Boralex Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boralex Bundle

Unlock the strategic blueprint behind Boralex's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear view of their renewable energy operations. Discover the key partnerships and cost structures that drive their sustainable growth.

Want to understand Boralex's competitive advantage? Our full Business Model Canvas provides an in-depth look at their core activities and resources, revealing how they deliver value in the energy sector. Ideal for investors and strategists seeking actionable insights.

Gain exclusive access to the complete Business Model Canvas for Boralex, detailing every aspect of their operations. This professionally crafted document is perfect for business students and analysts wanting to dissect a thriving renewable energy company. Download it now to accelerate your learning.

Partnerships

Boralex actively partners with governmental and regulatory bodies to navigate the complex landscape of renewable energy development. These collaborations are essential for obtaining crucial permits and licenses, ensuring projects align with environmental standards and energy policies.

These partnerships are fundamental to securing long-term power purchase agreements (PPAs), which provide Boralex with stable and predictable revenue streams. For instance, agreements with entities like the New York State Energy Research and Development Authority (NYSERDA) have been instrumental in facilitating Boralex's expansion into the U.S. solar market, underscoring the vital role of these governmental collaborations in project success and market penetration.

Boralex prioritizes strong relationships with local communities and Indigenous groups to secure social license and ensure smooth project development. This focus on engagement means open dialogue, actively addressing community concerns, and building partnerships that offer shared benefits. A prime example is Boralex's long-standing collaboration with the Innu Nation on the Apuiat wind project in Quebec, highlighting a commitment to respectful and collaborative development.

Boralex actively partners with leading technology providers and equipment manufacturers to secure access to advanced wind turbines, solar panels, and energy storage systems. These collaborations are crucial for Boralex to integrate the most efficient and dependable renewable energy technologies into its projects, ensuring the high performance and longevity of its power generation facilities.

Financial Institutions and Investors

Boralex's ability to fund its ambitious growth plans hinges on strong relationships with financial institutions and investors. These partnerships are crucial for securing the substantial capital needed for developing, constructing, and acquiring renewable energy assets. For instance, Boralex has leveraged project-level debt and corporate financing to fuel its expansion.

These collaborations are not just about traditional loans. Boralex also explores opportunities like selling minority stakes in operational assets. This strategy frees up capital, allowing the company to reinvest in new projects and accelerate its development pipeline. A prime example is the green loan financing Boralex secured for its battery storage projects, demonstrating a commitment to sustainable finance.

- Project Financing: Access to diverse debt instruments, including project finance, is essential for funding the construction of wind, solar, and hydroelectric facilities.

- Corporate Financing: Establishing strong credit lines and potentially issuing corporate bonds or equity provides Boralex with flexible capital for acquisitions and general corporate purposes.

- Investor Relations: Cultivating relationships with institutional investors, pension funds, and private equity firms can lead to equity investments and strategic partnerships.

- Green Finance: Securing green loans and other sustainable financing options aligns with Boralex's environmental, social, and governance (ESG) commitments and attracts a growing pool of ESG-focused investors.

Corporate Offtakers and Industrial Clients

Boralex is forging direct partnerships with corporate offtakers and industrial clients, securing long-term power purchase agreements for green electricity. This strategic move diversifies its revenue streams and actively supports the sustainable energy transition for major energy consumers.

These collaborations are crucial for Boralex's growth, providing stable, predictable income. For instance, agreements with companies like Nestlé France and Saint-Gobain demonstrate Boralex's ability to meet the specific energy needs of large industrial players, thereby accelerating their decarbonization efforts.

- Direct Customer Engagement: Boralex is actively pursuing direct relationships with corporations and industrial entities seeking reliable green energy solutions.

- Long-Term Revenue Stability: Power purchase agreements (PPAs) with these offtakers provide predictable revenue streams, underpinning financial planning and investment.

- Driving Sustainable Transitions: Partnerships with major consumers like Nestlé France and Saint-Gobain directly contribute to the decarbonization goals of these industries.

Boralex's key partnerships are multifaceted, encompassing governmental bodies, local communities, technology providers, financial institutions, and corporate offtakers. These relationships are crucial for securing permits, obtaining social license, accessing advanced technologies, financing projects, and ensuring stable revenue through power purchase agreements (PPAs).

In 2024, Boralex continued to solidify these partnerships. For example, its ongoing collaboration with entities like NYSERDA highlights its successful market penetration in the U.S. solar sector, driven by governmental agreements. The company’s commitment to community engagement is exemplified by its work with Indigenous groups, such as the Innu Nation on the Apuiat wind project, fostering collaborative development.

Financially, Boralex's ability to fund its growth relies heavily on its relationships with financial institutions. The company has actively utilized green loan financing for projects like its battery storage initiatives, demonstrating a strong alignment with sustainable finance trends. These financial partnerships are vital for securing the substantial capital required for its development pipeline.

| Partner Type | Key Role | Example/Impact |

|---|---|---|

| Governmental & Regulatory Bodies | Permitting, Policy Alignment, PPAs | NYSERDA agreements facilitating U.S. solar expansion |

| Local Communities & Indigenous Groups | Social License, Project Acceptance | Collaboration with Innu Nation on Apuiat wind project |

| Technology Providers & Manufacturers | Access to Advanced Equipment | Integration of efficient wind turbines and solar panels |

| Financial Institutions & Investors | Project & Corporate Financing | Securing capital for development, construction, and acquisitions; green loan financing for battery storage |

| Corporate Offtakers & Industrial Clients | Revenue Stability, Decarbonization Support | PPAs with Nestlé France and Saint-Gobain |

What is included in the product

A detailed exploration of Boralex's strategy, outlining key partners, activities, and resources in renewable energy development and operation.

This model emphasizes Boralex's value propositions, customer relationships, and cost structure for sustainable energy generation and supply.

Boralex's Business Model Canvas acts as a pain point reliever by offering a structured, visual representation of their renewable energy operations, simplifying complex stakeholder relationships and revenue streams.

