Bluescope Steel Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bluescope Steel Bundle

Bluescope Steel's marketing prowess is evident in its strategic approach to the 4Ps. Their product portfolio, encompassing innovative steel solutions, is a cornerstone of their success, catering to diverse construction and industrial needs.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Bluescope Steel's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

BlueScope Steel's diverse product portfolio is a cornerstone of its market strategy, offering everything from foundational steel slabs and hot rolled coil to specialized plate products. This breadth ensures they can meet a vast spectrum of demands across numerous industries.

The company's commitment to quality is evident in its engineered steel solutions, designed for superior performance in both construction and industrial applications. This focus on excellence underpins customer trust and product reliability.

Key to their product offering are highly recognized brands like COLORBOND® steel and ZINCALUME® steel, which have become industry benchmarks. In fiscal year 2023, BlueScope reported strong performance, with underlying EBIT for the year reaching A$2.7 billion, reflecting the market's demand for their quality steel products and brands.

BlueScope's Specialized Building Solutions, including brands like Butler® and Varco Pruden®, offer engineered solutions beyond basic steel. These are tailored for industrial and commercial needs, such as manufacturing facilities and warehouses, providing customized structures.

The company is actively expanding its production capabilities. For instance, a new plant in Western Sydney is set to boost output of light gauge steel framing (TRUCORE) and COLORBOND® steel, crucial for roofing and walling applications. This investment reflects a commitment to meeting growing demand for their specialized building products.

BlueScope Steel is actively pursuing innovation and sustainability, investing in R&D to improve its well-regarded brands and adapt to new technologies and environmental concerns. They are channeling resources into talent, partnerships, and advanced technology to bolster these research and development initiatives.

This commitment includes investigating cleaner ironmaking methods, such as utilizing natural gas and hydrogen. Furthermore, BlueScope is developing programs like Environmental Product Declarations (EPDs) and ecolabels to showcase products that are better for the environment and support green building certifications.

Quality Assurance and Performance

Bluescope Steel prioritizes rigorous quality assurance, implementing formalized processes to guarantee products consistently meet stringent specifications, thereby minimizing defects and ensuring reliable, high-performance steel for the building and construction sectors. This dedication is crucial for cultivating customer confidence and fostering long-term loyalty.

Their steel undergoes extensive testing to verify durability and performance across a wide array of environmental conditions, confirming suitability for diverse applications. For instance, in 2024, Bluescope reported a significant reduction in product non-conformance rates, attributing this success to enhanced quality control measures across their manufacturing facilities.

- Product Durability Testing: Ensuring steel withstands various environmental stresses.

- Defect Minimization Programs: Implementing Six Sigma methodologies to reduce imperfections.

- Customer Feedback Integration: Using client input to refine quality standards and performance benchmarks.

- Performance Certification: Adhering to international standards like ISO 9001 for quality management.

Tailored Solutions for Specific Industries

BlueScope Steel excels in tailoring its offerings to meet the distinct requirements of various sectors. For instance, in the building and construction industry, they provide specialized metallic coated steel crucial for roofing, walling, and framing applications. This focus on industry-specific solutions is a key element of their product strategy.

Their product portfolio is designed with specific applications in mind. This includes a range of plate products such as mild steel, high tensile steel, and weather-resistant steel, all engineered to perform under different conditions. This detailed product differentiation caters directly to the performance demands of their target markets.

The company's commitment to tailored solutions is evident across multiple industries, including manufacturing and automotive. By understanding the unique needs of each segment, BlueScope ensures its steel materials and innovative solutions provide optimal value and performance. In 2024, the global steel market saw continued demand from these sectors, with BlueScope leveraging its specialized product lines to capture market share.

BlueScope’s approach ensures their products align with customer preferences and industry standards. This includes:

- Metallic coated steel for durable building envelopes.

- High tensile steel for structural integrity in automotive applications.

- Weather-resistant steel for demanding environmental conditions.

- A broad range of plate products meeting diverse manufacturing needs.

