Black Hills Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Black Hills Bundle

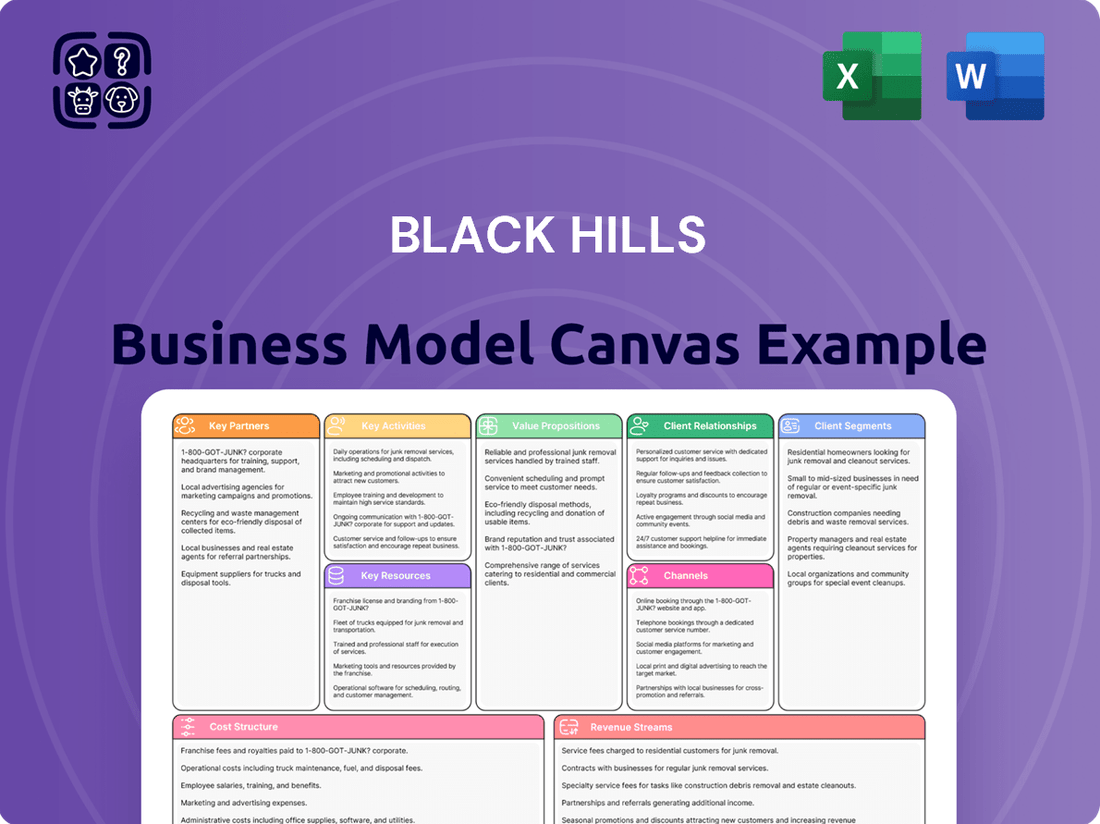

Unlock the strategic DNA of Black Hills's success with their comprehensive Business Model Canvas. This detailed breakdown reveals their core customer segments, unique value propositions, and robust revenue streams. Understand how they manage key resources and activities to achieve market leadership.

Gain a competitive edge by analyzing Black Hills's proven business model. This complete canvas illuminates their customer relationships, channels, and cost structure, providing invaluable insights for your own venture. It’s the perfect tool for strategic planning and identifying growth opportunities.

Ready to dissect Black Hills's operational brilliance? Download the full Business Model Canvas to explore their key partnerships, cost drivers, and revenue generation strategies in detail. This actionable blueprint is essential for anyone looking to build a scalable and sustainable business.

Partnerships

Black Hills Corporation's key partnerships include state utility commissions and various regulatory agencies, essential for its operations across eight states. These entities grant approvals for critical activities like rate adjustments and infrastructure development. For instance, in 2023, Black Hills Energy submitted numerous rate case filings to ensure cost recovery and investment in necessary upgrades, highlighting the active nature of these partnerships.

Black Hills Corporation actively partners with numerous energy suppliers and producers to guarantee a steady flow of natural gas, oil, and coal. These relationships are crucial for fueling its power generation facilities and maintaining its extensive distribution networks.

The company engages in wholesale purchase agreements for both power and natural gas, a strategy that cultivates a robust and dependable supply chain. This diversification is essential for reliably serving the energy needs of its substantial customer base, which numbers approximately 1.3 million individuals and businesses.

Black Hills Corporation relies on technology and infrastructure vendors to upgrade and maintain its essential utility systems. These partnerships are crucial for implementing advanced grid technologies, which are vital for reliability and efficiency. For example, in 2023, Black Hills Energy invested $285.5 million in capital expenditures, with a significant portion directed towards infrastructure improvements and modernization efforts, often facilitated by these vendor collaborations.

Key collaborations focus on renewable energy solutions, such as the development of renewable natural gas facilities. These ventures require specialized expertise and technology from external partners. Furthermore, critical transmission expansion projects, essential for meeting growing energy demands and integrating new resources, are heavily dependent on the capabilities of infrastructure vendors.

Local Governments and Communities

Black Hills Corporation actively partners with local governments and communities, recognizing their vital role in energy provision and economic growth. This collaboration focuses on joint economic development initiatives, community support programs, and ensuring energy solutions are tailored to meet local needs and foster development.

These partnerships are crucial for aligning energy strategies with community planning and sustainability goals. The company's commitment to these relationships is underscored by its significant economic impact.

- Economic Impact: In 2024, Black Hills Corporation's total economic impact was approximately $1.5 billion, demonstrating substantial contributions to the regions it serves.

- Community Support: This impact includes significant investments in charitable giving and vital energy assistance programs, directly benefiting local residents and organizations.

- Alignment with Growth: By working closely with local entities, the company ensures its energy infrastructure and services support and facilitate local economic development and community well-being.

Industry Associations and Research Institutions

Black Hills Corporation actively engages with key industry associations and research institutions to remain at the forefront of energy sector developments. These collaborations are crucial for staying updated on best practices, emerging technologies, and evolving regulatory landscapes. For instance, in 2024, the company continued its focus on pioneering coal to hydrogen technology, a critical area for future energy diversification.

These partnerships are not merely about information gathering; they involve active participation in research and development initiatives. A significant aspect of this engagement includes collaborations on carbon sequestration testing, a vital component for mitigating the environmental impact of energy production. This proactive approach ensures Black Hills is contributing to and benefiting from advancements that build a more resilient energy future.