This concise, one-page snapshot of Boralex's strategy helps alleviate the pain of information overload, making their approach to renewable energy development and management easily understandable for diverse audiences.

Activities

Project development is Boralex's engine for growth, focusing on identifying and advancing new renewable energy opportunities across wind, solar, and energy storage. This crucial phase involves meticulous site selection, comprehensive feasibility studies, and rigorous environmental impact assessments to ensure project viability and sustainability.

Securing essential land rights and obtaining necessary permits are foundational activities within Boralex's project development. These steps pave the way for the subsequent construction and operational phases, underscoring the importance of thorough planning and due diligence. For instance, in 2023, Boralex advanced its development pipeline, bringing new capacity closer to realization.

Boralex’s construction management is a crucial activity, encompassing the entire lifecycle of renewable energy projects from financing through to completion. This hands-on approach ensures efficient execution.

The company actively manages contractors and supply chains, a critical factor in delivering projects on schedule and within budgetary constraints. This is evident in their ongoing work at facilities such as the Apuiat wind project and the Hagersville and Tilbury energy storage sites.

Boralex actively manages and enhances its portfolio of renewable energy assets, including wind, solar, and hydroelectric power. This crucial activity ensures peak operational efficiency and longevity for each facility.

The company's operational focus includes meticulous maintenance, performance monitoring, and strategic upgrades to maximize electricity generation. In 2023, Boralex's installed capacity reached 1,513 MW, with a significant portion derived from its operational assets, demonstrating their ongoing optimization.

Furthermore, Boralex is committed to effective contract management and fostering positive relationships with local communities. This proactive engagement contributes to the smooth and sustainable operation of its power generation sites throughout their lifecycles.

Electricity Sales and Contract Management

Boralex’s core activity revolves around selling the electricity it produces from its renewable energy facilities. This is largely achieved through long-term Power Purchase Agreements (PPAs) with a mix of public utilities and commercial customers, ensuring stable revenue streams.

The company actively manages these existing contracts, focusing on optimizing the selling price of electricity to maximize profitability. This involves careful negotiation and ongoing performance monitoring to ensure favorable terms are maintained.

- Electricity Sales: Boralex's primary revenue driver is the sale of electricity generated from its wind and solar farms.

- Contract Management: This includes negotiating, executing, and managing long-term PPAs, ensuring predictable income.

- Price Optimization: Boralex works to secure the best possible prices for its electricity output through its contractual agreements.

- Customer Base: Key customers include public utilities and private businesses seeking clean energy solutions.

Strategic Planning and Diversification

Boralex actively pursues strategic planning to fuel its expansion, aiming to broaden its energy sources to include wind, solar, and storage solutions. This diversification extends across key markets such as Canada, France, the United States, and the United Kingdom, ensuring resilience and capturing varied market opportunities.

The company is committed to embedding corporate social responsibility (CSR) into its core operations, aligning growth ambitions with sustainable practices. Boralex has set aggressive goals for increasing its installed capacity and enhancing its financial results, reflecting its forward-thinking approach to energy development.

- Growth Acceleration: Boralex aims to significantly increase its installed capacity, targeting 5,000 MW by 2025 and 10,000 MW by 2030 across its diversified portfolio.

- Geographic Expansion: The company is actively developing projects in Canada, France, the United States, and the United Kingdom, strengthening its international presence.

- Technology Diversification: Boralex is investing in wind, solar, and energy storage technologies to create a robust and adaptable energy offering.

- CSR Integration: Sustainable development and community engagement are central to Boralex's strategy, influencing project selection and operational management.

Boralex's key activities center on developing, constructing, and operating renewable energy projects. They secure sites, obtain permits, and manage the entire construction process, ensuring efficient project execution. The company also actively manages its operational assets, focusing on maintenance and performance optimization to maximize electricity generation.

A significant part of Boralex's business model involves selling the electricity generated, primarily through long-term Power Purchase Agreements (PPAs). They also engage in strategic planning for expansion, diversifying energy sources and geographic reach while integrating corporate social responsibility into their operations.

| Activity | Description | Key Metrics/Data (as of latest available, including 2024 where applicable) |

|---|---|---|

| Project Development | Identifying, assessing, and advancing new renewable energy opportunities. | Development pipeline growth, number of projects in advanced stages. |

| Construction Management | Overseeing the construction of renewable energy facilities. | Project completion rates, adherence to budget and timelines. |

| Asset Management & Operation | Managing and optimizing operational renewable energy assets. | Installed capacity (MW), energy production (GWh), operational efficiency rates. Boralex's installed capacity reached 1,513 MW in 2023. |

| Electricity Sales & Contract Management | Selling electricity through PPAs and managing contracts. | Revenue from electricity sales, number and value of PPAs, price optimization. |

| Strategic Planning & Expansion | Planning for growth, diversification, and market expansion. | Targets for installed capacity (e.g., 5,000 MW by 2025), geographic presence in Canada, France, US, UK. |

