BlueLinx PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BlueLinx Bundle

Unlock the strategic advantage with our comprehensive PESTLE analysis for BlueLinx. Discover how political shifts, economic fluctuations, and technological advancements are redefining the building materials landscape. This expert-crafted report provides actionable insights into the social and environmental factors impacting BlueLinx's operations and future growth. Don't be left behind; gain a competitive edge by understanding the external forces shaping this dynamic industry. Download the full PESTLE analysis now for immediate, in-depth intelligence.

Political factors

Trade policies significantly impact BlueLinx, as tariffs on imported building materials like Canadian lumber and steel directly affect their operational costs and supply chain stability. For example, the U.S. Department of Commerce maintained duties on Canadian softwood lumber imports at 7.99% as of early 2024, influencing material pricing for distributors. Potential changes in trade agreements, such as adjustments to the USMCA, or the imposition of new Section 232 tariffs on steel and aluminum by the current administration, could lead to price volatility and supply disruptions. BlueLinx must navigate these ongoing policy shifts to manage profitability and maintain competitive pricing in the evolving market.

Government housing policies directly shape demand for BlueLinx's building materials. Initiatives like the Low-Income Housing Tax Credit (LIHTC) are projected to support over 100,000 affordable housing units in 2024, stimulating construction. Tax incentives, such as mortgage interest deductions, continue to encourage homeownership and remodeling activity. Furthermore, evolving land use regulations and permitting processes, which vary by state and municipality, can either accelerate or slow down new residential development. These policy shifts directly influence the volume of construction and remodeling, impacting BlueLinx's sales and distribution network through 2025.

Government infrastructure initiatives, such as those funded by the Bipartisan Infrastructure Law, increasingly include Buy American provisions, mandating the use of domestically produced materials for projects through 2025 and beyond. For BlueLinx, a leading U.S. distributor, this presents a significant opportunity to capitalize on demand for American-made building products, especially given the over $550 billion in new federal infrastructure spending allocated. These policies directly influence BlueLinx's sourcing strategies, potentially increasing its reliance on domestic manufacturers to meet projected shifts in market demand. Adapting its product mix to prioritize U.S.-origin goods could further enhance its competitive position in the coming years.

National Security and Critical Industries

The U.S. government views the wood products industry as critical for national security, potentially leading to increased domestic supply chain support. This focus could result in new federal programs, such as grants or low-interest loans, targeting domestic producers and distributors like BlueLinx. Such initiatives aim to bolster resilience and reduce reliance on volatile global supply chains. For instance, the Bipartisan Infrastructure Law, while broad, prioritizes domestic sourcing, indicating a trend toward strengthening U.S. manufacturing capabilities.

- Potential for federal grants, mirroring 2024 supply chain resilience initiatives.

- Reduced reliance on imports, enhancing domestic market stability for BlueLinx.

- Increased demand for domestically sourced building materials driven by policy.

Political Stability and Elections

The US political climate, particularly around the 2024 Presidential election, creates market uncertainty for BlueLinx. Changes in administration can shift economic and housing policies, directly impacting the construction industry. This uncertainty affects investment decisions by builders and homeowners, leading to fluctuations in demand for building products. For instance, potential policy changes regarding interest rates or housing incentives could alter project timelines and material orders.

- The 2024 US election outcomes could influence future housing starts, projected to be around 1.35 million in 2025.

- Policy adjustments on mortgage rates or tariffs on imported building materials directly impact BlueLinx's operational costs and sales volumes.

- Government spending on infrastructure, a focus for 2024-2025, indirectly boosts demand for BlueLinx's distribution channels.

- Regulatory shifts in environmental or labor policies could affect construction project viability and material sourcing for the industry.

