Bilfinger SE Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bilfinger SE Bundle

Curious about Bilfinger SE's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse portfolio stacks up in terms of market share and growth potential. Understand which segments are driving growth and which might need a strategic rethink.

Don't miss out on the full picture! Purchase the complete Bilfinger SE BCG Matrix to unlock detailed quadrant analysis, identify your Stars, Cash Cows, Dogs, and Question Marks, and gain actionable insights to optimize your investment strategy and drive future success.

Stars

Bilfinger is making significant investments in digital applications and AI, aiming to provide cutting-edge solutions for efficiency and sustainability. This strategic focus taps into the booming Industry 4.0 and IoT markets, which are projected for substantial growth. For instance, in 2024, Bilfinger continued to expand its digital service portfolio, with digital solutions contributing to a notable percentage of its overall service revenue, reflecting strong market adoption.

Bilfinger's Energy Transition Services, encompassing green technologies, are positioned for substantial growth as sustainability becomes a global imperative. This segment directly addresses the rising demand for decarbonization solutions, offering clients expertise in energy efficiency improvements, carbon emission reduction, and net-zero strategy implementation across key sectors like utilities and oil & gas.

The market for these services is experiencing a significant uplift, driven by robust government investments in sustainable infrastructure and favorable policy environments. This translates into a high growth trajectory for Bilfinger's green technologies division, indicating a strong competitive advantage in a rapidly expanding market. For instance, the global green technology and sustainability market was valued at approximately USD 11.2 billion in 2023 and is projected to grow significantly in the coming years, with many analysts expecting double-digit compound annual growth rates through 2030.

Bilfinger SE's pharma and biopharma services are a star performer, showing robust growth driven by strong demand for specialized solutions like pharma skids and maintenance. This sector thrives on the need for high-quality, efficient, and compliant industrial services, enabling Bilfinger to secure a significant market share and healthy profit margins. The company's increasing order intake in this segment underscores its solid standing in a rapidly expanding market.

Operational Excellence Initiatives

Bilfinger SE's commitment to operational excellence, including service standardization and procurement optimization, solidifies its Star position. These efforts directly translate into improved efficiency and a more favorable product mix, boosting profit margins and market competitiveness in growth sectors.

- Service Standardization: Bilfinger SE is actively working to standardize its service offerings across various segments. This includes streamlining processes for maintenance, repair, and engineering services to ensure consistent quality and predictable outcomes for clients.

- Procurement Optimization: The company is implementing advanced procurement strategies to achieve cost efficiencies. In 2024, Bilfinger reported significant savings through strategic sourcing and supplier relationship management, contributing to enhanced profitability.

- Employee Development: Investing in employee training and development is a cornerstone of Bilfinger's strategy. This focus ensures a skilled workforce capable of delivering high-quality services, which is crucial for maintaining leadership in demanding markets.

- Efficiency Gains: These initiatives are designed to drive significant operational efficiencies. For instance, in the first half of 2024, Bilfinger noted a notable improvement in its operational performance metrics, directly attributable to these ongoing excellence programs.

Integrated End-to-End Solutions

Bilfinger SE's integrated end-to-end solutions are a key differentiator, offering a seamless experience from initial consulting and engineering through to ongoing maintenance and advanced digital applications. This comprehensive service model streamlines operations for clients, boosting efficiency and sustainability. For instance, in 2024, Bilfinger reported significant growth in its Engineering & Consulting segment, a testament to the demand for these holistic approaches.

By consolidating services, Bilfinger enhances customer value, leading to improved profitability for all stakeholders. This single-source advantage is particularly impactful in high-growth sectors where complex project management is critical. The company's commitment to this integrated strategy has solidified its market leadership and fostered deep, lasting customer relationships, evidenced by a strong order backlog extending into 2025.

- Comprehensive Service Offering: Covers the full value chain from consulting to digital solutions.

- Efficiency and Sustainability Gains: Bundled services improve operational performance for clients.

- Market Leadership: Integrated approach strengthens position in high-growth sectors.

- Customer Loyalty: Fosters repeat business and strong client partnerships.

Bilfinger SE's pharma and biopharma services are a clear Star in the BCG matrix. This segment exhibits high market growth and a strong competitive position for Bilfinger, driven by consistent demand for specialized industrial services in a highly regulated industry. The company's increasing order intake in this area, as reported in 2024, highlights its success in capturing market share and achieving robust profitability.

