Black Hills Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Black Hills Bundle

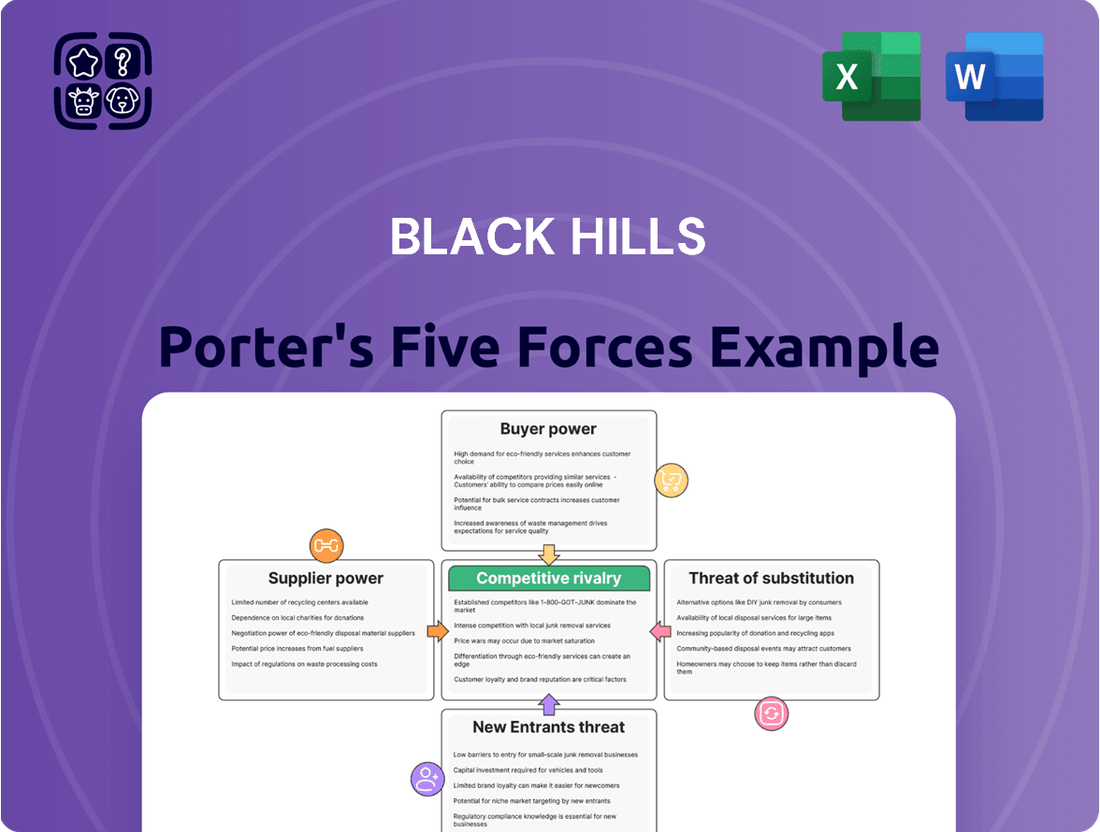

Black Hills's competitive landscape is shaped by several key forces, influencing everything from pricing power to market entry barriers. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threat of substitutes and new entrants is crucial for strategic success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Black Hills’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Black Hills Corporation, a diversified energy provider, faces considerable supplier power due to its dependence on a limited number of key suppliers for essential resources like natural gas, coal, and specialized power generation equipment. This concentration means fewer options for procuring critical inputs, potentially increasing costs for Black Hills.

For instance, the natural gas market, while vast, often sees major pipeline and extraction companies holding significant sway, especially for long-term supply agreements that are vital for power plant operations. Similarly, securing specialized components for its diverse energy infrastructure, from wind turbines to transmission lines, relies on a select group of manufacturers, granting them pricing leverage.

In 2024, the volatility in global energy markets, particularly for natural gas, highlighted how a few dominant suppliers can dictate terms, impacting Black Hills' operational expenses and profitability. The need for reliable and high-quality specialized equipment further solidifies the bargaining power of these concentrated suppliers, as alternatives may be scarce or less dependable.

