Black Hills Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Black Hills Bundle

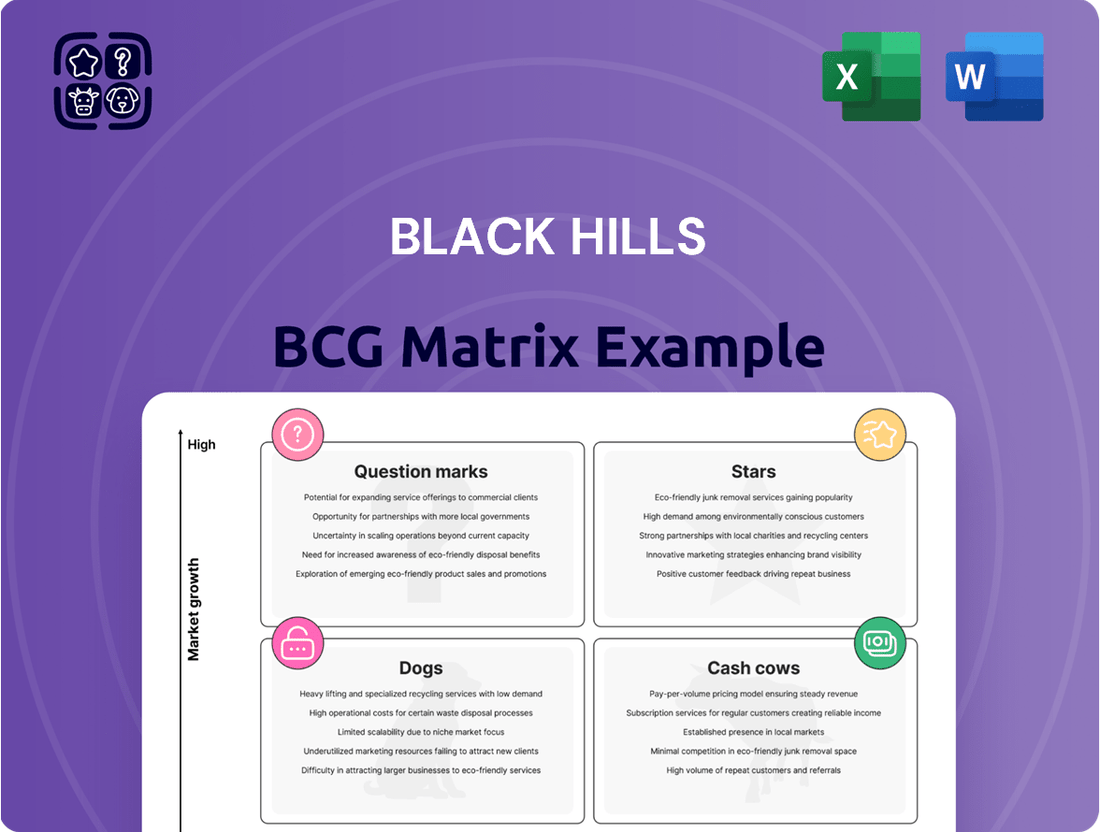

Curious about the Black Hills' strategic product positioning? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Understanding these dynamics is crucial for any business aiming for growth and efficiency.

Don't let this initial insight be your only takeaway; unlock the full potential of this analysis by purchasing the complete Black Hills BCG Matrix. Gain a comprehensive breakdown of each product's market share and growth rate, along with actionable strategies tailored to their specific quadrant.

The full report provides the detailed data and expert commentary needed to make informed decisions about resource allocation and future investments. Empower yourself with the clarity to identify lucrative opportunities and mitigate potential risks within the Black Hills' portfolio.

Invest in the complete BCG Matrix today and equip yourself with a powerful tool for strategic planning and competitive advantage. Discover the roadmap to optimizing your product portfolio and driving sustainable success.

Stars

Black Hills Corporation is strategically positioning itself to capitalize on robust data center demand, with plans to serve 500 megawatts by 2029. This surge in demand is a key driver for the company's growth, projected to more than double the earnings per share contribution from data centers to over 10% by 2028 or 2029. This highlights the significant market share expansion anticipated in this high-growth sector.