Government trade policies, including the 7.99% tariff on Canadian softwood lumber, directly impact BlueLinx's material costs and supply chain. Housing initiatives like LIHTC, supporting 100,000+ affordable units in 2024, and Bipartisan Infrastructure Law spending of over $550 billion, drive demand for domestic building materials. The 2024 US election outcomes could influence housing starts, projected around 1.35 million in 2025, and future regulatory environments. Policy shifts create both opportunities for domestic sourcing and challenges from market uncertainty.

| Policy Area | Key Impact | 2024/2025 Data Point |

|---|---|---|

| Trade Tariffs | Material Cost Volatility | 7.99% on Canadian Softwood Lumber |

| Housing Initiatives | Demand for Building Materials | 100,000+ LIHTC Units (2024) |

| Infrastructure Spending | Domestic Sourcing Focus | $550B+ Bipartisan Infrastructure Law |

| Political Climate | Market Uncertainty | 1.35M US Housing Starts (2025 projection) |

What is included in the product

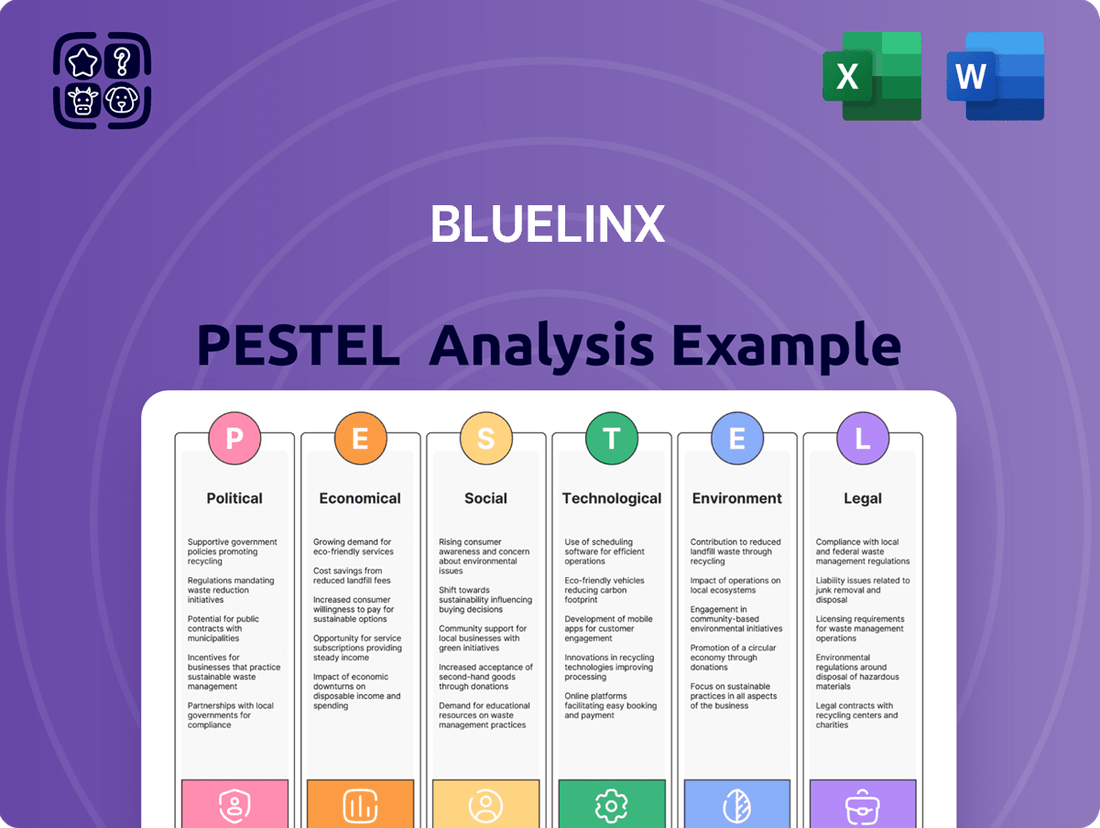

This PESTLE analysis provides a comprehensive review of the external macro-environmental factors influencing BlueLinx, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex external factors into actionable insights for strategic decision-making.

Economic factors

The level of interest rates profoundly impacts the housing market, a critical driver for BlueLinx. As of early 2024, the Federal Funds Rate holding steady at 5.25%-5.50% has translated to average 30-year fixed mortgage rates hovering around 7.0-7.2%, significantly increasing homeownership costs. This elevated financing burden directly dampens demand for new home construction and large-scale remodeling projects, impacting BlueLinx sales volumes. Conversely, any potential rate cuts anticipated later in 2024 or 2025 could stimulate housing activity and improve affordability. Home affordability, a function of both interest rates and median home prices, remains a key constraint for the industry.

