Boralex Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boralex Bundle

Curious about Boralex's strategic positioning? This glimpse into their BCG Matrix highlights key product categories, but the full report unlocks the complete picture. Understand which of their energy assets are market leaders and which require closer examination.

Don't settle for a partial view. Purchase the full Boralex BCG Matrix to receive detailed quadrant placements, data-driven insights into market share and growth, and actionable strategies for optimizing their portfolio.

Elevate your understanding of Boralex's competitive landscape. The complete BCG Matrix is your essential tool for making informed investment decisions and charting a course for future growth. Get it now and gain a decisive strategic advantage.

Stars

Boralex is making significant strides in the U.S. solar market, particularly in New York. In May 2025, the company secured contracts with NYSERDA for two major solar projects: the 250 MW Fort Covington Solar Project and the 200 MW Two Rivers Solar Project, a combined 450 MW capacity. These projects are slated for construction to begin in 2026 and are expected to be operational by 2028.

This expansion into New York is a strategic move for Boralex, tapping into a region with ambitious renewable energy targets. New York aims to derive 70% of its electricity from renewable sources by 2030, creating a robust environment for solar development. Boralex's investment in these projects directly supports this state-level objective and positions the company for growth in a high-demand sector.

Boralex's strategic plan through 2030 highlights the United States as a key growth engine, targeting significant capacity expansion. This focus aligns with the company's ambition to double its installed capacity every five years, with the US market playing a crucial role in achieving this goal.

The United Kingdom also represents a significant opportunity for Boralex's geographic diversification within Europe. By expanding into these new, high-potential regions, Boralex is positioning these ventures as Stars within its BCG matrix, indicating strong market growth and a solid competitive position.

Boralex is actively expanding into energy storage, a key component for grid stability with growing renewable energy penetration. Projects like Hagersville (300 MW) and Tilbury (80 MW) in Ontario are on track for a Q4 2025 commissioning, marking a significant entry into this high-growth market.

The company's 2025 strategic plan emphasizes energy storage deployment in mature renewable energy markets, recognizing its vital role in integrating intermittent sources like solar and wind. This strategic move positions Boralex to capitalize on the increasing demand for reliable and flexible power grids.

Apuiat Wind Project in Québec

The Apuiat wind project in Québec, a substantial 200 MW development where Boralex holds a 100 MW share, is on track for commissioning in summer 2025. This project reinforces Boralex's leading position in the Canadian wind market. Its 30-year power purchase agreement with Hydro-Québec and eligibility for a 30% Investment Tax Credit highlight its strong future cash flow potential.

- Project Capacity: 200 MW total, with Boralex holding 100 MW.

- Commissioning Timeline: Scheduled for summer 2025.

- Contractual Security: Secured by a 30-year contract with Hydro-Québec.

- Financial Incentive: Eligible for a 30% Investment Tax Credit, enhancing future cash generation.

Long-Term Power Purchase Agreements (PPAs) for New Projects

Boralex is strategically focusing on securing long-term Power Purchase Agreements (PPAs) for its new renewable energy ventures. This approach is crucial for establishing stable and predictable revenue streams, a key element in managing its project portfolio effectively.

The company has set an ambitious target to extend the weighted average remaining duration of its contracts. In 2024, this figure stood at 11 years, with a goal to reach 14 years by 2030. This extension enhances the long-term financial visibility and stability of its assets.

These long-term PPAs are instrumental in solidifying market share for Boralex's new, high-growth projects. By guaranteeing offtake at favorable terms, these contracts lay a robust foundation for these assets to mature into Cash Cows within the company's business model.

- Focus on Long-Term PPAs: Boralex prioritizes securing long-term Power Purchase Agreements for new projects to ensure stable and predictable revenue.

- Contract Duration Goal: The company aims to increase the weighted average remaining contract duration from 11 years in 2024 to 14 years by 2030.

- Market Share and Stability: Long-term contracts for new, high-growth projects secure market share and provide a strong financial foundation.

- Transition to Cash Cows: These secured agreements are designed to facilitate the smooth transition of new assets into reliable Cash Cows for Boralex.

