Bourbon PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bourbon Bundle

Navigate the complex external forces shaping the Bourbon industry with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and social trends are impacting this iconic spirit. Gain a strategic advantage by identifying opportunities and mitigating risks. Download the full PESTLE analysis now to unlock actionable intelligence and refine your market strategy.

Political factors

Government policies play a crucial role in shaping the offshore energy market, directly impacting demand for marine services. For instance, the European Union's commitment to renewable energy, with targets like achieving 300 GW of offshore wind capacity by 2030, drives investment in related infrastructure and services. Conversely, evolving regulations on carbon emissions and safety standards for traditional oil and gas operations can alter operational costs and investment decisions for companies like Bourbon.

Bourbon Corporation's global offshore operations mean it's sensitive to geopolitical shifts and regional conflicts. For instance, the ongoing tensions in the Red Sea, which saw significant shipping disruptions in early 2024, directly impact supply chains and the cost of moving equipment and personnel to various project sites.

Instability in regions where Bourbon operates, such as parts of West Africa or the Middle East, can lead to project delays and increased security expenses. In 2024, the company's ability to safely and efficiently deploy its fleet is directly tied to the political climate in these areas, with any escalation potentially raising insurance premiums and operational overheads.

Therefore, a thorough assessment of political risk in target markets is not just a formality but a critical component of Bourbon's business continuity and strategic planning. Understanding the likelihood of conflicts or political unrest in key operational zones, like the Gulf of Guinea where Bourbon has a significant presence, is essential for forecasting revenues and managing asset deployment effectively.

International trade agreements, tariffs, and sanctions significantly influence the global beverage market. For Bourbon Corporation, navigating these complexities is crucial for its worldwide operations and supply chain. For instance, the United States' imposition of tariffs on goods from various countries in 2023 and 2024 can impact the cost of imported raw materials or finished products, potentially affecting profit margins or pricing strategies.

Sanctions against particular nations can directly restrict Bourbon Corporation's ability to export to or import from those markets, thereby limiting growth opportunities or disrupting existing business relationships. For example, sanctions on Russia or Iran could mean Bourbon Corporation must find alternative markets or cease operations in those regions, impacting its overall revenue diversification and market reach.

Maritime and Shipping Regulations

Political decisions, both nationally and internationally, significantly shape maritime and shipping regulations. These rules cover critical areas like safety standards, crew qualifications, and permitted operational zones, directly impacting companies like Bourbon Corporation. For instance, the International Maritime Organization (IMO) continually updates safety and environmental regulations, such as the Ballast Water Management Convention, which came into full effect in 2017 and requires significant compliance efforts from all vessels. Failure to adhere to these evolving mandates can jeopardize Bourbon's licenses and operational continuity.

These regulatory shifts can necessitate substantial adjustments to Bourbon's fleet. Changes might influence vessel design, requiring retrofits or new builds to meet updated environmental standards, like the IMO's 2020 sulfur cap on fuel oil. Furthermore, operational procedures and crew training programs must be continuously updated to align with new safety protocols and crewing requirements, impacting operational costs and efficiency. The global maritime industry saw an estimated $10 billion invested in scrubber technology to comply with the 2020 sulfur cap, illustrating the financial impact of such political decisions.

- Safety Standards: Political bodies like the IMO and national maritime authorities set and enforce safety standards, directly affecting vessel construction and operation.

- Crewing Requirements: Regulations dictate minimum crewing levels and the qualifications of seafarers, impacting labor costs and recruitment strategies.

- Operational Zones: Political agreements and sanctions can define or restrict where vessels can operate, influencing market access and route planning.

- Environmental Regulations: Increasingly stringent environmental rules, such as those concerning emissions and ballast water, require significant investment in compliance technology and procedures.

Government Support for Domestic Industries

Governments worldwide are increasingly implementing policies to bolster their own maritime and energy sectors. For instance, France, Bourbon's home country, has historically supported its domestic industries through various subsidies and preferential treatment in public procurement, a trend that continued into 2024 with ongoing discussions around strengthening European maritime capabilities. This can create a more challenging environment for international competitors seeking contracts in these regions, as domestic firms often receive an advantage. Bourbon must navigate these nationalistic tendencies by forming strategic local partnerships or demonstrating superior value propositions that outweigh protectionist measures.

These government initiatives often manifest as:

- Financial Incentives: Direct subsidies, tax breaks, or low-interest loans for domestic companies in key sectors like offshore energy services.

- Preferential Procurement: Government contracts or tenders that favor or exclusively target national service providers.

- Regulatory Advantages: Streamlined permitting processes or relaxed regulations for domestic firms compared to foreign entities.

- Investment in National Infrastructure: Development of ports, shipyards, and training facilities that primarily benefit local businesses.

Government policies, particularly those related to energy transition and maritime safety, directly influence Bourbon's operational landscape and investment decisions. For example, the EU's commitment to offshore wind, aiming for 300 GW by 2030, creates demand for marine services, while evolving carbon emission regulations can increase operational costs for traditional oil and gas activities.

