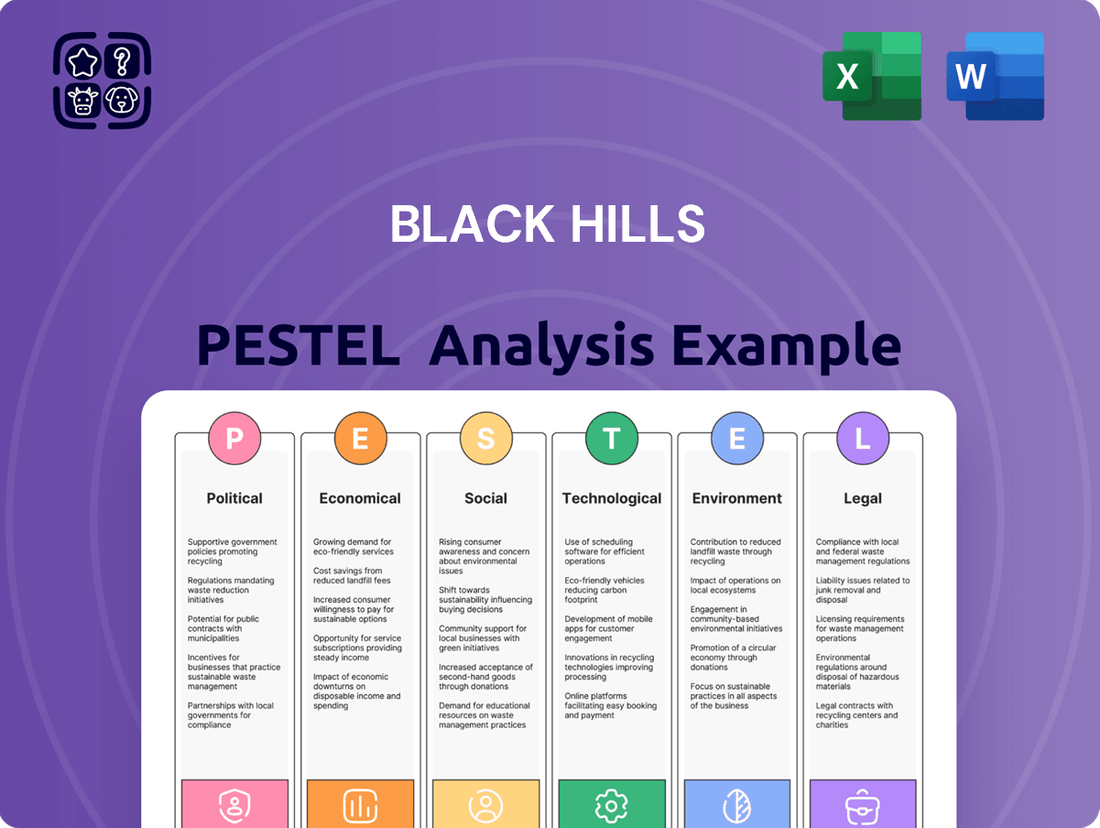

Black Hills PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Black Hills Bundle

Unlock the secrets to Black Hills's success with our comprehensive PESTLE Analysis. Understand the intricate political, economic, social, technological, legal, and environmental factors shaping its destiny. This expert-crafted report offers actionable intelligence for strategic planning and competitive advantage. Download the full version now and navigate the future with confidence.

Political factors

Government policy and regulation significantly shape Black Hills Corporation's operating environment. Changes in federal and state energy policies, such as new clean energy mandates or carbon reduction targets, directly influence the company's investment strategies and operational costs. For instance, varying state Renewable Portfolio Standards (RPS) across the eight states where Black Hills operates necessitate tailored compliance approaches.

Utility regulations, including rate-setting processes and approval for infrastructure projects, are critical for Black Hills' financial performance. The ability to recover investments in new generation or transmission assets through customer rates is paramount. In 2023, Black Hills sought rate increases in several jurisdictions, highlighting the ongoing impact of regulatory proceedings on its revenue streams.

Legislative actions, such as infrastructure spending bills or tax incentives for clean energy development, can create both opportunities and challenges. The Infrastructure Investment and Jobs Act of 2021, for example, offers potential funding for grid modernization and renewable energy projects, which Black Hills could leverage.

The company's exposure to diverse regulatory frameworks means that shifts in political priorities at both federal and state levels can have a substantial impact. Black Hills must actively monitor and adapt to evolving legislation and regulatory decisions to maintain its competitive position and financial stability.

Black Hills Corporation's financial performance is significantly shaped by regulatory rate cases handled by state public utility commissions. These bodies determine the rates utilities can charge customers, directly impacting revenue recovery and the company's capacity for infrastructure investment. For instance, in 2023, Black Hills sought rate increases in several jurisdictions, with outcomes varying by state.

