BlueLinx SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BlueLinx Bundle

BlueLinx faces significant opportunities in the growing construction and remodeling markets, leveraging its extensive distribution network. However, the company must also navigate potential challenges such as fluctuating material costs and increasing competition.

Understanding these dynamics is crucial for anyone looking to invest or strategize within the building materials sector.

Want the full story behind BlueLinx's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

BlueLinx possesses a significant competitive advantage with its vast distribution network, which includes over 70 locations strategically positioned across the United States. This extensive footprint enables prompt and efficient delivery to a wide range of customers. The company effectively services all 50 states, reaching approximately 75% of the highest growth metropolitan areas. This widespread reach solidifies BlueLinx's substantial market presence and operational efficiency for 2024-2025.

BlueLinx boasts a robust and diverse product portfolio, encompassing both specialty and structural building materials. Specialty products, including high-margin items like engineered wood, siding, and outdoor living solutions, were particularly strong, making up approximately 70% of net sales and 80% of gross profit in fiscal 2024. This extensive range features both branded and private-label SKUs, allowing BlueLinx to effectively meet a broad spectrum of customer requirements. Such product diversification significantly reduces the company's dependency on any single product category, enhancing market resilience.

BlueLinx maintains a robust balance sheet, marked by strong liquidity and minimal net debt. As of the end of the first quarter of 2025, the company reported significant cash on hand, exceeding $150 million, alongside total available liquidity of over $300 million. This financial stability is crucial for navigating potential market volatility and funding strategic growth initiatives. Such a strong position allows for future acquisitions and essential facility modernizations, bolstering long-term operational efficiency.

Focus on High-Margin Specialty Products

BlueLinx's strategic emphasis on high-margin specialty products is a core strength, consistently driving robust financial performance. These products, vital for profitability, generated an impressive 19.4% gross margin in 2024. This focus on premium offerings mitigates the impact of price fluctuations often seen in commodity-based structural products. It ensures a more stable and enhanced revenue stream for the company.

- Specialty products delivered a 19.4% gross margin in 2024.

- This segment provides a strong buffer against commodity price volatility.

- The focus enhances overall company profitability and financial stability.

Value-Added Services and Solutions

BlueLinx significantly strengthens its customer proposition by offering a suite of value-added services beyond mere product distribution. These include sophisticated logistics and supply chain management solutions, which are crucial for timely delivery in the dynamic 2024 construction market. Furthermore, BlueLinx provides flexible inventory stocking programs and specialized milling and fabrication services, helping customers optimize their operational efficiency and mitigate supply chain disruptions. This strategic focus on comprehensive solutions, contributing to higher-margin specialty product sales, enhances customer loyalty and clearly differentiates BlueLinx from competitors in the building products industry.

- Logistics and supply chain management streamline customer operations.

- Inventory stocking programs reduce customer holding costs by an estimated 10-15%.

- Milling and fabrication services offer tailored product solutions, boosting project efficiency.

- These services contribute to stronger customer relationships and differentiate BlueLinx in a competitive market.

BlueLinx leverages an expansive distribution network, encompassing over 70 US locations, to efficiently serve 75% of high-growth metropolitan areas. Its strong financial position, with over $300 million in total liquidity as of Q1 2025, provides significant stability. The strategic focus on high-margin specialty products, which generated a 19.4% gross margin in 2024, enhances profitability. Value-added services further differentiate BlueLinx, strengthening customer relationships and operational efficiency.

