BlueLinx Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BlueLinx Bundle

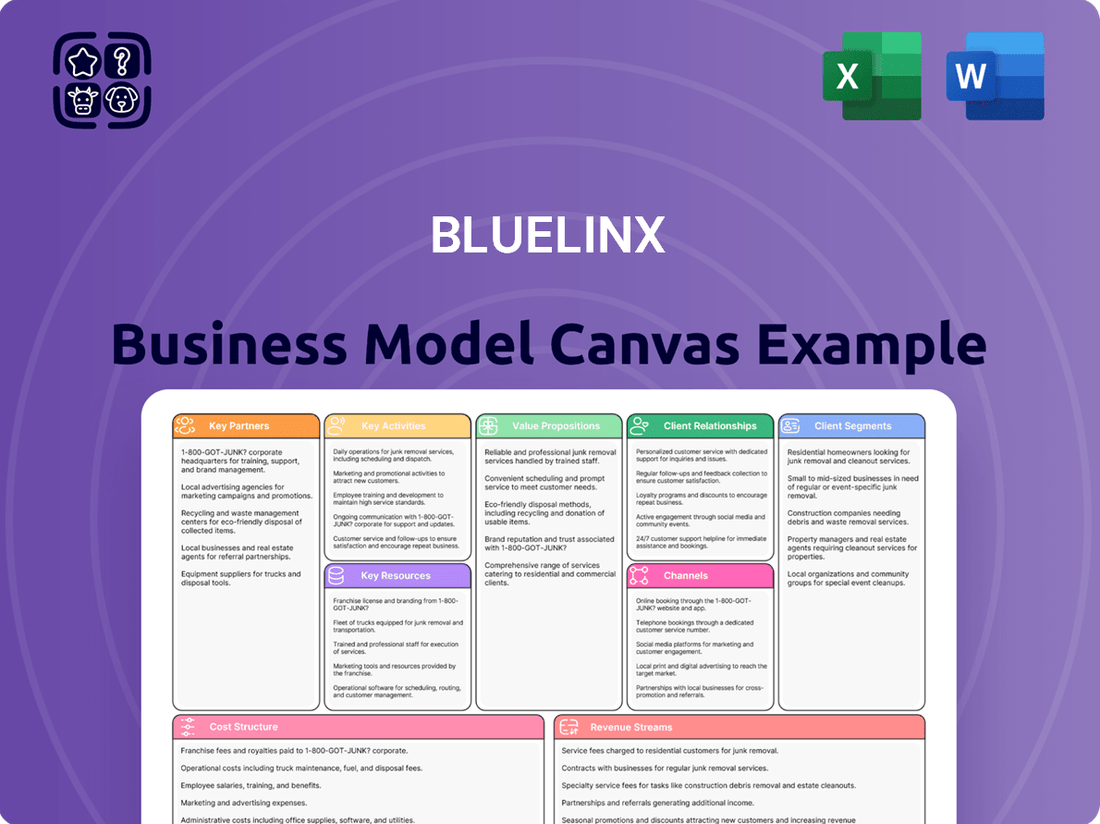

Discover the strategic core of BlueLinx's operations with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear view of their market approach. It's an essential tool for anyone aiming to understand industry leaders.

Unlock the full strategic blueprint behind BlueLinx's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

BlueLinx maintains strategic alliances with leading building product manufacturers like LP Building Solutions, James Hardie, and Boise Cascade. These key partnerships are crucial for securing a consistent, diverse, and high-quality supply of both specialty and structural products, reflecting BlueLinx's extensive 2024 product offerings. Strong relationships ensure favorable pricing, access to the latest product innovations, and collaborative marketing efforts. For instance, such collaborations help BlueLinx distribute products efficiently across its over 60 distribution centers nationwide, reinforcing its market position.

BlueLinx strategically partners with third-party logistics (3PL) providers and independent freight carriers, augmenting its private fleet for nationwide distribution. This hybrid logistics model offers essential flexibility and scalability, critical for adapting to fluctuating demand across diverse regions. Such collaborations are vital for optimizing transportation costs, a significant factor in their operational efficiency. For instance, in 2024, leveraging these partnerships continues to enhance BlueLinx’s ability to manage over 70 distribution centers efficiently, ensuring timely product delivery.

