Bluescope Steel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bluescope Steel Bundle

Bluescope Steel's strategic positioning is laid bare in its BCG Matrix, revealing which of its steel products are market leaders and which may be lagging. Understanding these dynamics is crucial for any investor or competitor looking to navigate the steel industry.

This preview offers a glimpse into the core of Bluescope's product portfolio. To truly grasp the nuances of their market share and growth potential, and to unlock actionable strategies for investment and resource allocation, you need the complete picture.

Purchase the full BCG Matrix report to gain a comprehensive understanding of Bluescope Steel's Stars, Cash Cows, Dogs, and Question Marks, equipping you with the data-driven insights necessary for informed decision-making.

Stars

BlueScope's North Star steel mill in Ohio is a significant growth engine for the company, especially as its expansion projects continue to progress. This facility is recognized as one of the most efficient and profitable mini-mills across the United States.

The North Star mill holds a substantial market share within a growing regional steel market, underscoring its competitive strength. Ongoing investments in increasing its production capacity and enhancing operational efficiency are crucial for its future earnings potential.

BlueScope is heavily investing in decarbonization technologies, recognizing the growing demand for sustainable steel. Their significant investments in Electric Arc Furnaces (EAF), like the Glenbrook EAF project in New Zealand, and pilot plants such as Project NeoSmelt for Electric Smelting Furnace (ESF) technology, highlight this commitment. These initiatives are positioned in a high-growth market driven by global environmental regulations and consumer preferences.

Collaborations with major players like BHP and Rio Tinto further solidify BlueScope's leadership in developing lower-emission steelmaking. While these projects require considerable capital expenditure, they are vital for BlueScope's long-term growth strategy and securing market leadership in an increasingly decarbonized industrial landscape.

BlueScope's innovative steel solutions are making significant inroads into the renewable energy sector. The company is supplying specialized steel profiles crucial for solar farm construction and robust steel for wind turbine towers, tapping into a rapidly expanding market. This strategic focus positions BlueScope as a key player in the global energy transition.

The demand for steel in green infrastructure is projected to surge. For instance, the global renewable energy sector is expected to grow significantly, with wind and solar power leading the charge. BlueScope's commitment to this high-growth area, even if its current market share is developing, highlights its forward-looking strategy. By 2024, the company's investments in these specialized products are anticipated to yield substantial returns as the demand for sustainable energy infrastructure continues to escalate.

BlueScope Recycling and Materials (BRM)

BlueScope Recycling and Materials (BRM) is becoming increasingly vital as BlueScope Steel expands its steelmaking capacity, especially with Electric Arc Furnaces (EAFs) that depend on scrap steel. BRM plays a crucial role in supplying this essential raw material.

BRM processes a substantial amount of the scrap steel utilized at BlueScope's North Star facility, and there are ongoing initiatives to enhance its processing capacity to cater to rising demand. This strategic focus on BRM underpins the robust growth of EAF steelmaking by ensuring a consistent and reliable supply of raw materials.

- Strategic Importance: BRM's role is elevated due to the increasing reliance on EAFs, which require significant scrap steel input.

- North Star Support: The segment processes a considerable portion of the scrap used at the North Star facility, a key growth driver for BlueScope.

- Capacity Expansion: Efforts are actively underway to boost BRM's processing capabilities to meet the escalating demand for scrap steel.

- Enabling Growth: BRM's operations are critical for supporting the high-growth trajectory of BlueScope's EAF steelmaking ventures by securing necessary raw material supply.

Engineered Building Solutions

BlueScope's Engineered Building Solutions, featuring brands like Varco Pruden, are a key component of their business. These solutions serve a broad range of sectors, including building and construction, which can experience significant growth influenced by economic trends in different regions.

By integrating BlueScope's foundational steel products into these engineered solutions, the company offers enhanced value. This strategy allows BlueScope to achieve better profit margins and expand its footprint within particular segments of the construction market.

- Market Focus: Targeting diverse industries like building and construction, with growth potential tied to regional economic performance.

- Value Proposition: Leveraging core steel products to create value-added engineered building solutions.

- Strategic Benefit: Capturing higher profit margins and increasing market share in specific construction niches.

- Brand Example: Varco Pruden represents a significant offering within this segment.

