Black Hills Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Black Hills Bundle

Uncover the strategic brilliance behind Black Hills' success by dissecting their 4Ps. We've meticulously analyzed their product offerings, pricing strategies, distribution channels, and promotional campaigns, providing a clear roadmap to their market dominance. This comprehensive breakdown reveals the synergistic interplay of these elements, offering invaluable insights for any business aiming for similar achievements.

Go beyond the surface-level understanding and gain access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Black Hills. Ideal for business professionals, students, and consultants seeking actionable strategic insights.

Product

Black Hills Corporation's core product is the delivery of regulated natural gas and electric services, serving about 1.35 million customers across eight states. These services are fundamental to daily life, emphasizing reliability and safety for homes, businesses, and industries. The company invests heavily in its extensive infrastructure to guarantee uninterrupted energy supply.

Black Hills Corporation actively participates in the wholesale power market, selling surplus electricity generated from its diverse portfolio to other utilities and energy marketers. This strategy utilizes its generation assets, which encompass natural gas, coal, diesel oil, and wind power, to serve broader market needs.

In 2023, Black Hills Corporation's wholesale power sales contributed significantly to its overall revenue, reflecting the company's ability to capitalize on regional energy demand. The company's investments in enhancing its generation capacity, including renewable sources like wind, are crucial for maintaining energy stability across the regions it serves.

Black Hills Corporation’s upstream operations directly involve the production of natural gas, crude oil, and coal, mainly in the Rocky Mountain and Midwestern United States. This integration is a key part of their strategy, allowing for better control over their energy supply chain and offering a buffer against fluctuating commodity prices that could impact their utility businesses. For instance, in 2023, Black Hills’ Wyoming operations produced approximately 17.6 billion cubic feet of natural gas and 1.5 million barrels of oil, contributing to their overall energy portfolio.

The company’s coal segment is particularly important as it directly fuels electric generation facilities, including those owned by Black Hills. This ensures a stable and cost-effective power source for their utility customers. In 2023, their coal mines supplied over 3.2 million tons of coal, a significant portion of which was utilized in their own power plants, demonstrating a clear link between their upstream production and downstream utility services.

Energy Infrastructure Development

Black Hills Corporation’s commitment to energy infrastructure development is a cornerstone for its stakeholders, particularly investors and business strategists. This involves substantial capital expenditures aimed at modernizing and expanding its energy delivery systems.

A prime example is the Ready Wyoming project, an electric transmission expansion initiative. This project is designed to bolster the resilience of Black Hills’ service territory and improve access to broader energy markets. For instance, the company has consistently invested billions in capital expenditures, with a significant portion allocated to infrastructure upgrades. In 2023, Black Hills reported capital expenditures of approximately $1.4 billion, with a substantial portion directed towards transmission and distribution projects.

These infrastructure enhancements are critical for several reasons:

- Ensuring Reliability: Upgraded infrastructure minimizes outages and ensures a consistent power supply for customers.

- Facilitating Growth: Expanded transmission capacity allows for the integration of new energy sources and supports economic development in its service areas.

- Market Access: Projects like Ready Wyoming improve the ability to wheel power, potentially creating new revenue streams and optimizing resource allocation.

- Future-Proofing: Investments in modern infrastructure position Black Hills to meet evolving energy demands and regulatory requirements.

These strategic investments in infrastructure are fundamental to Black Hills Corporation's long-term value proposition, promising both operational stability and avenues for future expansion.

Renewable Energy Solutions and Efficiency Programs

Black Hills Corporation is actively broadening its offerings to encompass renewable energy solutions and energy efficiency programs, reflecting a strategic shift towards cleaner energy. A key development in 2024 was the acquisition of a renewable natural gas facility, signaling a tangible commitment to expanding its clean energy portfolio.

The company is also making strides in integrating other clean energy resources, with ongoing efforts in solar and battery storage projects. These initiatives are designed to meet evolving customer demands and regulatory landscapes, positioning Black Hills for future growth in the energy sector.