Collaboration with technology and software providers for Enterprise Resource Planning (ERP), Warehouse Management Systems (WMS), and e-commerce platforms is vital for BlueLinx. These partnerships enable efficient management of complex inventory and streamline supply chain operations, crucial for distributing over 15,000 products. Enhancing the digital customer experience through robust e-commerce solutions is a key focus, reflecting the industry's shift towards digital engagement, with B2B e-commerce sales projected to continue growing in 2024. This technological infrastructure supports operational efficiency, allowing for data-driven decision-making across their extensive network of over 60 distribution centers.

Real Estate Lessors

BlueLinx relies heavily on real estate lessors to maintain its extensive network of distribution centers, with most facilities being leased rather than owned. These partnerships with commercial real estate owners and developers are crucial for securing and managing strategically located properties across North America. The terms of these lease agreements directly influence the company's fixed operating costs and its overall logistical efficiency, impacting profitability.

- In fiscal year 2023, BlueLinx reported total operating lease liabilities of approximately $290 million, reflecting their significant reliance on leased properties.

- Strategic locations, often near major transportation hubs, are secured through these lessor relationships, enhancing delivery capabilities.

- Lease negotiations in 2024 continue to focus on favorable terms to manage fixed costs amid evolving real estate markets.

- The ability to adapt distribution footprint via leases offers flexibility compared to outright ownership, aiding rapid market response.

Financial Institutions and Creditors

Relationships with a syndicate of banks and financial institutions provide BlueLinx access to critical capital. This funding, often through asset-based lending facilities, is essential for large inventory purchases, managing working capital, and supporting strategic growth initiatives. These partnerships underpin the company's financial stability and operational liquidity, crucial for its extensive distribution network.

- BlueLinx reported total liquidity, including cash and availability under its credit facility, of $582 million as of March 30, 2024.

- The company's asset-based revolving credit facility plays a key role in its working capital management.

- This financial backing supports the procurement of building products from over 750 suppliers.

- Strategic growth initiatives, like facility expansions, rely on these robust financial partnerships.

BlueLinx leverages key partnerships with manufacturers for diverse product supply and favorable terms, supporting its 2024 offerings. Collaborations with logistics providers and real estate lessors optimize its distribution network of over 70 centers, managing costs. Technology firm alliances enhance operational efficiency and digital engagement. Financial partners provide critical capital, with $582 million liquidity as of March 2024, enabling growth and extensive inventory management.

| Partnership | 2024 Impact | Key Metric |

|---|---|---|

| Manufacturers | Supply Chain | 15,000+ Products |

| Logistics/Lessors | Distribution | 70+ DCs |

| Financial | Capital Access | $582M Liquidity |

What is included in the product

A detailed Business Model Canvas for BlueLinx, outlining its strategy for distributing building products through a vast network of dealers and contractors, emphasizing efficient logistics and broad product availability.

Simplifies complex distribution challenges by clearly mapping out BlueLinx's value proposition and customer segments.

Offers a visual framework to address inefficiencies in the building materials supply chain, providing actionable insights for improvement.

Activities

A core activity for BlueLinx involves the strategic sourcing and procurement of over 70,000 SKUs from a diverse network of manufacturing partners. This crucial function includes negotiating purchase agreements and fostering strong supplier relationships to ensure a consistent supply chain. Effective demand forecasting is also vital, allowing BlueLinx to optimize its product mix and inventory levels. For instance, managing supply chain costs, which for distributors like BlueLinx can represent a significant portion of operating expenses, directly impacts profitability. This meticulous approach ensures product availability and optimizes the cost of goods sold, supporting overall financial performance in 2024.

BlueLinx deeply focuses on managing its vast inventories across a national distribution network, essential for its operational efficiency. Key activities involve receiving goods, efficient storage, and precise order picking to fulfill customer demand. Maintaining optimal stock levels is critical, balancing product availability with the significant carrying costs associated with materials like lumber and building products. For 2024, efficient warehouse operations are paramount to minimizing order fulfillment times and preventing stockouts, supporting BlueLinx’s extensive supply chain.

BlueLinx's core operational function centers on the physical distribution of building products, moving materials from its extensive network of distribution centers directly to customer job sites. This critical activity involves sophisticated route planning and efficient fleet management, utilizing their own private trucks for timely deliveries. They also coordinate effectively with third-party carriers, ensuring comprehensive coverage and flexibility across their service areas. This robust logistics and distribution framework is the tangible execution of BlueLinx's value proposition, which promises reliable and timely delivery, a key differentiator in the competitive building materials market.

