Bluescope Steel Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bluescope Steel Bundle

Unlock the strategic blueprint behind Bluescope Steel's success with our comprehensive Business Model Canvas. This detailed analysis dissects their customer segments, value propositions, and revenue streams, offering a clear view of their market dominance. Discover how they leverage key partnerships and manage their cost structure to stay ahead.

Ready to gain a deeper understanding of Bluescope Steel's operational genius? Our full Business Model Canvas provides an in-depth, section-by-section breakdown, perfect for anyone looking to learn from a global leader in steel production. Download it now to accelerate your strategic thinking.

Partnerships

BlueScope Steel’s operations are deeply dependent on reliable access to key inputs like iron ore, coking coal, and scrap steel. These materials form the very foundation of their steel production, making strong supplier relationships paramount. For instance, in 2024, securing stable pricing and availability of these commodities remained a top priority amidst global supply chain fluctuations.

Major mining companies, such as Rio Tinto and BHP, are critical partners for BlueScope. These collaborations are not just about sourcing raw materials but also about jointly exploring and developing more sustainable, lower-emission ironmaking technologies. This strategic alignment is essential for BlueScope's long-term decarbonization goals and ensuring a resilient supply chain.

Bluescope Steel actively collaborates with research institutions and universities to drive innovation in steelmaking, particularly in reducing environmental impact. These partnerships are vital for developing and adopting cutting-edge technologies like electric arc furnaces (EAF) and electric smelting furnaces (ESF).

A prime example is Project NeoSmelt, a joint venture with industry giants Rio Tinto and BHP, focused on advancing smelting technologies. Such collaborations are crucial for staying at the forefront of sustainable steel production, a key strategic imperative.

Efficient transportation and warehousing are crucial for BlueScope's success, ensuring steel products reach customers reliably. BlueScope's logistics partners are key to managing this complex network.

A significant partnership is the seven-year agreement with Toll Group, which handles the transport and warehousing of steel products across vital Australian regions like New South Wales and Victoria. This collaboration underpins timely deliveries and operational efficiency.

Government and Regulatory Bodies

Bluescope Steel actively partners with government and regulatory bodies, recognizing their crucial role in advancing strategic initiatives, especially in decarbonization and large-scale infrastructure. These collaborations are vital for securing support and alignment on ambitious projects.

A significant example is the co-investment with the New Zealand government for the electric arc furnace (EAF) at the Glenbrook site. This partnership is instrumental in Bluescope's commitment to substantially reducing its carbon footprint. By 2024, the company aims to cut its direct emissions intensity by 20% compared to 2018 levels, with the EAF playing a pivotal role in this transition.

- Government Support for Decarbonization: Partnerships facilitate access to funding and policy frameworks essential for emission reduction projects.

- Infrastructure Development: Collaborations with governments are key for supplying steel to major national infrastructure projects.

- Regulatory Alignment: Working with regulatory bodies ensures compliance and fosters an environment conducive to sustainable business practices.

- Strategic Project Funding: Government co-investment, like that for the Glenbrook EAF, de-risks and accelerates critical technological upgrades.

Construction and Building Solution Providers

BlueScope collaborates with a range of construction and building solution providers, including those specializing in engineered building systems and pre-engineered steel structures. These alliances are crucial for integrating BlueScope's high-quality coated and painted steel products into a wide array of building projects.

These partnerships are instrumental in extending BlueScope's market presence and enabling the delivery of complete, integrated building solutions. For instance, in 2024, BlueScope's focus on sustainable building practices likely saw increased collaboration with providers offering green building certifications and materials.

- Engineered Building Systems: Partnerships with companies designing and fabricating custom steel building components.

- Pre-engineered Steel Buildings: Collaborations with manufacturers offering complete steel building kits for various applications.

- Construction Material Suppliers: Working with distributors and suppliers of complementary building materials to offer bundled solutions.

- Innovation in Design and Application: Joint efforts to develop new uses and designs for steel in construction, potentially leveraging advanced manufacturing techniques.

BlueScope Steel's key partnerships extend to technology providers and equipment manufacturers, crucial for maintaining and upgrading its production facilities. These collaborations ensure access to advanced machinery and process innovations, vital for efficiency and environmental performance. For example, in 2024, investments in new blast furnace technologies and rolling mill upgrades likely involved close ties with specialized engineering firms.

The company also engages with downstream manufacturers and distributors who utilize BlueScope's steel products in their own manufacturing processes, such as appliance makers or automotive component suppliers. These relationships are vital for market penetration and understanding evolving customer needs, particularly in sectors prioritizing lightweight and durable materials.

Strategic alliances with financial institutions and investment partners are essential for funding large-scale capital projects and strategic acquisitions. These partnerships provide the necessary financial backing to pursue growth opportunities and technological advancements, as seen in ongoing decarbonization investments.

| Partner Type | Example | Strategic Importance |

|---|---|---|

| Raw Material Suppliers | Rio Tinto, BHP | Ensuring stable supply of iron ore and coking coal, joint development of sustainable technologies. |

| Logistics Providers | Toll Group | Efficient and reliable transportation and warehousing of steel products across key regions. |

| Government Bodies | New Zealand Government | Co-investment in decarbonization projects (e.g., Glenbrook EAF), policy support. |

| Construction Solution Providers | Engineered building system manufacturers | Integrating steel products into building projects, offering complete solutions. |

| Technology & Equipment Providers | Specialized engineering firms | Access to advanced machinery for production efficiency and environmental upgrades. |

What is included in the product

A detailed BlueScope Steel Business Model Canvas, reflecting its strategy of providing innovative steel solutions to diverse customer segments across construction and manufacturing.

This model highlights BlueScope's value propositions, key activities, and revenue streams, offering a clear view of its operational framework and market approach.

Bluescope Steel's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex operations, simplifying understanding for stakeholders.

This visual tool helps identify and address operational inefficiencies or market gaps within their steel production and distribution, streamlining strategic decision-making.