The inputs Black Hills Corporation relies on, such as natural gas, coal, and critical infrastructure like turbines and grid technology, are often highly specialized. This specialization means Black Hills cannot easily switch to alternative suppliers without significant cost and disruption. For instance, securing reliable, certified components for their power generation facilities is a complex process that limits flexibility.

This uniqueness directly translates to increased bargaining power for suppliers. When inputs are not readily available from multiple sources, suppliers can command higher prices or dictate terms. In 2024, the ongoing global demand for natural gas, a primary fuel for Black Hills, continued to exert upward pressure on input costs, illustrating this dynamic in action.

Moreover, the absolute necessity of high-quality and reliable inputs for maintaining consistent utility service amplifies supplier leverage. Any compromise on the quality of fuel or specialized equipment can lead to service interruptions and reputational damage, making Black Hills more amenable to supplier demands.

Switching suppliers presents significant hurdles for Black Hills, particularly when dealing with critical infrastructure like power generation equipment or long-term fuel procurement. These switching costs encompass potential contract penalties, the expense of modifying or replacing existing machinery, and the complex process of obtaining necessary regulatory clearances for new providers. For instance, a change in a major turbine supplier could involve millions in retooling and certification, effectively locking Black Hills into existing relationships.

The substantial financial and operational implications of changing suppliers directly empower Black Hills' current vendors. These high switching costs diminish Black Hills’ leverage in negotiations, as suppliers understand the significant barriers to entry for competitors. This dynamic strengthens the bargaining power of suppliers, allowing them to potentially command higher prices or less favorable contract terms.

Supplier's Ability to Forward Integrate

The ability of suppliers to forward integrate, meaning they might enter Black Hills' business of energy generation or distribution, is a potential threat, though generally low in the regulated utility sector. This is largely due to the immense capital investment and complex regulatory approvals needed to operate as a utility. For instance, building a new power plant or expanding a distribution network can cost billions of dollars, a significant barrier even for large suppliers.

While a direct takeover of a utility like Black Hills by a supplier is improbable, the threat could be marginally higher in less regulated areas, such as the wholesale power market. Even there, however, the established infrastructure and market access held by existing players like Black Hills present considerable challenges.

- High Capital Costs: Entering the utility sector requires substantial upfront investment, often in the billions, for generation facilities and distribution networks.

- Regulatory Hurdles: Gaining approval from state and federal regulatory bodies for operations, pricing, and service is a lengthy and complex process.

- Limited Applicability: This threat is most relevant in non-regulated wholesale markets, but even then, it is constrained by existing infrastructure and market dynamics.

- Supplier Disincentives: Many large fuel suppliers or equipment manufacturers may find their core competencies and existing business models more profitable than venturing into the highly regulated utility space.

Importance of Black Hills to the Supplier

Black Hills Corporation's substantial operational footprint across eight states makes it a vital customer for numerous specialized suppliers. This significant demand can create leverage for Black Hills, as the loss of such a large client would pose a considerable financial challenge for many of its suppliers. For instance, in 2024, Black Hills invested over $400 million in its utility infrastructure, signaling a consistent need for a wide array of specialized equipment and services.

However, the bargaining power of these suppliers can still be considerable, particularly for those providing essential or monopolistic inputs. For suppliers with unique technologies or limited competition, Black Hills' reliance on their products can shift the power dynamic. For example, if a specific, high-demand component for their renewable energy projects is only available from a single manufacturer, that supplier can command higher prices and more favorable terms, regardless of Black Hills' overall size.

- Supplier Dependence: Black Hills' significant purchasing volume can make individual suppliers highly dependent on the company.

- Monopolistic Inputs: Suppliers of essential or unique components may hold substantial power due to limited alternatives.

- Infrastructure Investment: Significant capital expenditures, like Black Hills' 2024 infrastructure investments, underscore demand for specialized suppliers.