Geopolitical instability, such as the Red Sea tensions in early 2024, disrupts supply chains and increases costs for Bourbon by affecting equipment and personnel movement. Regional conflicts in areas like West Africa or the Middle East can cause project delays and necessitate higher security spending, impacting operational overheads and insurance premiums.

International trade agreements, tariffs, and sanctions significantly shape Bourbon's global operations. Tariffs imposed in 2023-2024 can affect raw material costs, while sanctions on specific nations can restrict market access, forcing Bourbon to seek alternative markets or cease operations, thus impacting revenue diversification.

Maritime and shipping regulations, set by bodies like the IMO, dictate safety, crewing, and operational zones, directly impacting Bourbon's fleet. Compliance with updated environmental standards, such as the IMO's 2020 sulfur cap, required significant fleet adjustments and investments, with the industry seeing an estimated $10 billion spent on scrubber technology.

What is included in the product

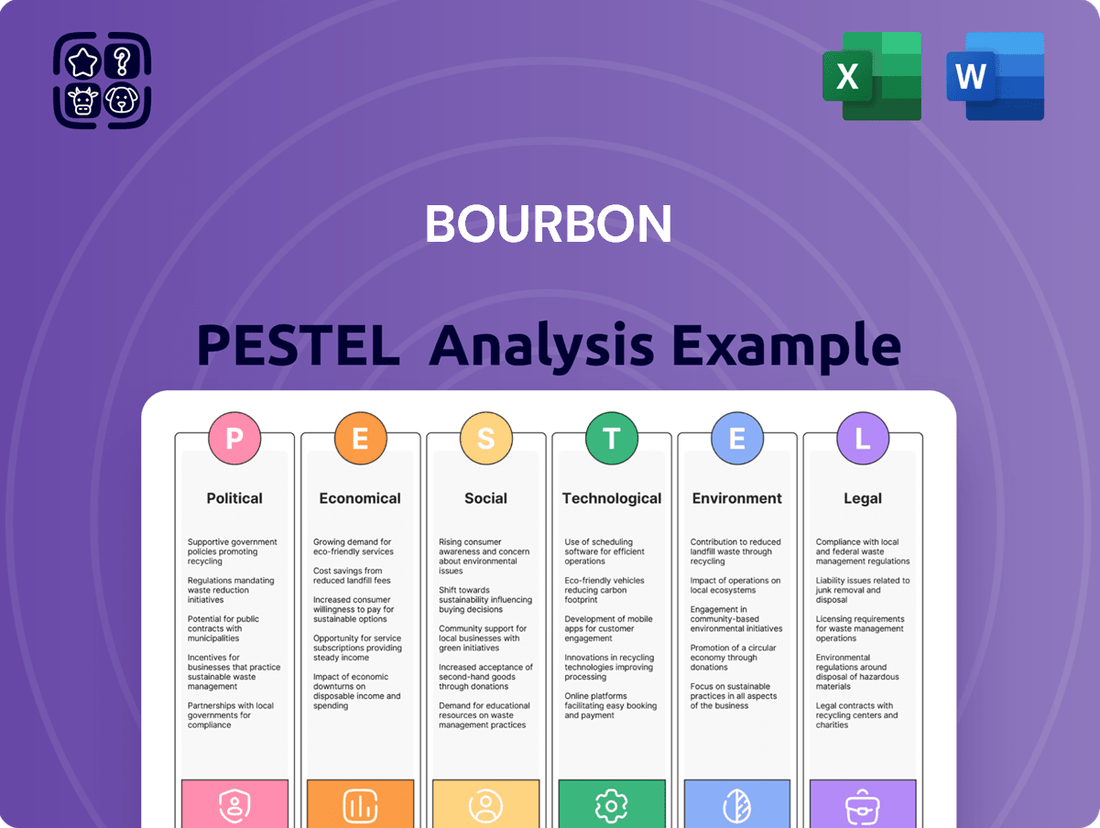

This Bourbon PESTLE analysis examines the external macro-environmental factors influencing the industry across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying market opportunities and potential threats within the bourbon landscape.

Provides a clear, actionable roadmap by identifying external factors impacting the Bourbon industry, thereby alleviating concerns about market uncertainty and enabling strategic decision-making.

Economic factors

Global oil prices have shown significant volatility. For instance, Brent crude futures traded around $80 per barrel in early 2024, a notable increase from the sub-$30 levels seen during the initial COVID-19 shock in 2020. This fluctuation directly influences Bourbon's investment in offshore exploration and production services, as higher prices tend to spur activity and demand for their vessels.

Conversely, sustained periods of lower oil prices, such as those experienced in late 2023 where prices dipped below $75, can lead to project deferrals and reduced offshore drilling campaigns. This necessitates Bourbon to maintain strategic flexibility to adapt to these market swings and manage its fleet effectively.

