Bilfinger SE SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bilfinger SE Bundle

Bilfinger SE navigates a complex industrial landscape, leveraging its engineering prowess and global reach as key strengths. However, potential challenges like fluctuating project pipelines and intense competition demand a closer look. Understanding these dynamics is crucial for anyone looking to invest or partner with this industry leader.

Want the full story behind Bilfinger SE's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bilfinger SE boasts a comprehensive service portfolio that spans the entire industrial value chain. This includes everything from initial consulting and engineering to ongoing maintenance, plant expansions, and cutting-edge digital solutions.

This extensive offering allows Bilfinger to deliver tailored solutions for clients across critical sectors such as energy, chemicals, pharmaceuticals, and oil & gas. By addressing diverse needs, they significantly enhance customer operational efficiency and sustainability.

For instance, in 2023, Bilfinger reported a significant increase in its order backlog, reaching €10.1 billion, underscoring the strong demand for its integrated service capabilities. This broad service base is a key differentiator in the market.

Bilfinger SE showcased impressive financial performance in Q1 2025, with revenue climbing to €1,191 million and an EBITA margin of 7.5%. This builds on a strong FY 2024, where revenue reached €4,767 million and the EBITA margin was 7.1%, demonstrating consistent operational improvement.

The company has confidently reaffirmed its full-year 2025 targets, anticipating revenue between €4.8 billion and €5.2 billion, with an EBITA margin of at least 7.5%. Mid-term objectives also point to continued profitable growth, with a projected EBITA margin of 8-9% by 2027.

Supporting this positive outlook is Bilfinger's robust free cash flow generation, which was €203 million in FY 2024. Furthermore, the company's financial stability is underscored by its upgraded investment-grade rating, reflecting a solid balance sheet and effective financial management.

Bilfinger is strategically positioning itself as a leader in enhancing efficiency and sustainability for its clients, a critical focus given global trends and regulatory pressures. Their services and ongoing projects, including those tied to decarbonization and digital solutions, directly address these growing demands, reflecting a forward-looking business model. For instance, in 2023, Bilfinger reported a significant increase in its order backlog, with a substantial portion attributed to sustainability-focused projects, signaling strong market demand for their expertise in this area.

Geographic Diversification and Market Position

Bilfinger SE's geographic diversification, spanning Europe, North America, and the Middle East, provides a significant advantage. This broad operational base helps to smooth out the impact of economic downturns in any single region, as seen in their robust performance in the Middle East's utilities and oil & gas sectors, which often exhibit different economic cycles than European markets.

Their strong market position in key areas, such as industrial services in Europe and specialized services in the Middle East, allows them to leverage local expertise and established relationships. For instance, in 2024, Bilfinger continued to secure significant contracts in the Middle East, contributing to their overall revenue stability and growth despite varied global economic conditions.

- Geographic Spread: Operations across Europe, North America, and the Middle East.

- Risk Mitigation: Diversification reduces reliance on any single regional economy.

- Market Penetration: Strong presence in utilities and oil & gas in the Middle East.

- Revenue Stability: Global footprint supports consistent financial performance.

Operational Excellence and Strategic Acquisitions

Bilfinger SE consistently drives operational excellence, a core strength that underpins its performance. This focus is evident in its successful integration of strategic acquisitions, notably Stork. By bringing these entities into the fold, Bilfinger aims to unlock significant synergies and boost overall efficiency across its operations.

This strategic approach to portfolio optimization and performance enhancement directly contributes to margin expansion. For instance, in 2023, Bilfinger reported an adjusted EBITDA of €610 million, reflecting the positive impact of these initiatives. The company's commitment to structural resilience is further bolstered by its ability to effectively manage and integrate acquired businesses, ensuring they contribute positively to the group's financial health.

- Operational Excellence: Bilfinger's continuous pursuit of efficiency in its service delivery and project execution.

- Strategic Acquisitions: Successful integration of companies like Stork to create value and expand capabilities.

- Synergy Realization: Driving cost savings and revenue enhancements through the combined strengths of acquired businesses.

