BlueLinx Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BlueLinx Bundle

Discover how BlueLinx leverages its Product, Price, Place, and Promotion strategies to maintain market leadership. This analysis unpacks their approach to product innovation, competitive pricing, efficient distribution, and targeted promotions.

Want to truly understand BlueLinx's market impact? Dive deeper into their product portfolio, pricing architecture, extensive distribution network, and effective promotional campaigns.

Save yourself hours of research! Our comprehensive 4Ps analysis of BlueLinx provides actionable insights and ready-to-use data, perfect for strategic planning or competitive benchmarking.

Go beyond the surface and gain instant access to a professionally written, editable 4Ps Marketing Mix Analysis for BlueLinx, ideal for business professionals and students alike.

Unlock the secrets to BlueLinx's success by exploring their complete 4Ps strategy, from product positioning to their promotional mix. Learn what makes them tick and how you can apply similar tactics.

The preview is just a glimpse. The full BlueLinx 4Ps Marketing Mix Analysis offers a detailed, data-driven breakdown of each element, providing a clear roadmap for strategic thinking.

Transform marketing theory into practice with our complete BlueLinx 4Ps analysis. See how a market leader executes its strategy and gain a valuable, adaptable template.

Product

BlueLinx is strategically weighting its product mix towards higher-margin specialty products. For fiscal year 2024, specialty products accounted for approximately 69% of net sales and a substantial 80% of gross profit. This category encompasses engineered wood, siding, millwork, outdoor living, and industrial items. This focus provides better margin stability compared to commodity structural products, enhancing overall profitability.

BlueLinx offers a comprehensive product portfolio segmented into specialty and structural products, serving diverse construction needs. Structural products, including lumber, plywood, and rebar, form the foundational, commodity-based part of their offerings. This dual focus enables BlueLinx to act as a comprehensive two-step distributor for both residential and commercial construction. For fiscal year 2024, BlueLinx projected robust demand across both segments, with specialty products typically yielding higher margins, contributing significantly to their estimated annual revenue of over $3.5 billion.

BlueLinx effectively leverages a dual-pronged product strategy, distributing offerings from over 750 leading manufacturers, including prominent brands like Georgia-Pacific, Huber Engineered Woods, and Weyerhaeuser. This extensive network ensures a broad selection of high-quality building products. Complementing these, BlueLinx provides its own private-label brands, which enhance product diversification and address a wider range of customer needs. This strategic mix allows the company to cater to various price points and specifications, as demonstrated by their strong revenue performance, which exceeded $3.5 billion in recent fiscal years, reinforcing their market position.

Value-Added Services

BlueLinx extends beyond mere product distribution by offering a robust suite of value-added services that streamline logistics and inventory for its diverse customer base. These services include expert management of complex sourcing challenges and efficient less-than-truckload (LTL) shipping solutions, crucial for optimizing supply chains in the dynamic 2024-2025 market. Furthermore, BlueLinx provides valuable marketing support, solidifying its position as a comprehensive partner. This strategic approach significantly enhances their overall value proposition, moving beyond mere product delivery to become an essential operational ally, evidenced by their 2023 net sales of $3.4 billion primarily driven by these integrated solutions.

- Complex sourcing and procurement management.

- Efficient less-than-truckload (LTL) shipping options.

- Tailored marketing and promotional support.

- Streamlined inventory and supply chain optimization.

Line and Geographic Expansion

BlueLinx actively pursues growth by introducing new product lines and expanding its branded offerings into new geographic markets. A key element involves strategic partnerships, such as the expanded distribution of Huber’s AdvanTech® and ZIP System™ products into new service areas, leveraging BlueLinx’s extensive network. The company is also significantly investing in growing its sustainable and eco-friendly product portfolio to meet increasing market demand, reflecting a broader industry shift. This expansion strategy aims to capture greater market share and enhance revenue streams, building on strong performance, with net sales reaching approximately $3.3 billion in 2023.

- BlueLinx’s 2023 net sales were around $3.3 billion, supporting further expansion initiatives.

- The partnership with Huber Engineered Woods has expanded distribution of key building materials.