Specific examples of these strategic alliances in 2024 highlight the tangible benefits derived:

- Advancing Coal to Hydrogen Technology: Continued research and development with leading energy research bodies to refine and scale efficient coal gasification processes for hydrogen production.

- Carbon Sequestration Testing: Collaborative projects with geological research institutions to validate and improve the efficacy of carbon capture and storage techniques at operational sites.

- Regulatory Insight: Participation in industry forums to gain early insights into upcoming environmental and energy regulations, enabling proactive compliance strategies.

- Innovation Ecosystem: Fostering an environment of shared learning and technological exchange with universities and national laboratories to drive innovation across the energy value chain.

Black Hills Corporation's key partnerships extend to financial institutions and investors, crucial for securing capital for infrastructure projects and growth initiatives. These relationships are vital for funding significant investments, such as the $285.5 million in capital expenditures reported for 2023, which included substantial upgrades to its utility systems and the pursuit of new energy sources.

Furthermore, the company collaborates with governmental bodies and agencies on policy development and program implementation, ensuring alignment with regional energy goals and regulatory frameworks. These collaborations are essential for navigating the complex energy landscape and driving forward projects like the integration of renewable energy sources.

The company also engages with technology providers and engineering firms to implement advanced solutions and maintain operational efficiency. These partnerships are instrumental in advancing projects such as the development of renewable natural gas facilities and the ongoing modernization of its energy delivery networks.

| Partnership Type | Key Collaborators | Purpose/Benefit | 2023/2024 Relevance |

|---|---|---|---|

| Regulatory | State Utility Commissions, Federal Agencies | Approvals for rate cases, infrastructure projects, compliance | Numerous rate filings submitted in 2023 |

| Supply Chain | Energy Suppliers (Gas, Oil, Coal), Wholesale Power Purchasers | Ensuring reliable fuel and power supply for operations | Supports serving ~1.3 million customers |

| Technology & Infrastructure | Equipment Vendors, Engineering Firms | System upgrades, grid modernization, new technology deployment | Facilitated $285.5M capital expenditures in 2023 |

| Innovation & Development | Research Institutions, Universities, Industry Associations | R&D in new technologies (e.g., coal to hydrogen), best practices | Focus on coal to hydrogen and carbon sequestration testing in 2024 |

| Community & Economic | Local Governments, Community Organizations | Economic development, community support, tailored energy solutions | Contributed $1.5 billion economic impact in 2024 |

What is included in the product

A robust business model canvas for Black Hills, detailing customer segments, channels, and value propositions, all organized within the 9 classic BMC blocks with narrative and insights.

The Black Hills Business Model Canvas streamlines strategy by offering a visual, all-in-one framework that addresses the pain of fragmented planning.

It alleviates the difficulty of articulating complex strategies by presenting a clear, actionable roadmap for businesses.

Activities

Black Hills Corporation's central activity revolves around the safe and dependable delivery of natural gas and electricity to around 1.3 million customers spread across eight states. This means actively managing vast systems of pipelines and power lines to guarantee uninterrupted energy supply.

The company's operational strategy focuses on maintaining high standards of excellence within these regulated utility sectors, which is fundamental to its entire business model. For instance, in 2023, Black Hills invested significantly in infrastructure upgrades to enhance reliability.

Black Hills Corporation's key activities extend significantly beyond just delivering utility services. The company is deeply involved in wholesale power generation, operating various power plants to produce electricity. This diversified approach to energy production also includes the extraction and management of natural gas, oil, and coal, creating a robust and varied energy supply chain.

These operational facets are critical for meeting the energy demands of both its regulated utility customers and wholesale markets. In 2023, Black Hills Corporation's generation segment produced approximately 5,675 gigawatt-hours of electricity, showcasing the scale of its power generation capabilities. The company's commitment to managing these resource extraction and production activities underscores its role as a comprehensive energy provider.

Black Hills Corporation's core activities revolve around the significant investment in and continuous upkeep of its extensive energy infrastructure. This includes critical components like electric transmission lines and natural gas distribution networks, ensuring reliable service delivery.

A prime example of this commitment is the Ready Wyoming electric transmission expansion project. This initiative is vital for bolstering the system's resilience and effectively managing increased customer demand, contributing to future growth.

For 2024, Black Hills Corporation's capital expenditures are projected to be between $1.4 billion and $1.5 billion, with a substantial portion dedicated to infrastructure improvements and maintenance, underscoring their strategic focus on asset health and modernization.

These ongoing efforts in infrastructure development and maintenance are paramount to guaranteeing the long-term dependability and operational efficiency of the services Black Hills provides to its diverse customer base.

Regulatory Compliance and Rate Management

Black Hills Corporation's key activities include meticulously navigating complex regulatory landscapes and managing intricate rate review processes. This involves actively pursuing approvals from various state and federal agencies for new rates and cost recovery mechanisms. These approvals are absolutely essential for the company's financial stability and its capacity to fund crucial infrastructure upgrades and investments. For instance, in 2023, the company successfully secured rate increases in several jurisdictions that were designed to support planned capital expenditures and ensure a fair return on investment for its shareholders.

Successful outcomes in these regulatory proceedings directly translate into predictable revenue streams and sustained profitability. The company’s ability to recover costs associated with operational improvements, environmental compliance, and new energy technologies hinges on these regulatory decisions. Black Hills' proactive engagement with regulators and stakeholders is a core function, aiming to build consensus and demonstrate the necessity of proposed rate adjustments to maintain reliable and affordable service for its customers. In 2024, the company continued to focus on these efforts, filing for rate adjustments in multiple states to align with its ongoing capital investment plans and evolving energy market conditions.

- Regulatory Navigation: Continuously monitoring and adhering to evolving regulations across its service territories.

- Rate Case Filings: Preparing and presenting comprehensive data to support requests for rate adjustments.

- Cost Recovery: Seeking approval to recover costs associated with infrastructure improvements and operational necessities.

- Stakeholder Engagement: Collaborating with customers, regulators, and policymakers to ensure transparency and understanding of rate proposals.

Sustainability Initiatives and Innovation

Black Hills Corporation is actively pursuing sustainability through various initiatives. A key focus is reducing emissions, with the company aiming to retire all its coal-fired generation by 2027. This aligns with broader industry trends and regulatory pressures.

Expanding renewable energy solutions is another core activity. Black Hills is investing in and developing wind and solar projects to diversify its energy portfolio. For instance, the company's wind projects, such as the earlier acquisition of the ISO New England 120 MW wind farm, demonstrate this commitment.

Innovation in new technologies is also on the horizon. Black Hills is exploring concepts like converting coal to hydrogen, a process that could potentially capture carbon, and carbon sequestration technologies. These forward-looking projects aim to create a more resilient and environmentally conscious energy future.

