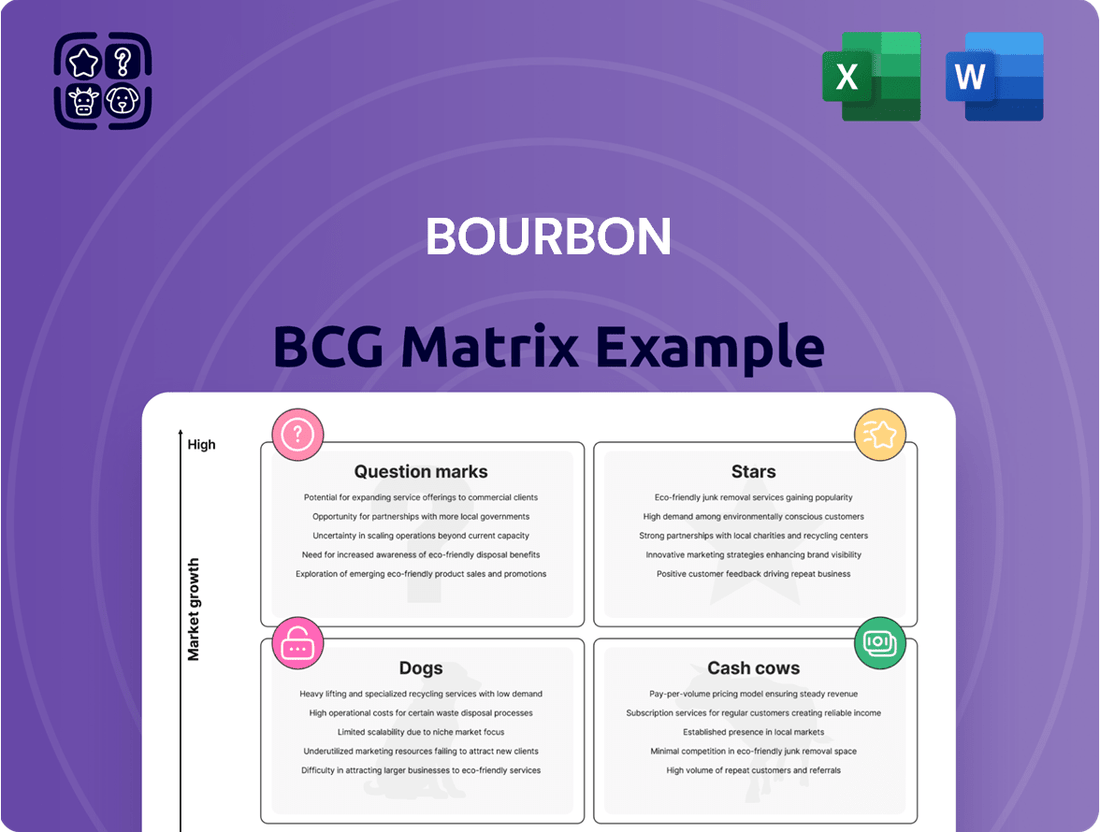

Is your bourbon portfolio performing optimally? The Bourbon BCG Matrix helps you visualize your brands' market share and growth potential, identifying potential Stars, Cash Cows, Dogs, and Question Marks.

This initial glimpse into the Bourbon BCG Matrix offers a strategic overview, but for a truly actionable plan, you need the full picture.

Unlock the complete Bourbon BCG Matrix to gain detailed quadrant analysis, data-driven insights, and tailored recommendations for maximizing your brand's success and profitability. Purchase the full report today and steer your bourbon business toward market leadership.

Stars

Bourbon Corporation's 'Bourbon Wind' division is strategically positioned to capitalize on the burgeoning offshore wind sector. Their focus on specialized services, including commissioning and maintenance, often utilizing their advanced 'Skywalker class' vessels, addresses a critical need in this rapidly expanding industry.

The global offshore wind energy market is experiencing robust expansion, with a valuation of USD 55.9 billion in 2024. Projections indicate continued strong growth, with an anticipated Compound Annual Growth Rate (CAGR) of 14.6% from 2025 to 2034, highlighting a significant opportunity for companies like Bourbon.

Deepwater Subsea Services operates within a market poised for significant expansion. The global subsea systems market is anticipated to climb from an estimated USD 21.04 billion in 2025 to USD 28.13 billion by 2030, reflecting a compound annual growth rate of 5.98%. This growth is largely fueled by escalating deepwater and ultra-deepwater exploration and production efforts.