- Margin Expansion: The direct financial benefit of operational improvements and portfolio optimization, as seen in its 2023 EBITDA performance.

Bilfinger SE's comprehensive service portfolio, covering the entire industrial value chain from consulting and engineering to maintenance and digital solutions, is a significant strength. This integrated approach allows them to cater to diverse client needs across vital sectors like energy and chemicals, enhancing operational efficiency and sustainability.

The company's strong financial performance further solidifies its position. In Q1 2025, revenue reached €1,191 million with a 7.5% EBITA margin, building on a solid FY 2024 where revenue was €4,767 million and EBITA margin was 7.1%. These figures demonstrate consistent operational improvement and growth.

Bilfinger's strategic focus on efficiency and sustainability aligns with global trends, attracting demand for its services, particularly in decarbonization and digital solutions. This forward-looking strategy is supported by a robust order backlog, with a substantial portion in 2023 attributed to sustainability projects.

Geographic diversification across Europe, North America, and the Middle East mitigates regional economic risks and ensures revenue stability. Their strong market penetration in key areas, like Middle Eastern utilities and oil & gas, further bolsters consistent financial performance.

| Metric | Q1 2025 | FY 2024 | FY 2023 |

|---|---|---|---|

| Revenue (€ million) | 1,191 | 4,767 | N/A |

| EBITA Margin (%) | 7.5 | 7.1 | N/A |

| Order Backlog (€ billion) | N/A | N/A | 10.1 |

What is included in the product

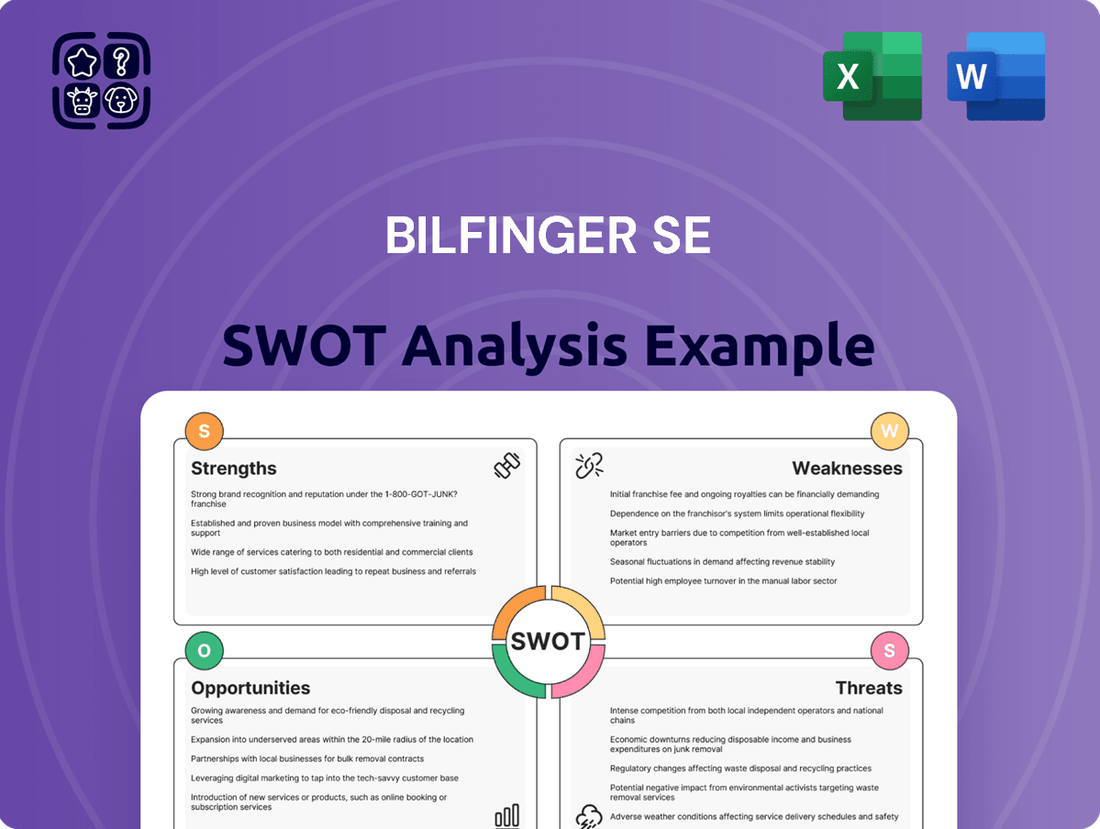

Delivers a strategic overview of Bilfinger SE’s internal and external business factors, highlighting its strengths in engineering and maintenance, weaknesses in project execution, opportunities in energy transition, and threats from competition.