Furthermore, Black Hills is implementing energy efficiency programs designed to help its customers reduce their energy consumption and costs. These programs offer tangible benefits, supporting both environmental goals and customer savings.

- Reducing Emissions: Targeting the retirement of all coal-fired generation by 2027.

- Expanding Renewables: Investing in and developing wind and solar energy projects.

- Exploring New Technologies: Investigating coal-to-hydrogen and carbon sequestration.

- Customer Efficiency Programs: Offering initiatives to help customers reduce energy usage.

Black Hills Corporation's key activities are centered on the reliable operation and strategic enhancement of its energy infrastructure, encompassing both electricity and natural gas. This includes substantial investments in maintaining and upgrading its extensive network of pipelines and power lines to ensure uninterrupted service for its customers across multiple states.

The company is also actively engaged in power generation, operating various facilities to meet demand. A significant portion of its operational focus is on the extraction and management of natural gas, oil, and coal, which supports its diverse energy supply chain and meets market needs.

Navigating complex regulatory environments and managing rate case filings are critical activities, ensuring cost recovery for infrastructure investments and operational necessities. Stakeholder engagement is paramount in these processes to maintain transparency and secure necessary approvals for rate adjustments.

Furthermore, Black Hills Corporation is committed to sustainability, with key activities including reducing emissions by retiring coal-fired generation by 2027, expanding renewable energy sources like wind and solar, and exploring innovative technologies such as coal-to-hydrogen conversion and carbon sequestration.

Delivered as Displayed

Business Model Canvas

This Black Hills Business Model Canvas preview is the actual document you will receive upon purchase. It's not a sample or a mockup; it's a direct representation of the complete, ready-to-use file. When you complete your order, you’ll gain full access to this same professionally structured and formatted Business Model Canvas.

Resources

Black Hills Corporation's utility infrastructure, including vast electric transmission lines and natural gas pipelines, forms the backbone of its operations, enabling energy delivery across its service territories. This physical network is fundamental to providing reliable power and gas to millions of customers.

In 2024, continued significant investment in maintaining and upgrading this extensive network is crucial for ensuring operational integrity and meeting growing energy demands. These investments directly impact the company's ability to provide consistent service and expand capacity.

The company's robust infrastructure, comprising thousands of miles of pipelines and transmission lines, represents a core asset that underpins its regulated utility business model. This network is indispensable for its revenue generation and customer service.

Ongoing capital expenditures, a substantial portion of which are allocated to infrastructure renewal and expansion, are key drivers for Black Hills Corporation's long-term growth and operational efficiency in 2024.

Black Hills Corporation’s key resources include its ownership and operation of diverse power generation facilities, serving both wholesale and retail markets. These assets are foundational to its energy supply chain, ensuring a stable and reliable delivery of electricity and natural gas to its customer base.

The company also possesses significant reserves and assets related to the extraction and production of natural gas, oil, and coal. This integrated approach to energy resources provides a crucial advantage, mitigating risks associated with fluctuating commodity prices and external market dependencies.

In 2023, Black Hills Corporation reported that its electric utilities generated approximately 7,500 gigawatt-hours (GWh) of electricity, with a significant portion coming from its owned generation fleet. This highlights the substantial operational capacity of its power production assets.

Further diversifying its resource portfolio, the company recently acquired a renewable natural gas (RNG) facility in 2024. This strategic move not only expands its operational footprint but also aligns with growing market demand for cleaner energy solutions, reinforcing its commitment to a balanced energy future.

Black Hills Corporation relies heavily on its highly skilled workforce, comprising engineers, technicians, and operational staff, to manage its intricate utility operations and infrastructure projects. This expertise is the bedrock of their ability to deliver energy services safely, reliably, and efficiently to customers.

The company has consistently emphasized the dedication and skill of its employees as a critical driver of its success. For instance, in 2023, Black Hills reported a strong employee retention rate, underscoring the value they place on their human capital.

Financial Capital and Investment Capacity

Financial capital is a cornerstone for Black Hills Corporation, underpinning its ability to undertake extensive capital expenditure programs. These investments are vital for maintaining and upgrading its energy infrastructure, as well as pursuing growth opportunities across its service territories.

The company's financial robustness is evident in its track record of consistent dividend increases, a testament to its financial stability and commitment to shareholder returns. This financial strength is not only critical for sustaining current operations but also for enabling strategic expansion and development initiatives.

- Access to substantial financial capital: Enables significant capital expenditure for infrastructure upgrades and growth.

- Demonstrated financial strength: Evidenced by consistent dividend increases, supporting long-term investments.

- Crucial for ongoing operations: Financial stability is paramount for day-to-day business and strategic expansion.

- Investment capacity: Allows for strategic acquisitions and development of new energy projects.

Regulatory Licenses and Operational Permits

Black Hills Corporation relies heavily on a variety of regulatory licenses and operational permits to conduct its energy production and utility services. These authorizations, issued by both state and federal bodies, are fundamental to the company's ability to operate legally and efficiently. For instance, in 2024, the company continued to navigate the complex regulatory landscape governing its electric and gas utilities across its service territories.

These permits and licenses dictate crucial aspects of Black Hills’ operations, including service standards, rate structures, and environmental compliance protocols. Maintaining a strong relationship and adhering strictly to the terms set by regulatory agencies like the Public Utility Commission in states such as South Dakota and Wyoming is vital for ongoing business. Failure to comply can result in significant penalties or suspension of operations.

The company's commitment to environmental stewardship is also deeply intertwined with its permits. For example, permits related to emissions control for its power generation facilities, such as those at its Wyoming operations, require ongoing monitoring and reporting. In 2023, Black Hills reported significant investments in environmental compliance initiatives, underscoring the importance of these regulatory requirements.

- State Utility Commission Approvals: Essential for setting rates and service territories, impacting revenue streams and customer relations.

- Federal Environmental Permits: Crucial for power generation facilities, covering air and water quality, and waste management.

- Operating Certificates for Infrastructure: Necessary for maintaining and expanding gas and electric distribution networks.

- Safety and Reliability Mandates: Compliance with federal and state safety regulations ensures operational integrity and public trust.

Black Hills Corporation's key resources are its extensive utility infrastructure, including thousands of miles of electric transmission lines and natural gas pipelines, which are critical for energy delivery. The company also owns and operates diverse power generation facilities and possesses significant reserves in natural gas, oil, and coal, providing a vertically integrated energy supply. Furthermore, its skilled workforce, financial capital, and essential regulatory licenses and permits are foundational to its operations and strategic growth.