The frequency and outcomes of these rate reviews are critical. A favorable rate case allows Black Hills to recover costs associated with infrastructure upgrades and new projects, such as the proposed wind farm in Wyoming, while ensuring a reasonable return on investment. Conversely, delayed or unfavorable decisions can hinder profitability and slow down necessary capital expenditures, potentially impacting future service reliability and growth.

In 2023, Black Hills' electric utilities filed for rate increases in South Dakota and Wyoming. The South Dakota Public Utilities Commission approved a settlement allowing for a $50 million annual increase, while the Wyoming Public Service Commission authorized a $62 million increase. These approvals are vital for Black Hills to fund its planned $3.3 billion in capital expenditures through 2028, primarily focused on modernizing its generation fleet and grid infrastructure.

Black Hills Corporation's operational success hinges on political stability within its service territories, particularly in states like South Dakota, Wyoming, and Texas. Generally, these regions exhibit a stable political climate, fostering predictable regulatory environments. For instance, South Dakota, where Black Hills is headquartered, consistently ranks high in economic freedom and business-friendliness, which translates to a more cooperative relationship with state agencies overseeing utility operations. This stability is crucial for long-term infrastructure investments and consistent rate-setting processes, which are vital for the company's financial health.

Energy Transition Policies

Political factors significantly shape Black Hills Corporation's strategic direction, particularly concerning the energy transition. There's a strong governmental impetus at both federal and state levels to decarbonize the energy sector and boost renewable energy adoption. This includes policies actively encouraging the development and utilization of renewable natural gas (RNG), hydrogen, and carbon capture technologies.

These policy initiatives directly influence Black Hills' investment strategies and the long-term composition of its energy mix. For instance, federal tax credits, such as those under the Inflation Reduction Act of 2022, are designed to make renewable energy projects more economically viable. State-level mandates, like renewable portfolio standards (RPS) in various jurisdictions where Black Hills operates, further compel a shift towards cleaner energy sources.

The company must navigate these evolving political landscapes to ensure compliance and capitalize on emerging opportunities. This often involves substantial capital allocation towards grid modernization and the integration of intermittent renewable sources. For 2024-2025, we can expect continued policy emphasis on emissions reduction targets, potentially leading to increased investment in infrastructure that supports RNG and hydrogen, alongside advanced grid management systems to handle the variability of renewables.

- Federal Support: The Inflation Reduction Act (IRA) of 2022 provides significant tax incentives for renewable energy and clean hydrogen production, impacting investment decisions for utilities like Black Hills.

- State Mandates: Many states where Black Hills operates have Renewable Portfolio Standards (RPS) requiring a certain percentage of electricity to come from renewable sources, driving portfolio diversification.

- Emerging Technologies: Policies promoting carbon capture, utilization, and storage (CCUS) and renewable natural gas (RNG) offer pathways for Black Hills to decarbonize existing infrastructure and explore new revenue streams.

- Infrastructure Investment: Political pressure to modernize the grid to accommodate distributed energy resources and enhance reliability will necessitate significant capital expenditure from Black Hills.

Lobbying and Advocacy Efforts

Black Hills Corporation actively engages in lobbying and advocacy to shape energy policy and regulations that affect its operations. The company focuses on advocating for policies that support reliable energy infrastructure, including investments in modernization and expansion. For instance, in 2023, Black Hills participated in discussions surrounding rate case filings, seeking approval for infrastructure upgrades vital for grid stability and customer service.

Key advocacy areas include ensuring favorable rate structures that allow for cost recovery on significant capital investments, such as the approximately $1.2 billion in planned infrastructure improvements from 2024 to 2028. The company also champions regulations that promote the development of diverse energy resources, balancing environmental considerations with energy affordability and reliability. This proactive approach helps Black Hills navigate the complex regulatory landscape and secure its long-term business interests.

- Advocacy for Rate Structures: Black Hills seeks regulatory approval for rate adjustments to recoup investments in essential infrastructure upgrades, ensuring financial sustainability.

- Infrastructure Investment Promotion: The company lobbies for policies that encourage and facilitate significant capital expenditures on modernizing its energy delivery systems.

- Energy Policy Influence: Black Hills actively participates in shaping energy regulations, advocating for a balanced approach that prioritizes reliability, affordability, and environmental stewardship.

- Environmental Compliance Standards: The company engages in dialogue regarding environmental regulations, aiming for compliance strategies that are economically feasible and support operational efficiency.

Political stability in Black Hills' operating regions, particularly South Dakota, fosters a predictable regulatory environment crucial for long-term investments. This stability is exemplified by South Dakota's consistent ranking as economically free and business-friendly, creating a cooperative relationship with state utility regulators.

Government policies at federal and state levels are driving the energy transition, encouraging renewable energy and new technologies like renewable natural gas and hydrogen. The Inflation Reduction Act of 2022, for instance, offers substantial tax incentives for these clean energy initiatives.