Furthermore, Black Hills empowers its customers to manage their energy consumption more effectively through various energy efficiency rebate programs. These programs not only help customers reduce their energy bills but also contribute to overall system efficiency. For instance, in 2024, the company continued to offer incentives for energy-efficient appliance upgrades and building retrofits, encouraging broader adoption of energy-saving practices.

Key aspects of their renewable and efficiency push include:

- Acquisition of a renewable natural gas facility in 2024.

- Ongoing integration of solar and battery storage technologies.

- Provision of customer energy efficiency rebates for various upgrades.

- Focus on empowering customer choice in energy consumption management.

Black Hills Corporation's product is multifaceted, encompassing the essential delivery of regulated natural gas and electricity to over 1.35 million customers across eight states. Beyond core utility services, the company actively engages in wholesale power sales, leveraging its diverse generation assets, which include natural gas, coal, and wind. This strategic approach allows Black Hills to meet broader market demands while optimizing its resource utilization.

The company is also expanding its product portfolio to include renewable energy solutions. A significant move in 2024 was the acquisition of a renewable natural gas facility, underscoring a commitment to cleaner energy. This is complemented by ongoing investments in solar and battery storage projects, aiming to align with evolving customer preferences and regulatory trends.

Furthermore, Black Hills offers energy efficiency programs designed to empower customers. These initiatives, including rebates for energy-efficient appliances and building retrofits, help customers manage consumption and reduce costs, contributing to overall system efficiency.

| Product Offering | Key Features/Developments | Impact/Benefit |

|---|---|---|

| Regulated Utility Services (Gas & Electric) | Reliable delivery to 1.35M+ customers across 8 states. | Essential services for homes and businesses; infrastructure investment ensures reliability. |

| Wholesale Power Sales | Utilizes surplus generation from natural gas, coal, wind. | Capitalizes on regional energy demand; optimizes asset utilization. |

| Renewable Energy Solutions | Acquisition of renewable natural gas facility (2024); solar & battery storage projects. | Expands clean energy portfolio; meets evolving customer and regulatory demands. |

| Energy Efficiency Programs | Customer rebates for upgrades; incentives for energy-saving practices. | Empowers customer cost management; enhances overall system efficiency. |

What is included in the product

This Black Hills 4P's Marketing Mix Analysis provides a comprehensive breakdown of its product offerings, pricing strategies, distribution channels, and promotional activities, offering actionable insights for marketing professionals.

This Black Hills 4P's analysis streamlines marketing strategy, eliminating the pain of scattered information and enabling confident decision-making.

It provides a clear, actionable roadmap to optimize product, price, place, and promotion, alleviating the stress of ineffective marketing campaigns.

Place

Black Hills Corporation's service territory is vast, spanning eight states: Arkansas, Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming. This extensive reach allows the company to serve a diverse customer base, totaling over 1.35 million natural gas and electric utility customers. This broad geographic footprint highlights Black Hills's position as a significant regional energy provider.

Black Hills Corporation's core 'place' is its extensive network of electric transmission and distribution lines and natural gas pipelines. This physical infrastructure is how energy reaches customers, making it absolutely fundamental to the company's business model.

The company is consistently investing in these vital assets. For instance, in 2023, Black Hills invested approximately $1.1 billion in its utility infrastructure, a significant portion of which goes towards modernizing and expanding its transmission and distribution capabilities. This ensures reliable and efficient energy delivery across its service territories.

Projects like the Ready Wyoming electric transmission project exemplify this commitment. Such investments are crucial for meeting growing energy demands and enhancing grid resilience. They are the backbone of Black Hills' ability to serve its customer base effectively.

Black Hills Corporation's power generation facilities are strategically positioned to serve its customer base efficiently. These sites, often located within or close to their service territories, reduce energy lost during transmission, ensuring power gets where it's needed most. In 2023, the company's generation portfolio included approximately 2,900 megawatts of capacity across various fuel types, emphasizing a diverse and reliable energy mix.

