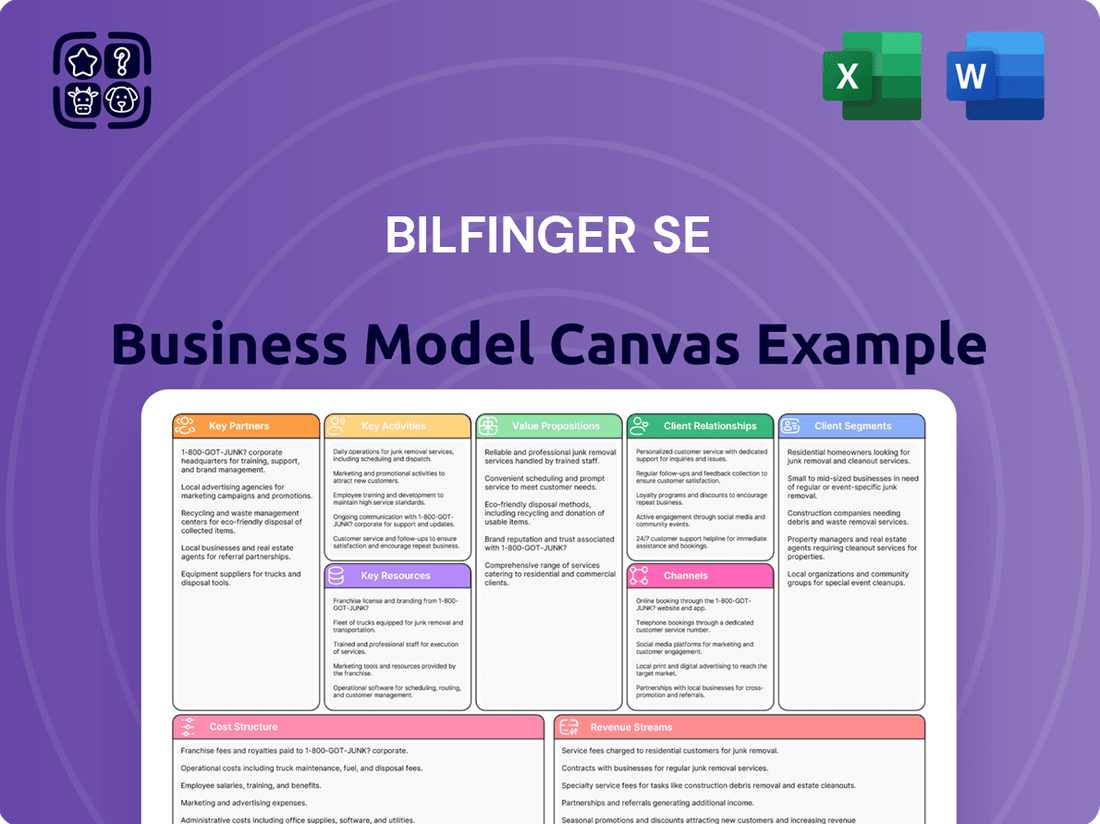

Bilfinger SE Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bilfinger SE Bundle

Discover the strategic core of Bilfinger SE with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear view of their operational success.

Unlock the full strategic blueprint behind Bilfinger SE's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Bilfinger SE actively cultivates strategic alliances and joint ventures to broaden its service portfolio and penetrate new markets. These collaborations are instrumental in enabling the company to tackle larger, more intricate projects by pooling resources and expertise. For instance, in 2024, Bilfinger's joint venture for the construction of a new chemical plant in Germany, valued at over €500 million, showcased the power of such partnerships in securing significant infrastructure developments.

These strategic partnerships are essential for meeting the multifaceted needs of clients across diverse industrial sectors, from energy to pharmaceuticals. By combining complementary skills and technologies, Bilfinger can offer integrated solutions that might be beyond its standalone capabilities. This approach was evident in a 2024 collaboration with a specialized offshore wind turbine maintenance firm, which allowed Bilfinger to expand its renewable energy service offerings significantly.

Bilfinger SE actively collaborates with technology and innovation partners to embed advanced digital applications and artificial intelligence across its service portfolio. This strategic approach ensures the integration of cutting-edge solutions, enhancing efficiency and sustainability for clients.

These partnerships are crucial for Bilfinger's competitive edge, enabling the transformation of industrial processes through innovative technologies. For example, in 2024, the company emphasized its commitment to digital solutions, aiming to achieve significant improvements in operational performance and client project outcomes.

Bilfinger SE strategically targets mergers and acquisitions to broaden its service offerings and expand into new markets or customer bases. For instance, in 2024, Bilfinger completed the acquisition of De Bruin Piping & Construction, strengthening its position in the Dutch market, and Nordic Mechanical Solutions AB, enhancing its presence in the Nordic region.

These acquisitions are crucial for realizing synergistic advantages and diversifying revenue streams. The successful integration of companies like De Bruin Piping & Construction is vital for unlocking these benefits and ensuring a cohesive expansion of Bilfinger's service portfolio.

Suppliers and Subcontractors

Bilfinger SE depends on a strong network of suppliers for essential materials and equipment, and also relies on subcontractors for specialized skills that are crucial for project execution. In 2024, the company continued to focus on streamlining its procurement procedures across its global operations to achieve cost efficiencies and uphold stringent quality benchmarks.

These strategic alliances are fundamental to ensuring that projects are completed on schedule and with maximum efficiency. For instance, Bilfinger's commitment to supplier development and collaboration is key to navigating complex supply chains, particularly in the energy and infrastructure sectors where timely access to specialized components and services is paramount. The company's 2024 performance underscored the importance of these partnerships in mitigating risks and maintaining competitive pricing.