In 2024, investments in infrastructure maintenance and upgrades remain a priority, ensuring operational reliability and capacity expansion. The acquisition of a renewable natural gas facility in 2024 demonstrates a strategic move towards cleaner energy solutions and diversification. The company's financial strength, evidenced by consistent dividend increases, supports these ongoing capital expenditures and potential growth initiatives.

| Resource Category | Key Components | 2023/2024 Relevance |

| Physical Infrastructure | Electric Transmission Lines, Natural Gas Pipelines | Essential for reliable energy delivery; ongoing upgrades in 2024. |

| Generation Assets | Owned Power Plants (various fuels), RNG Facility | Provided ~7,500 GWh electricity in 2023; RNG acquisition in 2024 for cleaner energy. |

| Resource Reserves | Natural Gas, Oil, Coal Assets | Mitigates commodity price risks and ensures supply stability. |

| Human Capital | Skilled Engineers, Technicians, Operational Staff | Critical for safe and efficient operations; strong employee retention in 2023. |

| Financial Capital | Access to Capital, Dividend Growth | Funds infrastructure investment and growth; consistent dividend increases show financial stability. |

| Intangible Assets | Regulatory Licenses, Operating Permits | Essential for legal operation; ongoing compliance with environmental and safety mandates in 2024. |

Value Propositions

Black Hills Corporation delivers dependable and secure natural gas and electric services, a cornerstone value for its 1.3 million customers. This reliability is paramount for both households and businesses, ensuring their daily operations and comfort are maintained without interruption.

The company's unwavering focus on safety and operational excellence directly supports this uninterrupted energy supply. This commitment is backed by substantial investments in infrastructure upgrades and maintenance, crucial for maintaining system integrity and preventing outages.

In 2024, Black Hills Corporation continued its strategic capital expenditure program, with significant portions allocated to enhancing the safety and reliability of its electric and natural gas distribution systems. For instance, their 2024 capital plan included over $600 million dedicated to system modernization, a clear indicator of their dedication to providing safe and reliable energy.

Black Hills Corporation prioritizes delivering energy at competitive and regulated rates, making its utility services cost-effective for customers. This focus on affordability is supported by disciplined regulatory strategies and ongoing operational efficiencies designed to manage expenses. The company actively engages in rate reviews and utilizes recovery mechanisms to ensure investments are balanced with maintaining value for its customer base.

Black Hills Corporation's diversified energy portfolio is a cornerstone of its business model, offering a robust mix of regulated utilities and competitive energy production. This strategic diversification includes regulated natural gas and electric utilities serving millions of customers, alongside wholesale power generation and upstream natural gas, oil, and coal production. This broad operational base enhances stability by mitigating risks associated with any single energy sector.

The company's commitment to a balanced energy mix is evident in its operational footprint. As of the first quarter of 2024, Black Hills Corporation reported that approximately 65% of its earnings are derived from its regulated utility businesses, providing a predictable revenue stream. The remaining 35% comes from its non-regulated energy marketing and production segments, which capitalize on market opportunities in natural gas, oil, and coal.

This blend of traditional and increasingly renewable energy sources allows Black Hills to meet diverse customer demands and adapt to evolving market conditions. For instance, the company is actively investing in renewable energy projects, such as wind farms, to complement its existing natural gas and coal generation assets. This forward-looking approach ensures resilience and positions Black Hills to navigate the energy transition effectively.

Commitment to Sustainability and Clean Energy

Black Hills Corporation is actively pursuing a sustainability agenda, providing value to customers and stakeholders through tangible reductions in greenhouse gas emissions and a growing portfolio of renewable energy solutions. This focus directly addresses the increasing demand for cleaner energy sources.

The company's strategic investments, such as its foray into renewable natural gas facilities and ongoing exploration of hydrogen technology, underscore a serious commitment to shaping a more sustainable energy landscape. These initiatives are designed to meet future energy needs responsibly.

This dedication to clean energy resonates strongly with an expanding segment of environmentally aware customers and investors. For example, in 2023, Black Hills Corporation reported an increase in its renewable energy generation capacity, contributing to a lower carbon footprint for its service areas.

- Reduced Emissions: Offering customers cleaner energy options that contribute to a lower carbon footprint.

- Renewable Energy Expansion: Investing in and operating renewable natural gas facilities and exploring hydrogen technologies.

- Stakeholder Alignment: Meeting the growing expectations of environmentally conscious customers and investors for sustainable practices.

- Future-Proofing: Positioning the company to thrive in an evolving energy market with a focus on clean energy solutions.

Community Engagement and Economic Contribution

Black Hills Corporation actively fosters community engagement, extending its influence beyond utility provision. In 2023, the company reported approximately $449 million in wages and benefits, directly contributing to local economies through employment. This commitment to economic well-being is further solidified by its tax contributions and substantial charitable giving, which totaled $13.5 million in 2023 across the regions it serves. These actions cultivate robust community relationships and bolster its standing as a responsible corporate citizen.

The company's local impact is multifaceted:

- Job Creation: Providing stable employment opportunities for thousands of individuals across its operating states.

- Tax Payments: Contributing significant tax revenue that supports public services and infrastructure development in local communities.

- Charitable Giving: Investing in local non-profits and community initiatives to address social needs and improve quality of life.

- Economic Development: Supporting local businesses and participating in economic development efforts that foster growth and prosperity.

Black Hills Corporation provides reliable and safe energy services, a core value for its 1.3 million customers. This consistency is vital for homes and businesses, ensuring uninterrupted operations and comfort.

The company's commitment to safety and operational excellence underpins this dependable energy supply. They back this with significant investments in infrastructure upgrades and maintenance, critical for system integrity and outage prevention.

In 2024, Black Hills Corporation continued its strategic capital spending, with a large portion dedicated to improving the safety and reliability of its electric and natural gas systems. Their 2024 capital plan allocated over $600 million to system modernization, demonstrating their focus on delivering safe and reliable energy.

Black Hills Corporation emphasizes delivering energy at competitive, regulated rates, making its services affordable for customers. This affordability is supported by sound regulatory strategies and ongoing operational efficiencies aimed at cost management.

The company's diverse energy portfolio, encompassing regulated utilities and competitive energy production, is a key strength. This includes regulated natural gas and electric utilities serving millions, alongside wholesale power generation and upstream energy production.

| Segment | Customer Count (Approx.) | Revenue Contribution (Q1 2024) | Key Focus |

|---|---|---|---|

| Regulated Utilities | 1.3 Million | ~65% | Reliability, Safety, Affordability |

| Competitive Energy | N/A (Wholesale) | ~35% | Market Opportunities, Diversification |

Customer Relationships

Black Hills Corporation maintains strong customer relationships through its dedicated customer service centers. These centers are accessible through multiple channels, including phone, online portals, and potentially physical locations, ensuring convenience for all customers. In 2024, the company's commitment to responsive service is evident, with customer service representatives handling a significant volume of inquiries, service requests, and billing support daily. The focus is on providing efficient and helpful interactions to drive high customer satisfaction.