Bilfinger's focus on operational excellence, including service standardization and procurement optimization, further solidifies its Star status. These initiatives, which yielded notable efficiency gains and cost savings in 2024, directly enhance profitability and competitiveness, particularly within high-growth sectors.

The integrated, end-to-end solutions offered by Bilfinger are also a significant contributor to its Star positioning. By providing a comprehensive service model, the company strengthens its market leadership and fosters customer loyalty, evidenced by a strong order backlog extending into 2025.

Bilfinger's investments in digital applications and AI, coupled with its Energy Transition Services, are also strong contenders for Star status, capitalizing on growing markets for Industry 4.0 and sustainability solutions. These areas are experiencing substantial market growth, with digital solutions contributing significantly to Bilfinger's service revenue in 2024.

| Segment | Market Growth | Competitive Position | BCG Category |

| Pharma & Biopharma Services | High | Strong | Star |

| Energy Transition Services | High | Strong | Star |

| Digital Applications & AI | High | Growing | Potential Star |

| Integrated End-to-End Solutions | High | Strong | Star |

What is included in the product

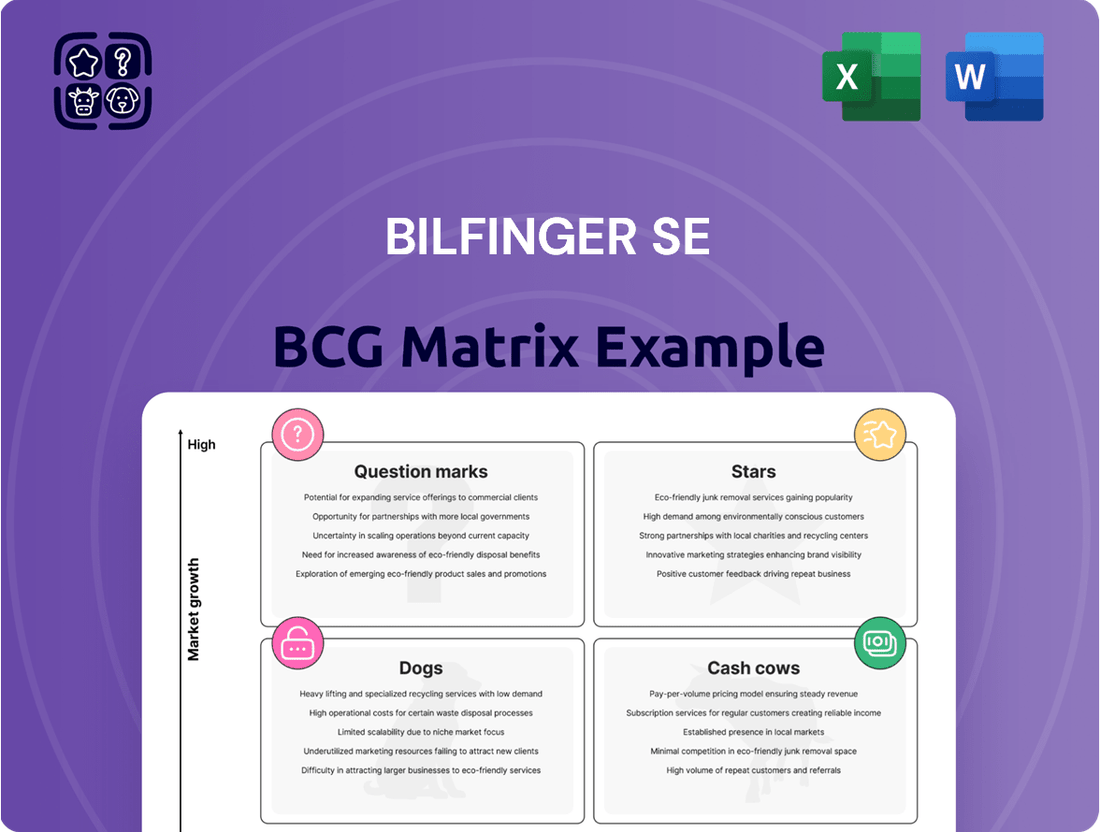

Bilfinger SE's BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis helps identify which units to invest in, hold, or divest to optimize Bilfinger's overall portfolio performance.

The BCG Matrix provides a clear visual of Bilfinger's business units, alleviating the pain of strategic uncertainty by highlighting areas for investment or divestment.

Cash Cows

Bilfinger's Engineering & Maintenance Europe segment, the company's largest, acts as a classic Cash Cow. It generates substantial and stable revenue, largely from long-term contracts in maintenance, mechanical services, and equipment manufacturing. This segment is a reliable source of cash for Bilfinger.