BlueScope's North Star facility in Ohio is a standout performer, operating as a highly efficient mini-mill within the US steel market. Its significant market share in a growing regional demand for steel makes it a key growth engine for the company.

The company's strategic investments in decarbonization technologies, such as Electric Arc Furnaces and pilot projects for Electric Smelting Furnace technology, position it in a high-growth market driven by environmental regulations. BlueScope is also innovating in steel solutions for the renewable energy sector, supplying critical components for solar and wind power infrastructure.

BlueScope Recycling and Materials (BRM) is crucial for supplying scrap steel to its Electric Arc Furnaces, particularly for the North Star mill. Expansion efforts at BRM aim to meet the increasing demand for this vital raw material, directly supporting the growth of EAF steelmaking.

Engineered Building Solutions, including brands like Varco Pruden, leverage BlueScope's steel products to offer value-added solutions across various construction sectors. This strategy enhances profit margins and expands market presence in specific construction niches.

| BlueScope Steel Segment | Key Characteristics | Growth Drivers | Financial Impact (Illustrative) |

|---|---|---|---|

| North Star (Mini-mill) | High efficiency, significant regional market share | Growing steel demand, capacity expansion | Strong profitability, revenue growth |

| Decarbonization & Renewables | Investment in EAF, ESF pilot, steel for solar/wind | Environmental regulations, energy transition | Future revenue streams, market leadership |

| BlueScope Recycling & Materials (BRM) | Scrap steel supply for EAFs | Increased EAF capacity, demand for recycled materials | Cost efficiency, raw material security |

| Engineered Building Solutions | Value-added construction products (e.g., Varco Pruden) | Construction sector growth, regional economic trends | Higher margins, market share expansion |

What is included in the product

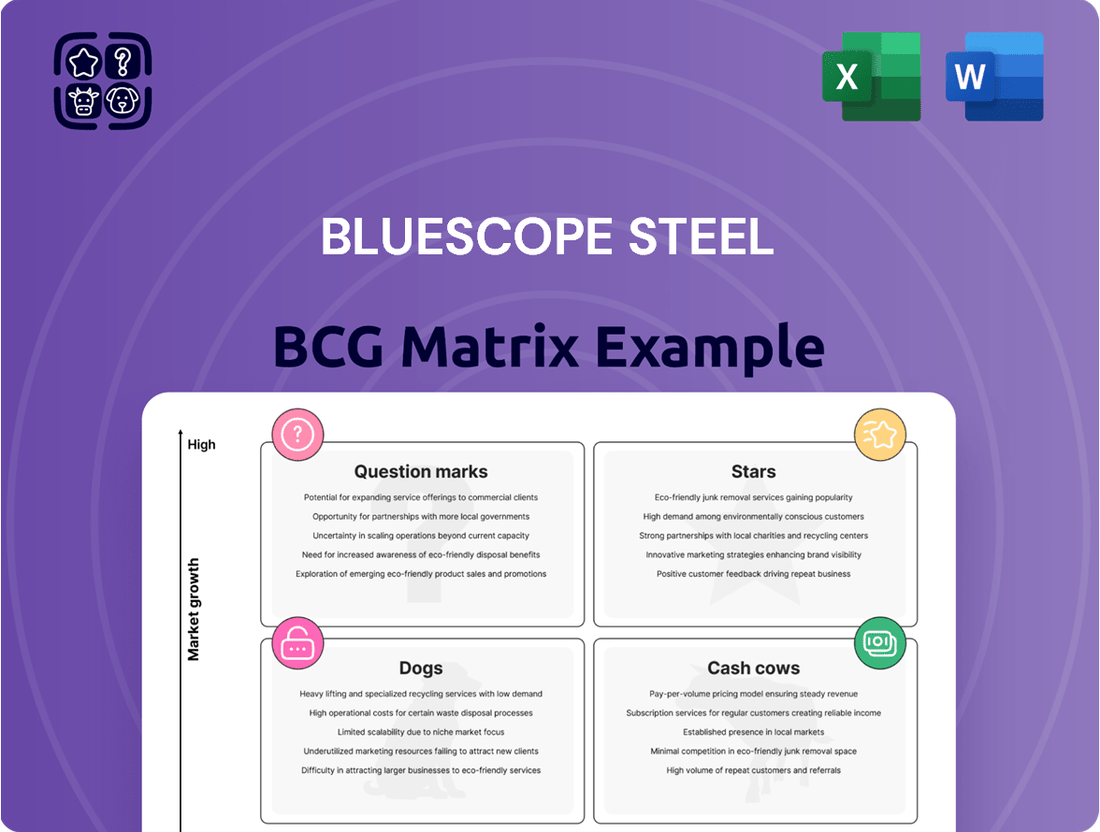

This BCG Matrix overview examines BlueScope Steel's business units, categorizing them to inform strategic decisions.

