Boralex SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boralex Bundle

Boralex, a key player in renewable energy, boasts significant strengths in its diversified portfolio and strong project pipeline. However, understanding the full scope of its opportunities and the potential threats it faces is crucial for informed decision-making.

Want the full story behind Boralex's market position, growth drivers, and potential risks? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment research.

Strengths

Boralex boasts a robust and diverse renewable energy portfolio, encompassing wind, solar, and hydroelectric power generation. This strategic breadth of assets underpins a stable operational foundation, enabling the company to effectively optimize electricity production across its various renewable sources.

This diversification is a key strength, significantly reducing the inherent risks tied to over-reliance on any single energy technology. For instance, as of the first quarter of 2024, Boralex reported a total installed capacity of 1,500 MW, with wind power representing approximately 60% of this, solar 30%, and hydroelectricity 10%, showcasing a balanced approach to renewable energy generation.

Boralex's strength lies in its substantial portfolio of secured long-term Power Purchase Agreements (PPAs). These contracts are the bedrock of its predictable revenue, effectively shielding the company from market price fluctuations.

At the close of 2024, an impressive 90% of Boralex's operational capacity was under these secure agreements. This high coverage, coupled with a weighted average remaining term of 11 years, provides significant financial visibility and stability.

Looking ahead, Boralex anticipates this stability to strengthen, with the weighted average PPA term projected to extend to 14 years by 2030. This ongoing commitment to long-term contracts is a key factor in mitigating revenue volatility.

Boralex is actively pursuing an aggressive growth strategy, with a clear objective to double its installed capacity every five years. This ambition is underpinned by a substantial project pipeline that currently exceeds 78 gigawatts across wind, solar, and energy storage technologies.

The company's 2030 Strategic Plan is focused on driving organic growth, particularly in its established markets of Canada and France. Simultaneously, Boralex is strategically targeting expansion into the United States and the United Kingdom to broaden its geographical reach.

This proactive and forward-looking approach is designed to position Boralex for sustained, long-term expansion within the dynamic renewable energy sector.

Extensive Geographic Diversification

Boralex's extensive geographic diversification is a significant strength, with established operations in Canada and France, and strategic expansion into the United States and United Kingdom. This broad operational base helps to smooth out performance by reducing reliance on any single market's economic or regulatory conditions. For instance, as of Q1 2024, Boralex reported a total installed capacity of 3,748 MW, with a substantial portion spread across these key regions, demonstrating the tangible benefit of this diversified approach.

This geographical spread allows Boralex to tap into varying renewable energy support mechanisms and market dynamics. By operating in multiple countries, the company can leverage different government incentives and power purchase agreement structures, enhancing its ability to secure profitable projects. This strategy is crucial for long-term stability and growth in the often-volatile renewable energy sector.

The company's commitment to expanding its international presence is evident in its ongoing development pipeline. Boralex aims to increase its total installed capacity to 5,000 MW by 2025, with a significant portion of this growth targeted for its newer markets like the US and UK. This proactive expansion underscores the strategic importance of geographic diversification in achieving its growth objectives.

Key aspects of Boralex's geographic diversification include:

- Established Presence: Strong operational footprint in Canada and France.

- Growth Markets: Active expansion into the United States and United Kingdom.

- Risk Mitigation: Reduced exposure to regional market volatility and policy changes.

- Opportunity Capture: Ability to capitalize on diverse renewable energy support policies globally.

Integrated Business Model and CSR Leadership

Boralex's strength lies in its fully integrated business model, overseeing every stage of renewable energy asset management, from initial development and construction through to ongoing operation and direct energy sales. This end-to-end control enhances efficiency and profitability.

This integrated approach is powerfully complemented by Boralex's robust commitment to corporate social responsibility (CSR) and Environmental, Social, and Governance (ESG) principles. These are not afterthoughts but are woven directly into the company's strategic planning, making it an attractive proposition for investors prioritizing sustainability.

Boralex has set a clear target to achieve a net-zero trajectory by 2050, reinforcing its dedication to environmental stewardship. This forward-looking commitment is crucial in attracting capital and partnerships in today's climate-conscious market.