- Counter-Leverage: The sheer scale of Black Hills can deter suppliers from alienating such a key customer.

Black Hills Corporation's supplier power is significant due to reliance on specialized inputs like natural gas and advanced equipment. In 2024, fluctuating natural gas prices, influenced by a few key suppliers, directly impacted Black Hills' operating costs. The high cost and complexity of switching specialized equipment providers, such as turbine manufacturers, further solidifies supplier leverage, as switching costs for Black Hills can run into millions.

Suppliers of essential or unique components, like those for renewable energy projects, possess considerable power. For instance, if a critical component for Black Hills' 2024 infrastructure investments is only available from one manufacturer, that entity can dictate terms. This is particularly true when alternatives are scarce or require extensive retooling and regulatory approval, making Black Hills more susceptible to supplier demands.

| Factor | Impact on Black Hills | 2024 Data/Context |

|---|---|---|

| Supplier Concentration | High | Limited number of key natural gas and equipment suppliers |

| Switching Costs | High | Millions for specialized power generation equipment changes |

| Input Uniqueness | High | Specialized components for diverse energy infrastructure |

| Forward Integration Threat | Low | Billions in capital and regulatory hurdles for utility entry |

What is included in the product

This analysis unpacks the competitive forces impacting Black Hills, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly identify and address competitive threats with a visual breakdown of industry rivalry, buyer power, supplier power, threat of new entrants, and threat of substitutes, all in one place.

Customers Bargaining Power

Black Hills Corporation's customer base is incredibly diverse, serving around 1.3 million natural gas and electric utility customers. This massive number of users spans residential, commercial, and industrial sectors, meaning no single customer or small group holds significant sway.

The highly fragmented nature of this customer base is a key factor in their limited bargaining power. With millions of individual accounts, the ability for any one customer or a small consortium to demand concessions is greatly diminished.

This fragmentation directly translates to a weak bargaining position for customers. The sheer volume of users means Black Hills doesn't rely heavily on any specific customer segment, reducing the pressure to cater to individual demands.

For regulated utility services like those provided by Black Hills, customer switching costs are incredibly high, often considered near infinite. This is because customers within their designated service territories have virtually no alternative providers for essential services like electricity and natural gas.

This near-monopoly situation severely limits the bargaining power of customers. They simply cannot easily switch to a different provider if they are dissatisfied with pricing or service quality, as there isn't another option available to them.

In 2024, Black Hills Corporation continued to operate under these regulated structures in most of its key markets, reinforcing the low substitutability of its services for the vast majority of its customer base.

Customer price sensitivity for Black Hills is significantly moderated by state regulatory commissions that approve utility rates. This means customers have limited direct power to negotiate or influence pricing, as it's determined through a formal, often lengthy, approval process. For instance, in 2024, Black Hills Corporation filed various rate increase requests across its operating states, demonstrating the regulatory pathway for price adjustments rather than direct customer negotiation. While customers certainly react to higher bills, their options for switching providers or leveraging competitive pressure are largely absent in this regulated utility environment.

Availability of Substitutes

The availability of substitutes presents a moderate threat to Black Hills' bargaining power of customers. While direct utility service substitutes are scarce, customers can mitigate their reliance on grid-supplied energy. For instance, advancements in energy efficiency technologies allow consumers to reduce overall consumption, a behavior that directly impacts utility demand. In 2023, the U.S. Energy Information Administration reported that residential sector energy intensity continued its downward trend, indicating improved efficiency.

Furthermore, the growing adoption of distributed generation, such as rooftop solar installations, offers a partial substitute for traditional utility services. Although these systems require substantial initial investment, they can offset a portion of a customer's electricity needs. As of early 2024, the cost of residential solar installations has seen a gradual decrease, making it a more accessible option for some consumers, though it doesn't fully replace the need for grid backup or entirely eliminate demand for utility services.

- Limited direct substitutes for core utility services.

- Energy efficiency measures reduce overall consumption.