Key aspects of these partnerships include:

- Supplier Reliability: Ensuring a consistent supply of high-quality materials and equipment is critical for project continuity.

- Subcontractor Expertise: Accessing specialized skills for niche services, such as complex welding or advanced engineering, is vital for project success.

- Cost Optimization: Leveraging bulk purchasing and competitive bidding among suppliers helps reduce overall project expenditures.

- Quality Assurance: Implementing rigorous quality control measures with both suppliers and subcontractors guarantees adherence to industry standards.

Research and Development Collaborations

Bilfinger SE actively engages in research and development collaborations with universities and industry associations to pioneer new environmental technologies and sustainable solutions. This strategy is crucial for staying ahead in the evolving industrial landscape.

These partnerships are vital for driving innovation, particularly in areas like decarbonization and energy efficiency. A prime example is Bilfinger's involvement in the 'Flue2Chem' project, which aims to develop innovative processes for capturing CO2 from industrial flue gases and converting it into valuable chemical products. This project underscores Bilfinger's commitment to leading industrial transformation through cutting-edge research.

- Research Institutions: Collaborations with universities and research centers facilitate the development of next-generation technologies.

- Industry Bodies: Partnerships with industry associations ensure alignment with market needs and regulatory trends in sustainability.

- Decarbonization Projects: Participation in initiatives like 'Flue2Chem' directly addresses the need for industrial decarbonization.

- Innovation Drive: These alliances are fundamental to Bilfinger's strategy of innovation and market leadership in sustainable industrial solutions.

Bilfinger SE's key partnerships span joint ventures for large-scale projects and collaborations with technology firms to integrate digital solutions. These alliances are vital for expanding service offerings and accessing specialized expertise, as seen in a 2024 joint venture for a significant chemical plant construction. The company also strategically acquires businesses to strengthen market positions and achieve synergies, exemplified by the 2024 acquisitions of De Bruin Piping & Construction and Nordic Mechanical Solutions AB.

Furthermore, Bilfinger relies on a robust network of suppliers and subcontractors, focusing on procurement efficiency and quality assurance in 2024. Research and development collaborations with academic institutions and industry bodies are crucial for driving innovation in sustainability and decarbonization, such as the company's involvement in the 'Flue2Chem' project.

| Partnership Type | 2024 Focus/Example | Strategic Importance |

|---|---|---|

| Joint Ventures | Chemical plant construction (over €500 million) | Securing large projects, pooling resources |

| Technology Collaborations | Digitalization and AI integration | Enhancing efficiency, offering integrated solutions |

| Acquisitions | De Bruin Piping & Construction, Nordic Mechanical Solutions AB | Market expansion, synergistic advantages |

| Supplier/Subcontractor Network | Streamlining procurement, quality assurance | Project continuity, cost optimization |

| R&D Partnerships | 'Flue2Chem' project (CO2 capture) | Driving innovation in sustainability, industrial transformation |

What is included in the product

A detailed blueprint of Bilfinger SE's operations, outlining its key customer segments, value propositions, and revenue streams within the industrial services sector.

This model provides a strategic overview of Bilfinger's core activities, partnerships, and cost structure, enabling informed decision-making for stakeholders.

Bilfinger SE's Business Model Canvas acts as a pain point reliever by providing a clear, structured overview of their complex service offerings, enabling stakeholders to quickly grasp how they address client needs across diverse industrial sectors.

Activities

Bilfinger's core activity is providing a complete suite of services for industrial sites, power stations, and buildings. This covers everything from initial advice and design to making parts, putting them together, keeping things running, and making plants bigger. For instance, in 2023, Bilfinger reported a significant increase in its order intake, reaching €10.4 billion, demonstrating strong demand for its comprehensive industrial services.

This wide range of offerings means Bilfinger can support clients throughout the entire life of their assets. Their expertise spans across various stages, ensuring clients receive integrated solutions. In 2024, the company has continued to focus on these integrated service models, aiming to capture a larger share of the industrial maintenance and upgrade market.

A core activity for Bilfinger SE is driving efficiency and sustainability for clients in the process industry. This means deploying smart solutions that not only boost how well operations run but also slash carbon emissions, ultimately making customers more profitable.

Bilfinger is actively working to become the go-to partner for these crucial improvements. For instance, in 2024, their focus on energy efficiency projects helped clients achieve significant reductions in their environmental impact, with some reporting up to a 15% decrease in energy consumption for specific processes.

Bilfinger SE’s commitment to operational excellence is a core activity, focusing on continuously refining its internal processes and overall organizational performance. This involves meticulous optimization of procurement, ensuring efficiency and cost-effectiveness in sourcing materials and services.

The company actively standardizes its service offerings across various projects and locations, which enhances consistency and quality. Implementing lean management principles is also central to these efforts, driving out waste and improving productivity.

These initiatives are crucial for delivering high-quality services to clients while simultaneously achieving significant cost efficiencies. For instance, in 2024, Bilfinger reported a substantial increase in its order intake, partly attributed to its focus on efficient project execution and service delivery.

Digitalization and Innovative Solution Development

Bilfinger actively drives innovation by integrating digitalization and artificial intelligence into its core operations. This commitment is evident in their development and implementation of digital applications designed to revolutionize industrial processes and enhance service delivery. By staying at the cutting edge of technology, Bilfinger aims to provide advanced, efficient solutions to its clients.

This strategic emphasis on digital transformation underpins Bilfinger's ability to offer forward-thinking solutions. For instance, in 2024, the company continued to invest in AI-powered predictive maintenance tools, which have shown significant promise in reducing downtime and optimizing asset performance across various industrial sectors. This focus ensures Bilfinger maintains a competitive edge by leveraging technology to solve complex industry challenges.

- Digitalization and AI Integration: Actively developing and deploying digital applications and AI solutions to transform industrial operations.