BlueScope Steel's product strategy centers on providing a diverse and high-quality range of steel solutions, from foundational materials to specialized building components. Brands like COLORBOND® steel and ZINCALUME® steel are industry benchmarks, demonstrating the company's commitment to excellence and innovation. In fiscal year 2023, BlueScope reported underlying EBIT of A$2.7 billion, underscoring the market's strong demand for their premium steel products.

The company actively invests in expanding production capabilities and enhancing product performance through R&D, focusing on sustainability and cleaner manufacturing methods. This forward-looking approach ensures BlueScope remains a leader in providing tailored steel solutions that meet the evolving needs of the construction and manufacturing sectors.

| Product Category | Key Brands/Examples | Target Industries | Fiscal Year 2023 Performance Indicator |

|---|---|---|---|

| Foundational Steel | Steel slabs, Hot rolled coil | Manufacturing, Construction | Contributed to overall A$2.7 billion underlying EBIT |

| Coated Steel | COLORBOND® steel, ZINCALUME® steel | Building & Construction (Roofing, Walling) | High market recognition and demand |

| Engineered Building Solutions | Butler®, Varco Pruden® | Industrial, Commercial (Manufacturing facilities, Warehouses) | Tailored structures for specific needs |

| Specialized Plate Products | Mild steel, High tensile steel, Weather-resistant steel | Manufacturing, Automotive, Infrastructure | Meeting diverse performance demands |

What is included in the product

This analysis provides a comprehensive breakdown of Bluescope Steel's marketing mix, examining its product innovation, pricing strategies, distribution channels, and promotional activities to understand its market positioning and competitive advantages.

This analysis distills Bluescope Steel's 4Ps marketing mix into actionable strategies that address key customer pain points, offering a clear roadmap for enhanced market penetration and customer satisfaction.

Place

BlueScope Steel boasts an extensive global manufacturing footprint, operating over 160 sites across 15 countries. This vast network includes key facilities like the Port Kembla Steelworks in Australia, the North Star steel mill in Ohio, USA, and the Glenbrook site in New Zealand. These locations are consistently receiving significant investment for capacity expansion and crucial upgrades, underscoring BlueScope's commitment to enhancing its production capabilities.

This widespread operational base is a cornerstone of BlueScope's strategy, enabling localized production and a high degree of responsiveness to diverse regional market demands. The company's strategic investments in 2024 and into 2025 are focused on bolstering these core manufacturing hubs, ensuring efficient supply chains and competitive market positioning worldwide.

Bluescope Steel employs a multi-channel distribution strategy to ensure broad product accessibility. This includes direct sales to major industrial clients and leveraging a robust network like BlueScope Distribution, which serves as a comprehensive provider for steel and aluminum products, processing, and solutions across Australia.

BlueScope Distribution's role is critical, acting as a single source for a wide array of steel and aluminum products, alongside value-added processing and integrated solutions. This approach streamlines the supply chain, making it easier for diverse customer segments, from large construction projects to smaller building operations, to access necessary materials efficiently.

BlueScope is prioritizing investment in supply chain and logistics to bolster its operational efficiency. This includes expanding internal scrap processing, as seen at their North Star mill, which is crucial for securing raw materials and managing costs. For example, in fiscal year 2023, BlueScope reported increased scrap utilization rates, contributing to improved cost competitiveness.

Further value chain integration is under consideration, with potential developments like a midstream facility in the US being evaluated. This strategic move aims to capture more value and enhance control over product flow, ultimately ensuring greater product availability and responsiveness to market demands. While specific investment figures for these initiatives are subject to ongoing review, the focus remains on building a more resilient and integrated supply network.

Proximity to Key Markets and Customer Segments

BlueScope's strategic placement of operations across Australia, New Zealand, Asia, and North America is a deliberate move to be physically close to its core customer bases. This proximity to key markets like building and construction, manufacturing, and automotive sectors is crucial for efficient service delivery and capturing market share.