- Distributed generation like rooftop solar offers partial substitution.

- High upfront investment for customer-owned generation limits widespread adoption.

Customer Information and Backward Integration

Individual utility customers typically possess limited insight into Black Hills' intricate cost structures, a factor that significantly curtails their ability to negotiate effectively. This information asymmetry inherently strengthens the utility's position.

The practical feasibility of customers engaging in backward integration, essentially producing their own electricity or natural gas on a substantial scale, is exceedingly low for the overwhelming majority of Black Hills' customer base. The prohibitive capital investment and advanced technical expertise required make this option largely inaccessible.

- Limited Customer Information: Customers often lack detailed knowledge of utility cost breakdowns, impacting their negotiation leverage.

- High Barriers to Backward Integration: Producing one's own electricity or natural gas requires massive capital and specialized technical skills, which are beyond the reach of most customers.

- Regulatory Oversight: While not directly customer power, regulatory bodies set rates, indirectly influencing what customers pay and limiting direct customer negotiation on price.

The bargaining power of customers for Black Hills Corporation is notably weak due to several critical factors. Their vast customer base, exceeding 1.3 million across residential, commercial, and industrial sectors, means no single customer or small group can exert significant influence. This fragmentation is compounded by extremely high switching costs, as customers in regulated service territories lack alternative providers for essential utilities.

Furthermore, customer price sensitivity is moderated by state regulatory commissions, which approve utility rates, limiting direct customer negotiation. While energy efficiency and distributed generation like rooftop solar offer some substitution, these are often partial solutions with high upfront costs, as seen in the continued downward trend of residential energy intensity reported by the EIA in 2023 and the gradual decrease in solar installation costs by early 2024.

| Factor | Assessment | Supporting Data/Reasoning |

| Customer Concentration | Low | Over 1.3 million diverse customers across residential, commercial, and industrial segments. |

| Switching Costs | Very High | Customers in regulated territories have virtually no alternative providers for essential services. |

| Price Sensitivity/Negotiation | Low | Rates are set by regulatory commissions, limiting direct customer negotiation; filed rate increase requests in 2024 across operating states. |

| Availability of Substitutes | Moderate | Energy efficiency improvements (EIA data 2023) and distributed generation (e.g., solar) offer partial offsets but face high initial investment. |

Full Version Awaits

Black Hills Porter's Five Forces Analysis

This preview shows the exact Black Hills Porter's Five Forces analysis you'll receive immediately after purchase, offering a comprehensive examination of competitive forces within the industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing firms. This document is professionally formatted and ready for your immediate use, providing actionable intelligence for strategic decision-making.

Rivalry Among Competitors

Black Hills Corporation's competitive landscape varies significantly between its regulated utility operations and its non-regulated energy businesses. In its core utility segments, the number of direct competitors is quite small, often limited to a single entity within a specific geographic service area, a structure dictated by regulatory approvals.

Conversely, the company's non-regulated wholesale power generation and exploration and production (E&P) segments encounter a much more crowded field. These areas are populated by a substantial number of larger, more dominant energy companies, many of which possess greater scale and market influence than Black Hills.

For instance, in the natural gas and oil production sector, Black Hills competes with major players who operate on a much larger scale, often with diversified portfolios and substantial capital resources. This intensifies rivalry, as these larger competitors can leverage economies of scale and greater market access.

While specific market share data for these non-regulated segments can fluctuate, the presence of numerous large, established energy firms underscores the high level of competitive rivalry Black Hills faces outside its protected utility territories, impacting pricing and profitability.

The utility sector traditionally sees steady, but not rapid, growth, typically tied to population shifts and economic activity in their service regions. This predictable, slow expansion generally keeps competitive rivalry in check.

However, recent shifts are accelerating electricity demand. Factors like the burgeoning data center industry and the broader trend of electrification are creating new growth opportunities, potentially drawing in more players and increasing competition in certain areas.