Inflationary pressures significantly impact BlueLinx, increasing the cost of building materials it distributes. While the company may pass some expenses to customers, high inflation, like the 3.3% year-over-year U.S. CPI increase in May 2024, can compress profit margins and reduce overall demand for building products. The volatility in commodity prices, such as lumber and steel, directly affects BlueLinx's revenue and profitability. For instance, lumber futures for July 2025 have shown continued price fluctuations, making inventory management and pricing strategies critical for the company's financial performance.

The overall health of the U.S. economy, primarily measured by Gross Domestic Product (GDP) growth, directly influences construction activity and, consequently, BlueLinx's demand. A robust economy, with the U.S. GDP growth projected at 2.1% for 2024, typically sparks increased residential and commercial construction projects, boosting demand for the company's building products. Conversely, an economic deceleration, with 2025 GDP growth anticipated around 1.7%, can lead to a contraction in the construction sector. This slowdown directly translates to lower sales volumes for BlueLinx, reflecting reduced new builds and renovation activity across the nation.

Housing Starts and Remodeling Market

The number of new housing starts directly influences demand for many of BlueLinx products, with the company's performance closely tied to both single-family and multi-family construction markets. Forecasts for 2024 and 2025 indicate a modest rebound in housing starts. Additionally, the repair and remodel market represents a significant portion of BlueLinx sales, driven by homeowner spending on improvements. This segment continues to show resilience, contributing substantially to overall demand.

- US housing starts are projected to reach approximately 1.45 million units in 2024 and 1.55 million in 2025.

- Single-family starts are expected to comprise a larger share of new construction through 2025.

- Homeowner spending on improvements and repairs is forecast to grow by 9% in 2024, reaching $485 billion.

Labor Market and Employment

The availability and cost of labor significantly impact BlueLinx's customers in the construction sector. Persistent labor shortages, notably in skilled trades, can delay project completion and elevate construction costs for builders, which subsequently dampens demand for building materials. For instance, the National Association of Home Builders reported in early 2024 that 80% of builders faced shortages of carpenters and framers. Moreover, steady employment rates and wage growth, with the U.S. unemployment rate projected to remain near 4.0% through 2025 by the Congressional Budget Office, bolster consumer confidence and discretionary spending on new housing and renovation projects.

- Construction labor shortages: 80% of U.S. builders reported shortages of carpenters and framers in Q1 2024.

- Projected unemployment rate: U.S. unemployment expected to hover around 4.0% through 2025.

- Average hourly earnings growth: Wage growth in construction was about 5.0% year-over-year as of early 2024.

- Housing starts forecast: New residential construction starts are projected to reach approximately 1.4 million units in 2025.

High interest rates, with 30-year fixed mortgage rates around 7.0-7.2% in early 2024, are dampening housing demand, while inflation, seen in the U.S. CPI at 3.3% year-over-year in May 2024, impacts material costs. U.S. GDP growth, projected at 2.1% for 2024, supports construction, with housing starts forecast to reach 1.45 million units in 2024 and 1.55 million in 2025. Additionally, the resilient repair and remodel market is expected to grow by 9% in 2024, reaching $485 billion, buoyed by stable labor markets and unemployment near 4.0% through 2025.

| Economic Indicator | 2024 Data | 2025 Projection |

|---|---|---|

| 30-Year Fixed Mortgage Rate | ~7.0-7.2% (Early 2024) | Potential Cuts (Anticipated) |

| U.S. CPI Growth (YoY) | 3.3% (May 2024) | Fluctuating (Commodities) |

| U.S. GDP Growth | 2.1% | 1.7% |

| U.S. Housing Starts | 1.45 million units | 1.55 million units |

| Homeowner R&R Spending | $485 billion (9% growth) | Continued Growth (Expected) |

| U.S. Unemployment Rate | ~4.0% | ~4.0% |

What You See Is What You Get

BlueLinx PESTLE Analysis

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. The BlueLinx PESTLE Analysis preview you see is the same document the customer will receive after purchasing. It's fully formatted, professionally structured, and ready to use immediately. What you’re previewing here is the actual file, offering a comprehensive look at the political, economic, social, technological, legal, and environmental factors impacting BlueLinx.

