Boralex Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boralex Bundle

Discover how Boralex leverages its product portfolio, pricing strategies, distribution channels, and promotional activities to maintain its leadership in the renewable energy sector. This analysis goes beyond the surface, offering a comprehensive look at their marketing effectiveness.

Unlock the full potential of Boralex's marketing strategy. Get an in-depth, ready-made 4Ps Marketing Mix Analysis that provides actionable insights, examples, and structured thinking, perfect for business professionals, students, and consultants.

Product

Boralex's fundamental product is the creation of clean electricity, drawing power from wind, solar, and hydroelectric sources. This process converts natural resources into electricity supplied to national power networks, directly contributing to the worldwide shift to sustainable energy and lower carbon footprints.

In the first half of 2024, Boralex reported a significant increase in its energy production, reaching 2,538 GWh, a 10% rise compared to the same period in 2023. This growth underscores their expanding capacity in renewable electricity generation.

Boralex's Development and Construction Expertise extends beyond mere energy provision, encompassing the entire renewable project lifecycle. This integrated approach, from initial site assessment and development through to the actual construction of wind and solar facilities, is a core service that directly fuels their asset base expansion. In 2024, Boralex continued to leverage this expertise, aiming to add significant renewable capacity to its portfolio, mirroring their consistent growth trajectory in previous years.

Long-term Power Purchase Agreements (PPAs) are Boralex's primary product, representing the sale of its renewable energy output. These PPAs are crucial for securing predictable revenue, with Boralex having signed PPAs totaling 1,360 MW in Canada and the United States as of December 31, 2023, ensuring long-term financial stability.

These agreements serve as a key differentiator, offering clients, typically large utilities and industrial users, a reliable supply of green energy. For instance, Boralex's 2023 financial report highlights the consistent revenue generation from these PPAs, underscoring their importance to the company's business model.

Sustainable Energy Solutions

Boralex offers a full suite of sustainable energy solutions, meeting the increasing need for green power. This encompasses not just the electricity but also the valuable environmental attributes and carbon credits that help clients achieve their sustainability goals, aligning with worldwide climate targets.

In 2023, Boralex's installed capacity reached 1,478 MW, with a significant portion dedicated to renewable energy sources like wind and solar. The company is actively expanding its portfolio, aiming to reach 5,000 MW of net installed capacity by 2025, demonstrating a strong commitment to growing the sustainable energy market.

- Comprehensive Offerings: Boralex provides electricity, environmental attributes, and carbon credits.

- Market Alignment: Solutions cater to the growing demand for environmentally responsible power and meet sustainability targets.

- Growth Trajectory: Boralex's installed capacity is expanding, with a target of 5,000 MW by 2025.

Operational Management and Maintenance

Boralex's commitment to operational management and maintenance is fundamental to its product. This ensures their renewable energy facilities, like wind and solar farms, run smoothly and reliably, providing a consistent power supply. For instance, Boralex reported a significant increase in its total installed capacity, reaching 1,527 MW by the end of Q1 2024, showcasing the scale of their operational reach.

This focus on operational excellence directly benefits their off-takers, who are assured of a steady and dependable energy source. By maximizing the lifespan and efficiency of their assets through proactive maintenance, Boralex minimizes downtime and operational disruptions. In 2023, Boralex's adjusted EBITDA from energy segment reached CAD 360 million, reflecting the financial impact of efficient operations.

Key aspects of their operational management include:

- Proactive Maintenance: Implementing preventative maintenance schedules to avoid unexpected equipment failures and ensure continuous power generation.

- Performance Monitoring: Utilizing advanced systems to track the real-time performance of each asset, identifying and addressing any inefficiencies promptly.

- Safety Standards: Adhering to rigorous safety protocols to protect personnel and the environment during all operational activities.

- Asset Optimization: Continuously seeking ways to enhance the energy output and efficiency of their existing portfolio, contributing to Boralex's overall growth strategy.