Black Hills itself is experiencing this trend, reporting substantial data center load growth. They anticipate serving 500 megawatts of data center load by 2028, a significant increase that is expected to more than double the earnings contribution from this sector to over 10% by 2029.

For Black Hills Corporation, competitive rivalry is significantly influenced by product differentiation and switching costs. In the essential utility services sector, electricity and natural gas are fundamentally undifferentiated commodities, meaning customers perceive little difference between providers. This lack of unique product features makes price a primary driver of choice.

In regulated retail markets, switching costs for customers are exceptionally high, practically a non-factor. Customers are typically tied to their local utility provider due to infrastructure and regulatory frameworks, creating a captive audience for Black Hills. This situation significantly dampens direct competitive rivalry at the retail level.

Conversely, in non-regulated wholesale markets, differentiation among energy providers is minimal. While Black Hills operates in both regulated and non-regulated segments, the wholesale side sees low switching costs. Here, competition is intense and largely based on price, as counterparties can readily shift their business to the lowest-cost supplier.

The impact of these factors is evident in market dynamics. While regulated segments offer stability, the wholesale market necessitates constant vigilance on pricing and operational efficiency to remain competitive. For instance, in 2024, the wholesale natural gas market has seen price volatility, underscoring the importance of cost management for companies like Black Hills to maintain profitability in these less-differentiated segments.

Exit Barriers

The utility sector, including companies like Black Hills Corporation, faces exceptionally high exit barriers. This is primarily due to substantial investments in fixed assets such as power plants, extensive transmission and distribution networks, and pipelines. These are not assets easily repurposed or sold off.

These significant capital outlays mean that even when profitability dips, companies are compelled to continue operations. This "stuck" capital prevents a rapid exit, intensifying competition as firms remain in the market, potentially for extended periods, even in less lucrative market segments. For instance, in 2024, the US electric utility sector continued to grapple with the need for ongoing infrastructure upgrades, estimated to cost trillions of dollars over the next two decades, reinforcing the long-term commitment required.

- Massive Fixed Asset Investments: Utilities commit billions to infrastructure like power plants and distribution grids.

- Public Service Obligation: Regulatory requirements often mandate continued service, hindering immediate cessation of operations.

- Low Profitability Persistence: High exit barriers encourage companies to operate through downturns, sustaining competitive intensity.

- Stranded Asset Risk: The potential for assets to become uneconomical due to regulatory changes or technological shifts further complicates exiting the market.

Diversity of Competitors

Black Hills Corporation faces a diverse competitive landscape within the broader energy market. This includes large, integrated energy companies with substantial fossil fuel assets and significant capital, alongside nimble, specialized renewable energy developers focused on solar, wind, and battery storage. This spectrum of players brings varied strategic objectives and risk appetites to the market, intensifying rivalry.

The strategic approaches differ significantly; some competitors double down on traditional energy sources like natural gas and coal, optimizing existing infrastructure and supply chains. Others are aggressively pursuing renewable generation, investing heavily in new technologies and project development. This divergence in focus means competition isn't just about price or efficiency but also about adapting to the evolving energy transition and meeting diverse customer demands.

As of early 2024, the energy sector continues to see substantial investment flowing into renewables. For instance, the U.S. Department of Energy reported that renewable energy sources accounted for approximately 22% of utility-scale electricity generation in 2023, a figure projected to grow. This growth fuels competition as more companies vie for market share in this expanding segment, potentially impacting Black Hills' traditional business lines.

- Integrated Energy Giants: Companies like ExxonMobil and Chevron, with vast upstream and downstream operations, can leverage economies of scale and significant financial reserves, posing a competitive threat across various energy segments.

- Renewable Energy Specialists: Firms such as NextEra Energy Resources and Ørsted are leaders in developing and operating wind and solar farms, often securing long-term power purchase agreements and benefiting from government incentives.

- Utilities with Diversified Portfolios: Many regional and national utilities are also expanding their renewable portfolios, creating direct competition for wholesale power supply and distributed generation opportunities.