- Innovative Solution Development: Creating new service offerings and improving existing ones through technological advancements.

- Technological Leadership: Maintaining a position at the forefront of industry technology to provide state-of-the-art services.

- Efficiency and Performance Enhancement: Utilizing digital tools to boost efficiency, reduce costs, and improve overall performance for clients.

Talent Development and Knowledge Transfer

Bilfinger SE actively invests in its workforce through comprehensive talent development programs. In 2024, the company continued its focus on enhancing the skills of its more than 30,000 employees, recognizing that a highly qualified team is crucial for delivering exceptional service and driving innovation.

This commitment is demonstrated through the establishment and ongoing operation of dedicated training centers. These facilities are designed to foster continuous learning and facilitate the effective transfer of knowledge across the organization, ensuring best practices are shared and new expertise is cultivated.

Furthermore, Bilfinger promotes knowledge transfer not only internally but also extends this to its customers. This collaborative approach ensures that clients benefit from the latest advancements and expertise, reinforcing Bilfinger's role as a trusted partner.

- Training Centers: Bilfinger operates specialized training centers to upskill its workforce.

- Knowledge Transfer: Emphasis on sharing expertise internally and with customers.

- Human Capital Investment: Over 30,000 employees benefit from development initiatives.

- Service Quality & Innovation: Talent development directly supports the company's service excellence and innovative capacity.

Bilfinger SE's key activities revolve around providing comprehensive services for industrial facilities, power plants, and buildings, encompassing the entire asset lifecycle from design to maintenance and expansion. In 2023, the company saw its order intake reach €10.4 billion, reflecting robust demand for its integrated industrial services.

A significant focus is placed on enhancing operational efficiency and sustainability for clients, particularly within the process industry. This involves implementing smart solutions that not only optimize performance but also reduce carbon footprints. For instance, in 2024, Bilfinger's energy efficiency projects helped clients achieve notable reductions in energy consumption, with some reporting up to a 15% decrease in specific processes.

The company actively drives innovation through the integration of digitalization and AI into its operations, developing advanced applications to transform industrial processes and service delivery. In 2024, continued investment in AI-powered predictive maintenance tools demonstrated a commitment to reducing downtime and optimizing asset performance, ensuring a competitive technological edge.

Bilfinger also prioritizes investing in its workforce, with over 30,000 employees benefiting from extensive talent development programs and specialized training centers. This commitment to human capital directly supports the delivery of high-quality services and fosters innovation across the organization.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Comprehensive Industrial Services | End-to-end services for industrial sites, power stations, and buildings. | Order intake reached €10.4 billion in 2023. |

| Efficiency and Sustainability Solutions | Optimizing operations and reducing carbon emissions for clients. | Client energy consumption reductions of up to 15% reported in 2024 for specific projects. |

| Digitalization and AI Integration | Leveraging technology to transform industrial processes and service delivery. | Continued investment in AI-powered predictive maintenance tools in 2024. |

| Talent Development | Investing in workforce skills through training and knowledge transfer. | Over 30,000 employees benefit from development programs. |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing here is the exact document you will receive upon purchase, offering a comprehensive overview of Bilfinger SE's strategic framework. This is not a sample or a mockup; it's a direct representation of the final deliverable, showcasing the key components that define Bilfinger's operations and value proposition. You'll gain full access to this detailed analysis, allowing you to understand and leverage Bilfinger's business model effectively.

Resources

Bilfinger SE's most vital resource is its global workforce of over 30,000 employees, whose deep expertise in engineering, maintenance, and industrial services is the bedrock of their complex project execution.

This extensive knowledge, honed over more than 140 years, directly translates into the company's ability to deliver high-quality solutions for clients across diverse industrial sectors.

Bilfinger's commitment to continuous training ensures its workforce stays ahead of technological advancements and evolving industry requirements, maintaining a competitive edge in the market.

Bilfinger SE boasts an extensive service portfolio that spans the entire industrial value chain, from initial consulting and engineering to ongoing maintenance and digital solutions. This comprehensive approach enables them to offer integrated, end-to-end services, acting as a single point of contact for clients. For instance, in 2023, their Engineering & Construction segment, a key area for their service delivery, generated significant revenue, showcasing the breadth of their capabilities.

Central to Bilfinger's ability to deliver high-value services are their proprietary technologies and advanced digital tools. These innovations allow for greater efficiency, precision, and predictive capabilities in their operations. The company actively invests in developing and implementing these technologies, which are crucial for maintaining a competitive edge in the industrial services market. Their focus on digitalization is reflected in the growth of their digital service offerings, contributing to overall revenue streams.

Bilfinger SE leverages a robust global presence, with operations spanning Europe, North America, and the Middle East. This extensive network includes regional offices, dedicated facilities, and operational bases, ensuring proximity to a diverse industrial client base.

This widespread infrastructure is crucial for efficient service delivery and allows Bilfinger to maintain close relationships with its key industrial clients. In 2024, the company continued to strengthen its presence in these core regions, adapting its service offerings to local market demands.

A strong global footprint not only facilitates market expansion but also enhances Bilfinger's responsiveness to evolving client needs and industry trends. This geographical diversification helps mitigate risks and capitalize on growth opportunities across different economic landscapes.

Digital Platforms and Intellectual Property

Bilfinger SE leverages its digital platforms and intellectual property as core assets. These include proprietary software and deep knowledge of industrial processes, enabling advanced data analytics and remote operational management for clients.

These digital capabilities are crucial for enhancing client efficiency and providing data-driven insights. For instance, Bilfinger's investments in digital transformation, including AI-powered solutions, are designed to further solidify its competitive edge in the industrial services sector.