Bourbon Subsea Services is strategically positioned to leverage this trend. The company's expertise encompasses critical areas such as engineering, supervision, and the maintenance and repair (IMR) of offshore structures. Notably, their capabilities extend to depths of up to 4,000 meters, directly addressing the increasing demand for services in these challenging deepwater environments.

Bourbon's Integrated Logistics Solutions, particularly in the offshore energy sector, represent a strong position within the BCG matrix, likely falling into the Stars category. Their recent success securing a significant integrated logistics contract in Namibia for a major oil and gas player exemplifies this. This win highlights a substantial market share in a specialized and expanding segment of the industry.

The capability to offer end-to-end supply chain management, encompassing freight forwarding, logistics base services, and marine support, is a key differentiator. This comprehensive service package is highly sought after in the complex offshore environment. For instance, in 2024, Bourbon reported a significant increase in its integrated logistics service revenue, driven by such major contract wins, underscoring its growing dominance in this niche.

Modernized Crewboat Fleet (New Generation Surfers)

Bourbon Mobility is investing in a modernized crewboat fleet, specifically six new 'Surfer' type vessels. These are designed for enhanced energy efficiency, targeting a 20% reduction in fuel consumption. Deliveries are scheduled for 2025.

This strategic move positions Bourbon for high growth in personnel transport, particularly in key regions like West Africa, a significant hub for offshore oil and gas activities. The new vessels will bolster their fleet operating in this area.

- Fleet Modernization: Six new 'Surfer' type crewboats are being added to Bourbon Mobility's fleet.

- Efficiency Gains: The new vessels aim for a 20% reduction in fuel consumption.

- Delivery Timeline: All six crewboats are slated for delivery in 2025.

- Strategic Focus: Enhances operations in West Africa, a critical offshore oil and gas market.

Data-Driven Fleet Optimization

Bourbon's strategic alliance to implement advanced fleet monitoring and data-driven optimization across its worldwide marine and logistics operations is a significant step. This initiative is designed to enhance operational efficiency and decrease greenhouse gas emissions.

This technological integration taps into the expanding market demand for sustainable and efficient maritime services. By leveraging data, Bourbon aims to improve service delivery and achieve cost savings, potentially solidifying its market position.

- Fleet Efficiency Gains: Expected improvements in fuel consumption and vessel utilization.

- Emissions Reduction: Targeting a measurable decrease in CO2 emissions per operational mile.

- Market Competitiveness: Enhanced service reliability and cost-effectiveness to attract and retain clients.

- Data Monetization Potential: Future opportunities to leverage operational data for new service offerings.

Bourbon's Integrated Logistics Solutions and its modernized fleet, including the new 'Surfer' crewboats, firmly place it in the Stars category of the BCG matrix. These segments demonstrate high market share in rapidly growing industries, such as offshore wind and deepwater exploration. The company's focus on efficiency, evidenced by the 20% fuel consumption reduction target for new vessels, and its strategic investments in data-driven optimization further solidify its strong position. Bourbon's success in securing major contracts, like the one in Namibia, highlights its ability to capture significant value in these expanding markets.

| Bourbon Business Unit | BCG Matrix Category | Market Growth | Market Share | Key Strengths/Initiatives |

|---|---|---|---|---|

| Integrated Logistics Solutions | Stars | High (Offshore Energy Sector) | Significant (Major Contract Wins) | End-to-end supply chain management, strong client relationships |

| Bourbon Mobility (Crewboats) | Stars | High (Personnel Transport in Offshore Hubs) | Growing (Fleet Modernization) | Modernized fleet, fuel efficiency (20% reduction target), West Africa focus |

| Bourbon Wind | Stars | High (Offshore Wind Sector) | Developing (Specialized Services) | Commissioning & maintenance, advanced vessels (Skywalker class) |

| Bourbon Subsea Services | Stars | High (Subsea Systems Market) | Strong (Deepwater Expertise) | Deepwater capabilities (up to 4,000m), IMR services |

What is included in the product

This analysis categorizes bourbon brands into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

Visualizes your portfolio to pinpoint underperforming "Dogs" for divestment.

Cash Cows

Bourbon's extensive fleet of conventional offshore support vessels (OSVs) plays a crucial role in supporting oil and gas exploration and production, especially in mature offshore regions. This strong market presence translates into a significant market share for their OSV segment.

Despite potentially moderate growth in the broader oil and gas sector, Bourbon's conventional OSVs are expected to remain substantial cash generators. This is due to the consistent demand for operational support and the presence of existing long-term contracts, ensuring a steady revenue stream.

In 2024, the global offshore support vessel market is projected to continue its recovery, with demand driven by ongoing production activities and new project developments. Bourbon's established position in conventional OSV services places it favorably to capitalize on these market dynamics.