- Emerging Technology Providers: The rise of advanced battery storage and green hydrogen technologies introduces new competitive dynamics, as specialized firms innovate and capture early market advantages.

In Black Hills Corporation's regulated utility segments, competitive rivalry is minimal due to the inherent nature of utility services and regulatory frameworks, which often grant exclusive service territories. However, the non-regulated wholesale power generation and exploration and production (E&P) segments face a more intense competitive environment. Here, competition is primarily driven by price, as customers in these markets have lower switching costs and view the energy products as largely undifferentiated commodities.

The presence of large, established energy companies with greater scale and capital resources intensifies this rivalry in the non-regulated areas. While utility operations offer stability, the wholesale market demands constant attention to pricing and operational efficiency. For instance, the natural gas market in 2024 has experienced price volatility, highlighting the critical need for effective cost management to maintain profitability in these less differentiated segments.

Black Hills operates within a competitive landscape that includes integrated energy giants and specialized renewable energy developers. These diverse players bring varied strategies, from focusing on traditional energy sources to aggressively pursuing renewables, intensifying competition across the energy transition. As of early 2024, significant investment continues to flow into renewables, with projections showing continued growth in their share of electricity generation, impacting traditional energy providers.

| Segment | Competitive Intensity | Key Competitive Factors | Example Competitors |

|---|---|---|---|

| Regulated Utilities | Low | Service territory exclusivity, regulatory approval, customer loyalty | Local monopolies (e.g., other regional electric/gas utilities) |

| Wholesale Power Generation | High | Price, reliability, contractual terms, fuel costs | Large independent power producers, other utilities |

| Exploration & Production (E&P) | High | Commodity prices, operational efficiency, access to capital, reserve replacement | Major oil and gas companies, independent producers |

SSubstitutes Threaten

The primary substitutes for Black Hills' core offerings of grid-supplied electricity and natural gas include emerging alternative energy sources such as rooftop solar installations, geothermal energy systems, and advanced energy efficiency technologies. These alternatives present a compelling value proposition, often promising long-term cost reductions and significant environmental advantages for consumers.

However, the adoption of these substitutes is frequently tempered by their considerable upfront installation expenses. For instance, a typical residential rooftop solar system can range from $15,000 to $25,000 before incentives, creating a notable price-performance trade-off that potential adopters must carefully weigh against the perceived benefits of reduced utility bills and increased energy independence.

Customer willingness to switch to alternative energy sources is on the rise. This shift is fueled by increased environmental awareness, a desire for personal energy control, and the falling prices of renewable energy solutions like solar and wind power. For instance, the U.S. solar industry installed a record 37 gigawatts of capacity in 2023, a significant jump from previous years, indicating growing customer adoption.

Government backing and changing environmental rules are also pushing more people towards decentralized energy systems. These factors create a steady, albeit slow, challenge to traditional utility models. In 2024, federal tax credits for renewable energy, such as the Investment Tax Credit (ITC) and Production Tax Credit (PTC), continue to make these alternatives more financially attractive for consumers and businesses alike.

The threat of substitutes for Black Hills Corporation's utility services is influenced by customer switching costs. For instance, transitioning to alternative energy sources like rooftop solar or geothermal systems involves considerable upfront capital expenditure, often tens of thousands of dollars, and complex installation processes that can take weeks or months. This significant initial investment and the disruption to existing infrastructure create substantial operational switching costs for customers, making immediate shifts less likely.

Innovation and Technological Advancements

Ongoing innovations in battery storage, smart home energy management systems, and modular renewable energy solutions are making substitutes more viable and accessible for Black Hills Corporation. For example, the declining cost of residential solar photovoltaic (PV) systems, which fell by approximately 9% in 2023, coupled with advancements in battery technology, enables consumers to generate and store their own power, reducing reliance on traditional utility providers.

The continuous improvement in efficiency and reduction in cost of these technologies enhance their attractiveness, increasing the long-term threat of substitution to traditional utility services. By 2024, the average cost of a residential solar-plus-storage system had dropped significantly, making it a more competitive option for energy consumers. This trend directly challenges the demand for conventional electricity delivery.