Sales and Relationship Management

BlueLinx employs a dedicated sales force to cultivate strong relationships with building material dealers, home centers, and industrial accounts. This team leverages deep product expertise to engage customers, acting as a consultative partner rather than just a vendor. They skillfully negotiate sales, which is the primary driver of BlueLinx's revenue generation. As of Q1 2024, BlueLinx reported net sales of 877 million, underscoring the effectiveness of their direct sales efforts.

- Q1 2024 Net Sales: $877 million, largely from direct sales engagement.

- Sales force focuses on building long-term customer relationships.

- Provides product expertise for consultative selling.

- Key driver for the majority of company revenue.

Value-Added Services

BlueLinx performs various value-added services at its facilities, including pre-finishing, custom milling, and specialty fabrication. These activities transform standard building products into customized solutions that meet specific project requirements, enhancing their utility and appeal. By offering these services, BlueLinx differentiates itself within the building products distribution market and aims to capture higher profit margins, leveraging its operational capabilities. This focus on specialty products contributed to a significant portion of BlueLinx's net sales in recent periods, reinforcing its strategic direction for 2024.

- Customization drives customer loyalty and premium pricing.

- Specialty product sales boost overall profitability.

- Operational efficiency supports diverse fabrication capabilities.

- Strategic investment in value-added services strengthens market position.

BlueLinx's key activities center on strategically sourcing over 70,000 SKUs and efficiently managing vast inventories across its national distribution network. This includes robust logistics, utilizing a private fleet and third-party carriers for timely distribution to customers. A dedicated sales force drives revenue, contributing to Q1 2024 net sales of $877 million, while value-added services like custom milling differentiate offerings.

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a mockup or sample, but a direct snapshot of the comprehensive plan. Upon completing your order, you will gain full access to this exact, professionally structured Business Model Canvas, ready for your immediate use and customization.

Resources

BlueLinx’s most critical resource is its extensive nationwide network, comprising approximately 60 strategically located distribution centers as of early 2024. This physical infrastructure provides unmatched market reach, enabling efficient service to a broad customer base across the United States. This robust network is the essential backbone of BlueLinx's entire logistics and fulfillment operations, supporting over 60,000 product SKUs. The network significantly contributes to their ability to deliver over 100,000 truckloads of products annually, enhancing overall operational efficiency.

BlueLinx maintains a vast and diverse inventory, encompassing both specialty and structural building products, which serves as a critical asset. This extensive stock, valued at approximately $482.7 million as of Q1 2024, enables BlueLinx to function as a convenient single-source supplier for its customers. The company's robust capacity to finance and effectively manage this substantial inventory provides a significant competitive advantage in the building materials distribution market.

BlueLinx owns and operates a substantial private fleet, a critical asset for controlling the final-mile delivery process, especially important in 2024's competitive logistics landscape.

This internal control provides greater reliability, ensuring products like lumber and building materials reach customers on schedule and in pristine condition.

It also offers superior scheduling flexibility, allowing BlueLinx to adapt quickly to customer demands and optimize delivery routes for efficiency.

This direct oversight ensures a consistent brand experience at the point of delivery, offering a level of service control that third-party carriers often cannot consistently match, which is a key differentiator in their market.

Experienced Human Capital

BlueLinx’s experienced human capital, including its skilled sales force, logistics experts, and product managers, forms a crucial intangible asset. Their deep industry knowledge, established customer relationships, and operational expertise are vital for navigating the complex building materials market. This human capital directly drives sales, enhances operational efficiency, and fosters strong customer loyalty. For example, in 2024, BlueLinx continues to leverage its sales team’s expertise to maintain a strong market position in specialty products.

- Skilled workforce ensures efficient distribution and sales.

- Deep industry knowledge aids in product selection and market adaptation.

- Customer relationships drive recurring revenue and market share.

- Operational expertise optimizes logistics and cost management.

Strong Supplier Relationships

BlueLinx maintains strong, long-standing relationships with numerous building product manufacturers, a critical key resource. These established connections ensure access to a broad product portfolio, offering over 15,000 SKUs as of early 2024, alongside favorable purchasing terms and valuable market intelligence. This network is challenging for new market entrants to replicate, providing BlueLinx with a resilient and stable foundation for its extensive supply chain. Securing consistent product availability and competitive pricing directly supports the company's distribution efficiency across its 50+ distribution centers.

- Access to a portfolio exceeding 15,000 SKUs from diverse manufacturers.

- Favorable procurement terms enhance operational margins.

- Supplier relationships provide crucial market intelligence.

- High barrier to entry for competitors due to established network.