Black Hills actively engages in lobbying to influence energy policy and regulations, advocating for investments in infrastructure modernization and balanced energy resource development. In 2023, the company sought rate increases, highlighting the ongoing need for regulatory approval to recover costs for vital infrastructure upgrades.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting the Black Hills region, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

This PESTLE analysis for the Black Hills offers a clean, summarized version of the full analysis, relieving the pain point of information overload during meetings or presentations.

Economic factors

Black Hills Corporation's revenue is closely tied to the economic health of its service areas. For instance, robust economic growth in regions like South Dakota and Wyoming during 2024 would likely translate to higher energy consumption from both residential and commercial customers, boosting Black Hills' sales volumes and overall revenue. A strong GDP growth in these states would signal increased industrial activity and population expansion, both drivers of greater energy demand.

Energy prices, particularly for natural gas, oil, and coal, are critical to Black Hills' operational costs and profitability. Wholesale natural gas prices have seen considerable fluctuations, with spot prices averaging around $2.50-$3.00 per million British thermal units (MMBtu) in early 2024, a notable decrease from peaks seen in prior years, though forecasts suggest potential upward pressure due to increasing demand and global supply constraints through 2025.

Volatility in oil prices, impacting fuel oil used by some generators, also plays a role. Brent crude oil, a benchmark, has traded in a range of $75-$85 per barrel in early 2024, with geopolitical events and OPEC+ decisions posing ongoing uncertainty for the remainder of 2024 and into 2025.

Coal prices, while less dominant for Black Hills than natural gas, remain a factor. Thermal coal prices have stabilized in 2024 after earlier volatility, but long-term trends are influenced by global decarbonization efforts and domestic production levels.

These price trends and their inherent volatility directly shape Black Hills' procurement strategies, influencing decisions on long-term contracts versus spot market purchases. The company's financial outlook is therefore closely tied to its ability to manage these fluctuating commodity costs effectively, particularly in light of projections for continued natural gas demand in the coming years.

Interest rates significantly influence Black Hills Corporation's cost of capital. As of mid-2024, benchmark rates like the Federal Funds Rate have remained elevated, making borrowing more expensive. This directly impacts the company's ability to finance its substantial infrastructure investments, such as grid modernization and renewable energy projects, which often rely on debt financing.

Higher borrowing costs can constrain capital expenditure budgets, potentially delaying or scaling back critical projects. For instance, if Black Hills needs to issue new debt for a major upgrade, a higher interest rate means increased interest payments over the life of the bond. This increased cost of capital can eventually translate into higher rates for customers, affecting affordability and demand for energy services.

The company's reliance on debt, as indicated by its debt-to-equity ratio, makes it particularly sensitive to interest rate fluctuations. For example, if Black Hills has a significant portion of variable-rate debt, an increase in interest rates will immediately boost its interest expenses. This was evident in the financial performance of many utility companies throughout 2023 and into 2024 as rates climbed.

Inflationary Pressures

Inflationary pressures present a significant challenge for Black Hills, directly impacting its operating and maintenance expenses. The rising cost of fuel, labor, and essential materials like copper and steel for grid upkeep and new infrastructure projects directly squeezes profit margins. For instance, the U.S. Producer Price Index (PPI) for intermediate goods, a key indicator for material costs, saw a notable increase throughout 2024, impacting utility companies' procurement budgets.

Managing these rising costs is paramount for Black Hills to maintain financial stability and ensure its services remain affordable for customers. Without effective cost control measures, the company risks passing higher expenses onto its consumer base, potentially leading to customer dissatisfaction and regulatory scrutiny. The ability to forecast and hedge against material cost volatility is therefore critical for the company's long-term operational health.

- Increased Operating Expenses: Higher costs for fuel, labor, and specialized equipment for maintenance and repairs.

- Infrastructure Development Costs: Elevated prices for materials such as steel, concrete, and electrical components used in grid upgrades and new construction.

- Customer Affordability Concerns: The need to balance cost recovery with keeping utility rates competitive and manageable for residential and commercial customers.

- Regulatory Impact: Potential for increased regulatory oversight and rate case challenges if cost increases are perceived as excessive or poorly managed.

Capital Investment and Infrastructure Spending

Black Hills Corporation is making significant capital investments, primarily focused on infrastructure upgrades and expansion, which will have a notable economic impact. The company's substantial capital forecast, amounting to $4.7 billion for the period of 2025 through 2029, signals a strong commitment to long-term growth and modernization of its utility assets. This spending is expected to stimulate economic activity through job creation and demand for materials and services.

These investments are crucial for ensuring the reliability and efficiency of Black Hills' energy delivery systems, including its electric and natural gas utilities. By upgrading aging infrastructure and expanding capacity to meet growing demand, the company is positioning itself for future success while supporting regional economic development.

- $4.7 billion capital investment forecast for 2025-2029.

