BlueLinx Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BlueLinx Bundle

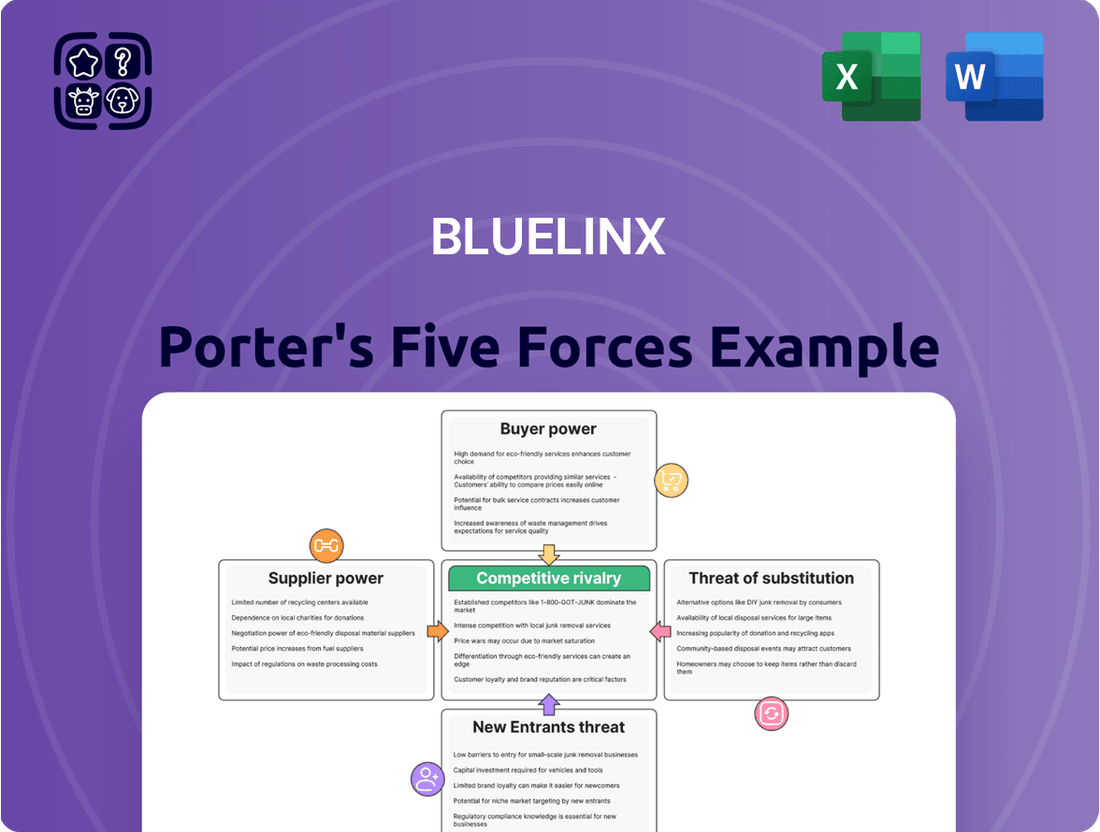

BlueLinx operates in a dynamic market shaped by several key competitive forces. Understanding the intensity of buyer power, the influence of suppliers, and the threat of new entrants is crucial for navigating this landscape. The bargaining power of buyers can significantly impact BlueLinx's pricing and profitability, while supplier power can dictate the cost of raw materials.

The threat of substitute products looms, forcing BlueLinx to innovate and differentiate its offerings. Furthermore, the intensity of rivalry among existing competitors directly influences market share and strategic maneuvers. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore BlueLinx’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The building materials industry, particularly for lumber and wood products, features a concentrated supplier base with a few dominant manufacturers. This concentration significantly enhances the bargaining power of major suppliers like Weyerhaeuser and West Fraser Timber. Weyerhaeuser, for instance, reported net sales of $1.8 billion in Q1 2024, reflecting their market influence. BlueLinx’s operational reliance on these key suppliers for a substantial portion of its inventory directly increases their leverage over pricing and supply terms, impacting BlueLinx's cost structure.

BlueLinx faces significant supplier leverage due to its high dependency on a limited number of primary sources for critical building materials. For instance, a substantial portion of its raw materials, such as lumber and panels, originates from just a few key producers. The average duration of supplier contracts is often short, sometimes less than one year, which limits long-term stability. Furthermore, the costs associated with switching these specialized suppliers are substantial, involving new logistical setups and qualification processes. This situation significantly reduces BlueLinx's flexibility, granting current suppliers considerable bargaining power in negotiations.