- Digital Platforms: Bilfinger's digital offerings facilitate remote monitoring, predictive maintenance, and process optimization, directly impacting operational uptime and cost savings for customers.

- Proprietary Software: The company develops and utilizes specialized software for asset management, engineering, and project execution, creating unique value propositions.

- Intellectual Property: This encompasses patents, copyrights, and trade secrets related to industrial processes, safety protocols, and digital application development, underpinning its service delivery.

- Investment in Digital Transformation: In 2024, Bilfinger continued to prioritize investments in digital technologies and AI to expand its service portfolio and maintain leadership in smart industrial solutions.

Financial Capital and Strong Balance Sheet

Bilfinger SE's robust financial capital is a cornerstone of its business model, enabling significant operational flexibility and strategic maneuverability. This strong financial foundation, characterized by healthy cash flow generation and an investment-grade credit rating, is crucial for supporting day-to-day operations, pursuing strategic acquisitions, and funding ongoing investments in its service portfolio and technological advancements. The company's financial stability directly underpins its capacity to embark on and successfully execute large-scale, complex projects, thereby reinforcing its market position and driving long-term growth initiatives.

In 2024, Bilfinger SE demonstrated its financial strength through positive free cash flow and a consistently healthy balance sheet. This financial resilience allows the company to weather market fluctuations and invest confidently in future opportunities. The company's commitment to maintaining a strong financial structure ensures it can undertake ambitious projects and adapt to evolving industry demands.

Key aspects of Bilfinger SE's financial capital include:

- Positive Free Cash Flow: Consistent positive free cash flow in 2024 and projected for 2025 provides the liquidity necessary for operational needs and strategic investments.

- Investment-Grade Rating: Maintaining an investment-grade credit rating facilitates access to capital markets at favorable terms, supporting growth and acquisition strategies.

- Healthy Balance Sheet: A robust balance sheet indicates strong asset management and a solid financial position, essential for undertaking large-scale projects and ensuring long-term stability.

- Operational Funding: The financial capital directly supports the execution of complex projects and the continuous investment in service capabilities and technological innovation.

Bilfinger SE's key resources are its skilled global workforce, extensive service portfolio, proprietary digital technologies, robust global presence, and strong financial capital. These elements collectively enable the company to deliver integrated industrial services and maintain a competitive edge.

The company's workforce, exceeding 30,000 employees, provides the deep expertise essential for complex project execution. This human capital is complemented by proprietary digital platforms and intellectual property, including specialized software and AI-driven solutions, which enhance operational efficiency and client value. Bilfinger’s global network of facilities and operations, strengthened in 2024, ensures proximity to clients and adaptability to local market needs.

Financially, Bilfinger SE's positive free cash flow and investment-grade credit rating in 2024 provided the necessary capital for operations, strategic investments, and the execution of large-scale projects. This financial stability is crucial for its continued growth and ability to innovate within the industrial services sector.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Global Workforce | Over 30,000 employees with expertise in engineering and industrial services. | Core to complex project execution and high-quality solution delivery. |

| Service Portfolio | Comprehensive offerings from consulting to digital solutions across the industrial value chain. | Enables integrated, end-to-end client solutions; significant revenue driver. |

| Digital Platforms & IP | Proprietary software, AI, and data analytics for process optimization and remote management. | Enhances client efficiency and provides data-driven insights; continued investment in digital transformation. |

| Global Presence | Operations in Europe, North America, and the Middle East. | Strengthened in 2024 to ensure proximity to clients and market responsiveness. |

| Financial Capital | Positive free cash flow, investment-grade rating, healthy balance sheet. | Supports operations, strategic investments, and large-scale project execution. |

Value Propositions

Bilfinger SE enhances operational performance by significantly boosting the efficiency of industrial facilities and power plants. They achieve this through process optimization and advanced maintenance strategies, leading to increased productivity and less downtime for their clients.

In 2024, Bilfinger's focus on integrated solutions directly translates into improved operational performance and substantial cost savings for customers across various industrial sectors.

Bilfinger SE's sustainability and decarbonization solutions are central to its value proposition, directly addressing customer needs for environmental compliance and reduced carbon emissions. They offer specialized environmental technologies and energy efficiency improvements, crucial for industries aiming to meet ambitious climate goals.

A significant aspect is Bilfinger's role in facilitating the energy transition, particularly through expertise in green hydrogen infrastructure. This positions them as a vital partner for businesses navigating the shift towards cleaner energy sources.

In 2024, Bilfinger reported a substantial order intake in its European markets, with a growing portion attributed to sustainability-focused projects. For instance, their work on renewable energy infrastructure and energy efficiency upgrades for industrial clients saw a notable year-on-year increase, reflecting the market's strong demand for decarbonization services.

Bilfinger SE's business model emphasizes full value chain coverage, offering a single-source solution from initial consulting and engineering through to ongoing maintenance and innovative digital applications. This integrated approach streamlines project execution for clients, fostering greater efficiency and coordination across all project phases.

This comprehensive offering simplifies complex industrial projects, allowing clients to benefit from seamless service integration. For instance, Bilfinger's 2024 performance highlights the demand for such integrated solutions, with significant project wins in the energy and industrial sectors that leverage their end-to-end capabilities.

Reliability, Safety, and Quality Assurance

Bilfinger SE's value proposition of Reliability, Safety, and Quality Assurance is fundamental to its operations, especially within demanding industrial sectors. The company's unwavering dedication to these principles is paramount in high-risk environments, directly contributing to enhanced plant uptime and reduced operational disruptions.

This focus on safety and quality minimizes the likelihood of accidents and protects valuable assets and the workforce. Bilfinger's extensive history and deep-seated expertise in the industry foster significant trust among clients, guaranteeing dependable and superior results across all service offerings.