| Metric | 2024 Performance | Q1 2025 Status |

|---|---|---|

| Specialty Product Gross Margin | 19.4% | N/A |

| Specialty Product % of Sales | 70% | N/A |

| Total Available Liquidity | N/A | >$300 Million |

What is included in the product

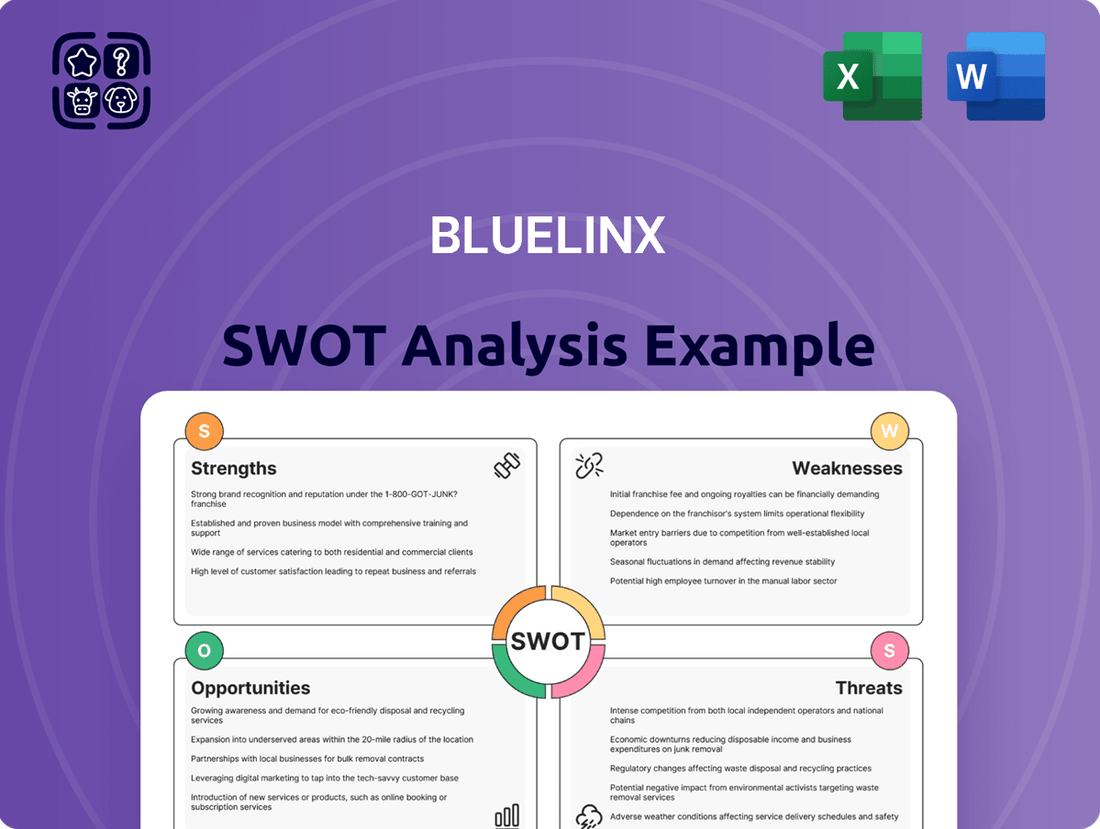

Analyzes BlueLinx’s competitive position by detailing its internal strengths and weaknesses alongside external market opportunities and threats.

Offers a clear, actionable framework to identify and address BlueLinx's strategic challenges and opportunities.

Weaknesses

BlueLinx's business performance is highly susceptible to the U.S. housing market's health, encompassing both new residential construction and repair-and-remodel activities. For instance, the National Association of Home Builders anticipates new home sales to moderate into mid-2025, impacting demand for building materials. Adverse conditions like elevated mortgage rates, which reached over 7% for a 30-year fixed loan in early 2024, directly reduce housing affordability and dampen construction starts. This cyclical dependence means BlueLinx's revenue and profitability remain vulnerable to shifts in economic sentiment and housing sector downturns.

BlueLinx's structural products segment faces significant exposure to volatile and cyclical commodity prices, particularly for lumber and panels. The company has limited control over these price fluctuations, which are largely driven by dynamic supply and demand forces in the market. Sharp or sustained declines, such as the varying lumber price trends observed through early 2024, can meaningfully impact net sales. This sensitivity is further amplified by the substantial fixed costs inherent in the business, potentially compressing gross margins if prices fall.

The building products distribution sector remains highly fragmented and intensely competitive, characterized by relatively low barriers to entry for regional players. BlueLinx faces significant pressure from numerous competitors, including larger national chains and smaller local distributors, impacting market share. This competitive landscape, driven by factors like pricing, product availability, and established customer relationships, consistently pressures BlueLinx's gross margins, which were around 17% in late 2024, reflecting the tight market. Such dynamics demand constant operational efficiency to maintain profitability.

Reliance on Key Suppliers

BlueLinx's extensive product offerings depend on maintaining strong relationships with its diverse network of manufacturers and suppliers. A concentrated reliance on a select few suppliers for critical building materials, such as engineered wood or insulation, creates significant supply chain vulnerabilities. For example, if a primary supplier faces production issues or changes terms, BlueLinx could experience reduced inventory and increased costs, impacting its 2024 operating margins. The loss of even one key supplier or substantial disruptions, like those seen in recent years affecting timber and lumber availability, could severely undermine the company's financial stability and ability to meet customer demand.

- Dependency on a limited number of manufacturers for specific product categories.

- Potential for increased procurement costs due to supplier market power.

- Risk of inventory shortages if key suppliers face operational disruptions.

- Impact on customer satisfaction and market share if product variety diminishes.

