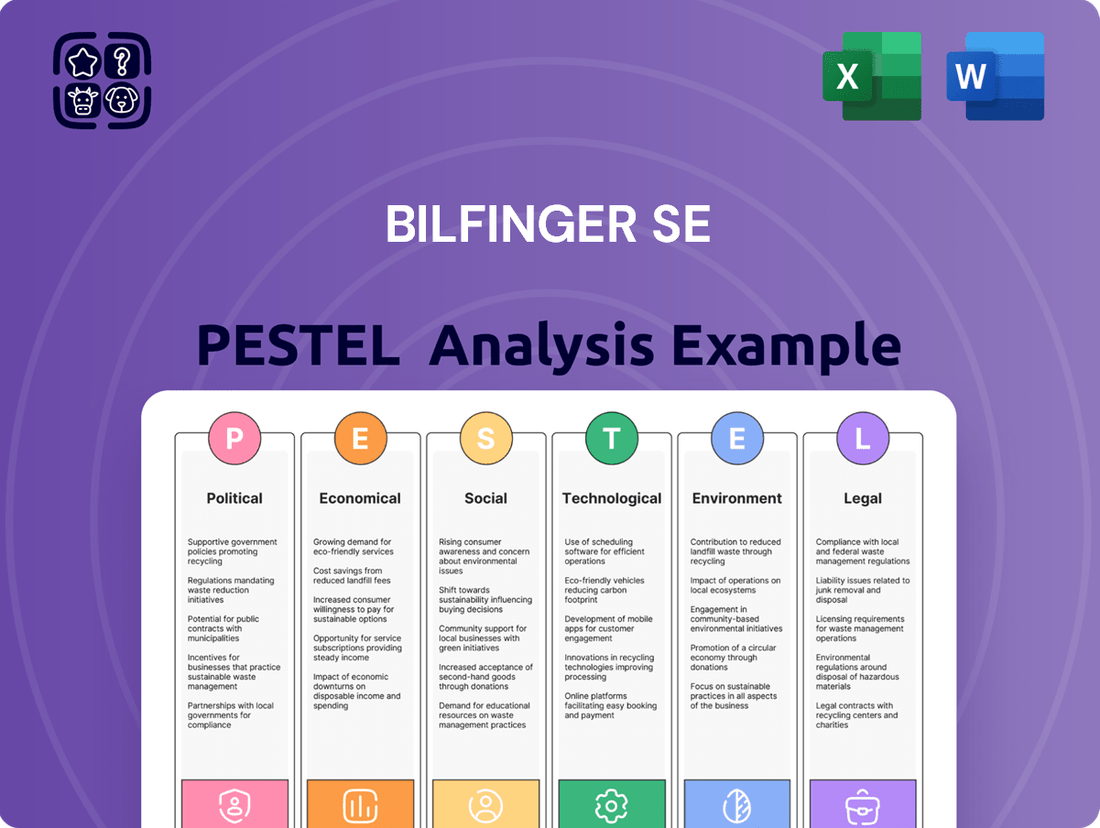

Bilfinger SE PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bilfinger SE Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting Bilfinger SE. Our PESTLE analysis provides a deep dive into these external forces, offering actionable intelligence to inform your strategic decisions. Gain the foresight needed to navigate market complexities and secure a competitive advantage. Download the full, professionally crafted PESTLE analysis now and empower your business strategy.

Political factors

Government infrastructure spending, especially in Europe and North America, is a key driver for Bilfinger's engineering, construction, and maintenance services. For instance, the European Union's NextGenerationEU recovery plan, with significant allocations towards green and digital transitions, is expected to boost infrastructure projects throughout 2024 and 2025, creating opportunities for companies like Bilfinger.

Shifts in government spending priorities or the implementation of austerity measures can directly impact the availability of large-scale industrial and public sector projects. For example, a slowdown in government investment in transportation networks or energy infrastructure could reduce Bilfinger's project pipeline and revenue streams in those sectors.

Bilfinger's success in securing contracts is closely linked to these governmental investment cycles and any stimulus packages introduced. The German government’s commitment to modernizing its railway infrastructure, with planned investments exceeding €40 billion through 2027, presents a significant opportunity for Bilfinger's rail sector expertise.

Shifts in industrial policy, such as Germany's €11 billion hydrogen strategy aiming to boost green energy, directly benefit Bilfinger by increasing demand for its engineering and construction services in renewable energy projects. Stricter environmental regulations, like the EU's Industrial Emissions Directive, which tightened limits for pollutants from large combustion plants, also drive Bilfinger's business as clients require upgrades and compliance solutions.

Bilfinger SE's operations are significantly shaped by geopolitical stability and international trade relations. For instance, the ongoing conflicts in Eastern Europe and the Middle East, as of early 2025, have led to increased energy price volatility and supply chain disruptions, impacting project costs and timelines for Bilfinger, particularly in its European markets.

Trade disputes, such as those between major economic blocs, can directly affect Bilfinger's access to key materials and components, potentially driving up procurement expenses. The company's extensive global footprint means it must continuously monitor and adapt to varying political climates and trade policies across its operating regions to mitigate risks and maintain operational efficiency.

