Boralex Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boralex Bundle

Boralex faces moderate bargaining power from buyers, as renewable energy contracts often involve long-term agreements, but the threat of new entrants is relatively low due to high capital requirements and regulatory hurdles. Understanding these dynamics is crucial for strategic planning.

The complete report reveals the real forces shaping Boralex’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The renewable energy industry, including companies like Boralex, depends heavily on specialized equipment such as wind turbines, solar panels, and inverters. The suppliers of these critical components are often few in number on a global scale, which can grant them considerable leverage in negotiations with buyers.

This concentration means that a limited number of manufacturers can dictate terms, potentially impacting Boralex's costs and project timelines. For instance, major wind turbine manufacturers like Vestas and Siemens Gamesa hold significant market share, giving them substantial bargaining power.

The bargaining power of these key equipment suppliers is further strengthened by the substantial costs and logistical challenges associated with switching vendors once a renewable energy project's design is finalized or construction is underway. This high switching cost effectively locks customers into existing supplier relationships.

The availability of financing is a crucial element for Boralex's growth, directly impacting its ability to undertake new renewable energy projects. In 2024, the cost of capital remained a significant consideration, with interest rate fluctuations influencing project economics.

When capital markets tighten, lenders gain increased bargaining power, which can affect Boralex's project funding and negotiation leverage. For instance, a higher cost of debt directly increases the overall project expenses, potentially impacting profitability and the speed of development.

The development, construction, and operation of renewable energy projects, like those Boralex undertakes, demand highly specialized engineering, technical, and project management skills. This creates a situation where a limited number of qualified individuals or specialized contractors can wield significant influence.

For instance, the intricate nature of large-scale wind farm installations or complex hydroelectric projects often necessitates niche expertise. This scarcity of specialized labor directly translates into increased bargaining power for those possessing these critical skills, impacting project costs and timelines.

Raw Material Price Volatility

Raw material price volatility significantly impacts Boralex's operational costs. Suppliers of key components for wind turbines and solar panels, like steel, copper, and polysilicon, face fluctuating commodity prices. These fluctuations can be directly passed on to Boralex, increasing the expense of acquiring essential equipment and potentially squeezing project profit margins. This dynamic grants suppliers considerable leverage in price negotiations.

For instance, the price of polysilicon, a critical element in solar panel manufacturing, experienced significant swings in 2023 and early 2024, influenced by global supply-demand imbalances and geopolitical factors. Similarly, steel prices, a major input for wind turbine towers, have shown considerable volatility due to factors like energy costs and construction demand. These market dynamics directly affect Boralex's capital expenditure for new projects.

- Steel prices: Global steel prices have seen fluctuations driven by energy costs and demand from construction sectors, impacting wind turbine tower manufacturing costs.

- Copper prices: Copper, essential for electrical components in both wind and solar installations, has experienced price volatility influenced by global economic activity and supply chain disruptions.

- Polysilicon prices: The cost of polysilicon, a fundamental material for solar panels, has been subject to significant swings due to production capacity changes and market demand, directly affecting solar project economics.

Regulatory and Permitting Services

The bargaining power of suppliers in regulatory and permitting services is substantial for companies like Boralex. Navigating the intricate web of environmental assessments, legal requirements, and specialized consulting is non-negotiable for renewable energy projects. These suppliers possess unique expertise, making their services indispensable and giving them considerable leverage.

Delays or cost escalations from these specialized service providers can directly impact project viability. For instance, a prolonged environmental impact assessment process could push back construction timelines, leading to increased financing costs and potentially missed revenue opportunities. In 2023, the average time to obtain major environmental permits in Canada for large infrastructure projects could extend over 18 months, depending on the complexity and jurisdiction, underscoring the critical nature of these services.

- Specialized Knowledge: Suppliers of environmental consulting and legal services for renewable energy projects possess niche expertise essential for compliance.

- Project Criticality: Obtaining permits and adhering to regulations are fundamental steps that cannot be bypassed, granting suppliers significant influence.

- Impact of Delays: Extended permitting processes or increased consulting fees can directly affect project budgets and schedules, highlighting supplier power.

- Market Concentration: In certain regions, a limited number of highly qualified regulatory and permitting service providers can further consolidate supplier bargaining power.

