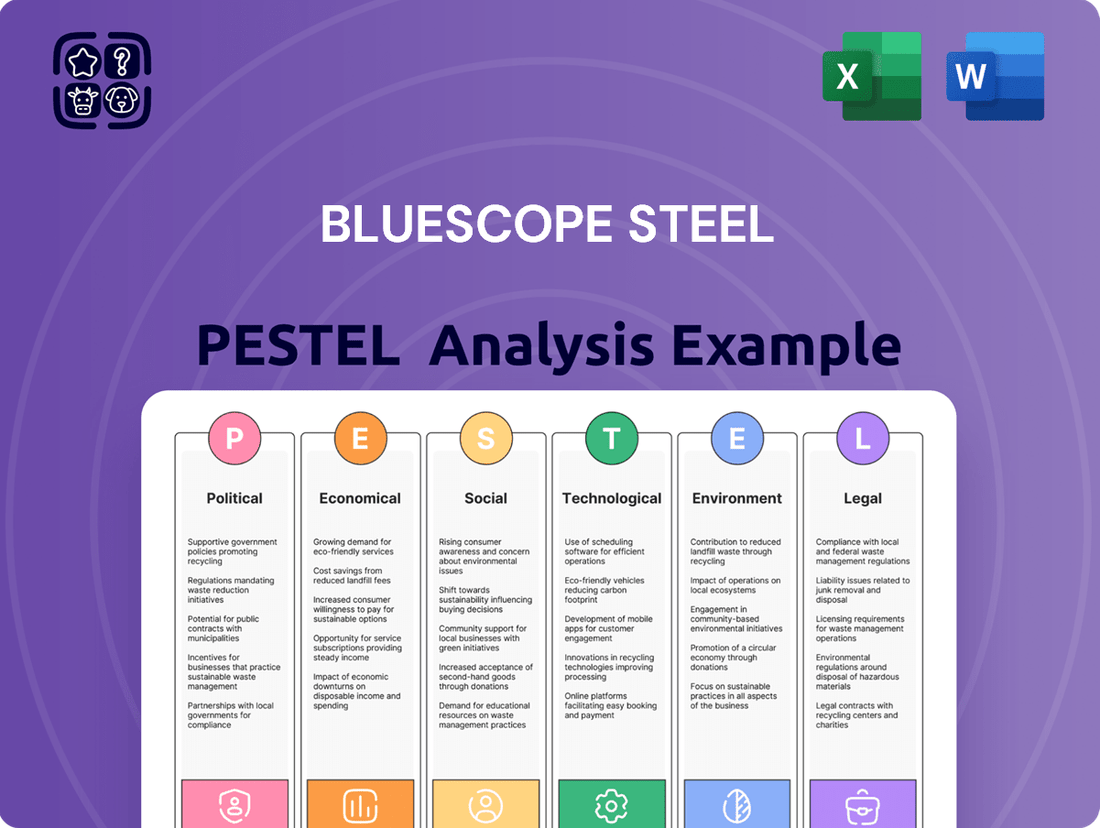

Bluescope Steel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bluescope Steel Bundle

Unlock the critical external factors impacting Bluescope Steel's operations and future growth. Our PESTEL analysis dives deep into political stability, economic fluctuations, social trends, technological advancements, environmental regulations, and legal frameworks that shape the industry. Equip yourself with this essential intelligence to make informed strategic decisions.

Gain a competitive edge by understanding the complex PESTEL landscape affecting Bluescope Steel. From government policies influencing trade to the growing demand for sustainable building materials, these external forces are key to navigating the market. Download the full analysis now to translate these insights into actionable strategies.

Political factors

Government policies, like the US Inflation Reduction Act, are crucial for the steel sector, offering incentives for domestic production and green manufacturing. BlueScope's North American operations are positioned to potentially benefit from this stimulus, particularly as it encourages lower-emission steelmaking. The company actively tracks and adjusts to evolving policy landscapes across its global footprint.

Trade policies, particularly tariffs on steel imports, significantly shape BlueScope's operating environment. For instance, the US imposition of tariffs on steel in recent years directly influences the competitive pricing and market access for BlueScope's products in that key region. These protectionist measures can bolster domestic steel prices, offering a potential advantage to BlueScope's US operations, but they also carry the risk of global trade disruptions and retaliatory actions.