Preview Before You Purchase

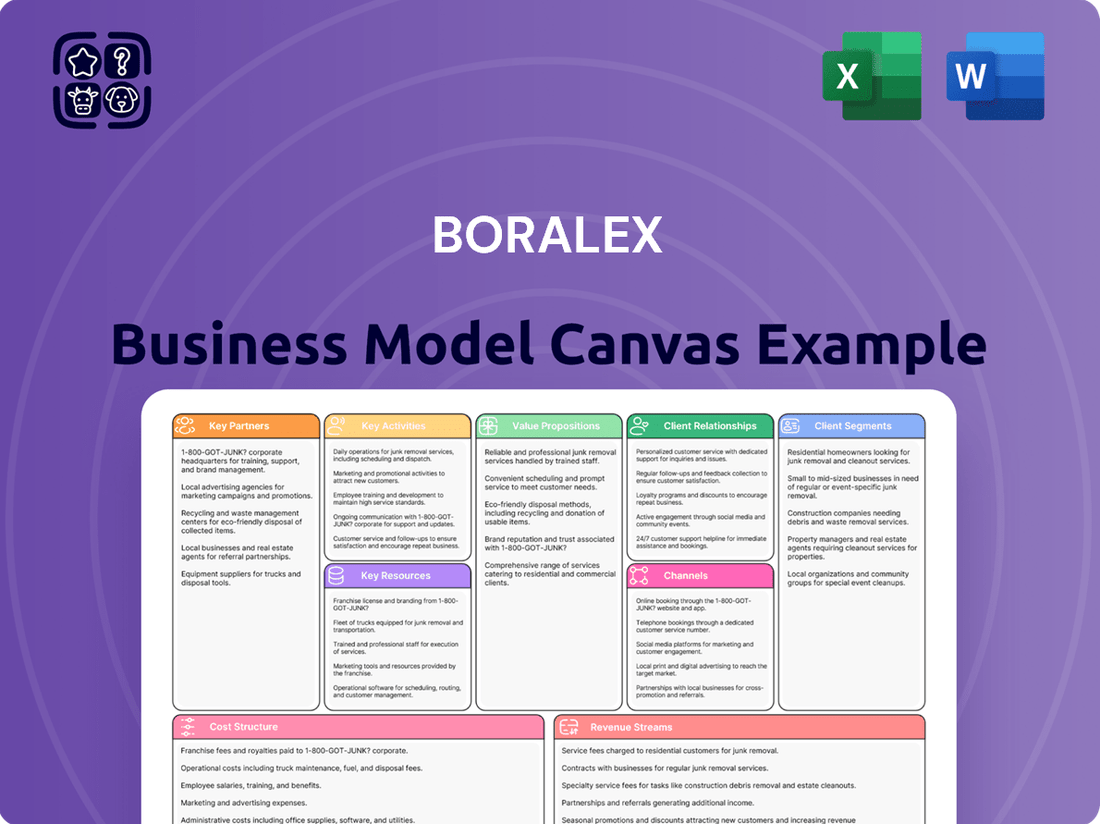

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means you're seeing the precise structure, content, and formatting that will be delivered, ensuring no discrepancies or hidden elements. Once you complete your order, you'll gain full access to this comprehensive and ready-to-use Business Model Canvas for Boralex.

Resources

Boralex's most crucial assets are its renewable energy power facilities, encompassing wind, solar, and hydroelectric power generation sites. These are the physical backbone of its operations, directly enabling the production of electricity and forming the bedrock of its revenue streams.

As of the first quarter of 2024, Boralex managed a significant portfolio of 4,000 MW of installed capacity, with a substantial portion, 2,900 MW, derived from its wind farms. This highlights the dominance of wind energy within its asset base, a key driver of its business.

The company's strategic focus on developing and operating these diverse renewable energy assets, including approximately 1,100 MW from hydroelectric and solar sources, underscores their role as the primary value creators within Boralex's business model.

Long-term Power Purchase Agreements (PPAs) are foundational to Boralex's business model, acting as vital contractual resources. These agreements secure predictable revenue by locking in electricity sales for extended durations, effectively shielding Boralex from the unpredictable swings of market prices.

As of the close of 2024, a significant 90% of Boralex's operational capacity was underpinned by these energy sales contracts. This high coverage demonstrates the company's strategic reliance on PPAs for financial stability and consistent cash flow generation.

The weighted average remaining term for these PPAs stood at an impressive 11 years at the end of 2024. This lengthy contractual horizon provides Boralex with a substantial degree of long-term revenue visibility, a critical factor for strategic planning and investment in renewable energy projects.

Boralex's specialized expertise in renewable energy project development, construction, and operation is a cornerstone of its business model. This intangible asset encompasses the deep knowledge and practical skills of its workforce in areas like wind and solar engineering, complex project management, and navigating intricate regulatory landscapes.

The company’s human capital is crucial for its success. In 2024, Boralex continued to invest in its teams, recognizing that skilled personnel are vital for identifying new opportunities, efficiently executing projects, and ensuring the long-term performance of its renewable energy assets. This expertise directly translates into lower development costs and higher operational efficiency.

Financial Capital and Access to Funding

Boralex’s robust financial capital is a cornerstone of its business model, enabling it to fund its capital-intensive renewable energy projects. This includes substantial cash reserves and access to diverse credit facilities. The company’s ability to secure both project-level and corporate debt is crucial for its expansion strategies.

Boralex consistently maintains a strong balance sheet, which underpins its capacity to pursue growth initiatives. As of the first quarter of 2024, Boralex reported a solid financial position, demonstrating its commitment to financial prudence and its capability to attract necessary funding for its pipeline of renewable energy developments.

- Financial Strength: Boralex’s financial capital includes significant cash and cash equivalents, alongside committed credit facilities, providing a stable foundation for project financing.

- Debt Access: The company has a proven track record of accessing both project-specific debt for individual renewable energy assets and corporate debt to finance its overall operations and strategic growth.

- Balance Sheet Health: A strong balance sheet, characterized by manageable leverage ratios and healthy liquidity, allows Boralex to absorb financial risks and seize investment opportunities.

- Growth Funding: This financial capacity is directly applied to the development, construction, and acquisition of renewable energy assets, supporting Boralex's ambitious growth targets in the clean energy sector.

Land Rights and Development Pipeline

Boralex's ability to secure land rights and cultivate a robust development pipeline is fundamental to its expansion strategy. This involves proactively identifying and acquiring suitable sites for future wind and solar energy projects, ensuring a continuous flow of opportunities.

The company's commitment to this area is evident in its substantial development portfolio. As of early 2024, Boralex boasts a significant pipeline, projecting a growth path that could add up to 8 GW of renewable energy capacity.

- Land Acquisition: Boralex actively seeks and secures land rights for new wind and solar farm developments, a critical step for future capacity expansion.

- Development Pipeline: The company maintains a strong portfolio of projects in various stages of development, ensuring a steady stream of future operational assets.