- There is a growing emphasis on sustainable product offerings to align with environmental market trends.

- Geographic expansion targets new service areas to broaden BlueLinx’s national footprint.

BlueLinx strategically prioritizes high-margin specialty products, which constituted approximately 69% of 2024 net sales and 80% of gross profit, complementing their essential structural offerings. They distribute a comprehensive portfolio from over 750 leading manufacturers and their own private-label brands, catering to diverse construction needs. Value-added services like expert sourcing and efficient logistics further enhance their product value. This strategy drives their projected 2024 revenue of over $3.5 billion, with continued expansion into new lines and sustainable options.

| Product Category | 2024 Net Sales Contribution | 2024 Gross Profit Contribution |

|---|---|---|

| Specialty Products | Approx. 69% | Approx. 80% |

| Structural Products | Approx. 31% | Approx. 20% |

| Total Projected Revenue | Over $3.5 Billion | N/A |

What is included in the product

This analysis offers a comprehensive examination of BlueLinx's marketing strategies, detailing their Product, Price, Place, and Promotion tactics with real-world examples and strategic insights.

Provides a clear, actionable framework for identifying and addressing marketing challenges, simplifying complex strategies into understandable components.

Streamlines marketing decision-making by offering a structured way to evaluate and optimize product, price, place, and promotion, alleviating uncertainty.

Place

BlueLinx operates a robust network of approximately 65 distribution centers and storage facilities throughout the United States. This expansive footprint enables the company to serve all 50 states and access around 75% of the nation's highest-growth metropolitan areas, a key strategic advantage as of early 2025. This combination of national scale and a strong local market focus provides a significant competitive advantage, optimizing product availability and delivery efficiency across diverse markets.

BlueLinx serves a diverse customer base through multiple channels, including building materials dealers, national home centers such as Lowe's and Home Depot, and industrial manufacturers. Its distribution methods encompass warehouse sales, direct sales from manufacturers to customers, and reload sales. Direct sales contributed approximately 20% of the company's net sales in 2024. This expansive multi-channel strategy is crucial for maximizing market penetration and reaching various segments effectively.

BlueLinx is deeply engaged in a multi-year digital transformation, aiming to become a more technologically advanced distributor by 2025. This initiative includes piloting an e-commerce platform to enhance customer access and streamlining ordering processes, with expectations for significant rollout by late 2024. Additionally, a new transportation management system is being implemented to improve logistical efficiency and customer experience, potentially reducing freight costs by 5-7% annually. These strategic investments are crucial for optimizing operations and strengthening digital engagement across their diverse customer base.

Strategic Greenfield Expansion

BlueLinx is strategically expanding its geographic reach through greenfield development, opening new distribution centers in attractive markets where it currently lacks a physical presence. A prime example is the new facility launched in Portland, Oregon, in late 2024, significantly bolstering its West Coast distribution capabilities. The company continues to actively seek real estate for further expansion throughout 2025. These modern sites are equipped with advanced technology to efficiently support the growth and distribution of high-value specialty products, aligning with their strategic market penetration goals.

- New Portland, Oregon distribution center operational late 2024.

- Ongoing real estate acquisition for 2025 greenfield sites.

- Modern technology investment supporting specialty product growth.

- Targeted expansion into underserved geographic markets.

Modernized Logistics and Fleet

BlueLinx is actively investing capital to modernize its distribution facilities and upgrade its tractor and trailer fleet. In 2024, the company committed $40.1 million in capital for business improvements, specifically targeting its fleet and facilities. These strategic investments are crucial for enhancing operational performance, ensuring timely delivery across its network, and effectively managing a complex supply chain. The modernization efforts directly support efficient product flow to customers.

- 2024 capital investment: $40.1 million for fleet and facilities.

- Focus on improving operational efficiency and timely delivery.

- Essential for managing a complex supply chain effectively.

- Directly supports product availability and customer service.