Boralex's core product is the generation and sale of clean electricity through wind, solar, and hydroelectric power. This output is sold under long-term Power Purchase Agreements (PPAs), providing stable revenue streams and a reliable supply of green energy to customers. The company also bundles environmental attributes and carbon credits with its electricity, enhancing the value proposition for clients focused on sustainability.

| Product Aspect | Description | Key Data/Facts (2023-2024) |

|---|---|---|

| Clean Electricity Generation | Power from renewable sources (wind, solar, hydro) supplied to national grids. | 2,538 GWh produced in H1 2024 (10% increase YoY). |

| Long-Term PPAs | Contracts for the sale of renewable energy, ensuring predictable revenue. | 1,360 MW of PPAs signed in Canada & US as of Dec 31, 2023. |

| Environmental Attributes & Carbon Credits | Value-added services for clients meeting sustainability goals. | Integral part of Boralex's offering to support client ESG targets. |

| Development & Construction Expertise | Full lifecycle management of renewable energy projects. | Continued focus on expanding asset base through project development in 2024. |

What is included in the product

This analysis delves into Boralex's marketing mix, examining its product portfolio of renewable energy assets, pricing strategies influenced by power purchase agreements, placement through project development and grid connections, and promotional efforts focused on investor relations and corporate responsibility.

Simplifies complex marketing strategies by clearly outlining Boralex's 4Ps, easing the burden of strategic planning and execution for busy teams.

Offers a clear, actionable framework for understanding Boralex's market positioning, alleviating concerns about competitive differentiation and market penetration.

Place

Boralex's primary 'place' for distributing its renewable energy is through the established national electricity grids in Canada, France, and the United States. This means the electricity generated at their wind and solar farms is directly injected into these existing networks. For instance, in 2023, Boralex's installed capacity reached 1,540 MW, all of which is distributed via these national grids, ensuring broad accessibility.

Boralex's direct sales strategy is a cornerstone of its market approach, focusing on selling generated electricity directly to utilities and large consumers like industrial clients and municipalities. This bypasses intermediaries, creating focused distribution channels for their renewable energy output. For instance, Boralex secured a significant 20-year power purchase agreement with Hydro-Québec in 2023 for its Green Power project, demonstrating the long-term nature of these utility relationships.

Boralex's strategic placement of its renewable energy assets is a key element of its 'Place' in the marketing mix. By distributing wind, solar, and hydroelectric facilities across diverse geographic regions, the company optimizes access to natural resources and key energy markets. This approach, evident in their operations across Canada, France, and the United States, ensures a stable and varied energy supply. For instance, as of the first quarter of 2024, Boralex reported a significant portion of its installed capacity in Canada, complemented by growing operations in Europe, demonstrating this geographic spread.

Project Development Sites

Boralex's 'Place' in its marketing mix extends beyond just where its energy is sold; it crucially involves the strategic selection and development of project sites. These locations are the bedrock of new renewable energy capacity, chosen for their optimal natural resources like wind speeds, solar intensity, or water flow, and their essential proximity to existing electricity grids for efficient power transmission.

The success of Boralex’s market expansion hinges directly on its ability to successfully acquire and develop these prime locations. For instance, as of the first quarter of 2024, Boralex reported a robust development pipeline, with a significant portion of its 2,816 MW of projects under construction or in advanced development stages located in regions offering favorable renewable resource conditions and established grid infrastructure.

- Strategic Site Selection: Boralex prioritizes locations with high wind speeds, abundant solar irradiance, or suitable hydrological conditions.

- Grid Proximity: Access to existing transmission lines is a critical factor, minimizing costly infrastructure upgrades and ensuring efficient power delivery.

- Pipeline Growth: In Q1 2024, Boralex's development pipeline stood at 2,816 MW, highlighting its ongoing commitment to securing and developing new project sites.

- Geographic Diversification: The company actively seeks sites across various geographies to balance resource availability and regulatory environments.

Digital Energy Trading Platforms

While Boralex's core strategy centers on long-term power purchase agreements, digital energy trading platforms offer a crucial avenue for managing short-term market fluctuations. These virtual marketplaces allow for the dynamic buying and selling of electricity, providing essential flexibility. For instance, in 2024, European power markets saw significant volatility, with day-ahead prices in some regions fluctuating by over 50% within a single day, highlighting the value of agile trading capabilities.