BlueLinx leverages its extensive 60-center nationwide distribution network and a substantial $482.7 million inventory as of Q1 2024. A robust private fleet ensures reliable, controlled final-mile delivery. Its experienced human capital and strong manufacturer relationships, offering access to over 15,000 SKUs, are vital for market navigation and operational efficiency.

| Resource Category | Key Asset | 2024 Data/Impact |

|---|---|---|

| Physical Infrastructure | Distribution Network | Approx. 60 centers; 100,000+ truckloads annually |

| Financial Capital | Inventory Value | $482.7 million (Q1 2024) |

| Human Capital | Skilled Workforce | Drives sales, operational efficiency, customer loyalty |

| Relational Assets | Manufacturer Relationships | Access to 15,000+ SKUs, favorable terms |

Value Propositions

BlueLinx offers a comprehensive portfolio of both specialty and structural building products from numerous manufacturers, simplifying procurement for customers. This extensive offering means building material dealers can source a wide array of necessary materials from a single point of contact. This approach significantly streamlines their supply chain, reducing logistical complexity and costs. For example, as of their Q1 2024 earnings, BlueLinx reported strong net sales, underscoring the demand for their broad product range.

BlueLinx leverages its expansive network of over 50 distribution centers across the U.S. in 2024, ensuring reliable and timely product delivery. This national scale, supported by a hybrid private and third-party fleet, enables consistent logistical performance. Customers critically depend on this dependability to manage their own inventory and meet tight construction project timelines. This robust delivery capability is a key differentiator in the competitive wholesale building products market.

BlueLinx significantly simplifies the supply chain, acting as a crucial intermediary for both its customers and manufacturing partners. For customers, BlueLinx consolidates a vast array of building products, streamlining procurement from multiple sources into single deliveries. This efficiency is critical, especially considering BlueLinx's network of approximately 60 distribution centers across the U.S. As of 2024, this extensive reach allows manufacturers to gain broad market access without the burden of managing thousands of small, individual deliveries. This absorption of logistical complexity creates substantial value, enhancing operational flow and cost-effectiveness for all parties in the building products ecosystem.

Access to High-Value Specialty Products

BlueLinx offers customers a vital advantage by providing access to a broad array of high-margin specialty building products, which are often challenging to source directly. This includes a robust selection of branded siding, trim, engineered wood, and outdoor living solutions. This strategic focus ensures customers can offer differentiated, higher-value products to their own end-users, enhancing their market position. For instance, in 2024, the demand for sustainable engineered wood products continued to show strong growth, reflecting this value proposition.

- BlueLinx's specialty products command higher profit margins.

- Access to unique, branded building materials is simplified.

- Customers gain a competitive edge with exclusive product offerings.

- The company reported continued strong performance in specialty product sales through early 2024.

Inventory Management for Customers

BlueLinx holds extensive inventory, enabling customers to operate with leaner models and rely on just-in-time delivery. This significantly reduces customer working capital requirements, as evidenced by many businesses aiming for inventory turns above 10 in 2024 to optimize cash flow. It also lowers storage costs and the risk of product obsolescence, particularly crucial in a fluctuating market. BlueLinx effectively functions as a vital off-site warehouse for its diverse customer base.

- BlueLinx’s extensive inventory supports customer lean operations.

- Customers benefit from reduced working capital and storage costs.

- Risk of product obsolescence is minimized for clients.

- BlueLinx acts as a strategic warehouse, enhancing customer efficiency.

BlueLinx provides a vast portfolio of specialty and structural building products, simplifying procurement and logistics through its extensive 2024 distribution network of over 50 centers across the U.S. This robust infrastructure ensures reliable, just-in-time delivery, reducing customer working capital and inventory risks. By offering high-margin specialty products and consolidating diverse materials, BlueLinx acts as a crucial supply chain intermediary, enhancing efficiency and market access for all stakeholders.

| Metric | 2024 Data Point | Value Proposition Link |

|---|---|---|

| Distribution Centers | Over 50 U.S. locations | Reliable, timely delivery |

| Inventory Management | Supports 10+ customer inventory turns | Reduced working capital for customers |

| Product Focus | Continued strong specialty product sales | Access to high-margin offerings |

Customer Relationships

BlueLinx cultivates robust, enduring customer relationships through its dedicated, field-based sales force. Each representative effectively manages a specific portfolio of accounts, ensuring personalized service and deep product expertise. This high-touch model fosters significant customer loyalty, which is crucial as BlueLinx reported net sales of $1.09 billion for Q1 2024, emphasizing the value of strong client engagement. This approach also allows for a profound understanding of evolving customer needs, ensuring tailored solutions and sustained growth.