For instance, in its 2023 fiscal year, Boralex reported a significant increase in its installed capacity, reaching over 3,000 MW, a testament to its operational execution and strategic growth in the renewable energy sector.

Boralex's diversified renewable energy portfolio, spanning wind, solar, and hydroelectric power, provides a stable operational foundation. This diversification, as seen in its Q1 2024 capacity breakdown (60% wind, 30% solar, 10% hydro), significantly mitigates risks associated with reliance on a single technology.

The company's strength is further solidified by its extensive portfolio of long-term Power Purchase Agreements (PPAs). By the end of 2024, 90% of its operational capacity was secured under these agreements, with an average remaining term of 11 years, ensuring predictable revenue streams and shielding it from market volatility.

Boralex's aggressive growth strategy, aiming to double capacity every five years, is supported by a substantial project pipeline exceeding 78 GW. This growth is geographically focused on established markets like Canada and France, with strategic expansion into the United States and United Kingdom.

The company's integrated business model, managing all stages from development to operation, enhances efficiency and profitability. This is complemented by a strong commitment to ESG principles, with a net-zero target by 2050, aligning with investor priorities for sustainability.

| Metric | Value (as of Q1 2024/End of 2024) | Significance |

|---|---|---|

| Total Installed Capacity | 3,748 MW | Demonstrates significant operational scale. |

| PPA Secured Capacity | 90% of operational capacity | Provides strong revenue visibility and stability. |

| Average PPA Remaining Term | 11 years | Ensures long-term predictable cash flows. |

| Project Pipeline | > 78 GW | Indicates substantial future growth potential. |

What is included in the product

Delivers a strategic overview of Boralex’s internal and external business factors, highlighting its established market position and renewable energy expertise while also considering potential regulatory shifts and competitive pressures.

Offers a structured approach to identify Boralex's competitive advantages and mitigate potential market threats, streamlining strategic planning.

Weaknesses

Boralex's reliance on natural resources means its electricity output is vulnerable to weather. For instance, lower wind speeds in key markets like France and Canada, or reduced hydropower availability in the US, can directly impact production volumes.

This variability can lead to a dip in revenue and earnings. In the first quarter of 2024, Boralex reported a decrease in revenue from its wind segment in Canada due to lower wind resources, highlighting this vulnerability.

Boralex faces a weakness due to its exposure to short-term power price volatility, even with a significant portion of its revenue secured by long-term power purchase agreements (PPAs). This is particularly relevant in markets such as France.

Fluctuations in spot market prices can directly affect the company's financial performance. For instance, lower short-term PPA prices were a contributing factor to a decrease in Boralex's EBITDA(A) during the first quarter of 2025, highlighting the impact on profitability.

This vulnerability is more pronounced for any energy output that is uncontracted or only partially contracted, as these volumes are directly subject to the unpredictable swings in the wholesale electricity market.

Boralex's historical strength in wind energy, while significant, presents a weakness due to its past concentration. As of 2022, over 80% of its installed capacity was derived from onshore wind projects. This past reliance on a single technology means that even with current diversification efforts into solar and storage, a substantial part of its operational base remains exposed to the specific risks associated with wind resource variability.

Project Execution and Permitting Risks

Boralex's aggressive expansion, with a substantial project pipeline, inherently carries execution risks. Delays in bringing new projects online are a key concern, particularly given the intricate permitting procedures in emerging markets such as the United States. For instance, navigating the U.S. regulatory landscape can be time-consuming, potentially pushing back revenue generation from newly developed sites.

Furthermore, the company faces challenges stemming from global supply chain volatility and escalating construction expenses. These factors can directly impact project timelines and the overall financial viability of new developments. For example, unforeseen increases in the cost of solar panels or wind turbines, coupled with logistical bottlenecks, could significantly affect Boralex's ability to meet its ambitious growth objectives for 2024-2025.

- Project Delays: Complex permitting in new markets, like the U.S., can push back commissioning dates.

- Supply Chain Disruptions: Volatility in global supply chains can impact the availability and cost of essential construction materials.

- Rising Construction Costs: Increased expenses for materials and labor can erode project profitability and hinder growth targets.