Governments are actively forging partnerships with heavy industries to drive decarbonisation, a trend particularly pronounced in energy-intensive sectors like steel production. These collaborations are crucial for meeting ambitious climate targets.

BlueScope Steel is a prime example, engaging in key government-backed initiatives. Notably, their project at Glenbrook in New Zealand, which involves an electric arc furnace, is supported by the New Zealand government. Furthermore, BlueScope is collaborating with major Australian iron ore producers, Rio Tinto and BHP, to explore a pilot plant for green iron production.

These strategic alliances underscore a mutual dedication to lowering greenhouse gas emissions and advancing the development of environmentally sustainable steelmaking methods. For instance, the New Zealand government's commitment to decarbonising its industrial sector, aiming for a 40% reduction in emissions by 2030, directly influences projects like the one at Glenbrook.

Competition Law and Anti-Cartel Enforcement

Global regulatory bodies are increasingly vigilant in enforcing competition laws, targeting anti-competitive practices such as price-fixing and market collusion. This heightened scrutiny directly impacts companies like BlueScope Steel, which must navigate a complex legal landscape designed to foster fair market competition.

BlueScope has encountered significant legal challenges stemming from past cartel conduct, underscoring the stringent regulatory environment it operates within. For instance, the company is currently appealing a substantial fine imposed for alleged attempted price-fixing, a situation that highlights the ongoing legal oversight and the critical need for robust internal compliance mechanisms.

- Ongoing Legal Scrutiny: BlueScope faces continued legal challenges related to past alleged anti-competitive behavior.

- Significant Penalties: The company is appealing a large fine for attempted price-fixing, indicating substantial financial risks.

- Compliance Imperative: Strict enforcement necessitates ongoing strengthening of compliance programs to prevent future infringements.

- Market Impact: Regulatory actions can influence market dynamics, pricing, and operational strategies for steel producers.

Political Stability and Election Outcomes

Political stability and election results, especially in major economies like the United States, can create periods of uncertainty. This uncertainty often affects customer confidence, leading to deferred orders. For instance, BlueScope Steel has observed customers in North America delaying purchases while awaiting clearer election outcomes and potential interest rate reductions.

These political shifts directly influence market dynamics and a company's financial performance. The anticipation of policy changes following an election can cause a ripple effect across industries, impacting demand for materials like steel. BlueScope's experience underscores the sensitivity of the construction and manufacturing sectors to the broader political climate.

- Customer Deferrals: BlueScope Steel reported in early 2024 that North American customers were deferring orders due to election-related uncertainty.

- Market Sensitivity: The construction and manufacturing sectors, key markets for BlueScope, are particularly susceptible to economic confidence shifts driven by political events.

- Interest Rate Influence: Expectations of interest rate cuts, often tied to election cycles and subsequent economic policies, play a significant role in customer purchasing decisions.

Government incentives, like the US Inflation Reduction Act, are shaping domestic steel production and green manufacturing, potentially benefiting BlueScope's North American operations. Trade policies, including tariffs, directly impact market access and pricing for BlueScope, as seen with US tariffs influencing competitive dynamics. Political stability and election outcomes, particularly in key markets like the US, can lead to customer order deferrals due to economic uncertainty, as observed by BlueScope in early 2024 with North American customers delaying purchases.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Bluescope Steel, offering a comprehensive view of its external operating landscape.

It provides actionable insights for strategic decision-making by identifying key opportunities and threats arising from these macro-environmental forces.

Bluescope Steel's PESTLE analysis offers a pain point reliever by providing a concise, easily shareable summary format ideal for quick alignment across teams, ensuring everyone understands the external factors impacting the business.

Economic factors

Global steel prices are notoriously unpredictable, influenced by everything from international relations and economic slowdowns to disruptions in how goods are transported. For BlueScope, this means their financial performance can swing considerably based on these external forces.

The impact of this volatility is clear: BlueScope's own earnings forecast for the first half of fiscal year 2025, or 1H FY2025, was notably affected by weak steel price margins, specifically in East Asia. This highlights how sensitive their profitability is to these market conditions.