Sociological factors

Demographic shifts, including an aging population and the increasing household formation rates of millennials and Gen Z, significantly influence housing demand for BlueLinx. The US Census Bureau projects sustained household growth, with formations expected to average around 1.3 to 1.5 million annually through 2025, driving demand for new housing units. A notable trend is the move towards smaller single-family homes and multi-family dwellings in urban centers, affecting the types and quantities of building products required. This shift necessitates adaptable product offerings from suppliers like BlueLinx to meet evolving residential construction needs, as approximately 60% of new housing starts in 2024 are projected to be single-family. Overall, robust household formation directly correlates with increased demand for building materials.

Consumer preferences for sustainable and eco-friendly products are significantly shaping the building materials market. There is a strong and growing demand from both consumers and builders for green building materials, presenting a key opportunity for BlueLinx to expand its offerings. The global green building materials market is projected to reach approximately $700 billion by 2025, driven by a rising preference for materials with lower environmental impact and those contributing to energy-efficient structures. This trend underscores a shift towards more environmentally conscious construction practices across the industry.

The persistent do-it-yourself (DIY) trend and a strong cultural emphasis on home improvement projects significantly bolster demand in the repair and remodel market. This growing segment is crucial for BlueLinx’s primary customers, including major home improvement centers like The Home Depot and Lowe's. The influence of popular home renovation television shows and accessible online tutorials continues to inspire homeowners, driving increased sales of building materials. Industry projections indicate the global home improvement market could reach approximately $1.1 trillion by 2025, underscoring this sustained consumer interest.

Shift Towards Outdoor Living Spaces

The growing homeowner focus on outdoor living spaces, like decks and patios, significantly boosts demand for BlueLinx's specialty products. This trend, driven by a desire for expanded usable home areas, has seen continued investment, with the outdoor living market projected to reach $13.5 billion by 2025. BlueLinx directly benefits from this, supplying essential decking materials, specialty lumber, and other outdoor living products. This lifestyle shift is a key driver for the company's specialty product segment, contributing to its robust performance.

- The outdoor living market is projected to reach $13.5 billion by 2025, indicating sustained growth.

- BlueLinx's specialty products segment, including decking and lumber, directly capitalizes on this trend.

Urbanization vs. Suburbanization Trends

The dynamic interplay between urbanization and suburbanization significantly shapes construction demand, directly impacting BlueLinx product lines. A sustained preference for suburban living often drives robust demand for single-family homes and extensive renovation projects, with single-family housing starts projected to reach approximately 1.05 million units in 2024. Conversely, a renewed focus on urban centers fuels the need for multi-family residential buildings and commercial construction, though multi-family starts are forecast to decline to around 360,000 units in 2024. These population shifts dictate the types of building materials and services required, influencing BlueLinx inventory and sales strategies. The market adapts to these evolving demographic footprints, dictating material flow.

- Single-family housing starts are projected to be around 1.05 million units in 2024.

- Multi-family housing starts are forecast to decline to approximately 360,000 units in 2024.

- Renovation spending continues to be a significant driver in suburban markets, supporting lumber and building material sales.

Sociological factors like evolving consumer preferences for sustainable building materials and the strong DIY trend significantly influence demand for BlueLinx products. The global green building materials market is projected to reach approximately $700 billion by 2025, reflecting a shift towards eco-conscious construction. Additionally, the overall home improvement market, driven by sustained homeowner interest, is forecast to reach $1.1 trillion by 2025. These trends, alongside a growing focus on outdoor living spaces projected at $13.5 billion by 2025, reshape product needs.

| Factor | Market Projection (2025) | Impact on BlueLinx |

|---|---|---|

| Green Building Materials | $700 Billion | Expand eco-friendly offerings |

| Home Improvement Market | $1.1 Trillion | Increased sales via retail partners |

| Outdoor Living Market | $13.5 Billion | Boost specialty product demand |

Technological factors

BlueLinx is currently undergoing a multi-year digital transformation, enhancing its operational efficiency and customer engagement. This includes implementing advanced transportation management systems and re-architecting master data for improved accuracy. The company is also expanding its e-commerce solutions, aiming for a significant increase in online order processing by late 2024. These technological investments are crucial for maintaining a competitive edge and improving customer service.

Innovation in building materials, like advanced engineered wood and durable composite products, profoundly shapes BlueLinx's product mix. This technological shift, driving a focus on higher-margin specialty items, is evident as specialty products comprised over 75% of BlueLinx's net sales in 2023. Offering these cutting-edge materials is crucial for meeting evolving customer demands in 2024 and 2025. The global engineered wood market alone is projected to exceed $400 billion by 2025, underscoring the market's reliance on these advancements.