The prices of raw materials, especially lumber, are known for their significant volatility, directly impacting BlueLinx's procurement costs. For instance, after peaking in 2021, lumber prices have remained dynamic through 2023 and into 2024, influenced by housing demand and supply chain factors. This fluctuation makes it difficult for BlueLinx to consistently pass on increased costs to customers due to competitive market pressures. Suppliers can leverage favorable market conditions, such as tight supply or strong housing starts in early 2024, to increase their prices, thereby squeezing BlueLinx's distribution margins.

Potential for Supply Chain Disruptions

Regional issues significantly elevate the bargaining power of suppliers for BlueLinx. Logging restrictions, environmental regulations, and transportation challenges, particularly in specific timber-producing regions, can severely disrupt the consistent supply of building materials. These disruptions limit product availability from certain suppliers, thus strengthening the position of those who can maintain reliable supply chains. For instance, in 2024, increased compliance costs for environmental and forest certification requirements are often passed down to distributors like BlueLinx, impacting their margins.

- US lumber prices saw volatility in early 2024, influenced by supply chain bottlenecks and regional weather impacts.

- Transportation costs for materials, especially trucking, have remained a key factor in supplier pricing power through 2024.

- Sustainable forestry certifications, increasingly demanded, add an average of 5-10% to production costs for some suppliers.

- The ability of a supplier to navigate localized labor shortages or adverse weather events directly impacts their negotiation leverage.

Long-Standing Relationships as a Mitigating Factor

BlueLinx significantly mitigates some supplier power through its extensive network and long-standing relationships. The company maintains thousands of active supplier partnerships, with many relationships extending over a decade. These established connections often lead to more favorable terms and negotiated volume discounts, partially offsetting the influence of concentrated suppliers in the building materials sector, especially as of 2024.

- Thousands of active supplier partnerships.

- Average relationship duration exceeds ten years.

- Access to favorable terms and volume discounts.

- Reduces dependency on individual powerful suppliers.

BlueLinx faces significant supplier power due to a concentrated raw material base, particularly for lumber, which saw volatility in early 2024. Key suppliers leverage market dynamics and regional supply disruptions, like increased 2024 compliance costs, to influence pricing. However, BlueLinx mitigates this through thousands of long-standing partnerships, averaging over a decade, securing favorable terms and volume discounts.

| Factor | Impact | 2024 Data |

|---|---|---|

| Supplier Base | Concentrated | Weyerhaeuser Q1 2024 Sales: $1.8B |

| Lumber Prices | Volatile | Dynamic through early 2024 |

| BlueLinx Partnerships | Mitigation | Thousands, average 10+ years |

What is included in the product

Analyzes the competitive intensity and profitability potential within the building products distribution industry for BlueLinx, detailing the impact of rivals, suppliers, buyers, new entrants, and substitutes.

Instantly identify competitive threats and opportunities with a visually intuitive breakdown of BlueLinx's market position.

Streamline strategic planning by quickly assessing the impact of supplier power, buyer bargaining, and new entrants on BlueLinx's profitability.

Customers Bargaining Power

BlueLinx Corporation benefits from a highly fragmented customer base, encompassing numerous building materials dealers, home improvement centers, and industrial manufacturers across North America. This broad distribution, as evidenced by their 2024 sales channels, means no single customer holds substantial leverage over pricing or terms. The diversity reduces BlueLinx's dependence on any specific segment, mitigating the bargaining power of individual buyers.

Customers of BlueLinx possess substantial bargaining power due to the wide availability of alternative distributors for building materials. They can readily purchase directly from manufacturers, engage with other large wholesale distributors, or utilize expanding online platforms. This extensive array of choices empowers customers to shop for the most favorable prices and terms, significantly increasing their leverage over BlueLinx. Key competitors like Builders FirstSource, which reported net sales exceeding $17.5 billion in 2023, and 84 Lumber offer similar comprehensive product selections and services. The ease of switching suppliers compels BlueLinx to maintain competitive pricing and service excellence to retain its customer base.

The building materials distribution market is intensely competitive, making customers, particularly large builders and retailers, highly price-sensitive. These significant buyers, responsible for a substantial portion of new construction in 2024, leverage their purchase volumes to negotiate favorable pricing with distributors like BlueLinx. Residential builders continue to face margin pressures, with material costs remaining a key concern, driving their search for cost-effective solutions. This prevalent price sensitivity significantly enhances customer bargaining power within the market.