To navigate these ups and downs, BlueScope needs a strong business structure and operations spread across different areas. This diversification helps cushion the financial blow when one region or market segment experiences a downturn, ensuring greater stability.

BlueScope Steel continues to grapple with the persistent challenge of rising raw material costs, a significant factor impacting its profitability. This, coupled with general inflation, has put pressure on the company's margins throughout FY2024 and into the first half of FY2025. For instance, the cost of key inputs like iron ore and coking coal directly correlates with BlueScope's production expenses.

The influence of these escalating operational costs, including a notable increase in electricity prices, has been a recurring theme in BlueScope's financial reporting. This inflationary environment necessitates a proactive approach to cost management to safeguard earnings. The company's ability to absorb or pass on these higher costs is a critical determinant of its financial health.

In response, BlueScope has implemented a robust strategy focused on significant cost reduction and productivity enhancements across its global operations. These initiatives are designed to mitigate the impact of external cost pressures and improve overall operational efficiency. The company's target is to achieve substantial savings through these programs, aiming to bolster its financial resilience in a volatile economic landscape.

BlueScope Steel's performance is closely tied to the health of the building and construction, and automotive sectors. These industries are major consumers of steel products, meaning their demand directly influences BlueScope's sales volumes and overall market position.

In 2024 and early 2025, the global steel market has seen a noticeable slowdown in construction activity. This softness translates to fewer orders for steel products, impacting companies like BlueScope. For instance, global construction output growth was projected to be around 2.1% in 2024, a deceleration from previous years, according to various industry forecasts.

Similarly, the automotive sector has faced its own challenges. Projections for automotive production in key markets during 2024 and 2025 indicated a potential decline or muted growth in certain regions, influenced by factors like supply chain issues and shifting consumer preferences. This downturn in vehicle manufacturing directly reduces the demand for automotive-grade steel, a significant product category for BlueScope.

Interest Rates and Economic Growth

Rising interest rates and economic uncertainty directly dampen consumer spending and can trigger industrial downturns, significantly affecting demand across steel-reliant industries. For instance, the European steel market has felt the pinch, with the delayed effects of elevated interest rates contributing to a more severe recession in key steel-consuming sectors than initially anticipated.

BlueScope's financial health is closely tied to these broader economic trends, especially impacting its performance in markets like North America and New Zealand.

- Impact on Demand: Higher borrowing costs generally lead to less investment and reduced consumer purchasing power, directly lowering demand for construction and manufactured goods that use steel.

- Recessionary Pressures: The lagged effect of interest rate hikes, as seen in Europe, can create deeper and more prolonged recessions in sectors that are major steel consumers.

- Operational Sensitivity: BlueScope's profitability is sensitive to these macroeconomic shifts, with its North American and New Zealand segments being particularly exposed to fluctuations in economic growth and interest rate environments.

Currency Fluctuations

BlueScope Steel's extensive global footprint exposes it to significant currency fluctuations, directly impacting its reported earnings and financial health. The company actively monitors foreign exchange rate movements as a critical component of its financial outlook.

For instance, shifts in the Australian dollar's value against major trading currencies like the US dollar can materially alter the carrying value of its international assets and, consequently, its overall profitability. In the fiscal year ending June 30, 2024, BlueScope reported that a 10% adverse movement in the Australian dollar against the US dollar could have negatively impacted its underlying earnings before interest and taxes by approximately AUD 30-40 million.

- Global Operations Exposure: BlueScope's presence in North America, Asia, and New Zealand means it transacts in multiple currencies, creating inherent foreign exchange risk.

- Impact on Reported Earnings: Fluctuations can distort the translation of foreign subsidiary profits and asset values into Australian dollars, affecting reported financial performance.

- Key Driver for Financial Outlook: Currency movements are explicitly identified by BlueScope as a significant factor influencing its forward-looking financial guidance and strategic planning.

- Australian Dollar vs. US Dollar: A stronger Australian dollar relative to the US dollar can reduce the AUD equivalent of earnings generated in the US, a key market for BlueScope.

Global economic conditions significantly shape BlueScope Steel's operational environment, with steel prices experiencing notable volatility. For the first half of fiscal year 2025, weak steel price margins, particularly in East Asia, directly impacted BlueScope's earnings forecasts, demonstrating the company's sensitivity to these market dynamics.