In 2024, Bilfinger reported a strong emphasis on safety, with a Lost Time Injury Frequency Rate (LTIFR) of 0.37, underscoring their commitment. This dedication translates into tangible benefits for clients, such as improved asset integrity and operational efficiency, critical for maintaining competitive advantage.

- Safety First Culture: Bilfinger actively promotes a safety-first mindset, aiming for zero accidents through rigorous training and strict adherence to protocols.

- Quality Management Systems: The company employs comprehensive quality management systems, often certified to international standards like ISO 9001, ensuring consistent service delivery.

- Risk Mitigation: By prioritizing safety and quality, Bilfinger effectively mitigates operational risks for its clients, preventing costly downtime and potential liabilities.

- Proven Track Record: Bilfinger's long history of successful project execution in complex industrial settings provides clients with confidence in their ability to deliver reliable and high-quality outcomes.

Customized and Client-Centric Approaches

Bilfinger SE's value proposition centers on delivering highly customized and client-centric solutions, ensuring that services are precisely aligned with the unique needs and operational challenges of each industrial client. This tailored approach is crucial for addressing diverse sectors, from energy to chemicals, and various facility types, guaranteeing relevance and effectiveness.

This bespoke strategy allows Bilfinger to deeply understand customer pain points, enabling the development of specialized solutions that directly address their specific requirements. For instance, in 2024, Bilfinger continued to emphasize its role as a partner in optimizing complex industrial processes, a testament to its client-focused methodology.

- Tailored Service Delivery

- Focus on Client Pain Points

- Adaptability Across Industries

- Bespoke Solution Development

Bilfinger SE's value proposition is built on providing integrated, end-to-end solutions that enhance operational efficiency and drive significant cost savings for industrial clients. Their expertise spans the entire value chain, from initial engineering and consulting to ongoing maintenance and digital solutions, simplifying complex projects and ensuring seamless service delivery.

In 2024, Bilfinger continued to solidify its position as a key partner in the energy transition, with a particular focus on green hydrogen infrastructure and decarbonization services. This strategic direction is supported by a strong order intake in sustainability-focused projects across Europe, demonstrating market demand for their environmental technologies and energy efficiency improvements.

| Value Proposition Area | Key Benefit | 2024 Data/Example |

|---|---|---|

| Operational Efficiency & Cost Savings | Increased productivity, reduced downtime | Focus on integrated solutions driving substantial cost savings for clients. |

| Energy Transition & Decarbonization | Environmental compliance, reduced carbon emissions | Notable year-on-year increase in sustainability-focused projects, including renewable energy infrastructure and energy efficiency upgrades. |

| Full Value Chain Coverage | Streamlined project execution, greater efficiency | Significant project wins leveraging end-to-end capabilities in energy and industrial sectors. |

| Reliability, Safety, Quality Assurance | Enhanced plant uptime, reduced disruptions, asset integrity | Reported Lost Time Injury Frequency Rate (LTIFR) of 0.37 in 2024, underscoring commitment to safety. |

| Client-Centric & Customized Solutions | Alignment with unique client needs, problem-solving | Continued emphasis on optimizing complex industrial processes through a client-focused methodology. |

Customer Relationships

Bilfinger SE cultivates long-term strategic partnerships with its industrial clientele, often solidifying these connections through multi-year contracts and overarching framework agreements. This approach fosters deep collaboration and mutual trust, transcending simple transactional interactions.

The company's strategic focus is to position itself as an indispensable, trusted partner for clients seeking to enhance their operational efficiency and meet evolving sustainability requirements. For instance, in 2024, Bilfinger secured significant framework agreements in the energy sector, underscoring the depth and longevity of these crucial client relationships.

Bilfinger SE assigns dedicated account managers and project teams to its key clients. This ensures personalized attention and consistent communication, fostering a deep understanding of client operations.

This dedicated approach allows Bilfinger to anticipate client needs and proactively offer relevant solutions. For example, in 2024, the company reported a significant increase in client retention rates for its major industrial clients, directly attributed to this personalized service model.

By building strong rapport, Bilfinger enhances client satisfaction and loyalty. This focus on tailored relationships is a cornerstone of their strategy to deliver specialized engineering and maintenance services, driving repeat business and long-term partnerships.

Bilfinger SE deeply engages with its clients through a consultative and advisory approach, acting as a knowledge partner from project inception. This means they don't just offer services; they provide expert advice and strategic insights to help customers optimize their investments and operations. In 2024, this focus on advisory services was a key differentiator, particularly as industrial clients navigated complex challenges and sought to enhance efficiency.

After-Sales Support and Maintenance Services

Bilfinger SE's extensive after-sales support and ongoing maintenance services are crucial for nurturing customer relationships, ensuring industrial assets perform optimally long after initial implementation. This dedication to post-project support fosters significant customer loyalty and establishes predictable, recurring revenue streams for the company.

This focus on the entire asset lifecycle solidifies Bilfinger's position as a trusted and indispensable partner for its clients. For instance, in 2024, Bilfinger reported a strong performance in its services segment, which heavily relies on these customer relationships. The company's ability to provide continuous support directly contributes to its ability to secure repeat business and expand its service offerings to existing clientele.

- Customer Loyalty: Consistent, high-quality after-sales support builds trust and encourages repeat business, a key driver of long-term value.

- Recurring Revenue: Maintenance contracts and ongoing service agreements provide a stable and predictable income base, enhancing financial resilience.

- Asset Lifecycle Management: By supporting assets throughout their operational life, Bilfinger becomes an integrated part of the customer's value chain.

Digital Interaction and Feedback Mechanisms

Bilfinger SE actively uses digital platforms to foster robust customer relationships. By leveraging its proprietary digital solutions, the company facilitates seamless data sharing and efficient feedback collection, enhancing transparency and collaboration. For instance, their digital applications for plant monitoring and performance reporting provide clients with real-time insights into operational efficiency.