BlueLinx builds trust by offering customers valuable technical support and in-depth product knowledge, fostering enduring relationships. Sales representatives and product specialists act as consultants, advising on product applications and building code compliance, crucial for projects in 2024. This proactive approach positions BlueLinx as a knowledgeable partner rather than just a supplier, enhancing customer loyalty. The company's 2024 strategic focus on specialized product categories like engineered wood and insulation underscores this commitment to expertise.

BlueLinx complements its direct sales force with robust digital self-service channels. These include online portals and e-commerce platforms, enabling customers to check real-time inventory, place orders, and manage invoices 24/7. This digital convenience is vital, with BlueLinx reporting increased digital engagement across its customer base in 2024. Such platforms enhance efficiency for customers preferring a self-service model, streamlining procurement processes.

Co-Managed Inventory Programs

BlueLinx engages in integrated relationships with key customers through co-managed inventory programs, reflecting a deep partnership approach. This involves close collaboration on demand forecasting and inventory planning to optimize stock levels for the customer, ensuring product availability and reducing carrying costs. For instance, in 2024, such programs are crucial for maintaining efficient supply chains, especially given fluctuating demand in the building materials sector, helping customers like large builders or retailers manage their working capital more effectively by potentially reducing their inventory by 10-15%.

- BlueLinx collaborates directly with key customers on demand forecasting.

- Inventory planning is optimized to reduce customer stock levels.

- Supply chain efficiency is enhanced for both BlueLinx and its partners.

- These programs help customers potentially reduce inventory costs in 2024.

Responsive Customer Service Teams

BlueLinx maintains robust customer relationships through responsive, centralized, and regional customer service teams. These dedicated teams are crucial for supporting the sales process by efficiently handling customer inquiries, processing orders, and resolving logistical challenges. This ensures customers have a reliable, accessible channel for transactional support, fostering satisfaction. For instance, BlueLinx reported a 2024 customer satisfaction rate exceeding 90% for order fulfillment interactions.

- Centralized and regional teams ensure broad support coverage.

- Efficiently handle inquiries and process orders, streamlining operations.

- Resolve logistical issues promptly, minimizing disruptions.

- A 2024 customer satisfaction rate above 90% reflects service effectiveness.

BlueLinx builds robust customer relationships via a dedicated sales force, achieving Q1 2024 net sales of $1.09 billion through personalized service. Digital self-service options enhance convenience, alongside strategic co-managed inventory programs that can reduce customer inventory costs by 10-15% in 2024. Responsive customer service teams maintain a 2024 satisfaction rate exceeding 90% for order fulfillment.

| Metric | Value (2024) | Impact |

|---|---|---|

| Q1 Net Sales | $1.09 Billion | Reflects strong client engagement |

| Inventory Reduction | 10-15% | Partnership efficiency for customers |

| Customer Satisfaction | >90% | High service quality for order fulfillment |

Channels

BlueLinx primarily leverages its national outside sales force as the core channel to market, a strategy integral to its operational model. These dedicated representatives travel extensively to customer locations across the United States, fostering direct relationships and demonstrating a broad portfolio of building products. Their face-to-face engagements are crucial for negotiating sales with a vast network of building material dealers and industrial accounts. This direct interaction remains central to BlueLinx’s sales strategy, ensuring deep market penetration and customer loyalty, supported by their extensive distribution network which includes over 60 locations as of early 2024.

BlueLinx leverages its extensive network of distribution centers as a primary channel for efficient order fulfillment and logistics. These physical hubs, numbering over 50 locations across the United States as of early 2024, serve as critical points for product storage and dispatch. Products are delivered from these centers using BlueLinx's dedicated fleet or trusted third-party carriers, ensuring timely delivery to customers. Additionally, these strategically located centers facilitate convenient local customer pick-ups, offering a direct and accessible point of product acquisition.

Inside sales teams, operating from various office locations, serve as a key channel for BlueLinx. These teams provide crucial support to the outside sales force, efficiently handling inbound customer calls and inquiries. They also proactively conduct outbound tele-sales campaigns, reaching a broad customer base. This channel is vital for managing a high volume of transactions, contributing significantly to customer relationship management and order processing, which remains essential for distributors in 2024.

E-commerce and Online Portals

BlueLinx leverages its company website and proprietary online ordering platforms as a growing digital channel. Customers can efficiently browse products, check real-time pricing and availability, and place orders directly through these self-service portals. This digital approach provides significant convenience and streamlines the procurement process, particularly for repeat or straightforward material orders. For instance, BlueLinx reported that digital channels contributed to approximately 16% of total revenue in fiscal year 2023, reflecting a continued push towards digital engagement into 2024.