Activities

Steel Manufacturing and Processing is the heart of BlueScope Steel's operations. This involves taking raw materials and transforming them into essential steel products like slabs, hot rolled coil, and plate. The process covers everything from making iron to the finished steel, utilizing advanced technologies such as blast furnaces and electric arc furnaces.

In 2024, BlueScope's North Star BlueScope facility in Ohio, a significant part of its US operations, was undergoing expansion to boost its slab production capacity. This expansion is designed to support the company's growing demand for high-quality steel inputs for its downstream processing and coating businesses.

Coating and painting steel products is a core activity for BlueScope, transforming raw steel into high-value materials. This process imbues the steel with enhanced durability, resistance to corrosion, and desirable aesthetic qualities, crucial for its widespread use in construction and manufacturing.

A prime example is COLORBOND® steel, a flagship product resulting from this key activity. In 2023, BlueScope reported that its coated and painted steel products, including COLORBOND®, contributed significantly to its revenue, reflecting strong market demand for these value-added solutions.

BlueScope is actively investing in research and development to lower its environmental impact, particularly in ironmaking. They are exploring advanced technologies like Direct Reduced Iron (DRI) and Electric Smelting Furnaces (ESF) to cut down greenhouse gas emissions.

A key focus of their R&D is the integration of natural gas and green hydrogen as fuel sources. This strategic shift aims to achieve substantial reductions in their carbon footprint, aligning with global decarbonization efforts.

Supply Chain Management

Bluescope Steel's supply chain management is a critical function, orchestrating the flow of raw materials like iron ore and coking coal to its manufacturing facilities and then delivering finished steel products to customers worldwide. This involves intricate logistics, inventory control, and risk mitigation across diverse geographical regions.

The company places significant emphasis on responsible sourcing and robust supplier relationships. This includes rigorous due diligence and ongoing performance evaluations to ensure ethical practices, quality consistency, and supply chain resilience. For instance, in fiscal year 2023, Bluescope continued to strengthen its supplier partnerships, aiming for greater transparency and sustainability throughout its operations.

- Global Sourcing: Procuring essential raw materials such as iron ore, coal, and alloying metals from a diverse international supplier base.

- Logistics and Distribution: Managing the transportation of raw materials to production sites and finished goods to customers via sea, rail, and road.

- Supplier Relationship Management: Cultivating strong partnerships with key suppliers through performance monitoring, audits, and collaborative initiatives.

- Inventory Optimization: Maintaining optimal stock levels of raw materials and finished products to balance operational needs with cost efficiency.

Sales, Marketing, and Customer Support

Bluescope Steel actively engages diverse sectors, including building and construction, manufacturing, and automotive, to market and sell its steel products. This involves tailored sales strategies and robust marketing campaigns to reach a broad customer base.

The company prioritizes providing comprehensive technical support and innovative solutions to its customers. This focus on customer needs helps foster strong, lasting relationships and addresses specific industry challenges effectively.

- Sales Reach: In the fiscal year 2023, Bluescope Steel reported total sales revenue of AUD 17.7 billion, demonstrating its extensive market presence.

- Customer Engagement: The company serves over 100,000 customers globally, highlighting the breadth of its customer support operations.

- Market Focus: Key markets include Australia, North America, and Asia, where tailored marketing efforts drive product adoption in construction and manufacturing.

BlueScope Steel's key activities center on transforming raw materials into finished steel products and providing value-added solutions to diverse industries. This includes the fundamental processes of steel manufacturing and processing, where raw inputs are converted into essential steel forms. Furthermore, the company excels in coating and painting steel, enhancing its durability and aesthetic appeal for applications like COLORBOND® steel. Crucially, BlueScope invests heavily in research and development, particularly focusing on decarbonization technologies for ironmaking and exploring alternative fuel sources to reduce its environmental impact.

The company also manages a complex global supply chain, ensuring the efficient procurement of raw materials and the timely distribution of finished products. This involves robust supplier relationship management and inventory optimization to maintain operational efficiency and resilience. BlueScope's customer engagement strategy involves actively marketing and selling its steel products across various sectors, supported by comprehensive technical assistance and tailored solutions to meet specific client needs.

| Key Activity | Description | 2023/2024 Data/Focus |

|---|---|---|

| Steel Manufacturing & Processing | Transforming raw materials into steel products. | North Star BlueScope Ohio expansion for slab production capacity. |

| Coating & Painting | Adding protective and aesthetic layers to steel. | COLORBOND® steel remains a flagship product, contributing significantly to revenue. |

| Research & Development | Innovating for lower environmental impact, especially in ironmaking. | Exploration of DRI, ESF, and hydrogen as fuel sources for emissions reduction. |

| Supply Chain Management | Procurement of raw materials and distribution of finished goods. | Strengthening supplier partnerships for transparency and sustainability (FY23). |

| Sales & Marketing | Engaging diverse sectors with tailored strategies and technical support. | FY23 sales revenue of AUD 17.7 billion; serving over 100,000 global customers. |