The construction industry is rapidly adopting prefabrication and modular building methods, a segment projected to exceed $140 billion globally by 2025. These innovative approaches significantly enhance efficiency, often reducing project timelines by 20-50% and minimizing on-site waste by up to 70%. Such methods demand specialized building materials and robust logistical support for components. BlueLinx can strategically adapt its product offerings, including engineered wood products and panels, and optimize distribution services to cater directly to this high-growth construction segment. This positions BlueLinx to capitalize on evolving market demands and sustain competitive advantage through 2024 and 2025.

Data Analytics and Inventory Management

Utilizing robust data analytics is crucial for BlueLinx to optimize its inventory management, leading to more accurate demand forecasting and enhanced supply chain efficiency. Advanced analytical tools provide vital insights into evolving market trends and customer purchasing patterns, allowing BlueLinx to adapt quickly. This strategic application of technology ensures better working capital management, potentially reducing inventory holding costs by 10-15% in 2024, and guarantees product availability to meet customer needs. Such data-driven approaches are essential for maintaining competitiveness in the building materials distribution sector.

- Optimized inventory management can reduce carrying costs by up to 15% for distributors in 2024.

- Predictive analytics can improve demand forecast accuracy by 20-30%, minimizing stockouts and overstock.

- Real-time data integration can cut supply chain lead times by 5-10% in the 2024-2025 period.

- Enhanced data visibility supports a 5-7% improvement in working capital efficiency for companies like BlueLinx.

Automation in Warehousing and Logistics

BlueLinx can significantly enhance operational efficiencies by adopting automation technologies in its distribution centers. This includes integrating automated storage and retrieval systems and robotics for material handling, which can reduce labor costs by an estimated 25-35% by 2025. Such advancements also improve order fulfillment accuracy to over 99% and accelerate delivery routes, crucial as the global logistics automation market approaches $88 billion by 2025.

- Labor cost reductions: Up to 35% in automated warehouses.

- Order fulfillment accuracy: Reaching over 99% with advanced robotics.

- Logistics automation market value: Projected at nearly $88 billion by 2025.

- Increased throughput: Automated systems can boost processing speeds by over 30%.

BlueLinx's digital transformation, including advanced e-commerce and logistics systems, is boosting operational efficiency and customer engagement, with online order processing expected to significantly increase by late 2024. Innovation in engineered wood and composite products, comprising over 75% of 2023 sales, aligns with the market projected to exceed $400 billion by 2025. Data analytics are optimizing inventory, potentially reducing holding costs by 10-15% in 2024, and automation in distribution centers can cut labor costs by 25-35% by 2025, enhancing order fulfillment accuracy to over 99%.

| Technological Area | 2024/2025 Impact | Key Metric |

|---|---|---|

| Digital Transformation | Enhanced E-commerce | Increased online order processing by late 2024 |

| Material Innovation | Market Shift to Specialty | Engineered wood market >$400B by 2025 |

| Data Analytics | Inventory Optimization | 10-15% reduction in holding costs (2024) |

| Automation | Operational Efficiency | 25-35% labor cost reduction by 2025 |

Legal factors

BlueLinx's extensive product line, including lumber and specialty building materials, must strictly adhere to a complex web of federal, state, and local building codes and safety standards. These regulations are dynamic, often tightening, as seen with ongoing updates to the International Building Code (IBC) for 2024, emphasizing enhanced structural integrity and fire safety. The company faces the continuous challenge of ensuring its diverse product portfolio, distributed across various regions, meets the latest requirements, which can significantly vary by jurisdiction, impacting product development and inventory management.

BlueLinx Corporation faces extensive environmental regulations covering land use, waste management, and the materials it distributes. Strict compliance is required for waste disposal, with national regulations pushing for reduced landfill reliance by 2025. Regulations for sourcing wood products, particularly from certified sustainable forests, are increasingly critical; over 438 million hectares globally were certified by early 2024. Adhering to these evolving environmental standards can elevate operating costs, potentially increasing compliance expenses by 5-10% for new initiatives. This also impacts product sourcing, favoring suppliers meeting stringent environmental criteria through late 2025.