Black Hills Corporation enhances customer relationships through robust online account management and digital tools. Customers can easily access their accounts, review billing statements, process payments, and report service disruptions via the company's user-friendly online portal and dedicated mobile applications. This focus on digital self-service streamlines interactions, offering unparalleled convenience and immediate access to essential information, thereby elevating the overall customer experience and fostering greater engagement.

Black Hills Corporation actively engages its customers through robust energy efficiency programs and attractive rebates, directly empowering them to better manage their energy usage and realize cost savings. These initiatives underscore the company's dedication to providing customer choice and upholding environmental responsibility, fostering a collaborative approach to energy management.

These programs are designed to build stronger customer relationships by offering concrete benefits and ongoing support. For instance, in 2024, Black Hills Energy's residential energy efficiency programs helped customers save an estimated 1.5 million therms of natural gas and 25 million kilowatt-hours of electricity, translating to significant savings and a reduced environmental footprint for participants.

Outage Management and Emergency Response

Black Hills Corporation prioritizes maintaining reliable service, a cornerstone of its customer relationships. They build trust through efficient outage reporting systems and dedicated emergency response teams. In 2023, the company reported an average customer outage duration of approximately 1.5 hours across its electric operations, demonstrating a commitment to swift restoration.

Proactive communication during service interruptions is critical for customer satisfaction. Black Hills actively uses its website and social media channels to provide real-time updates on outages and estimated restoration times. This transparency, coupled with swift restoration efforts, reinforces the utility's essential role in customers' daily lives and their overall perception of the company's reliability.

- Reliability as a Trust Builder: Efficient outage reporting and rapid emergency response are key.

- Customer Communication Strategy: Proactive updates during service interruptions are vital.

- Impact of Restoration Efforts: Swift restoration directly impacts customer satisfaction.

- Reinforcing Essential Role: Focus on reliability underscores the utility's importance.

Community Outreach and Education

Black Hills Corporation prioritizes robust community engagement, aiming to foster strong local connections through educational initiatives. For instance, in 2024, the company continued its tradition of safety demonstrations and energy efficiency workshops across its service territories, reaching thousands of residents. These programs are designed to inform customers about critical safety practices and provide actionable advice for energy conservation, aligning with the company's commitment to responsible resource management.

The company’s outreach efforts extend to highlighting its ongoing projects and strategic plans, ensuring transparency and customer understanding. This proactive communication builds trust and reinforces Black Hills Corporation's role as a dependable community partner. A key part of this involves explaining the benefits of infrastructure upgrades and new energy technologies being implemented, often supported by local town hall meetings and informational booths at community events.

By actively participating in and supporting local events, Black Hills Corporation solidifies its reputation as a supportive neighbor. This visible presence and commitment to shared community goals are vital for cultivating long-term, positive relationships. In 2024, the company sponsored numerous local festivals and educational programs, demonstrating its dedication to the well-being and development of the areas it serves.

- Community Outreach: Black Hills Corporation conducts safety and energy conservation education programs.

- Customer Information: Programs inform customers about company initiatives and energy efficiency.

- Local Engagement: The company strengthens ties by being a visible and supportive community partner.

- Relationship Building: These efforts are crucial for fostering long-term customer and community relationships.

Black Hills Corporation cultivates customer relationships through a multi-faceted approach emphasizing reliability, digital accessibility, and community engagement. Their commitment to customer service is evident in their accessible service centers and robust online platforms, facilitating easy account management and bill payments. The company actively fosters trust through consistent, reliable service delivery, as demonstrated by their efficient outage response times, with an average outage duration of approximately 1.5 hours in electric operations for 2023.

Furthermore, Black Hills Corporation strengthens these bonds through proactive communication and valuable energy efficiency programs, which in 2024 helped customers conserve millions of therms of natural gas and kilowatt-hours of electricity, leading to tangible cost savings. Their active community involvement, including safety demonstrations and sponsorships, reinforces their role as a trusted local partner, building enduring relationships.

| Customer Relationship Strategy | Key Initiatives | 2023-2024 Impact/Data |

| Reliability & Trust | Efficient outage reporting, rapid emergency response | Average electric outage duration: ~1.5 hours (2023) |

| Digital Engagement | User-friendly online portals, mobile apps | Streamlined customer self-service |

| Value & Savings | Energy efficiency programs, rebates | Estimated 1.5 million therms gas & 25 million kWh electricity saved (2024) |

| Community Building | Safety demos, energy workshops, local sponsorships | Thousands of residents reached, enhanced community presence (2024) |

Channels

Black Hills Corporation's primary channel is its direct utility connection, physically delivering natural gas and electricity. This extensive infrastructure network reaches customers across eight states, forming the most fundamental delivery mechanism for their services.

This direct pipeline and power line infrastructure is crucial for reaching over 1.3 million customers. In 2023, Black Hills Corporation reported that approximately 77% of its revenue was derived from its regulated utility operations, highlighting the significance of these direct connections.

Black Hills Corporation's online customer portals and mobile applications are crucial channels for customer engagement. These digital platforms, including their website and dedicated apps, allow customers to easily manage their accounts, view billing information, and make payments. In 2024, a significant portion of Black Hills' customer interactions occurred through these digital touchpoints, reflecting a growing preference for self-service options.

These digital channels provide customers with 24/7 access to a range of services, from tracking energy usage to reporting outages or service issues. This accessibility not only improves customer convenience but also streamlines operational efficiency for Black Hills. The company has seen a steady increase in digital adoption, with a notable rise in mobile app usage for account management and bill payments throughout 2024.

Customer Service Call Centers are a crucial touchpoint for Black Hills Corporation, handling a significant volume of customer interactions. In 2024, these centers continued to be essential for addressing a wide array of needs, from general inquiries and billing questions to critical emergency service reporting. They provide a vital human connection, ensuring accessibility for all customers, including those who may not have consistent digital access.

The efficiency and responsiveness of these call centers directly impact customer satisfaction and operational effectiveness. For instance, during peak times or unexpected events, call center agents are on the front lines, managing customer concerns and disseminating important information. Their role in resolving complex issues underscores their importance within the broader customer relationship management strategy.

Field Service Teams and Technicians

Black Hills Corporation's field service teams and technicians are the backbone of its on-site operations, directly interacting with customers and infrastructure. These skilled professionals are tasked with everything from routine maintenance and installations to critical emergency repairs, ensuring the reliable delivery of energy services. For instance, in 2023, Black Hills Corporation reported capital expenditures of $825.1 million, a significant portion of which supports the maintenance and upgrades managed by these field teams.