The company is leveraging an innovative tariff structure for this burgeoning demand. This approach is designed to require minimal additional capital investment, thereby significantly enhancing profitability and return on investment. This focus on efficient capital deployment is crucial for maximizing the financial benefits of this expanding market segment.

The Ready Wyoming Electric Transmission Expansion, a $350 million, 260-mile project, is a significant undertaking for Black Hills Corporation. Nearing completion by the end of 2025, with some initial segments already operational, this initiative is designed to bolster system resilience and broaden market access. This ambitious project directly supports strategic growth initiatives in Wyoming and South Dakota, positioning it as a vital component of the company's future development.

The Colorado Clean Energy Plan positions Black Hills Corporation's renewable energy initiatives as potential stars within the BCG matrix. In 2024, the company secured approval for 350 megawatts of new renewable resources, a significant step towards its goal of an 80% emissions reduction by 2030.

This plan includes a 100-megawatt utility-owned solar project and a 50-megawatt battery storage project. These investments highlight Black Hills’ commitment to high-growth renewable energy markets, indicating strong future potential.

These crucial renewable energy projects are scheduled to begin service between 2027 and 2028. This timeline suggests a strategic build-up of capacity, aiming to capture future market share in the expanding clean energy sector.

South Dakota Lange II Gas-Fired Generation

South Dakota Lange II Gas-Fired Generation represents a strategic investment for Black Hills, aiming to bolster its energy portfolio. This 99-megawatt natural gas project, slated for operation in the latter half of 2026, is designed to meet escalating regional energy demands and ensure dependable power supply. It is a key component of Black Hills’ capital expenditure plan, reflecting a commitment to expanding generation capacity responsibly.

The Lange II project is anticipated to significantly improve grid reliability and accommodate the increasing energy needs of its customer base. This forward-looking approach underscores Black Hills’ dedication to providing stable and sufficient power as the region continues to grow. The company is investing in dispatchable resources to complement its existing infrastructure.

- Project Name: Lange II Gas-Fired Generation

- Capacity: 99 megawatts

- Planned Service Date: Second half of 2026

- Objective: Address growing resource needs and enhance reliability

Strategic Capital Investment Plan

Black Hills has announced a significant strategic capital investment plan, allocating $4.7 billion for the period of 2025 through 2029. This figure marks a 10% increase compared to prior investment projections, signaling an amplified commitment to future growth and operational enhancements.

The core focus of this substantial capital allocation is directed towards three key areas: enhancing the rate base, modernizing critical infrastructure, and pursuing strategic growth opportunities. These investments are designed to improve service reliability and expand the company's operational footprint.

- Rate Base Growth: Investments aimed at increasing the regulated asset base, leading to potential revenue growth.

- Infrastructure Modernization: Upgrading existing facilities and networks to improve efficiency, safety, and reliability.

- Strategic Growth Initiatives: Pursuing new projects and market expansions that align with long-term business objectives.

This forward-looking investment strategy is a key driver for Black Hills' financial outlook, directly supporting its objective to achieve a long-term earnings per share growth target in the range of 4% to 6%. The company views these capital expenditures as foundational to its sustained financial performance and market position.

The renewable energy initiatives, particularly those aligned with the Colorado Clean Energy Plan, are positioned as Stars in Black Hills Corporation's BCG matrix. The company secured approval for 350 megawatts of new renewable resources in 2024, including a 100-megawatt solar project and a 50-megawatt battery storage project. These projects, slated for service between 2027 and 2028, represent high-growth potential areas for the company.

| BCG Category | Key Initiatives | Capacity | Planned Service | Strategic Significance |

|---|---|---|---|---|

| Stars | Colorado Clean Energy Plan Renewables | 350 MW (total new renewable resources) | 2027-2028 | High growth, significant investment in clean energy, aligns with emissions reduction goals. |

| 100 MW Utility-Owned Solar | 100 MW | 2027-2028 | Key component of renewable expansion. | |

| 50 MW Battery Storage | 50 MW | 2027-2028 | Supports renewable integration and grid stability. |

What is included in the product

This BCG Matrix offers a strategic overview of product portfolio performance, categorizing units as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

A one-page overview of the Black Hills BCG Matrix quickly identifies underperforming units, relieving the pain of resource misallocation.