This geographical advantage directly translates into tangible benefits for both BlueScope and its customers. By reducing the distance to its target industries, the company can significantly shorten lead times and lower transportation expenses, making its products more competitive and convenient to procure.

- Proximity to Major Construction Hubs: BlueScope's facilities are situated to serve burgeoning urban development and infrastructure projects, a key driver for steel demand.

- Reduced Logistics Costs: For example, in FY2024, BlueScope reported significant savings in its logistics network due to optimized facility locations, contributing to a more competitive pricing structure.

- Enhanced Customer Responsiveness: The ability to deliver products quickly and reliably from nearby plants improves customer satisfaction and strengthens relationships, especially critical in fast-paced construction environments.

- Targeted Market Penetration: New investments, such as the planned expansion of its Colorbond® steel production capacity in Western Sydney, directly address the growing demand from Australia's housing and infrastructure sectors.

Digital Platforms and Customer Access

BlueScope is actively enhancing customer access through digital platforms, aiming to streamline interactions and boost operational efficiency. This includes providing comprehensive product information online, and while direct online sales channels aren't heavily publicized, their focus on digital transformation signals a move towards modern customer engagement.

Their commitment to transparency is evident in the readily available investor briefings and sustainability reports online. For instance, BlueScope's 2023 Annual Report, accessible via their investor relations portal, details their strategic initiatives, including digital advancements.

- Digital Presence: BlueScope utilizes digital channels for product information dissemination and customer support.

- Information Accessibility: Key corporate documents like annual reports and sustainability reports are available online, fostering transparency.

- Customer Engagement: The company's digital transformation efforts suggest a strategy to improve overall customer access and experience.

BlueScope's strategic placement of manufacturing and distribution facilities is a key element of its 'Place' strategy. By operating over 160 sites across 15 countries, including major hubs in Australia, the USA, and New Zealand, BlueScope ensures proximity to its core customer bases in construction and manufacturing.

This geographical advantage directly translates into reduced logistics costs and shorter lead times, enhancing customer responsiveness. For instance, investments in 2024 and 2025 are focused on upgrading these core manufacturing sites to further optimize supply chains.

BlueScope's distribution network, exemplified by BlueScope Distribution, acts as a critical link, providing localized access to steel and aluminum products and processing solutions. This multi-channel approach ensures broad product accessibility for diverse customer segments.

The company is also prioritizing investment in its supply chain and logistics, including expanding internal scrap processing, as seen at their North Star mill, to improve cost competitiveness and secure raw materials.

| Region | Key Facilities | Strategic Focus |

|---|---|---|

| Australia | Port Kembla Steelworks, Western Sydney | Capacity expansion, serving housing & infrastructure |