- Growth Capacity: Boralex's current development pipeline represents a significant growth opportunity, with a target to add up to 8 GW of renewable energy capacity.

Boralex's key resources are its renewable energy power facilities, primarily wind, solar, and hydroelectric sites. These physical assets are the core of its operations and revenue generation. As of Q1 2024, Boralex managed 4,000 MW of installed capacity, with 2,900 MW from wind and 1,100 MW from hydro and solar.

Long-term Power Purchase Agreements (PPAs) are critical contractual resources, securing predictable revenue for extended periods. By the end of 2024, 90% of Boralex's operational capacity was covered by PPAs, with an average remaining term of 11 years, ensuring revenue visibility.

The company's specialized expertise in developing, constructing, and operating renewable energy projects is a vital intangible asset. This includes skilled personnel in engineering, project management, and regulatory navigation, crucial for efficiency and cost reduction.

Boralex's financial strength, including cash reserves and credit facilities, underpins its capital-intensive projects. This financial capacity, demonstrated by a strong balance sheet in Q1 2024, enables the pursuit of growth initiatives and funding for its development pipeline.

Securing land rights and maintaining a robust development pipeline are fundamental for Boralex's expansion. The company's development portfolio, aiming to add up to 8 GW of capacity by early 2024, highlights its focus on future growth opportunities.

Value Propositions

Boralex offers clean, renewable energy from wind, solar, and hydroelectric assets, actively combating climate change and fostering a sustainable energy future. This commitment resonates with customers and stakeholders aiming to lower their environmental impact.

In 2024, Boralex's portfolio generated a significant amount of clean energy, contributing to a substantial reduction in greenhouse gas emissions for the regions it serves. For instance, their operational capacity in Canada and France is a testament to their dedication to a greener grid.

Boralex secures long-term power purchase agreements, offering customers predictable and stable electricity prices. This shields them from the unpredictable swings often seen in fossil fuel markets, providing a significant financial advantage for large industrial consumers.

For instance, Boralex's portfolio in 2024 includes numerous PPAs with durations often extending beyond 15 years, locking in revenue streams and providing crucial budget certainty for its clientele. This stability is a cornerstone of its value proposition, particularly for businesses with high energy consumption.

Boralex ensures a steady flow of electricity by utilizing a broad mix of renewable energy sources, including wind, solar, and hydroelectric power. This variety in generation methods, coupled with operations across multiple regions, significantly strengthens the reliability of its power supply.

This strategic diversification is key to maintaining grid stability and minimizing risks associated with relying on any single energy technology or geographic location. For instance, as of the first quarter of 2024, Boralex reported a total installed capacity of 1,544 MW, with a balanced contribution from its various renewable assets.

Integrated Project Lifecycle Management

Boralex's integrated project lifecycle management offers a comprehensive, end-to-end solution for renewable energy assets. This means they handle everything from the initial idea and development stages, through construction, and all the way to ongoing operation and performance enhancement. This holistic approach is key to their business model, ensuring a streamlined process and consistent quality control from start to finish.

This integrated service model allows Boralex to maintain tight control over efficiency and project outcomes. By managing each phase internally, they can better anticipate challenges and optimize performance at every step. For instance, in 2024, Boralex continued to expand its portfolio, demonstrating the effectiveness of this model in delivering new renewable energy capacity.

- End-to-End Service: Covers project conception, development, construction, operation, and optimization.

- Efficiency Gains: Streamlines processes and reduces delays by managing the entire lifecycle internally.

- Quality Assurance: Ensures consistent high standards and performance across all project phases.

- Risk Mitigation: Proactive management of each stage helps identify and address potential issues early on.

Commitment to Corporate Social Responsibility (CSR)

Boralex's unwavering dedication to Corporate Social Responsibility (CSR) and robust sustainable practices, encompassing environmental, social, and governance (ESG) priorities, delivers significant added value to its partners and the communities it serves. This commitment is more than just producing renewable energy; it’s about fostering positive impacts within the regions where Boralex operates.

In 2023, Boralex continued to champion ESG principles, with a notable focus on reducing its environmental footprint. For instance, their investments in wind and solar projects directly contribute to decarbonization efforts, aligning with global climate goals. Their community engagement strategies often involve local job creation and support for regional economic development, further solidifying their positive societal contributions.

- Environmental Stewardship: Boralex actively manages its environmental impact throughout the lifecycle of its renewable energy projects, from site selection to decommissioning.

- Social Impact: The company prioritizes creating shared value by engaging with local communities, supporting employment, and contributing to regional economic growth.

- Governance Excellence: Boralex maintains high standards of corporate governance, ensuring transparency, ethical conduct, and accountability in all its operations.

- Sustainable Growth: Their CSR commitment is integrated into their business strategy, driving long-term value creation for stakeholders and contributing to a sustainable future.

Boralex provides reliable, clean energy, helping clients meet sustainability goals and reduce their carbon footprint. Their commitment to renewable sources like wind and solar directly combats climate change, offering a tangible way for partners to contribute to a greener future.

In 2024, Boralex's operational capacity across Canada and France demonstrated a significant contribution to decarbonization, with their projects actively displacing fossil fuel generation. This focus on environmental stewardship is a core element of their appeal to environmentally conscious businesses and investors.

By securing long-term power purchase agreements, Boralex offers price stability, shielding customers from volatile energy markets. This predictability is crucial for businesses, especially those with high energy demands, allowing for better financial planning and cost management.

The company's diversified portfolio, encompassing wind, solar, and hydroelectric assets, ensures a consistent and reliable power supply. This multi-source approach mitigates risks associated with single-technology dependence and geographical concentration, enhancing overall energy security for their clients.

Boralex's integrated project management, from development to operation, ensures efficiency and quality. This end-to-end control allows them to optimize asset performance and deliver projects smoothly, a key advantage for clients seeking hassle-free renewable energy solutions.