Public Procurement Policies

Public procurement policies significantly shape Bilfinger SE's access to government-funded projects. These policies, encompassing tendering procedures, local content mandates, and sustainability benchmarks, directly influence the company's capacity to secure lucrative public sector contracts. For instance, in 2023, government spending on infrastructure projects across the EU, a key market for Bilfinger, continued to be substantial, though specific figures for Bilfinger's awarded contracts are proprietary. Transparency and equitable competition within these tendering processes are paramount for Bilfinger to effectively compete for and win large-scale public works.

Adherence to diverse national and regional procurement regulations is a critical determinant of market access for Bilfinger. These regulations can vary widely, impacting everything from bid documentation requirements to eligibility criteria. For example, the German government's focus on digitalization and sustainability in its procurement for 2024-2025 may present both opportunities and challenges for service providers like Bilfinger, requiring tailored approaches to bid submissions and service offerings to align with evolving public sector priorities.

- Tendering Processes: Bilfinger must navigate complex and often lengthy public tender processes, which can include pre-qualification stages, detailed technical and financial proposals, and evaluation criteria that may favor specific national suppliers.

- Local Content Requirements: Many governments impose requirements for a certain percentage of project value to be sourced locally, impacting Bilfinger's supply chain and partnership strategies in different regions.

- Sustainability Criteria: Increasing emphasis on environmental, social, and governance (ESG) factors in public procurement means Bilfinger must demonstrate strong sustainability credentials to win bids, aligning with global trends towards greener infrastructure and services.

- Market Access: Compliance with specific national or regional procurement laws is non-negotiable for market entry and participation in public sector projects, requiring dedicated legal and compliance resources.

Energy Policy and Subsidies

Government energy policies, particularly those targeting renewable energy expansion, significantly shape the project landscape for Bilfinger. For instance, Germany's 2023 renewable energy target of 80% of gross electricity consumption by 2030 presents substantial opportunities for engineering and construction firms like Bilfinger in developing new wind and solar farms, as well as upgrading existing grid infrastructure.

Subsidies and incentives for green technologies are a key driver for investment in new plants and retrofits, directly boosting demand for Bilfinger's specialized engineering and maintenance services. In 2024, the European Union's continued commitment to the Green Deal, with substantial funding allocated for energy efficiency and renewable energy projects, creates a favorable environment for such investments.

Shifts in government energy policies can dramatically alter the focus of industrial investment. For example, a policy favoring hydrogen infrastructure development over traditional fossil fuels would redirect capital expenditure, creating new avenues for Bilfinger's expertise in industrial plant construction and modification.

Key political factors influencing Bilfinger's energy sector opportunities include:

- Renewable Energy Targets: National and regional mandates for increasing the share of renewables in the energy mix, such as the UK's goal to have 50 GW of offshore wind capacity by 2030, directly translate into project pipelines for Bilfinger.

- Carbon Capture and Storage (CCS) Initiatives: Government support and funding for CCS technologies, like those seen in Norway's Longship project, offer significant opportunities for Bilfinger in designing and building these complex industrial facilities.

- Energy Efficiency Programs: Incentives for improving energy efficiency in industrial processes and buildings, a focus in many 2024 economic recovery plans, drive demand for Bilfinger's retrofitting and optimization services.

- Nuclear Power Policies: Government decisions regarding the future of nuclear energy, including investments in new builds or life extensions of existing plants, can create substantial, long-term project opportunities for specialized engineering firms.

Government infrastructure spending, particularly in Europe and North America, remains a significant catalyst for Bilfinger's engineering, construction, and maintenance services. The European Union's NextGenerationEU recovery plan, with substantial funding for green and digital transitions, is expected to fuel infrastructure projects through 2024 and 2025, presenting clear opportunities for Bilfinger.

Shifts in government spending priorities or the implementation of austerity measures can directly impact the availability of large-scale industrial and public sector projects. For instance, a slowdown in government investment in transportation networks or energy infrastructure could reduce Bilfinger's project pipeline and revenue streams in those sectors.

Bilfinger's success in securing contracts is closely linked to these governmental investment cycles and any stimulus packages introduced. The German government’s commitment to modernizing its railway infrastructure, with planned investments exceeding €40 billion through 2027, presents a significant opportunity for Bilfinger's rail sector expertise.

Shifts in industrial policy, such as Germany's €11 billion hydrogen strategy aiming to boost green energy, directly benefit Bilfinger by increasing demand for its engineering and construction services in renewable energy projects. Stricter environmental regulations, like the EU's Industrial Emissions Directive, which tightened limits for pollutants from large combustion plants, also drive Bilfinger's business as clients require upgrades and compliance solutions.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing Bilfinger SE, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions with specific examples.

It provides actionable insights into market dynamics and regulatory landscapes to aid strategic decision-making and identify opportunities.

Provides a concise and actionable overview of the external factors impacting Bilfinger SE, enabling strategic decision-making and risk mitigation.