Cash Cows

Black Hills' regulated electric utility operations are a classic Cash Cow, generating consistent and reliable income. These segments, serving a broad customer base across states like South Dakota, Wyoming, and Arkansas, benefit from the stability inherent in regulated industries. In 2023, Black Hills Corporation reported total operating revenue of $2.69 billion, with its Electric Utilities segment being a significant contributor, demonstrating the substantial and predictable cash flow this division provides.

Black Hills' regulated natural gas utility operations are a cornerstone of its business, mirroring the stability of its electric segment. These operations serve a substantial customer base across various states, providing essential energy services. The company's commitment to safety and system integrity is paramount in maintaining these foundational assets.

These natural gas operations generate dependable cash flows, largely due to the established regulatory environments in which they operate. These regulations typically allow for the recovery of operational costs and ensure a fair return on the capital invested, making them a classic cash cow. For instance, in 2024, Black Hills continued to invest in infrastructure upgrades and maintenance for its natural gas systems, ensuring reliability for its customers while benefiting from the predictable revenue streams these regulated assets provide.

Black Hills Corporation's (BKH) consistent success in obtaining favorable rate case approvals and rider recoveries significantly bolsters its position as a cash cow. This regulatory stability allows the company to effectively manage rising operational expenses while preserving healthy profit margins.

For instance, in 2024, Colorado Electric saw new rates become effective, contributing to the company's predictable revenue streams. Furthermore, successful rate review settlements in Arkansas and Iowa in the same year underscore this ongoing regulatory strength.

These achievements translate directly into reliable revenue and robust cash flow generation, key indicators of a mature business with a strong market position, aligning perfectly with the characteristics of a cash cow in the BCG matrix.

Long-standing Dividend Growth Record

Black Hills Corporation stands out with a remarkable 55-year streak of consistent quarterly dividend increases. This longevity speaks volumes about the company's robust financial health and its capacity to consistently generate reliable cash flows, primarily from its established utility businesses. This track record firmly places it in the Cash Cows quadrant of the BCG Matrix, signifying a mature business model that reliably rewards its investors.

The company's sustained dividend growth is a direct reflection of its stable earnings power and its commitment to shareholder returns. For instance, in 2024, Black Hills Corporation continued this tradition, further solidifying its reputation as a dependable income-generating investment. This consistent performance makes it an attractive option for investors seeking stability and predictable income streams.

- 55 Years of Dividend Growth: A testament to financial stability and consistent cash flow generation.

- Mature Utility Operations: Core business provides a reliable foundation for sustained performance.

- Shareholder Value Focus: Demonstrates a commitment to returning capital to investors through dividends.

- 2024 Performance: Continued the long-standing dividend increase, reinforcing its Cash Cow status.

Broad and Stable Customer Base

Black Hills Corporation benefits significantly from its broad and stable customer base, serving around 1.3 million natural gas and electric utility customers across eight states. This widespread presence in essential services creates a reliable and diversified revenue stream, making the company less susceptible to downturns in any specific geographic area or economic sector.

The sheer scale of its customer operations translates into consistent demand for its services. For instance, in 2023, Black Hills reported total operating revenues of $2.8 billion, demonstrating the substantial economic activity generated from its customer base. This stability is a hallmark of a Cash Cow, providing predictable cash flows.

Customer growth directly fuels increased margins for Black Hills. As more customers connect to its utility services, the company expands its revenue without a proportional increase in fixed costs. This scalability is a key characteristic that solidifies its position as a Cash Cow within the BCG Matrix. In 2023, the company added approximately 25,000 new customer connections across its service territories.

- Approximately 1.3 million customers across eight states.

- Essential utility services ensure consistent demand.

- Diversified customer base mitigates regional economic risks.

- Customer growth contributes directly to margin expansion.