Full Document Unlocks After Purchase

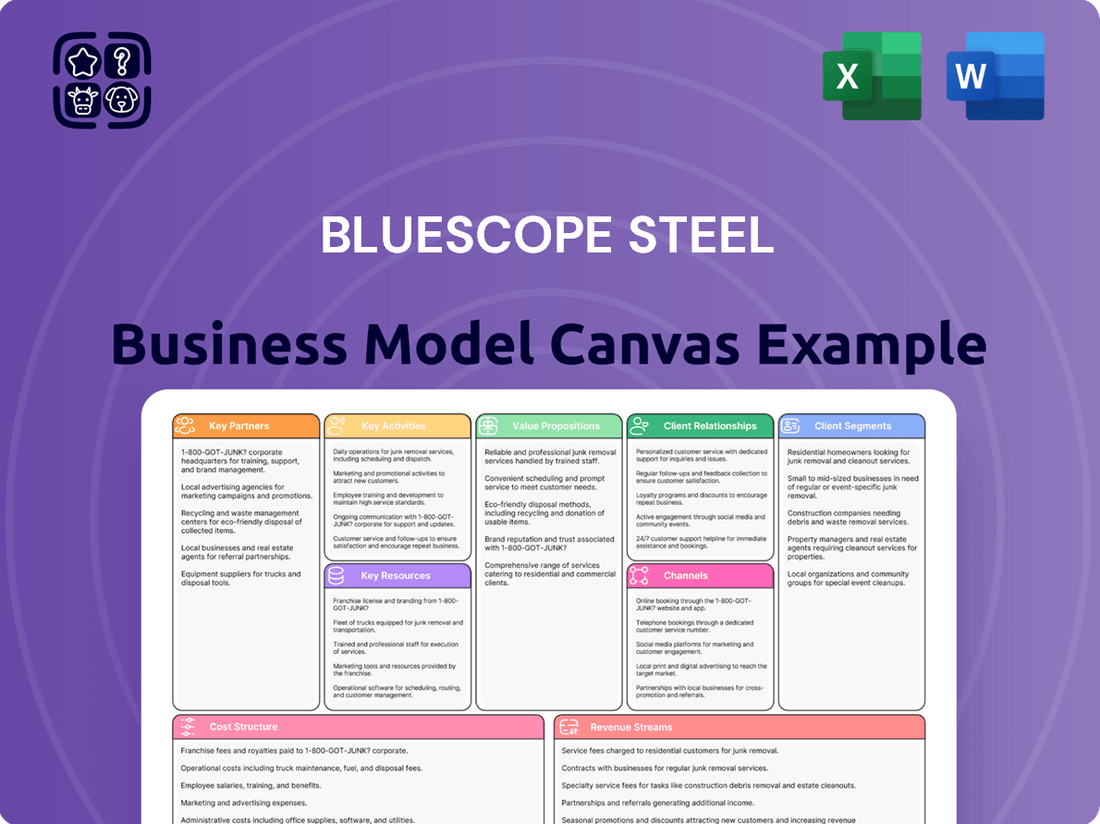

Business Model Canvas

This preview is a direct representation of the Bluescope Steel Business Model Canvas you will receive upon purchase. It is not a mockup or a sample, but an actual snapshot from the complete document. Once your order is processed, you will gain full access to this exact same professional, ready-to-use file, ensuring no surprises and immediate usability.

Resources

BlueScope's manufacturing facilities are its bedrock, featuring extensive steel mills, advanced coating lines, and cutting-edge equipment. Key sites like Port Kembla Steelworks in Australia and North Star in the US are central to its operations.

These physical assets are crucial for producing a wide range of steel products. For instance, the Port Kembla Steelworks is a major integrated steelmaking facility, while North Star specializes in producing high-strength steel for the automotive sector.

Significant investments are being made to upgrade and expand these facilities, aiming to boost production capacity and improve environmental performance. In 2024, BlueScope continued its focus on these upgrades, with projects at North Star and other sites designed to enhance efficiency and sustainability.

BlueScope Steel's intellectual property and brands are critical resources. These include proprietary technologies and unique manufacturing processes that set them apart. Their strong brands, such as COLORBOND® steel, are recognized for quality and innovation, forming a significant competitive advantage.

These well-established brands are more than just names; they embody BlueScope's value proposition to customers. For instance, COLORBOND® steel is synonymous with durability and aesthetic appeal in the construction industry, directly contributing to their market position.

BlueScope Steel relies heavily on its highly skilled workforce, encompassing engineers, metallurgists, and experienced operational staff. This expertise is critical for the intricate manufacturing processes involved in producing their diverse range of steel products and for fostering ongoing innovation within the company.

The company places a strong emphasis on a people-centred approach, prioritizing health and safety across all operations. This commitment is complemented by significant investment in continuous learning and development programs, ensuring their workforce remains at the forefront of industry knowledge and best practices.

In 2023, BlueScope reported that its total workforce stood at approximately 18,000 employees globally, underscoring the scale of human capital required to support its extensive operations and strategic objectives.

Raw Material Reserves and Access

Bluescope Steel's business model relies heavily on securing consistent access to key raw materials such as iron ore, coking coal, and scrap steel. This access is fundamental to maintaining uninterrupted production cycles and meeting customer demand.

Strategic partnerships and long-term supply agreements are crucial for ensuring the reliability and cost-effectiveness of these essential inputs. These relationships provide stability in a volatile commodity market.

- Iron Ore: Access to high-grade iron ore is paramount. For instance, in fiscal year 2023, Bluescope's Australian operations sourced a significant portion of their iron ore from Western Australia, leveraging established supply chains.

- Coking Coal: Reliable coking coal supply is vital for steelmaking. Bluescope maintains contracts with major coal producers, securing volumes necessary for their blast furnace operations.

- Scrap Steel: The increasing use of electric arc furnaces (EAFs) makes access to high-quality scrap steel a critical resource. Bluescope actively manages scrap procurement to support its EAF operations, contributing to sustainability goals.

- Supplier Diversification: To mitigate risks associated with single-source dependency, Bluescope pursues a strategy of diversifying its supplier base for all key raw materials.

Financial Capital

BlueScope Steel's financial capital is crucial for its operational stability and future expansion. Adequate funding ensures the company can cover day-to-day expenses, invest in cutting-edge manufacturing technologies, and pursue strategic acquisitions to enhance its market position. This financial strength underpins its ability to innovate and grow.

The company’s financial strategy aims for a balance. BlueScope focuses on maintaining a healthy balance sheet, which is vital for securing favorable financing terms and weathering economic fluctuations. Simultaneously, it prioritizes reinvesting in sustainable growth initiatives. This dual approach supports both immediate operational needs and long-term value creation for its stakeholders.

In 2024, BlueScope demonstrated this financial discipline. For the fiscal year ended June 30, 2024, the company reported underlying earnings before interest and tax (EBIT) of approximately AUD 1.0 billion. This performance highlights its capacity to generate substantial profits that can be allocated to capital expenditures and shareholder returns.