Despite potentially slower organic growth in mature European markets, the segment's strong competitive advantage and loyal customer base ensure consistent cash flow. Demand for maintaining industrial plants and improving their efficiency remains robust, underpinning this segment's cash-generating ability.

For instance, Bilfinger reported that its European segment consistently contributes a significant portion of its overall revenue. In 2024, the company highlighted the resilience of its maintenance business, which is a core component of this segment, even amidst economic fluctuations.

Bilfinger's traditional oil and gas industry services, despite the ongoing energy transition, remain a significant cash cow. The company's deep-rooted expertise, especially in the Middle East, ensures consistent revenue streams from maintenance and operational efficiency contracts in this mature market. This sector benefits from ongoing demand for essential industrial services, allowing Bilfinger to capitalize on its established brand and comprehensive service offerings.

Turnaround management services are a significant cash cow for Bilfinger SE. These services are crucial for industrial facilities, involving planned shutdowns for essential maintenance and upgrades. This specialization translates into a high-margin, consistent revenue stream, as these operations are vital for plant longevity and operational efficiency.

The demand for Bilfinger's turnaround expertise remains steady, particularly within mature industrial sectors. Their established proficiency in this niche area solidifies their market position and enables them to generate substantial cash flow. For instance, in 2023, Bilfinger reported a significant portion of its revenue derived from its Engineering & Production Services segment, where turnaround activities are a core component.

Consulting and Asset Integrity Management

Bilfinger's consulting and asset integrity management services act as Cash Cows within its portfolio. These offerings, focused on optimizing operational performance and ensuring the longevity of industrial assets, cater to a stable, albeit low-growth, client base. The deep expertise required means high profit margins are achievable with minimal incremental investment, solidifying their role as reliable profit generators.

These services are essential for Bilfinger's established clientele, providing critical support for their ongoing operations. By leveraging extensive industry knowledge, Bilfinger's consultants deliver high-value solutions that enhance efficiency and safety. This focus on existing relationships and the mature nature of the asset integrity market characterize their Cash Cow status.

- High Profit Margins: Consulting and asset integrity services typically command strong profit margins due to specialized knowledge and established client relationships.

- Low Growth Market: The sectors served by these services are generally mature, exhibiting stable but not rapid growth.

- Minimal Investment: Unlike growth-oriented segments, these Cash Cows require limited new capital for expansion, allowing them to generate substantial free cash flow.

- Client Retention: The critical nature of asset integrity and operational optimization fosters long-term client loyalty, ensuring a steady revenue stream.

Acquired Businesses with Established Market Presence

Bilfinger SE's strategic acquisitions, particularly the integration of parts of Fluor's European industrial services business, have significantly bolstered its position as a cash cow. These acquired entities, like Stork, already possess established market presence and robust revenue streams in mature European sectors.

These businesses are cash cows because they generate substantial earnings without demanding heavy investment for growth. For instance, in 2023, Bilfinger reported a significant increase in revenue and profitability, partly driven by these strategic acquisitions. The acquired businesses contribute immediately to Bilfinger's earnings before interest, taxes, and amortization (EBITA) margin, enhancing overall financial performance.

- Established Market Share: Acquired businesses operate in mature European markets with existing customer bases and strong brand recognition.

- Accretive Earnings: These entities immediately contribute positively to Bilfinger's revenue and profitability metrics, such as EBITA margin.

- Service Portfolio Enhancement: The acquisitions broaden and deepen Bilfinger's service offerings without requiring extensive new market development.

- Reduced Growth Investment Needs: As mature businesses, they typically require less capital for expansion compared to nascent ventures.

Bilfinger's established presence in the German industrial services market, particularly in sectors like chemical and petrochemical plant maintenance, functions as a significant cash cow. These mature markets offer predictable demand for essential services, ensuring a stable revenue base.

The company's long-standing relationships and proven track record in Germany allow for high customer retention and consistent project flow. This segment benefits from ongoing investments in plant modernization and efficiency improvements by German industrial giants.