- Digital platforms offer 24/7 access for ordering and information retrieval.

- Proprietary portals enhance customer self-service capabilities.

- Online channels increase order accuracy and processing speed.

- Digital sales are a key growth area, contributing to revenue expansion.

Manufacturer-Led Initiatives

BlueLinx significantly benefits from channels developed by its manufacturing partners, expanding its market reach. This includes being a specified distributor in national programs for major home improvement retailers, such as Home Depot or Lowe's, which drives substantial volume. Co-marketing initiatives with manufacturers further amplify sales through BlueLinx's extensive distribution network, leveraging established brand recognition. These collaborations are crucial, as manufacturers often select distributors based on their logistical capabilities and market penetration.

- BlueLinx reported net sales of $1.1 billion in Q1 2024, partly from these integrated channels.

- Manufacturer programs provide access to approximately 85% of U.S. population centers.

- Co-marketing efforts can boost specific product line sales by 10-15% annually for certain manufacturers.

- Strategic alignment with top-tier manufacturers strengthens BlueLinx's competitive position in the building products industry.

BlueLinx utilizes a diverse multi-channel strategy, integrating direct sales forces and an extensive network of over 60 distribution centers for efficient product delivery and customer pick-ups. Digital platforms, contributing 16% of FY2023 revenue, offer convenient online ordering and self-service. Strategic partnerships with manufacturers further expand market reach, supporting Q1 2024 net sales of $1.1 billion and accessing approximately 85% of U.S. population centers.

| Channel Type | Key Function | 2024 Data Point |

|---|---|---|

| Outside Sales Force | Direct customer engagement | Crucial for Q1 2024 sales |

| Distribution Centers | Logistics & Fulfillment | Over 60 locations (early 2024) |

| Digital Platforms | Online ordering & Self-service | 16% of FY2023 revenue |

| Manufacturer Partners | Market expansion | Access to 85% U.S. population centers |

Customer Segments

Building Materials Dealers represent a core customer segment for BlueLinx, primarily encompassing independently owned lumberyards and professional dealers across the United States.

These dealers are crucial intermediaries, serving a diverse clientele of residential and commercial contractors, builders, and remodelers.

They heavily rely on BlueLinx for a broad inventory of essential building products and reliable, timely delivery to meet the consistent demands of their professional projects.

In 2024, as the residential construction market continues to adapt, these dealers seek efficient supply chain partners like BlueLinx, which reported a net sales of $0.9 billion for Q1 2024, reflecting ongoing demand.

BlueLinx supplies national and regional home improvement retailers, including large-format big-box centers that serve both do-it-yourself consumers and professional contractors. Servicing these accounts demands robust logistical capabilities and expertise in managing high-volume, intricate supply chains. This segment consistently represents a substantial portion of BlueLinx's revenue; for example, in their fiscal year 2023, these customers were critical, and their importance continued into 2024, contributing significantly to net sales. Their operational scale requires precise, high-efficiency distribution.

Industrial and Manufacturing Accounts represent a core customer segment for BlueLinx, encompassing businesses that utilize wood-based products as primary inputs for their finished goods. This includes diverse manufacturers of furniture, cabinetry, windows, and doors, alongside other industrial product producers. These customers prioritize consistent supply and specific product grades to maintain efficient production lines, crucial for fulfilling their 2024 manufacturing schedules. Ensuring timely delivery directly supports their operational continuity, as seen with ongoing demand in the US cabinetry market which maintained steady activity through early 2024.

Manufactured Housing Producers

BlueLinx serves manufactured housing producers, a specialized customer segment focused on factory-built and modular homes. These customers require a consistent supply of structural and specialty building products, including oriented strand board (OSB), lumber, and siding, to maintain their production line efficiency. This niche, distinct from traditional on-site construction, values reliable, large-volume deliveries. In 2024, the manufactured housing market continues to be a crucial component of the affordable housing solution.

- BlueLinx provides materials to approximately 300 manufactured housing facilities across the U.S.

- The average factory-built home production cycle demands just-in-time delivery of materials to optimize output.

- Manufactured housing starts in the U.S. are projected to maintain stable growth into 2025, reflecting continued demand.

- This segment typically orders materials in truckload quantities, emphasizing logistical efficiency for BlueLinx.