- Robust Balance Sheet: Maintains strong financial health to support operations and investments.

- Capital Investment: Allocates funds for new technologies and facility upgrades to enhance efficiency and output.

- Strategic Acquisitions: Pursues targeted acquisitions to expand market reach and product offerings.

- Shareholder Returns: Balances reinvestment with distributions to shareholders, reflecting financial prudence.

BlueScope's key resources also encompass its robust intellectual property and well-recognized brands. Proprietary technologies and unique manufacturing processes provide a distinct competitive edge. Brands like COLORBOND® steel are synonymous with quality and innovation, directly translating into customer preference and market strength.

| Resource Category | Key Components | Significance |

|---|---|---|

| Intellectual Property | Proprietary manufacturing technologies, unique processes | Competitive differentiation, operational efficiency |

| Brands | COLORBOND® steel, ZINCALUME® steel, etc. | Customer recognition, market loyalty, premium pricing potential |

| Patents | Specific steel coating and forming technologies | Exclusive rights, barrier to entry for competitors |

Value Propositions

BlueScope's high-quality coated and painted steel products, like the iconic COLORBOND® steel, are central to its value proposition, offering exceptional durability and aesthetic appeal for the building and construction industries. These products are engineered for long-lasting performance, meeting stringent demands for weather resistance and structural integrity.

In 2024, BlueScope continued to emphasize innovation in its coated steel offerings, aiming to enhance sustainability and performance. The company's commitment to quality ensures that its steel solutions provide reliable and attractive outcomes for a wide array of architectural and infrastructure projects, contributing significantly to their longevity and visual appeal.

Bluescope Steel's value proposition centers on delivering innovative steel materials and tailored solutions, including engineered building systems. This commitment is fueled by ongoing research and development, ensuring their advanced steel products consistently meet the dynamic demands and high-performance expectations of various industries.

For instance, in 2024, Bluescope continued to invest in its R&D pipeline, focusing on lighter, stronger, and more sustainable steel options. Their engineered solutions, like the COLORBOND® steel range, offer enhanced durability and aesthetic versatility, a key differentiator in the competitive construction market.

BlueScope is actively investing in decarbonization technologies and sustainable manufacturing, aiming to lower its environmental footprint. This focus is crucial for attracting customers and partners who prioritize environmentally responsible materials and supply chains.

In 2024, BlueScope announced a target to reduce its Scope 1 and Scope 2 greenhouse gas emissions by 30% by 2030, compared to a 2020 baseline. This commitment directly addresses growing market demand for greener building materials and responsible sourcing.

Reliable Supply and Global Presence

BlueScope's reliable supply and global presence are cornerstones of its value proposition. With operations spanning 15 countries, the company ensures a consistently available and globally distributed supply of steel products. This extensive network is crucial for serving diverse international markets efficiently.

This global footprint translates to tangible benefits for customers. For instance, in fiscal year 2023, BlueScope reported total sales revenue of AUD 17.7 billion, underscoring the scale of its operations and its ability to meet demand across various regions. The company's commitment to a robust supply chain allows it to navigate geopolitical and logistical challenges, providing customers with greater certainty.

- Global Reach: Operations in 15 countries.

- Product Availability: Consistent supply of steel products.

- Market Service: Efficient service for diverse international markets.

- Financial Scale: AUD 17.7 billion in total sales revenue (FY23).

Technical Expertise and Customer Support

BlueScope Steel offers deep technical expertise, guiding customers through product selection and application to ensure optimal use of their steel solutions. This support is crucial for achieving project success.

Their customer support extends to troubleshooting and problem-solving, acting as a valuable partner throughout the project lifecycle. For instance, in 2024, BlueScope reported a significant increase in customer satisfaction scores directly linked to their enhanced technical advisory services.

- Technical Guidance: Expert advice on steel product suitability and performance.

- Application Support: Assistance in integrating steel products effectively into diverse projects.

- Problem Resolution: Proactive and reactive support to overcome technical challenges.

- Project Optimization: Helping clients maximize efficiency and outcomes with BlueScope's steel.

BlueScope's value proposition is built on delivering high-quality, innovative steel products and tailored solutions, such as COLORBOND® steel, renowned for durability and aesthetics. In 2024, the company continued to focus on R&D for lighter, stronger, and more sustainable steel options, ensuring advanced products meet dynamic industry demands.

The company also emphasizes sustainable manufacturing and decarbonization, a key driver for environmentally conscious customers. In 2024, BlueScope reinforced its commitment to reducing emissions, targeting a 30% cut in Scope 1 and 2 emissions by 2030 against a 2020 baseline.

BlueScope's reliable global supply chain, operating in 15 countries, ensures product availability and efficient service across diverse international markets. This extensive network is supported by significant financial scale, with total sales revenue reaching AUD 17.7 billion in fiscal year 2023.

Furthermore, BlueScope provides deep technical expertise and application support, acting as a partner to ensure optimal product use and project success. Customer satisfaction in 2024 saw notable increases, directly attributed to enhanced technical advisory services.

| Value Proposition Element | Description | Key 2024/Recent Fact |

|---|---|---|

| Product Quality & Innovation | High-performance coated and painted steel products (e.g., COLORBOND® steel) offering durability and aesthetics. | Continued R&D investment in lighter, stronger, and more sustainable steel options in 2024. |

| Sustainability Focus | Commitment to decarbonization and environmentally responsible manufacturing. | Targeted 30% reduction in Scope 1 & 2 GHG emissions by 2030 (vs. 2020 baseline) announced in 2024. |

| Global Reach & Reliability | Consistent supply of steel products across operations in 15 countries. | FY23 total sales revenue of AUD 17.7 billion highlights operational scale and market reach. |

| Technical Expertise & Support | Guidance on product selection, application, and problem-solving. | Reported significant increase in customer satisfaction scores in 2024 linked to enhanced technical advisory services. |

Customer Relationships

BlueScope Steel prioritizes robust customer connections via dedicated account managers. These professionals deeply understand each client's unique operational demands, enabling them to craft bespoke solutions. This focused approach is especially vital for BlueScope's significant industrial clientele, driving exceptional satisfaction and fostering enduring loyalty.