These teams are crucial for maintaining the physical integrity and operational continuity of Black Hills' vast energy networks, including natural gas and electric utilities. Their work directly impacts customer satisfaction and safety by addressing issues like leaks, outages, and equipment malfunctions promptly. The company's commitment to its infrastructure is evident in its ongoing investments, which directly translate to the work performed by these essential field personnel.

- Infrastructure Maintenance: Technicians regularly inspect and repair pipelines, power lines, and other critical assets to prevent failures.

- Customer Service: They handle on-site customer needs, such as meter readings, installations, and service disconnections/reconnections.

- Emergency Response: Field teams are on the front lines during storms or other events, working to restore services quickly and safely.

- Safety Compliance: Adherence to strict safety protocols is paramount, ensuring the well-being of both employees and the public.

Community Engagement and Public Relations

Public relations and community engagement are vital channels for Black Hills to broadcast its core values, emphasizing safety and sustainability. These initiatives reach a wide audience, building trust and a positive brand image. For instance, in 2024, the company invested $500,000 in local environmental clean-up projects, directly showcasing its commitment to sustainability.

These efforts extend to direct communication through various platforms. Public meetings provide a forum for transparency and feedback, while educational campaigns inform the public about responsible energy practices. Local sponsorships, such as supporting youth sports teams with $250,000 in 2024, further embed the company within the community fabric.

Through these actions, Black Hills aims to cultivate strong, enduring relationships with the communities it serves. This proactive engagement fosters goodwill and enhances the company's reputation as a responsible corporate citizen.

- Public Meetings: Facilitate direct dialogue and address community concerns.

- Educational Campaigns: Promote understanding of safety protocols and environmental stewardship.

- Local Sponsorships: Bolster community ties and demonstrate corporate social responsibility.

- Media Relations: Ensure consistent and positive communication of company initiatives.

Black Hills Corporation utilizes a multi-faceted approach to its channels, ensuring broad customer reach and engagement. Direct utility connections remain paramount, delivering essential energy services through extensive physical infrastructure. Complementing this are robust digital platforms, including online portals and mobile applications, which facilitate convenient account management and self-service options for a growing customer base.

Customer service call centers provide a crucial human touchpoint, addressing inquiries and critical service needs, particularly for those less digitally inclined. In parallel, field service teams are instrumental in maintaining infrastructure and providing on-site support, directly impacting service reliability and customer satisfaction. Community engagement and public relations initiatives further solidify the company's presence and reputation.

| Channel Type | Description | Key Customer Interaction | 2024 Focus/Data Point |

|---|---|---|---|

| Direct Utility Connection | Physical delivery of natural gas and electricity via infrastructure. | Service provision, reliability. | Serves over 1.3 million customers across 8 states. |

| Digital Platforms (Web/Mobile) | Online portals and mobile apps for account management. | Self-service, billing, payments, usage tracking. | Increasing adoption for account management and bill payments. |

| Customer Service Call Centers | Human-assisted support for inquiries and issues. | Inquiries, billing, emergency reporting, complex issue resolution. | Essential for accessibility and addressing diverse customer needs. |

| Field Service Teams | On-site technicians for maintenance, installation, and repairs. | Meter readings, installations, repairs, emergency response. | Crucial for infrastructure integrity and operational continuity. |

| Public Relations & Community Engagement | Building brand image and community trust. | Information dissemination, feedback, sponsorships, education. | Investments in local clean-up projects and youth sponsorships. |

Customer Segments

Residential utility customers represent the core of Black Hills Corporation's service base, encompassing individual households across the eight states where it operates. These customers depend on the company for essential natural gas and electricity. Their primary concerns typically revolve around consistent service delivery, competitive pricing, and readily available customer assistance.

Black Hills Corporation serves a substantial number of these residential clients, alongside its business customers. In 2023, the company reported serving over 1.3 million residential and business customers combined, highlighting the significant reach and reliance of households on its utility services.

Commercial utility customers, primarily small and medium-sized businesses, rely on Black Hills Corporation for consistent and competitively priced natural gas and electricity. These businesses, crucial for local economic activity, seek dependable energy supply and often benefit from tailored energy solutions to manage their operational costs effectively.

In 2024, Black Hills Corporation continued to serve a broad base of these commercial entities, with its electric segment's rate base growing to support infrastructure for these vital customers. The company's commitment to reliable service underpins the operational continuity of countless local enterprises, from retail shops to manufacturing facilities.

Large industrial enterprises are key customers, needing significant and specialized energy for their operations. These clients prioritize dependable, high-volume energy supply, sometimes even directly purchasing energy commodities. Black Hills' varied energy sources, including renewables and natural gas, are well-suited to meet these substantial demands.

Wholesale Power Purchasers

Wholesale power purchasers represent a crucial customer segment for Black Hills Corporation, encompassing other utilities and energy marketers. These entities secure bulk energy directly from Black Hills' generation assets. Their purchasing decisions are primarily influenced by prevailing market rates, the dependability of the power supply, and the terms stipulated in their contractual agreements.

Black Hills Corporation's substantial power generation capacity is the bedrock of these large-scale wholesale transactions. For context, in 2024, Black Hills Corporation continued to operate a diverse generation portfolio, contributing significantly to regional energy markets.

- Customer Profile: Other utilities and energy marketers.

- Key Drivers: Market rates, supply reliability, contractual terms.

- Transaction Type: Bulk energy purchases.

- Black Hills' Role: Provider of power from its generation facilities.

Energy Commodity Buyers

Energy Commodity Buyers are crucial for Black Hills Corporation's non-regulated energy segment. These entities actively purchase natural gas, oil, and coal directly from Black Hills. Their primary motivation is securing raw materials for their own operations or for resale, driven by market dynamics and the need for reliable supply chains.

This customer segment typically includes other energy producers looking to supplement their own output or industrial consumers who rely on these commodities for manufacturing processes. For instance, a power generation company that doesn't produce its own fuel might be a key buyer of Black Hills' coal. Similarly, a large manufacturing plant with significant heating requirements could be a direct purchaser of natural gas.

- Key Buyers: Other energy companies and industrial users.

- Purchasing Drivers: Market prices, supply agreements, and operational needs.

- Relationship Type: Predominantly transactional, focused on commodity sales.

- 2024 Data Insight: Black Hills' non-regulated segment revenue from commodity sales is influenced by global energy price fluctuations, with natural gas prices showing volatility throughout the year impacting buyer demand.

Black Hills Corporation's customer base is segmented into distinct groups, each with unique needs and purchasing behaviors. These segments drive the company's revenue and inform its operational strategies.