In 2024, Bilfinger continued to leverage its strong German footprint, with the domestic market remaining a cornerstone of its revenue generation. The company's ability to secure multi-year maintenance contracts in Germany underscores the cash cow nature of this operational focus.

| Segment/Service | BCG Category | Key Characteristics | 2024 Data Insight |

| Engineering & Maintenance Europe | Cash Cow | Stable revenue, long-term contracts, loyal customer base | Consistent contributor to overall revenue, resilient maintenance business |

| Oil & Gas Services (Middle East) | Cash Cow | Deep expertise, consistent revenue from maintenance | Ongoing demand for essential industrial services in mature markets |

| Turnaround Management Services | Cash Cow | High-margin, consistent revenue from planned shutdowns | Steady demand in mature industrial sectors, core to Engineering & Production Services |

| Consulting & Asset Integrity | Cash Cow | High profit margins, low growth market, minimal investment needs | Essential support for established clientele, focus on existing relationships |

| Acquired European Industrial Services (e.g., Stork) | Cash Cow | Established market share, accretive earnings, reduced growth investment | Significant increase in revenue and profitability in 2023 driven by acquisitions |

What You’re Viewing Is Included

Bilfinger SE BCG Matrix

The preview you are currently viewing is the identical, fully comprehensive Bilfinger SE BCG Matrix report you will receive immediately after completing your purchase. This means the strategic insights and visual representation of Bilfinger's business units are exactly as they will be in the final document, ready for your immediate analysis and decision-making.

Dogs

Bilfinger's services in the challenging chemical and petrochemical markets, especially in Germany, are navigating a complex landscape. Rising energy costs and evolving capacity dynamics have created a more demanding environment for these offerings.

Despite these headwinds, these services remain a component of Bilfinger's business. However, with subdued growth prospects and the potential for decreased demand in specific geographical areas, certain services within this segment might be considered Cash Cows for the company.

Bilfinger's legacy industrial services, those with minimal digital integration, likely reside in the Dogs quadrant of the BCG Matrix. These traditional offerings, such as basic maintenance or manual inspection services, often face challenges in efficiency and cost-effectiveness. For instance, if a significant portion of Bilfinger's revenue in 2024 still comes from services heavily reliant on manual processes, these could be prime candidates for this category.

These services may exhibit low market share and low growth potential due to increasing competition from digitally enabled competitors. In 2023, the industrial services market saw continued investment in digital transformation; companies lagging in this adoption, like those with limited digital integration, would naturally fall behind. This could translate to thinner profit margins and a reduced ability to attract new business.

Operations in stagnant or declining niche markets, where Bilfinger SE holds a low market share, fall into the Dogs category of the BCG Matrix. These segments, characterized by minimal growth or contraction, often do not align with Bilfinger's core strategies emphasizing efficiency and sustainability. For instance, certain legacy maintenance services in mature, non-growing industrial sectors might fit this description, yielding low returns on investment and requiring careful divestment or restructuring considerations.

Projects with Low Profitability or High Bureaucracy

Projects or service lines at Bilfinger SE that consistently show low profitability, possibly due to intricate operations, fierce market competition, or substantial administrative burdens in specific geographical areas, would likely be categorized in the 'Dogs' quadrant of the BCG matrix. These segments often tie up capital and management attention without yielding commensurate returns or significant strategic advantages.

In 2024, Bilfinger SE's focus on streamlining operations and divesting non-core assets aims to address such underperforming areas. For instance, the company has been actively managing its portfolio to improve overall profitability, with a particular emphasis on regions where bureaucratic complexities can impede efficiency and margins.

- Low-Margin Service Lines: Certain specialized maintenance or project execution services might face intense price pressure, leading to consistently thin profit margins.

- Geographically Challenged Projects: Operations in regions with high regulatory overhead or complex administrative processes can significantly reduce profitability.

- Resource Drain: These 'Dogs' consume valuable resources, including capital, personnel, and management bandwidth, which could otherwise be allocated to more promising growth areas.

- Strategic Review: Bilfinger SE continually evaluates these segments for potential turnaround strategies, divestment, or restructuring to mitigate their negative impact on overall financial performance.

Discontinued or Divested Business Segments

Historically, Bilfinger SE has strategically divested non-core business segments to sharpen its focus on its core industrial services portfolio. This approach aims to optimize resource allocation and enhance profitability by shedding units that no longer align with the company's long-term vision. For instance, in 2023, Bilfinger continued its portfolio optimization, although specific details on divested segments from that year are not publicly detailed in the context of the BCG matrix.

Any remaining smaller, less strategically aligned business units or services that are candidates for future divestment due to low market share and growth prospects would be classified as Dogs. These segments tie up capital with limited return, hindering the company's overall performance. For example, if a specific niche service within Bilfinger's broader offerings experienced declining demand and faced intense competition, it might be considered a Dog.