Black Hills' utility operations are prime examples of Cash Cows, characterized by their stable, predictable cash generation. The company's ability to secure favorable rate case outcomes, such as the new rates effective in Colorado Electric in 2024 and successful settlements in Arkansas and Iowa, directly contributes to this. This regulatory support allows for consistent revenue streams, reinforcing their position as mature, reliable income generators within the BCG framework.

The extensive customer base, exceeding 1.3 million across eight states, further solidifies these utility segments as Cash Cows. This broad reach in essential services ensures consistent demand, as seen in the $2.8 billion in total operating revenues reported in 2023. The addition of approximately 25,000 new customer connections in 2023 highlights the scalability and margin expansion potential inherent in these mature operations.

Black Hills' impressive 55-year streak of consistent quarterly dividend increases, including continued growth in 2024, is a direct testament to the robust cash flow generated by its utility businesses. This sustained commitment to shareholder returns, underpinned by the stability of its regulated operations, firmly positions these segments as strong Cash Cows, indicating a mature business model capable of reliably rewarding investors.

| Metric | 2023 Data | 2024 Update |

| Total Operating Revenue | $2.8 billion | Continued strong performance expected |

| Customer Base | ~1.3 million | Ongoing growth, ~25,000 new connections in 2023 |

| Dividend Growth Streak | 55 years | Continued in 2024 |

| Key Rate Case Successes | N/A | Colorado Electric, Arkansas, Iowa |

What You See Is What You Get

Black Hills BCG Matrix

The Black Hills BCG Matrix preview you see is the identical, fully completed document you will receive upon purchase. This means you are viewing the exact strategic analysis, complete with all data and recommendations, ready for immediate implementation or presentation. There are no hidden sections, watermarks, or demo elements; what you preview is precisely what you will download and use for your business planning.

Dogs

Black Hills Corporation’s legacy non-strategic fossil fuel production, encompassing older natural gas, oil, and coal assets, likely falls into the Dogs category of the BCG Matrix. These segments, particularly those detached from the company’s core utility expansion plans, are characterized by low market share and minimal growth prospects. For instance, while specific production volumes for these non-strategic assets aren't always granularly broken out in public filings, their overall contribution to revenue and earnings has been declining as the company prioritizes renewable energy integration and regulated utility investments.

In the first quarter of 2025, Black Hills experienced a noticeable drag on net profits, with increased operational and maintenance expenses cited as a primary concern. These rising costs, coupled with a higher frequency of unplanned generation outages, directly impacted the company's bottom line.

These financial headwinds are strongly linked to the performance of the company's older generation assets. These facilities, while still contributing to the energy mix, are becoming increasingly costly to maintain and operate, often requiring substantial investment without delivering commensurate returns or growth potential.

For instance, Black Hills reported that maintenance costs for its legacy power plants rose by 8% in Q1 2025 compared to the same period in 2024. This rise is attributed to the aging infrastructure necessitating more frequent repairs and component replacements.

Consequently, these underperforming older generation assets can be characterized as cash traps within the Black Hills portfolio. They consume significant capital for upkeep, diverting resources that could otherwise be invested in more modern, efficient, or growth-oriented energy sources.

Black Hills Corporation's portfolio, while showing overall strength, contains segments that contribute minimally to earnings per share (EPS). These units, characterized by flat or negligible year-over-year EPS growth, signal a low growth trajectory and possibly a minor market presence within their respective sectors.

For instance, if a particular segment, such as a smaller utility operation or a niche energy service, saw its EPS contribution remain unchanged from 2023 to 2024, it would be categorized here. This lack of advancement indicates these areas are not driving strategic expansion for the company.

Divested or Non-Core Assets

Divested or Non-Core Assets in the context of Black Hills Corporation's BCG Matrix represent business units or assets that no longer fit the company's strategic direction or exhibit limited growth potential. Historically, Black Hills has demonstrated a proactive approach to shedding such assets. For instance, the sale of its hydroelectric plants in the northeastern United States in 2003 clearly illustrates this strategy, as these operations were outside the company's primary geographic focus and strategic alignment.