Offers a clear roadmap to leverage Bilfinger SE's strengths and address weaknesses, thereby simplifying complex strategic planning.

Weaknesses

Bilfinger SE's organic order growth exhibited volatility, with a notable slowdown in the first quarter of 2025. This dip was largely attributed to a cautious approach from clients in the United States, influenced by political uncertainties, and a subdued performance within Germany's chemical industry. This highlights a vulnerability to specific geopolitical and sector-specific economic headwinds that can impact the company's ability to secure new contracts.

Bilfinger SE's deep involvement in industries such as oil & gas, chemicals, and petrochemicals, while a source of revenue, also presents a significant vulnerability. These sectors are known for their inherent volatility and susceptibility to economic cycles, meaning that downturns can directly affect Bilfinger's business.

For instance, a sharp drop in oil prices, a common occurrence, can lead to reduced investment in new projects within the energy sector, directly impacting Bilfinger's order intake. Similarly, shifts in chemical demand or stricter environmental regulations can create uncertainty and affect the company's long-term project pipeline and profitability.

Bilfinger SE has faced legal settlements stemming from past projects, which, while generally manageable and incorporated into their financial outlook, can still lead to one-time financial impacts. For instance, the company has historically set aside provisions for such eventualities, and while these are factored into their guidance, they represent a potential drain on immediate earnings.

These unforeseen expenses, even when anticipated to some degree, have the capacity to influence short-term financial results and how investors perceive the company's stability. For example, in 2023, while specific settlement figures weren't detailed as a singular event, the company's financial statements reflected ongoing provisions for legal and other claims, demonstrating the continuous nature of managing such risks.

Challenges in Specific Market Segments

While Bilfinger has seen positive momentum, the chemicals and petrochemicals sector continues to present significant hurdles. This persistent challenge in a core industrial area could impede overall expansion and necessitate tailored strategic shifts to preserve or enhance market standing.

For instance, the company's Engineering & Technologies segment, which serves these industries, faced headwinds. Although specific 2024 or 2025 figures are still emerging, historical performance indicates that volatility in the chemical industry directly impacts project pipelines and execution. This segment's performance is crucial for Bilfinger's diversified revenue streams.

- Persistent challenges in the chemicals and petrochemicals sector could limit Bilfinger's growth potential.

- The Engineering & Technologies segment, heavily reliant on these industries, may experience project delays or reduced order intake.

- Strategic adjustments are likely needed to navigate the complexities and competition within this specific market.

Need for Continuous Workforce Development

The industrial services sector is seeing rapid changes, driven by innovations like artificial intelligence, the Internet of Things, and predictive maintenance. For Bilfinger to truly benefit from these advancements, it requires ongoing investment in training its employees and integrating new technologies. This constant need for upskilling represents a considerable challenge and expense.

This continuous development is crucial, especially considering the increasing complexity of industrial operations. For instance, the adoption of digital twin technology, which creates virtual replicas of physical assets, demands specialized skills that may not be readily available within the existing workforce. Bilfinger's commitment to training in areas such as data analytics and advanced automation is therefore paramount to maintaining its competitive edge.

- Technological Disruption: The rapid pace of technological change necessitates constant workforce adaptation.

- Upskilling Investment: Significant financial resources are required for continuous training and development programs.

- Skills Gap: A potential shortage of personnel with expertise in emerging industrial technologies poses a risk.

- Competitive Pressure: Competitors investing heavily in workforce development could gain an advantage.