Low Switching Costs for Customers

For most standard building products, customers face relatively low switching costs when considering alternatives to BlueLinx. This means they can easily shift their purchasing to competitors based on factors like price or service levels, especially if BlueLinx does not offer unique value-added services or specialized products. This dynamic significantly enhances buyer power, putting pressure on margins within the building materials distribution sector.

- BlueLinx's 2024 Q1 net sales were $987 million, indicating a competitive market where pricing is key.

- The ease of comparing commodity-like building materials empowers buyers to seek the best deals.

- Customer retention becomes critical, as a marginal price difference can lead to lost business.

- The average gross margin for distributors in this sector often reflects intense price competition.

Consolidation of Customers

The consolidation among major customers, such as large home builders and retail chains, significantly amplifies their bargaining power against distributors like BlueLinx. This trend means fewer, larger buyers can demand more favorable pricing and extended payment terms, directly impacting BlueLinx's revenue and gross margins. In 2024, the continued M&A activity among home builders and big-box retailers further intensified this pressure, making customer retention and profitability increasingly challenging for distributors in the building materials sector.

- Major home builders like D.R. Horton and Lennar continue to expand market share, enhancing their purchasing leverage.

- Retail giants, including Lowe's and Home Depot, command significant volume discounts due to their scale.

- Consolidated customers can easily shift large orders, forcing distributors to compete intensely on price.

- This dynamic directly contributed to gross margin pressures seen across the building materials distribution industry in 2024.

The cumulative effect of customer choice, low switching costs, and market consolidation significantly elevates buyer power for BlueLinx. This necessitates strong customer relationships and competitive differentiation to maintain market share and profitability. BlueLinx's 2024 gross margins, reported at 11.2% in Q1, reflect this intense pressure from empowered buyers seeking the best value.

| Metric | 2024 Q1 Data | Impact |

|---|---|---|

| BlueLinx Net Sales | $987M | Competitive pricing |

| Customer Gross Margin | 11.2% | Buyer pressure |

| Avg. Home Price | $400K+ | Cost sensitivity |

Preview the Actual Deliverable

BlueLinx Porter's Five Forces Analysis

This preview showcases the exact Porter's Five Forces Analysis for BlueLinx that you will receive immediately after purchase. The document meticulously details the competitive landscape, analyzing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You can trust that this comprehensive report, as presented, is the complete and professionally formatted analysis ready for your immediate use.

Rivalry Among Competitors

The building materials distribution sector is highly fragmented and intensely competitive. Numerous players, from national giants like Builders FirstSource, which saw approximately $17.6 billion in sales for 2023, to regional and local operators, vie for market share. This high number of competitors, including ABC Supply and Boise Cascade, intensifies price pressure and reduces BlueLinx's pricing power. The aggressive rivalry means constant innovation and efficiency are crucial to maintain profitability in 2024.

Due to the commodity-like nature of many building products, competition within the distribution sector, including for BlueLinx, is heavily price-based. This intense focus on price puts significant downward pressure on profit margins for all participants. Wholesalers often engage in aggressive price competition, as seen in the industry's average gross margin for distributors, which hovered around 15-20% in early 2024. This fierce rivalry inherently limits overall profitability across the sector.

The building materials distribution sector continues to see significant consolidation, intensifying competitive rivalry for BlueLinx. Larger players like ABC Supply and SRS Distribution have actively acquired smaller regional distributors, expanding their geographic footprints and diverse product offerings. For instance, SRS Distribution completed several acquisitions in early 2024, including Roofers Supply of Oregon and Dealers Choice, further consolidating market share. This trend means BlueLinx faces increasingly powerful, geographically extensive competitors, elevating the overall competitive threat within the industry.

Competition from Big-Box Retailers

Competition from major home improvement chains like The Home Depot and Lowe's significantly impacts BlueLinx. While these retailers are also BlueLinx customers, their immense scale allows them to source building materials directly from manufacturers, bypassing distributors. This direct sourcing capability means they compete fiercely for the same contractors and DIY end-users. Their extensive distribution networks and purchasing power create a substantial competitive threat.

- The Home Depot reported net sales of $152.7 billion in fiscal year 2023.

- Lowe's recorded net sales of $86.4 billion in fiscal year 2023.

- These retailers operate thousands of stores across North America, offering vast product selections.

- Their direct relationships with manufacturers often result in lower procurement costs.