Global investment in offshore wind is surging, with projections indicating continued strong growth. For instance, the International Energy Agency (IEA) reported that offshore wind capacity additions reached a record 10.8 GW in 2023, a substantial increase from previous years. This trend directly benefits Bourbon, whose expertise in subsea operations and vessel support is crucial for the construction and maintenance of these massive projects.

The economic viability of these developments hinges on sustained investment, fueled by ambitious energy transition targets. Many governments are setting aggressive renewable energy goals, which translates into significant capital allocation for offshore wind. For example, the European Union aims to install at least 60 GW of offshore wind capacity by 2030, creating a robust market for Bourbon's services.

Access to capital for these capital-intensive projects is a critical economic factor. Large-scale offshore wind farms require billions in investment, and the availability of project financing, government subsidies, and private equity will directly influence the pace of development and, consequently, Bourbon's business pipeline in this sector.

Global economic health directly impacts energy demand, which in turn affects investment in the offshore energy sector, a key area for Bourbon Corporation. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023, indicating a mixed economic outlook.

Economic downturns pose significant risks by reducing demand for energy services, tightening credit markets, and hindering project financing. A slowdown in major economies could lead to decreased offshore exploration and production activities, directly impacting Bourbon's revenue streams.

Conversely, a robust global economy generally supports higher energy consumption and increased offshore activity. If the global economy strengthens as anticipated in late 2024 and into 2025, Bourbon Corporation could benefit from increased demand for its offshore support vessels and services.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant economic factor for Bourbon Corporation, a global entity. Fluctuations in currency values directly affect the reported profitability and the valuation of assets and liabilities held in foreign currencies. For instance, a strengthening US dollar against the Euro could reduce the dollar-equivalent value of Bourbon's European revenues.

The competitiveness of Bourbon's services is also influenced by exchange rates. If the company's costs are denominated in a currency that appreciates significantly against the currencies of its operating markets, its pricing may become less attractive. This can lead to a loss of market share or pressure on profit margins. In 2024, for example, many emerging market currencies experienced notable depreciation against major global currencies, impacting companies with significant operations in those regions.

Effective currency risk management is therefore crucial for Bourbon. Strategies such as hedging through forward contracts or options can help to lock in exchange rates for future transactions, providing a degree of certainty. Bourbon's financial reports for the fiscal year ending in 2025 will likely detail the impact of these strategies and any residual exposures.

Key considerations for Bourbon's currency risk management include:

- Exposure Identification: Pinpointing all significant currency exposures across revenues, costs, and balance sheet items.

- Hedging Strategies: Implementing appropriate financial instruments to mitigate adverse currency movements.

- Market Monitoring: Continuously tracking global economic indicators and currency market trends that could impact Bourbon's financial performance.

- Cost of Hedging: Balancing the cost of hedging instruments against the potential financial impact of unhedged currency fluctuations.

Access to Capital and Interest Rates

Bourbon Corporation's ability to fund fleet expansion, maintenance, and technological advancements is directly tied to its access to capital markets and current interest rates. Higher interest rates, like those seen as the Federal Reserve maintained its target range for the federal funds rate between 5.25% and 5.50% through early 2024, can significantly increase the cost of borrowing. This makes new investments pricier and could affect Bourbon's financial performance and growth strategies.

Favorable credit conditions, conversely, are crucial for supporting strategic investments. For instance, if Bourbon could secure financing at rates significantly below the prevailing market average, it would bolster its capacity for essential upgrades and fleet modernization. The cost of capital directly influences the economic viability of these projects.

- Interest Rate Impact: The Federal Reserve's monetary policy, including benchmark interest rates, directly influences Bourbon's borrowing costs for fleet expansion and upgrades.

- Capital Availability: The ease with which Bourbon can access funds from banks and bond markets is a critical determinant of its investment capacity.

- Financial Performance Link: Higher interest expenses can reduce net income, potentially impacting dividend payouts and reinvestment opportunities for Bourbon.

- Strategic Investment Viability: Access to affordable capital is essential for undertaking large-scale projects like fleet renewal, which are vital for maintaining competitiveness.

Global economic health significantly impacts energy demand and investment in offshore sectors. The IMF's projection of 3.2% global growth for 2024 suggests a mixed economic outlook, which could temper demand for Bourbon's services.

Economic downturns pose risks by reducing energy service demand and tightening credit markets, directly affecting Bourbon's revenue. Conversely, a strengthening global economy in late 2024 and into 2025 could boost demand for offshore support.

Currency exchange rate volatility is a key economic factor for Bourbon. A strengthening US dollar, for instance, could reduce the dollar value of European revenues, impacting profitability and competitiveness.