- Impact on Growth Targets: Execution challenges directly threaten Boralex's ability to achieve its stated renewable energy capacity expansion goals.

Foreign Exchange Rate Exposure

As Boralex continues its international expansion, particularly in the United States and Europe, its exposure to foreign exchange rate volatility becomes a more significant concern. Fluctuations in currency values directly affect the conversion of revenues and expenses from these foreign operations back into Canadian dollars, potentially impacting reported financial performance. This risk is projected to intensify as Boralex's non-Canadian asset base grows.

For instance, in 2023, Boralex reported a substantial portion of its revenue originating from outside Canada. A weakening US dollar against the Canadian dollar, for example, would directly reduce the Canadian dollar value of its US-based earnings. This currency risk needs careful management to protect profitability.

Boralex's increasing global footprint means that currency mismatches between its assets and liabilities in different regions can also create financial exposure. Managing these exposures requires strategic hedging or natural hedging techniques to mitigate the impact of adverse currency movements on its financial statements.

Key currency exposures for Boralex include:

- US Dollar (USD): Significant operations in the United States expose Boralex to USD/CAD exchange rate fluctuations.

- Euro (EUR): Expansion into European markets introduces exposure to EUR/CAD and other intra-European currency movements.

- British Pound (GBP): Operations in the UK add exposure to GBP/CAD exchange rate volatility.

Boralex's reliance on weather-dependent renewable sources like wind and hydro exposes it to production variability. Lower wind speeds or reduced hydropower availability directly impact electricity output and revenue, as seen in the Q1 2024 Canadian wind segment performance.

The company also faces risks from short-term power price volatility, especially for uncontracted or partially contracted energy. This was evident in Q1 2025, where lower short-term PPA prices affected EBITDA(A).

While Boralex is diversifying, its historical concentration in onshore wind (over 80% of capacity as of 2022) leaves a significant portion of its operations vulnerable to wind resource fluctuations.