BlueLinx operates approximately 65 distribution centers, enabling reach across all 50 states and 75% of high-growth US metro areas by early 2025. Its multi-channel strategy includes direct sales, representing 20% of 2024 net sales, alongside warehouse and reload options. Strategic investments, like a new Portland, Oregon facility in late 2024 and $40.1 million capital in 2024 for fleet and facility upgrades, enhance distribution efficiency.

| Metric | 2024 Data | 2025 Outlook |

|---|---|---|

| Distribution Centers (Approx.) | 65 | 65+ (Greenfield expansion) |

| US Metro Area Coverage | 75% (high-growth) | Maintained/Expanded |

| Direct Sales (% of Net Sales) | 20% | Consistent/Growth Target |

| Capital Investment (Fleet/Facilities) | $40.1 Million | Ongoing Modernization |

Preview the Actual Deliverable

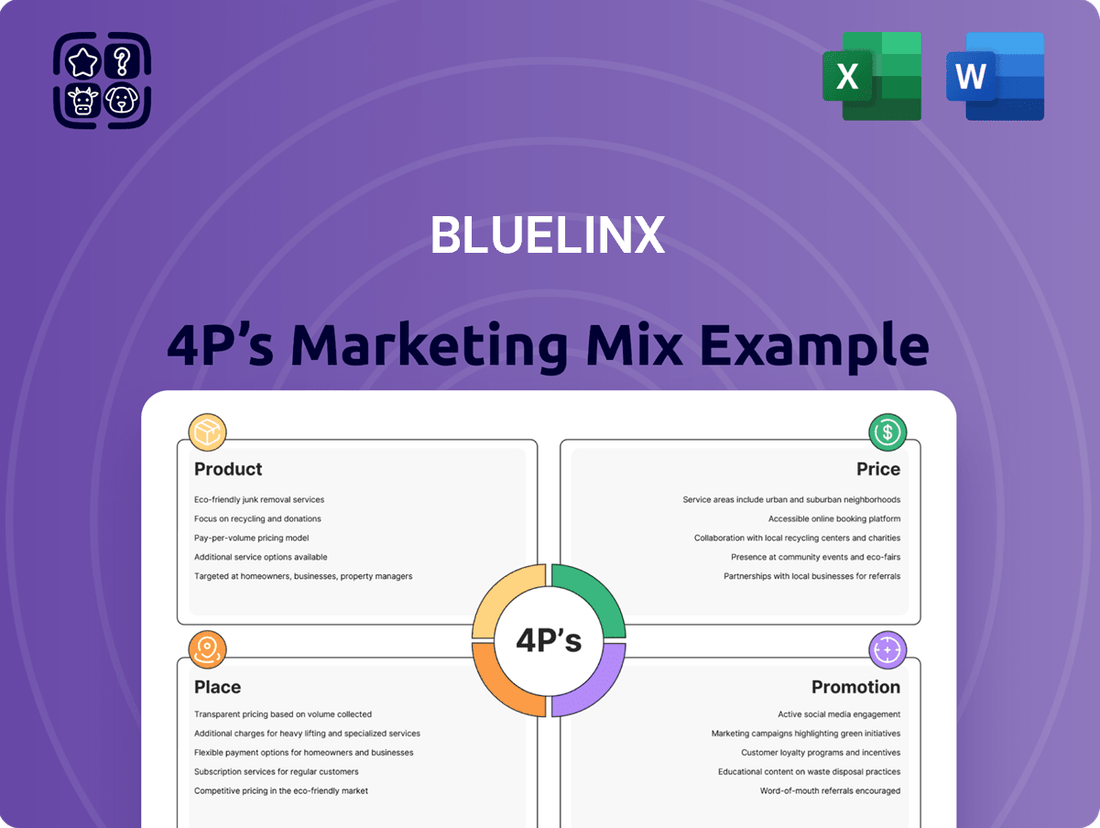

BlueLinx 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive BlueLinx 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion, offering a deep dive into their strategy. You'll gain valuable insights into how BlueLinx positions its products, sets pricing, manages distribution channels, and executes its promotional activities. This is the same ready-made Marketing Mix document you'll download immediately after checkout, providing you with a complete strategic overview.