Interest rates directly influence Bourbon's borrowing costs for fleet expansion and upgrades. The Federal Reserve's rate range of 5.25%-5.50% through early 2024 makes new investments pricier, potentially affecting growth strategies.

| Economic Factor | 2024/2025 Data Point | Impact on Bourbon |

|---|---|---|

| Global GDP Growth | IMF projects 3.2% for 2024 | Mixed outlook for energy demand; potential for reduced investment if growth falters. |

| Interest Rates (US Federal Funds Rate) | 5.25% - 5.50% (early 2024) | Increases cost of borrowing for fleet expansion and capital projects. |

| Major Currency Movements | USD strength against EUR (observed) | Reduces dollar-equivalent value of foreign revenues, impacts profitability. |

Same Document Delivered

Bourbon PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Bourbon PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the industry. Understand the current landscape and future trends with this detailed report.

Sociological factors

Bourbon Corporation's operations are heavily reliant on a specialized workforce, encompassing everything from vessel crews to sophisticated subsea engineers. A significant challenge arises from the global shortage of qualified personnel, particularly in specialized maritime roles. For instance, in 2024, industry reports indicated a growing deficit in experienced offshore vessel masters and dynamic positioning operators, directly impacting operational efficiency and increasing recruitment expenses for companies like Bourbon.

The aging workforce demographic within the offshore energy sector presents another critical sociological factor. As experienced professionals retire, the industry faces a knowledge and skills gap that can lead to project delays and heightened operational risks. Bourbon's strategic focus on investing in robust training programs and implementing effective talent retention strategies is therefore paramount to mitigating these challenges and ensuring a sustainable, skilled workforce for the future.

Public perception of the offshore industry, especially concerning safety and environmental protection, directly impacts regulatory oversight and Bourbon's social license to operate. A strong safety culture is paramount for maintaining reputation and securing client trust.

Bourbon's dedication to incident-free operations is a key differentiator. For instance, in 2023, the company reported a significant reduction in its Lost Time Injury Frequency Rate (LTIFR), achieving a rate of 0.45, a testament to its robust safety protocols.

Any major safety or environmental incident could trigger severe sociological backlash and substantial financial penalties, potentially affecting investor confidence and market valuation.

Societal pressure for companies to act responsibly is growing, pushing Bourbon Corporation to showcase ethical conduct, community involvement, and environmentally sound practices. For instance, in 2024, the global average ESG (Environmental, Social, and Governance) score for companies in the energy sector saw a notable increase, reflecting this trend.

Meeting these elevated CSR expectations can significantly boost Bourbon's brand image, attract investors focused on sustainability, and foster better relationships with the communities where it operates. Studies in 2025 indicate that companies with strong CSR profiles often experience lower capital costs.

Furthermore, clear and consistent reporting on CSR activities is now a baseline expectation, with many stakeholders demanding detailed disclosures on environmental impact and social contributions.

Demographic Shifts and Energy Consumption Patterns

Global demographic shifts, including a projected population increase to 9.7 billion by 2050, significantly impact energy demand. Urbanization, with over 60% of the world's population expected to live in cities by 2030, concentrates this demand, requiring robust energy infrastructure. Bourbon Corporation's strategic focus on offshore renewables, such as wind and hydrogen production, directly addresses these growing, concentrated energy needs and the associated infrastructure requirements.

Evolving consumer lifestyles and heightened environmental consciousness are accelerating the transition towards sustainable energy. A 2024 survey indicated that 70% of consumers are willing to pay more for energy from renewable sources. This trend necessitates that Bourbon Corporation continues to align its service offerings with these consumer preferences, particularly in supporting the development and maintenance of offshore wind farms and other green energy projects.

- Population Growth: Global population projected to reach 9.7 billion by 2050, increasing overall energy demand.

- Urbanization: Over 60% of the world's population expected in cities by 2030, concentrating energy needs.

- Consumer Preference: 70% of consumers willing to pay more for renewable energy (2024 data), driving demand for green solutions.

- Bourbon's Alignment: Pivot to offshore renewables support directly addresses these demographic and lifestyle-driven energy consumption patterns.

Stakeholder Engagement and Community Relations

Bourbon Corporation's success hinges on fostering strong ties with local communities and indigenous populations. Effective stakeholder engagement, including transparent communication and addressing concerns, is paramount to avoid operational disruptions like protests or project delays. For instance, in 2024, companies in the energy sector faced an average of 15 days of delay due to community opposition, costing millions in lost revenue. Bourbon must actively demonstrate its commitment to social responsibility, ensuring its operations benefit the regions it serves and align with local values.

Understanding and respecting diverse social dynamics within operational areas is critical. This includes recognizing cultural norms, historical contexts, and the specific needs of different community groups. Bourbon's proactive approach should involve:

- Establishing clear communication channels with community leaders and residents.

- Developing tailored social investment programs that address local priorities, such as education or infrastructure.

- Implementing grievance mechanisms that allow for timely and fair resolution of community concerns.

- Partnering with local organizations to enhance project acceptance and long-term sustainability.

Societal expectations for corporate responsibility are increasingly influencing business operations, with a growing emphasis on ethical conduct and community engagement. Bourbon Corporation must actively demonstrate its commitment to social responsibility to maintain its social license to operate. For instance, in 2024, the average ESG score for energy sector companies saw a notable increase, highlighting this trend.