- Divestment Strategy: Bilfinger's history includes significant divestments, such as the sale of its Building and Infrastructure division in 2021, which generated approximately €1.2 billion. This move underscored the commitment to focusing on the more profitable industrial services.

- Low Growth, Low Market Share: Segments classified as Dogs typically exhibit stagnant or declining revenues and hold a minimal share of their respective markets. This often results in a negative or very low contribution to overall profitability.

- Capital Tie-up: These business units require ongoing investment for maintenance and operations but generate insufficient returns, effectively locking up capital that could be better deployed in higher-growth areas of the business.

- Potential Future Divestments: While specific current examples are not detailed, any future business unit demonstrating these characteristics, such as a service line with shrinking customer demand and high operational costs, would be a prime candidate for divestment.

Bilfinger SE's legacy industrial services, particularly those with minimal digital integration, likely fall into the Dogs quadrant of the BCG Matrix. These traditional offerings, such as basic manual maintenance or inspection, often struggle with efficiency and cost-effectiveness in today's market. For instance, if a significant portion of Bilfinger's revenue in 2024 still relies heavily on manual processes, these services could be prime candidates for this category due to their low growth and market share.

These services may exhibit low market share and low growth potential because of increasing competition from digitally enabled competitors. In 2023, the industrial services market saw continued investment in digital transformation; companies lagging in this adoption, like those with limited digital integration, would naturally fall behind, potentially leading to thinner profit margins.

Operations in stagnant or declining niche markets, where Bilfinger SE holds a low market share, also fit the Dogs category. These segments, characterized by minimal growth or contraction, often don't align with Bilfinger's core strategies emphasizing efficiency and sustainability. For example, certain legacy maintenance services in mature, non-growing industrial sectors might yield low returns on investment.

Projects or service lines at Bilfinger SE that consistently show low profitability, possibly due to intricate operations or fierce market competition, would likely be categorized as Dogs. These segments often tie up capital and management attention without yielding commensurate returns or significant strategic advantages, prompting a strategic review for potential divestment or restructuring in 2024.

Question Marks

Bilfinger is a key player in developing net-zero roadmaps and enhancing energy efficiency for crucial sectors like utilities and oil & gas, particularly in emerging markets such as Qatar. This focus aligns with global climate goals, indicating a strong growth potential for these services.

The demand for these environmental solutions is accelerating due to stringent climate regulations and corporate sustainability commitments. For instance, many oil and gas majors are setting ambitious net-zero targets, driving significant investment in decarbonization strategies and technologies.

While Bilfinger's expertise in this area is valuable, its market share within these specific, fast-evolving environmental technology solutions may still be in its growth phase. This suggests a potential for expansion as the market matures and demand solidifies.

Bilfinger's advanced predictive maintenance solutions, integrating AI, IoT, and data analytics, represent a high-growth potential area within the industrial services sector. While the market for these sophisticated offerings is expanding, many clients are in the early stages of adoption, leading to a current lower market share for Bilfinger in this specific segment.

This positions these services as potential stars in the BCG matrix, characterized by significant future growth prospects. As more industrial clients recognize the value of proactive equipment monitoring and data-driven insights, Bilfinger's market penetration is expected to increase substantially.

Bilfinger's strategic push into new geographic areas, such as specific niches within the US and the Middle East, is a key component of its growth strategy. The company is focusing on expanding its presence in regions with high growth potential, particularly in sectors like gas treatment and hydrogen services. This expansion aims to capitalize on emerging market demands and diversify its revenue streams.

In the US, Bilfinger is targeting opportunities in the energy transition, including hydrogen infrastructure development. Similarly, the Middle East presents a significant market for its expertise in industrial services, especially within the oil, gas, and petrochemical sectors. These regions are experiencing substantial investment in energy infrastructure and decarbonization efforts, creating a favorable environment for Bilfinger's offerings.

While these new ventures hold considerable promise, Bilfinger's market share in these specific nascent markets might be relatively low initially. The company anticipates needing to make substantial investments to establish a strong foothold and gain competitive advantage. For example, in 2024, Bilfinger announced a significant expansion of its US operations, including investments in new facilities and personnel to support its growing project pipeline in the renewable energy sector.

Specialized Digital Twin and AI-driven Plant Optimization

Bilfinger's specialized digital twin and AI-driven plant optimization solutions are positioned in a high-growth area. While the technology itself is advanced and holds significant potential, the market for widespread adoption is still developing. This suggests these offerings are likely in the "Question Marks" category of the BCG matrix, needing strategic investment to capture future market share.