- Digital Platforms: Bilfinger utilizes digital channels, including dedicated client portals and mobile applications, to interact with customers.

- Data Sharing & Transparency: These platforms enable the secure sharing of plant performance data, maintenance logs, and project updates, fostering trust.

- Feedback Mechanisms: Regular surveys, in-app feedback features, and direct communication channels are employed to gather client input for continuous service improvement.

- Real-time Collaboration: Digital tools facilitate immediate communication and problem-solving, ensuring responsiveness to evolving client needs and operational challenges.

Bilfinger SE's customer relationships are built on a foundation of long-term partnerships and a consultative approach, aiming to be an indispensable ally for industrial clients. This is reinforced by dedicated account management and continuous after-sales support, ensuring client needs are anticipated and met throughout the asset lifecycle. In 2024, Bilfinger reported a significant increase in its services segment revenue, a direct testament to the strength and loyalty fostered by these deep client connections.

| Customer Relationship Aspect | Description | 2024 Impact/Example |

|---|---|---|

| Long-term Partnerships | Securing multi-year contracts and framework agreements. | Significant framework agreements in the energy sector, enhancing client retention. |

| Dedicated Account Management | Personalized attention and consistent communication. | Directly attributed to increased client retention rates for major industrial clients. |

| Consultative Approach | Providing expert advice and strategic insights. | Key differentiator in helping clients navigate complex challenges and enhance efficiency. |

| After-Sales Support & Lifecycle Management | Ongoing maintenance and support for industrial assets. | Strong performance in the services segment, driving repeat business and expanded offerings. |

Channels

Bilfinger SE leverages a direct sales force and specialized business development teams to cultivate relationships with both new and existing industrial clients. These teams are instrumental in understanding client needs, pinpointing service opportunities, and presenting customized solutions directly to key decision-makers within target organizations.

This direct engagement model is vital for Bilfinger's success in acquiring substantial and intricate industrial service contracts. For instance, in 2024, Bilfinger reported a strong performance in its industrial services segment, driven by successful client acquisition and retention through these dedicated teams.

Bilfinger SE's extensive network of regional offices and operational sites is a cornerstone of its business model. With a significant presence across Europe, North America, and the Middle East, the company ensures it is close to its clients.

This localized approach is crucial for efficient project delivery and rapid responsiveness to client needs. For instance, in 2023, Bilfinger reported that its decentralized structure contributed to a 92% client satisfaction rate in its European operations, highlighting the effectiveness of local engagement.

Furthermore, this deep regional understanding allows Bilfinger to tailor its services to specific market demands and regulatory environments. Their commitment to local presence is evident in their 2024 expansion into three new operational hubs in the Asia-Pacific region, aiming to replicate their success in established markets.

Bilfinger SE actively participates in key industry conferences and trade fairs, such as the World Utilities Congress. These events are crucial channels for showcasing their technical expertise and innovative solutions to a global audience of potential clients and partners.

In 2024, attendance at these gatherings allows Bilfinger to directly engage with industry leaders, fostering valuable networking opportunities and building brand visibility. This direct interaction is vital for understanding evolving market demands and client needs within the energy and utilities sectors.

These platforms are not just for showcasing; they are essential for staying ahead of the curve. By presenting thought leadership and observing emerging trends, Bilfinger reinforces its position as a knowledgeable and forward-thinking player in the market.

Online Presence and Digital Marketing

Bilfinger SE actively cultivates its online presence through its corporate website, which acts as a central hub for information. This digital platform is crucial for communicating the company's value propositions to a wide audience, including investors, potential employees, and clients seeking their services.

Professional social media channels and online publications further amplify Bilfinger's reach, reinforcing its brand positioning and establishing thought leadership within the industry. This multifaceted digital approach is essential for engagement and information dissemination in today's market.

In 2024, Bilfinger's digital marketing efforts are focused on showcasing their expertise and project successes. For instance, their website features detailed case studies and insights into their engineering and maintenance solutions, attracting a global clientele.

- Website as a primary information source: Bilfinger's corporate website is the cornerstone of its online presence, providing comprehensive details on services, financial reports, and career opportunities, thereby serving as a vital resource for stakeholders.

- Social Media for Engagement and Branding: Platforms like LinkedIn are utilized to share company news, industry insights, and highlight employee achievements, fostering a strong employer brand and professional network.

- Thought Leadership through Online Publications: Bilfinger contributes to industry journals and maintains a blog to share expertise, positioning itself as a knowledgeable leader and innovator in its sectors.

- Digital Reach and Audience Connection: The company's digital strategy aims to connect with a broad audience, ensuring that its value proposition is clearly communicated and accessible to potential clients, investors, and talent worldwide.

Strategic Partnerships and Referral Networks

Bilfinger SE leverages its existing strategic partnerships, including those established through acquisitions and joint ventures, as crucial channels for generating new business and securing client referrals. These alliances are fundamental to expanding market reach and fostering organic growth.

A robust network of industry contacts and dependable collaborators is instrumental in enhancing Bilfinger's market penetration. These relationships are actively cultivated to open new avenues for projects and client acquisition.

- Existing Partnerships: Bilfinger's strategic alliances, often born from acquisitions and joint ventures, act as conduits for new business, facilitating client referrals and cross-selling opportunities.

- Industry Network: A well-developed network of industry contacts and trusted partners is key to expanding market reach and accessing untapped client bases.

- Referral Channels: These established relationships serve as vital referral channels, directly contributing to the acquisition of new projects and clients, thereby supporting revenue diversification.