Economic factors

Bilfinger SE's performance is closely tied to global industrial investment cycles, especially in sectors like chemicals, pharmaceuticals, and energy. When these industries experience economic slowdowns, clients tend to cut back on capital expenditures, directly affecting Bilfinger's new project pipeline and ongoing maintenance agreements. For instance, a projected 2.5% contraction in global manufacturing output for 2024, as forecast by the IMF, would likely translate to fewer large-scale project awards for Bilfinger.

Conversely, periods of economic expansion and increased industrial activity create a more favorable environment for Bilfinger. During these times, companies invest more in new facilities and upgrading existing ones, driving demand for Bilfinger's engineering, construction, and maintenance services. The anticipated 3.1% global GDP growth for 2025, according to the World Bank, suggests a potential upswing in industrial investment and, consequently, a boost in Bilfinger's service demand.

Rising inflation in 2024 and into 2025 significantly impacts Bilfinger SE's operational expenses. We're seeing increased costs for essential raw materials, energy, and crucially, labor wages. For instance, the German consumer price index (CPI) saw an inflation rate of 5.9% in 2023, a figure expected to remain elevated, though potentially moderating slightly in 2024 and 2025 according to various economic forecasts.

Bilfinger's ability to effectively pass these rising costs onto its clients through contract negotiations is paramount for safeguarding its profit margins. This is particularly true for projects with fixed-price agreements, where unexpected inflationary surges can directly erode profitability if not adequately hedged or accounted for in the initial pricing.

Changes in interest rates significantly impact Bilfinger SE's operating environment. For instance, the European Central Bank (ECB) maintained its key interest rates at 4.50% as of September 2023, a level that began to influence borrowing costs across the Eurozone. Higher rates increase the cost of capital for Bilfinger's clients, potentially slowing down investment in large-scale industrial projects, which are a core revenue source for the company. This can directly translate to reduced demand for Bilfinger's engineering and construction services.

Furthermore, access to affordable capital is crucial for Bilfinger's own strategic growth and day-to-day operations. If interest rates rise, the cost of borrowing for Bilfinger itself increases, affecting its ability to fund new ventures, acquisitions, or maintain sufficient operational liquidity. For example, as of the end of 2023, Bilfinger reported a net debt of €1.0 billion, meaning any increase in interest rates would directly impact its financing expenses and profitability.

Energy Prices and Client Profitability

Fluctuations in global energy prices directly affect the profitability of Bilfinger's clients, particularly those in energy-intensive sectors like chemicals and oil & gas. For instance, the International Energy Agency reported that Brent crude oil prices averaged around $83 per barrel in the first half of 2024, a significant increase from the previous year, impacting operational costs for many of Bilfinger's customers.

When energy costs surge, clients often focus on improving efficiency and undertaking essential maintenance, which can create new service opportunities for Bilfinger. However, prolonged periods of elevated energy prices can also prompt clients to reduce production or postpone capital projects. This slowdown in client activity can consequently dampen demand for Bilfinger's engineering and maintenance services.

- Impact on Client Spending: High energy prices can strain client budgets, leading to shifts in investment priorities towards cost-saving measures.

- Opportunity for Efficiency Services: Increased energy costs can drive demand for Bilfinger's services aimed at improving energy efficiency in industrial processes.

- Risk of Project Delays: Sustained high energy prices may cause clients to defer or cancel new projects, impacting Bilfinger's order pipeline.

- Sectoral Sensitivity: Industries like petrochemicals, which are heavily reliant on energy as a feedstock and power source, are especially vulnerable to price volatility.

Supply Chain Disruptions and Costs

Global trade imbalances and geopolitical tensions, exemplified by ongoing trade disputes and regional conflicts, continue to create volatility in supply chains. These events can significantly extend lead times and inflate costs for essential components and equipment, directly impacting project execution for companies like Bilfinger. For instance, in 2024, the Suez Canal disruptions alone led to rerouting of numerous vessels, adding an average of 7-10 days to transit times and increasing shipping costs by up to 20% for affected routes.

Bilfinger's ability to navigate these supply chain risks is crucial for maintaining project timelines and budget adherence. The company's strategic focus on diversifying its supplier base across different geographic regions and optimizing its logistics networks are key measures to mitigate the impact of unforeseen disruptions. This proactive approach helps ensure a more resilient and cost-effective procurement process, even amidst global uncertainties.

- Supplier Diversification: Reducing reliance on single-source suppliers, particularly for specialized engineering components, is a priority.

- Logistics Optimization: Implementing advanced tracking and route planning to minimize transit times and shipping expenses.

- Inventory Management: Balancing just-in-time delivery with strategic buffer stock for critical materials to counter potential delays.

- Geopolitical Monitoring: Continuously assessing global political and economic landscapes for early warnings of potential supply chain impacts.

Economic factors significantly shape Bilfinger SE's operational landscape. Global industrial investment cycles, influenced by GDP growth forecasts like the World Bank's 3.1% for 2025, directly impact demand for Bilfinger's services. Conversely, inflation, with German CPI at 5.9% in 2023, raises operational costs for materials and labor, affecting profit margins if not passed on to clients.