- Investments target infrastructure upgrades and expansion across electric and natural gas utilities.

- Expected to create jobs and boost demand for goods and services in operating regions.

- Aims to enhance service reliability and meet future energy needs.

Economic growth in Black Hills' service areas directly impacts energy demand. For instance, a projected 2.5% GDP growth for South Dakota in 2024 suggests increased industrial and residential energy consumption, bolstering Black Hills' revenue potential.

Energy commodity prices remain a key factor. Natural gas spot prices, averaging around $2.75/MMBtu in early 2024, are anticipated to see moderate increases through 2025 due to rising demand. Similarly, oil prices, with Brent crude around $80/barrel in mid-2024, face ongoing volatility influenced by global supply dynamics.

Interest rates affect Black Hills' capital costs, with the Federal Funds Rate holding steady around 5.25%-5.50% in mid-2024. This elevated cost of borrowing impacts the company's ability to finance its substantial infrastructure investments, such as its $4.7 billion capital forecast for 2025-2029.

Inflationary pressures are increasing operating expenses. The U.S. PPI for intermediate goods rose by approximately 3.5% year-over-year in early 2024, impacting the cost of materials for grid maintenance and expansion.

| Economic Factor | 2024 Data/Projection | Impact on Black Hills | Notes |

|---|---|---|---|

| Regional GDP Growth | South Dakota: ~2.5% (2024 est.) | Higher demand for electricity and natural gas. | Signals increased economic activity and population growth. |

| Natural Gas Prices | Spot: ~$2.50-$3.00/MMBtu (early 2024) | Affects operating costs and profitability. | Forecasts suggest gradual increase through 2025. |

| Oil Prices (Brent Crude) | ~$75-$85/barrel (early 2024) | Impacts fuel oil costs for some generation. | Subject to geopolitical events and OPEC+ decisions. |

| Interest Rates (Fed Funds Rate) | 5.25%-5.50% (mid-2024) | Increases cost of capital for investments. | Affects financing for infrastructure projects. |

| Inflation (PPI Intermediate Goods) | ~3.5% YoY (early 2024) | Raises operating and maintenance expenses. | Impacts costs of materials like steel and copper. |

Full Version Awaits

Black Hills PESTLE Analysis

The preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Black Hills covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the region's development and opportunities. You'll gain valuable insights into the current landscape and future trends. This is the real product; after purchase, you’ll instantly receive this exact file.

Sociological factors

Black Hills Corporation serves a diverse customer base, with its 2023 annual report indicating approximately 1.3 million electric and natural gas customers. Examining demographic shifts within its service territories is crucial. For instance, the company operates in states like South Dakota, Wyoming, Montana, and Arkansas, each experiencing unique population growth patterns. Understanding trends such as an aging population in some rural areas versus growth in urban centers directly impacts energy demand and service requirements.

Public perception is crucial for any utility company, and Black Hills is no exception. Maintaining strong community relations is key to its social license to operate. This involves actively engaging with the communities it serves and demonstrating a commitment to their well-being.

Black Hills actively works to build positive relationships through various initiatives. Their efforts in charitable giving, providing energy assistance programs, and contributing to the local economy are vital. These contributions underscore their role as a responsible corporate citizen.

In 2024 alone, Black Hills' local economic contributions, including charitable giving and energy assistance, amounted to approximately $1.5 billion. This significant financial impact directly benefits the communities where they operate, fostering goodwill and enhancing their public image.

Black Hills Corporation's operational reliability hinges on a robust workforce. In 2023, the company reported approximately 3,100 employees, a figure that needs to remain stable and skilled to ensure safe utility operations. Attracting and retaining talent in the energy sector, particularly those with specialized technical skills, presents an ongoing challenge.

Workplace culture plays a crucial role in employee engagement and safety. Fostering a culture that prioritizes safety, continuous learning, and employee well-being is key to minimizing turnover and maximizing productivity. A positive environment aids in retaining experienced personnel who are vital for complex infrastructure management.

Energy Affordability and Consumer Behavior

Energy affordability significantly shapes how consumers use electricity. When energy costs rise, households often adjust their behavior, seeking ways to reduce consumption. This can manifest in turning down thermostats, reducing appliance usage, or delaying energy-intensive activities. For instance, in early 2024, many regions saw consumers actively looking for ways to cut utility bills due to persistent inflation.

Energy efficiency programs and rebates play a crucial role in this dynamic. By offering financial incentives, these programs empower customers to make choices that lower their energy bills. Black Hills Energy, for example, offers various rebates on efficient appliances and home weatherization. In 2023, their residential energy efficiency programs helped customers save an estimated $1.5 million on their energy bills, demonstrating a tangible impact on affordability and encouraging more conscious consumption.

- Consumer Behavior Shift: Rising energy prices in 2024 prompted a noticeable shift in consumer behavior, with a greater emphasis on reducing electricity usage.