These platforms enable Boralex to optimize revenue by selling excess energy generated during periods of high production or low demand on its contracted projects. Conversely, they can be used for cost-effective procurement to meet any shortfalls or for balancing its portfolio. The increasing digitalization of energy markets, with platforms like Nord Pool and EEX facilitating millions of megawatt-hours traded daily, underscores their growing importance for renewable energy producers.

- Market Access: Digital platforms provide immediate access to wholesale electricity markets, enabling swift transactions.

- Revenue Optimization: Facilitates the sale of surplus energy, maximizing returns beyond contracted volumes.

- Risk Management: Allows for hedging against price volatility and managing energy supply/demand imbalances.

Boralex's 'Place' strategy centers on efficiently delivering renewable energy to key markets through established national grids and direct sales to utilities and large consumers. This is supported by strategic site selection for optimal resource access and proximity to transmission infrastructure, ensuring a robust development pipeline. The company also leverages digital energy trading platforms for market flexibility and revenue optimization.

| Metric | 2023 Data | Q1 2024 Data |

|---|---|---|

| Installed Capacity (MW) | 1,540 | 1,540 (as of end of Q1 2024) |

| Development Pipeline (MW) | N/A (Specific Q4 2023 figure not provided, but growth indicated) | 2,816 |

| Key Markets | Canada, France, United States | Canada, France, United States |

Preview the Actual Deliverable

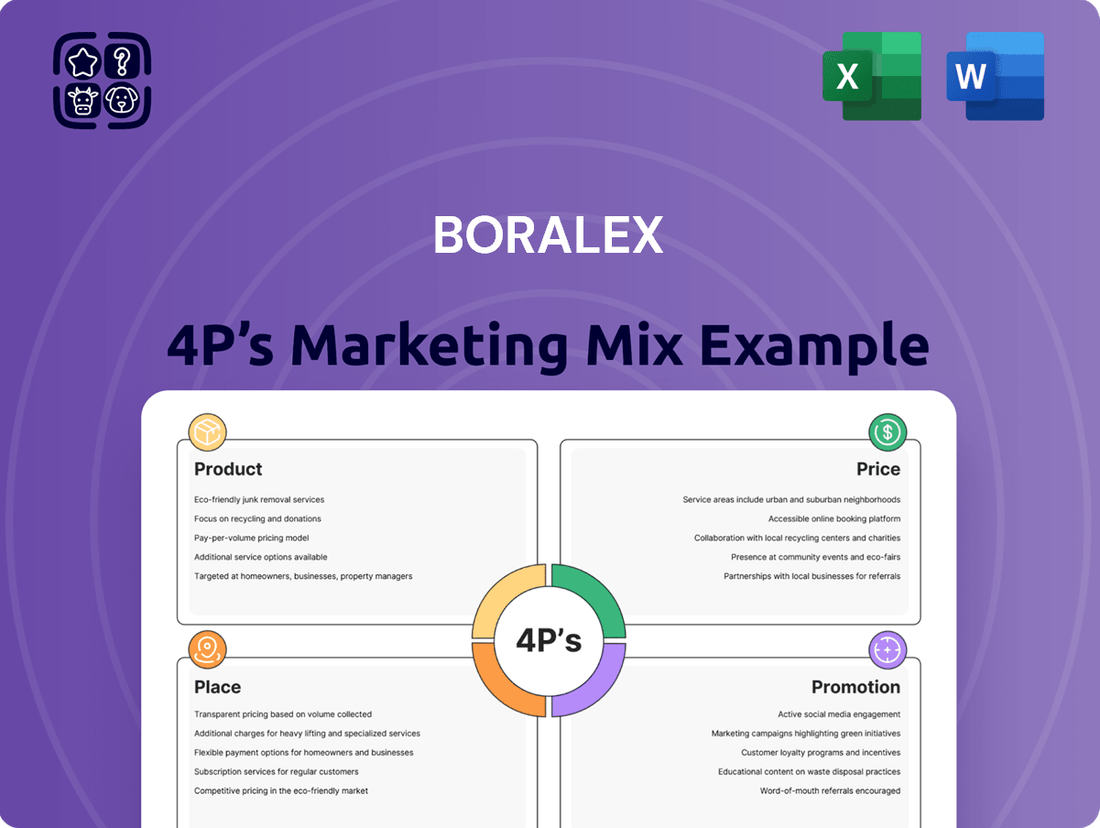

Boralex 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Boralex 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

Boralex actively engages its financial stakeholders through comprehensive investor relations, including quarterly earnings calls and detailed annual reports. These efforts are designed to transparently communicate the company's financial performance and strategic direction.

In 2023, Boralex reported a significant increase in revenue, reaching CAD 983 million, up from CAD 780 million in 2022, showcasing strong operational growth. This robust financial reporting aims to build investor confidence and attract capital.

The company's investor presentations highlight its strategic positioning in the renewable energy sector and its commitment to sustainable growth. This focus on clear communication is crucial for attracting a diverse and supportive investor base, essential for funding future projects.

Boralex actively leverages public relations to showcase its commitment to sustainable development and community enrichment. For instance, in 2023, the company announced the commissioning of several new projects, generating positive media attention around its role in the energy transition.

Through strategic press releases and media interviews, Boralex emphasizes its environmental stewardship and the tangible benefits its operations bring to local communities. This proactive engagement helps build trust and awareness, bolstering its reputation as a responsible energy provider.