Their strong emphasis on Corporate Social Responsibility and ESG principles further enhances their value proposition. Boralex actively engages with communities, promotes local economic development, and maintains high governance standards, creating positive societal and environmental impacts.

| Value Proposition | Key Features | 2024 Data/Examples |

|---|---|---|

| Clean Energy Provider | Renewable energy from wind, solar, hydro | Active contribution to decarbonization in Canada and France |

| Price Stability | Long-term Power Purchase Agreements (PPAs) | PPAs often exceed 15 years, locking in revenue and client costs |

| Reliable Power Supply | Diversified renewable energy portfolio | 1,544 MW installed capacity (Q1 2024) across multiple asset types |

| Integrated Project Management | End-to-end lifecycle control | Continued portfolio expansion demonstrating model effectiveness |

| CSR & ESG Commitment | Environmental stewardship, social impact, governance | Community engagement, local job creation, focus on reducing environmental footprint |

Customer Relationships

Boralex secures its customer base through long-term contractual relationships, primarily via Power Purchase Agreements (PPAs). These PPAs are crucial, typically spanning 15 to 20 years, providing a stable revenue stream and predictable cash flows. For instance, in 2023, Boralex's portfolio of PPAs ensured a consistent demand for its renewable energy output, underpinning its financial stability.

For its key utility and industrial clients, Boralex likely utilizes dedicated account management teams. These specialized teams focus on delivering personalized service, ensuring that the unique needs of each major client are met effectively. This approach helps maintain strong, consistent communication throughout the often long-term power purchase agreements, fostering reliable partnerships.

Boralex actively fosters strong ties with local communities near its renewable energy installations, exemplified by their commitment to transparent communication and addressing resident concerns. This proactive approach ensures smooth project development and long-term acceptance.

In 2024, Boralex continued its focus on local integration, contributing to regional economies through job creation and local procurement. For instance, their projects often prioritize local suppliers and workforce development, strengthening community bonds and economic benefits.

Partnerships for Sustainable Development

Boralex cultivates strategic alliances with corporate entities focused on enhancing their environmental and social impact. These relationships transcend typical customer interactions, evolving into shared endeavors aimed at achieving ambitious sustainable energy objectives.

A prime illustration of this commitment is Boralex's engagement in corporate Power Purchase Agreements (PPAs). These agreements solidify long-term collaborations, enabling clients to secure renewable energy and meet their climate targets. For instance, in 2024, Boralex continued to expand its portfolio of corporate PPAs, demonstrating a tangible commitment to this partnership model.

- Corporate PPAs: Boralex actively seeks and secures long-term Power Purchase Agreements with corporations aiming to decarbonize their operations and achieve sustainability goals.

- Joint Development: Partnerships may involve co-development of renewable energy projects, aligning Boralex's expertise with corporate sustainability mandates.

- Impact Measurement: Collaborations often include frameworks for measuring and reporting on the climate and societal benefits achieved through the partnership.

Investor Relations and Transparency

Boralex prioritizes open communication with its investors and financial community. This includes providing timely and detailed financial reports, hosting investor presentations, and clearly outlining its strategic direction and performance. For instance, in its 2024 first-quarter results, Boralex reported a significant increase in revenues, underscoring its growth trajectory and commitment to transparency.

- Regular Financial Reporting: Boralex consistently publishes quarterly and annual financial statements, adhering to strict disclosure standards.

- Investor Presentations and Calls: The company actively engages with investors through presentations and conference calls to discuss financial results and strategic initiatives.

- Strategic Objective Communication: Boralex clearly articulates its growth plans, project pipeline, and market outlook to its stakeholders.

This dedication to transparency fosters trust and confidence, which is crucial for attracting and retaining the capital needed to fund Boralex's expansion in the renewable energy sector. In 2024, the company continued to secure new financing and partnerships, a testament to its strong investor relations.

Boralex cultivates enduring relationships with its clients, predominantly through long-term Power Purchase Agreements (PPAs) that guarantee stable revenue. These agreements, often lasting 15 to 20 years, are central to Boralex's predictable cash flow. The company also engages corporate clients through PPAs, facilitating their decarbonization efforts and sustainability targets, a strategy actively pursued in 2024.

| Relationship Type | Key Features | Example/Focus Area |

| Long-term PPAs (Utilities/Industrial) | Revenue stability, predictable cash flows | 15-20 year agreements, ensuring consistent demand |

| Corporate PPAs | Client decarbonization, sustainability goals | Partnerships for renewable energy procurement, active in 2024 |

| Community Engagement | Local acceptance, transparent communication | Addressing concerns, contributing to local economies |

| Investor Relations | Transparency, financial reporting | Regular updates, clear strategic communication |

Channels

Direct Power Purchase Agreements (PPAs) are Boralex's primary channel for delivering its renewable energy solutions. These agreements are typically long-term, providing a stable revenue stream.

Boralex enters into these PPAs directly with a range of customers, including public utility companies and private corporations looking to secure clean energy. This direct engagement allows for tailored agreements that meet specific energy needs.

In 2024, Boralex continued to leverage PPAs to expand its portfolio. For instance, their projects in the United States are often underpinned by these contracts, which are crucial for financing and de-risking new developments.

Boralex leverages existing electricity grids and transmission networks as the essential physical channels to transport the renewable energy it produces from its wind and solar farms to consumers. This infrastructure is critical for ensuring the energy reaches its intended markets.

In 2024, Boralex continued to rely on these established networks, which are fundamental to its operations. For instance, its Canadian operations, which represent a significant portion of its installed capacity, are connected to Hydro-Québec's extensive transmission system, a vital artery for delivering clean power.

The company's strategy involves integrating its renewable assets into these networks efficiently. As of the first quarter of 2024, Boralex had 1,546 MW of installed capacity in operation, all of which is transmitted through these grids to end-users, underscoring the network's importance to its revenue generation.