- Program Effectiveness: Energy efficiency programs, like those offered by Black Hills Energy, are proving effective in helping customers manage costs and reduce consumption.

- Rebate Impact: Rebates for energy-efficient appliances and home improvements directly influence purchasing decisions, leading to lower long-term energy expenditures for households.

- Data-Driven Choices: Increased awareness of energy consumption patterns, often facilitated by utility smart meter data, empowers consumers to make more informed choices about their energy use.

Societal Expectations for Sustainability

Societal expectations are increasingly pushing companies, particularly in the energy sector, towards greater environmental and social responsibility. Consumers and investors alike are paying closer attention to a company's commitment to sustainability. This translates into a demand for tangible action on reducing emissions and adopting renewable energy sources.

Black Hills Corporation’s own sustainability reports reflect this shift, detailing progress in areas like emissions reduction targets and investments in cleaner energy. For instance, by the end of 2023, the company reported a significant increase in its renewable energy portfolio, aiming to further integrate sustainable practices into its operations. This public interest is a critical driver for companies to adopt and showcase their efforts.

- Growing consumer demand for ethically sourced and environmentally friendly products and services.

- Increased investor scrutiny and preference for companies with strong Environmental, Social, and Governance (ESG) ratings.

- Public pressure on energy companies to transition away from fossil fuels and invest in renewable energy infrastructure.

- Media coverage and social media amplification of corporate sustainability efforts or failures, influencing brand reputation.

Societal expectations are increasingly pushing companies, particularly in the energy sector, towards greater environmental and social responsibility. Consumers and investors alike are paying closer attention to a company's commitment to sustainability, demanding tangible action on reducing emissions and adopting renewable energy sources. Black Hills Corporation's own sustainability reports reflect this shift, detailing progress in areas like emissions reduction targets and investments in cleaner energy; by the end of 2023, the company reported a significant increase in its renewable energy portfolio, aiming to further integrate sustainable practices into its operations.

Demographic shifts within Black Hills' service territories, spanning states like South Dakota, Wyoming, Montana, and Arkansas, are crucial. Understanding trends such as an aging population in rural areas versus growth in urban centers directly impacts energy demand and service requirements, with approximately 1.3 million electric and natural gas customers relying on their services.

Public perception and strong community relations are vital for Black Hills' social license to operate. In 2024, the company's local economic contributions, including charitable giving and energy assistance, amounted to approximately $1.5 billion, directly benefiting communities and enhancing their public image.

The company's operational reliability hinges on a robust workforce, with approximately 3,100 employees in 2023. Attracting and retaining talent with specialized technical skills in the energy sector presents an ongoing challenge, making a positive workplace culture prioritizing safety and continuous learning essential.

Technological factors

Black Hills Corporation is actively integrating advanced renewable energy technologies to meet its clean energy goals. This includes significant investment in utility-scale solar projects, with a notable example being the presence of solar power generation in its portfolio, contributing to a cleaner energy mix.

The company is also expanding its capabilities in battery storage systems, crucial for grid stability and the reliable integration of intermittent renewable sources. This strategic deployment of storage enhances the overall efficiency and resilience of their renewable energy infrastructure.

Furthermore, Black Hills is exploring and investing in renewable natural gas (RNG) facilities. This initiative diversifies their renewable energy sources and aligns with broader decarbonization strategies, offering a pathway to reduce emissions from existing infrastructure.

These investments are central to Black Hills' commitment to achieving its emission reduction targets and navigating the evolving energy landscape, aiming for a substantial portion of its generation to come from renewable sources by 2030 and beyond.

Black Hills Corporation is actively engaged in the implementation of smart grid technologies and the digitalization of its utility operations. These advancements are crucial for improving grid reliability and optimizing energy distribution. For instance, smart meters, a key component of digitalization, allow for real-time data collection, enabling better load balancing and reducing transmission losses.

The digitalization of operations, including advanced metering infrastructure (AMI) and distribution automation, directly contributes to a more efficient energy management system for Black Hills' customers. This also enhances the company's ability to respond more quickly and effectively to outages, minimizing downtime and improving customer satisfaction. By mid-2024, a significant portion of Black Hills' customer base is expected to be equipped with smart meters, providing granular data for operational improvements.

The development and deployment of energy storage solutions, especially battery storage, are crucial for grid stability and integrating renewable energy sources like solar and wind. As Black Hills Corporation navigates the evolving energy landscape, these technologies are key to ensuring a reliable energy supply.

By 2024, the global energy storage market, dominated by battery storage, was projected to reach hundreds of billions of dollars, with significant growth expected through 2025. For instance, utility-scale battery storage projects are increasingly being deployed to smooth out the intermittent nature of renewables, providing backup power and ancillary services to the grid.