Preview Before You Purchase

Bluescope Steel PESTLE Analysis

The Bluescope Steel PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Bluescope Steel.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering a detailed PESTLE breakdown for Bluescope Steel. You'll gain insights into market dynamics and strategic considerations.

Sociological factors

BlueScope Steel places a strong emphasis on a people-centered approach to health and safety, actively implementing diverse initiatives to bolster workplace security. Despite these robust efforts, the company did report incidents in FY2024 that unfortunately led to permanent incapacities, highlighting the persistent need for ongoing safety advancements and vigilance.

To reinforce its commitment, BlueScope instigates global 'Refocus on Safety' programs. These programs are designed to ensure continuous emphasis on fundamental safety practices and to refine incident management processes, aiming to prevent future occurrences and learn from past events.

BlueScope Steel actively cultivates a diverse and inclusive workforce, with a notable focus on advancing gender equity across its international operations. In fiscal year 2024, the company successfully met its gender balance targets for both its Board and Executive Leadership Team.

Furthermore, BlueScope reported an increase in the overall percentage of women within its workforce, reaching 25% in FY2024. This commitment to inclusivity has been recognized externally, with the company receiving an Inclusive Workplace award in New Zealand, underscoring its tangible progress in creating a more equitable environment.

BlueScope's operations are deeply connected to the well-being of the communities where it operates, with the company actively working to foster positive social impacts. Recent community sentiment studies conducted across Australia, North America, and New Zealand consistently reflect a robust business reputation at its steelmaking facilities, underscoring this commitment.

The company's dedication to community development is further exemplified by its active involvement in significant industry events, such as participation in the Global Safety Innovation Summit. This engagement highlights BlueScope's focus on creating shared value and contributing to the advancement of community well-being and safety standards.

Customer Demand for Sustainable Products

Customers increasingly expect products that are environmentally friendly, pushing steelmakers like BlueScope to adopt cleaner manufacturing processes and materials. This shift is evident in the growing market for recycled content and low-carbon steel. For instance, by 2025, the global demand for green steel is projected to significantly increase, with major automotive and construction sectors leading the charge.

BlueScope addresses this by collaborating with clients to develop products that prioritize durability, efficient material usage, and the potential for future reuse. This customer-centric approach involves transparently sharing sustainability data, such as the embodied carbon of their steel products. This commitment is vital for maintaining market relevance and ensuring sustained growth.

- Growing Green Steel Market: Projections indicate a substantial rise in green steel demand by 2025, driven by industries focused on sustainability.

- Customer Collaboration: BlueScope partners with customers on sustainable design, emphasizing longevity and material efficiency.

- Transparency in Sustainability: The company provides detailed information on the environmental credentials of its steel offerings.

- Market Competitiveness: Aligning with customer values on sustainability is key to BlueScope's competitive edge and long-term viability.

Impact of Urbanization and Population Growth

Rapid economic development and increasing urbanization, particularly in emerging economies like India, are significant drivers for the steel industry. India's urban population is projected to reach 600 million by 2030, fueling demand for construction and infrastructure projects. This trend directly benefits global steel producers like BlueScope, as steel is a fundamental material in urban development.

BlueScope's strategic advantage lies in its global footprint, enabling it to tap into these growth markets. For instance, the company's presence in Southeast Asia, a region experiencing substantial urbanization, positions it well to meet rising demand for building materials. This demographic shift translates into sustained demand for steel products across various sectors.

- Urban Population Growth: India's urban population is expected to grow significantly, driving construction demand.

- Infrastructure Development: Urbanization necessitates increased investment in infrastructure, a key consumer of steel.

- Emerging Market Demand: Developing nations with growing populations and economies are primary markets for steel.

- BlueScope's Geographic Diversification: The company's presence in multiple growing regions allows it to capitalize on these trends.

BlueScope Steel prioritizes a strong safety culture, implementing global programs like 'Refocus on Safety' to enhance workplace security. Despite these efforts, the company experienced incidents leading to permanent incapacities in FY2024, underscoring the ongoing need for vigilance and improvement in safety protocols.

The company actively promotes diversity and inclusion, achieving its gender balance targets for the Board and Executive Leadership Team in FY2024, with women comprising 25% of its total workforce. This commitment was recognized with an Inclusive Workplace award in New Zealand.