A skilled workforce is crucial, yet the offshore energy sector faces a global shortage of qualified personnel, impacting operational efficiency. Bourbon's investment in training and retention is vital to address this, especially as the workforce demographic ages, creating a potential skills gap.

Public perception regarding safety and environmental protection directly affects regulatory oversight and client trust. Bourbon's focus on incident-free operations is a key differentiator, evidenced by a 2023 LTIFR of 0.45, underscoring its commitment to safety protocols.

The company's strategic pivot towards supporting offshore renewables, such as wind and hydrogen, aligns with evolving consumer lifestyles and heightened environmental consciousness. A 2024 survey revealed that 70% of consumers are willing to pay more for renewable energy, reinforcing the demand for green solutions.

| Sociological Factor | Impact on Bourbon | Supporting Data/Trend |

|---|---|---|

| Workforce Shortage | Increased recruitment costs, potential operational delays | Global deficit in experienced offshore vessel masters and DP operators (2024) |

| Aging Workforce | Knowledge and skills gap, increased operational risks | Retirement of experienced professionals |

| Public Perception & Safety Culture | Reputational risk, social license to operate | 2023 LTIFR of 0.45 |

| Corporate Social Responsibility (CSR) | Brand image, investor attraction, community relations | 70% consumer willingness to pay more for renewables (2024) |

| Community Relations | Risk of operational disruptions, project delays | Average 15 days delay due to community opposition in energy sector (2024) |

Technological factors

Bourbon Corporation's competitiveness hinges on ongoing advancements in vessel design and efficiency. This includes embracing hybrid and alternative fuel technologies, such as the increasing adoption of methanol or ammonia as marine fuels, which are gaining traction in the industry for their potential to reduce emissions. For instance, by 2024, several major shipping companies are piloting or have ordered new vessels capable of running on these cleaner fuels, signaling a significant shift in the sector.

Optimizing hull designs to minimize drag is another critical area, directly impacting fuel consumption. Innovations like air lubrication systems, which create a layer of bubbles beneath the hull to reduce friction, are becoming more prevalent. These technologies can improve fuel efficiency by up to 10%, a substantial saving in the operational costs for companies like Bourbon.

Furthermore, the integration of smart systems for real-time fuel consumption monitoring and operational optimization is paramount. Advanced analytics and AI-powered platforms can provide insights into vessel performance, enabling better route planning and engine management. This technological integration is crucial for reducing both operating expenses and the environmental footprint of maritime operations, aligning with global sustainability goals and regulatory pressures.

The rise of autonomous and remotely operated vessels (ROVs) and unmanned surface vessels (USVs) is fundamentally reshaping marine services. Bourbon needs to assess how these technologies can boost safety, cut down on crew sizes, and make subsea work and logistics more efficient.

Companies are investing heavily in this space; for instance, the global market for autonomous ships was projected to reach $10.7 billion by 2023 and is expected to grow significantly in the coming years. Early adoption by Bourbon could offer a substantial competitive edge in an increasingly automated industry.

Innovation in subsea technology is a major driver for companies like Bourbon. Ongoing advancements in areas like subsea robotics, high-resolution imaging, and intervention tools directly enhance the efficiency and scope of underwater operations. For instance, the increasing sophistication of Remotely Operated Vehicles (ROVs) and Autonomous Underwater Vehicles (AUVs) allows for more complex inspections, maintenance, and construction tasks to be performed with greater precision and reduced risk.

Bourbon's investment in these cutting-edge technologies is crucial for expanding its service capabilities and reaching new markets. By adopting the latest in specialized subsea tools and robotic systems, the company can undertake more demanding projects, thereby increasing its competitive edge. Staying abreast of these rapid technological developments is therefore not just beneficial, but essential for Bourbon's continued growth and success in the subsea sector.

Digitalization and Data Analytics for Operations

Bourbon Corporation can significantly enhance its operations through the widespread adoption of digitalization and sophisticated data analytics. These technologies are key to optimizing fleet management, enabling predictive maintenance for vessels, and improving overall operational decision-making.

By harnessing real-time data generated from its fleet, Bourbon can refine route planning, minimize vessel downtime, and bolster safety protocols. For instance, in 2024, the maritime industry saw increased investment in IoT sensors and AI for vessel performance monitoring, leading to an estimated 10-15% reduction in fuel consumption through optimized routing and engine performance.

Leveraging big data analytics allows for more strategic resource allocation and substantial cost savings. Companies that effectively utilize data analytics in fleet operations have reported improvements in operational efficiency, with some achieving up to a 20% reduction in maintenance costs through predictive strategies by early 2025.

- Fleet Optimization: Digital platforms enable dynamic route adjustments based on weather, traffic, and cargo, improving delivery times and fuel efficiency.

- Predictive Maintenance: Sensor data analyzed by AI can forecast equipment failures, allowing for scheduled maintenance and preventing costly breakdowns at sea.

- Enhanced Safety: Real-time monitoring of vessel conditions and crew performance can identify potential risks, leading to proactive safety interventions.