Black Hills Corporation itself has been investing in and exploring various energy storage projects to complement its renewable energy portfolio. These investments are vital for managing the fluctuating output of wind and solar farms, thereby enhancing the overall reliability and efficiency of its energy delivery systems.

Advanced Generation Technologies

Black Hills Corporation is actively exploring and investing in advanced generation technologies to secure a resilient energy future and achieve further emissions reductions. A key area of focus is coal-to-hydrogen technology, which offers a pathway to produce cleaner fuels from existing resources. Additionally, the company is examining carbon sequestration capabilities to mitigate the environmental impact of its operations.

These technological advancements are crucial for Black Hills as they align with broader industry trends toward decarbonization and sustainable energy practices. For instance, in its 2023 Integrated Resource Plan, the company highlighted continued evaluation of emerging technologies, including advanced nuclear and hydrogen, as potential components of its future generation mix.

- Coal-to-Hydrogen: Investigating the feasibility of converting coal into hydrogen, a cleaner fuel source.

- Carbon Sequestration: Evaluating technologies to capture and store carbon dioxide emissions.

- Resilient Energy Future: Aiming to diversify generation sources and enhance grid stability.

- Emissions Reductions: Committing to lowering the company's carbon footprint through technological innovation.

Cybersecurity and Data Management

Technological advancements present significant challenges for Black Hills, particularly in cybersecurity and data management. The company must continually invest in sophisticated systems to safeguard its critical energy infrastructure and sensitive customer information from evolving cyber threats. This is a growing concern, with the energy sector experiencing a significant rise in cyberattacks.

Protecting digital assets is not just a technical requirement but a fundamental business imperative. A breach could disrupt operations, compromise customer trust, and lead to substantial financial penalties. In 2024, the U.S. Department of Energy highlighted that the utility sector remains a prime target for sophisticated cyber adversaries.

Black Hills' investments in cybersecurity and data management are therefore crucial for maintaining operational integrity and regulatory compliance. The company is actively enhancing its defenses to address these risks, recognizing that robust data governance and protection are paramount in today's interconnected energy landscape.

- Cybersecurity spending in the energy sector is projected to increase significantly through 2025, driven by the need to protect critical infrastructure.

- Robust data management systems are essential for compliance with data privacy regulations like GDPR and CCPA, impacting how Black Hills handles customer information.

- The sophistication of cyber threats continues to escalate, requiring continuous investment in advanced threat detection and response capabilities.

- Failures in data management can lead to operational inefficiencies and increased vulnerability to external attacks.

Technological factors are driving Black Hills Corporation's strategic shift towards renewables and grid modernization. Investments in utility-scale solar and battery storage are key components of their strategy to meet clean energy goals, with a notable presence in solar power generation.

The company is also embracing digitalization, implementing smart grid technologies like smart meters to improve operational efficiency and customer service. By mid-2024, a substantial portion of their customer base is expected to have smart meters, enhancing data collection for better load balancing.

Exploring advanced generation technologies like coal-to-hydrogen and carbon sequestration reflects a commitment to decarbonization, aligning with industry trends. Black Hills continues to evaluate emerging technologies, including advanced nuclear and hydrogen, for its future energy mix as highlighted in its 2023 Integrated Resource Plan.

However, technological advancements also introduce cybersecurity risks. The energy sector, a prime target for cyber adversaries in 2024, requires continuous investment in robust data management and advanced threat detection systems to protect critical infrastructure and customer data.

Legal factors

Black Hills Corporation operates within a robust legal framework governing environmental compliance, encompassing strict regulations on air emissions, water quality, and waste management. These laws, often driven by federal statutes like the Clean Air Act and Clean Water Act, mandate significant investments in advanced pollution control technologies and meticulous environmental monitoring and reporting. For instance, in 2023, the EPA continued to emphasize reductions in greenhouse gas emissions, impacting utility operations. Failure to comply can result in substantial fines and operational disruptions, underscoring the critical need for proactive environmental stewardship.

Utility rate regulation is a crucial legal framework governing Black Hills' operations. The company must navigate complex rate case filings, which involve detailed proposals for electricity and natural gas prices submitted to state public utility commissions. These commissions, such as the South Dakota Public Utilities Commission or the Wyoming Public Service Commission, then conduct hearings to scrutinize these filings.

These legal proceedings are vital as they directly determine the rates Black Hills can charge its customers. The commissions also approve the company's allowed return on investment, influencing its profitability and ability to fund future infrastructure projects. For example, in 2023, Black Hills Energy filed for a rate increase in Wyoming, seeking to recover costs associated with natural gas supply and infrastructure improvements.

Land use and permitting laws are critical for any new infrastructure development in the Black Hills region, especially for projects like transmission lines and power plants. These regulations dictate where and how facilities can be built, often involving extensive environmental reviews and public comment periods. For instance, securing rights-of-way across public and private lands requires adherence to federal laws like the National Environmental Policy Act (NEPA) and state-specific land management statutes.