Direct Customer Service Channels

Black Hills Corporation maintains direct customer service channels, including physical local service centers and robust online platforms. These direct touchpoints are crucial for customer accessibility, enabling easy bill payments, prompt service inquiries, and seamless access to valuable energy efficiency programs. This approach fosters direct engagement and builds stronger relationships with their customer base.

This direct customer service model is a standard practice for regulated utility companies, prioritizing consistent reliability and comprehensive customer support. For instance, in 2023, Black Hills Corporation reported that approximately 75% of its customer inquiries were handled through digital channels, highlighting the growing importance of online self-service options.

- Local Service Centers: Providing in-person assistance for various customer needs.

- Online Platforms: Offering digital access for payments, account management, and program information.

- Customer Support: Facilitating inquiries and support for energy services.

- Energy Efficiency Programs: Direct access for customers to learn about and enroll in energy-saving initiatives.

Wholesale Market Participation

Black Hills Corporation actively engages in wholesale energy markets, notably the Western Energy Imbalance Market (WEIM), extending its market presence beyond its direct customer base. This participation allows for the real-time buying and selling of electricity, a crucial aspect of optimizing resource deployment and bolstering grid stability across a wider operational area. In 2023, Black Hills Corporation reported approximately $5.9 billion in total operating revenues, with a significant portion derived from its diverse energy generation and distribution activities, which include wholesale market transactions. This strategy diversifies revenue streams and leverages their generation assets more effectively.

By participating in markets like the WEIM, Black Hills Corporation can strategically manage its power supply and demand. This includes capturing opportunities to sell surplus energy and procuring power at competitive prices when needed, contributing to overall financial performance. The WEIM, for instance, connects utilities across 14 western states and British Columbia, facilitating efficient energy balancing. This broader market engagement enhances the company's ability to respond to fluctuating energy needs and market conditions, a key element of its 'Place' strategy in the 4Ps marketing mix.

- Market Reach: Extends operational influence beyond direct service territories through wholesale market participation.

- Real-time Optimization: Enables strategic buying and selling of power to enhance resource utilization.

- Grid Reliability: Contributes to a more stable and efficient energy grid across a larger footprint.

- Revenue Diversification: Creates additional revenue opportunities by capitalizing on market price differentials.

Black Hills Corporation's 'Place' in marketing revolves around its extensive physical infrastructure and strategic market positioning. This includes its vast network of electric and natural gas distribution systems, serving over 1.35 million customers across eight states. The company's commitment to this infrastructure is evident in its substantial investments, with approximately $1.1 billion allocated to utility infrastructure in 2023 alone, ensuring reliable energy delivery.

Furthermore, Black Hills Corporation's strategically located power generation facilities, totaling around 2,900 megawatts of capacity in 2023, minimize transmission losses. Complementing this physical network are direct customer service channels, featuring local service centers and robust online platforms, which handled about 75% of customer inquiries digitally in 2023. This integrated approach ensures efficient energy distribution and accessible customer support.

The company also actively participates in wholesale energy markets, such as the Western Energy Imbalance Market (WEIM), which spans 14 western states. This participation allows for real-time energy trading, optimizing resource deployment and enhancing grid stability beyond its direct service areas. In 2023, Black Hills Corporation reported total operating revenues of approximately $5.9 billion, with wholesale market transactions contributing to this financial performance.

| Aspect | Description | Key Data Point (2023) |

|---|---|---|

| Service Territory | Extensive network across 8 states | 1.35+ million customers |

| Infrastructure Investment | Modernization and expansion of transmission & distribution | ~$1.1 billion invested in utility infrastructure |

| Generation Capacity | Strategically located facilities | ~2,900 megawatts |

| Customer Channels | Direct service centers and online platforms | ~75% of inquiries handled digitally |

| Market Participation | Wholesale markets like WEIM | $5.9 billion total operating revenues |