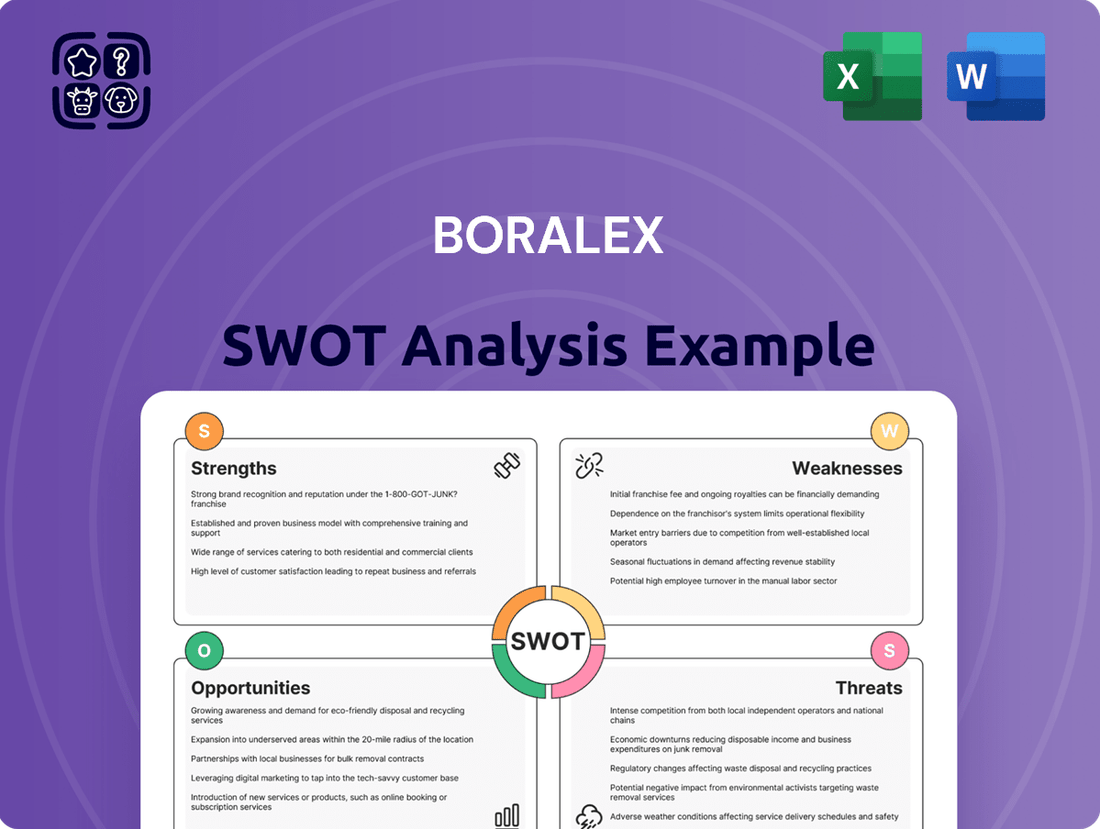

Preview the Actual Deliverable

Boralex SWOT Analysis

The preview you see is the same Boralex SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and actionable insights.

This is a real excerpt from the complete Boralex SWOT analysis. Once purchased, you’ll receive the full, editable version ready for strategic planning.

You’re viewing a live preview of the actual Boralex SWOT analysis file. The complete, in-depth version becomes available after checkout, offering a comprehensive strategic overview.

Opportunities

The global imperative to decarbonize is fueling unprecedented demand for renewable energy. Governmental initiatives like the EU's REPowerEU plan, aiming to fast-track renewables, and the U.S. Inflation Reduction Act, which allocates substantial tax credits, are creating a robust market. Canada's own Clean Energy Export Strategy further underscores this global trend, offering significant opportunities for companies like Boralex to capitalize on this expanding sector.

This intensified focus on sustainable energy sources presents a highly favorable market environment for Boralex. The company is well-positioned to leverage this momentum, expanding its current operational footprint and initiating new renewable energy projects. The substantial tailwind provided by the growing emphasis on clean energy directly supports Boralex's growth trajectory, with the global renewable energy market projected to reach over $1.9 trillion by 2030, according to some industry forecasts.

Boralex is strategically expanding its footprint in solar power and energy storage, recognizing these as crucial avenues for future growth. The company is committed to substantially increasing its solar capacity, with a particular focus on key U.S. markets such as New York.

Integrating energy storage solutions is a core part of Boralex's strategy, aiming to bolster grid stability and improve the financial performance of its projects. This move complements its existing wind and hydropower assets, creating a more robust and efficient energy portfolio.

By the end of 2024, Boralex plans to have 240 MW of solar projects in operation or under construction in the U.S., a significant step in its diversification efforts.

Boralex is actively pursuing strategic acquisitions and collaborative partnerships to fuel its expansion and diversify its renewable energy portfolio. These moves are designed to accelerate growth and tap into new markets and technologies.

Collaborations on significant projects offer Boralex access to crucial financing and new markets, directly supporting its substantial capital investment goals. For instance, in 2024, Boralex announced a strategic partnership for a major offshore wind project in France, aiming to leverage expertise and secure project financing.

This inorganic growth strategy, when combined with its ongoing organic development, allows Boralex to swiftly broaden its operational reach and increase its market share in the competitive renewable energy sector.

Technological Advancements and Operational Optimization

Ongoing advancements in renewable energy technologies, particularly in solar and wind power, offer significant opportunities for Boralex to enhance its energy production capabilities. For instance, advancements in turbine efficiency and solar panel technology can directly translate to higher output from existing and new projects. Boralex's strategic focus on operational optimization, including digitalization and asset enhancement, is crucial in capitalizing on these technological leaps. The company's commitment to simplifying processes and exploring repowering initiatives aims to boost performance and profitability.

Leveraging these innovations presents a clear path to increased energy generation and reduced operational costs. For example, Boralex reported in its 2024 first-quarter results that its operational improvements contributed to a stronger financial performance, highlighting the tangible benefits of its optimization strategies. This focus on efficiency can lead to improved overall profitability by maximizing the output from its renewable energy portfolio.

Key opportunities stemming from technological advancements and operational optimization include:

- Enhanced Energy Yield: Implementing newer, more efficient turbine or solar panel technologies can increase electricity generation from the same installed capacity.