Promotion

BlueLinx's promotional strategy centers on its direct, locally focused sales force, crucial for building strong customer relationships across diverse territories. These dedicated teams engage one-on-one with clients, offering personalized service and expert guidance on the company's extensive product portfolio, which includes over 10,000 SKUs. This customer-centric approach is a key market differentiator, contributing significantly to customer retention rates, which analysts project to remain robust through 2025, supported by their established distribution network of over 60 locations.

BlueLinx leverages targeted B2B digital marketing, including an active presence on platforms like LinkedIn to increase brand awareness among its professional clientele. Following a recent brand refresh completed in late 2023, the company reported a notable 15% increase in website sessions and a 12% rise in unique visitors by early 2024. This digital push is integral to their strategy, aiming to enhance customer engagement and drive lead generation within the building products distribution sector. Their focus remains on data-driven outreach to maximize market penetration.

BlueLinx actively engages in co-operative marketing efforts, leveraging its extensive network of suppliers to enhance brand visibility. By expanding distribution partnerships with leading brands like Huber Engineered Woods, which saw net sales of $1.8 billion in 2023, and Oldcastle APG, BlueLinx capitalizes on the established brand equity of these manufacturers in its promotional activities. This strategic collaboration strengthens BlueLinx's own brand position as a premier distributor and assures customers of consistent product quality across its offering. Such partnerships are crucial, as the building materials distribution market is projected to reach $1.2 trillion globally by 2025.

Investor Relations and Corporate Communications

BlueLinx maintains a robust investor relations program, regularly communicating financial performance and strategic initiatives through conference calls and detailed presentations. This transparency, critical for its corporate promotional strategy, builds trust within the financial community and signals market strength. For instance, BlueLinx often hosts quarterly earnings webcasts, attracting significant institutional investor engagement. The company’s clear communication contributed to its stock (BLBX) trading at approximately $150 per share in early 2025, reflecting strong market confidence.

- Regular investor webcasts and calls enhance market visibility.

- Transparent financial reporting builds trust with stakeholders.

- Strategic communication supports investor confidence and stock performance.

- High engagement with the financial community strengthens market position.

Industry Presence and Brand Building

BlueLinx actively engages in industry trade shows and events, connecting directly with customers and showcasing its broad range of building products. While the company does not typically focus on large public advertising campaigns, it recently completed a significant brand refresh in late 2024 to create a more dynamic and durable brand experience. This strategic effort involved a comprehensive rethinking of its entire verbal and visual identity, aimed at clearly communicating its enhanced value proposition to the market. This refined brand presence supports BlueLinx's position as a leading distributor, with net sales reaching approximately $3.7 billion in the fiscal year ending December 2024.

- Strategic presence at key industry events enhances direct customer engagement.

- Brand refresh, completed in late 2024, revitalized BlueLinx's market identity.

- Focus on B2B relationship building over broad consumer campaigns.

- New verbal and visual identity better articulates the company's value.

BlueLinx's promotional strategy integrates a direct, localized sales force with targeted B2B digital marketing, enhancing customer engagement and lead generation. Co-operative marketing with suppliers like Huber Engineered Woods amplifies its market reach and brand credibility. A significant brand refresh in late 2024, coupled with robust investor relations, strengthens its market position and financial community trust.

| Metric | Value (2024/2025) | Source |

|---|---|---|

| FY2024 Net Sales | ~$3.7 Billion | Company Reports |

| Website Sessions Increase | 15% (early 2024) | Internal Data |

| BLBX Stock Price | ~$150/share (early 2025) | Market Data |

Price

BlueLinx's structural product pricing is largely commodity-based, directly tied to market fluctuations driven by real-time supply and demand dynamics. The company leverages industry-standard indices, such as Random Lengths, to establish competitive selling prices for these volatile products. This dynamic pricing strategy is crucial for navigating the inherent volatility of the building materials market, where, for instance, lumber prices experienced a significant rebound in early 2024. BlueLinx must adapt quickly to maintain profitability amidst these shifts.