It highlights which units to invest in, hold, or divest based on their market growth and share.

A clear BCG Matrix visualizes Bluescope's portfolio, easing the pain of strategic resource allocation.

Cash Cows

COLORBOND® steel is a true cash cow for BlueScope Steel in Australia, dominating the residential and commercial roofing sectors with roughly 90% of the metal roofing market. This mature market offers consistent, high profit margins, a testament to its strong brand, competitive edge, and robust distribution network. Maintaining this leadership requires minimal promotional spending, allowing it to generate substantial, reliable cash flow for the company.

The Australian Steel Products division, featuring brands like COLORBOND® steel, TRUECORE® steel, and ZINCALUME® steel, is a consistent cash cow for BlueScope. This segment leverages its strong domestic market presence and emphasis on value-added products to generate reliable earnings.

In the fiscal year 2023, BlueScope reported that its Australian Steel Products segment delivered strong underlying earnings before interest and tax (EBIT). This demonstrates its role as a stable cash generator, contributing significantly to the company's overall financial health and providing crucial stability.

ZINCALUME® steel, a cornerstone of BlueScope's offerings, particularly in Australia and New Zealand, represents a classic cash cow. Its established market presence and consistent demand, fueled by its reputation for quality, generate reliable cash flow without requiring substantial growth-oriented investment.

In 2024, ZINCALUME® steel continued to benefit from robust demand in the construction sector, especially for roofing and wall cladding. BlueScope reported that its coated steel products, including ZINCALUME®, maintained strong sales volumes, contributing significantly to the company's overall profitability in its mature markets.

Port Kembla Steelworks (Core Operations)

The Port Kembla Steelworks, representing BlueScope Steel's core steelmaking operations, is a classic cash cow. Despite navigating market fluctuations, significant restructuring has positioned it as a competitive cost producer, consistently delivering strong earnings.

This foundational asset is crucial, supplying essential hot rolled coil and other primary steel products. These feed directly into BlueScope's more profitable coated and painted product lines, making Port Kembla a vital earnings generator for the entire company.

- Revenue Contribution: In the fiscal year 2023, BlueScope's Australian Steel Products segment, largely driven by Port Kembla's output, reported underlying earnings before interest and tax (EBIT) of AUD 1,242 million.

- Operational Efficiency: The steelworks has seen substantial capital investment aimed at improving efficiency, with over AUD 1 billion invested in upgrades in recent years to maintain its competitive edge.

- Market Position: Port Kembla supplies a significant portion of Australia's domestic steel needs, underpinning its stable demand and cash generation capabilities.

Diversified Business Model

BlueScope's diversified business model, operating across various geographies and product lines, functions as a substantial cash cow. This broad reach offers resilience against the inherent cyclical nature of the steel industry.

By balancing performance across different markets, BlueScope ensures more stable earnings and robust free cash flow generation. For example, in the fiscal year 2023, BlueScope reported underlying EBITDA of AUD 2.6 billion, demonstrating its capacity to generate consistent profits.

This financial strength directly supports shareholder returns through dividends and buybacks, while also funding crucial strategic investments for future growth.

- Geographic Diversification: Operations in North America, Asia, and Australia reduce reliance on any single market.

- Product Diversification: Offerings include coated and painted steel products, flat steel, and long steel, catering to diverse end-markets like construction and automotive.

- Resilience: The spread of operations and products mitigates the impact of regional economic downturns or specific sector weaknesses.

- Cash Generation: Consistent profitability from these diversified segments fuels strong free cash flow, a hallmark of a cash cow.