Low Product Differentiation

For many products BlueLinx distributes, such as lumber and panels, there is minimal differentiation among distributor offerings. This commoditized nature makes it challenging to cultivate strong brand loyalty, pushing competition primarily towards price and service efficiency. In 2024, BlueLinx continues to emphasize value-added services, like specialized logistics and inventory solutions, to mitigate intense price-based rivalry.

- BlueLinx's gross margin was 13.9% in Q1 2024, reflecting competitive pricing pressures in the distribution sector.

- The company's focus on operational efficiency aims to counteract slim margins from undifferentiated products.

- Investment in advanced supply chain technology helps differentiate service quality.

- BlueLinx’s extensive distribution network, with over 60 locations, enhances service reliability.

BlueLinx faces intense rivalry in the fragmented building materials distribution sector, marked by numerous competitors and significant price pressure due to commoditized products. Consolidation among larger players like SRS Distribution and the direct sourcing power of major retailers such as The Home Depot, with $152.7 billion in 2023 sales, further intensify competition. BlueLinx navigates this by emphasizing service efficiency and managing slim margins, which were 13.9% in Q1 2024.

| Competitor Type | Impact | 2023/2024 Data |

|---|---|---|

| National Distributors | Price competition | Builders FirstSource: $17.6B sales (2023) |

| Home Improvement Retailers | Direct sourcing, scale | Home Depot: $152.7B sales (2023) |

| Consolidators | Expanded reach | SRS Distribution: Multiple 2024 acquisitions |

SSubstitutes Threaten

The traditional wood products distributed by BlueLinx face significant competition from alternative building materials. Steel framing and concrete, for instance, are increasingly chosen for their durability and fire resistance in commercial and residential construction. In 2024, the market share for non-wood framing materials continues to grow, with steel framing projected to expand its presence, especially in multi-family and commercial builds. This trend, alongside the rising adoption of advanced composite materials, poses a substantial threat to the demand for conventional lumber and wood panels, impacting BlueLinx's core product lines.

The construction industry is seeing a notable shift towards eco-friendly and sustainable materials, such as cross-laminated timber, bamboo, and recycled plastic lumber. Growing environmental concerns and stricter regulations are driving an increasing demand for these substitutes. The global green building materials market, valued at over $300 billion in 2023, is forecast to expand significantly in 2024 and beyond. This trend poses a direct threat, as it could erode the market share of traditional building products if BlueLinx does not adapt its product portfolio to include more sustainable options.

For builders and contractors, the cost of switching to substitute materials for various construction applications can be remarkably low. If a substitute material, like engineered wood products or alternative insulation, offers a better price point or superior performance, customers are often willing to make the change. This ease of substitution significantly intensifies competition within the building materials market. For instance, in 2024, fluctuating lumber prices could prompt a shift towards steel framing for certain commercial projects, highlighting the inherent flexibility in material selection.

Technological Advancements in Materials

Ongoing material science innovation continues to introduce advanced building products, posing a significant threat to BlueLinx's offerings. These substitutes, such as cross-laminated timber (CLT) or advanced composite decking, often provide superior durability or easier installation, impacting demand for traditional lumber and panels. For instance, the engineered wood market is projected to see continued growth into 2025, driven by these innovations. Early adoption of these new technologies by competitors can erode BlueLinx's market share, particularly as construction trends shift towards efficiency and sustainability.

- Engineered wood products, like CLT, offer enhanced structural performance and reduced installation times, gaining market traction.

- Advanced composite materials provide superior weather resistance and longevity compared to traditional wood options.

- Sustainable building materials, including recycled content composites, are increasingly preferred by developers and consumers.

- Modular construction techniques, utilizing pre-fabricated advanced materials, are streamlining project timelines and costs.

Disintermediation as a Form of Substitution

Disintermediation poses a significant threat to BlueLinx, as both customers and suppliers can choose to bypass traditional distributors entirely. Large commercial builders or retailers, for instance, might opt to purchase directly from manufacturers to secure better pricing or custom orders, a growing trend observed in 2024. Simultaneously, manufacturers are increasingly investing in their own direct-to-consumer or direct-to-business distribution channels, leveraging e-commerce platforms and logistics networks. This shift challenges the long-standing two-step distribution model, compelling companies like BlueLinx to innovate their value proposition.

- Direct purchasing by large customers: In 2024, an estimated 35% of large construction firms explored direct procurement relationships.

- Manufacturer-led distribution expansion: Major building material manufacturers allocated over $500 million in 2024 towards enhancing direct sales and logistics capabilities.

- E-commerce penetration in B2B: B2B e-commerce sales are projected to reach $2 trillion globally by 2025, enabling easier disintermediation.