- Reduced Operating Expenses: Digitalization and process simplification can lower maintenance costs and improve resource allocation.

- Extended Asset Lifespan: Strategic repowering of older facilities with modern components can extend their operational life and improve their economic viability.

- Improved Project Economics: The combination of higher yields and lower costs directly improves the financial returns of Boralex's renewable energy projects.

Growth in Corporate Power Purchase Agreements

Corporations are increasingly prioritizing sustainability, driving a significant uptick in demand for direct renewable energy sourcing. This trend is fueling the growth of corporate power purchase agreements (PPAs). For instance, in 2023, the volume of new corporate PPA announcements globally reached a record 36.7 GW, a substantial increase from previous years.

Boralex is well-positioned to leverage this opportunity by expanding its direct supply relationships with industrial clients. These long-term PPAs offer a stable and predictable revenue stream, diversifying Boralex's income beyond traditional utility-scale contracts. This strategic focus allows the company to directly serve businesses committed to reducing their carbon emissions.

The appeal of PPAs for corporations lies in their ability to secure long-term, fixed-price renewable energy, hedging against volatile traditional energy markets. This financial predictability, coupled with environmental benefits, makes PPAs an attractive proposition for businesses aiming to meet their ESG targets. Boralex's expertise in renewable energy development aligns perfectly with this corporate demand.

Key benefits for Boralex in pursuing corporate PPAs include:

- Diversified Revenue Streams: Reduced reliance on fluctuating utility tenders.

- Enhanced Market Position: Direct engagement with a growing corporate sustainability market.

- Long-Term Contract Stability: Predictable cash flows from committed off-takers.

- Contribution to Decarbonization Goals: Supporting corporate sustainability initiatives.

The global push for decarbonization and supportive government policies create a fertile ground for renewable energy expansion. Boralex is strategically increasing its solar capacity, particularly in key U.S. markets like New York, with plans for 240 MW of solar projects in operation or under construction in the U.S. by the end of 2024. Integrating energy storage solutions is also a core strategy to enhance grid stability and project economics, complementing its existing wind and hydro assets. The company is also actively pursuing acquisitions and partnerships to accelerate growth and broaden its operational reach.

Advancements in renewable energy technologies, such as more efficient turbines and solar panels, offer opportunities to boost energy yields and reduce operating expenses. Boralex's focus on digitalization and asset optimization, including exploring repowering initiatives, aims to enhance performance and profitability, as evidenced by its Q1 2024 results showing positive impacts from operational improvements. This technological adoption directly translates to better project economics and increased energy generation.

The increasing corporate demand for renewable energy through power purchase agreements (PPAs) presents a significant opportunity for Boralex to secure stable, long-term revenue streams. Global corporate PPA announcements reached a record 36.7 GW in 2023, highlighting this growing trend. By expanding direct supply relationships with industrial clients, Boralex can diversify its income, gain a stronger market position, and support corporate sustainability goals.

Threats

Rising interest rates present a considerable challenge for capital-intensive renewable energy ventures like those undertaken by Boralex. As borrowing costs climb, the financial viability of new developments comes under pressure, potentially making them less attractive compared to other investment opportunities. This trend directly impacts the profitability and overall return on investment for such projects.

For Boralex, persistently high or increasing interest rates can significantly increase the cost of financing new renewable energy projects. This financial strain can compress the expected returns on both existing and future investments, potentially slowing down the pace of expansion and development in the renewable sector. For instance, an increase in the Bank of Canada's overnight rate from 4.50% in early 2024 to 5.00% by mid-2024 would directly translate to higher borrowing costs for Boralex.

The renewable energy sector's appeal is drawing in many new competitors, including established giants. This surge in players means Boralex faces tougher bids for new projects, potentially squeezing profit margins. For instance, in 2024, the global renewable energy market saw significant investment, with solar and wind power leading the charge, creating a more crowded development pipeline.

As Boralex pushes into markets already teeming with energy developers, staying ahead requires constant innovation and efficient operations. The pressure is on to secure prime locations and favorable power purchase agreements before competitors do, ensuring continued growth and profitability in an increasingly competitive environment.