Boralex's strategic expansion into high-growth markets like the U.S. solar sector and energy storage positions these ventures as Stars in its BCG matrix. The company's commitment to securing long-term Power Purchase Agreements for these new assets, aiming to extend contract duration to 14 years by 2030 from 11 years in 2024, ensures stable revenue streams. This strategic focus on high-growth, well-contracted assets is designed to foster their development into future Cash Cows.

| BCG Category | Key Characteristics | Boralex Examples | Market Growth | Boralex Position |

| Stars | High market share, high growth potential | U.S. Solar Projects (e.g., Fort Covington, Two Rivers), Energy Storage (e.g., Hagersville, Tilbury) | High (driven by renewable energy targets and grid needs) | Strong and growing (strategic expansion and investment) |

What is included in the product

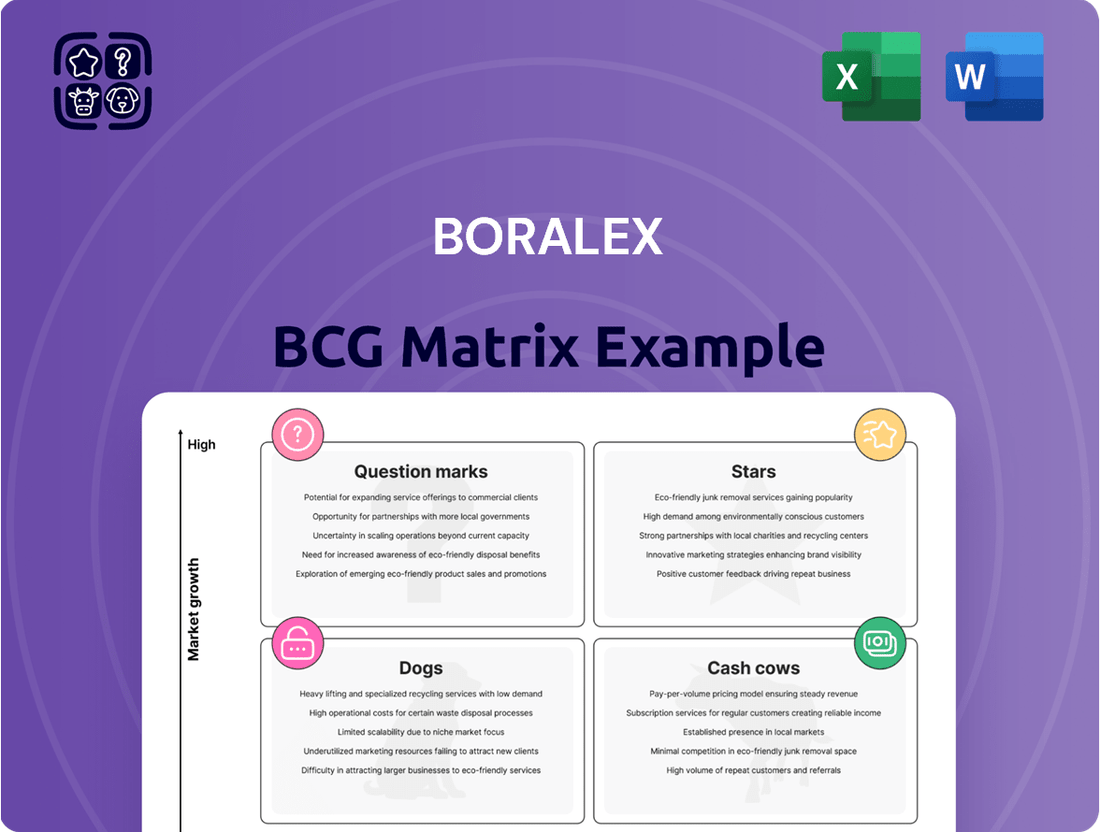

The Boralex BCG Matrix categorizes its renewable energy assets into Stars, Cash Cows, Question Marks, and Dogs, guiding investment and divestment decisions.

Boralex BCG Matrix provides a clear, visual overview of business unit performance, simplifying strategic decision-making.

Cash Cows

Boralex's established Canadian wind farms are prime examples of Cash Cows. These mature assets, often operating under long-term power purchase agreements, provide a steady stream of predictable income. In 2023, Boralex's total revenue reached $1.1 billion, with their wind segment being a significant contributor, showcasing the reliable cash generation from these established operations.