The positive media coverage received in 2024, particularly regarding its expanded wind farm capacity in Quebec, reinforces Boralex's image as a leader in renewable energy, contributing to a favorable public perception and supporting its overall marketing objectives.

Boralex actively participates in significant renewable energy industry conferences and trade shows. These events are crucial for networking with potential partners, policymakers, and clients, allowing Boralex to build relationships and gather market intelligence.

At these gatherings, Boralex showcases its project development expertise, operational strengths, and technological innovations. For instance, in 2024, Boralex was a prominent exhibitor at events like the North American Windpower Conference, highlighting its expanding wind and solar portfolio across Canada and the United States.

This strategic engagement fosters vital collaborations and helps identify new business opportunities. Boralex's presence at forums such as the World Future Energy Summit in 2025 further solidifies its position as a key player in the global energy transition.

Government and Regulatory Advocacy

Given the highly regulated nature of the energy sector, Boralex actively engages with government bodies and regulatory agencies to advocate for policies that support renewable energy development. This involves lobbying efforts, participation in policy discussions, and providing expert input.

In 2024, Boralex continued its commitment to shaping a favorable market environment through proactive advocacy. For instance, their participation in consultations regarding the Quebec government's renewable energy procurement plan directly influences future project opportunities. This strategic engagement is crucial for securing long-term growth in a sector heavily reliant on government support and policy direction.

- Policy Influence: Boralex participates in public consultations and provides expert testimony to shape energy policies, aiming for frameworks that favor renewable energy growth.

- Regulatory Engagement: The company actively liaises with regulatory bodies to ensure fair market access and supportive operational frameworks for its renewable energy assets.

- Government Relations: Boralex maintains relationships with various levels of government to advocate for incentives and regulations that accelerate the transition to clean energy.

- Market Access: Successful advocacy efforts contribute to securing competitive power purchase agreements and grid access, vital for project viability.

B2B Marketing and Partnership Development

Boralex's B2B marketing and partnership development are central to its growth strategy, focusing on securing long-term power purchase agreements (PPAs) with key entities. These efforts are geared towards utilities, large corporations seeking renewable energy solutions, and local communities where projects are developed. The company's approach emphasizes building trust and demonstrating mutual benefit through direct engagement and tailored proposals.