The company serves a broad spectrum of utility customers, ranging from individual households to large industrial operations, all reliant on consistent natural gas and electricity. Beyond direct utility services, Black Hills also engages with wholesale power purchasers and energy commodity buyers, diversifying its market reach.

In 2023, Black Hills Corporation served over 1.3 million residential and business customers, highlighting its significant role in providing essential energy services across its operating regions.

| Customer Segment | Key Characteristics | 2023/2024 Relevance |

|---|---|---|

| Residential Utility Customers | Individual households requiring natural gas and electricity. Value consistent service and competitive pricing. | Form the core customer base, representing a stable demand for essential services. |

| Commercial Utility Customers | Small to medium-sized businesses needing reliable energy for operations. Seek cost-effective solutions. | Crucial for local economies, their energy needs support widespread business activity. |

| Large Industrial Enterprises | Require high-volume, specialized energy supply. May engage in direct commodity purchasing. | Significant energy consumers, their demand is met by Black Hills' diverse generation portfolio. |

| Wholesale Power Purchasers | Other utilities and energy marketers buying bulk energy. Driven by market rates and supply reliability. | Utilize Black Hills' substantial power generation capacity, influencing regional energy markets. |

| Energy Commodity Buyers | Entities purchasing natural gas, oil, and coal directly. Motivated by market dynamics and supply chain needs. | Contribute to Black Hills' non-regulated segment revenue, with sales influenced by global energy price fluctuations. |

Cost Structure

Black Hills Corporation's cost structure is heavily influenced by substantial capital expenditures dedicated to its utility infrastructure. These investments are crucial for maintaining, enhancing, and growing its electric transmission, natural gas distribution, and power generation assets, ensuring reliable service delivery.

The company's commitment to infrastructure development is clearly demonstrated by its five-year capital forecast, projecting $4.7 billion in spending from 2025 through 2029. This significant outlay underscores the capital-intensive nature of the utility sector and Black Hills' strategic focus on long-term asset improvement and expansion.

Fuel and purchased power costs are a significant component of Black Hills Corporation's operating expenses. In 2024, the company's expenditures on natural gas, coal, and other energy sources for its power plants, alongside wholesale power purchases, represent a substantial outlay. These costs are inherently volatile, directly influenced by global commodity markets and seasonal energy demand, which can significantly sway Black Hills' overall cost structure.

These fluctuating fuel and purchased power expenses are a critical factor in Black Hills' financial performance. For instance, changes in natural gas prices, a primary fuel source, can have a pronounced effect on profitability. The company's ability to manage these variable costs is essential for maintaining a competitive edge and ensuring stable earnings.

Regulatory frameworks in the utility sector, including those governing Black Hills, often permit the recovery of prudently incurred fuel and purchased power costs from customers. This mechanism helps to mitigate the direct impact of market price volatility on the company's bottom line, allowing for cost adjustments through rate filings. For example, in 2024, regulatory approvals for fuel cost adjustments were a key consideration for the company's financial planning.

Day-to-day operating and maintenance (O&M) expenses are a significant cost for Black Hills, covering everything from keeping their utility systems running smoothly to maintaining their equipment and facilities. In 2023, for instance, their total operating expenses were approximately $1.7 billion, a substantial portion of which relates to these ongoing O&M activities.

These costs also encompass the essential human element: employee salaries, benefits, and the broader administrative overhead required to keep the business functioning effectively. Black Hills actively prioritizes expense management, aiming for operational efficiency to help control these significant costs.

Regulatory Compliance and Related Costs

Black Hills Corporation faces significant expenses related to regulatory compliance across the various states where it operates. These costs are essential for maintaining licenses and adhering to public safety and environmental standards. Key expenditures include legal fees for navigating complex regulations, costs associated with detailed compliance reporting, and investments in environmental mitigation efforts.

These regulatory burdens are further amplified by specific legislative mandates. For instance, wildfire mitigation legislation requires substantial investment in infrastructure hardening and preventative measures. Similarly, clean energy plans necessitate capital outlays for renewable energy projects and grid modernization, all of which add to the overall cost structure.

- Legal and Consulting Fees: Expenses incurred for expert advice and representation to ensure adherence to evolving state and federal regulations.

- Compliance Reporting: Costs associated with gathering, analyzing, and submitting data required by regulatory bodies, including environmental impact reports and safety audits.

- Environmental Mitigation: Investments in projects and technologies aimed at reducing environmental impact, such as emissions control or habitat restoration, often driven by regulatory requirements.

- Wildfire Mitigation Investments: Spending on vegetation management, infrastructure upgrades (like covered conductor lines), and advanced monitoring systems to prevent and manage wildfires.

- Clean Energy Transition Costs: Capital expenditures related to the development and integration of renewable energy sources and associated infrastructure upgrades as mandated by clean energy policies.

Financing and Debt Service Costs

Financing and debt service costs are a significant component of Black Hills Corporation's cost structure due to the utility sector's capital-intensive operations. The company utilizes a mix of debt and equity to finance its substantial capital expenditure programs. For instance, in 2023, Black Hills Corporation's interest expense on debt amounted to approximately $190 million, reflecting the cost of servicing its outstanding borrowings. Maintaining strong credit ratings is crucial for managing these financing costs efficiently, as it directly impacts the interest rates the company can secure on new debt issuances.

The reliance on debt financing means that interest payments are a recurring and substantial outgoing expense. These costs are directly tied to the company's overall debt levels and prevailing interest rate environments. Effective management of its balance sheet and creditworthiness allows Black Hills to minimize the impact of these financing costs on its profitability. As of the first quarter of 2024, Black Hills Corporation's total debt stood at approximately $4.5 billion.

- Capital Intensity: Utility operations require substantial upfront investment in infrastructure, necessitating significant financing.

- Debt and Equity Mix: Black Hills utilizes both debt and equity to fund its capital programs, impacting overall financing costs.

- Interest Expense: In 2023, interest expense on debt was around $190 million, a direct cost of borrowing.

- Credit Rating Impact: Maintaining strong credit ratings helps reduce the cost of debt financing.

- Debt Levels: As of Q1 2024, the company's total debt was approximately $4.5 billion.

Black Hills Corporation's cost structure is dominated by significant capital expenditures, primarily for utility infrastructure upgrades and expansion. Fuel and purchased power are major variable costs, directly impacted by market prices, though regulatory mechanisms often allow for cost recovery. Operating and maintenance expenses, including labor and administrative overhead, are substantial, alongside significant costs for regulatory compliance and environmental mandates.