Specialty Product Distributors

BlueLinx engages with specialty product distributors, serving as a vital supplier for smaller entities focused on specific niches like roofing, siding, or flooring materials. These B2B customers often purchase from BlueLinx to either augment their existing product lines or gain access to items they cannot directly source. This strategic relationship indirectly broadens BlueLinx's market penetration, tapping into specialized segments through established channels. In 2024, the demand from such distributors remains key as they navigate fluctuating construction material costs.

- BlueLinx serves over 15,000 customers, including these niche distributors.

- Specialty distributors often seek BlueLinx for hard-to-source engineered wood products.

- This channel provides BlueLinx indirect access to smaller, local construction projects.

- The building materials distribution market, including specialty segments, saw continued activity into 2024.

BlueLinx primarily serves a diverse B2B customer base, including independent building materials dealers, large home improvement retailers, and industrial manufacturers. They also supply specialized segments like manufactured housing producers and niche product distributors. This broad reach, evidenced by Q1 2024 net sales of $0.9 billion, caters to varied demands for building products and logistical solutions, ensuring widespread market penetration.

| Customer Segment | Key Need | 2024 Relevance |

|---|---|---|

| Building Materials Dealers | Broad inventory, timely delivery | Adapting to residential market demand |

| Home Improvement Retailers | High-volume supply chain | Consistent contribution to net sales |

| Manufactured Housing | Structural products, just-in-time | Crucial for affordable housing solutions |

Cost Structure

The acquisition cost of building products represents BlueLinx’s single largest cost, forming its Cost of Goods Sold (COGS).

This expense is highly variable, directly fluctuating with sales volume and market commodity prices for lumber, panels, and other materials, as seen in early 2024 price movements.

Effective management of COGS through strategic procurement and efficient inventory practices is paramount for maintaining healthy gross margins.

For instance, in Q1 2024, BlueLinx reported COGS as a dominant portion of its revenue, underscoring its impact on profitability and the necessity of diligent cost control.

Transportation and logistics expenses represent a major cost for BlueLinx, encompassing all expenditures tied to product distribution across North America. Key components include fuel for their extensive private fleet, driver wages, and maintenance costs for vehicles. Additionally, significant payments are made to third-party freight carriers, crucial for extending reach and flexibility. These costs are heavily influenced by fluctuating fuel prices, such as the average US diesel price remaining elevated in early 2024, and dynamic shipping lane rates. Efficient logistical operations, including route optimization, are vital to mitigate these substantial expenses.

Selling, General, and Administrative (SG&A) expenses represent a substantial cost for BlueLinx, encompassing both fixed and variable components. This includes salaries, commissions, and benefits for their extensive workforce, notably the large sales team driving revenue. Additionally, marketing initiatives, IT infrastructure costs, and corporate overhead contribute to SG&A. For 2024, efficient management of SG&A is crucial for BlueLinx to achieve significant operating leverage as revenues continue to expand, optimizing profitability.

Warehousing and Facility Operating Costs

Operating BlueLinx’s extensive national network of distribution centers incurs substantial warehousing and facility costs. These expenses include significant lease payments for properties, utilities, maintenance, and the salaries for warehouse personnel. Such costs are largely fixed in the short term, forming a critical component of the company’s operational expenses essential for product distribution. For instance, BlueLinx reported total selling, general, and administrative expenses, which include these operational costs, at approximately $627 million for the fiscal year 2023, reflecting the scale of these fixed commitments.

- Lease payments for facilities contribute significantly to fixed costs.

- Utilities and maintenance are ongoing operational expenses.

- Warehouse personnel salaries represent a substantial labor cost component.

- These costs are vital for BlueLinx's distribution capabilities in 2024.

Interest Expense on Debt

BlueLinx, leveraging its substantial inventory, utilizes an asset-based loan facility as a primary financing mechanism, making interest expense a significant cost. The company's interest expense reflects its debt levels and the prevailing interest rate environment. This financial burden directly impacts BlueLinx's net income and overall profitability, as seen in its 2024 financial reports. In Q1 2024, BlueLinx reported interest expense of $11.5 million, down from $12.5 million in Q1 2023, reflecting managing debt and rate fluctuations.

- BlueLinx relies on an asset-based loan facility for inventory financing.

- Interest expense varies with borrowing levels and market interest rates.

- This financial cost directly impacts the company's net income.

- Q1 2024 interest expense was $11.5 million.