The bargaining power of suppliers for Boralex is significant due to the specialized nature of renewable energy components and the limited number of global manufacturers. This concentration allows suppliers to dictate terms, impacting Boralex's costs and project timelines. For example, major wind turbine manufacturers like Vestas and Siemens Gamesa hold substantial market share, giving them considerable leverage.

High switching costs for specialized equipment further solidify supplier power, as changing vendors mid-project is often impractical and expensive. This dependence on a few key suppliers, coupled with the critical need for their products, means Boralex must carefully manage these relationships to mitigate potential cost increases and project delays.

| Supplier Type | Key Components | Impact on Boralex | Example Data (2024 Focus) |

|---|---|---|---|

| Equipment Manufacturers | Wind Turbines, Solar Panels | Price negotiation, delivery schedules | Concentrated market; major players dictate terms. |

| Raw Material Suppliers | Steel, Copper, Polysilicon | Input costs for manufacturing | Polysilicon prices saw volatility in early 2024 due to supply/demand shifts. Steel prices influenced by energy costs. |

| Specialized Labor/Contractors | Engineering, Project Management | Project execution costs and timelines | Scarcity of niche expertise can drive up labor costs for complex installations. |

| Regulatory & Permitting Services | Environmental Consulting, Legal | Project approval timelines, compliance costs | Permitting processes can take over 18 months for complex projects, increasing Boralex's exposure to service provider costs and delays. |

What is included in the product

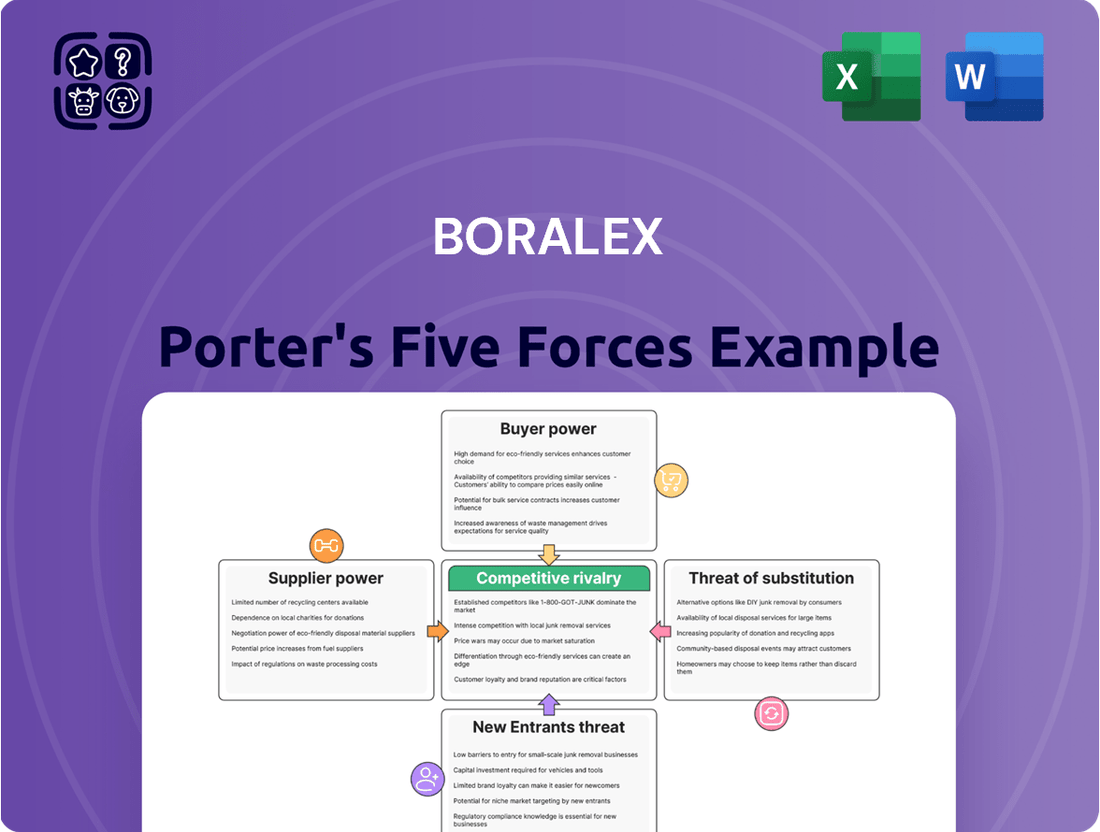

This analysis delves into the competitive forces impacting Boralex, examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and the prevalence of substitutes within the renewable energy sector.