BlueScope Steel offers extensive technical support, actively partnering with clients to overcome intricate challenges in steel utilization. This partnership extends to providing crucial design assistance, expert material selection advice, and guidance on optimizing performance, solidifying BlueScope's position as a comprehensive solutions provider, not just a material supplier.

In 2024, BlueScope's commitment to collaborative problem-solving was evident in projects where their technical teams worked alongside architects and engineers to develop innovative building solutions, leading to enhanced structural integrity and material efficiency for key infrastructure developments.

BlueScope cultivates deep customer loyalty by fostering long-term partnerships and securing multi-year contracts. These agreements are crucial in sectors like building and construction, manufacturing, and automotive, providing a predictable revenue stream. For instance, in fiscal year 2023, BlueScope's Buildings North America segment reported strong performance, partly driven by its established relationships with key clients in the construction industry, contributing to a robust order book.

Feedback Mechanisms and Continuous Improvement

BlueScope Steel actively gathers customer feedback through various channels to drive ongoing enhancements in its products and services. This commitment to listening ensures their solutions consistently meet and exceed evolving market demands.

This iterative feedback loop is vital for maintaining BlueScope's competitive edge. By understanding customer needs firsthand, the company can adapt its offerings, ensuring they remain both relevant and exceptionally valuable across its broad customer segments.

- Customer Surveys and Direct Engagement: BlueScope regularly conducts surveys and engages directly with customers to capture sentiment and identify areas for improvement.

- Product Performance Monitoring: Data on product performance in real-world applications is analyzed to pinpoint any issues and inform product development.

- Innovation Driven by Feedback: Customer insights directly influence BlueScope's innovation pipeline, leading to the development of new and improved steel solutions.

- 2024 Focus on Digital Feedback: In 2024, BlueScope has increased its focus on digital feedback platforms, allowing for more immediate and scalable collection of customer input.

Industry Engagement and Thought Leadership

BlueScope actively participates in industry associations and key events, solidifying its position as a thought leader. This engagement allows them to influence industry standards and showcase their dedication to the steel sector's progress. For example, in 2024, BlueScope was a prominent exhibitor and speaker at the World Steel Association's annual conference, sharing insights on sustainable steel production.

Their involvement extends to contributing to research and development initiatives that benefit the entire industry. This collaborative approach fosters stronger relationships and positions BlueScope as a forward-thinking organization. In 2023, BlueScope announced a partnership with a leading university to explore innovative steel recycling technologies.

- Industry Association Membership: BlueScope maintains active memberships in organizations like the World Steel Association and regional steel councils.

- Event Participation: The company regularly presents at and sponsors major industry conferences, including those focused on construction, manufacturing, and sustainability.

- Thought Leadership Content: BlueScope publishes white papers, case studies, and blog posts on topics such as advanced steel solutions and environmental stewardship.

- Stakeholder Engagement: They engage with policymakers, customers, and suppliers to foster dialogue and collaboration on industry challenges and opportunities.

BlueScope Steel's customer relationships are built on a foundation of personalized service and technical expertise, fostering loyalty through dedicated account management and collaborative problem-solving. This approach is crucial for their large industrial clients, ensuring tailored solutions that meet specific operational needs.

The company actively seeks and integrates customer feedback, using insights from surveys, direct engagement, and product performance monitoring to drive continuous improvement. In 2024, a heightened focus on digital feedback platforms allows for more agile response to evolving market demands.

BlueScope's commitment to long-term partnerships and multi-year contracts, particularly in construction and manufacturing, provides revenue stability. Their active participation in industry associations and events further cements their role as a thought leader, influencing standards and showcasing innovation.

| Customer Relationship Aspect | Description | 2024/2023 Data Point |

|---|---|---|

| Dedicated Account Management | Personalized service with deep understanding of client needs. | Key driver for strong client retention in Buildings North America (FY23). |

| Technical Support & Collaboration | Partnership in overcoming steel utilization challenges, including design assistance. | Collaborative projects with architects/engineers for innovative building solutions in 2024. |

| Feedback Integration | Utilizing surveys, direct engagement, and performance data for improvement. | Increased focus on digital feedback platforms in 2024 for scalable input. |

| Long-Term Partnerships | Securing multi-year contracts for revenue predictability. | Crucial for sectors like building and construction; contributed to robust order books in FY23. |

| Industry Engagement | Thought leadership through association participation and event presence. | Prominent exhibitor/speaker at World Steel Association conference in 2024. |

Channels

BlueScope Steel leverages its dedicated direct sales force to connect with key customers, including major industrial players, construction firms, and manufacturers. This direct engagement is crucial for tailoring solutions and fostering deep relationships.

In 2024, BlueScope's direct sales teams were instrumental in securing significant contracts. For instance, their efforts contributed to a substantial portion of the company's $17.7 billion in total revenue for the fiscal year ending June 30, 2024, demonstrating the channel's commercial impact.

This approach allows for nuanced technical discussions and the development of highly customized steel products and services, directly addressing the specific needs of these high-value clients and reinforcing BlueScope's market position.

Bluescope Steel relies on robust distribution networks and strategic supply chain partners to ensure its products reach a wide array of customers efficiently. For instance, their collaboration with logistics providers like Toll Group is instrumental in managing the complex movement of steel across diverse geographical markets, a critical component in maintaining product availability and market reach.

BlueScope Steel actively engages stakeholders through its corporate website, offering comprehensive product catalogs, detailed sustainability reports, and timely investor relations updates. This digital hub serves as a primary channel for information dissemination, enhancing transparency and accessibility for a global audience.

The company's digital presence extends to platforms that support potential e-commerce for specific product lines, streamlining the purchasing process for customers. In 2024, BlueScope reported a significant increase in website traffic, indicating growing interest in its digital offerings and commitment to online engagement.