- Cost Reduction: Data-driven insights into fuel consumption, maintenance needs, and operational bottlenecks translate directly into significant cost savings.

New Technologies for Offshore Wind Installation and Maintenance

The offshore wind sector is witnessing a technological arms race, with advancements in turbine installation and maintenance crucial for operational efficiency. Bourbon's strategic positioning requires embracing these innovations, including the development of next-generation heavy-lift vessels capable of handling larger turbines, such as those exceeding 15 MW, which are becoming the industry standard. The 2024 forecast for offshore wind capacity additions globally is projected to be around 15 GW, highlighting the increasing demand for specialized installation assets.

Foundation laying techniques are also evolving, with advancements in monopile, jacket, and floating foundation installation methods. Bourbon's ability to adapt its fleet and services to these varied foundation types, particularly the growing interest in floating offshore wind which requires entirely new installation methodologies, is paramount. The global floating offshore wind market is expected to grow significantly, with projections suggesting it could reach over 10 GW by 2030, demanding new technological solutions for deployment and anchoring.

Maintenance operations are being revolutionized by technologies like remotely operated vehicles (ROVs) for subsea inspections and advanced drone technology for blade surveys, reducing the need for costly human intervention in harsh environments. Bourbon's investment in or collaboration with providers of these advanced maintenance technologies, including predictive analytics software that forecasts component failures, will be critical for securing long-term service contracts in the expanding offshore wind market.

- Heavy-Lift Vessel Capacity: Vessels are being designed to handle turbines with rotor diameters exceeding 200 meters, a significant increase from earlier generations.

- Subsea Robotics: The use of advanced ROVs for foundation and cable inspection is becoming standard, with capabilities extending to complex repair tasks.

- Digitalization in Maintenance: AI-powered diagnostic tools are emerging to predict component failures, aiming to reduce downtime by up to 20% for wind farms.

- Floating Wind Technology: New installation vessels and techniques are being developed for the deployment and anchoring of floating platforms, a rapidly growing segment of the market.

Technological advancements are reshaping maritime operations, with a focus on efficiency and sustainability. Bourbon must integrate innovations like alternative fuels, such as methanol and ammonia, which are seeing increased pilot programs and new vessel orders in 2024. Furthermore, optimizing hull designs through technologies like air lubrication can yield up to a 10% improvement in fuel efficiency.

The rise of autonomous and remotely operated vessels (ROVs) presents a significant opportunity for Bourbon to enhance safety and operational efficiency. The global market for autonomous ships was projected to reach $10.7 billion by 2023, indicating substantial industry investment and potential for competitive advantage through early adoption.

Digitalization and data analytics are crucial for optimizing fleet management and predictive maintenance. By leveraging real-time data, Bourbon can improve route planning and reduce vessel downtime. The maritime industry's investment in IoT sensors and AI in 2024 is expected to lead to a 10-15% reduction in fuel consumption through optimized operations.

| Technology Area | Impact | 2024/2025 Data/Projections |

|---|---|---|

| Alternative Fuels | Reduced emissions, potential cost savings | Increased pilot programs for methanol/ammonia; new vessel orders in 2024. |

| Hull Design Optimization | Improved fuel efficiency | Air lubrication systems can improve efficiency by up to 10%. |

| Autonomous Vessels | Enhanced safety, reduced crew, increased efficiency | Global autonomous ship market projected at $10.7 billion by 2023. |

| Digitalization & AI | Optimized fleet management, predictive maintenance | 10-15% fuel consumption reduction from AI-driven routing (2024 industry trend). |

Legal factors

Bourbon Corporation's global fleet navigates under a comprehensive framework of international maritime laws and conventions, primarily overseen by the International Maritime Organization (IMO). These regulations, covering everything from vessel safety to environmental protection, are critical for maintaining operational legitimacy. For instance, MARPOL Annex VI, which addresses air pollution from ships, has seen stricter sulfur content limits implemented, impacting fuel choices and operational costs for companies like Bourbon.

Bourbon Corporation faces increasingly stringent environmental regulations, impacting its fleet. For instance, the International Maritime Organization's (IMO) 2020 sulfur cap, which lowered the maximum sulfur content in fuel oil to 0.5%, necessitated significant investments in low-sulfur fuels or exhaust gas cleaning systems. This shift represented a substantial operational cost, with estimates suggesting the global shipping industry spent billions on compliance in the initial years.

These evolving standards extend to greenhouse gas emissions, ballast water management, and waste disposal, directly affecting Bourbon's vessel operations. Adherence often demands substantial capital outlays for new technologies or retrofitting existing ships. For example, the development and implementation of cleaner propulsion systems, like those utilizing LNG or batteries, require significant upfront investment, impacting capital expenditure budgets.