Instantly identify and mitigate competitive threats with a clear, actionable overview of Boralex's market landscape.

Customers Bargaining Power

Boralex's reliance on long-term Power Purchase Agreements (PPAs) significantly shapes customer bargaining power. These agreements, while ensuring revenue stability, also fix prices for many years, giving customers considerable leverage during negotiations. For instance, in 2023, Boralex reported that over 90% of its revenue was secured by PPAs, highlighting the importance of these contracts.

The customers, frequently large utility companies or government bodies, possess substantial bargaining power due to their sheer size and the immense volume of electricity they procure. This scale, coupled with the long-term commitment inherent in PPAs, allows them to negotiate favorable terms, often leading to lower, fixed electricity prices for Boralex's output.

The concentration of electricity off-takers in Boralex's key markets, such as Canada, France, and the USA, significantly impacts customer bargaining power. In regions where a few large utility companies dominate the electricity purchasing landscape, these major buyers gain considerable leverage.

This limited pool of potential customers means Boralex has fewer alternative avenues to sell its generated renewable energy, increasing the bargaining power of existing off-takers. For instance, in Canada, the provincial utilities often act as the primary purchasers of electricity, creating a concentrated market.

Consequently, this concentration can exert downward pressure on the prices Boralex can negotiate in its Power Purchase Agreements (PPAs). As of early 2024, the trend of consolidation among energy providers in some of these regions continues, potentially further strengthening the bargaining position of these large off-takers.

Government energy policies and regulatory frameworks directly impact customer bargaining power. For instance, in 2024, many jurisdictions continued to implement policies promoting renewable energy, which can lead to a more competitive market for electricity. This increased competition, driven by regulatory targets for renewable energy adoption, allows customers to negotiate for better terms and pricing from power producers such as Boralex.

Shifts in these policies, like the introduction of competitive auctions for power purchase agreements or changes in government subsidies for renewable energy, can significantly alter the balance of power. When regulations favor customer choice or create more procurement options, customers gain leverage to demand more favorable contract terms, potentially impacting Boralex's revenue streams and profitability.

Customer's Ability to Self-Generate or Choose Alternatives

Large industrial and commercial clients of Boralex possess significant bargaining power if they can generate their own electricity or switch to alternative suppliers. This includes options like onsite solar or wind installations, or even sourcing power from other renewable or fossil fuel providers. For instance, as of early 2024, the declining costs of battery storage technology are making distributed generation solutions increasingly attractive for large energy consumers, thereby amplifying their ability to negotiate favorable terms with utility-scale providers like Boralex.

The growing feasibility of distributed generation, where power is produced closer to the point of consumption, directly enhances customer leverage. This trend allows customers to bypass traditional grid infrastructure and potentially reduce their reliance on Boralex's offerings.

- Customer Self-Generation: Large clients can invest in their own renewable energy projects.

- Alternative Suppliers: The market offers multiple energy providers, increasing choice.

- Price Negotiation Leverage: The ability to switch or self-generate strengthens customer negotiating positions.

- Distributed Generation Growth: Advancements in technology make smaller-scale, localized power production more viable.

Demand Elasticity for Electricity

While electricity is a fundamental necessity, large industrial users can exhibit some flexibility in their consumption, particularly influenced by economic cycles or changes in their operational schedules. This elasticity means that during economic downturns or periods of reduced industrial activity, these customers gain more bargaining power when negotiating electricity supply agreements.

This increased leverage can translate into pressure on Boralex's revenue streams as customers seek more favorable terms. For instance, if a major industrial client faces a significant slowdown, they might demand lower rates or more flexible contract structures, impacting Boralex's predictable income.

- Demand Elasticity: Industrial electricity demand can become more elastic during economic slowdowns, allowing large consumers to negotiate better terms.

- Bargaining Power Influence: Periods of lower overall demand can amplify customer leverage, potentially impacting Boralex's contract pricing and revenue stability.