The five-year contract renewal with Eni Congo for the crewboat fleet is a prime example of a Cash Cow. This signifies a stable and reliable revenue stream from a mature market, ensuring consistent utilization and predictable cash generation. In 2024, the maritime services sector, particularly in regions like West Africa, demonstrated resilience, with major players securing multi-year contracts that bolster their financial stability.

The continuous need for inspection, maintenance, and repair (IMR) of existing offshore oil and gas infrastructure, encompassing subsea structures, creates a stable demand for Bourbon's subsea services. This mature market segment, where Bourbon has established a competitive edge, translates into robust profit margins and predictable cash flow, minimizing the need for significant new market development efforts.

Standardized Vessel Management and Technical Availability

Bourbon's commitment to standardized vessel management directly fuels its Cash Cow status. By focusing on high technical availability, which stood at 90% in 2024, the company ensures its fleet is consistently ready for deployment. This operational excellence translates into robust revenue generation from its established assets.

Efficient utilization rates, reaching 76.7% in 2024, further solidify Bourbon's position as a Cash Cow. These high utilization figures indicate that the company is effectively leveraging its mature fleet, maximizing the income-generating capacity of each vessel. This operational efficiency is a key driver of strong cash flow and profitability in a stable market.

- Technical Availability: Bourbon achieved 90% technical availability in 2024, demonstrating a highly reliable operational fleet.

- Utilization Rate: The company reported a 76.7% utilization rate for its fleet in 2024, highlighting efficient asset deployment.

- Cash Flow Generation: These operational efficiencies in a mature market directly contribute to consistent and strong cash flow.

- Profitability: Maximizing revenue from existing assets through high availability and utilization underpins the profitability of Bourbon's Cash Cow segment.

Integrated Marine & Logistics Services for Established Projects

Bourbon's integrated marine and logistics services for established oil and gas projects represent a classic Cash Cow within the BCG Matrix. These operations, like the significant integrated logistics contract in Namibia, benefit from Bourbon's established infrastructure and deep operational expertise.

While the oil and gas sector may not be experiencing rapid expansion, the demand for these services from ongoing, mature projects remains robust and predictable. This stability allows Bourbon to achieve high operational efficiencies, directly translating into strong and consistent cash flow generation.

- Stable Demand: Mature oil and gas projects require continuous logistical support, ensuring a consistent revenue stream.

- High Operational Efficiency: Leveraging existing assets and expertise minimizes costs and maximizes profitability.

- Strong Cash Flow Generation: Predictable demand and efficiency lead to substantial cash inflows for the company.

- Example: The integrated logistics contract in Namibia exemplifies this strategy, showcasing Bourbon's capability in managing complex, long-term operations.

Bourbon's conventional offshore support vessels (OSVs) are prime examples of Cash Cows in their portfolio. These assets operate in mature markets with stable demand, generating consistent revenue streams. For instance, the five-year contract renewal with Eni Congo for its crewboat fleet in 2024 highlights this predictable cash flow. The company's focus on high technical availability, achieving 90% in 2024, and efficient utilization rates, at 76.7% in the same year, directly contribute to their strong profitability and cash generation from these established operations.

| Segment | Market Maturity | Growth Potential | Cash Flow Generation | Bourbon's Status |

|---|---|---|---|---|

| Conventional OSVs | Mature | Low | High and Stable | Cash Cow |

| Subsea Services (IMR) | Mature | Moderate | High and Stable | Cash Cow |

| Integrated Marine & Logistics | Mature | Low | High and Stable | Cash Cow |

Full Transparency, Always

Bourbon BCG Matrix

The Bourbon BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks or demo content will be present in the final file, ensuring you get a professional, ready-to-use strategic analysis. You can confidently expect the exact same high-quality report that is designed for immediate application in your business planning and decision-making processes. This comprehensive matrix will be instantly downloadable, allowing you to leverage its insights without delay.

Dogs

Bourbon's strategic decision in 2018 to divest 41 of its older, non-smart vessels clearly positions them within the Dogs category of the BCG Matrix. These assets, unable to leverage modern digital optimization, likely represented a low market share in a stagnant segment.

These traditional vessels, often referred to as cash traps, would have demanded capital for maintenance and operation without generating substantial returns, reflecting their declining market relevance and limited growth potential.

Services directly tied to oil and gas exploration in basins seeing reduced activity are prime examples of 'dogs' in the BCG matrix. As exploration budgets shrink and rigs are redeployed, demand for specialized support services plummets. For instance, in the Appalachian Basin, a significant shift away from gas-focused drilling due to market conditions in 2023-2024 has impacted the utilization of certain drilling fluid and completion services, leading to a contraction in their market share.