Boralex actively engages in competitive solicitations and Requests for Proposals (RFPs) from government entities, utility companies, and major energy purchasers. This avenue is crucial for Boralex to secure new power purchase agreements, thereby fueling the expansion of its project development pipeline.

Investor Relations Platforms and Events

Boralex actively engages with its stakeholders through a dedicated investor relations website, which serves as a central hub for crucial information. This includes easily accessible annual reports, detailed financial statements, and timely press releases, ensuring transparency for both current and potential investors.

The company leverages investor day presentations and other key events to foster direct communication and build relationships. These interactions are vital for attracting the necessary capital to fuel Boralex's ongoing expansion and development projects.

In 2024, Boralex's commitment to investor outreach is evident in its consistent reporting and engagement activities. For instance, their financial reports highlight significant progress in renewable energy capacity, demonstrating a clear path for growth that attracts investment.

- Investor Relations Website: A comprehensive digital platform offering financial reports, presentations, and company news.

- Annual Reports and Financial Documents: Detailed disclosures providing insights into financial performance and strategic direction.

- Investor Day Presentations: Opportunities for direct engagement with management, showcasing growth strategies and operational updates.

- Capital Attraction: These platforms are instrumental in attracting and securing the capital needed for Boralex's renewable energy projects.

Corporate and Industry Events

Boralex actively participates in key industry conferences and trade shows, such as the Canadian Hydropower Association (CHA) annual conference and the European Utility Week. These events are crucial for showcasing their capabilities in wind and solar energy development. In 2024, Boralex continued to leverage these platforms to forge new partnerships and secure project financing. Their presence at these events allows them to demonstrate their commitment to innovation and sustainable energy solutions.

These gatherings also provide Boralex with invaluable opportunities to stay informed about emerging technologies and regulatory shifts within the renewable energy landscape. By engaging with peers and experts, Boralex can refine its strategies and identify new avenues for growth. For instance, discussions at recent events have highlighted the increasing importance of energy storage solutions, a sector Boralex is actively exploring. This proactive engagement ensures Boralex remains at the forefront of the industry.

Boralex's corporate events, including investor days and project site visits, further strengthen relationships with stakeholders. These events offer transparency and build trust, which are essential for long-term success. In 2024, Boralex hosted several such events, providing detailed updates on their project pipeline and financial performance, reinforcing their position as a reliable partner in the renewable energy sector.

- Industry Conferences: Boralex attends events like the CHA conference to highlight its expertise in wind and hydropower.

- Networking Opportunities: These events facilitate connections with potential partners, clients, and investors.

- Market Intelligence: Participation keeps Boralex informed about new technologies and market trends in renewable energy.

- Corporate Engagement: Investor days and site visits enhance transparency and build stakeholder confidence.

Boralex utilizes competitive solicitations and Requests for Proposals (RFPs) as a key channel to secure new power purchase agreements, driving its project development pipeline. This process is vital for winning contracts with government entities and utility companies. In 2024, Boralex continued to actively participate in these tenders, demonstrating its competitive edge in the renewable energy market.

Customer Segments

Public utility companies represent a crucial customer segment for Boralex. These entities, often driven by regulatory mandates and a commitment to sustainability, actively seek to integrate renewable energy sources into their portfolios. Boralex serves these utilities by supplying electricity generated from its renewable assets, typically secured through long-term power purchase agreements.

In 2024, the global push for decarbonization continues to accelerate, with many utility companies setting ambitious renewable energy targets. For instance, in the United States, the Inflation Reduction Act of 2022, which continues to influence investment decisions throughout 2024, provides significant incentives for renewable energy adoption. Boralex leverages these market dynamics by offering stable, long-term power supply solutions that help utilities meet their clean energy obligations and diversify their generation mix away from fossil fuels.

A significant and expanding customer base for Boralex consists of large industrial and commercial businesses. These companies are actively looking to procure clean energy directly, a strategic move driven by a desire to lower their operational carbon footprint and achieve ambitious sustainability targets.

Boralex is responding to this demand by increasingly entering into corporate Power Purchase Agreements (PPAs) with these clients. Notable examples of such partnerships include agreements with major corporations like Nestlé and Saint-Gobain, demonstrating Boralex's success in serving this key market segment.

Governmental entities and municipalities are key customers, seeking to power public infrastructure like schools, hospitals, and streetlights with renewable energy. These bodies often initiate competitive bidding processes, issuing tenders and Requests for Proposals (RFPs) to secure long-term, stable clean energy supplies. For instance, in 2024, many municipalities across North America continued to prioritize decarbonization goals, driving demand for solar and wind power projects.

Energy Traders and Market Operators

Boralex engages with energy traders and market operators, particularly in markets where direct sales on wholesale energy platforms are feasible. This segment is crucial for managing uncontracted capacity and capitalizing on short-term price fluctuations. For instance, in 2024, Boralex continued to leverage its market presence to optimize revenue streams from its diverse portfolio of renewable energy assets.

These market participants are key to Boralex's strategy for maximizing financial returns. They provide a channel for Boralex to sell electricity that isn't covered by long-term power purchase agreements (PPAs). This flexibility allows Boralex to adapt to changing market conditions and potentially achieve better pricing than through fixed contracts alone.

Boralex's participation in these wholesale markets is supported by its operational expertise and understanding of market dynamics. In 2023, Boralex reported revenues of CAD 971 million, with a significant portion derived from the sale of electricity, underscoring the importance of these trading relationships. The company's strategy often involves balancing contracted sales with opportunistic market sales to enhance overall profitability.

- Wholesale Market Access: Direct sales to energy traders and operators for uncontracted power.

- Price Optimization: Leveraging market volatility for short-term revenue enhancement.

- Operational Flexibility: Managing capacity not covered by long-term contracts.

- Revenue Diversification: Supplementing PPA income with market-based sales.

Joint Venture Partners

Joint venture partners represent a unique customer segment for Boralex, particularly when their expertise and assets are leveraged in collaborative energy projects. In these instances, these partners are direct beneficiaries of Boralex's project management capabilities and operational power. For example, in 2024, Boralex actively engaged in several joint ventures to expand its renewable energy portfolio, demonstrating a strategic reliance on these partnerships for market access and project development.