| USA | North Star, Ohio | Upgrades, scrap processing expansion |

| New Zealand | Glenbrook | Crucial upgrades for production |

Preview the Actual Deliverable

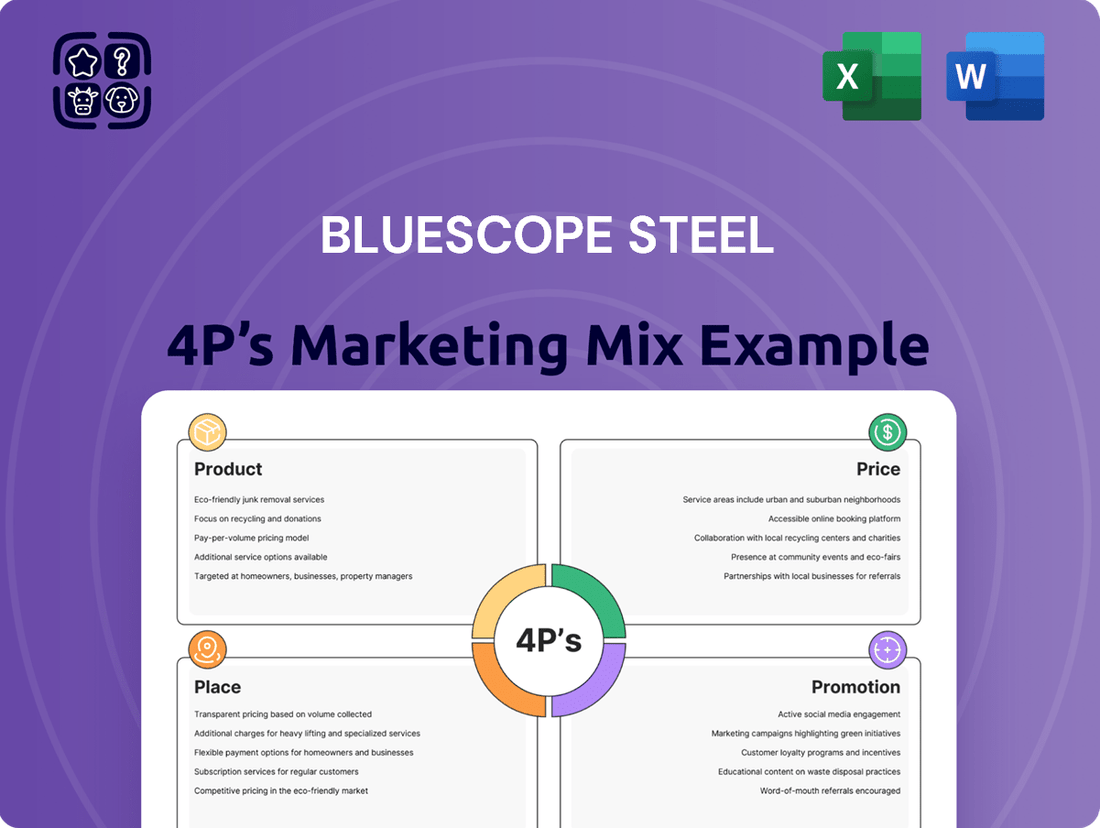

Bluescope Steel 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of BlueScope Steel's Marketing Mix (4Ps) details their product strategies, pricing models, distribution channels, and promotional activities. You'll gain a clear understanding of how these elements work together to position BlueScope in the market.

Promotion

BlueScope leverages its robust brand recognition, built on decades of trust in its flagship products like COLORBOND® steel and ZINCALUME® steel. These brands are synonymous with quality and innovation in the construction sector.

The company's strong corporate reputation is a significant asset, particularly in key markets like Australia, the US, and New Zealand. This positive standing was further solidified by its performance in the 2024 RepTrak study, which measures corporate reputation.

BlueScope Steel actively promotes its dedication to sustainability and climate action as a core element of its marketing strategy. This commitment is clearly communicated through their regular publication of Sustainability Reports and Climate Action Reports, which transparently outline their progress in lowering greenhouse gas emissions and fostering responsible supply chain management.

Further amplifying their environmental stewardship message, BlueScope's engagement in significant industry events like TRANSFORM 2025 and their recognition as a World Steel Sustainability Champion for 2025 underscore their proactive approach. For instance, their 2024 Sustainability Report detailed a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to their 2018 baseline, demonstrating tangible progress in their climate goals.

BlueScope actively partners with industry leaders like Rio Tinto and BHP on crucial initiatives such as NeoSmelt, aiming to pioneer lower-emission ironmaking. This collaborative approach underscores their commitment to advancing the steel sector's sustainability profile.

By hosting investor briefings and participating in key industry conferences, BlueScope effectively communicates its strategic vision and dedication to innovation. For instance, their participation in the 2024 Australian Steel Institute Conference highlighted advancements in sustainable steel production, reinforcing their industry leadership.

Targeted Marketing and s

BlueScope Steel employs targeted promotional strategies to connect with key audiences. A prime example is their COLORBOND® STEEL THE SHOW campaign, which incentivizes homeowners and builders to use their products by offering prize opportunities. This approach directly fosters engagement and encourages adoption among specific customer groups.