- Contract Renegotiation: Economic pressures on industrial clients may lead to demands for revised contract conditions, affecting Boralex's profit margins.

Boralex's customers, often large utilities or government entities, wield considerable bargaining power due to their significant purchasing volume and the long-term nature of Power Purchase Agreements (PPAs). These contracts, which covered over 90% of Boralex's revenue in 2023, lock in prices, giving buyers leverage. The concentration of off-takers in key markets like Canada and France further amplifies this power, as Boralex faces a limited number of major buyers.

| Factor | Impact on Boralex Customer Bargaining Power | 2023/2024 Relevance |

|---|---|---|

| PPA Dominance | Fixes prices, granting customers long-term leverage. | Over 90% of 2023 revenue secured by PPAs. |

| Customer Scale | Large volume buyers negotiate more favorable terms. | Utility companies and government bodies are primary customers. |

| Market Concentration | Fewer buyers in key regions increase their negotiation strength. | Continued consolidation of energy providers observed in early 2024. |

| Distributed Generation | Advancements make self-generation more viable, increasing customer options. | Declining battery storage costs enhance customer ability to negotiate. |

Preview Before You Purchase

Boralex Porter's Five Forces Analysis

This preview showcases the comprehensive Boralex Porter's Five Forces Analysis, offering critical insights into the competitive landscape of the renewable energy sector. The document you see here is precisely the same professionally formatted analysis you will receive immediately after purchase, ensuring you get the complete, ready-to-use file without any alterations or placeholders.

Rivalry Among Competitors

The renewable energy sector is seeing a significant influx of competitors, ranging from established independent power producers and large utilities expanding into renewables to nimble, smaller regional developers. This broad spectrum of players, each with different technological focuses and market strategies, creates a highly competitive environment.

Companies like Boralex are contending with this diverse field, where rivalry is fierce for prime project locations, crucial regulatory approvals, and the securing of Power Purchase Agreements (PPAs). For instance, in 2023, the global renewable energy market saw substantial investment, with solar and wind power leading the charge, indicating the growing number of entities actively pursuing these opportunities.

The renewable energy sector is booming, but this growth fuels fierce competition. Companies are scrambling for prime development locations and facing bottlenecks with grid connections, intensifying rivalry. For instance, in 2023, global renewable energy capacity additions reached a record 510 gigawatts, according to the International Energy Agency (IEA), highlighting the rapid expansion and the resulting competition for available resources.

This aggressive project pipeline building translates into bidding wars for new opportunities. As firms race to secure future revenue streams and market share in this expanding market, the pressure to acquire and develop projects quickly and efficiently becomes paramount, driving up costs and increasing the intensity of competition.

The renewable energy sector, including companies like Boralex, is inherently capital-intensive. Building wind farms or solar power plants requires substantial upfront investment in infrastructure and technology. For instance, the average cost to build a utility-scale solar farm in the US in 2023 was around $1.2 million per megawatt.

Once these assets are in place, they carry high fixed costs, such as maintenance, land leases, and debt servicing. Furthermore, these assets are highly specific to their location and purpose, meaning they cannot easily be repurposed or sold if a project underperforms.

This situation creates a strong incentive for companies like Boralex to maximize their operational capacity. They actively pursue long-term Power Purchase Agreements (PPAs) to secure predictable revenue streams, which intensifies competition among them to win these crucial contracts.

Differentiation and Technology Adoption

In the renewable energy sector, differentiating a company like Boralex can be tough since electricity itself is mostly a commodity. However, firms can stand out through innovative technology, such as more efficient wind turbines or advanced battery storage solutions. Strong project management skills and building good relationships with local communities also serve as key differentiators.

The speed at which competitors adopt new technologies directly influences Boralex's position in the market. For instance, if rivals quickly implement next-generation solar panel technology or more effective grid integration systems, Boralex needs to keep pace to maintain its competitive edge.

- Technological Innovation: Companies differentiate through advancements in turbine efficiency and battery storage, aiming for higher energy output and better grid stability.

- Project Execution: Superior ability to plan, permit, and construct renewable energy projects efficiently sets companies apart.

- Community Engagement: Building trust and support within local communities can streamline project development and enhance a company's reputation.