Bilfinger SE utilizes a multi-channel approach to reach its diverse clientele. This includes a direct sales force for key accounts, a strong regional presence for localized service, participation in industry events for visibility, and a robust digital strategy for broad engagement and information dissemination. Strategic partnerships also serve as vital referral channels, enhancing market penetration.

In 2024, Bilfinger's direct sales teams were instrumental in securing major contracts, contributing to the company's overall revenue growth. Their regional offices, spread across key industrial hubs, ensured timely and efficient project execution, leading to a reported 93% client satisfaction rate in its core European markets by the end of 2023. The company's digital platforms, including its website and active social media presence, saw a significant increase in engagement, with website traffic up 15% in the first half of 2024, showcasing their expertise and project successes to a global audience.

| Channel | Key Function | 2024 Impact/Focus |

|---|---|---|

| Direct Sales Force | Client acquisition and relationship management | Secured major industrial service contracts; strong client retention |

| Regional Offices | Localized service delivery and responsiveness | Supported efficient project execution, contributing to high client satisfaction |

| Industry Events | Brand visibility, networking, and thought leadership | Showcased technical expertise and innovative solutions to potential clients |

| Digital Platforms (Website, Social Media) | Information dissemination, brand building, lead generation | Increased website traffic by 15% (H1 2024); detailed case studies attracted global clientele |

| Strategic Partnerships | Referrals, market expansion, cross-selling | Facilitated new business opportunities and enhanced market reach |

Customer Segments

Bilfinger SE serves a broad range of clients within the energy sector, encompassing traditional power generation facilities like coal and gas plants, as well as those embracing the future with renewable sources such as wind and solar, and nuclear energy. These clients frequently seek comprehensive support for plant maintenance, crucial upgrades and expansions, and initiatives aimed at boosting operational efficiency.

A significant focus for Bilfinger in 2024 is supporting these energy clients in their decarbonization efforts. This includes providing services that help reduce emissions and transition to more sustainable energy production methods. For instance, Bilfinger's involvement in projects for enhanced efficiency in existing plants and the development of new renewable energy infrastructure highlights their commitment to this evolving sector.

Chemical and petrochemical clients demand highly specialized services for their intricate plant operations, major turnarounds, and crucial safety maintenance. They are looking for ways to boost production, lessen their environmental footprint, and manage the ups and downs of market volatility.

Bilfinger's deep understanding of this sector allows them to offer solutions that not only optimize plant performance but also aid in reducing CO2 emissions, a critical concern for many players in 2024. For instance, the global chemical industry faced significant energy cost pressures in 2024, making efficiency gains paramount.

The Pharma & Biopharma industry is a critical customer segment for Bilfinger SE, demanding exceptionally high standards for quality, compliance, and precision in industrial services, especially in manufacturing and maintenance operations. Bilfinger delivers specialized solutions designed to guarantee operational reliability and strict adherence to regulatory requirements within these highly sensitive production environments.

In 2024, the global pharmaceutical market was valued at approximately $1.6 trillion, showcasing the immense scale and growth potential within this sector. Bilfinger's expertise in ensuring sterile environments, precise process control, and robust maintenance is directly aligned with the sector's needs, contributing to operational uptime and product integrity.

Oil & Gas Industry

The Oil & Gas Industry is a core customer segment for Bilfinger SE, demanding extensive services for their critical infrastructure, including production facilities and pipelines. These clients prioritize asset integrity, operational efficiency, and robust maintenance solutions. Bilfinger acts as a full-service transformation partner, supporting their operations throughout the entire value chain, often through long-term contract extensions.

Bilfinger's commitment to the Oil & Gas sector is underscored by significant project involvement. For instance, in 2024, the company secured major contracts for maintenance and turnaround services at key European refineries, contributing to the operational continuity of these vital energy hubs. This segment represents a substantial portion of Bilfinger's revenue, with the energy sector, including oil and gas, accounting for approximately 40% of its total order intake in the first half of 2024.

- Asset Integrity Management: Providing specialized services to ensure the safety and reliability of offshore platforms, onshore processing plants, and extensive pipeline networks.

- Maintenance & Turnarounds: Delivering comprehensive maintenance, repair, and overhaul services, including complex turnaround projects to minimize downtime and maximize asset lifespan.

- Engineering & Construction Support: Offering engineering, procurement, and construction management (EPCM) services for new facilities and upgrades, enhancing production capacity and efficiency.

- Digitalization & Efficiency Solutions: Implementing advanced digital technologies for predictive maintenance, remote monitoring, and process optimization to drive operational excellence.

Real Estate and Adjacent Industries

While Bilfinger SE's core strength lies in serving process industries, it also extends its technical expertise to the real estate sector and other related industrial markets. This strategic diversification leverages Bilfinger's established competencies in areas like maintenance, engineering, and digitalization across a wider array of industrial assets.

The company offers a comprehensive suite of services for real estate and adjacent industries, encompassing facility management, building modernization, and specialized technical building services. These offerings are crucial for optimizing the performance and longevity of diverse industrial and commercial properties.

- Facility Management: Bilfinger provides integrated facility management solutions, ensuring efficient operation and maintenance of buildings and infrastructure.

- Modernization Services: The company undertakes modernization projects for existing real estate assets, enhancing their functionality, energy efficiency, and value.

- Technical Building Services: This includes specialized services such as HVAC, electrical, and plumbing system maintenance and upgrades, critical for industrial and commercial facilities.

Bilfinger SE's customer base is diverse, spanning critical industrial sectors. The company focuses on clients in energy, chemicals, petrochemicals, pharma, biopharma, and oil & gas, providing essential services for plant maintenance, upgrades, and operational efficiency.

A significant portion of Bilfinger's business in 2024 is dedicated to supporting the energy transition, assisting clients in decarbonization efforts across traditional and renewable power generation. The company also caters to the highly specialized needs of the chemical, petrochemical, and pharmaceutical industries, where precision, safety, and compliance are paramount.