Bilfinger SE's reliance on cyclical industries like oil, gas, and chemicals exposes it to significant revenue fluctuations. A downturn in these sectors, potentially triggered by volatile commodity prices or shifts in global demand, directly impacts Bilfinger's order pipeline and profitability. For example, a sustained period of low oil prices can curtail investment in new energy projects, a key revenue driver for the company.

The company's historical involvement in legal settlements, while managed through provisions, represents a potential for one-time financial impacts that can affect short-term earnings. These unforeseen expenses, even when anticipated, can influence investor perception of financial stability. For instance, while specific 2024/2025 settlement figures are not yet fully detailed, the ongoing nature of managing such risks is a consistent factor in financial planning.

Bilfinger faces ongoing challenges within the chemicals and petrochemicals sector, a core area for its Engineering & Technologies segment. This persistent difficulty could hinder overall expansion and necessitate strategic adjustments to maintain market standing. The segment's performance is crucial for diversified revenue streams, and headwinds here can impact the company's broader financial health.

The rapid evolution of industrial technologies, such as AI and IoT, demands continuous investment in employee training and technology integration. This upskilling requirement represents a considerable challenge and expense, as specialized skills in areas like data analytics and advanced automation become increasingly critical for maintaining a competitive edge. Failure to adapt could lead to a skills gap and increased competitive pressure.

Full Version Awaits

Bilfinger SE SWOT Analysis

This is the actual Bilfinger SE SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal Strengths and Weaknesses, alongside external Opportunities and Threats. This detailed report is designed to offer actionable insights for strategic decision-making.

Opportunities

The industrial services sector is experiencing a significant upswing, largely fueled by the escalating need for predictive maintenance solutions. Technologies like the Internet of Things (IoT), Artificial Intelligence (AI), and advanced data analytics are becoming crucial for boosting operational efficiency and refining process control within industries.

Bilfinger SE is strategically positioned to capitalize on this trend. Its existing digital applications and a clear emphasis on enhancing efficiency align perfectly with the market's growing appetite for digitalization, allowing the company to capture a substantial share of this expanding segment.

For instance, in 2023, Bilfinger reported a substantial increase in its order intake, partly driven by digital service offerings. The company's investment in digital solutions is expected to continue driving growth, with projections indicating that digital services will represent an even larger portion of revenue in the coming years, reflecting the strong market demand.

Global decarbonization efforts are accelerating, with many nations setting ambitious net-zero targets. This trend fuels substantial investment in energy efficiency, renewable energy infrastructure, and emerging carbon removal technologies, creating a fertile ground for growth.

Bilfinger's strategic emphasis on sustainability, coupled with its established expertise in environmental technologies and energy transition services, positions it favorably to capitalize on this expanding market. The company's ability to offer comprehensive solutions across the value chain is a key advantage.

For instance, the global green hydrogen market alone is projected to reach hundreds of billions of dollars by 2030, with significant opportunities in project development and maintenance. Bilfinger's involvement in such projects directly addresses this burgeoning demand, contributing to its revenue diversification and market penetration in the sustainability sector.

Bilfinger SE views geographic expansion and strategic acquisitions as key opportunities for growth, with a particular focus on the United States and the Middle East. This strategic priority aims to bolster its capabilities in high-growth sectors such as gas treatment, hydrogen services, and pharmaceutical infrastructure.

By actively pursuing mergers and acquisitions, Bilfinger seeks to enhance its service portfolio and secure a larger market share in these crucial regions. For instance, in 2024, the company has been actively exploring acquisition targets to strengthen its position in North America, a market showing significant demand for energy transition services.

Infrastructure Investment and Government Initiatives

Government investments in infrastructure development, particularly in key markets like Germany, are creating substantial demand for industrial services. Germany's substantial infrastructure package, for instance, aims to modernize the nation's aging infrastructure, presenting a significant opportunity for companies like Bilfinger.

Bilfinger, with its extensive engineering, construction, and maintenance expertise, is strategically positioned to capitalize on these large-scale public and private sector projects. The company's broad service portfolio directly aligns with the needs of infrastructure upgrades, from initial planning and construction to long-term maintenance and operational support.