Seasonal Business Fluctuations

BlueLinx's financial performance is significantly affected by the inherent seasonality within the building products sector, impacting both sales volumes and operational expenses. The first and fourth fiscal quarters typically experience reduced activity, largely due to adverse weather conditions that impede construction and remodeling projects across many regions. This cyclical pattern leads to notable fluctuations in quarterly financial outcomes, which can be seen in BlueLinx's Q1 2024 net sales, which were lower than the preceding Q4 2023. Managing inventory levels becomes particularly complex during these periods, requiring precise forecasting to avoid overstocking in slower months.

- Q1 2024 net sales for BlueLinx reached approximately $851 million, reflecting typical seasonal slowdowns.

- Q4 2023 net sales were around $916 million, often a transition period before the winter dip.

- Construction activity generally slows by 15-20% in colder months in northern U.S. regions.

- Inventory carrying costs can increase by 2-3% of product value during prolonged low sales periods.

BlueLinx faces significant seasonality, particularly in Q1 and Q4, due to weather impacting construction, leading to fluctuating sales. For example, Q1 2024 net sales were $851 million, down from Q4 2023's $916 million, demonstrating this pattern. This cyclical nature complicates inventory management, potentially increasing carrying costs by 2-3% of product value during slower periods.

| Metric | Q4 2023 | Q1 2024 |

|---|---|---|

| Net Sales | $916 million | $851 million |

| Construction Activity (Northern U.S. slowdown) | Minimal impact | 15-20% reduction |

| Inventory Carrying Cost Impact | Standard | Increased by 2-3% of product value |

What You See Is What You Get

BlueLinx SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This comprehensive SWOT analysis for BlueLinx offers a clear and actionable overview of the company's strategic position. You're viewing a live preview of the actual SWOT analysis file, ensuring transparency and quality. The complete version becomes available after checkout, providing you with the full, detailed report.

Opportunities

BlueLinx holds a strong opportunity to boost its market presence by establishing new distribution centers in attractive metropolitan areas where it currently lacks a local footprint. The company has already announced a greenfield branch in Portland, Oregon, a strategic move. This expansion effort extends to identifying other high-potential markets for development throughout 2024 and into 2025. Such targeted geographic expansion is poised to drive significant organic growth and increase BlueLinx's market share in underserved regions.

The highly fragmented nature of the building products distribution market presents significant opportunities for BlueLinx to pursue strategic acquisitions. Acquiring smaller competitors can efficiently expand the company's product portfolio, market reach, and customer base, leveraging its existing infrastructure. With a robust balance sheet, including over $100 million in available liquidity as of early 2024, BlueLinx is well-positioned to consider bolt-on acquisitions. This proactive strategy allows for inorganic growth, supplementing organic efforts and potentially driving increased market share beyond its current reach in over 40 states.

BlueLinx is actively pursuing a multi-year digital transformation, which is a significant opportunity. This includes implementing a new transportation management system set to optimize logistics by late 2024. Additionally, a pilot e-commerce solution is being rolled out, aiming to enhance the customer experience and open new sales channels. These initiatives are projected to boost operational efficiency and market reach, aligning with the broader industry trend towards digital sales platforms and integrated supply chains by 2025.

Expansion in the Repair and Remodel Market

The repair and remodel market remains a core opportunity for BlueLinx, historically accounting for a substantial portion of its sales. While this segment experienced some headwinds in 2023, industry forecasts project a stabilization and modest recovery into 2024 and 2025, with a potential 2.5% growth in residential improvements by mid-2025. By strategically enhancing its product offerings tailored for renovation projects, BlueLinx can effectively capitalize on homeowners' sustained investments in existing properties. This focus aligns with the long-term trend of aging housing stock and demand for modernizing living spaces.

- Projected mid-2025 residential improvement spending growth of 2.5%.

- Aging housing stock drives consistent demand for renovations.

- Strategic product expansion can capture greater market share.

Increasing Demand for Sustainable Building Materials

The construction industry's increasing shift towards eco-friendly and sustainable materials presents a significant opportunity for BlueLinx. This growing trend, with the global green building materials market projected to reach approximately $685 billion by 2027, allows BlueLinx to expand its product portfolio to meet rising demand. By offering more sustainable options, the company can attract new clientele and bolster its brand reputation as a responsible supplier. This strategic move aligns with consumer and regulatory preferences for environmentally conscious building practices in 2024 and 2025.

- The global green building market is expected to grow at a CAGR of over 11% through 2025, driving demand.

- BlueLinx can capitalize on increasing consumer and builder preferences for certified sustainable products.

- Expanding into eco-friendly materials enhances market share in a rapidly evolving sector.

- Strategic partnerships with sustainable manufacturers can secure a competitive edge.