BlueScope's Australian Steel Products segment, anchored by brands like COLORBOND® steel and ZINCALUME® steel, consistently acts as a cash cow. Its mature, dominant market position in Australia, particularly in roofing and construction, ensures stable demand and high profit margins. This segment requires minimal investment for growth, allowing it to generate substantial and reliable cash flow for the company, a key characteristic of a BCG cash cow.

| Segment | Key Products | Market Position | 2023 Underlying EBIT (AUD million) |

|---|---|---|---|

| Australian Steel Products | COLORBOND® steel, ZINCALUME® steel, TRUECORE® steel | Dominant in Australian residential and commercial roofing/cladding | 1,242 |

| North Star BlueScope (USA) | Hot-rolled coil, coated steel | Strong regional player in coated steel | N/A (Included in overall results) |

| New Zealand Steel | Steel products for construction | Key supplier in NZ | N/A (Included in overall results) |

Delivered as Shown

Bluescope Steel BCG Matrix

The Bluescope Steel BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, will be delivered without any watermarks or demo content, ready for immediate professional use.

Rest assured, the BCG Matrix report for Bluescope Steel that you see here is the final, polished version you will acquire after completing your purchase. It has been meticulously crafted with market-backed insights, ensuring you receive a high-quality, analysis-ready document directly to your inbox.

What you are previewing is the actual, editable BCG Matrix file for Bluescope Steel that will be yours once you complete the purchase. This professionally designed report is instantly downloadable, allowing you to seamlessly integrate it into your business planning or presentations without delay.

This preview showcases the complete Bluescope Steel BCG Matrix report that you will receive after your purchase. It is a professionally designed, analysis-ready file, free from any mockups or demo elements, ensuring you get an immediately usable document for your strategic needs.

Dogs

BlueScope Steel's decision to exit the export market for steel slab from Port Kembla strongly suggests this segment was a 'dog' in their BCG Matrix. This move indicates a low market share within a fiercely competitive, low-margin global commodity sector.

The company likely found that investing further in this area provided insufficient returns, leading to its discontinuation. For instance, global steel prices can fluctuate significantly; in 2023, the average price for rebar steel was around $530 per tonne, a figure that would need substantial volume to generate meaningful profit in a commodity export market.

The BlueScope Coated Products group, significantly shaped by the Coil Coatings acquisition, has struggled with operational hurdles and declining sales. Its performance has notably worsened, with projections indicating a continued downward trend.

This situation clearly places this segment in the 'dog' category of the BCG matrix. It signifies a low market share within a challenging industry, demanding resources for potential turnarounds but offering minimal immediate financial returns.

For instance, in the fiscal year ending June 2023, BlueScope reported a significant decline in its Coated Products segment's underlying earnings before interest and taxes (EBIT). This underperformance is a direct reflection of the difficulties encountered in integrating and optimizing the acquired operations within a contracting market.

Certain lower-margin standard steel products at BlueScope Steel, like basic structural steel sections, often fall into the 'dog' category of the BCG matrix. These are typically undifferentiated products highly sensitive to global steel price swings and periods of 'softer steel spreads', meaning the difference between the selling price and the cost of raw materials narrows significantly.

During challenging market conditions, these products can become unprofitable on a per-unit basis or yield only minimal profits. For instance, in the fiscal year 2023, BlueScope reported that its North Star BlueScope business, which produces a range of steel products, faced margin pressures due to increased input costs and softer demand in certain segments, impacting the profitability of lower-value offerings.

Inefficient Legacy Assets without Decarbonization Pathways

Inefficient legacy assets within BlueScope Steel, particularly those reliant on older, high-emission production methods and lacking concrete decarbonization strategies, represent a significant challenge. These units, if left unaddressed, face the prospect of becoming economically unviable as global markets and regulatory pressures increasingly favor sustainable steel production. For instance, older blast furnace operations, which are inherently carbon-intensive, could fall into this category if significant capital is not allocated for their modernization or replacement with greener technologies.

Without clear and funded pathways to reduce their carbon footprint, these assets risk obsolescence. The financial burden of maintaining outdated infrastructure, coupled with potential carbon taxes or penalties, could severely impact profitability. This situation is exacerbated by the growing demand for ‘green steel’ from downstream industries and consumers, creating a competitive disadvantage for producers with high-emission assets.

- Asset Obsolescence Risk: Older, less efficient steelmaking facilities, particularly those utilizing blast furnaces without clear decarbonization plans, face a high risk of becoming obsolete.