Navigating these legal complexities can be time-consuming and costly. In 2024, the average time to secure all necessary federal and state permits for major energy infrastructure projects in the U.S. exceeded 4 years, with some facing delays of up to 7 years due to legal challenges and stakeholder disputes. Stakeholder negotiations, including those with Native American tribes and local landowners, are often integral to the permitting process, aiming to mitigate impacts and gain community support.

Consumer Protection Laws

Black Hills, like all utility providers, operates under a stringent framework of consumer protection laws. These regulations mandate specific service quality standards, ensuring reliable and safe delivery of electricity and gas. For instance, in 2024, regulatory bodies continued to emphasize uptime percentages and response times for service disruptions, with penalties for non-compliance impacting utility revenue. Billing practices are also heavily scrutinized, requiring transparency in charges and fair dispute resolution processes. Failing to adhere to these can lead to significant fines and reputational damage.

Customer data privacy is another critical legal area, especially with the increasing digitization of services. Laws like the California Consumer Privacy Act (CCPA) and similar state-level regulations set strict guidelines on how customer information is collected, stored, and used. Black Hills must ensure robust cybersecurity measures are in place to prevent data breaches. In 2024, data privacy settlements for major corporations often ran into the millions of dollars, underscoring the financial risks associated with non-compliance. Staying current with these evolving legal landscapes is paramount for maintaining customer trust and avoiding costly litigation.

- Service Quality Standards: Adherence to mandated uptime and response times, with potential financial penalties for deviations.

- Billing Transparency: Clear and accurate billing practices, including fair procedures for customer inquiries and disputes.

- Data Privacy Compliance: Strict adherence to regulations governing the collection, storage, and use of customer personal information.

- Regulatory Oversight: Ongoing monitoring and enforcement by state public utility commissions and federal agencies.

Workplace Safety and Labor Laws

Black Hills Corporation must navigate a complex web of federal and state legal obligations concerning workplace safety and labor. This includes adhering to Occupational Safety and Health Administration (OSHA) standards, which mandate safe working conditions and require employers to implement programs to prevent accidents and injuries. For instance, in 2023, OSHA reported over 2.8 million workplace injuries and illnesses across various industries, highlighting the critical importance of compliance.

Furthermore, the company is bound by labor laws that govern fair employment practices, wages, and working hours. The Fair Labor Standards Act (FLSA) sets minimum wage requirements and overtime pay, impacting how Black Hills compensates its workforce. As of January 1, 2024, the federal minimum wage remains $7.25 per hour, though many states have higher rates, potentially affecting labor costs.

- OSHA Compliance: Ensuring adherence to safety regulations to prevent workplace accidents and meet legal reporting requirements.

- Fair Labor Standards: Upholding minimum wage laws, overtime provisions, and equal employment opportunity statutes.

- Employee Relations: Managing employment contracts, collective bargaining agreements (if applicable), and grievance procedures in line with legal frameworks.

- Worker's Compensation: Maintaining appropriate worker's compensation insurance to cover employee injuries sustained on the job.

Regulatory compliance is a cornerstone of Black Hills' operations, demanding strict adherence to environmental protection laws, including those governing emissions and water quality, with federal mandates like the Clean Air Act setting stringent standards. The company must also navigate utility rate regulation, where state public utility commissions approve electricity and natural gas prices through detailed rate case filings, directly impacting profitability. For instance, in 2023, Black Hills Energy filed for a rate increase in Wyoming to cover infrastructure costs.

Environmental factors

Climate change concerns significantly impact Black Hills Corporation's operations and strategic planning. The company is actively addressing these pressures by setting ambitious greenhouse gas emission reduction targets.

Black Hills Corporation has already achieved a substantial 38% reduction in electric utility greenhouse gas emissions compared to its 2005 baseline. This demonstrates a tangible commitment to environmental stewardship and a response to evolving regulatory and societal expectations.

Looking ahead, the company has set further targets, aiming for a 40% reduction in electric utility greenhouse gas emissions by 2030 and an 80% reduction by 2040, both relative to the 2005 baseline. These goals underscore a strategic shift towards cleaner energy sources.

Environmental factors are increasingly shaping energy companies' strategies, pushing for a greater share of renewable sources. State-level renewable portfolio standards (RPS), for instance, mandate that a certain percentage of electricity sold must come from renewable sources, driving investment in wind, solar, and other clean technologies. By the end of 2023, for example, 31 states and the District of Columbia had adopted some form of RPS, with many setting ambitious targets for 2030 and beyond.

Black Hills Corporation is actively responding to these environmental drivers. The company's strategic moves, such as the acquisition of renewable natural gas facilities and solar projects, directly reflect a commitment to diversifying its energy portfolio with cleaner options. This aligns with broader corporate sustainability goals that aim to reduce greenhouse gas emissions and improve environmental performance.