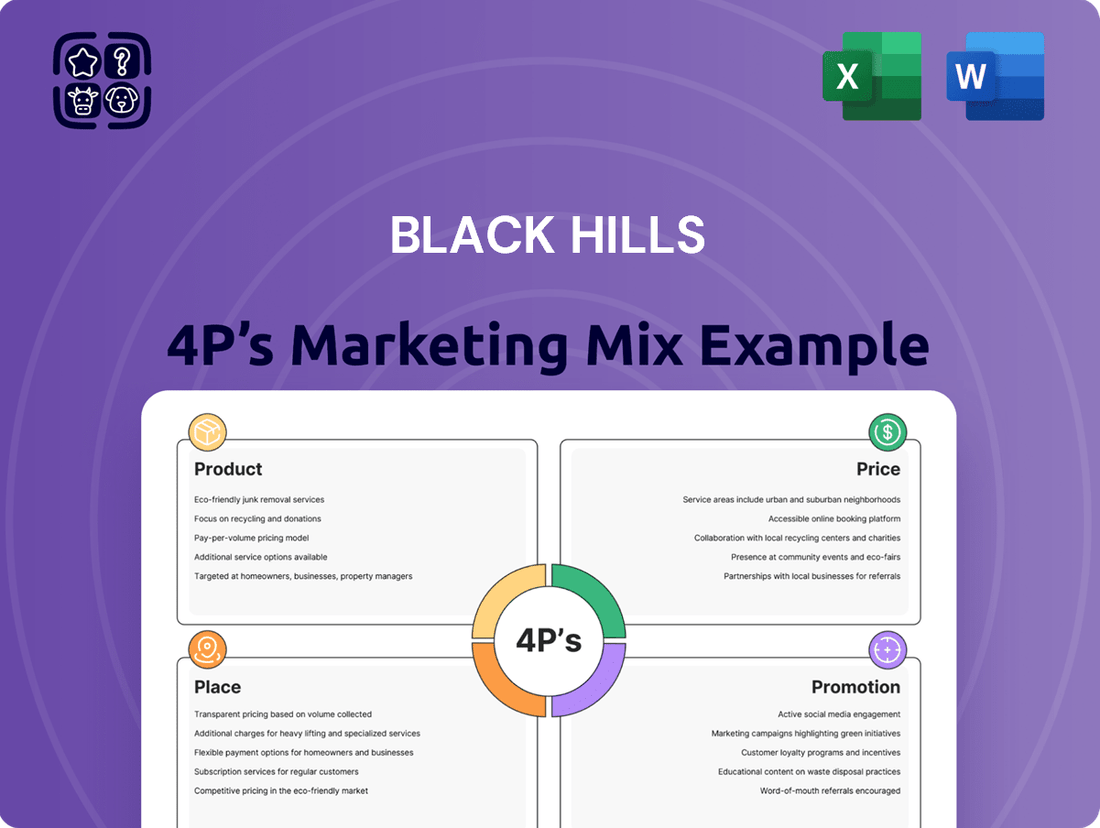

Preview the Actual Deliverable

Black Hills 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Black Hills 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion. You'll gain insights into the strategic considerations for marketing within this unique geographical and cultural region. This is the same ready-made Marketing Mix document you'll download immediately after checkout, offering actionable strategies.

Promotion

Black Hills Corporation prioritizes investor relations by offering detailed financial reports, including SEC filings and earnings data, to a discerning audience of investors and financial professionals. These materials are crucial for informing decisions about the company's performance and strategy.

Regular earnings calls and in-depth annual reports serve as vital promotional avenues. They communicate Black Hills' financial results, strategic direction, and future prospects effectively. For example, in Q1 2024, Black Hills reported adjusted earnings per share of $0.85, up from $0.72 in the prior year, demonstrating positive financial momentum.