Boralex continues to grapple with persistent supply chain issues and rising costs for essential construction components like steel and solar panels. These global pressures directly translate to higher project expenses and the risk of extended development schedules, potentially squeezing profit margins for new renewable energy installations.

For instance, the average price of polysilicon, a key material for solar panels, saw significant volatility throughout 2023 and early 2024, with some reports indicating price increases of over 50% year-over-year at certain points, directly impacting Boralex's procurement costs.

Effectively navigating these external cost escalations remains a critical and ongoing operational challenge for Boralex, requiring strategic sourcing and robust risk management to maintain project viability.

Unfavorable Regulatory and Policy Changes

Unfavorable regulatory and policy shifts across Boralex's key markets, including Canada, France, the U.S., and the UK, pose a significant threat. Changes to government incentives, tax credits, or evolving permitting processes for renewable energy projects could directly impact project economics and Boralex's development pipeline.

For instance, a reduction in feed-in tariffs or the phasing out of investment tax credits in a major operating region could diminish the projected returns for new wind and solar farms. Such changes might necessitate a reassessment of Boralex's capital allocation and could slow down the pace of new project development, affecting its long-term growth strategy and financial performance.

- Policy Uncertainty: Evolving government support mechanisms for renewables create uncertainty in project financial modeling.

- Subsidy Reductions: Decreases in renewable energy subsidies or tax credits could lower project profitability.

- Permitting Hurdles: Stricter or more complex permitting requirements can delay project timelines and increase costs.

- Market Competitiveness: Policy changes can alter the competitive landscape, potentially favoring other energy sources or technologies.

Resource Variability Exceeding Projections

Despite Boralex’s efforts to diversify its energy sources, the natural unpredictability of wind and solar resources presents a significant challenge. Extended periods of unfavorable weather, such as consistently low wind speeds or reduced solar irradiation, can cause production to fall short of projections. For instance, in the first quarter of 2024, Boralex reported that lower wind speeds in certain regions impacted their wind power generation compared to expectations.

This resource variability directly affects revenue stability and the ability to meet financial objectives. Even with a diverse portfolio across various geographies and technologies, prolonged underperformance due to climatic factors can strain financial targets. Boralex’s 2023 annual report highlighted that while overall production met guidance, specific wind farms experienced periods of lower-than-average wind resource, demonstrating the ongoing impact of this threat.

- Impact on Revenue: Lower-than-projected energy generation due to adverse weather directly reduces revenue streams.

- Financial Target Risk: Consistent underperformance can make it difficult to achieve projected financial results and shareholder expectations.

- Diversification Limitations: While diversification mitigates some risk, it cannot entirely eliminate the impact of widespread adverse climatic conditions affecting multiple energy sources simultaneously.

Rising interest rates continue to be a significant threat, increasing financing costs for Boralex's capital-intensive projects. For example, if the Bank of Canada's overnight rate were to remain at 5.00% through 2024 and into early 2025, Boralex would face consistently higher borrowing expenses for new developments, potentially impacting project profitability and the company's overall return on investment.

Increased competition within the renewable energy sector, fueled by substantial global investments in solar and wind power during 2024, intensifies pressure on Boralex. This crowded market means tougher competition for securing prime project locations and favorable power purchase agreements, potentially squeezing profit margins and slowing expansion.

Persistent supply chain disruptions and rising material costs, such as the volatility in polysilicon prices seen in 2023-2024, directly increase project expenses for Boralex. These cost escalations, coupled with potential permitting hurdles and evolving government incentives, create an uncertain operating environment that can delay timelines and reduce profitability.

The inherent unpredictability of renewable energy resources, like wind speeds and solar irradiation, poses a continuous threat to Boralex's revenue stability. For instance, lower-than-average wind speeds impacting specific wind farms, as noted in Q1 2024, demonstrate how adverse weather can lead to production shortfalls and hinder the achievement of financial targets, even with a diversified portfolio.

SWOT Analysis Data Sources

This Boralex SWOT analysis is built upon a foundation of robust data, drawing from official financial filings, comprehensive market research reports, and expert industry commentary to provide a thorough and insightful assessment.