Industry Events and Trade Shows

Bluescope Steel actively participates in key industry events and trade shows to highlight its latest innovations, including advanced steel solutions and environmental commitments. These gatherings are crucial for connecting with customers, partners, and industry influencers, driving new business opportunities and reinforcing brand recognition.

These channels allow Bluescope to demonstrate its technological advancements and sustainable practices directly to a relevant audience.

- Showcasing Innovation: At events like the World Steel Association's World Steel Day, Bluescope can present its pioneering steel products and manufacturing processes.

- Networking and Lead Generation: Trade shows provide direct access to potential clients and collaborators, fostering relationships that can translate into significant sales. For example, in 2023, the construction industry trade show, Bauma, saw significant engagement with companies seeking advanced materials.

- Brand Visibility: Consistent presence at major industry forums enhances Bluescope's profile as a leader in the steel sector, particularly in areas like sustainable construction and advanced manufacturing.

Licensed Manufacturers and Fabricators

Licensed manufacturers and fabricators are a crucial part of BlueScope Steel's business model, acting as key partners in bringing their steel products to a wider market. These entities take BlueScope's foundational steel materials, like coated steel coils, and transform them into finished goods. Think of them as the skilled artisans who craft everything from durable roofing sheets to essential structural beams used in construction.

This network of licensed partners significantly extends BlueScope's market penetration. By integrating BlueScope's steel into their own product lines, these fabricators open up diverse end-use applications that BlueScope might not directly serve. For instance, a licensed fabricator might specialize in creating pre-engineered building systems, leveraging BlueScope's steel for strength and longevity.

In 2024, BlueScope continued to foster these relationships, recognizing their importance in driving sales and innovation. The company's strategy often involves providing technical support and quality assurance to these partners, ensuring that the final products meet high standards. This collaborative approach allows BlueScope to tap into specialized manufacturing expertise and reach a broader customer base across various industries.

- Key Partners: Licensed manufacturers and fabricators are vital intermediaries.

- Value Addition: They transform raw steel into finished products like roofing and structural components.

- Market Reach: This partnership expands BlueScope's presence into numerous end-use applications.

- Strategic Importance: BlueScope provides support to ensure quality and drive sales through this network.

BlueScope Steel utilizes a multi-channel approach to reach its diverse customer base, combining direct sales with robust distribution networks and strategic partnerships. This ensures efficient product delivery and broad market penetration.

The company's digital presence, including its corporate website and potential e-commerce platforms, plays a significant role in information dissemination and customer engagement. In 2024, increased website traffic highlighted the growing importance of these online channels.

Industry events and trade shows are also key channels for BlueScope, allowing them to showcase innovations and build relationships. These forums are critical for brand visibility and generating new business opportunities.

Licensed manufacturers and fabricators are essential partners, transforming BlueScope's steel into finished goods and extending the company's reach into various end-use markets.

| Channel | Description | Key Activities | 2024 Impact/Data |

|---|---|---|---|

| Direct Sales Force | Engaging directly with major industrial, construction, and manufacturing clients. | Tailoring solutions, fostering relationships, technical discussions. | Contributed significantly to $17.7 billion revenue (FY24). |

| Distribution Networks & Supply Chain Partners | Efficiently moving products to a wide customer base. | Logistics management, ensuring product availability. | Collaboration with partners like Toll Group. |

| Digital Presence (Website, E-commerce) | Information dissemination and customer engagement. | Product catalogs, sustainability reports, investor updates. | Reported significant increase in website traffic in 2024. |

| Industry Events & Trade Shows | Showcasing innovations and building industry presence. | Networking, lead generation, brand visibility. | Consistent participation in key forums. |

| Licensed Manufacturers & Fabricators | Transforming steel into finished products. | Value addition, market penetration, specialized manufacturing. | Continued fostering of these vital relationships in 2024. |

Customer Segments

The building and construction industry is a cornerstone customer segment for BlueScope Steel, encompassing residential, commercial, and industrial projects. They utilize BlueScope's coated and painted steel for a wide array of applications, from roofing and walling to vital structural components and sophisticated engineered building solutions. This sector’s demand is closely tied to key economic indicators like housing approval rates and the level of government investment in infrastructure projects.

In 2024, the global construction market is projected to reach approximately $17.4 trillion, with steel remaining a critical material. For instance, in Australia, a key market for BlueScope, new dwelling commencements were around 170,000 in the year ending March 2024, indicating sustained activity in the residential sub-segment.

Manufacturers in sectors like automotive, white goods, and general fabrication rely on BlueScope's steel slabs, hot rolled coil, and plate as essential raw materials. These industries demand consistent, high-quality steel to ensure the integrity and performance of their finished products.

For instance, in 2023, the automotive industry, a significant consumer of steel products, saw global vehicle production reach approximately 80 million units. This demand directly translates to a need for reliable steel suppliers like BlueScope, who provide the foundational materials for vehicle bodies and components.

This segment targets major infrastructure developments, including transportation networks like bridges and railways, as well as energy projects such as power plants and pipelines. These projects demand high-strength steel plate and structural sections for their durability and load-bearing capabilities.

The mining sector also represents a significant portion of this customer base, requiring heavy-duty steel for equipment, processing facilities, and structural components in harsh environments. In 2024, global mining investment was projected to reach over $130 billion, underscoring the substantial demand for robust steel solutions in this area.

Heavy engineering applications, encompassing large industrial machinery and complex fabrication works, further contribute to this segment. Demand here is closely tied to government infrastructure spending initiatives and the cyclical nature of resource commodity prices, with many nations prioritizing infrastructure upgrades in their 2024 economic plans.

Distributors and Steel Service Centers

Distributors and steel service centers are key intermediaries for BlueScope, purchasing large volumes of steel products. These partners then onwardly sell to a diverse range of smaller businesses or apply value-added processing for specialized market needs. For instance, in fiscal year 2023, BlueScope's North Star business, a significant player in coated and painted steel products, relied heavily on its distribution network to reach a broad customer base across various industries.