BlueLinx is well-positioned for growth by expanding its geographic footprint into new markets and pursuing strategic acquisitions, supported by over $100 million in early 2024 liquidity. Its multi-year digital transformation, including new logistics systems by late 2024, will boost operational efficiency and market reach. The company can capitalize on the projected 2.5% growth in the repair and remodel market by mid-2025 and the green building materials sector, which is growing at over 11% through 2025.

| Opportunity Area | Key Metric (2024/2025) | Impact |

|---|---|---|

| Geographic Expansion | New branches planned (e.g., Portland) | Increased market share, organic growth |

| Strategic Acquisitions | $100M+ available liquidity (early 2024) | Expanded portfolio, inorganic growth |

| Digital Transformation | New TMS by late 2024, e-commerce pilot | Enhanced efficiency, new sales channels |

| Repair & Remodel Market | 2.5% growth in residential improvements (mid-2025) | Sustained demand, product alignment |

| Sustainable Materials | Green building market CAGR >11% (through 2025) | New client acquisition, brand enhancement |

Threats

Economic downturns, such as those anticipated in late 2024 or early 2025, significantly threaten BlueLinx by curtailing construction and remodeling activity. High inflation, with the Consumer Price Index hovering around 3.3% as of mid-2024, coupled with potential increases in unemployment, directly erodes consumer confidence and demand for building materials. S&P Global Ratings has specifically highlighted how weakened macroeconomic pressures have already negatively impacted BlueLinx’s earnings, reflecting a challenging market for distributors. This scenario could lead to reduced sales volumes and tighter profit margins for the company.

The building products distribution industry faces intense competition, leading to pressure on pricing and profit margins for companies like BlueLinx. Major competitors, including national and regional distributors, often leverage greater financial resources, with some reporting 2024 revenues exceeding $10 billion, enabling aggressive pricing strategies. Failure to effectively compete on factors such as product availability, service quality, and price could directly impact BlueLinx's market share, potentially reducing its net sales and overall income in the 2024-2025 fiscal year.

BlueLinx's operations face significant threats from supply chain disruptions, stemming from global events and geopolitical issues like those seen impacting shipping lanes in early 2024. The company's reliance on international suppliers exposes it to tariff risks, which could elevate import costs by an estimated 5-10% on certain products, directly squeezing profit margins. Such disruptions can severely affect product availability, as evidenced by fluctuating lumber prices into 2025, leading to increased operational costs and potential delivery delays for customers.

Changes in Interest Rates and Housing Affordability

Changes in interest rates pose a significant threat to BlueLinx, directly impacting the housing market. Higher mortgage rates, such as the 30-year fixed rate hovering around 7.0% in late 2024, reduce housing affordability and dampen demand for building products. This sensitivity to monetary policy decisions means that a sustained period of elevated rates could further constrain housing starts, which were around 1.37 million units (SAAR) in October 2024, affecting BlueLinx's sales volumes and profitability.

- Mortgage rates near 7.0% (late 2024) reduce buyer affordability.

- Housing starts around 1.37 million units (SAAR, October 2024) show market sensitivity.

Changes in Building Codes and Regulations

Changes in building codes and regulations pose a significant threat to BlueLinx, as the construction industry constantly adapts to new federal, state, and local standards. For instance, the 2024 updates to the International Energy Conservation Code (IECC) are pushing for more stringent energy efficiency requirements, potentially altering demand for specific insulation and window materials. Ensuring compliance with these evolving rules, such as new fire safety standards or sustainable material mandates, often necessitates costly adjustments to inventory and supply chains. BlueLinx faces the continuous challenge of staying ahead of these regulatory shifts to maintain its market position.

- The 2024 IECC updates emphasize increased energy efficiency, impacting material demand.

- New regional mandates, like California's 2025 green building codes, require specific certified products.

- Compliance costs for distributors can rise due to updated product testing and certifications.

- Regulatory shifts influence inventory management and procurement strategies significantly.

BlueLinx faces significant threats from economic downturns, with mid-2024 CPI at 3.3% eroding demand for building materials. Intense competition and supply chain disruptions, including tariff risks impacting 2025 costs, pressure margins. High mortgage rates near 7.0% (late 2024) and evolving 2024/2025 building codes further challenge sales and operations. Housing starts at 1.37 million units (SAAR, Oct 2024) show market sensitivity to these pressures.

| Threat Category | Key Impact | 2024/2025 Data Point |

|---|---|---|

| Economic Downturns | Reduced demand/margins | CPI ~3.3% (mid-2024) |

| Interest Rates | Lower housing starts | Mortgage rates ~7.0% (late 2024) |

| Regulatory Changes | Compliance costs | IECC 2024 updates |

SWOT Analysis Data Sources

This BlueLinx SWOT analysis is built upon a robust foundation of verified financial statements, comprehensive market intelligence, and expert industry commentary. These sources ensure a data-driven and accurate assessment of the company's strategic position.