BlueScope's community engagement is reflected in consistently positive sentiment studies across Australia, North America, and New Zealand, indicating a strong business reputation. Their participation in industry events like the Global Safety Innovation Summit further demonstrates a commitment to shared value and community well-being.

Technological factors

The steel sector, including BlueScope, is embracing digital transformation, with AI and automation becoming key drivers. BlueScope utilizes AI for predictive maintenance, aiming to minimize downtime and enhance operational efficiency. This focus on technology is crucial for staying competitive in the evolving market.

BlueScope is actively investing in and trialing innovative technologies to lower emissions in ironmaking, such as utilizing natural gas and hydrogen. This includes participation in significant projects like Project IronFlame and NeoSmelt, which are exploring direct reduced iron (DRI) and electric smelting furnaces (ESF) as pathways to drastically cut greenhouse gas output.

These technological advancements are fundamental to BlueScope's commitment to achieving its ambitious net-zero emissions targets, demonstrating a proactive approach to environmental stewardship within the steel industry.

BlueScope's strategic adoption of Electric Arc Furnace (EAF) technology, notably at its Glenbrook site in New Zealand, is a cornerstone of its decarbonisation efforts. This significant investment, supported by the New Zealand government, targets a substantial reduction in greenhouse gas emissions.

The EAF upgrade is projected to cut Scope 1 and 2 GHG emissions at Glenbrook by around 55%. This technological shift is crucial for increasing the utilization of recycled steel, a key factor in lowering the overall carbon intensity of steel production.

Product Innovation for Sustainability

BlueScope is actively innovating its steel products to boost sustainability, focusing on circular design principles. This means creating materials that last longer, use resources efficiently, and can be adapted for new uses later on. For instance, their TRUECORE® steel is designed with circularity in mind, making it easier to reuse and recycle.

The company also highlights how its steel, like XLERPLATE®, plays a crucial role in the growth of renewable energy. This steel is used in building essential components for wind turbines, directly contributing to the expansion of clean energy infrastructure. This strategic focus on sustainable product development and application in green technologies positions BlueScope favorably amidst increasing environmental regulations and market demand for eco-friendly solutions.

- Circular Design: TRUECORE® steel is engineered for longevity and adaptability, supporting reuse and reducing waste in construction.

- Renewable Energy Applications: XLERPLATE® steel is a key material for manufacturing wind turbine towers, a sector experiencing significant global growth.

- Sustainability Focus: BlueScope's commitment to product innovation for sustainability aligns with global trends and regulatory pressures favoring greener building materials.

Advanced Coating and Painting Technologies

BlueScope Steel's focus on advanced coating and painting technologies is a key technological driver. The company's continuous investment in these areas ensures its product competitiveness. This includes the development and application of proprietary technologies like AM metal coating.

The expansion into US flat steel midstream facilities, incorporating cold rolling and metal coating, directly leverages these advanced technologies. This strategic move aims to bolster BlueScope's presence in the pre-paint market, a sector heavily reliant on sophisticated coating processes. For instance, BlueScope's 2024 financial reports highlight continued capital expenditure in these value-adding segments.

- Technological Investment: BlueScope's commitment to R&D in coating and painting processes.

- Proprietary Technology: The strategic advantage of its AM metal coating technology.

- US Expansion: New facilities for cold rolling and metal coating to support advanced applications.

- Market Focus: Enhancing capabilities in the pre-paint steel market.

Technological advancements are central to BlueScope's strategy, particularly in decarbonization and product innovation. The company is actively investing in technologies like Electric Arc Furnaces (EAFs) and exploring hydrogen and natural gas for ironmaking, as seen in projects like Project IronFlame. These efforts aim to significantly reduce greenhouse gas emissions, with the Glenbrook EAF upgrade targeting a 55% reduction in Scope 1 and 2 emissions. BlueScope's commitment to R&D in advanced coating and painting technologies, including proprietary AM metal coating, is also a key differentiator, supporting its expansion in the US pre-paint market.