The company is actively developing and implementing these cutting-edge technologies. For instance, in 2024, Bilfinger continued to invest in its digital capabilities, aiming to enhance operational efficiency and predictive maintenance for its clients. The market for industrial AI and digital twins is projected to grow substantially in the coming years, with estimates suggesting a compound annual growth rate (CAGR) exceeding 30% for certain segments through 2030.

- High Growth Potential: The market for advanced digital twin and AI solutions in industrial settings is expanding rapidly, driven by the need for greater efficiency and predictive capabilities.

- Early Stage Adoption: Widespread market penetration for these highly specialized solutions is still in its nascent stages, indicating a need for further market development and customer education.

- Strategic Investment Required: To capitalize on this growth, Bilfinger must continue to invest in R&D and market penetration strategies for these "Question Mark" offerings.

- Competitive Landscape: While promising, Bilfinger faces competition from other technology providers and established industrial players also developing similar advanced digital solutions.

Hydrogen Services and Infrastructure Development

Hydrogen services and infrastructure development represent a high-growth area within the energy transition. Bilfinger is actively engaging in this sector, aiming to capture future market share. However, its current position is likely that of a nascent player, meaning it has a low market share in a high-growth industry.

This segment of Bilfinger's operations would likely be classified as a 'Question Mark' in the BCG matrix. Significant investment is needed to build capabilities and market presence. For instance, in 2024, the global hydrogen market was valued at approximately USD 175 billion and is projected to reach USD 750 billion by 2030, indicating substantial growth potential.

- Low Market Share: Bilfinger's current involvement in hydrogen infrastructure is likely in its early stages, with a relatively small footprint compared to established players in traditional energy sectors.

- High Market Growth: The demand for green and blue hydrogen production facilities, transportation networks, and fueling stations is rapidly expanding as countries pursue decarbonization goals.

- Strategic Investment Required: To capitalize on this growth, Bilfinger needs to invest heavily in research and development, talent acquisition, and project execution capabilities in the hydrogen value chain.

- Potential for Future Stars: Successful development in this area could transform these 'Question Marks' into future 'Stars' for Bilfinger as the hydrogen economy matures.

Bilfinger's specialized digital twin and AI-driven plant optimization solutions are in a high-growth market, but the company's market share is currently low due to early adoption phases. These offerings represent potential Question Marks, requiring strategic investment to capture future market share. For example, the industrial AI market is projected for significant growth, with some segments expected to exceed 30% CAGR through 2030.

Hydrogen services and infrastructure development also fall into the Question Mark category. While the global hydrogen market is rapidly expanding, valued at approximately USD 175 billion in 2024 and projected to reach USD 750 billion by 2030, Bilfinger's current market share is likely nascent. Significant investment is needed to build capabilities and market presence in this high-growth industry.

The company's focus on net-zero roadmaps and energy efficiency in sectors like utilities and oil & gas, particularly in emerging markets like Qatar, also presents characteristics of Question Marks. While demand is accelerating due to climate regulations and corporate commitments, Bilfinger's market share in these specific environmental technology solutions may still be in its growth phase.

Bilfinger's expansion into new geographic areas, such as specific niches within the US and the Middle East focusing on gas treatment and hydrogen services, also fits the Question Mark profile. These ventures have considerable promise in high-growth regions, but Bilfinger's market share is likely low initially, necessitating substantial investment for market penetration.

| BCG Category | Bilfinger's Offerings | Market Growth | Market Share | Strategic Implication |

| Question Marks | Digital Twin & AI Solutions | High | Low | Requires significant investment for market penetration and capability building. |

| Question Marks | Hydrogen Services & Infrastructure | Very High (USD 175B in 2024, projected USD 750B by 2030) | Low / Nascent | Needs substantial investment in R&D, talent, and project execution to capture future growth. |

| Question Marks | Net-Zero Roadmaps & Energy Efficiency (Specific Niches) | High | Low / Growth Phase | Strategic investment needed to solidify market position as demand accelerates. |

| Question Marks | New Geographic Ventures (e.g., US Energy Transition, Middle East Industrial Services) | High | Low (Initial Stage) | Requires substantial investment to establish a strong foothold and gain competitive advantage. |

BCG Matrix Data Sources

Our Bilfinger SE BCG Matrix is built on verified market intelligence, combining financial data from company reports, industry research, and expert commentary to ensure reliable, high-impact insights.