These partnerships are crucial for Boralex's growth strategy, enabling shared risk and capital investment in large-scale renewable energy installations. The value proposition for these partners often lies in Boralex's established track record, technical proficiency, and access to project financing. By collaborating, both parties can achieve economies of scale and tap into new markets more effectively.

- Shared Project Development: Joint venture partners receive Boralex's project management and operational services for co-developed renewable energy assets.

- Risk Mitigation: These partnerships allow for the distribution of financial and operational risks associated with large-scale energy projects.

- Market Access: Collaboration provides partners with entry into new geographical markets or specific renewable energy sectors where Boralex has established a presence.

- Capital Efficiency: Joint ventures enable Boralex to leverage partner capital, reducing its own upfront investment requirements for new projects.

Boralex's customer base is diverse, encompassing public utility companies, large industrial and commercial businesses, governmental entities, energy traders, and joint venture partners. Each segment has distinct needs and motivations for procuring renewable energy, from meeting regulatory requirements and sustainability goals to optimizing operational costs and expanding market reach.

In 2024, the demand for clean energy solutions continues to grow across all these segments. Utilities are increasingly integrating renewables to meet decarbonization targets, while corporations are pursuing direct clean energy procurement to enhance their environmental, social, and governance (ESG) profiles. Governmental bodies are also prioritizing renewable energy for public infrastructure, and energy traders play a vital role in market liquidity and price discovery.

Boralex's strategy involves tailoring its offerings, such as long-term power purchase agreements (PPAs) and corporate PPAs, to meet the specific requirements of each customer segment. The company's ability to secure partnerships and manage projects effectively makes it a valuable supplier and collaborator in the evolving renewable energy landscape.

Cost Structure

Boralex's cost structure is heavily influenced by significant capital expenditures for developing and constructing new renewable energy projects. These costs encompass crucial elements like acquiring suitable land, purchasing essential equipment such as wind turbines and solar panels, undertaking civil engineering works, and establishing vital grid connections to integrate new facilities.

For instance, in 2024, Boralex continued to invest substantially in its development pipeline. The company reported capital expenditures of approximately $500 million in the first half of 2024, primarily directed towards the construction of its various wind and solar farms across North America and Europe, reflecting the upfront investment required to expand its renewable energy portfolio.

Operating and Maintenance (O&M) costs are the ongoing expenses Boralex incurs to keep its power generation facilities running smoothly. These include everything from routine checks and minor repairs to the salaries of the staff who manage the sites and the premiums for insurance policies. For instance, in 2023, Boralex reported O&M expenses of approximately $234 million, a crucial figure for understanding the day-to-day financial health of their operational portfolio.

Given the capital-intensive nature of renewable energy projects, financing costs, including interest payments on project-level and corporate debt, form a significant portion of Boralex's cost structure. For instance, in the first quarter of 2024, Boralex reported financing costs of $70 million, reflecting the substantial borrowing required to fund its expanding portfolio of wind and solar farms.

Boralex prioritizes a conservative financial approach, which influences how these financing costs are managed. This strategy aims to ensure long-term stability and profitability by carefully structuring its debt and managing interest rate exposure, even as it pursues growth opportunities.

Development and Administrative Expenses

Boralex's cost structure includes significant development and administrative expenses. These encompass the crucial early stages of project lifecycles, such as identifying potential sites, conducting thorough feasibility studies, and navigating the complex permitting processes. Additionally, general administrative overhead, including salaries for their dedicated development teams, legal counsel, and corporate management, forms a substantial part of these costs. Boralex actively works to optimize these expenditures to enhance project profitability.

For the fiscal year ending December 31, 2023, Boralex reported total operating expenses of CAD 1,219 million. This figure encompasses a broad range of costs, including those associated with development and administration. The company's commitment to efficiency is evident in its ongoing efforts to streamline operations and manage these essential overheads effectively.

- Project Identification and Feasibility: Costs incurred in scouting new renewable energy sites and assessing their viability.

- Permitting and Legal Fees: Expenses related to obtaining necessary regulatory approvals and legal services for project development.

- Salaries and Corporate Overhead: Compensation for development personnel, management, and general corporate administrative functions.

- Optimization Efforts: Boralex's continuous focus on reducing these development and administrative costs through operational efficiencies.

Regulatory Compliance and Environmental Costs

Boralex dedicates resources to meeting stringent environmental regulations and securing necessary operating permits. These expenses are crucial for maintaining a license to operate and demonstrating commitment to sustainable practices. For instance, in 2024, the company continued to invest in environmental impact assessments for new wind and solar projects, ensuring compliance with evolving standards.

Corporate Social Responsibility (CSR) initiatives also form a significant part of Boralex's cost structure. This includes community engagement programs designed to foster positive relationships with local stakeholders where its renewable energy facilities are located. These investments are vital for long-term social acceptance and operational stability.

- Environmental Compliance: Costs for environmental impact studies, emissions monitoring, and waste management.

- Permitting and Licensing: Fees and administrative expenses for obtaining and renewing permits for renewable energy installations.

- CSR Programs: Investments in community development, local employment initiatives, and stakeholder consultations.

- Sustainability Reporting: Expenses related to tracking, measuring, and reporting on environmental, social, and governance (ESG) performance.

Boralex's cost structure is dominated by the significant upfront capital expenditures required for developing and constructing new renewable energy projects, alongside ongoing operating and maintenance expenses. Financing costs also represent a substantial portion due to the capital-intensive nature of the industry.