- Pace of Adoption: Competitors' speed in adopting new technologies, such as AI for predictive maintenance or advanced materials for solar cells, directly impacts market dynamics and Boralex's relative standing.

Regulatory Environment and Market Design

The specific regulatory frameworks and market designs in different jurisdictions significantly shape competitive rivalry within the renewable energy sector. For instance, competitive auction mechanisms for renewable energy capacity, a common practice in many global markets, directly influence pricing and intensify competition among developers. In 2024, many European countries continued to utilize these auctions, with some seeing bid prices fall below €50 per megawatt-hour for wind and solar projects, demonstrating the price-dampening effect of robust competition driven by regulatory design.

Policy stability, or conversely, sudden shifts, plays a crucial role in either fostering or diminishing opportunities, thereby impacting the intensity of rivalry. For example, the intermittent nature of policy support, such as changes in tax credits or renewable energy targets, can create periods of heightened competition as developers scramble to secure projects before incentives expire. Conversely, stable, long-term policies can attract more investment, potentially leading to a broader base of competitors but also more predictable market conditions.

- Auction Mechanisms: Competitive auctions for renewable energy capacity, prevalent in 2024, often result in lower prices and increased developer competition.

- Policy Impact: Stable, supportive policies can attract more players, intensifying rivalry, while policy uncertainty can lead to a rush for opportunities.

- Jurisdictional Differences: Regulatory variations across regions create distinct competitive landscapes for renewable energy developers.

The renewable energy sector is characterized by intense competition, with numerous players vying for prime project locations, regulatory approvals, and Power Purchase Agreements (PPAs). This rivalry is fueled by the sector's rapid growth, as evidenced by global renewable energy capacity additions reaching a record 510 gigawatts in 2023. Companies differentiate through technological innovation, project execution efficiency, and community engagement, while the pace of adopting new technologies directly impacts market standing.

Competitive auctions for renewable energy capacity, common in 2024, often drive down prices and heighten developer competition. Policy stability also plays a critical role; supportive, long-term policies can attract more investment and competitors, while policy uncertainty can lead to a surge in activity as developers rush to capitalize on expiring incentives.

| Factor | Description | Impact on Rivalry |

| Market Growth | Significant expansion in renewable energy deployment. | Increases the number of competitors vying for opportunities. |

| Project Scarcity | Competition for prime locations and PPAs. | Drives up costs and intensifies bidding wars. |

| Technological Pace | Rapid adoption of new energy technologies. | Requires constant innovation and investment to maintain competitiveness. |

| Regulatory Design | Auction mechanisms and policy frameworks. | Can lead to price pressures and concentrated competition. |

SSubstitutes Threaten

Despite the global shift towards decarbonization, traditional fossil fuels such as natural gas and coal continue to pose a significant threat of substitution for renewable energy sources like those Boralex focuses on. Their established infrastructure and historical cost advantages mean they remain viable, though more carbon-intensive, options for electricity generation in many markets.

The dispatchability of natural gas and coal, meaning they can be turned on and off as needed, provides a crucial advantage over intermittent renewables, making them a reliable fallback. This, coupled with regions that may have abundant and cheaper fossil fuel reserves, means the substitution threat is persistent, especially where environmental regulations are less strict.

In 2024, while renewables saw significant growth, natural gas still accounted for approximately 39% of U.S. electricity generation, demonstrating its continued relevance. Coal's share, though declining, remained around 17% in the same year, highlighting the enduring presence of these traditional alternatives.

Nuclear power represents a significant threat of substitution for renewable energy sources like wind and solar, offering a consistent, baseload, and carbon-free electricity supply. Despite high initial investment and public perception hurdles, advancements in reactor technology and supportive government policies in various nations are bolstering its potential. For instance, the International Atomic Energy Agency (IAEA) reported in 2024 that 31 countries were operating 439 nuclear reactors, with 57 new reactors under construction, highlighting a renewed global interest.

Emerging energy technologies like advanced geothermal and green hydrogen represent a growing threat of substitutes for Boralex. As these sectors mature, they could offer competitive alternatives to Boralex's current wind, solar, and hydro offerings. For instance, the global green hydrogen market is projected to reach $71.4 billion by 2030, indicating significant investment and potential for displacement.