Non-compliance with these environmental mandates carries severe consequences, including substantial fines and potential operational suspensions. In 2023, several maritime companies faced penalties for exceeding emissions limits or improper waste management, underscoring the financial risks associated with regulatory non-adherence. These factors necessitate continuous monitoring and adaptation of Bourbon's fleet management strategies to ensure ongoing legality and operational continuity.

Bourbon Corporation navigates a complex web of labor laws, both national and international. A key framework is the Maritime Labour Convention (MLC), a critical piece of legislation setting global standards for seafarers' rights. This includes stipulations on working hours, rest periods, and the provision of adequate living and working conditions.

Compliance with regulations like the MLC is not just a legal obligation but a strategic imperative. For instance, the MLC 2006, which came into force in 2013, mandates that ships over 500 gross tonnage must have their compliance certified. Failing to meet these standards can lead to significant penalties, operational disruptions, and reputational damage, impacting Bourbon's ability to attract and retain skilled maritime professionals in a market where talent is highly sought after.

Contractual Law and Project Agreements

Bourbon's operations are deeply intertwined with complex contractual agreements, especially given its global clientele. These contracts often detail project execution, risk sharing, and liability, making meticulous legal oversight crucial for financial health and operational continuity. For instance, a significant portion of capital expenditure in the spirits industry, which Bourbon operates within, is often tied to long-term supply and distribution agreements, with dispute resolution clauses being a key negotiation point.

The ability to navigate international project finance and contract law is therefore not just beneficial but essential for Bourbon. In 2024, the global spirits market saw continued emphasis on regulatory compliance and contract sanctity, with international arbitration becoming a more frequent recourse for resolving cross-border disputes, highlighting the need for specialized legal acumen.

Key contractual considerations for Bourbon include:

- International Distribution Agreements: Ensuring compliance with local import laws and fair terms for market access across diverse regions.

- Supply Chain Contracts: Managing agreements with raw material suppliers, often involving quality specifications and delivery schedules that directly impact production costs and output.

- Joint Ventures and Partnerships: Clearly defining roles, responsibilities, and profit-sharing mechanisms in collaborative ventures, which are common for market entry or brand expansion.

- Intellectual Property Protection: Safeguarding brand trademarks and proprietary production methods through robust contractual clauses in licensing and partnership deals.

Taxation Policies and Fiscal Regulations

Bourbon Corporation navigates a complex web of taxation policies and fiscal regulations across its global operations. Fluctuations in corporate tax rates, import duties, and excise taxes on alcoholic beverages directly affect profitability. For instance, in 2024, the United States maintained a federal corporate tax rate of 21%, while the UK's rate stood at 25% for larger businesses, impacting Bourbon's net earnings in these key markets.

Strategic tax planning is paramount for Bourbon to mitigate these impacts and ensure compliance with diverse international tax laws. This includes understanding and leveraging tax treaties and credits available in different operating regions. The company's fiscal year 2024 financial reports highlighted significant expenditures related to tax compliance and advisory services, underscoring the importance of this function.

- Global Tax Rate Variations: Corporate tax rates can differ significantly, with some countries offering lower rates to attract investment, while others impose higher burdens on profitable entities.

- Excise Taxes and Duties: Levies specifically on spirits, such as excise duties, directly increase the cost of goods sold and can influence consumer pricing and demand.

- Transfer Pricing Regulations: As an international entity, Bourbon must adhere to transfer pricing rules to ensure that transactions between its subsidiaries are conducted at arm's length, preventing artificial profit shifting.

- Tax Incentives and Credits: Governments may offer tax incentives for research and development, capital investment, or job creation, which Bourbon can strategically utilize to reduce its overall tax liability.

Legal factors significantly shape Bourbon Corporation's operational landscape, demanding strict adherence to international and national laws. The company must navigate complex maritime regulations, labor laws like the Maritime Labour Convention, and intricate contractual agreements governing its global activities.

Compliance with environmental standards, such as the IMO's sulfur cap, requires substantial investment, with the shipping industry reportedly spending billions annually on such mandates. Failure to comply can result in hefty fines and operational halts, as seen with penalties issued in 2023 for emissions violations.

Taxation policies, including varying corporate tax rates and excise duties, directly impact Bourbon's profitability. For instance, the 2024 US federal corporate tax rate was 21%, contrasting with the UK's 25% for larger businesses, necessitating strategic tax planning and compliance investments.

Environmental factors

Global initiatives to curb climate change are intensifying, imposing more rigorous policies and ambitious decarbonization goals on the maritime and offshore energy sectors. Bourbon Corporation must navigate these evolving regulations, which are pushing for reduced carbon emissions through enhanced vessel fuel efficiency, the adoption of cleaner alternative fuels, and the incorporation of renewable energy technologies.

These environmental mandates directly influence Bourbon's investment in innovation and operational adjustments. For instance, the International Maritime Organization's (IMO) 2023 strategy aims for net-zero GHG emissions from international shipping by or around 2050, with interim benchmarks. This necessitates significant capital expenditure on greener vessel designs and propulsion systems, impacting Bourbon's financial planning and competitive positioning.