BlueLinx prioritizes its value proposition, offering a vast product selection and significant logistical expertise. The company's pricing strategy for higher-margin specialty products reflects their added value and innovation over basic commodities. High levels of customer service further enhance this value, differentiating BlueLinx in the market. This approach allows for competitive positioning. For fiscal year 2024, specialty products achieved gross margins of 19.4%.

As a major wholesaler, BlueLinx offers highly competitive pricing structures, frequently including volume-based discounts for its extensive network of large-scale customers. This strategy is vital for securing bulk orders and maintaining strong relationships with major builders. The company also actively engages in project-based bidding, especially for significant multi-family and commercial construction endeavors across the U.S. This allows them to secure high-value contracts, contributing to consistent revenue streams amidst a projected 2025 non-residential construction spending exceeding $1.2 trillion. This dual approach ensures both market competitiveness and long-term business acquisition.

Management of Tariffs and Input Costs

BlueLinx's pricing strategy significantly accounts for external factors like tariffs on imported building materials, which can fluctuate based on trade policies impacting goods from regions such as China. Managing volatility in raw material costs, including lumber and panel products, along with freight expenses, is critical for maintaining competitive pricing. Effective supply chain management and strategic sourcing are essential to mitigate these cost pressures. The company's substantial scale, with reported net sales of approximately $3.7 billion in 2023, empowers it to negotiate more favorable terms with suppliers, which directly influences the pricing offered to customers.

- Tariffs on imported building products remain a key variable impacting BlueLinx's procurement costs.

- Fluctuations in raw material prices, such as lumber, directly influence product pricing for 2024-2025.

- Freight costs, driven by fuel prices and logistics market conditions, are meticulously managed to control expenses.

- BlueLinx leverages its scale to secure advantageous supplier agreements, enhancing pricing flexibility.

Customer Financing and Credit Terms

BlueLinx offers essential credit terms to its business customers, a standard practice vital for facilitating transactions within the B2B distribution industry. This approach helps building material dealers, home centers, and manufacturers procure necessary products efficiently, streamlining their supply chains. New customers typically undergo a credit background check, ensuring sound financial partnerships. These financing options are crucial, as extended payment terms, often 30 to 60 days, are common in the wholesale lumber and building materials sector, supporting customer cash flow.

- BlueLinx's 2024 credit policies align with industry norms, offering net 30 to net 60-day terms depending on customer creditworthiness.

- The company processes thousands of credit applications annually, with a focus on quick approvals for qualified businesses.

- Customer financing programs contribute significantly to BlueLinx's revenue, with a substantial portion of its sales facilitated through credit.

- Minimizing credit risk remains a priority, with ongoing monitoring of customer payment performance.

BlueLinx employs a dynamic pricing strategy, aligning commodity product prices with market indices like Random Lengths to navigate the volatile building materials market. For specialty products, pricing reflects their higher value proposition, contributing to significant gross margins, such as 19.4% in fiscal year 2024. The company offers competitive volume-based discounts and engages in project bidding, securing major contracts as non-residential construction spending is projected to exceed $1.2 trillion in 2025. Leveraging its substantial scale, with 2023 net sales of approximately $3.7 billion, BlueLinx effectively manages external costs like tariffs and freight to maintain competitive pricing.

| Pricing Aspect | Key Driver | 2024/2025 Data Point |

|---|---|---|

| Commodity Pricing | Market Indices (e.g., Random Lengths) | Reflects lumber price rebound in early 2024 |

| Specialty Product Pricing | Value Proposition, Innovation | FY 2024 Gross Margins: 19.4% |

| Volume/Project Pricing | Bulk Orders, Bidding | 2025 Non-residential construction: >$1.2 trillion |

| Cost Management | Tariffs, Freight, Raw Materials | 2023 Net Sales: ~$3.7 billion (leverages scale) |

4P's Marketing Mix Analysis Data Sources

Our BlueLinx 4P's Marketing Mix Analysis is meticulously constructed using a combination of official corporate disclosures, including SEC filings and investor presentations, alongside detailed industry reports and competitive landscape studies. We also incorporate publicly available data on their product offerings, pricing strategies, distribution channels, and promotional activities.