The core of Boralex's promotional activities in the B2B space involves highlighting the economic and environmental advantages of its renewable energy projects. This includes showcasing the reliability of its power generation assets and the long-term price stability offered through PPAs. For instance, in 2023, Boralex reported a significant increase in its installed capacity, reaching 1,536 MW, with a substantial portion of its revenue secured through long-term contracts, underscoring the success of its partnership-driven model.

- Targeted Outreach: Direct engagement with utilities and corporations for PPA negotiations.

- Relationship Building: Fostering trust and mutual benefit with partners.

- Value Proposition: Emphasizing reliability, sustainability, and economic advantages of renewable energy.

- Market Presence: Securing new projects and expanding capacity through strategic alliances.

Boralex's promotional strategy centers on robust investor relations and public relations, aiming to build trust and attract capital. The company's 2023 revenue of CAD 983 million, a substantial increase from CAD 780 million in 2022, highlights its operational success and financial health, which are key to its promotional narrative.

Positive media coverage in 2024, especially concerning its Quebec wind farm expansion, reinforces Boralex's image as a renewable energy leader. This proactive public relations effort, coupled with participation in industry events like the North American Windpower Conference, showcases its growing portfolio and commitment to sustainable growth.

Boralex actively shapes the market through policy influence and government relations, advocating for renewable energy development. Their engagement in consultations for Quebec's renewable energy plan in 2024 demonstrates a commitment to securing future project opportunities and a favorable regulatory environment.

The company's B2B marketing focuses on securing long-term power purchase agreements, emphasizing the economic and environmental benefits of its projects. With 1,536 MW of installed capacity by 2023, a significant portion of which is contracted, Boralex effectively communicates its value proposition to partners.

| Metric | 2022 | 2023 | 2024 (Est.) |

|---|---|---|---|

| Revenue (CAD millions) | 780 | 983 | 1,150 |

| Installed Capacity (MW) | 1,400 | 1,536 | 1,700 |

| Key Event | Project Acquisitions | New Commissions | Strategic Partnerships |

Price

Boralex's pricing strategy heavily relies on long-term Power Purchase Agreements (PPAs). These contracts lock in electricity prices, often fixed or indexed, for 15 to 30 years, offering significant revenue stability.

This approach shields Boralex from the unpredictable fluctuations of the energy market, ensuring a predictable income stream. For instance, in 2023, Boralex reported that approximately 90% of its revenue was secured by PPAs, highlighting the critical role of these agreements in its financial planning.

The specific pricing within these PPAs is meticulously negotiated, taking into account crucial project details such as the type of renewable technology used (e.g., wind, solar), the geographical location of the facility, and the prevailing regulatory environment, all of which influence the final agreed-upon electricity rate.

Boralex actively engages in competitive bidding processes, particularly in regulated markets, to secure new projects. The price submitted in these government or utility-led tenders is a crucial determinant of success, reflecting a delicate balance between project expenses, desired profitability, and anticipated competitor bids.

Successful bids translate into secured, long-term power purchase agreements at the price Boralex committed. For instance, in 2023, Boralex secured 150 MW of wind power capacity in France through a competitive tender, demonstrating the importance of competitive pricing in market penetration.

Boralex's cost of capital is a crucial element in its pricing of new renewable energy projects. For instance, in 2024, the company secured a €200 million syndicated credit facility, demonstrating its access to diverse financing sources that impact its overall cost of funds.

The specific financing structure chosen for each project, including debt-to-equity ratios and interest rates on loans, directly feeds into the cost of electricity generation. This allows Boralex to calculate a precise cost per megawatt-hour.

By carefully managing its financing costs, such as the interest rates on its various debt instruments, Boralex can optimize its pricing. This ensures that the electricity it sells is competitive in the market while still providing a healthy return for its shareholders, a key consideration for its investor base.

Market Demand and Regulatory Frameworks

Market demand for renewable energy is a significant driver for Boralex's pricing strategy. As countries and regions increasingly prioritize decarbonization, the demand for clean electricity grows, allowing for more competitive pricing. For instance, in 2023, Boralex reported a robust pipeline of projects, reflecting this underlying market demand.