Energy Efficiency and Demand-Side Management

Improvements in energy efficiency, such as the widespread adoption of LED lighting and smart grid technologies, are significantly reducing overall electricity consumption. For instance, the International Energy Agency reported in 2023 that energy efficiency measures saved the equivalent of the European Union's total final energy consumption in 2022. This trend indirectly substitutes the need for new power generation capacity, impacting companies like Boralex by dampening revenue growth opportunities.

Demand-side management programs, which encourage consumers to reduce or shift their electricity usage during peak times, further exacerbate this effect. These programs, often incentivized by governments and utilities, can lead to a structural decrease in the demand for electricity. In 2024, many regions are seeing increased investment in these initiatives, aiming to improve grid stability and reduce reliance on traditional power sources.

- Reduced Demand: Energy efficiency measures directly lower the total electricity consumed, lessening the need for new generation infrastructure.

- Smart Grid Integration: Advanced grid technologies enable better management of energy flow, optimizing consumption and reducing waste.

- Policy Support: Government incentives and regulations often promote energy efficiency and demand-side management, accelerating their adoption.

- Impact on Growth: For renewable energy producers like Boralex, a slowdown in demand growth can limit opportunities for expanding their installed capacity.

Distributed Generation and Microgrids

The rise of distributed generation, such as rooftop solar and battery storage, presents a significant threat of substitutes for companies like Boralex. Consumers can increasingly generate their own electricity, reducing their need for power from large-scale producers. This trend allows for greater energy independence and resilience at the local level.

Microgrids, which can operate independently or connected to the main grid, further amplify this threat. They allow communities or businesses to manage their own power supply, often integrating renewable sources. For instance, by mid-2024, the US saw a substantial increase in residential solar installations, with over 1.7 million homes equipped, demonstrating a tangible shift in energy consumption patterns.

This decentralization of power generation directly challenges the business model of traditional utility-scale renewable energy developers. As more consumers adopt these distributed solutions:

- Reduced demand for grid-supplied power: Less reliance on large power purchase agreements for utility-scale projects.

- Increased competition for customers: Consumers become their own power providers, shrinking the addressable market for centralized generation.

- Potential for grid disaggregation: The utility grid's role could shift from primary supplier to a backup or transmission service.

- Technological advancements: Falling costs of solar panels and battery storage continue to make these substitutes more economically viable.

The threat of substitutes for Boralex's renewable energy offerings remains significant, primarily from traditional fossil fuels and other low-carbon sources. While renewables are growing, natural gas and coal still hold substantial market share in electricity generation globally. For example, in 2024, natural gas supplied around 39% of U.S. electricity, and coal, though declining, still provided about 17%.

Entrants Threaten

The utility-scale renewable energy sector demands substantial capital for land acquisition, turbine or panel manufacturing, installation, and grid connection. For instance, a single large wind farm can cost hundreds of millions of dollars, a figure that deters many smaller or less capitalized firms from entering.

This high upfront financial commitment acts as a formidable barrier, effectively limiting the number of new competitors who can realistically enter the market. Boralex, having already invested billions in its portfolio, benefits from economies of scale and proven project execution capabilities, making it more resilient to new, underfunded entrants.

The renewable energy sector, where Boralex operates, is heavily influenced by complex regulatory and permitting processes. Navigating environmental regulations, securing land use permits, and obtaining grid interconnection agreements are significant hurdles. For instance, in 2024, the average time to obtain all necessary permits for a new solar farm in the United States could range from 18 to 36 months, depending on the state and project size, significantly increasing development costs and timelines.

These intricate requirements demand specialized knowledge and established relationships, which new entrants often lack. The substantial time investment and expertise needed to successfully navigate these approval pathways act as a powerful deterrent. Companies without prior experience or a strong track record in these areas may find it prohibitively difficult to enter the market, thus protecting incumbent players like Boralex.

Securing access to existing electricity grids and transmission infrastructure is a major hurdle for new players wanting to enter the renewable energy market, like those Boralex operates in. This is a significant threat of new entrants.

Limited grid capacity, long queues for interconnection, and the substantial costs of upgrading transmission lines create a formidable barrier. For example, in 2023, the average wait time for new generation interconnections in the US reached over 4 years, a considerable deterrent.