- Increased Demand: Government infrastructure spending, like Germany's reported €165 billion investment plan for 2024-2027, directly translates to more project opportunities for industrial service providers.

- Strategic Alignment: Bilfinger's core competencies in engineering, maintenance, and digitalization are essential for executing complex infrastructure projects, enhancing its competitive advantage.

- Project Pipeline: The ongoing focus on energy transition infrastructure, transportation networks, and digital connectivity ensures a sustained pipeline of work for companies with relevant capabilities.

Leveraging Long-Term Contracts and Outsourcing Trends

The industrial market's ongoing volatility fuels a consistent demand for outsourcing services, a trend Bilfinger SE is well-positioned to exploit. The company has already seen success through extensions of its long-term contracts, especially within the crucial oil and gas sector.

Securing and growing these long-term service agreements is a key opportunity for Bilfinger, as they offer a predictable and stable revenue foundation. For instance, in 2023, Bilfinger reported a significant increase in its order backlog, reaching €9.4 billion, largely driven by these types of contracts.

- Increased Outsourcing Demand: The volatile industrial landscape continues to drive companies towards outsourcing non-core functions, creating a sustained market for Bilfinger's services.

- Long-Term Contract Extensions: Bilfinger's proven track record has led to extensions of existing long-term contracts, particularly in the resilient oil and gas industry.

- Stable Revenue Streams: Capitalizing on these outsourcing trends by securing new and expanding existing long-term service agreements provides a predictable and stable revenue base.

- Order Backlog Growth: Bilfinger's order backlog stood at €9.4 billion in 2023, reflecting the success of its strategy in securing long-term commitments.

Bilfinger SE is poised to benefit from the global push towards decarbonization, with significant opportunities in renewable energy infrastructure and efficiency solutions. The company's expertise in energy transition services aligns with substantial market growth projections, such as the expanding green hydrogen sector.

Geographic expansion, particularly in the United States and the Middle East, coupled with strategic acquisitions, presents a pathway to bolster capabilities in high-demand areas like hydrogen and pharmaceutical infrastructure. For instance, Bilfinger's 2024 focus on North American acquisitions targets the growing demand for energy transition services.

Government investments in infrastructure, exemplified by Germany's €165 billion plan for 2024-2027, are creating a robust pipeline of projects for industrial service providers. Bilfinger's core competencies in engineering and maintenance are crucial for these large-scale upgrades, ensuring sustained project opportunities.

The ongoing trend of outsourcing in volatile industrial markets offers Bilfinger a chance to secure and extend long-term service agreements, particularly within the oil and gas sector. This strategy is evident in its 2023 order backlog of €9.4 billion, highlighting the success of its approach to building stable revenue streams.

Threats

Bilfinger SE operates in an industrial services market highly susceptible to global volatility. Geopolitical tensions, such as ongoing conflicts and trade disputes, can disrupt supply chains and delay critical projects, directly impacting Bilfinger's operational efficiency and revenue streams. For instance, the ongoing energy transition and related geopolitical shifts in energy supply could significantly alter demand for certain industrial services.

Shifting regulatory landscapes, particularly concerning environmental standards and energy policies, introduce further uncertainty. Changes in these regulations can necessitate costly adaptations to services or equipment, potentially affecting profitability. Economic uncertainty, including inflation and interest rate hikes seen throughout 2023 and into 2024, also dampens investment decisions by clients, leading to a more cautious approach to new projects and potentially reducing the overall demand for Bilfinger's offerings.

The industrial services sector is indeed a crowded arena, with many companies actively seeking the same contracts. This high level of competition means that pricing power can be limited, potentially squeezing profit margins for all involved.

For Bilfinger, this intense rivalry necessitates a constant focus on innovation and demonstrating unique value to clients. Maintaining its market share requires not just offering competitive pricing but also delivering superior service and specialized expertise that sets it apart from other providers in the 2024-2025 period.

Economic slowdowns, particularly in major markets like the United States and Germany, present a significant threat. For instance, the German economy experienced a contraction in GDP in 2023, and forecasts for 2024 suggest continued subdued growth. This economic climate can dampen industrial investment and lead to project postponements, directly affecting Bilfinger's order intake and revenue streams.