This willingness to divest non-core assets allows Black Hills to concentrate resources on areas with higher growth prospects and strategic importance. While specific recent divestitures fitting the "dog" category aren't prominently highlighted in readily available public data up to mid-2025, the underlying principle remains. The company's portfolio management continually assesses which segments contribute most effectively to its overall mission, often leading to the repositioning or sale of underperforming or strategically misaligned units.

- Strategic Realignments: Black Hills has historically divested assets that do not align with its core geographic focus or strategic objectives, such as the 2003 sale of northeastern U.S. hydroelectric plants.

- Focus on Core Business: This strategy allows the company to concentrate capital and management attention on its primary utility operations and growth opportunities.

- Portfolio Optimization: Divesting non-core assets is a key component of portfolio optimization, ensuring that resources are allocated to the most promising segments.

- Future Considerations: While specific recent examples of "dog" category divestitures are not publicly detailed, the company's historical actions indicate a readiness to shed assets that demonstrate low potential or strategic misfit.

Inefficient Operational Cost Centers

Inefficient operational cost centers within a business, particularly those grappling with escalating employee and insurance expenses without a commensurate rise in revenue or market share, represent significant drains on cash flow. These segments of the business, if left unchecked, can severely erode overall profitability and signal fundamental operational inefficiencies. For instance, in 2024, many service-based industries reported employee-related costs climbing by an average of 5-8%, while insurance premiums saw increases of 10-15%, often without a corresponding uplift in their market position or customer acquisition rates.

- Rising Employee Costs: Wage inflation and increased benefits packages are pushing up labor expenses.

- Escalating Insurance Premiums: Higher claims frequency and broader coverage needs are driving up insurance costs.

- Stagnant Revenue Growth: These cost increases are not being offset by proportional gains in sales or market penetration.

- Cash Drain: The net effect is a reduction in available cash, impacting investment in growth areas.

These legacy fossil fuel assets, characterized by declining production and high maintenance costs, fit the 'Dog' quadrant of the BCG Matrix. Their limited growth prospects and low market share mean they are unlikely to generate significant returns and may even act as cash drains. For example, the 8% rise in maintenance costs for Black Hills' legacy power plants in Q1 2025, compared to Q1 2024, highlights the increasing burden of operating these older facilities without a corresponding increase in revenue or strategic importance.

These segments consume capital without contributing meaningfully to the company's growth or strategic objectives. They represent areas where Black Hills Corporation may consider divestment or minimal investment to free up resources for more promising ventures.

The company's historical divestiture of non-core assets, like the 2003 sale of hydroelectric plants, demonstrates a strategy to shed underperforming units. While specific recent examples are not detailed, this approach suggests a continuous evaluation of portfolio assets to optimize resource allocation towards growth-oriented segments.

The impact of rising operational costs on these older assets is significant, as seen with the 5-8% increase in employee-related costs and 10-15% rise in insurance premiums reported across service industries in 2024, which directly affect profitability without expanding market share.

Question Marks

Black Hills' 2024 acquisition of a renewable natural gas (RNG) facility in Iowa positions it to enter a high-growth sector. This strategic move signifies its first direct foray into RNG production.

While the RNG market is expanding rapidly, Black Hills' current market share in this segment is minimal. The Iowa facility, though a significant first step, represents a very small fraction of the company's total assets and revenue streams at this time.

This new venture, while promising, aligns with the characteristics of a Question Mark in the BCG Matrix. It operates in a high-growth industry but currently holds a low relative market share.

Black Hills is investing in coal to hydrogen technology, a promising area for future energy solutions. This initiative positions them to potentially capture significant market share as the technology matures. For instance, in 2024, numerous pilot projects globally focused on coal gasification for hydrogen production received substantial government funding, signaling strong industry interest.

Despite the potential, coal to hydrogen remains a developmental technology, meaning Black Hills' current market share is negligible. The industry is still in its early stages, characterized by high investment requirements and uncertain commercial viability. Analysts projected the global hydrogen market to reach $183.1 billion by 2025, but the coal-to-hydrogen segment's contribution is still a fraction of this, reflecting its nascent status.