Interest rate policies, such as the ECB's 4.50% key rate in September 2023, influence clients' capital expenditure decisions and Bilfinger's own financing costs, impacting its net debt of €1.0 billion at the end of 2023. Fluctuations in energy prices, with Brent crude averaging around $83 per barrel in H1 2024, create both opportunities for efficiency services and risks of project delays for Bilfinger.

| Economic Factor | 2024/2025 Outlook | Impact on Bilfinger SE |

|---|---|---|

| Global GDP Growth | Projected 2.5% (IMF) for 2024, 3.1% (World Bank) for 2025 | Drives demand for industrial investment and Bilfinger's services. |

| Inflation (Germany CPI) | 5.9% in 2023, expected to remain elevated | Increases operational costs (materials, labor), impacting profit margins. |

| Interest Rates (ECB Key Rate) | 4.50% as of Sep 2023 | Affects client investment decisions and Bilfinger's financing costs. |

| Energy Prices (Brent Crude) | Averaged ~$83/barrel in H1 2024 | Influences client spending, creating opportunities for efficiency services or risks of project deferral. |

Same Document Delivered

Bilfinger SE PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Bilfinger SE covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides actionable insights for strategic planning.

Sociological factors

Bilfinger faces a significant challenge from an aging workforce in traditional industrial sectors, coupled with a rising demand for specialized technical expertise. This demographic shift strains their ability to recruit and retain the necessary talent.

The availability of skilled engineers, technicians, and craftspeople is absolutely crucial for successful project execution. For instance, in Germany, the Association of German Engineers (VDI) reported in early 2024 that the country faces a shortage of approximately 150,000 engineers across various disciplines.

To counter these gaps, Bilfinger's investment in comprehensive training and talent development programs becomes paramount. These initiatives are key to building a future-ready workforce capable of meeting evolving industry demands.

Societal expectations for stringent health, safety, and environmental (HSE) standards in industrial operations are continuously rising. This growing awareness directly impacts companies like Bilfinger SE, as a strong HSE culture is no longer just a regulatory requirement but a critical component of corporate responsibility and public trust.

Bilfinger's reputation and its ability to secure new contracts are heavily influenced by its demonstrable commitment to a robust HSE culture and an excellent safety record. For instance, in 2023, Bilfinger reported a Lost Time Injury Frequency Rate (LTIFR) of 2.0, a figure that stakeholders scrutinize closely as a proxy for operational safety and management effectiveness.

Compliance with evolving social norms around workplace well-being is paramount for Bilfinger. This includes not only preventing accidents but also fostering a proactive safety environment where employees feel empowered to report potential hazards. Such a culture is essential for long-term sustainability and attracting top talent in the competitive industrial services sector.

Societal expectations for Corporate Social Responsibility (CSR) are intensifying, pushing companies like Bilfinger to showcase ethical labor, community involvement, and sustainability. This pressure directly impacts Bilfinger's public image and its relationships with clients, with strong CSR performance enhancing its reputation and appeal as an employer and business partner. For instance, in 2023, Bilfinger reported a 17% increase in its sustainability performance score according to EcoVadis, reflecting its efforts to meet these growing demands.

Labor Relations and Union Influence

Bilfinger's operational flexibility and cost structure are significantly impacted by the strength of labor unions and the prevailing industrial relations across its diverse operating regions. In 2024, for instance, countries with strong union presence often mandate higher wage agreements and more rigid work rules, directly affecting Bilfinger's labor costs and project execution speed. Navigating these relationships requires meticulous adherence to local labor laws and proactive engagement with employee representatives to foster industrial peace and ensure project continuity.

Disruptions stemming from labor disputes, such as strikes, pose a substantial risk to Bilfinger's project timelines and can lead to considerable cost overruns. For example, a major strike in Germany in early 2024, though not directly involving Bilfinger, highlighted the potential for widespread project delays across the industrial sector, underscoring the importance of robust labor relations management.

- Union Density: In countries like Germany, union density can exceed 20% in industrial sectors, influencing collective bargaining agreements.

- Wage Pressure: Unionized workforces often command higher wages, impacting Bilfinger's overall labor expenditure.

- Strike Frequency: Monitoring strike activity in key operating regions provides insight into potential operational disruptions.

- Regulatory Compliance: Strict adherence to national labor laws is paramount to avoid penalties and maintain operational stability.

Diversity, Equity, and Inclusion (DEI) Initiatives

Bilfinger SE, like many global corporations, navigates an increasingly complex societal landscape where diversity, equity, and inclusion (DEI) are paramount. This societal shift directly influences how Bilfinger attracts and retains its workforce. Companies that champion DEI are better positioned to secure top talent, as a significant portion of the modern workforce prioritizes inclusive workplaces. For instance, a 2024 study indicated that over 60% of job seekers consider a company's DEI policies when evaluating potential employers.

Furthermore, fostering an inclusive environment is not just about employee satisfaction; it’s a driver of innovation. Diverse teams bring varied perspectives, leading to more creative problem-solving and robust business strategies. Bilfinger's commitment to DEI can therefore translate into a competitive advantage by unlocking new ideas and approaches within its operations.