These campaigns are meticulously crafted to resonate with both end-users and the professional installers they rely on. By creating direct lines of communication and offering tangible rewards, BlueScope aims to build brand loyalty and drive sales within these crucial segments.

- Targeted Campaigns: COLORBOND® STEEL THE SHOW incentivizes product usage with prize giveaways.

- Customer Engagement: Promotions aim to boost awareness, interest, and desire among homeowners and builders.

- Channel Focus: Campaigns directly engage end-users and their trusted installer networks.

Corporate Communications and Investor Relations

Bluescope Steel's corporate communications and investor relations are central to its marketing mix, ensuring transparency and engagement. The company regularly publishes its financial results, annual reports, and investor presentations, keeping stakeholders informed about its performance and strategic direction. For instance, in its FY24 results, Bluescope reported a net profit after tax of AUD 1.12 billion, demonstrating its operational resilience.

These communications highlight Bluescope's commitment to its people-centred approach, emphasizing safety initiatives and community engagement. This focus aims to foster trust and build strong, positive relationships with investors, customers, and suppliers alike. The company actively shares updates on its sustainability efforts and its contribution to local communities, reinforcing its brand as a responsible corporate citizen.

Key aspects of their investor relations strategy include:

- Regular Disclosure: Timely and comprehensive release of financial and operational information.

- Stakeholder Engagement: Active dialogue with investors, analysts, customers, and suppliers.

- Brand Messaging: Emphasis on people, safety, and community to build trust and reputation.

- Strategic Outlook: Clear communication of the company's future plans and growth drivers.

BlueScope's promotional efforts center on building brand equity through a blend of targeted campaigns and strong corporate communications. The COLORBOND® STEEL THE SHOW campaign, for instance, directly engages homeowners and builders with incentives, fostering product adoption. This strategic outreach, coupled with consistent communication of their sustainability leadership and financial performance, reinforces their market position.

The company's commitment to transparency is evident in its regular disclosure of financial results, such as the reported FY24 net profit after tax of AUD 1.12 billion, and its active participation in industry events like TRANSFORM 2025. These actions build trust and highlight their dedication to innovation and responsible operations.

BlueScope's promotional mix also emphasizes its people-centric approach and community engagement, aiming to cultivate positive relationships across all stakeholder groups. This holistic strategy, supported by tangible achievements like a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity by 2024 from a 2018 baseline, strengthens its brand reputation.

| Promotion Element | Key Initiatives | Objective | 2024/2025 Data/Focus |

|---|---|---|---|

| Brand Building | COLORBOND® STEEL THE SHOW | Drive product usage and brand loyalty | Incentivized use, prize opportunities |

| Corporate Communications | Sustainability Reports, Investor Briefings | Enhance reputation, inform stakeholders | FY24 Net Profit After Tax: AUD 1.12 billion; TRANSFORM 2025 participation |

| Sustainability Messaging | Climate Action Reports, Industry Partnerships | Highlight environmental commitment | 15% reduction in Scope 1 & 2 GHG emissions intensity (vs. 2018); World Steel Sustainability Champion 2025 |

Price

BlueScope Steel likely employs a value-based pricing strategy, aligning prices with the superior quality and engineered solutions it provides across demanding sectors like construction and automotive. This approach focuses on the tangible benefits and reliability customers receive, rather than simply offering the lowest cost. For instance, in 2024, the company's commitment to innovation in coated steel products, such as COLORBOND® steel, supports premium pricing by offering enhanced durability and aesthetic appeal, directly translating to long-term value for builders and manufacturers.

BlueScope navigates a competitive global steel landscape marked by fluctuating steel prices and spreads, alongside persistent cost inflation. This environment necessitates a keen awareness of competitor pricing strategies, market demand levels, and broader economic trends to inform their own pricing decisions.

The company's financial results for FY2024, which saw a negative impact from reduced Asian steel spreads, underscore how sensitive BlueScope's pricing power is to these dynamic market forces.