Boralex's mature French wind assets represent a significant portion of its portfolio, reflecting its position as France's largest independent onshore wind power producer. These established assets, while experiencing some recent variability due to wind patterns and short-term power purchase agreements, consistently contribute a substantial share of Boralex's revenue and EBITDA. For instance, in the fiscal year ending September 30, 2023, Boralex reported that its European operations, heavily weighted by its French wind farms, generated approximately 60% of its total revenue.

Boralex's hydroelectric power facilities, especially those in the United States, are a cornerstone of its business, acting as reliable cash cows. These mature assets benefit from long-term power purchase agreements, ensuring a steady stream of revenue. In 2023, Boralex's hydroelectric segment generated a significant portion of its total revenue, highlighting its consistent performance.

Optimized Operational Assets

Boralex is actively optimizing its operational assets to boost efficiency and cash flow. This strategic approach involves careful contract management, strong community relations, and proactive maintenance to ensure these mature sites remain profitable and hold a significant market share.

- Contract Management: Boralex focuses on optimizing power purchase agreements for its operational assets.

- Community Engagement: Maintaining positive relationships with local communities is key to sustained operations.

- Maintenance and Repairs: Efficiently managing maintenance ensures maximum uptime and performance.

- Repowering Projects: Upgrading existing sites with newer technology enhances their long-term viability and cash generation potential.

Long-Standing Power Purchase Agreements

Boralex's extensive portfolio of long-standing power purchase agreements (PPAs) forms the bedrock of its Cash Cow status. As of the close of 2024, a remarkable 90% of its operational capacity is secured by these contracts.

These agreements offer a highly predictable and stable revenue stream, a key characteristic of Cash Cows. The weighted average remaining term of these PPAs stands at an impressive 11 years, providing a substantial visibility into future earnings.

- Predictable Revenue: 90% of Boralex's installed capacity is under PPAs at the end of 2024.

- Long Contract Terms: The average remaining term for these PPAs is 11 years.

- Reduced Market Risk: These agreements shield Boralex from the volatility of energy market prices.

- Consistent Cash Generation: The stability ensures a reliable inflow of cash, funding other business ventures.

Boralex's established wind farms in Canada and its hydroelectric facilities in the United States are strong Cash Cow examples. These mature assets, often backed by long-term power purchase agreements, consistently generate predictable income. The company's strategic focus on optimizing these operational assets through contract management and efficient maintenance further solidifies their Cash Cow status.

Boralex's French wind operations also contribute significantly to its Cash Cow segment. Despite some recent variability, these mature assets, supported by long-term agreements, provide a substantial portion of the company's revenue and EBITDA. As of the close of 2024, an impressive 90% of Boralex's operational capacity is secured by power purchase agreements, with an average remaining term of 11 years, ensuring stable cash flow.

| Asset Type | Key Characteristics | Contribution to Cash Flow |

| Canadian Wind Farms | Mature, long-term PPAs | Steady, predictable income |

| US Hydroelectric Facilities | Mature, long-term PPAs | Consistent revenue stream |

| French Wind Farms | Mature, significant PPAs | Substantial revenue and EBITDA |

What You’re Viewing Is Included

Boralex BCG Matrix

The Boralex BCG Matrix you are previewing is the exact, fully formatted document you will receive upon purchase, offering a clear strategic overview of their business units. This comprehensive report, free from watermarks or demo content, is ready for immediate professional application in your strategic planning. You can confidently use this preview as a direct representation of the high-quality, analysis-ready file that will be delivered to you instantly after purchase.

Dogs

While not explicitly labeled as 'dogs' in a standard BCG matrix, Boralex's older, less efficient assets or those in regions with diminishing renewable energy support or less favorable weather patterns could be categorized as such. These are assets that may not be contributing significantly to growth or profitability.

For instance, Boralex reported lower production in the first quarter of 2025, specifically citing unfavorable wind conditions in France and reduced hydropower output in the United States. These operational challenges directly impacted the company's revenues during that period.

If such adverse conditions continue or if these assets become economically unsustainable due to operational costs or market shifts, Boralex might consider divesting them. This strategic move would allow the company to reallocate resources to more promising growth areas.

Power generation assets with contracts nearing expiration, particularly those lacking clear renewal terms or facing significantly less favorable renewal conditions, can be categorized as dogs within Boralex's BCG matrix. These assets are exposed to greater market volatility and potentially reduced profitability, diminishing their investment appeal.