- Declining Costs: Residential solar PV costs have seen a consistent downward trend, with further reductions anticipated through 2025.

- Improved Efficiency: Newer solar panels and battery storage systems offer higher energy conversion rates and longer lifespans.

- Grid Independence: Homeowners are increasingly exploring solutions that allow for greater energy independence and resilience.

- Smart Grid Integration: The integration of smart home technology allows for optimized energy usage, further enhancing the appeal of distributed generation.

Regulatory and Policy Support for Substitutes

Government policies and incentives are a significant driver for the growth of substitute energy sources. For instance, tax credits for renewable energy installations, like solar and wind, actively encourage their adoption. Many regions are also implementing mandates for clean energy, pushing customers towards alternatives. In 2024, the U.S. Department of Energy continued to emphasize clean energy initiatives, with programs designed to accelerate the transition away from traditional fossil fuels. This regulatory push directly impacts utilities like Black Hills, as it can hasten the adoption of these substitutes by their customer base.

Black Hills must therefore strategically adapt to this evolving regulatory landscape. The company's ability to integrate or compete with these government-supported substitutes will be crucial for its long-term viability. For example, the Inflation Reduction Act of 2022 provides substantial tax credits for renewable energy projects, making substitutes more financially attractive. These policies can accelerate the shift in customer preferences, influencing Black Hills' market share and revenue streams.

- Government incentives like tax credits for renewables make substitutes more competitive.

- Clean energy mandates push customers towards alternative energy sources.

- The U.S. Department of Energy's continued focus on clean energy in 2024 shapes the market.

- Black Hills must navigate these regulations to manage the adoption of substitutes by its customers.

The threat of substitutes for Black Hills' services is growing as alternative energy sources become more cost-effective and accessible. While high upfront costs for options like rooftop solar, often starting around $15,000, remain a barrier, declining prices and increased efficiency, with residential solar PV costs falling approximately 9% in 2023, are making them more appealing. Furthermore, government incentives, such as federal tax credits, continue to boost the competitiveness of these substitutes, creating a dynamic market environment for traditional utilities.

| Substitute Technology | Typical Upfront Cost (USD) | Key Benefit | 2023 Cost Trend |

|---|---|---|---|

| Residential Rooftop Solar | 15,000 - 25,000 | Long-term cost savings, energy independence | -9% (PV systems) |

| Home Battery Storage | 10,000 - 20,000 | Energy resilience, peak shaving | Declining costs |

| Energy Efficiency Upgrades | Variable (e.g., insulation, smart thermostats) | Reduced energy consumption | Consistent improvement |

Entrants Threaten

The capital requirements for entering the natural gas and electric utility sector are a substantial hurdle. Significant investment is needed for building and maintaining power generation facilities, extensive transmission lines, and intricate distribution networks.

Black Hills itself projects capital expenditures of approximately $4.7 billion for the period between 2025 and 2029. This considerable investment figure underscores the immense financial commitment necessary to establish and operate within this industry, effectively deterring most potential new entrants.

Existing utilities like Black Hills leverage significant economies of scale in generation, transmission, and distribution. This cost advantage makes it challenging for new entrants to match their operational efficiency. For instance, Black Hills' service to approximately 1.35 million customers across eight states underscores their established infrastructure and broad customer base, creating a formidable barrier.

The utility sector, including companies like Black Hills Corporation, faces significant regulatory hurdles that deter new entrants. Operating requires obtaining numerous state and federal licenses and approvals, a complex and time-consuming process. For instance, securing a Certificate of Public Convenience and Necessity (CPCN) is a crucial step that often leads to a de facto monopoly within a service territory, making it exceptionally difficult for new companies to establish a foothold.