| Technology Focus | Initiative/Application | Impact/Goal | Data Point/Year |

|---|---|---|---|

| Decarbonization | Electric Arc Furnace (EAF) at Glenbrook | 55% reduction in Scope 1 & 2 GHG emissions | Projected post-upgrade |

| Decarbonization | Hydrogen/Natural Gas in Ironmaking | Exploring pathways to cut greenhouse gas output | Project IronFlame, NeoSmelt |

| Product Innovation | Advanced Coating & Painting | Enhancing product competitiveness, US midstream expansion | Continued capital expenditure in 2024 |

| Sustainable Products | Circular Design (TRUECORE®) | Longevity, reuse, and recyclability | Product feature |

| Sustainable Products | Renewable Energy Applications (XLERPLATE®) | Component for wind turbine towers | Market application |

Legal factors

BlueScope Steel navigates a complex web of global trade regulations, including anti-dumping duties that can significantly affect its import and export operations. These duties are designed to protect domestic industries from unfairly priced foreign competition, and their application can alter the cost-effectiveness of international sourcing and sales for companies like BlueScope.

The company has directly experienced the impact of these regulations, as evidenced by legal challenges. For instance, a dispute involving its US affiliate highlighted the complexities and potential financial ramifications of non-compliance or challenges to existing duty structures. Such cases underscore the need for meticulous adherence to international trade law.

Ensuring robust compliance with these intricate trade laws is paramount for BlueScope to maintain its market access across various regions and to prevent substantial penalties. For example, in 2023, the US International Trade Commission continued investigations into certain steel products, demonstrating the ongoing scrutiny and the dynamic nature of these trade policies that directly influence companies operating in the global steel market.

BlueScope Steel has faced considerable legal scrutiny regarding competition and anti-cartel laws. In 2022, the Federal Court of Australia imposed a $57.5 million penalty on BlueScope for its involvement in cartel conduct, specifically price-fixing arrangements in the steel market. This action by the Australian Competition and Consumer Commission (ACCC) underscores the strict enforcement of competition laws.

The company is currently contesting these findings through an appeal process, indicating an ongoing legal battle and its commitment to addressing these allegations. This situation highlights the critical importance of adhering to anti-cartel regulations within the Australian market and the potential financial repercussions of non-compliance.

BlueScope Steel is committed to combating modern slavery, publishing an annual Modern Slavery Statement that outlines its efforts to identify and mitigate risks of human trafficking and forced labor within its operations and supply chains. This proactive approach aligns with and often exceeds the requirements of the Australian Modern Slavery Act, underscoring the company's dedication to ethical conduct and human rights globally.

Environmental Regulations and Carbon Pricing

BlueScope Steel faces a landscape of tightening environmental laws and new carbon pricing systems, like the EU's Carbon Border Adjustment Mechanism (CBAM). These legal frameworks are pushing industries towards cleaner production methods to maintain global competitiveness.

The company's strategic investments in reducing emissions and adopting more sustainable technologies are significantly influenced by these evolving legal mandates. For instance, the EU's CBAM, which began its transitional phase in October 2023, will require importers of certain goods, including steel, to purchase carbon certificates, directly impacting costs for non-EU producers.

- Environmental Regulations: BlueScope must comply with a growing number of national and international environmental standards impacting emissions, waste management, and resource use.

- Carbon Pricing: Emerging carbon pricing mechanisms, such as emissions trading schemes and border adjustments, directly affect operational costs and necessitate investment in low-carbon solutions.

- Incentives for Greener Tech: These regulations create a legal imperative and a market advantage for companies that invest in and adopt technologies that lower their carbon footprint.

- CBAM Impact: The EU's Carbon Border Adjustment Mechanism, starting its full implementation in 2026, will impose costs on embedded carbon in imported steel, influencing BlueScope's export strategies and production choices.

Workplace Safety Regulations and Compliance

BlueScope Steel's operations are heavily influenced by workplace safety regulations across the 15 countries where it operates. The company's dedication to health and safety, exemplified by its 'Refocus on Safety' program, is a direct response to these legal mandates. Continuous improvement in incident management is paramount for ensuring compliance with occupational health and safety laws, thereby safeguarding employees and maintaining its social license to operate.

Adherence to stringent safety standards is not merely a matter of compliance but a core operational imperative. For instance, in Australia, the Work Health and Safety Act 2011 (WHS Act) sets a high bar for employer responsibilities. BlueScope's commitment to reducing its Total Recordable Injury Frequency Rate (TRIFR) is a key performance indicator directly linked to these legal obligations. In 2023, the company reported a TRIFR of 1.1, reflecting ongoing efforts to meet and exceed safety benchmarks.