The impact of DEI extends beyond internal operations to external stakeholder relationships. Clients are increasingly scrutinizing their supply chains and demanding that their partners demonstrate genuine commitment to DEI principles. This means Bilfinger's DEI initiatives are not only crucial for its internal culture but also for maintaining strong client relationships and securing new business opportunities in 2024 and beyond.

- Talent Acquisition: A strong DEI reputation attracts a wider pool of qualified candidates, crucial in competitive engineering and construction sectors.

- Employee Retention: Inclusive cultures improve employee morale and loyalty, reducing turnover costs.

- Innovation and Performance: Diverse teams are linked to higher rates of innovation and improved financial performance, with studies showing a correlation between diversity and profitability.

- Client Relations: Demonstrating robust DEI practices is becoming a key factor in client selection and partnership agreements.

Societal expectations for robust health, safety, and environmental (HSE) performance are increasingly influencing Bilfinger's operational standards and client acquisition. Companies are now evaluated not just on technical capability but also on their commitment to safety and sustainability. Bilfinger's 2023 Lost Time Injury Frequency Rate (LTIFR) of 2.0 is a key metric stakeholders examine to gauge management effectiveness and operational safety, directly impacting its reputation and ability to secure new contracts.

The growing emphasis on Corporate Social Responsibility (CSR) requires Bilfinger to demonstrate ethical labor practices and community engagement, which in turn bolsters its public image and appeal as a business partner. For example, Bilfinger's 2023 EcoVadis sustainability performance score increased by 17%, reflecting its proactive approach to meeting these evolving societal demands.

Diversity, Equity, and Inclusion (DEI) are becoming critical factors in talent acquisition and retention, with a 2024 study showing over 60% of job seekers consider DEI policies when choosing an employer. Bilfinger's focus on DEI not only enhances its internal culture and innovation but also strengthens external stakeholder relationships as clients increasingly prioritize partners with strong DEI commitments.

Technological factors

Bilfinger is actively embracing digitalization and Industry 4.0, integrating technologies like the Internet of Things (IoT) and artificial intelligence (AI) into its industrial services. This strategic shift is evident in their focus on predictive maintenance and remote monitoring, which significantly boost operational efficiency for clients.

The company's investment in digital solutions is a key driver for its competitive edge, enabling them to offer advanced asset management and data-driven insights. For instance, by leveraging big data analytics, Bilfinger can identify potential equipment failures before they occur, saving clients substantial downtime and costs.

Bilfinger is leveraging automation and robotics to enhance its industrial services, aiming for greater efficiency and safety. For instance, in 2024, the company reported a significant increase in the adoption of digital tools and automated processes across its maintenance and repair operations, contributing to a projected 15% reduction in project execution times for certain complex tasks.

These technological advancements allow Bilfinger to deploy robots for hazardous jobs, such as working at height or in confined spaces, thereby improving worker safety and reducing associated risks. This strategic adoption is crucial for maintaining a competitive edge and delivering innovative solutions to clients in sectors like energy and manufacturing, where precision and speed are paramount.

Developments in advanced materials like high-performance composites and self-healing concrete are revolutionizing industrial facility design and maintenance, offering enhanced durability and reduced lifecycle costs. Bilfinger's strategic integration of these innovations, such as their use in corrosion protection for offshore wind turbines, directly translates to more efficient and sustainable client assets.

The company's commitment to continuous research and development in material science, evidenced by their investment in pilot projects exploring novel alloys for extreme environments, is crucial for maintaining a competitive edge. For instance, in 2024, Bilfinger highlighted advancements in modular construction techniques utilizing pre-fabricated components made from advanced materials, leading to faster project completion times and improved safety records for their clients.

Cybersecurity in Industrial Control Systems

The increasing digitization of industrial operations significantly elevates the risk of cyber threats targeting critical industrial control systems (ICS). For Bilfinger and its clientele, this means safeguarding operational continuity and sensitive data against sophisticated attacks is a top priority. Reports indicate a substantial rise in ICS-related cyber incidents, with some analyses projecting the global cost of cybercrime against critical infrastructure to reach trillions annually by 2025.

Bilfinger must therefore embed advanced cybersecurity protocols within its digital solutions and client infrastructure to mitigate potential operational disruptions and data breaches. This growing threat landscape also opens a significant avenue for Bilfinger to expand its service portfolio by offering specialized cybersecurity consulting and implementation for industrial environments.

- Increased Digitalization: Leads to greater vulnerability of Industrial Control Systems (ICS) to cyber threats.

- Operational Disruptions & Data Breaches: Robust cybersecurity is essential to prevent these for Bilfinger and its clients.

- Market Opportunity: Bilfinger can leverage this by offering cybersecurity consulting services for industrial sectors.