Black Hills Corporation emphasizes its commitment to ESG through its annual Corporate Sustainability Report. This report details progress on climate targets, including a 2023 reduction of 1.4 million metric tons of CO2 equivalents compared to a 2005 baseline, and significant investments in renewable energy projects, such as the recently approved Cheyenne Ridge Wind Farm expected to generate 190 MW.

The company's reporting showcases community engagement and social impact initiatives, which are vital for attracting socially conscious investors and fostering public goodwill. For instance, in 2023, Black Hills invested over $2.5 million in community support programs across its service territories.

This transparent reporting on environmental stewardship and social responsibility not only strengthens its brand reputation but also aligns with the growing demand for sustainable business practices from stakeholders and the investment community, supporting its long-term value proposition.

Black Hills Corporation actively participates in community engagement and charitable giving, a key component of its marketing strategy. In 2023, the company contributed over $2.3 million to various charitable organizations and community initiatives across its service territories. This commitment extends to employee volunteerism, with hundreds of employees dedicating thousands of hours to local causes annually.

These efforts go beyond simple philanthropy; they are strategic investments in public relations and brand building. By supporting local non-profits, energy assistance programs, and economic development, Black Hills Corporation strengthens its ties with the communities it serves. This fosters goodwill and enhances the company's reputation as a responsible corporate citizen, a crucial element in maintaining customer trust and regulatory support.

Regulatory Communications and Public Hearings

As a regulated utility, Black Hills Corporation's promotional efforts heavily rely on transparent communication with public utility commissions. This includes active participation in rate cases and public hearings, which are essential for justifying proposed rate adjustments and gaining approval for crucial infrastructure investments. For instance, in 2023, Black Hills participated in multiple rate case filings across its service territories, seeking to recover significant capital expenditures. These engagements directly shape stakeholder perception and regulatory decisions, influencing the company's ability to operate and grow.

These regulatory communications are critical for demonstrating compliance with state and federal regulations, thereby building trust with both regulators and the public. The company's approach to these proceedings directly impacts its financial health and operational flexibility. In 2024, filings are anticipated for major infrastructure upgrades, particularly in renewable energy and grid modernization, requiring extensive justification and public engagement.

Key aspects of Black Hills' regulatory communication strategy include:

- Data-Driven Justification: Presenting detailed financial and operational data to support requests for rate increases or new projects, often citing specific capital investment figures approved in prior periods.

- Stakeholder Engagement: Actively participating in public comment periods and hearings to address concerns from customers, consumer advocates, and other interested parties.

- Transparency in Filings: Making regulatory filings readily accessible to the public, often detailing the reasons for requested changes and the expected impact on customer bills.

- Compliance Demonstrations: Clearly outlining how proposed actions align with environmental regulations and service quality standards set by regulatory bodies.

Customer Education and Energy Efficiency Programs

Black Hills Corporation actively engages customers through programs designed to boost energy efficiency and promote safety. These initiatives are key to their marketing efforts, fostering a relationship built on shared responsibility for energy consumption. For instance, in 2023, Black Hills Energy’s energy efficiency programs helped customers save over 100,000 MWh of electricity and nearly 200,000 therms of natural gas, translating into significant cost savings for households and businesses. This focus on education and tangible benefits enhances their brand reputation.

The company offers various incentives, such as rebates on energy-efficient appliances and HVAC systems, alongside educational materials and workshops. These resources empower customers to make informed decisions about their energy usage. In the first half of 2024, Black Hills Corporation reported a 5% increase in participation in their residential energy efficiency programs compared to the same period in 2023. Such programs not only reduce overall energy demand but also position Black Hills as a partner in their customers' financial well-being.

These customer education and energy efficiency programs directly contribute to Black Hills Corporation's commitment to sustainability and customer service. By providing tools and knowledge, they encourage responsible energy stewardship. Data from their 2024 sustainability report indicates that customers participating in their advanced home energy audits reported an average reduction of 15% in their monthly energy bills.