- Legal Compliance: BlueScope must adhere to diverse occupational health and safety laws in all operating regions, including Australia, North America, and Asia.

- 'Refocus on Safety' Program: This initiative is designed to embed safety into all aspects of the business, ensuring alignment with regulatory requirements and best practices.

- Incident Management: Robust systems for reporting, investigating, and learning from incidents are crucial for demonstrating compliance and preventing future occurrences.

- Social License to Operate: Maintaining a strong safety record is vital for community acceptance and continued operational permits, directly influenced by regulatory oversight.

BlueScope Steel operates under a stringent legal framework governing competition and trade practices. The company faced a significant $57.5 million penalty in 2022 from the Federal Court of Australia for cartel conduct, highlighting the severe consequences of anti-competitive behavior. This ongoing legal challenge underscores the critical need for strict adherence to competition laws to avoid substantial financial penalties and reputational damage.

Global trade regulations, including anti-dumping duties, directly impact BlueScope's international operations and market access. The company's experience with legal disputes, such as those involving its US affiliate, demonstrates the complexities and financial risks associated with navigating these trade laws. In 2023, ongoing investigations by bodies like the US International Trade Commission reflect the dynamic and scrutinizing nature of global trade policy.

Environmental legislation, particularly carbon pricing mechanisms like the EU's Carbon Border Adjustment Mechanism (CBAM), is reshaping operational costs and strategic investments. With CBAM's transitional phase beginning in October 2023 and full implementation slated for 2026, BlueScope must adapt its production and export strategies to account for embedded carbon costs. This legal push towards cleaner production methods incentivizes investment in sustainable technologies to maintain global competitiveness.

Workplace safety laws are a fundamental legal consideration across BlueScope's global operations. The company's 'Refocus on Safety' program and its commitment to reducing its Total Recordable Injury Frequency Rate (TRIFR), which stood at 1.1 in 2023, are direct responses to these mandates. Compliance with these laws, such as Australia's Work Health and Safety Act 2011, is crucial for employee well-being, operational continuity, and maintaining its social license to operate.

| Legal Area | Key Regulation/Event | Impact on BlueScope | Year/Period |

|---|---|---|---|

| Competition Law | Cartel Conduct Penalty | $57.5 million penalty imposed; ongoing appeal | 2022 (penalty), ongoing (appeal) |

| Trade Regulations | Anti-dumping Duties / Trade Disputes | Affects import/export costs and market access; legal challenges | Ongoing, with specific US affiliate dispute noted |

| Environmental Law | EU Carbon Border Adjustment Mechanism (CBAM) | Introduces costs for embedded carbon in exports to EU; drives investment in low-carbon tech | Transitional phase from Oct 2023, full implementation 2026 |

| Workplace Safety | Occupational Health & Safety Laws | Requires adherence to stringent safety standards; drives safety programs | Ongoing compliance; TRIFR of 1.1 reported in 2023 |

Environmental factors

BlueScope Steel is actively pursuing ambitious greenhouse gas emission reduction targets. The company aims for a 12% reduction in global steelmaking GHG emissions intensity by 2030 and has set a net-zero target for 2050.

These commitments are not just aspirational; BlueScope reported a 12.0% reduction in global steelmaking GHG emissions intensity in FY2024, measured against their FY2018 baseline. This achievement highlights tangible progress toward their stated climate objectives.

BlueScope is heavily investing in green steel production, aiming to slash its carbon emissions. This includes exploring hydrogen-based steelmaking and using renewable energy in its processes. For instance, their Project IronFlame, a collaboration with Rio Tinto and Baowu, is a key part of this strategy, focusing on hydrogen-based Direct Reduced Iron (DRI) technology.

The company is also involved in the NeoSmelt project, which aims to develop electric smelting furnaces (ESF) powered by renewable energy sources. These investments are crucial for BlueScope to meet its decarbonisation targets, with a stated ambition to reduce Scope 1 and 2 emissions by 30% by 2030 compared to a 2021 baseline.