Established companies such as Boralex often possess existing grid connections or have well-defined pathways to obtain them, giving them a distinct advantage. This existing infrastructure and established relationships make it considerably more difficult for newcomers to compete on a level playing field.

Economies of Scale and Experience Curve

Existing players in the renewable energy sector, such as Boralex, significantly leverage economies of scale. This allows them to spread fixed costs across a larger operational base, leading to lower per-unit costs in areas like turbine procurement and project development. For instance, Boralex's extensive portfolio of wind and solar farms enables them to negotiate better terms with suppliers, a crucial advantage for new market entrants.

The experience curve further solidifies this advantage. Boralex has accumulated years of expertise in navigating regulatory landscapes, optimizing construction processes, and managing operational efficiencies. This accumulated knowledge translates into smoother project execution and reduced risk, making it challenging for newcomers without this track record to match their cost-effectiveness and project delivery timelines.

- Economies of Scale: Boralex's large-scale operations in wind and solar energy development allow for significant cost reductions in procurement and project execution, a barrier for new competitors.

- Experience Curve Advantage: Accumulated expertise in project management, regulatory navigation, and operational efficiency provides Boralex with a competitive edge in cost and execution speed.

- Cost Disadvantage for New Entrants: New companies entering the market lack the established scale and experience, resulting in higher initial costs and potentially less efficient operations compared to incumbents like Boralex.

Established Relationships and PPA Acquisition

The threat of new entrants for Boralex, particularly concerning established relationships and Power Purchase Agreement (PPA) acquisition, is moderated by significant barriers. Boralex has cultivated long-standing partnerships with utilities, government agencies, and various corporate off-takers. These relationships are crucial for securing new PPAs, which are the lifeblood of renewable energy projects. For instance, in 2023, Boralex continued to expand its portfolio through strategic PPA wins, demonstrating the value of these established connections.

New players entering the renewable energy sector face the daunting task of replicating these deep-seated relationships. Building trust and a track record with utilities and governments takes considerable time and effort. Furthermore, in many mature markets, the acquisition of new PPAs often occurs through competitive auction processes. These auctions frequently favor bidders with proven experience and existing relationships, making it harder for newcomers to secure the necessary agreements to develop projects. In 2024, the trend of competitive auctions for renewable energy capacity is expected to persist, further solidifying the advantage of incumbents like Boralex.

- Established Relationships: Boralex benefits from long-term ties with key industry stakeholders, easing PPA acquisition.

- PPA Competition: New entrants must overcome the challenge of building these relationships and competing for limited PPA opportunities.

- Auction Favoritism: Competitive auction processes often favor experienced bidders, creating a barrier for new companies.

The threat of new entrants in the renewable energy sector, where Boralex operates, is significantly mitigated by high capital requirements and complex regulatory landscapes. For instance, developing a utility-scale wind farm can easily cost hundreds of millions of dollars, a substantial hurdle for potential newcomers. Furthermore, navigating lengthy permitting processes, which can take 18 to 36 months in 2024 for a new solar farm in the US, adds considerable time and cost, favoring established players with experience.

Securing grid access and negotiating Power Purchase Agreements (PPAs) are additional formidable barriers. The average wait time for new generation interconnections in the US exceeded 4 years in 2023, and established companies like Boralex benefit from existing infrastructure and relationships. New entrants must also contend with competitive auctions for PPAs, which often favor bidders with proven track records and existing industry ties, a trend expected to continue in 2024.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High upfront investment for land, equipment, and installation. | Deters smaller, less capitalized firms. |

| Regulatory & Permitting | Complex environmental and land-use approvals. | Increases development costs and timelines, requires specialized knowledge. |

| Grid Interconnection | Limited capacity and long queues for connection. | Creates significant delays and costs for new projects. |

| PPA Acquisition | Need for established relationships to secure long-term contracts. | New entrants struggle to compete in auctions favoring experienced players. |

Porter's Five Forces Analysis Data Sources

Our Boralex Porter's Five Forces analysis is built upon a foundation of robust data, including Boralex's annual reports and financial statements, alongside industry-specific market research and regulatory filings from relevant energy authorities.

We supplement this with insights from financial news outlets, competitor disclosures, and macroeconomic data to provide a comprehensive understanding of the competitive landscape Boralex operates within.