Key aspects of these programs include:

- Rebate Programs: Offering financial incentives for purchasing energy-efficient appliances and equipment.

- Educational Resources: Providing online guides, workshops, and tips for reducing energy consumption.

- Safety Initiatives: Promoting safe natural gas and electricity usage through awareness campaigns.

- Partnerships: Collaborating with local organizations to broaden outreach and impact.

Black Hills Corporation's promotional activities are multifaceted, encompassing investor relations, community engagement, and customer education. These efforts aim to build trust, enhance brand reputation, and support regulatory approvals. By showcasing financial performance, ESG commitments, and community support, the company targets a broad spectrum of stakeholders, from individual investors to regulatory bodies.

The company strategically uses investor relations, earnings calls, and annual reports to communicate financial health and future prospects. For instance, Q1 2024 adjusted EPS was $0.85, an increase from $0.72 in Q1 2023. Simultaneously, significant community investment, exemplified by over $2.5 million in community support in 2023, reinforces its role as a responsible corporate citizen.

Regulatory communication is paramount, with active participation in rate cases and public hearings. These engagements, such as the multiple rate case filings in 2023, are crucial for justifying investments and ensuring operational flexibility. Customer-focused programs, like energy efficiency initiatives that helped customers save over 100,000 MWh in 2023, further solidify customer relationships and brand loyalty.

Black Hills Corporation's promotional strategy effectively leverages transparency and data to build confidence across all stakeholder groups.

| Promotional Area | Key Activities | 2023/2024 Data Points | Objective |

|---|---|---|---|

| Investor Relations | SEC Filings, Earnings Calls, Annual Reports | Q1 2024 Adj. EPS: $0.85 (vs. $0.72 in Q1 2023) | Inform investors, build confidence |

| Community Engagement | Charitable Giving, Employee Volunteerism | $2.3M+ in community support (2023) | Enhance reputation, foster goodwill |

| Sustainability/ESG | Corporate Sustainability Report | 1.4M metric tons CO2e reduction (vs. 2005 baseline) | Attract socially conscious investors |

| Regulatory Communication | Rate Case Filings, Public Hearings | Multiple rate case filings (2023) | Gain approval for investments, maintain operational flexibility |

| Customer Education & Efficiency | Rebates, Workshops, Energy Audits | 100,000+ MWh electricity saved by customers (2023) | Reduce demand, build customer loyalty |

Price

Black Hills Corporation's pricing for natural gas and electric services is heavily influenced by regulated rate structures. These rates are established and approved by state public utility commissions, ensuring they cover operating expenses and infrastructure investments. For instance, in 2024, Black Hills Energy filed for rate adjustments in several states, seeking to recover significant investments in grid modernization and renewable energy projects. These filings are crucial for the company to earn a fair return on its equity and maintain service reliability.

Black Hills Corporation employs various cost recovery mechanisms and riders beyond its base rates to adapt pricing to fluctuating expenses. These can include adjustments for fuel costs, purchased power, and critical infrastructure upgrades, allowing for more dynamic pricing that reflects real-time operational needs.

These riders are crucial for financial stability, enabling the company to recoup specific expenditures promptly. For instance, in 2024, energy companies often see riders adjusted quarterly to account for volatile natural gas prices, a key component in electricity generation for many utilities.

This approach ensures that Black Hills can maintain service reliability and fund necessary investments without solely relying on infrequent base rate changes. Such mechanisms are vital for managing the inherent unpredictability of the energy market and its impact on operating costs.

The authorized Return on Equity (ROE) is a crucial element in Black Hills Corporation's pricing, directly impacting customer costs. Regulators establish this percentage, which dictates the profit margin allowed on equity investments within the company's utility operations. For instance, in their 2023 rate case filings, Black Hills sought an ROE that reflected current market conditions and investment needs.