BlueLinx must strictly adhere to Occupational Safety and Health Administration (OSHA) regulations and various labor laws across its distribution network, crucial for maintaining operational compliance in 2024. Adjustments in these regulations, for instance, increased mandates for personal protective equipment (PPE) or shifts in union activity rules, directly impact operational procedures and can elevate compliance costs. The company also manages multiple collective bargaining agreements, with renegotiations occurring periodically, influencing labor expenses and ensuring workforce stability. For example, a 2024 renegotiation could shift average hourly wages, impacting up to 30% of its unionized workforce.

Transportation and Logistics Regulations

As a major distributor, BlueLinx navigates evolving transportation regulations impacting its extensive truck fleet. Rules like the Federal Motor Carrier Safety Administration's (FMCSA) updated Hours-of-Service (HOS) regulations, which continue to refine driver rest periods into 2025, directly influence delivery schedules and driver availability. Stricter vehicle emissions standards, such as those from the Environmental Protection Agency (EPA) targeting heavy-duty trucks, drive up fleet maintenance and acquisition costs, with new models often costing 15-20% more for compliance. Additionally, varying state weight limits necessitate route optimization to avoid penalties, impacting logistical efficiency and potentially increasing fuel consumption by up to 5% on less direct routes.

- FMCSA HOS regulations continue to refine driver rest periods into 2025, impacting delivery schedules.

- EPA emissions standards for heavy-duty trucks are driving up fleet acquisition and maintenance costs.

- New compliant truck models can be 15-20% more expensive than non-compliant alternatives.

- Varying state weight limits necessitate route optimization, potentially increasing fuel consumption by up to 5%.

Corporate Governance and Financial Reporting

As a publicly traded entity, BlueLinx Holdings Inc. must strictly adhere to Securities and Exchange Commission (SEC) regulations concerning financial reporting and robust corporate governance. These legal mandates, such as those derived from the Sarbanes-Oxley Act (SOX) and Dodd-Frank Wall Street Reform and Consumer Protection Act, ensure transparency for investors and the broader public regarding BlueLinx's financial health and operations. Maintaining compliance with SEC filing deadlines, like the upcoming Form 10-K for the fiscal year ending December 2024 and subsequent 10-Q filings in 2025, is critical for investor confidence. Adherence to these standards is crucial for maintaining investor confidence and access to capital markets, influencing share price stability and debt financing terms. Non-compliance can lead to significant penalties, reputational damage, and a decline in market capitalization, potentially impacting the company's ability to raise capital.

- SEC Enforcement Actions: The SEC continues to prioritize accurate disclosures; in fiscal year 2024, the SEC brought numerous enforcement actions related to financial reporting and disclosure violations, totaling billions in penalties.

- Audit Committee Oversight: BlueLinx's audit committee plays a vital role in overseeing financial reporting integrity, a key focus for institutional investors in 2025.

- ESG Reporting Trends: Emerging SEC rules for climate-related disclosures, expected by late 2024 or early 2025, will broaden BlueLinx's reporting obligations.

- Internal Controls: Robust internal controls over financial reporting (ICFR) remain a primary focus, with companies investing significantly to ensure SOX compliance.

BlueLinx faces growing legal exposure from product liability claims for distributed materials, with 2024 litigation trends showing increased focus on construction defects. Adherence to evolving consumer protection laws, including warranty and disclosure mandates, is critical to avoid fines and maintain trust into 2025. Additionally, the company must navigate antitrust regulations to ensure fair market practices, given heightened federal scrutiny on supply chain concentration in 2024.

| Legal Area | Key Impact | 2024/2025 Trend |

|---|---|---|

| Product Liability | Financial penalties, reputational damage | Increased litigation in construction sector |

| Consumer Protection | Fines, brand erosion | Evolving disclosure and warranty mandates |

| Antitrust | Market access, operational restrictions | Heightened federal scrutiny on supply chains |

Environmental factors

The increasing frequency and intensity of extreme weather events, like the record 28 billion-dollar disasters in the U.S. during 2023, significantly impact BlueLinx's operations. These events, including projected severe 2024 hurricane seasons, disrupt critical supply chains and can damage distribution facilities, leading to operational delays. Conversely, such disasters often spur heightened demand for building materials needed for repair and reconstruction efforts, potentially shifting product needs for BlueLinx.