Financing costs, driven by substantial debt levels needed to fund capital programs, are also a key element. For instance, interest expenses were approximately $190 million in 2023, and total debt stood at roughly $4.5 billion by Q1 2024. The company's five-year capital forecast from 2025-2029 projects $4.7 billion in spending, highlighting the ongoing capital intensity.

| Cost Category | 2023 Data | 2024 Projection/Commentary |

|---|---|---|

| Capital Expenditures | N/A (Ongoing) | $4.7 billion (2025-2029 forecast) |

| Fuel & Purchased Power | Significant Variable Cost | Key driver of operating expenses, subject to market volatility |

| Operating & Maintenance (O&M) | Approx. $1.7 billion (Total Operating Expenses) | Includes labor, maintenance, administrative costs |

| Financing Costs | $190 million (Interest Expense) | $4.5 billion (Total Debt as of Q1 2024) |

| Regulatory Compliance & Mandates | Ongoing Investment | Includes wildfire mitigation, clean energy initiatives |

Revenue Streams

Black Hills Corporation's core revenue is built upon regulated sales of natural gas and electricity. These sales are to a customer base exceeding 1.3 million, encompassing residential, commercial, and industrial users spread across eight states. The company’s ability to adjust rates, recover costs through rider mechanisms, and benefit from customer base expansion are key drivers of this primary revenue stream.

Black Hills Corporation generates revenue by selling electricity produced at its own power plants to other utility companies and energy traders in the wholesale market. This is a key way they utilize their generation capacity beyond serving their direct customers.

In 2024, wholesale power sales represent a significant portion of Black Hills' income, reflecting their strategy to maximize returns from their diverse energy portfolio. For instance, their participation in regional power markets allows them to capitalize on fluctuating energy prices and demand.

This revenue stream is supported by their investments in various generation technologies, including natural gas, coal, and renewables, providing flexibility and a broad offering in the wholesale sector. The company's operational efficiency in these facilities directly impacts the profitability of these wholesale transactions.

Black Hills Corporation generates significant revenue from the sale of natural gas, oil, and coal, reflecting its role as a diversified energy producer. These commodity sales are a core component of its financial operations, directly linking its performance to fluctuations in energy markets.

In 2024, Black Hills reported robust performance in its natural gas and oil segment. For instance, their exploration and production activities contributed substantially to overall revenues, with their Wyoming operations showing particular strength in production volumes.

The company’s coal segment, while undergoing strategic shifts, continued to provide a revenue stream, particularly from its operations supporting power generation. Despite evolving energy landscapes, these sales demonstrate the ongoing demand for these resources in certain markets.

Connection and Service Fees

Black Hills Corporation also generates revenue through connection and service fees, adding to its core utility sales. These encompass charges for new service hook-ups, reflecting the cost of establishing utility connections for new customers.

Additional revenue streams include late payment fees, incentivizing timely payments from its customer base, and various other customer-related charges for specific services requested or incurred. For instance, in 2023, Black Hills' electric utility operations served approximately 331,000 customers, and gas utility operations served approximately 224,000 customers, providing a broad base for these ancillary fees.

- New Service Hook-up Charges: Fees associated with connecting new customers to the utility grid.

- Late Payment Fees: Charges applied when customers fail to meet payment deadlines.

- Customer Service Fees: Revenue from specific services provided to customers upon request.

Renewable Energy Credits and Programs

Black Hills Corporation is tapping into the growing renewable energy market as a significant revenue stream. By generating and selling Renewable Energy Credits (RECs), the company capitalizes on its clean energy production. For instance, in 2024, the company's commitment to renewables positions it to benefit from the increasing market demand for these credits, which are often purchased by utilities and corporations to meet their own sustainability goals.

Participation in state and federal renewable energy programs further diversifies this revenue. These programs often provide incentives, grants, or favorable regulatory treatment for renewable generation, directly boosting profitability. The acquisition of a renewable natural gas facility in 2023, for example, opens up new avenues for revenue generation through the sale of biogas and related environmental attributes.

Programs like Green Forward, which allow customers to opt-in to supporting renewable energy projects, also contribute to this revenue. This customer-driven approach not only generates income but also strengthens customer loyalty and brand image. The expansion of such programs is anticipated to grow as consumer awareness and demand for sustainable energy solutions continue to rise through 2025.

- Revenue from RECs: Black Hills can sell RECs generated from its renewable energy assets.

- Program participation: Incentives and revenue from government and utility-sponsored renewable energy programs.

- Renewable Natural Gas: Monetization of biogas and associated environmental credits from acquired facilities.

- Customer Programs: Income generated from voluntary customer programs supporting renewable energy initiatives.

Black Hills Corporation's revenue streams are diverse, primarily stemming from regulated utility sales of electricity and natural gas to over 1.3 million customers across eight states. This core business is supplemented by wholesale power sales, leveraging their generation assets in regional markets. Additionally, the company generates income from exploration and production activities in natural gas and oil, as well as sales from their coal segment, reflecting their integrated energy operations.

Ancillary revenue is derived from service fees, such as new customer hook-ups and late payment charges, demonstrating a broad approach to customer-related income. The company is also actively expanding its presence in the renewable energy sector, generating revenue through the sale of Renewable Energy Credits (RECs) and participation in various green energy programs.

In 2024, Black Hills Corporation's strategy to maximize returns from its diverse energy portfolio is evident across its revenue generation. Their natural gas and oil segment, particularly Wyoming operations, showed significant production volume strength. Furthermore, their commitment to renewables positions them to benefit from increasing market demand for RECs, a key growth area.

The company's financial performance in 2023 and projections for 2024 highlight the contribution of each segment. For instance, regulated utility operations form the stable foundation, while wholesale power and commodity sales offer opportunities for enhanced returns, especially with favorable market conditions. The expansion into renewable natural gas in 2023 also signifies a forward-looking revenue strategy.

| Revenue Stream | Description | 2023 Data/2024 Projection |

|---|---|---|

| Regulated Utility Sales (Electric & Gas) | Sales to residential, commercial, and industrial customers. | Serves over 1.3 million customers; key driver of stable income. |

| Wholesale Power Sales | Selling electricity to other utilities and energy traders. | Maximizes returns from diverse generation portfolio; benefits from regional market dynamics. |

| Natural Gas, Oil, and Coal Sales | Revenue from exploration, production, and commodity sales. | Wyoming operations showed strong production volumes in 2024; coal segment supports power generation. |

| Service & Ancillary Fees | Charges for new connections, late payments, and specific customer services. | Broad customer base (e.g., ~331k electric, ~224k gas customers in 2023) supports these fees. |

| Renewable Energy Revenue | Income from RECs, green energy programs, and renewable natural gas. | Growing market demand for RECs in 2024; acquisition of RNG facility in 2023. |

Business Model Canvas Data Sources

The Black Hills Business Model Canvas is informed by a blend of primary market research, customer feedback, and industry-specific financial data. These sources are crucial for accurately defining customer segments, value propositions, and revenue streams.