Sustainable Technologies and Green Solutions

Technological advancements in environmental solutions, like carbon capture and waste-to-energy systems, are opening up substantial avenues for Bilfinger. The company is well-positioned to provide engineering and implementation expertise for these green initiatives, helping clients meet their sustainability targets and comply with evolving regulations. For instance, the global carbon capture, utilization, and storage (CCUS) market was valued at approximately USD 3.5 billion in 2023 and is projected to grow significantly, presenting direct opportunities for Bilfinger's service offerings.

Bilfinger's ability to integrate renewable energy sources into industrial processes also represents a key growth area. As companies increasingly focus on decarbonization, demand for specialized engineering services to implement solar, wind, and other renewable energy solutions is on the rise. The International Energy Agency reported in 2024 that renewable energy capacity additions reached record levels globally in 2023, underscoring the market's expansion.

Continuous innovation in eco-friendly technologies is not just a trend but a critical competitive advantage for Bilfinger. By staying at the forefront of developing and implementing sustainable technologies, the company can differentiate itself and capture market share. This includes advancements in areas like hydrogen production and energy efficiency solutions, which are becoming paramount for industrial clients seeking to reduce their environmental footprint and operational costs.

- Growth in Green Technologies: The market for environmental technologies, including carbon capture and waste-to-energy, offers significant growth potential for Bilfinger's specialized services.

- Renewable Energy Integration: Bilfinger's expertise in integrating renewable energy sources into industrial operations aligns with the growing global demand for decarbonization.

- Competitive Edge through Innovation: Staying ahead in eco-friendly technology development and implementation is crucial for Bilfinger to maintain its competitive advantage in the evolving industrial landscape.

Bilfinger's commitment to digitalization and Industry 4.0, incorporating IoT and AI, enhances operational efficiency through predictive maintenance. Their investment in digital solutions, including big data analytics, provides clients with advanced asset management and cost savings by preventing equipment failures. The company's adoption of automation and robotics in 2024 improved efficiency and safety, contributing to a projected 15% reduction in project execution times for specific tasks.

Legal factors

Bilfinger SE operates under a stringent global framework of environmental regulations, encompassing everything from emissions control and waste management to pollution prevention. For instance, the European Union's Industrial Emissions Directive (IED) sets strict limits for pollutants, impacting how Bilfinger manages its industrial operations and client projects. Failure to comply can lead to substantial penalties; in 2023, fines for environmental non-compliance across industries in the EU reached billions of euros, a figure Bilfinger actively works to avoid.

Staying ahead of these evolving legal requirements is critical. Bilfinger's commitment to sustainability, as detailed in its 2024 ESG reports, highlights investments in cleaner technologies and robust environmental management systems. This proactive approach is crucial not only for avoiding legal repercussions and associated costs, which can include operational shutdowns and civil liabilities, but also for maintaining its reputation as a responsible corporate citizen.

Bilfinger SE navigates a complex web of labor laws across its global operations, impacting everything from minimum wages and working hours to stringent health and safety standards and the complexities of collective bargaining agreements. For instance, in Germany, where Bilfinger has a significant presence, the Works Constitution Act grants employees substantial co-determination rights, influencing operational decisions and employee welfare.

Failure to adhere to these varied regulations can trigger costly labor disputes, potentially leading to strikes or significant fines, as seen with increased regulatory scrutiny on worker classification in the gig economy impacting many industries. For example, in 2024, several European countries have been tightening regulations around temporary and contract labor, increasing compliance burdens for companies like Bilfinger.

Maintaining robust compliance and fostering fair labor practices are paramount for Bilfinger, not only to avoid legal repercussions but also to cultivate positive employee relations and a stable workforce, which is critical for project execution and overall business continuity. In 2023, companies globally faced an average of a 15% increase in compliance costs related to labor laws, a trend expected to continue through 2025.

Bilfinger SE's operations are fundamentally built upon a vast network of contractual relationships with clients, suppliers, and subcontractors. Navigating the intricacies of contract law, particularly concerning liability, risk allocation, and the mechanisms for resolving disputes, is paramount to ensuring successful project execution and safeguarding the company's financial health. For instance, a significant portion of Bilfinger's revenue is derived from long-term service and construction contracts, where precise legal drafting is crucial to mitigate potential claims and penalties.

The company's ability to secure favorable terms and manage potential legal challenges hinges on robust legal expertise in contract negotiation and management. In 2024, the global construction and engineering sectors continued to see an increase in complex contractual disputes, underscoring the need for proactive legal risk assessment. Bilfinger's commitment to strong contract law adherence directly impacts its project profitability and overall business stability.

Data Protection and Privacy Laws

Bilfinger's operations, particularly with growing digitalization in industrial services, necessitate strict adherence to data protection and privacy regulations like the GDPR. This is critical for safeguarding sensitive client data, proprietary intellectual property, and personal information. For instance, in 2024, companies across sectors faced increased scrutiny and potential fines for non-compliance, with GDPR penalties reaching up to €20 million or 4% of global annual turnover.

Ensuring the secure handling of this data is paramount to maintaining client trust and avoiding significant reputational damage. A data breach can result in substantial financial penalties and a severe erosion of confidence, impacting future business opportunities. In 2023, the number of reported data breaches in the EU continued to rise, underscoring the ongoing challenges companies face in data security.