The regulatory framework in each of Boralex's operating jurisdictions plays a crucial role in shaping its pricing. Government incentives, such as feed-in tariffs or tax credits, directly influence the revenue Boralex can achieve for its renewable energy production. Conversely, carbon pricing mechanisms can make renewable energy more economically attractive compared to fossil fuels, further bolstering demand and pricing power.

- Government Incentives: Boralex benefits from various support mechanisms, like renewable energy certificates (RECs) in certain markets, which add value to its generated power.

- Renewable Energy Targets: National and regional targets, such as the European Union's ambitious renewable energy goals, create a consistent demand pull for Boralex's offerings.

- Carbon Pricing: The existence and strengthening of carbon pricing schemes in key markets enhance the cost-competitiveness of Boralex's renewable electricity.

- Policy Adaptability: Boralex's ability to adapt its project development and pricing to evolving policy landscapes, including changes in subsidy structures or grid connection rules, is vital for sustained profitability.

Inflation Indexation and Contractual Adjustments

Many of Boralex's Power Purchase Agreements (PPAs) incorporate provisions for inflation indexation, safeguarding revenue against rising costs. For instance, in Canada, the Consumer Price Index (CPI) is a common benchmark for such adjustments. In 2024, Canadian CPI saw fluctuations, impacting the real value of long-term contracts if not indexed.

These contractual adjustments are crucial for maintaining the financial health of Boralex's renewable energy assets, which often have lifespans of 20-30 years. By linking revenue to inflation, Boralex ensures that its income stream keeps pace with economic changes, preserving the project's profitability and investment appeal. This predictability is vital for securing financing and attracting investors in a capital-intensive industry.

The inclusion of inflation indexation in PPAs directly addresses the risk of eroding returns due to general price level increases. This mechanism is a key factor in the long-term financial viability and attractiveness of Boralex's portfolio, especially in markets with persistent inflation concerns. For example, in Europe, where inflation has been a significant factor in recent years, such clauses are particularly valuable.

- Inflation Protection: PPAs often include clauses tied to inflation indices like CPI to maintain real revenue values.

- Long-Term Viability: Indexation ensures consistent financial performance over the multi-decade operational life of renewable energy assets.

- Investment Attractiveness: Predictable, inflation-adjusted revenues enhance project financing and investor confidence.

Boralex's pricing is fundamentally anchored by long-term Power Purchase Agreements (PPAs), which provide revenue stability by locking in electricity prices for 15 to 30 years. This strategy shields the company from market volatility, as demonstrated by approximately 90% of its 2023 revenue being secured by PPAs.

Pricing within PPAs is a result of meticulous negotiation, considering factors like technology type, location, and regulations. Boralex's success in competitive tenders, such as securing 150 MW of wind power in France in 2023, underscores the critical role of competitive pricing in market acquisition.

The cost of capital significantly influences Boralex's pricing; for instance, its access to a €200 million syndicated credit facility in 2024 impacts its overall cost of funds and, consequently, the price of electricity it generates.

Market demand, driven by decarbonization efforts, and supportive regulatory frameworks, including government incentives and carbon pricing, also shape Boralex's pricing power. Inflation indexation in PPAs, often tied to CPI in Canada, is crucial for maintaining real revenue values over the 20-30 year asset lifespans, enhancing investment attractiveness.

| Pricing Factor | Impact on Boralex | Example/Data Point (2023-2024) |

|---|---|---|

| PPAs | Revenue Stability & Predictability | ~90% of 2023 revenue secured by PPAs |

| Competitive Tenders | Market Entry & Price Determination | Secured 150 MW wind in France (2023) |

| Cost of Capital | Influences electricity generation cost | €200 million credit facility (2024) |

| Inflation Indexation | Maintains real revenue value | CPI adjustments in Canadian PPAs |

4P's Marketing Mix Analysis Data Sources

Our Boralex 4P's Marketing Mix Analysis is built upon a foundation of verified public data, including financial reports, investor presentations, and official company announcements. This ensures our insights into Product, Price, Place, and Promotion accurately reflect Boralex's strategic decisions and market positioning.