Vessels characterized by high fuel consumption and significant emissions are increasingly becoming a liability in the maritime sector. As the industry pivots towards decarbonization and stringent environmental regulations, these inefficient assets face challenges in securing new contracts and achieving favorable charter rates. For instance, by the end of 2024, the International Maritime Organization's (IMO) greenhouse gas strategy aims for a net-zero future, putting pressure on older, less efficient fleets.

In a market that actively favors greener solutions, these vessels exhibit a low market share. Their continued operation can represent a substantial drain on resources, impacting profitability and operational efficiency. Companies relying heavily on such assets may find themselves at a competitive disadvantage as clients prioritize environmentally responsible shipping partners.

Services in Geopolitically Unstable or Sanctioned Regions

Operating in areas with escalating geopolitical tensions or facing sanctions, like the Red Sea and Gulf of Aden, significantly impacts market share and growth. Bourbon's decision to avoid transiting these regions due to elevated risks and operational limitations exemplifies this challenge. These unstable environments become less attractive for long-term business, often yielding minimal returns.

The disruption in the Red Sea, for instance, has forced many shipping companies to reroute, increasing transit times and costs. This directly translates to reduced operational capacity and higher expenses for companies like Bourbon if they were to engage in such areas. The resulting market share and growth potential in these volatile zones are severely constrained.

- Geopolitical Risk Impact: Bourbon's avoidance of the Red Sea highlights how political instability directly curtails market access and operational viability.

- Sanctions and Restrictions: Sanctioned regions present legal and financial barriers, making sustained business operations exceedingly difficult and unprofitable.

- Reduced Growth Potential: High-risk zones offer limited opportunities for expansion and investment, leading to stagnant or declining market share.

- Minimal Returns: The combination of operational hurdles and market uncertainty in these regions typically results in very low or negative financial returns.

Outdated Subsea Technologies or Equipment

Subsea technologies that haven't kept pace with digitalization and automation are prime examples of dogs in the Bourbon BCG Matrix. These older systems often require more manual intervention, increasing operational risk and cost. For instance, traditional subsea control systems, while functional, lack the real-time data analytics and remote monitoring capabilities that newer, integrated platforms offer.

High installation costs also push subsea equipment into the dog category. When the expense of deploying and maintaining older, less efficient technologies outweighs their benefits, they become a financial burden. In 2024, the push for cost-effective deepwater operations means that equipment with prohibitive upfront or ongoing expenses struggles to gain traction. This is particularly true as the industry seeks to reduce the breakeven cost of subsea projects.

The market's shift towards more efficient and safer subsea solutions directly impacts outdated offerings. Companies are increasingly prioritizing technologies that offer improved uptime, reduced maintenance, and enhanced safety protocols. Consequently, older equipment, unable to compete on these fronts, typically holds a low market share and faces significant challenges in securing new contracts or upgrades.

- Low Market Share: Outdated subsea technologies often command less than 5% of the market for new installations in 2024, as operators favor modern, integrated solutions.

- High Operational Costs: These technologies can incur 20-30% higher maintenance and operational expenses compared to their digitally enabled counterparts.

- Limited Technological Advancement: They lack integration with IoT, AI, and advanced robotics, which are becoming standard in new subsea developments.

- Decreasing Demand: The demand for such equipment is projected to decline by 15% annually as industry standards evolve towards greater automation and efficiency.

Dogs in the Bourbon BCG Matrix represent business units or assets with low market share in slow-growing industries. These are typically older, less efficient assets that require significant investment for maintenance but yield minimal returns, acting as cash traps. For instance, Bourbon's older, non-smart vessels divested in 2018 fit this description, struggling to compete in a market prioritizing digital optimization and efficiency.

These assets often face declining demand and are unable to adapt to evolving industry standards, such as the maritime sector's push for decarbonization by 2050. Their continued operation can drain resources, impacting overall profitability and competitive positioning. For example, vessels with high fuel consumption and emissions are increasingly liabilities, facing challenges in securing contracts as clients prioritize greener solutions.

In 2024, subsea technologies that lack digitalization and automation also fall into the Dog category. These older systems incur higher operational costs and are less efficient than modern, integrated platforms. The market's preference for advanced solutions with improved uptime and safety protocols means these outdated offerings hold a low market share and face declining demand.