Cultivating robust relationships with these channel partners is paramount for BlueScope to achieve widespread market penetration and ensure efficient product delivery. Their ability to break down bulk purchases and cater to specific customer requirements is vital for market reach.

- Key Role: These entities act as BlueScope's extended sales and logistics arm, reaching segments that might be uneconomical for direct engagement.

- Value Addition: Many distributors offer cutting, slitting, and coating services, transforming raw steel into ready-to-use components for specific applications.

- Market Reach: BlueScope's success in markets like Australia and North America is significantly bolstered by the extensive networks of its distribution partners.

Export Markets

BlueScope Steel actively engages with international markets, exporting a significant portion of its steel products across diverse global regions. This export strategy is crucial for revenue diversification and leveraging economies of scale.

The company's export performance is intrinsically linked to several macroeconomic factors. Global steel prices, which can fluctuate based on supply and demand dynamics worldwide, directly impact the profitability of these overseas sales. For instance, in 2024, global steel prices experienced volatility influenced by production levels in major producing nations and demand from key construction and automotive sectors.

Regional production levels also play a vital role. When other regions have lower domestic production, demand for BlueScope's exports tends to increase. Furthermore, foreign exchange rates are a critical determinant, as currency fluctuations can significantly affect the cost of imported steel for customers and the repatriated value of export earnings for BlueScope. In 2024, the strength of currencies in key export markets like the United States and Southeast Asia presented both opportunities and challenges.

- Global Reach: BlueScope exports steel products to numerous countries, contributing to its international market presence.

- Price Sensitivity: Export sales are directly influenced by global steel price trends, which saw considerable movement in 2024 due to various economic factors.

- Regional Dynamics: The company's export volumes are shaped by production capacities and demand within specific international regions.

- Currency Impact: Fluctuations in foreign exchange rates significantly affect the competitiveness and profitability of BlueScope's export operations.

BlueScope Steel serves a broad customer base, ranging from the construction industry, which uses its steel for everything from roofing to structural components, to manufacturers in automotive and white goods sectors needing raw steel materials. They also cater to large-scale infrastructure projects and the mining sector, requiring high-strength steel for demanding applications.

Distributors and steel service centers are crucial partners, acting as intermediaries to reach smaller businesses and provide value-added processing. BlueScope also engages in international exports, with sales influenced by global steel prices, regional production, and currency exchange rates.

| Customer Segment | Key Needs | 2024 Relevance/Data Point |

|---|---|---|

| Building & Construction | Coated/painted steel for roofing, walls, structures | Global construction market projected at $17.4 trillion; Australia's new dwelling commencements ~170,000 (year ending March 2024) |

| Manufacturing (Auto, White Goods) | Steel slabs, hot rolled coil, plate for components | Global vehicle production ~80 million units in 2023 |

| Infrastructure & Mining | High-strength steel plate, structural sections, heavy-duty steel | Global mining investment projected over $130 billion in 2024 |

| Distributors & Service Centers | Bulk steel products, value-added processing | North Star business relies on distribution network for market reach (FY2023) |

| International Markets | Steel products for diverse global regions | Global steel prices volatile in 2024; currency fluctuations impact export profitability |

Cost Structure

Raw material costs represent a substantial component of BlueScope's expenses, primarily driven by the acquisition of iron ore, coking coal, and scrap steel. These commodities are essential for steel production, and their prices are highly volatile on the global market.

For instance, in the fiscal year 2023, BlueScope reported significant impacts from these input costs. The company's cost of goods sold, which is heavily influenced by raw material prices, saw considerable movement. Global commodity markets experienced price swings throughout 2023, directly affecting BlueScope's procurement expenses.

Manufacturing and production costs are a significant component for Bluescope Steel, encompassing energy consumption like electricity and natural gas, which are vital for the intense processes of steelmaking, coating, and finishing. In 2024, energy prices remained a key driver of these operational expenses.

Labor costs, including wages and benefits for skilled workers operating the plants, are also a substantial outlay. Furthermore, the continuous maintenance of sophisticated plant and equipment is essential to ensure operational efficiency and safety, adding to the overall cost structure.

Beyond day-to-day running costs, Bluescope Steel's commitment to ongoing investment in efficiency improvements and decarbonization technologies, such as those aimed at reducing greenhouse gas emissions, represents a considerable capital expenditure that impacts the cost structure.

Logistics and distribution costs are a significant component for Bluescope Steel, encompassing the expense of moving raw materials like iron ore and coal to their manufacturing facilities, as well as transporting finished steel products to a diverse customer base. These costs include freight charges, warehousing expenses for storing materials and goods, and the ongoing management of inventory to ensure efficient supply chains.

Bluescope actively partners with third-party logistics providers to streamline operations and reduce these expenditures. For instance, in their 2023 financial year, Bluescope reported total freight and distribution costs of approximately $999 million AUD, highlighting the scale of these operational outlays.

Research and Development Expenses

Bluescope Steel's commitment to innovation and sustainability significantly impacts its cost structure through substantial investments in Research and Development. These expenditures are crucial for developing new products, enhancing existing ones, and pioneering more efficient manufacturing processes. A key focus area is the development of decarbonization technologies, reflecting the industry's shift towards environmental responsibility.

In 2024, Bluescope continued to allocate resources towards these critical R&D initiatives. This includes funding for pilot plants designed to test and scale up new production methods, as well as ongoing studies into lower-emission ironmaking techniques. These investments are essential for maintaining a competitive edge and meeting future regulatory and market demands.

- Investment in new product development: Funding for research into advanced steel grades and coated steel products.

- Process improvement initiatives: Costs associated with optimizing manufacturing efficiency and reducing waste.

- Decarbonization technology funding: Expenditures on pilot projects and studies for lower-emission ironmaking and steel production methods.

- Intellectual property and patent costs: Expenses related to protecting innovative advancements.

Sales, General, and Administrative (SG&A) Costs

Sales, General, and Administrative (SG&A) costs are a significant component of BlueScope Steel's operational expenses. These include the salaries of sales teams, marketing campaigns, and the general overhead required to run a global business. For the fiscal year 2023, BlueScope reported SG&A expenses of approximately AUD 1.1 billion.