Political hesitancy and uncertainty in these key regions further exacerbate this threat. Such factors can create an environment of caution for businesses, leading them to delay or scale back capital expenditure plans. This directly impacts Bilfinger's ability to secure new projects and achieve its projected financial growth targets for 2024 and beyond.

Skills Gap and Talent Shortage

The industrial services sector, including Bilfinger's operational areas, faces a significant challenge from a growing skills gap. As technologies like digitalization and automation become more integrated into complex industrial projects, the demand for specialized technical expertise escalates. This trend means that a lack of qualified personnel could directly impede Bilfinger's capacity to adopt and deploy cutting-edge solutions, thereby affecting service delivery quality and innovation.

Specifically, the shortage of skilled labor in fields such as advanced engineering, digital maintenance, and specialized construction trades is a pervasive issue. For instance, reports from industry bodies in late 2024 and early 2025 highlight an ongoing deficit in qualified technicians and engineers across Europe, a key market for Bilfinger. This talent scarcity not only raises recruitment costs but also intensifies competition for experienced professionals, potentially impacting project timelines and profitability.

Challenges in attracting and retaining top talent are further exacerbated by the need for continuous upskilling and reskilling of the existing workforce to keep pace with technological evolution. Bilfinger, like its competitors, must invest heavily in training programs. Failure to do so could lead to a decline in the company's competitive edge and its ability to offer the advanced, technology-driven services that clients increasingly demand.

- Increasing Demand for Specialized Skills: Technological advancements require expertise in areas like digital twins, predictive maintenance, and advanced robotics.

- Talent Shortage in Key Markets: Reports from 2024 indicate a persistent deficit of skilled engineers and technicians in core European industrial hubs.

- Retention Challenges: High demand for skilled workers leads to increased competition and potential difficulties in retaining experienced personnel.

Regulatory Changes and Environmental Compliance Costs

Evolving environmental regulations, especially concerning carbon emissions and broader sustainability goals, present a significant threat by potentially escalating operational expenditures for industrial service providers like Bilfinger. The company's commitment to sustainability leadership means it must proactively adapt to increasingly stringent mandates, which can introduce substantial financial and operational hurdles.

For instance, the European Union's continued push for decarbonization, as seen in its Fit for 55 package, will likely translate into higher costs for energy-intensive operations and require further investment in greener technologies. Bilfinger's 2023 annual report indicated investments in sustainability initiatives, but future regulatory shifts could demand accelerated spending, impacting profitability if not managed effectively. The challenge lies in balancing these compliance costs with maintaining competitive pricing in the market.

- Increased operational costs due to stricter environmental laws.

- Financial strain from adapting to new sustainability mandates.

- Potential for higher investment needs in green technologies.

- Risk of competitive disadvantage if compliance costs are not absorbed.

Intensifying competition in the industrial services sector poses a threat to Bilfinger's market position and profitability. The need to constantly innovate and offer superior value against numerous rivals, particularly in pricing, is a continuous challenge. This rivalry requires significant investment in service differentiation to maintain market share.

Economic downturns, especially in key regions like Germany which saw GDP contraction in 2023, can significantly reduce client investment in industrial projects. This economic climate, coupled with political hesitancy in major markets, creates a cautious environment that directly impacts Bilfinger's order intake and revenue forecasts for 2024-2025.

A critical threat for Bilfinger is the growing skills gap in specialized technical areas, exacerbated by rapid technological advancements. Reports from late 2024 highlight a persistent deficit of skilled engineers and technicians across Europe, increasing recruitment costs and competition for talent, which could hinder project execution and innovation.

Stricter environmental regulations, particularly those related to decarbonization and sustainability, are likely to increase operational expenditures. Bilfinger's proactive investments in green technologies face the challenge of balancing compliance costs with competitive pricing, as seen with EU initiatives like Fit for 55.

SWOT Analysis Data Sources

This Bilfinger SE SWOT analysis is built upon a foundation of credible data, encompassing official financial filings, comprehensive market research, and expert industry commentary to provide a robust and accurate strategic overview.