Black Hills has initiated testing for carbon sequestration at its Gillette, Wyoming energy complex. This venture into a burgeoning environmental technology signals a strategic move towards emissions reduction.

The company's current market share in the carbon sequestration sector is negligible, reflecting its early stage in this high-growth area. This investment aligns with a forward-looking approach to environmental stewardship and potential future revenue streams.

Exploratory Emerging Energy Technologies

Black Hills Corporation actively explores and invests in emerging energy technologies, positioning these as question marks within its BCG matrix. These ventures, while holding significant long-term growth potential, currently have a low market share. For instance, their investments in advanced battery storage and hydrogen fuel cell technology are in early stages, requiring substantial capital outlay to prove viability and achieve market acceptance.

The company's commitment to innovation means it's looking at technologies that could reshape the energy landscape. In 2024, Black Hills continued to allocate resources to pilot programs for these nascent technologies, recognizing the high risk but also the potential for substantial future returns. These investments are crucial for maintaining a competitive edge and ensuring a diversified and resilient energy portfolio.

- Battery Storage: Black Hills is investing in utility-scale battery storage projects to enhance grid stability and integrate renewable energy sources more effectively.

- Hydrogen Fuel Cells: The company is exploring the potential of hydrogen as a clean energy carrier and is participating in pilot projects to understand its application in power generation and transportation.

- Carbon Capture Utilization and Storage (CCUS): While still in development, Black Hills is monitoring and potentially investing in CCUS technologies as a means to reduce emissions from existing fossil fuel assets.

- Smart Grid Technologies: Enhancements to the grid infrastructure to improve efficiency, reliability, and customer engagement are also part of their exploratory efforts.

Uncommitted Future Transmission and Generation Investments

Black Hills Corporation's uncommitted future transmission and generation investments represent potential growth areas outside their defined five-year capital plan. These opportunities are driven by anticipated upside from sectors like data centers and other organic service territory expansion. While the company has a clear capital plan, these additional projects are not yet fully defined or committed, meaning their market share is currently speculative and low.

These uncommitted investments are being tracked as potential future drivers of transmission and generation opportunities. For example, in 2024, Black Hills announced plans to invest approximately $1.5 billion in capital expenditures, with a significant portion allocated to transmission and distribution infrastructure. The uncommitted portion signifies potential additions to this, driven by emerging demand.

- Speculative Growth: Opportunities in data centers and organic growth are considered high-growth but not yet committed, leading to a speculative market share.

- Beyond Current Plan: These investments are expected to occur above and beyond the company's current five-year capital expenditure forecast.

- Future Investment Drivers: Black Hills is actively identifying these as potential future transmission and generation investment opportunities.

- Data Center Impact: The increasing demand from data centers is a key factor expected to spur these uncommitted investments.

These ventures are in high-growth markets but have not yet established a significant market presence for Black Hills. The company's investments in areas like battery storage and hydrogen fuel cells are examples of this, requiring substantial capital to prove commercial viability. As of 2024, Black Hills is actively piloting these technologies, acknowledging the inherent risks and the need to build market share from the ground up.

The company's focus on emerging technologies like carbon sequestration and advanced grid solutions also falls into the Question Mark category. These areas represent future growth potential but currently have negligible market share for Black Hills due to their developmental nature. For instance, the carbon sequestration sector, while growing, is still in its infancy, with Black Hills in an early exploration phase.

Black Hills' uncommitted future investments, driven by demand from sectors like data centers, also represent Question Marks. These are high-growth opportunities that are not yet defined or committed, meaning their market share is currently speculative. In 2024, the company's capital expenditure plans, while substantial, did not fully encompass these potential future projects, highlighting their uncertain market position.

These initiatives, while promising for future revenue, are characterized by low current market share and high market growth potential. Black Hills is strategically positioning itself in these nascent industries, understanding that significant investment and time are required to develop a competitive market position.

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of proprietary market research, financial statements, and competitive analysis, ensuring a robust and actionable strategic overview.