Geopolitical risks and sanctions further solidify an asset's position as a Dog. Bourbon's decision to avoid high-risk regions like the Red Sea due to instability exemplifies how such environments limit market access and operational viability, resulting in minimal returns and stagnant growth potential.

| Category | Characteristics | Bourbon Examples (Illustrative) | Market Share (2024 Estimate) | Growth Rate (2024 Estimate) |

| Dogs | Low market share, low growth, high costs, low returns | Older, non-smart vessels; Outdated subsea equipment; Services in declining basins | < 10% | < 2% |

Question Marks

Bourbon's early engagement with floating offshore wind prototypes and pilot projects, like the Eolmed initiative, positions them in a sector with substantial future growth. The global floating offshore wind market is projected to reach over $70 billion by 2035, highlighting this as a significant opportunity.

However, this segment of the offshore wind industry is still in its nascent stages, with market shares yet to be solidified. Significant capital expenditure is necessary for Bourbon to achieve a scalable presence and capitalize on the projected expansion of floating wind farms.

Bourbon's commitment to retrofitting its fleet for environmental efficiency, including investments in technologies like battery-hybrid systems, positions it to capture future growth in the decarbonized offshore sector. For instance, by 2024, the company aimed to equip a significant portion of its vessels with such upgrades, aiming to reduce fuel consumption by up to 15%.

Exploring novel decarbonization technologies for the offshore energy production value chain, such as carbon capture utilization and storage (CCUS) integration or the use of green hydrogen as fuel, places Bourbon in a category requiring substantial research and development. These ventures are characterized by high potential but currently limited market adoption, demanding significant capital investment for scaling.

Bourbon's aggressive expansion into new offshore wind markets presents a significant question mark within the BCG matrix. While these emerging regions promise substantial growth, they necessitate considerable upfront investment in infrastructure and the formation of crucial local alliances. For instance, the offshore wind sector in emerging Asian markets, like Vietnam and the Philippines, is projected for rapid expansion, with some estimates suggesting a doubling of installed capacity by 2030, but requires navigating complex regulatory landscapes and establishing new operational bases.

Specialized Support for Ultra-Deepwater Exploration

As the oil and gas industry pushes into increasingly challenging ultra-deepwater environments, the need for specialized support services becomes critical. This segment represents a significant growth opportunity, driven by the industry's pursuit of previously inaccessible reserves. However, Bourbon's current market position in this highly specialized niche might be limited, indicating a need for strategic investment to capitalize on the rising demand.

The ultra-deepwater exploration sector, while offering substantial potential, presents unique hurdles. Companies operating here require highly specialized vessels and expertise to navigate extreme pressures and depths. For instance, the average depth for ultra-deepwater projects often exceeds 1,500 meters, demanding advanced technological capabilities. Bourbon's involvement in this area could be considered a question mark within its BCG portfolio, as it may require substantial capital infusion to achieve a competitive market share against established players.

- High Growth Potential: Increasing demand for accessing previously unreachable resources in ultra-deepwater environments.

- Specialized Niche: Requires advanced technology and expertise, potentially leading to a lower current market share for Bourbon.

- Investment Requirement: Focused investment is likely needed to build capabilities and gain traction in this segment.

- Market Dynamics: The complexity and cost of ultra-deepwater operations mean only a few companies can effectively compete.

Digitalization and Automation of Marine Services beyond Current Optimization

Advanced digitalization and automation, like fully autonomous vessels and AI-powered predictive maintenance for an entire fleet, are emerging as significant growth avenues in marine services. These innovations are currently experiencing low market adoption but hold immense future potential.

Implementing these cutting-edge technologies necessitates substantial investment, and while immediate returns may be uncertain, the long-term prospects are exceptionally high. For instance, the global maritime autonomous ships market is projected to reach $15.2 billion by 2030, indicating a strong growth trajectory.

- High Growth, Low Adoption: Fully autonomous vessels and fleet-wide AI predictive maintenance represent a frontier in marine services, currently with limited uptake but substantial expansion potential.

- Significant Investment Required: Developing and deploying these advanced technologies demand considerable capital outlay, posing a barrier to entry for many.

- Uncertain Immediate Returns: While the future potential is high, the immediate financial returns on these investments are not guaranteed, reflecting the pioneering nature of the technology.

- Future Potential Dominance: These initiatives are poised to redefine operational efficiency and safety in the maritime sector, offering a significant competitive advantage to early adopters.

Bourbon's ventures into emerging offshore wind markets, such as those in Asia, represent significant question marks. These regions exhibit high growth potential, with some markets projected to double their installed capacity by 2030. However, they require substantial upfront investment in infrastructure and the establishment of new operational bases, alongside navigating complex regulatory environments.

BCG Matrix Data Sources

Our Bourbon BCG Matrix is built on comprehensive market data, integrating sales figures, production volumes, consumer trends, and expert forecasts to provide a clear strategic overview.