- Financial Strain: High operational costs associated with legacy assets, combined with potential carbon pricing mechanisms, could lead to significant financial strain and reduced profitability for BlueScope.

- Market Disadvantage: The increasing market demand for sustainably produced steel puts these legacy assets at a competitive disadvantage against newer, greener technologies and producers.

- Investment Imperative: Significant capital investment is required to either upgrade these legacy assets with decarbonization technologies or to replace them entirely to remain competitive and compliant with future environmental standards.

Operations in Regions with Sustained Low Profitability

BlueScope Steel's operations in regions with sustained low profitability are often categorized as 'dogs' within the BCG matrix framework. This indicates areas that generate low returns and have limited growth potential.

In the first half of fiscal year 2024-25, BlueScope reported losses across all its operating regions, including Australia, North America, Asia, New Zealand, and the Pacific. This widespread underperformance was largely attributed to declining steel spreads and escalating operational costs.

While some of these regions might be considered strategic for market presence or future growth, persistent losses in specific pockets or smaller regional operations can firmly place them in the 'dog' category if their market share and growth prospects remain stagnant or negative.

- FY2024-25 H1 Losses: BlueScope experienced losses in Australia, North America, Asia, New Zealand, and the Pacific.

- Key Drivers: Softer steel spreads and higher costs contributed to the negative financial performance.

- BCG Matrix Classification: Persistent underperformance in these regions, coupled with low market share and growth prospects, can lead to their classification as 'dogs'.

- Strategic Consideration: Even 'dog' segments might be retained if they serve a strategic purpose, such as market access or supporting other business units.

BlueScope Steel's less profitable standard steel products, like basic structural steel, often land in the 'dog' category due to their low margins and sensitivity to market price swings. For example, in FY2023, the company noted margin pressures on its North Star BlueScope business due to rising input costs and softer demand, impacting these lower-value offerings.

Inefficient, high-emission legacy assets, such as older blast furnaces without clear decarbonization plans, also risk becoming 'dogs'. These units face obsolescence and financial strain from high maintenance costs and potential carbon pricing, making them a competitive disadvantage in a market favoring green steel.

BlueScope's decision to exit the Port Kembla steel slab export market clearly marks this segment as a 'dog', reflecting a low market share in a competitive, low-margin global sector where further investment yielded insufficient returns.

The Coil Coatings acquisition's struggles within the BlueScope Coated Products group, marked by operational issues and declining sales, have firmly placed this segment in the 'dog' category, signifying a low market share in a challenging industry with minimal immediate financial upside.

| Segment/Product Type | BCG Category | Key Challenges | Relevant Data Point (FY2023/2024) |

| Port Kembla Steel Slab Exports | Dog | Low market share, low margins, competitive global market | Exit from export market |

| Lower-Margin Standard Steel Products | Dog | Price sensitivity, narrow steel spreads, input cost pressures | North Star BlueScope margin pressures |

| Inefficient Legacy Assets | Dog | High emissions, high operational costs, risk of obsolescence | Need for decarbonization investment |

| BlueScope Coated Products (post-acquisition) | Dog | Operational hurdles, declining sales, market contraction | Segment EBIT decline |

Question Marks

The NeoSmelt pilot plant, a collaborative effort with Rio Tinto and BHP, represents a significant, albeit nascent, high-growth prospect for Bluescope Steel. This venture aims to pioneer Australia's first electric smelting furnace (ESF) for ironmaking, targeting near-zero greenhouse gas emissions in steel production.

As a pilot project, NeoSmelt currently holds a low market share and is a substantial cash consumer due to ongoing research and development. Commercial production is not anticipated before 2028, and its ultimate scalability and market success remain unproven, placing it in the Stars or Question Marks quadrant of the BCG matrix, leaning towards Question Marks given the development stage and unproven commercial viability.

BlueScope Steel's planned $1.2 billion greenfield cold rolling and metal coating facility in the United States represented a significant bet on a high-growth market. This ambitious project, however, has been deferred, placing it squarely in the question mark category of the BCG matrix.

The deferral signifies a strategic shift, with BlueScope prioritizing other initiatives, such as accelerating its branded product offerings through external supply chains. This move suggests a cautious approach to immediate market penetration in the US, despite the underlying market potential.