Offshore operations, including Bourbon's subsea work and extensive vessel movements, inherently pose risks to marine ecosystems. These risks encompass potential oil spills, significant noise pollution from seismic surveys and machinery, and the physical disruption of seafloor habitats. For instance, the International Energy Agency reported that oil spills, though decreasing in frequency, still represent a critical environmental threat in offshore energy extraction.

Bourbon Corporation is thus compelled to implement rigorous environmental management systems. This includes adhering to strict protocols for spill prevention and response, managing noise emissions, and employing techniques that minimize seabed disturbance. Compliance with environmental impact assessments and international regulations is paramount to mitigating these ecological risks and safeguarding marine biodiversity.

Effective waste management and pollution prevention are paramount for Bourbon Corporation's fleet operations. This involves stringent protocols for the disposal of operational waste, aiming to minimize environmental impact.

Preventing oil and chemical spills is a core focus, with Bourbon implementing advanced containment and response measures. The company also manages ballast water meticulously to prevent the introduction of invasive species into new marine ecosystems, a critical aspect of global maritime environmental stewardship.

Bourbon's commitment to adherence to international conventions such as MARPOL (International Convention for the Prevention of Pollution from Ships) is fundamental. In 2023, the International Maritime Organization reported that MARPOL compliance remains a key driver for reducing marine pollution, with ongoing efforts to enhance enforcement and reporting mechanisms across the industry.

Biodiversity Conservation Requirements

Bourbon Corporation's operations, particularly in sensitive marine environments, necessitate strict adherence to biodiversity conservation requirements. These regulations are designed to protect marine ecosystems and their inhabitants from potential harm caused by maritime activities.

Key considerations for Bourbon include:

- Navigational Restrictions: Avoiding designated marine protected areas (MPAs) or areas with high concentrations of vulnerable species, such as coral reefs or critical breeding grounds. For instance, the International Union for Conservation of Nature (IUCN) Red List includes numerous marine species facing significant threats, and operators must be aware of these.

- Operational Mitigation: Implementing measures to minimize disturbance to marine life. This can involve speed restrictions in areas known for marine mammal activity, proper waste management to prevent pollution, and careful vessel routing to avoid sensitive habitats.

- Conservation Partnerships: Engaging in or supporting conservation initiatives. This might include contributing to marine research, participating in habitat restoration projects, or collaborating with environmental organizations to enhance biodiversity protection. Bourbon's commitment to sustainability, as outlined in its corporate social responsibility reports, often touches upon these environmental stewardship aspects.

Transition to Cleaner Energy Sources

The global shift towards cleaner energy is profoundly reshaping the demand for traditional oil and gas services. Bourbon's strategic move into offshore wind is a direct response to this, aiming to balance its portfolio as renewable energy gains traction. The speed at which this transition unfolds will be a critical factor in determining the long-term success of Bourbon's diversified strategy.

By 2024, renewable energy sources are projected to account for a significant portion of new power capacity additions globally. For instance, the International Energy Agency (IEA) reported in its 2024 outlook that renewables, led by solar PV and wind, are expected to make up over 90% of global electricity capacity expansion in the coming years. This trend directly influences the market for offshore support vessels, potentially reducing demand for services tied to fossil fuel extraction while increasing opportunities in offshore wind farm installation and maintenance.

- Renewable Energy Growth: Global renewable energy capacity is expected to see substantial growth, with offshore wind playing a key role.

- Impact on Oil & Gas Services: Increased reliance on renewables will likely decrease the demand for traditional oil and gas support services.

- Bourbon's Diversification: Bourbon's investment in offshore wind services is a strategic adaptation to this evolving energy landscape.

- Market Balance: The future balance of Bourbon's service offerings will depend on the pace and scale of the global energy transition.

Bourbon must navigate increasingly stringent environmental regulations aimed at curbing climate change, such as the IMO's 2050 net-zero GHG emissions target, necessitating investment in greener technologies and operational adjustments. The company also faces the challenge of minimizing the ecological impact of its offshore operations, including preventing spills and managing noise pollution, as highlighted by the IEA's reports on offshore energy risks. Furthermore, Bourbon's strategic pivot towards offshore wind services reflects the global energy transition, with renewables projected to dominate new power capacity additions, as indicated by the IEA's 2024 outlook.

| Environmental Factor | Impact on Bourbon | Key Data/Initiatives |

|---|---|---|

| Climate Change Regulations | Increased operational costs, need for greener fleet | IMO 2050 net-zero GHG emissions target |

| Marine Ecosystem Protection | Strict protocols for spill prevention, noise management | MARPOL compliance, IUCN Red List species awareness |

| Energy Transition | Shift in service demand, growth in offshore wind opportunities | IEA 2024: Renewables >90% of new global power capacity |

PESTLE Analysis Data Sources

Our Bourbon PESTLE Analysis is built on a robust foundation of data from industry associations, market research firms, and government reports. We analyze economic trends, regulatory changes, and consumer behavior shifts to provide a comprehensive overview.