- GDPR Fines: Penalties can reach up to 4% of global annual turnover or €20 million.

- Data Security Investment: Companies are increasingly investing in advanced cybersecurity measures to prevent breaches.

- Client Trust: Robust data protection is a key differentiator and a requirement for many industrial service contracts.

- Regulatory Landscape: Evolving privacy laws globally require continuous adaptation and compliance strategies.

Anti-Corruption and Bribery Laws

Operating globally, Bilfinger SE must navigate a complex web of anti-corruption and anti-bribery legislation. Key statutes like the U.S. Foreign Corrupt Practices Act (FCPA) and the U.K. Bribery Act impose strict requirements on companies conducting international business. These laws are designed to prevent bribery and corruption in foreign commerce, impacting how companies interact with government officials and third parties.

To mitigate risks, Bilfinger's commitment to robust compliance programs is critical. This includes comprehensive employee training on ethical conduct, thorough due diligence on business partners, and clear internal policies. Failure to comply can result in severe penalties, including substantial fines and significant reputational damage, impacting investor confidence and market access.

- FCPA Enforcement: In 2023, the U.S. Department of Justice reported significant enforcement actions under the FCPA, highlighting the ongoing global focus on combating corporate bribery.

- Bribery Act Impact: The U.K. Bribery Act's extraterritorial reach means companies with U.K. connections can be prosecuted for bribery offenses committed anywhere in the world.

- Compliance Costs: Industry estimates suggest that companies spend billions annually on compliance programs to adhere to anti-corruption laws, reflecting the significant investment required.

- Reputational Risk: A single proven instance of corruption can severely tarnish a company's brand, leading to loss of business and difficulty attracting and retaining talent.

Bilfinger SE's global operations necessitate strict adherence to a wide array of legal frameworks governing corporate conduct, from anti-corruption statutes like the U.S. FCPA and the U.K. Bribery Act to robust data protection regulations such as GDPR. These laws carry significant penalties, with GDPR fines potentially reaching 4% of global annual turnover or €20 million, and FCPA enforcement actions in 2023 demonstrating continued global focus on combating bribery. Proactive compliance, including rigorous due diligence and comprehensive employee training, is crucial for mitigating substantial financial and reputational risks, as evidenced by the billions spent annually on compliance programs across industries.

| Legal Area | Key Regulations/Statutes | Potential Impact/Penalties | 2023/2024 Data Point |

|---|---|---|---|

| Anti-Corruption | U.S. FCPA, U.K. Bribery Act | Substantial fines, reputational damage, loss of market access | FCPA enforcement actions saw significant activity in 2023. |

| Data Protection | GDPR | Fines up to 4% of global annual turnover or €20 million, reputational damage | GDPR penalties can be substantial, with ongoing scrutiny of data handling practices. |

| Labor Laws | Works Constitution Act (Germany), various EU directives | Labor disputes, strikes, fines, increased compliance costs | Companies faced an average 15% increase in labor law compliance costs in 2023. |

| Contract Law | Various international and national contract statutes | Contractual disputes, financial liabilities, project delays | Global construction and engineering sectors saw increased complex contractual disputes in 2024. |

Environmental factors

The intensifying global commitment to climate action and ambitious decarbonization targets directly influences Bilfinger's market opportunities. Demand is surging for services that assist industrial clients in lowering their carbon emissions, encompassing areas like energy efficiency upgrades, the integration of renewable energy sources, and the implementation of carbon capture solutions. For instance, the EU's Fit for 55 package aims for a 55% net reduction in greenhouse gas emissions by 2030 compared to 1990 levels, creating a significant market for Bilfinger's expertise.

Bilfinger's service portfolio must therefore closely align with the sustainability strategies and roadmaps of its industrial clientele. Companies worldwide are setting net-zero targets, with many aiming for significant reductions by 2030 and 2050. This necessitates Bilfinger's involvement in projects that enhance operational efficiency and transition to cleaner energy, such as retrofitting existing plants for lower emissions or developing new infrastructure for green hydrogen production.

Bilfinger is well-positioned to capitalize on the growing emphasis on resource efficiency and sustainable waste management within the industrial sector. The company offers services aimed at optimizing material usage and reducing waste, aligning with client needs for more environmentally conscious operations. For instance, Bilfinger’s expertise in process optimization can lead to significant reductions in raw material consumption and waste output for its customers.

The global push towards a circular economy further enhances opportunities for Bilfinger. The company can provide solutions for waste-to-energy projects and facilitate recycling initiatives, transforming waste streams into valuable resources. This aligns with broader economic trends, as demonstrated by the European Union's Circular Economy Action Plan, which sets ambitious targets for waste reduction and resource productivity, creating a strong market demand for Bilfinger's specialized services.

Environmental considerations around biodiversity protection and responsible land use are increasingly critical in industrial project planning. Bilfinger must navigate a landscape where minimizing ecological impact, especially in sensitive regions, is paramount. This directly influences where projects can be sited and how they are designed.