BlueScope Steel's pricing strategy is heavily influenced by the fluctuating costs of key raw materials. For instance, iron ore and hard coking coal prices directly impact production expenses. In 2024, the global steel market has seen volatility in these input costs, affecting BlueScope's cost structure and pricing decisions.

Global trade policies, including tariffs, also play a crucial role. US tariffs on imported steel, for example, can artificially inflate domestic steel prices. This dynamic was highlighted by BlueScope's CEO, who indicated potential benefits for the company if these higher prices persist, impacting the competitiveness and affordability of their products.

Strategic Capital Management and Shareholder Returns

BlueScope Steel's capital management strategy is designed to deliver value to shareholders while funding growth. The company targets distributing at least 50% of its free cash flow back to shareholders through dividends and share buy-backs. This commitment ensures a balanced approach between reinvesting in the business and rewarding investors.

This financial discipline indirectly supports BlueScope's pricing power. By maintaining financial stability and a focus on long-term sustainability, the company can strategically invest in product innovation and operational enhancements. These improvements can justify premium pricing and improve competitiveness in the market.

- Shareholder Returns: BlueScope aims to return at least 50% of free cash flow to shareholders.

- Financial Stability: A robust capital management framework underpins the company's long-term viability.

- Investment Capability: Financial health enables strategic investments in R&D and operational upgrades.

- Pricing Justification: Investments in product and process improvements support pricing strategies.

Future Outlook and Cost/Productivity Initiatives

Bluescope Steel is targeting around $200 million in annualised cost and productivity savings across the Group. These initiatives are vital for navigating difficult market conditions and will likely shape future pricing by reducing the overall cost base.

The company has announced some price increases slated for early 2025. However, these cost-saving measures are designed to bolster long-term competitiveness, ensuring that any pricing adjustments are sustainable.

- Targeted Savings: Approximately $200 million in annualised cost and productivity improvements.

- Strategic Importance: Crucial for resilience during challenging operating environments.

- Pricing Influence: Optimizing the cost base will inform future pricing strategies.

- Competitiveness: Initiatives aim to ensure Bluescope's long-term market position.

BlueScope Steel's pricing strategy is a delicate balance, influenced by input costs, competitor actions, and global trade dynamics. The company's FY2024 results, impacted by lower Asian steel spreads, highlight this sensitivity. For example, the volatility in iron ore and hard coking coal prices in 2024 directly affects their production expenses and, consequently, their pricing decisions.

Anticipating early 2025 price increases, BlueScope is also implementing significant cost-saving measures, targeting around $200 million in annualised improvements. This dual approach aims to maintain competitiveness while adjusting to market conditions.

The company's value-based pricing, exemplified by COLORBOND® steel, justifies premium pricing through enhanced durability and aesthetics, offering long-term value. This strategy is further supported by a capital management plan that prioritizes shareholder returns while enabling strategic investments in innovation and operational upgrades, which in turn bolster pricing power.

| Pricing Factor | Impact on BlueScope | 2024/2025 Relevance |

| Input Costs (Iron Ore, Coal) | Directly impacts production expenses and cost base. | Volatility in 2024 necessitates careful pricing adjustments. |

| Asian Steel Spreads | Affects profitability and pricing power in key markets. | Negative impact in FY2024 underscores sensitivity to regional market health. |

| Competitor Pricing | Requires strategic alignment to remain competitive. | Ongoing market analysis is crucial for effective pricing. |

| Global Trade Policies (Tariffs) | Can artificially inflate domestic prices, potentially benefiting BlueScope. | US tariffs are a noted factor influencing domestic steel pricing dynamics. |

| Cost Savings Initiatives | Reduces cost base, supporting sustainable pricing. | Target of $200M annualised savings aims to bolster long-term competitiveness. |

4P's Marketing Mix Analysis Data Sources

Our Bluescope Steel 4P's Marketing Mix Analysis is built upon a foundation of verified data, including company annual reports, investor presentations, and official product catalogs. We also incorporate insights from industry publications and market research reports to ensure a comprehensive understanding of their strategic decisions.