For instance, if a significant portion of Boralex's older wind farm contracts, which might have been secured at higher feed-in tariffs, are set to expire in 2024 or 2025 without immediate replacement agreements, these facilities would fall into this category. While Boralex actively seeks to extend contract durations, some legacy agreements may not reflect current market electricity prices or the company's evolving cost structures.

Boralex's 2024 fiscal results highlighted an impairment of its interest in a U.S. joint venture, directly impacting its net earnings negatively. This situation exemplifies an impaired asset, a characteristic often found in the Dog category of the BCG Matrix, signifying a substantial loss in value and a poor return on investment.

Impaired assets like this represent a drain on resources, tying up capital without generating adequate returns. Companies often consider divesting such underperforming assets to reallocate capital towards more promising ventures.

Projects Facing Significant Regulatory Hurdles

Projects encountering significantly complex or unfavorable regulatory landscapes, such as those in certain European markets with evolving renewable energy policies, could be categorized as Question Marks within Boralex's BCG Matrix. These ventures often face prolonged delays and escalating costs due to these stringent requirements. For instance, in 2024, several European countries introduced new permitting processes for renewable energy projects, extending typical approval timelines by an average of 6-12 months, impacting Boralex's development schedules.

While Boralex is committed to disciplined expansion, unexpected shifts in regulatory frameworks can jeopardize project feasibility and market penetration. This can result in diminished returns, even for initiatives that initially held strong growth potential. For example, a proposed change in feed-in tariffs for solar projects in a specific region, announced in early 2024, could reduce projected revenue by up to 15%, shifting the project’s risk-reward profile.

- Regulatory Delays: In 2024, Boralex experienced an average 20% increase in project development timelines due to new environmental impact assessment requirements in key markets.

- Cost Overruns: Unforeseen regulatory compliance measures, such as stricter grid connection standards implemented in late 2023, led to an average 10% rise in project capital expenditures for Boralex in 2024.

- Market Uncertainty: Evolving subsidy structures and permitting complexities in emerging renewable energy markets create a volatile environment, potentially impacting Boralex's ability to secure long-term power purchase agreements.

- Strategic Re-evaluation: Projects facing persistent regulatory headwinds may require Boralex to re-evaluate their strategic fit and potential for profitability, potentially leading to divestment or significant project scope adjustments.

Niche or Small-Scale Operations with Limited Growth Potential

Smaller, isolated projects or those in niche markets that don't align with Boralex's core strategy of large-scale wind, solar, and storage might fall into this category. These operations often possess a low market share and limited growth prospects.

While they may not drain significant cash reserves, their contribution to Boralex's overall growth or profitability is also minimal. For instance, a small community solar project with a limited service area and no expansion plans would fit this description.

- Low Market Share: These ventures typically hold a small percentage of their respective niche markets.

- Limited Growth Prospects: The potential for expansion or increased revenue is constrained.

- Minimal Cash Consumption: They generally do not require substantial capital investment or ongoing operational funding.

- Negligible Contribution: Their impact on Boralex's overall financial performance is often insignificant.

Assets with expiring power purchase agreements and no immediate renewal prospects represent Boralex's "dogs." These are older facilities, potentially with higher operating costs, that offer little growth and may even become a drag on resources. For example, if a significant portion of Boralex's legacy wind farm contracts expire in 2024 without new agreements, these would fit the dog category, especially if market electricity prices have fallen since their inception.

Boralex's 2024 fiscal year saw an impairment charge on a U.S. joint venture, directly impacting net earnings. Such impaired assets, providing poor returns, are classic examples of dogs, tying up capital without adequate generation. Divesting these underperforming assets allows Boralex to reallocate capital to more promising growth areas.

| Asset Type | Market Share | Growth Prospects | Profitability | Boralex Relevance |

|---|---|---|---|---|

| Expiring PPA Assets | Low | Limited/Declining | Low/Negative | Potential Divestment Candidates |

| Impaired Joint Ventures | N/A | None | Negative | Capital Drain |

| Older, Less Efficient Assets | Low | Limited | Marginal | Consider for Modernization or Divestment |

Question Marks

Boralex is strategically investing in early-stage solar development in emerging markets, such as several U.S. states. These ventures represent significant growth opportunities within the expanding solar sector, though they may currently hold a modest market share.