These costs are distributed across BlueScope's various segments and geographical locations, reflecting its international footprint. This includes expenses for corporate functions, legal, finance, and human resources departments. Additionally, significant investment is allocated to safety programs, a crucial aspect of the steel industry.

- Sales and Marketing: Expenses for promoting and selling BlueScope's steel products and solutions globally.

- Administrative Overheads: Costs associated with managing corporate functions, including executive salaries, IT, and legal services.

- Corporate Functions: Expenses related to the central management and strategic direction of the company.

- Safety Programs: Investments in ensuring safe working environments across all operational sites.

BlueScope's cost structure is heavily influenced by its reliance on key raw materials like iron ore and coking coal, whose prices fluctuate significantly on global markets. Manufacturing and production expenses, particularly energy consumption, also represent a substantial portion of operational outlays. The company also incurs significant costs related to logistics, distribution, research and development for new products and decarbonization, and general administrative expenses.

| Cost Category | FY2023 Impact/Data | FY2024 Focus |

|---|---|---|

| Raw Materials | Significant impact from volatile commodity prices | Continued monitoring of global price trends |

| Manufacturing & Production | Energy costs (electricity, natural gas) are key drivers | Managing energy price volatility |

| Logistics & Distribution | AUD 999 million in freight and distribution costs | Streamlining operations with third-party providers |

| Sales, General & Administrative (SG&A) | AUD 1.1 billion in SG&A expenses | Managing global overheads and corporate functions |

| Research & Development | Investment in new products and decarbonization | Funding pilot plants and lower-emission technologies |

Revenue Streams

Bluescope Steel's primary revenue comes from selling coated and painted steel products like COLORBOND® steel. These are used extensively in roofing and walling for buildings.

These value-added products, offering enhanced durability and aesthetics, typically fetch higher prices than basic steel. For example, in the fiscal year 2023, Bluescope reported total sales revenue of AUD 17.7 billion, with a significant portion attributed to these branded steel solutions.

Bluescope Steel generates substantial income from selling fundamental steel products such as steel slabs, hot rolled coil, and plate products. These essential materials serve a wide array of manufacturing and engineering sectors, forming a core component of the company's financial performance.

For the fiscal year ending June 30, 2023, Bluescope Steel reported total revenue of approximately AUD 17.1 billion, with a significant portion attributed to these foundational steel product sales, underscoring their importance to the business.

Bluescope Steel generates revenue by offering complete engineered building solutions. This includes supplying pre-engineered steel structures and essential structural elements, primarily catering to substantial commercial and industrial construction ventures. This approach provides clients with a more integrated service than just delivering raw materials.

For the fiscal year ending June 30, 2023, Bluescope Steel's North Star segment, which encompasses engineered building solutions in North America, reported underlying EBIT of AUD 251 million. This demonstrates the significant financial contribution of these comprehensive project-based offerings.

Export Sales

Bluescope Steel generates earnings from selling its steel products to customers in international markets. These export sales are a significant part of its revenue, but they are also influenced by global economic conditions.

Fluctuations in worldwide steel prices directly impact the profitability of these export sales. For instance, during the first half of fiscal year 2024, Bluescope noted that while domestic demand remained robust, international pricing was more subdued, affecting overall export performance.

- Global Steel Prices: Export revenue is directly tied to the prevailing international prices for steel, which can be volatile.

- Regional Demand: Demand for steel products varies across different geographic regions, impacting the volume of export sales.

- Foreign Exchange Rates: Currency exchange rate movements can significantly affect the value of revenue earned from international sales when converted back to the company's reporting currency.

By-product Sales (e.g., Coke)

Bluescope Steel generates revenue not only from its primary steel products but also through the sale of by-products derived from its manufacturing processes, such as coke. This diversification adds another layer to its income streams.

The financial contribution from these by-product sales can be quite variable. It’s heavily influenced by the prevailing market conditions and the fluctuating prices for these secondary materials.

- By-product Revenue: Sales of materials like coke contribute to overall revenue.

- Market Dependency: Income from by-products is sensitive to market demand and pricing fluctuations for these secondary goods.

- Contribution Variability: The financial impact of by-product sales can change significantly over time.

Bluescope Steel's revenue streams are diverse, encompassing both branded, value-added steel products and fundamental steel materials. The company also generates income from engineered building solutions and the sale of manufacturing by-products.

For the fiscal year 2023, Bluescope reported total sales revenue of AUD 17.7 billion. This highlights the significant scale of its operations across various product categories and geographic markets.

In the fiscal year ending June 30, 2023, Bluescope Steel's total revenue was approximately AUD 17.1 billion, with foundational steel products forming a crucial part of this figure.

The North Star segment, focused on engineered building solutions, reported underlying EBIT of AUD 251 million for the fiscal year ending June 30, 2023, demonstrating the financial contribution of these integrated offerings.

| Revenue Stream | Description | Fiscal Year 2023 Relevance |

|---|---|---|

| Coated and Painted Steel Products | Branded products like COLORBOND® steel for roofing and walling. | Significant contributor to overall sales revenue. |

| Fundamental Steel Products | Slabs, hot rolled coil, and plate products for manufacturing and engineering. | Core component of financial performance, forming a large part of total revenue. |

| Engineered Building Solutions | Pre-engineered steel structures and essential structural elements for construction. | North Star segment reported AUD 251 million underlying EBIT (FY23). |

| Export Sales | Sales to international markets, influenced by global economic conditions and steel prices. | Impacted by subdued international pricing in H1 FY24. |

| By-products | Sales of materials like coke derived from manufacturing processes. | Variable contribution dependent on market conditions and pricing. |

Business Model Canvas Data Sources

The Bluescope Steel Business Model Canvas is informed by a blend of internal financial reports, market intelligence on steel demand and pricing, and analyses of competitor strategies. These diverse data streams ensure a comprehensive and actionable representation of the business.