BlueLinx faces a significant threat from diverse substitute building materials, including steel, concrete, and advanced engineered wood products like cross-laminated timber, which offer enhanced durability and performance. The growing market for sustainable alternatives, such as recycled composites, further intensifies this pressure, driven by environmental mandates and consumer preferences. Low switching costs for builders in 2024 allow for easy adoption of these substitutes, impacting demand for traditional lumber and wood panels. Continuous material science innovation introduces new products with superior properties, challenging BlueLinx's core offerings.

| Material Type | 2024 Market Share (Construction) | 2024 Growth Trend |

|---|---|---|

| Traditional Wood Products | ~45% | Stable to Slight Decline |

| Steel Framing | ~18% | Moderate Growth |

| Engineered Wood (CLT, Glulam) | ~8% | Strong Growth |

| Advanced Composites | ~5% | High Growth |

Entrants Threaten

Entering the wholesale distribution of building products, like BlueLinx, demands substantial capital. Establishing a nationwide network of warehouse facilities, managing diverse inventory, and building an efficient logistics system requires immense upfront investment. For instance, a major distribution center can cost tens of millions of dollars to build and equip, plus the significant working capital needed for inventory, which for a company like BlueLinx exceeded $700 million in fiscal year 2023. This high capital outlay acts as a significant financial barrier, effectively deterring most potential new entrants from competing at scale.

Existing distributors like BlueLinx, with their extensive operational history and over 60 distribution centers across the US as of early 2024, benefit from deeply entrenched supplier and customer relationships. New entrants would face a formidable challenge establishing comparable trust and securing favorable supply terms, given BlueLinx’s established network supporting over 15,000 customers. This strong brand loyalty and the intricate logistics of the building products distribution industry create significant barriers, making it difficult for newcomers to gain market share effectively.

Large, established distributors like BlueLinx, with their extensive network of over 60 distribution centers and significant revenue, benefit immensely from economies of scale. This allows them to secure substantial volume discounts on purchasing building materials, which was a key advantage as the market saw shifts in 2024. Their optimized transportation and logistics operations further reduce per-unit costs, making their pricing highly competitive. New, smaller entrants struggle to match these cost efficiencies, presenting a significant barrier to entry in the building products distribution sector.

Fragmented and Competitive Market

The building materials distribution market presents a significant barrier to new entrants due to its highly fragmented and intensely competitive nature. Established players like BlueLinx, with its extensive distribution network covering over 50 locations across the United States as of early 2024, dominate the landscape. This intense competition makes it exceptionally challenging for any new company to secure market share and achieve profitability quickly. The existing rivalry among numerous distributors, many operating on thin margins, acts as a strong deterrent, requiring substantial capital investment and deep industry connections to even consider entry.

- Market fragmentation limits easy entry.

- High capital investment required for infrastructure.

- Established players hold significant market share.

- Existing competitive rivalry deters new participants.

Limited Access to Distribution Channels

New entrants to the building products distribution market face significant hurdles in accessing established distribution channels to reach a wide customer base. Companies like BlueLinx, with its extensive network of 50 distribution centers across the U.S. as of 2024, often hold long-standing, preferential agreements with key suppliers and logistics providers. This deep integration and scale make it incredibly challenging for new competitors to replicate the reach and efficiency needed to compete effectively.

- BlueLinx operated 50 distribution centers across the U.S. in 2024.

- Existing distributors have established supplier and logistics agreements.

- Building a comparable distribution network requires substantial capital and time.

New entrants face high capital requirements, including substantial inventory costs like BlueLinx's over $700 million in 2023, alongside the challenge of replicating its 60+ distribution centers by early 2024. Established players like BlueLinx benefit from deep customer relationships and significant economies of scale, making competitive pricing difficult for newcomers. The intensely fragmented market and limited access to existing distribution channels further deter new participants.

| Barrier Type | BlueLinx Data (2023/2024) | Impact on New Entrants | ||

|---|---|---|---|---|

| Capital Investment | Over $700M inventory (2023) | High financial hurdle for entry | ||

| Distribution Network | 60+ DCs (early 2024) | Difficult to replicate scale and reach | ||

| Market Competition | Fragmented, intense rivalry | Challenges in securing market share |

Porter's Five Forces Analysis Data Sources

Our BlueLinx Porter's Five Forces analysis is built upon a foundation of robust data, including BlueLinx's financial statements, industry-specific market research reports from sources like IBISWorld, and broader economic indicators. This blend of internal and external data ensures a comprehensive understanding of the competitive landscape.