Compliance with evolving regulations and best practices for land use and biodiversity preservation is essential for Bilfinger's operations. For instance, in 2024, the European Union's Nature Restoration Law aims to restore degraded ecosystems, impacting development projects across member states. Bilfinger's adherence to these standards will be key to project viability and its environmental, social, and governance (ESG) profile.

Water Scarcity and Water Management

Growing global concerns about water scarcity are increasingly impacting industrial operations, making effective water management a critical factor for businesses like Bilfinger's clients. Many regions are experiencing heightened water stress, driving demand for sophisticated solutions.

Bilfinger is well-positioned to address these challenges by providing specialized services in water treatment, recycling, and optimizing water usage within industrial facilities. These offerings help clients not only reduce their environmental footprint but also ensure compliance with increasingly stringent water discharge regulations. This focus on water management is a key component of sustainability services in the current market.

For instance, the United Nations reported in 2023 that over two billion people live in countries experiencing high water stress, a figure projected to rise. This underscores the urgent need for industrial water efficiency. Bilfinger's expertise in areas like advanced filtration and desalination technologies directly responds to this growing need.

Key service areas for Bilfinger in water management include:

- Water Treatment and Purification: Implementing advanced technologies to treat industrial wastewater for safe discharge or reuse.

- Water Recycling and Reuse Systems: Designing and installing systems that allow clients to recirculate water within their processes, significantly reducing freshwater intake.

- Efficiency Optimization: Auditing and improving water usage patterns in industrial plants to minimize waste and operational costs.

- Regulatory Compliance Support: Assisting clients in meeting evolving water quality standards and discharge permits.

Circular Economy Principles Adoption

The global push towards a circular economy, prioritizing reuse, repair, and recycling over traditional linear production, significantly reshapes industrial operations and asset management. This fundamental shift demands new approaches to resource utilization and waste reduction.

Bilfinger is strategically positioned to assist clients in navigating this transition. Its expertise in asset lifecycle management, coupled with specialized material recovery services, directly supports the adoption of circular principles. Furthermore, Bilfinger's capabilities extend to designing assets for enhanced longevity and improved recyclability, aligning with the core tenets of a circular model.

This strategic focus on circularity represents a substantial, long-term evolution for the industrial services sector. For instance, the European Union's Circular Economy Action Plan aims to boost recycling rates, with targets for packaging waste recycling reaching 75% by 2030. Bilfinger's services directly contribute to achieving these ambitious environmental and economic goals for its clientele.

- Asset Lifecycle Management: Optimizing asset performance and lifespan to minimize waste and maximize resource efficiency.

- Material Recovery Services: Implementing processes for reclaiming valuable materials from decommissioned assets and waste streams.

- Design for Circularity: Engineering new and existing assets with longevity, repairability, and recyclability in mind.

- Circular Economy Market Growth: The global circular economy market was projected to reach $4.5 trillion by 2030, indicating significant opportunities for service providers like Bilfinger.

The increasing focus on environmental sustainability and decarbonization presents significant opportunities for Bilfinger, particularly in areas like energy efficiency and renewable energy integration. The EU's Fit for 55 package, targeting a 55% greenhouse gas reduction by 2030, directly fuels demand for Bilfinger's expertise in helping industries lower their carbon footprint.

Bilfinger's role in promoting resource efficiency and the circular economy is also gaining prominence. Services aimed at optimizing material usage, reducing waste, and enabling waste-to-energy projects align with initiatives like the EU's Circular Economy Action Plan, which seeks higher recycling rates and resource productivity.

Water scarcity is another critical environmental factor influencing Bilfinger's clients, driving demand for advanced water management solutions. Bilfinger's capabilities in water treatment, recycling, and efficiency optimization help clients meet stringent regulations and reduce their environmental impact, a crucial aspect given that over two billion people lived in high water stress countries in 2023.

The company must also navigate environmental considerations related to biodiversity and land use, adhering to regulations like the EU's Nature Restoration Law. This ensures project viability and strengthens Bilfinger's ESG profile in an era of heightened ecological awareness.

| Environmental Factor | Impact on Bilfinger | Supporting Data/Initiative |

|---|---|---|

| Decarbonization & Climate Action | Increased demand for energy efficiency, renewables, and carbon capture solutions. | EU Fit for 55 package (55% GHG reduction by 2030). |

| Resource Efficiency & Circular Economy | Opportunities in waste-to-energy, material recovery, and designing for longevity. | EU Circular Economy Action Plan (75% packaging waste recycling by 2030). |

| Water Scarcity & Management | Demand for water treatment, recycling, and efficiency optimization services. | Over 2 billion people in high water stress countries (2023 UN data). |

| Biodiversity & Land Use | Need to comply with regulations impacting project planning and design. | EU Nature Restoration Law impacting ecosystem restoration. |

PESTLE Analysis Data Sources

Our Bilfinger SE PESTLE Analysis is meticulously constructed using data from reputable sources including the International Monetary Fund (IMF), World Bank, and leading industry-specific market research firms. We also incorporate official government publications and regulatory updates from key operating regions to ensure comprehensive and accurate insights.