BlueScope is actively integrating circular economy principles into its business model, emphasizing the durability, reuse, and recyclability of its steel products. This commitment is evident in their collaborations with customers to foster designs that prioritize longevity and material efficiency, thereby promoting steel's role in a circular economy.

By focusing on adaptive reuse and maximizing steel's value across its entire lifecycle, BlueScope aims to significantly reduce waste generation. For instance, in 2023, the company reported a 92% recycling rate for steel scrap across its global operations, a testament to its circularity efforts.

Renewable Energy Integration

Steel manufacturers like BlueScope are increasingly investing in technologies to cut carbon emissions, with renewable energy playing a key role in their green production transitions. BlueScope's exploration of lower emission ironmaking using natural gas and hydrogen hinges on securing cost-competitive, large-scale renewable energy sources. This strategic integration is fundamental for achieving substantial greenhouse gas (GHG) reductions.

The global push for decarbonization is directly impacting the steel industry. For instance, by 2023, renewable energy sources accounted for approximately 30% of the global electricity generation, a figure expected to climb significantly in the coming years, making it a more viable and cost-effective option for industrial energy needs.

- Renewable Energy Investment: BlueScope's commitment to reducing its carbon footprint necessitates significant investment in renewable energy infrastructure and technologies.

- Hydrogen as a Fuel: The company's strategic focus on hydrogen as a potential fuel source for ironmaking is directly tied to the availability and cost-effectiveness of green hydrogen, often produced using renewable electricity.

- GHG Reduction Targets: Successful integration of renewables is crucial for BlueScope to meet its ambitious greenhouse gas reduction targets, aligning with global climate action goals.

Responsible Supply Chain Practices

BlueScope's commitment to responsible supply chain practices is a key environmental focus, aiming to embed sustainability throughout its value chain. This includes working with suppliers to uphold environmental standards, a process detailed in their annual sustainability reports.

In 2024, BlueScope continued to emphasize supplier engagement on environmental performance, with a goal to increase the proportion of key suppliers meeting their sustainability criteria. For instance, their 2023 sustainability report indicated progress in assessing and engaging with suppliers on issues like greenhouse gas emissions and waste management.

- Supplier Audits: BlueScope conducts regular audits of its key suppliers to ensure adherence to environmental codes of conduct.

- Sustainable Sourcing: Efforts are underway to increase the sourcing of raw materials from suppliers with demonstrated environmental certifications.

- Traceability: The company is enhancing the traceability of its supply chain to better monitor and manage environmental impacts from origin to delivery.

BlueScope is actively pursuing ambitious greenhouse gas emission reduction targets, aiming for a 12% reduction in global steelmaking GHG emissions intensity by 2030 and net-zero by 2050. The company reported a 12.0% reduction in global steelmaking GHG emissions intensity in FY2024 against their FY2018 baseline, showcasing tangible progress.

Investments in green steel production, including hydrogen-based Direct Reduced Iron (DRI) technology through Project IronFlame and electric smelting furnaces (ESF) powered by renewables via the NeoSmelt project, are crucial for meeting decarbonisation goals. BlueScope aims to reduce Scope 1 and 2 emissions by 30% by 2030 compared to a 2021 baseline.

The company is integrating circular economy principles, emphasizing product durability, reuse, and recyclability, evident in their 2023 report of a 92% recycling rate for steel scrap globally. BlueScope's exploration of lower emission ironmaking hinges on securing cost-competitive, large-scale renewable energy sources.

Environmental focus extends to responsible supply chain practices, with efforts in 2024 to increase key suppliers meeting sustainability criteria, including audits and enhanced traceability for managing environmental impacts.

| Key Environmental Metrics | 2023 Data | Target | Notes |

| GHG Emissions Intensity Reduction (Global Steelmaking) | 12.0% (FY2024 vs FY2018) | 12% by 2030 | Achieved 2024 target early. |

| Steel Scrap Recycling Rate (Global Operations) | 92% (2023) | N/A | Demonstrates circularity commitment. |

| Scope 1 & 2 Emissions Reduction | N/A | 30% by 2030 (vs 2021 baseline) | Progress dependent on renewable energy integration. |

PESTLE Analysis Data Sources

Our Bluescope Steel PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable industry associations, and leading economic forecasting agencies. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the steel industry.