Black Hills Corporation is actively engaged in managing natural resources across its operations. For instance, in 2023, the company reported utilizing approximately 2.5 billion gallons of water for its power generation activities, with a significant portion being recycled or reused through advanced cooling technologies.

Their commitment extends to responsible land management, particularly concerning mining operations. In 2024, Black Hills Corporation continued its reclamation efforts on over 1,500 acres of previously mined land, focusing on restoring native vegetation and ensuring land stability.

Sustainable practices are paramount for the company's long-term environmental stewardship. They are investing in technologies to minimize water consumption and reduce land impact, aligning with evolving regulatory landscapes and stakeholder expectations for conservation.

Environmental Impact Assessments and Mitigation

Environmental Impact Assessments (EIAs) are crucial for any new development by Black Hills, ensuring potential ecological harm is identified and addressed before projects commence. For instance, a 2024 study on infrastructure projects in similar regions found that thorough EIAs can reduce unforeseen environmental costs by an average of 15% through proactive mitigation. This involves detailed planning to protect local biodiversity and critical habitats, as well as outlining strategies for land reclamation post-operation.

Mitigation strategies are key to minimizing Black Hills’ ecological footprint. This includes implementing advanced waste management systems, as seen in the 2023 rollout of a new recycling initiative by a major energy firm that diverted 90% of operational waste from landfills. Furthermore, efforts focus on preserving habitat connectivity for species like the prairie dog, a keystone species in the Black Hills ecosystem, and ensuring disturbed land is restored to its natural state, often exceeding regulatory requirements.

- Biodiversity Protection: Implementing habitat restoration plans, such as replanting native grasses and wildflowers, to support local wildlife populations.

- Habitat Protection: Establishing buffer zones around sensitive ecological areas to minimize disruption from operational activities.

- Land Reclamation: Developing detailed plans for the rehabilitation of any land used for project construction, aiming to restore it to a pre-development ecological condition.

- Water Resource Management: Employing water conservation techniques and advanced wastewater treatment to protect local water sources.

Waste Management and Pollution Control

Black Hills Corporation is actively engaged in managing its environmental footprint, with a particular focus on waste management and pollution control across its operations. This includes stringent measures for controlling emissions from its power generation facilities, such as coal-fired plants, and ensuring the safe handling and disposal of byproducts like coal ash. The company's commitment to preventing spills, particularly concerning fuel and chemicals, is a critical aspect of its environmental stewardship.

Compliance with a complex web of environmental regulations is paramount for Black Hills. For instance, in 2023, the company reported significant investments in environmental compliance and improvements, including upgrades to emission control systems at its coal-fired power plants. Failure to adhere to these regulations can result in substantial fines and operational disruptions, making robust pollution control a core business necessity.

Key areas of focus for Black Hills' waste management and pollution control efforts include:

- Emissions Reduction: Implementing technologies to lower sulfur dioxide (SO2), nitrogen oxides (NOx), and particulate matter emissions from its power plants.

- Byproduct Management: Developing safe and sustainable methods for managing coal combustion residuals (CCR), often referred to as coal ash, including beneficial reuse initiatives.

- Spill Prevention and Response: Maintaining comprehensive plans and infrastructure to prevent accidental releases of hazardous materials and ensure rapid, effective response if they occur.

- Water Quality Protection: Managing wastewater discharge from its facilities to meet strict water quality standards and protect local water bodies.

Environmental pressures are a significant force shaping Black Hills Corporation's strategy, driving a move towards cleaner energy. The company has made strides in reducing emissions, achieving a 38% decrease in electric utility greenhouse gas emissions from a 2005 baseline by the end of 2023. Further targets include a 40% reduction by 2030 and 80% by 2040, reflecting a commitment to sustainability and compliance with evolving regulations.

State-level Renewable Portfolio Standards (RPS) are a key driver, with 31 states and D.C. having adopted them by late 2023, mandating increased renewable energy usage. Black Hills is responding by acquiring renewable natural gas facilities and solar projects, diversifying its portfolio to meet these demands and broader corporate sustainability goals.

Responsible resource management is also critical. In 2023, Black Hills utilized approximately 2.5 billion gallons of water for power generation, employing advanced cooling technologies for recycling. Ongoing land reclamation efforts in 2024 focus on restoring over 1,500 acres of mined land, demonstrating a commitment to minimizing ecological impact and adhering to conservation expectations.

Black Hills Corporation is actively managing its environmental footprint through stringent waste management and pollution control. This includes upgrading emission control systems, as evidenced by significant investments in 2023, and developing safe methods for managing byproducts like coal ash, with a focus on beneficial reuse initiatives.

PESTLE Analysis Data Sources

Our Black Hills PESTLE analysis is meticulously constructed using data from South Dakota state government agencies, regional economic development reports, and industry-specific publications. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the region.