The building materials industry faces increasing pressure to source wood products from sustainably managed forests, impacting companies like BlueLinx. This commitment to responsible sourcing, often highlighted by certifications such as the Forest Stewardship Council (FSC), directly influences BlueLinx's market access and corporate reputation. For instance, the global market for FSC-certified products is projected to exceed $150 billion by 2025, reflecting growing consumer and regulatory demand. BlueLinx's proactive adoption of such practices is crucial for maintaining competitive advantage and meeting evolving stakeholder expectations.

The rising adoption of green building standards, like LEED certification, significantly boosts demand for sustainable and energy-efficient construction materials. BlueLinx is well-positioned to capitalize on this trend by expanding its offerings of products that meet these rigorous environmental criteria. For instance, the global green building materials market is projected to reach $680 billion by 2025, driven by a preference for low VOC emissions, high recycled content, and enhanced insulation properties. BlueLinx can leverage its extensive distribution network to supply materials such as eco-friendly insulation panels and composite decking with recycled plastics, aligning with evolving market demands and regulatory pushes.

Waste Management and Recycling

Environmental regulations and industry initiatives are increasingly emphasizing the reduction of construction and demolition waste, which reached over 600 million tons in the U.S. in 2023. This trend presents opportunities for BlueLinx to expand its offering of products made from recycled content, such as composite decking or insulation from recycled materials, aligning with market demand for sustainable building solutions. Participation in material take-back and recycling programs for wood and other building components further enhances its environmental profile. Additionally, efficient waste management practices at BlueLinx's distribution centers are crucial, targeting a significant reduction in landfill waste by 2025 through comprehensive recycling programs.

- U.S. construction and demolition waste exceeded 600 million tons in 2023.

- Demand for recycled content in building products is projected to grow by 7% annually through 2025.

- BlueLinx aims for a 15% reduction in operational landfill waste by the end of 2025.

Carbon Footprint and Emissions Reduction

The construction value chain faces increasing pressure to significantly reduce its carbon footprint, encompassing emissions from manufacturing and transporting building materials. BlueLinx is under heightened scrutiny to report on and actively decrease its operational emissions, aligning with evolving environmental regulations expected through 2025. Partnering with suppliers committed to decarbonization is also becoming crucial for BlueLinx to meet these sustainability demands. The company’s 2024 Annual Report indicates a focus on enhancing operational efficiencies, which can indirectly contribute to emissions reductions.

- Growing industry focus on Scope 1, 2, and 3 emissions reduction across the construction sector.

- BlueLinx faces pressure to report and decrease its direct operational emissions (Scope 1 & 2).

- Strategic partnerships with low-carbon suppliers are essential for reducing Scope 3 emissions.

- Regulatory shifts in 2025 may mandate more stringent carbon reporting for building material distributors.

Environmental factors significantly impact BlueLinx, from extreme weather disrupting operations and supply chains to increasing demand for sustainable building materials. The company faces pressure to source responsibly, with the FSC-certified market exceeding $150 billion by 2025, and capitalize on the $680 billion green building materials market. Regulatory pushes for waste reduction, like the 600 million tons of U.S. C&D waste in 2023, and carbon emission reductions necessitate strategic shifts and operational efficiencies for BlueLinx through 2025.

| Environmental Factor | Key Data (2024/2025) | Impact on BlueLinx |

|---|---|---|

| Extreme Weather Events | 28 billion-dollar disasters (U.S. 2023) | Supply chain disruption, increased demand for repair materials |

| Sustainable Sourcing | FSC-certified market > $150 billion (2025) | Influences market access, reputation, competitive advantage |

| Green Building Materials | Global market $680 billion (2025) | Opportunity for expanded product offerings (e.g., eco-insulation) |

| Waste Reduction | U.S. C&D waste > 600 million tons (2023) | Demand for recycled content, BlueLinx 15% landfill waste reduction target (2025) |

| Carbon Footprint | Growing focus on Scope 1, 2, 3 emissions | Pressure for reporting, operational efficiency, low-carbon supplier partnerships |

PESTLE Analysis Data Sources

Our BlueLinx PESTLE Analysis is built on a foundation of comprehensive data from government agencies, industry associations, and market research firms. We leverage economic reports, regulatory updates, and technological trend analyses to provide a thorough understanding of the macro-environment.