In 2024, Boralex reported capital expenditures of approximately $500 million in the first half, primarily for new wind and solar farms. For the full year 2023, operating expenses were CAD 1,219 million, encompassing development, administration, and O&M costs. Financing costs in Q1 2024 alone were $70 million.

| Cost Category | 2023 (CAD million) | H1 2024 (USD million) | Q1 2024 (USD million) |

|---|---|---|---|

| Total Operating Expenses | 1,219 | N/A | N/A |

| Capital Expenditures (H1 2024) | N/A | ~500 | N/A |

| Operating & Maintenance (2023) | ~234 | N/A | N/A |

| Financing Costs (Q1 2024) | N/A | N/A | ~70 |

Revenue Streams

Boralex's core revenue generation relies on long-term Power Purchase Agreements (PPAs). These crucial contracts lock in the sale of electricity, primarily with public utilities and private corporations, ensuring a steady and predictable income stream for extended periods, often spanning decades.

In 2024, Boralex continued to leverage PPAs as its foundational revenue source. The company's portfolio, bolstered by ongoing project development and acquisitions, generated substantial and reliable income through these agreements, underscoring their importance to financial stability and growth.

Boralex benefits from feed-in premiums and government incentives, crucial for its revenue. These programs guarantee a set price for electricity, often higher than market rates, particularly in regions prioritizing renewable energy development.

In 2024, Boralex's strategy heavily relies on these supportive policies. For instance, the company's operations in France are bolstered by feed-in tariffs that provide long-term revenue certainty for its wind and solar projects, contributing significantly to its financial stability.

Boralex can generate revenue by selling surplus electricity or available capacity directly on spot electricity markets. This offers a chance to profit from immediate market conditions, though it means revenue can vary significantly with price swings.

For example, in the first quarter of 2024, Boralex reported that its average selling price for electricity in Canada was C$67.8 per megawatt-hour, a decrease from C$77.7 per megawatt-hour in the same period of 2023, highlighting the volatility of uncontracted sales.

Sale of Renewable Energy Certificates (RECs)

Boralex generates income through the sale of Renewable Energy Certificates (RECs). These certificates are a way to monetize the environmental benefits associated with producing clean energy, like solar or wind power. Companies or entities looking to meet their own sustainability goals or regulatory requirements can purchase these RECs, even if they don't directly consume the electricity produced by Boralex.

This revenue stream diversifies Boralex's income beyond just selling the physical electricity. For example, in 2023, Boralex's operations contributed to the environmental attributes that could be bundled into RECs, supporting their overall financial performance and the transition to cleaner energy sources.

Key aspects of this revenue stream include:

- Monetizing Environmental Attributes: RECs allow Boralex to capture additional value from its renewable energy generation beyond the sale of electricity itself.

- Meeting Renewable Targets: The certificates are crucial for other organizations aiming to fulfill renewable energy mandates or voluntary corporate social responsibility commitments.

- Market Demand for Green Attributes: Growing awareness and regulatory pressures are increasing the demand for RECs, creating a stable revenue opportunity for producers like Boralex.

- Potential for Higher Premiums: Depending on market conditions and the specific type of renewable energy, RECs can command premium prices, enhancing profitability.

Asset Optimization and Management Services

Boralex’s expertise in managing its own substantial portfolio of renewable energy assets extends to offering asset optimization and management services to third-party owners. This revenue stream leverages Boralex’s deep operational knowledge and proven track record in maximizing the performance and profitability of wind and solar farms.

These services can encompass a range of activities, from technical oversight and maintenance planning to energy market participation and regulatory compliance. By entrusting their assets to Boralex, third-party owners can benefit from enhanced operational efficiency and potentially higher returns.

For instance, Boralex’s commitment to operational excellence is reflected in its consistent performance metrics. While specific figures for third-party management revenue are not always granularly disclosed, the company’s overall operational efficiency, which underpins these services, is a key differentiator. In 2024, Boralex continued to focus on optimizing its asset base, a strategy that directly translates to the value proposition offered to potential third-party clients.

Key aspects of Boralex's asset optimization and management services for third parties include:

- Performance Monitoring and Analysis: Utilizing advanced analytics to identify and address underperformance issues in renewable energy assets.

- Predictive Maintenance: Implementing proactive maintenance strategies to minimize downtime and extend asset lifespan.

- Operational Efficiency Improvements: Streamlining operational processes to reduce costs and enhance energy generation.

- Market Engagement and Optimization: Strategically managing energy sales and grid interactions to maximize revenue.

Boralex's revenue streams are primarily built upon long-term Power Purchase Agreements (PPAs) with stable counterparties, ensuring predictable income. Additionally, the company capitalizes on government incentives like feed-in tariffs, which guarantee favorable prices for renewable energy. Surplus energy can be sold on spot markets, though this introduces price volatility, as seen in Q1 2024 Canadian sales averaging C$67.8/MWh.

The sale of Renewable Energy Certificates (RECs) offers another avenue for revenue, monetizing the environmental benefits of their clean energy production. Furthermore, Boralex leverages its operational expertise to provide asset optimization and management services to third-party owners, enhancing their portfolio's performance and profitability.

| Revenue Stream | Description | 2024 Relevance/Example | Key Benefit |

| Power Purchase Agreements (PPAs) | Long-term contracts to sell electricity | Foundation of revenue, securing predictable income | Revenue stability and visibility |

| Government Incentives (Feed-in Tariffs/Premiums) | Guaranteed prices for renewable energy | Crucial for revenue certainty, especially in France | Enhanced profitability and reduced market risk |

| Spot Market Sales | Selling surplus electricity at current market prices | Offers potential profit from price fluctuations | Flexibility and opportunistic gains |

| Renewable Energy Certificates (RECs) | Monetizing environmental attributes of clean energy | Diversifies income beyond electricity sales | Captures additional value from generation |

| Asset Optimization & Management Services | Managing renewable energy assets for third parties | Leverages operational expertise for additional income | Expands service offerings and revenue base |

Business Model Canvas Data Sources

The Boralex Business Model Canvas is built upon a foundation of detailed financial reports, comprehensive market research on renewable energy trends, and internal operational data. These sources provide the necessary insights to accurately define customer segments, value propositions, and cost structures.