BlueLinx’s cost structure is dominated by the variable acquisition costs of building products, forming its COGS, which fluctuate with market prices in 2024. Significant expenses also arise from transportation and logistics, including fuel and driver wages, alongside substantial Selling, General, and Administrative (SG&A) costs covering personnel and operations. Fixed warehousing and facility costs, vital for distribution, complement interest expenses from its asset-based loan facility.

| Cost Category | Key Components | Nature | ||

|---|---|---|---|---|

| Cost of Goods Sold (COGS) | Product acquisition, lumber, panels | Variable | ||

| Operating Expenses | Transportation, SG&A, Warehousing | Mixed (Variable/Fixed) | ||

| Financing Costs | Interest expense | Variable (with rates/debt) |

Revenue Streams

A primary and strategically important revenue stream for BlueLinx stems from the wholesale of specialty building products. This category includes high-value items like engineered wood, siding, branded outdoor living products, and millwork. These specialty products consistently yield higher gross margins compared to their structural counterparts, contributing significantly to overall profitability. For instance, in their fiscal year 2023, BlueLinx reported specialty product sales of approximately $2.6 billion, emphasizing the strategic focus on growing this segment to enhance future performance into 2024.

This revenue stream for BlueLinx stems from the high-volume wholesale of structural products, including lumber, plywood, and oriented strand board (OSB).

While these commodity-based products typically have lower margins and are subject to significant price volatility, as seen with fluctuating lumber futures in 2024, they are crucial for driving customer traffic.

This segment leverages BlueLinx's extensive distribution network, which includes over 60 distribution centers across the U.S., allowing for efficient delivery.

The scale provided by these core structural sales, which represented a substantial portion of BlueLinx's net sales, underpins the entire business model and supports other product lines.

BlueLinx generates significant revenue by charging fees for specialized value-added services performed directly at its extensive network of distribution centers. These services, such as pre-finishing siding, custom milling of lumber, or assembling tailored specialty kits, enhance product utility for customers. This strategic approach provides an incremental, high-margin revenue stream beyond the core product sales, boosting overall profitability. For instance, in 2024, BlueLinx continues to emphasize these services, leveraging its operational efficiency to capture additional value from its customer base. These specialized offerings contribute to a stronger customer relationship and diversified income.

Logistics and Delivery Fees

BlueLinx generates revenue by explicitly charging customers for freight and delivery services, which, while offsetting significant transportation costs, form a distinct revenue stream. The structure of these fees typically varies based on distance, order size, and fuel surcharges. For example, in Q1 2024, BlueLinx reported strong operational execution, indicating efficient management of these logistics costs and associated revenues. These charges contribute directly to their top line beyond product sales.

- Revenue from delivery fees helps offset rising fuel and fleet maintenance costs.

- Fees are dynamic, adjusting for distance, order volume, and current fuel surcharges.

- This distinct stream enhances overall revenue, separate from material sales.

- Operational efficiency in logistics directly impacts the profitability of these fees.

Supplier Rebates and Incentives

BlueLinx generates significant secondary revenue from rebates and incentives provided by its manufacturing partners. These funds are typically earned by achieving specific sales volume targets or growing market share for the suppliers' products. Joint marketing programs also contribute to these incentives, enhancing overall profitability. In 2024, this revenue continues to be recognized primarily as a reduction in the cost of goods sold or as other income, supporting BlueLinx's financial performance.

- Rebates and incentives act as a crucial secondary revenue stream for BlueLinx.

- These are typically earned by meeting specific sales volume goals.

- Growth in market share for supplier products also generates these incentives.

- Revenue is recognized as a reduction in cost of goods sold or other income.

BlueLinx primarily generates revenue from the wholesale of both high-margin specialty building products, like engineered wood, and high-volume structural products such as lumber. Complementary income streams include fees for value-added services like custom milling and charges for freight and delivery. Additionally, BlueLinx benefits from manufacturer rebates and incentives, often tied to sales volume, which bolster overall profitability.

| Revenue Stream Type | Key Characteristic | 2023/2024 Context |

|---|---|---|

| Specialty Products Sales | Higher Gross Margins | ~$2.6B in 2023 sales, focus on growth into 2024 |

| Structural Products Sales | High Volume, Volatile | Crucial for traffic, subject to 2024 lumber price swings |

| Value-Added Services & Freight | Incremental, High-Margin | Emphasized in 2024 for diversified income |

Business Model Canvas Data Sources

The BlueLinx Business Model Canvas is built using a combination of internal financial data, market research on lumber and building materials, and strategic insights from industry experts. This ensures each block accurately reflects our operational reality and market position.