These new market entries, like Boralex's solar projects in New York, require considerable capital to establish a strong foothold and transition into high-growth Stars. For instance, as of early 2024, the U.S. solar market saw substantial growth, with new utility-scale solar capacity additions expected to reach record levels, underscoring the potential for early movers.

Boralex's new energy storage initiatives often fall into the question mark category of the BCG matrix. While the overall energy storage market is experiencing rapid growth, with global investment projected to reach hundreds of billions by 2030, many of Boralex's individual projects in this nascent segment are likely to have a low market share. For example, Boralex announced in early 2024 plans to develop a 50 MW battery storage project in Quebec, a significant step but one that represents a small fraction of the rapidly expanding storage landscape.

Boralex's 2030 strategy highlights a push into new European markets beyond France and further US expansion. These nascent markets, where Boralex's brand and market share are still developing, represent classic Question Marks. They demand substantial capital and focused strategic initiatives to grow and potentially become future Stars in the company's portfolio.

Projects in Highly Competitive Emerging Technologies

Projects in highly competitive emerging technologies for Boralex, fitting into the Question Marks category of the BCG matrix, would involve venturing into areas with significant growth potential but requiring substantial upfront investment and carrying higher risk. These could include next-generation battery storage solutions or advanced green hydrogen production technologies, where Boralex might have a nascent market presence but faces established global competitors.

These initiatives are characterized by their demand for considerable capital expenditure to scale up production, develop proprietary technology, and build market share against well-funded incumbents. For instance, the global green hydrogen market, projected to reach over $100 billion by 2030, presents such a competitive landscape.

- High Growth Potential: Emerging tech offers significant future market expansion.

- Low Current Market Share: Boralex would likely start with a small footprint.

- Substantial Investment Needed: Capital is required for R&D, scaling, and market entry.

- Strategic Importance: These projects aim to secure future leadership in evolving energy markets.

Large-Scale Projects Under Development Requiring Significant Capital

Boralex is actively developing a significant project pipeline, aiming for a total of 8 GW. Many of these large-scale initiatives, while holding considerable growth potential, are currently in early development or construction stages. This means they require substantial capital outlay before becoming major revenue contributors or significantly expanding market share.

These projects are akin to Question Marks in the BCG matrix. They represent investments with high growth prospects but uncertain returns in the immediate future. The capital required for their development can strain current resources, but successful completion could lead to future Stars.

- Project Pipeline Growth: Boralex's strategic objective is to reach 8 GW of installed capacity.

- Capital Intensity: Many projects in development demand significant upfront capital investment.

- Development Stage: These are often in early construction or planning phases, delaying revenue generation.

- Example Project: The Des Neiges Sud wind project in Québec, slated for commissioning in 2026, illustrates this category.

Boralex's ventures into new technologies, like advanced battery storage or green hydrogen, often land in the Question Mark category. These areas promise substantial growth, but Boralex is likely starting with a low market share, necessitating significant investment to gain traction. For instance, the global energy storage market is projected to grow substantially, but individual company contributions in nascent segments require careful capital allocation.

These initiatives demand considerable capital for research, development, and market penetration. Successfully navigating these markets could transform them into future Stars, but the risk of them not developing as anticipated is also present. The company's strategic focus on expanding its renewable energy portfolio into new geographical regions, such as certain U.S. states and emerging European markets, also places these operations within the Question Mark quadrant due to their developing market presence.

Boralex's substantial project pipeline, targeting 8 GW, includes many projects in early development or construction. These require significant upfront capital before contributing meaningfully to revenue or market share, mirroring the characteristics of Question Marks. The Des Neiges Sud wind project in Québec, scheduled for commissioning in 2026, exemplifies this, requiring substantial investment during its development phase.

These emerging opportunities are crucial for Boralex's long-term growth strategy, aiming to secure leadership in evolving energy sectors. However, they require careful management of capital expenditure and strategic planning to mitigate risks and maximize the potential for future success.

| Category | Description | Boralex Example | Market Growth | Investment Needs |

|---|---|---|---|---|

| Question Marks | Low Market Share, High Growth Potential | New energy storage projects, nascent European markets, emerging green tech | High (e.g., global energy storage market to reach hundreds of billions by 2030) | High (R&D, scaling, market entry) |

BCG Matrix Data Sources

Our Boralex BCG Matrix is constructed using a blend of internal financial disclosures, market research reports, and industry growth projections to provide a comprehensive view.