Access to Distribution Channels and Infrastructure

New entrants face significant hurdles in accessing and developing distribution channels and infrastructure comparable to Black Hills Corporation. Replicating its extensive natural gas pipeline network and electric transmission and distribution lines requires massive capital investment, estimated in the billions for similar utility-scale projects. Securing rights-of-way and obtaining regulatory approvals for new infrastructure is a protracted and complex process, often encountering local community resistance, which further escalates costs and timelines.

The inherent difficulty in duplicating Black Hills' established infrastructure acts as a formidable barrier to entry. For example, the capital expenditures for utility infrastructure development are substantial; in 2023, Black Hills invested approximately $550 million in its capital expenditure program, a significant portion of which is directed towards maintaining and enhancing its existing infrastructure. Building a parallel network would involve immense upfront costs, making it economically unviable for most potential new market participants.

- Capital Intensity: The sheer cost of building new pipeline and transmission networks is prohibitive.

- Rights-of-Way: Acquiring land and easements for new infrastructure is time-consuming and legally complex.

- Regulatory Hurdles: Gaining permits and approvals from various government agencies adds significant delays and costs.

- Local Opposition: Community concerns and potential litigation can stall or halt infrastructure projects.

Brand Loyalty and Switching Costs

While utilities like Black Hills Corporation (BKH) might not inspire the same brand devotion as consumer goods, the practical realities of energy provision create a significant barrier for new competitors. Customers typically face substantial switching costs, both in terms of physical infrastructure changes and the sheer inconvenience of changing providers for an essential service. This makes customer retention naturally high.

The essential nature of electricity and gas means consumers are unlikely to experiment with new providers unless there's a compelling, and often regulated, reason to do so. For instance, in many service territories, the process of switching electricity suppliers, if even permitted, can involve significant lead times and potential service interruptions. This inherent stickiness of the customer base effectively discourages new entrants who would need to overcome these ingrained customer habits and infrastructure hurdles.

- High Switching Costs: Customers face significant expenses and logistical challenges when attempting to switch energy providers.

- Essential Service Nature: Energy is a non-discretionary purchase, meaning customers prioritize reliability and continuity over brand preference.

- Limited Customer Mobility: The regulatory environment and physical infrastructure often restrict the ease with which customers can change suppliers.

- Discourages New Entrants: These factors create a natural moat, making it difficult and expensive for new companies to gain a foothold in the market.

The threat of new entrants in the utility sector, particularly for companies like Black Hills Corporation, is significantly low due to immense capital requirements and stringent regulatory oversight. Building new energy infrastructure demands billions in investment, a scale that most new players cannot match. For example, Black Hills' projected capital expenditures of approximately $4.7 billion from 2025 to 2029 highlight the ongoing need for substantial funding within the industry.

Existing players benefit from established economies of scale and extensive infrastructure networks, making it difficult for newcomers to compete on cost. Black Hills serves roughly 1.35 million customers across eight states, demonstrating a significant operational footprint that new entrants would struggle to replicate. Furthermore, regulatory barriers, such as the need for Certificates of Public Convenience and Necessity, often grant existing utilities de facto monopolies within their service territories, effectively blocking new competition.

| Barrier Type | Description | Example Data (Black Hills) |

| Capital Requirements | High upfront investment needed for infrastructure like power plants and transmission lines. | Projected CAPEX of $4.7 billion (2025-2029) |

| Regulatory Hurdles | Complex licensing and approval processes, often leading to exclusive service territories. | Requirement for Certificates of Public Convenience and Necessity (CPCN) |

| Economies of Scale | Existing utilities have lower per-unit costs due to large-scale operations. | Serves ~1.35 million customers across 8 states |

| Infrastructure Duplication | Replicating extensive pipeline and transmission networks is prohibitively expensive. | $550 million CAPEX in 2023 focused on infrastructure enhancement |

Porter's Five Forces Analysis Data Sources

Our Black Hills Porter's Five Forces analysis leverages data from industry-specific trade publications, government economic reports, and financial filings of key players in the region. This blend ensures a comprehensive understanding of the competitive landscape, including supplier power and the threat of new entrants.