BlueScope's exploration of lower-emission ironmaking using natural gas and hydrogen in Australia represents a significant opportunity for substantial greenhouse gas (GHG) emission reductions. In 2024, the Australian government continued to support green steel initiatives, with several feasibility studies underway for hydrogen-based steelmaking, aiming to cut emissions by up to 90% compared to traditional blast furnace methods.

These technologies are currently in the early stages of development for BlueScope, meaning they have a low current market share within the company's operations. However, successful implementation could fundamentally alter BlueScope's future production methods, offering a pathway to decarbonization in a sector known for its high emissions intensity.

Expansion of Branded Products into New International Markets

Bluescope Steel's branded products, such as COLORBOND® steel, currently dominate the Australian market. However, their strategic push into new international territories, where the brand recognition and market share are still developing, positions them as question marks within the BCG matrix.

These emerging markets hold significant promise for future growth, but success hinges on considerable investment in marketing and a keen understanding of local consumer preferences and competitive dynamics. For instance, BlueScope's expansion into Southeast Asia, a region with a growing construction sector, presents this question mark scenario.

- Market Potential: Emerging economies often exhibit higher GDP growth rates, translating to increased demand for construction materials. In 2024, the global construction market was projected to reach approximately $14.7 trillion, with developing regions showing particularly robust expansion.

- Investment Required: Entering new markets necessitates significant capital for brand building, distribution networks, and potentially local manufacturing or partnerships. BlueScope's reported capital expenditure for FY24 was around AUD 1.5 billion, part of which is allocated to international growth initiatives.

- Competitive Landscape: Local competitors may already have established relationships and tailored products, requiring BlueScope to differentiate its offerings effectively.

- Risk vs. Reward: While the potential for high returns exists, the initial investment and market penetration challenges carry inherent risks, making these ventures question marks until their success is proven.

New Product Innovations for Specific Niche Applications

BlueScope's focus on new product innovations for specific niche applications, like advanced weathering steels, highlights their potential to capture emerging markets. These specialized materials, with a projected CAGR of 4.6% from 2024 to 2031, offer tailored solutions for unique industrial needs.

While these innovations may currently represent a small portion of BlueScope's overall market share, their development in high-growth niche sectors indicates a strong potential for future expansion. Successful adoption by buyers in these developing markets could significantly boost their contribution to the company's portfolio.

- Specialized Weathering Steel: Targeting niche applications with a projected CAGR of 4.6% (2024-2031).

- Emerging Market Potential: Low current market share but high growth prospects in developing sectors.

- Tailored Solutions: Innovation focused on meeting specific, unique industrial requirements.

- Strategic Growth Areas: Identifying and developing products for future market demand.

BlueScope's ventures into new, undeveloped markets or technologies, like its US cold rolling facility deferral and early-stage green steel initiatives, represent classic question marks. These areas demand significant investment and face considerable uncertainty regarding future market share and profitability.

Despite the risks, the potential for high returns in these nascent segments is substantial. Success hinges on effective market entry strategies, technological breakthroughs, and favorable economic conditions, making their long-term contribution to BlueScope's portfolio uncertain.

The company's strategic focus on international expansion for its branded products also falls into this category. While these markets show promise, they require substantial capital for brand building and navigating local competition, a situation exemplified by their Southeast Asian expansion efforts.

These question mark initiatives are crucial for BlueScope's future growth, but they require careful management and a willingness to adapt to evolving market dynamics. Their performance will significantly shape the company's strategic direction in the coming years.

| Initiative | Status | Market Share (Current) | Growth Potential | Investment (Est. FY24) |

| NeoSmelt Pilot Plant | Development | Negligible | High (Green Steel) | Significant R&D |

| US Greenfield Facility | Deferred | N/A | High (US Market) | Capital Reallocated |

| Green Steel Tech (Hydrogen) | Feasibility | Negligible | High (Decarbonization) | R&D/Feasibility Studies |

| International Branded Products | Expansion | Low (New Markets) | Medium-High | Part of AUD 1.5B CapEx |

BCG Matrix Data Sources

Our Bluescope Steel BCG Matrix leverages financial disclosures, market research reports, and internal sales data to accurately assess product portfolio performance and strategic positioning.