This ROE directly influences the rates customers pay for essential services like electricity and natural gas. During rate case proceedings, the ROE is a focal point, with the company arguing for a level that supports continued investment and financial health, while regulators balance this with consumer affordability. The approved ROE for 2024, for example, will be a key determinant in the overall utility bills across their service territories.

Capital Investment Recovery

Black Hills Corporation's pricing strategy is intrinsically linked to recovering substantial capital investments necessary for its extensive utility infrastructure. This includes the ongoing maintenance and expansion of critical assets like transmission lines, pipelines, and power generation facilities to ensure reliable service delivery.

Future rate adjustments are strategically planned to accommodate significant capital expenditure forecasts. For instance, the company has projected approximately $4.7 billion in capital investments for the period of 2025 through 2029. This forward-looking financial planning ensures the company can continue to upgrade and maintain its operational capacity.

- Infrastructure Investment: Recovery of costs associated with maintaining and expanding transmission lines, pipelines, and power generation.

- Capital Forecasts: Factoring in planned capital expenditures, such as the $4.7 billion allocated for 2025-2029.

- Rate Adjustments: Future pricing reflects the need to recoup these significant capital outlays.

- Service Reliability: Ensuring continued investment maintains the reliability of essential utility services for customers.

Competitive Pricing for Non-Regulated Operations

For its non-regulated operations, like wholesale power and energy production, Black Hills Corporation navigates a market driven by supply, demand, and what competitors are charging. This is quite different from their regulated utility services, where pricing is set by authorities. In these competitive arenas, Black Hills needs to be adaptable with their pricing to bring in the most revenue and hold onto their market position.

Black Hills Corporation's non-regulated segments, including its Energy Marketing and Power Production businesses, actively participate in competitive wholesale energy markets. For instance, in 2023, the company reported that its non-regulated segments contributed significantly to overall performance, with wholesale power sales being a key revenue driver. The pricing in these segments is directly tied to fluctuating market prices for natural gas and electricity, which can be influenced by factors like weather patterns, fuel costs, and regional demand. This dynamic pricing environment necessitates constant monitoring and strategic adjustments to remain competitive.

- Market-Driven Pricing: Pricing for non-regulated segments is determined by prevailing market rates for wholesale power and energy commodities, rather than regulatory approval.

- Competitive Landscape: Black Hills competes with numerous other energy producers in its non-regulated wholesale markets, demanding agile pricing strategies.

- Revenue Maximization: Flexible pricing allows Black Hills to capitalize on favorable market conditions and optimize revenue from its energy production assets.

- 2023 Performance Insight: The non-regulated segments demonstrated resilience and contribution to the company’s financial results in 2023, highlighting the importance of their competitive pricing approach.

Black Hills Corporation's pricing for its regulated utility services is primarily determined by state public utility commissions, allowing for cost recovery and a regulated return on equity. For non-regulated segments, pricing is market-driven, reflecting supply, demand, and competitive pressures. This dual approach ensures both service reliability through approved rates and revenue optimization in competitive energy markets.

In 2024, Black Hills Energy filed for rate adjustments across several states to cover investments in modernization and renewables. The company projects $4.7 billion in capital expenditures from 2025 through 2029, which will influence future regulated pricing. The authorized Return on Equity (ROE) for 2024, a key component of customer rates, is set by regulators to balance company investment needs with consumer affordability.

| Pricing Element | Regulated Operations | Non-Regulated Operations |

| Primary Driver | State Utility Commission Approval | Market Supply & Demand |

| Key Factor | Cost Recovery & Authorized ROE | Wholesale Market Rates |

| 2024/2025 Focus | Rate Case Filings for Infrastructure Investment | Competitive Wholesale Power Sales |

4P's Marketing Mix Analysis Data Sources

Our Black Hills 4P's Marketing Mix Analysis is built upon a foundation of credible industry data, including official company statements, retail analytics, and competitive landscape reviews. We utilize information from brand websites, promotional materials, and public financial disclosures to ensure accuracy.