In the oil and gas sector, Bilfinger offers comprehensive support for critical infrastructure, emphasizing asset integrity and long-term operational continuity. Beyond these core industries, Bilfinger also extends its technical expertise to the real estate sector, providing facility management and modernization services.

| Customer Segment | Key Needs | 2024 Focus/Data Points |

|---|---|---|

| Energy (Power Generation) | Maintenance, upgrades, efficiency, decarbonization | Support for renewables, emission reduction initiatives |

| Chemical & Petrochemical | Specialized maintenance, turnarounds, safety, efficiency, emissions reduction | Addressing energy cost pressures, CO2 reduction |

| Pharma & Biopharma | Quality, compliance, precision in manufacturing & maintenance, operational reliability | Global market value ~$1.6 trillion; ensuring sterile environments |

| Oil & Gas | Asset integrity, operational efficiency, maintenance, turnarounds | Secured major European refinery contracts; ~40% of order intake (H1 2024) |

| Real Estate & Other Industrial | Facility management, modernization, technical building services | Leveraging core competencies across diverse assets |

Cost Structure

Personnel and labor costs represent a substantial part of Bilfinger SE's expenses, driven by its extensive global team of over 30,000 employees. These costs encompass salaries, benefits, and ongoing training initiatives essential for maintaining a skilled workforce.

Bilfinger's strategic focus on employee development directly influences its personnel expenditure. The company recognizes that investing in its people is crucial for innovation and operational excellence, which in turn impacts overall labor costs.

Managing these significant personnel costs effectively hinges on efficient resource allocation and maximizing employee productivity. By optimizing workflows and ensuring the right skills are in the right places, Bilfinger aims to control these expenses while driving business performance.

Bilfinger SE's cost structure is significantly influenced by the procurement of materials and equipment. These costs encompass everything from raw materials and components to highly specialized machinery essential for their diverse engineering, manufacturing, and maintenance operations.

Optimizing these procurement processes is paramount for cost control. In 2024, like previous years, Bilfinger likely focused on strategic sourcing initiatives to secure high-quality materials and equipment at competitive prices, directly impacting project profitability.

Bilfinger SE's operational and project delivery costs are the backbone of their industrial services, encompassing everything from on-site management and intricate logistics to stringent safety protocols and rigorous quality assurance. These are the direct expenses incurred to bring complex industrial projects to life.

The sheer scale and technical demands of the projects Bilfinger undertakes, such as those in the energy or chemical sectors, make effective management of these operational costs absolutely critical for maintaining profitability. For instance, in 2023, Bilfinger reported that its operational efficiency significantly impacted its financial results, with a focus on controlling project-specific expenditures being a key driver.

Ultimately, the company's ability to deliver projects efficiently and manage associated risks directly correlates with its bottom line. This means that streamlined execution, proactive risk mitigation, and cost-conscious operations are not just good practices, but essential components for Bilfinger’s financial success.

Research and Development Expenses

Bilfinger SE's cost structure heavily features investments in research and development. These expenditures are crucial for developing new technologies, digital applications, and sustainable solutions, ensuring the company remains competitive and fuels future expansion. For instance, in 2023, Bilfinger reported R&D spending that supported innovation in key areas such as carbon capture technologies and the integration of AI-driven solutions across its service portfolio.

These R&D efforts are not just about staying current; they are fundamental to Bilfinger's strategy for long-term growth and market leadership. The company actively fosters innovation in areas like advanced materials, digitalization of industrial processes, and the development of environmentally friendly solutions. This commitment to R&D is a significant component of their operational costs, directly impacting their ability to offer cutting-edge services.

- Investment in Innovation: Bilfinger allocates substantial resources to R&D for new technologies and digital applications.

- Competitive Edge: R&D expenditures are vital for maintaining and enhancing Bilfinger's market position.

- Sustainable Solutions: A focus on R&D drives the development of green technologies and sustainable practices.

- Future Growth: Innovation through R&D is a key driver for Bilfinger's long-term business expansion.

Administrative and Overhead Costs

Bilfinger SE's administrative and overhead costs encompass a range of essential functions, including corporate governance, IT support, marketing initiatives, and legal services. These expenses are crucial for the smooth operation and strategic direction of the company. For instance, in 2023, Bilfinger reported administrative expenses of €429 million, representing a significant portion of their overall operational expenditures.

The company is actively engaged in optimizing these costs through a strategic focus on streamlining administrative structures and consolidating tasks. This approach aims to enhance organizational efficiency and reduce redundancy. Bilfinger's commitment to systematic improvements in these overhead areas is a key element in their strategy to manage and reduce the overall cost base.

- General administrative expenses encompass corporate functions, IT infrastructure, marketing, and legal costs.

- Organizational efficiency is improved by streamlining administrative structures and bundling tasks.

- Cost optimization is a continuous aim through systematic improvements in overhead areas.

- 2023 administrative expenses for Bilfinger SE amounted to €429 million.

Bilfinger SE incurs significant costs related to depreciation and amortization of its assets. These non-cash expenses reflect the gradual reduction in the value of tangible and intangible assets used in its operations, such as specialized machinery and intellectual property. Effective management of these costs is tied to asset utilization and investment decisions.

Furthermore, financing costs, including interest payments on debt and other borrowing arrangements, form another crucial element of Bilfinger's cost structure. These expenses are directly linked to the company's capital structure and its reliance on debt financing to fund its extensive operations and strategic initiatives.

Bilfinger SE also accounts for various other operating expenses, which can include insurance premiums, IT system maintenance, and professional fees. These costs, while perhaps less dominant than personnel or materials, are essential for the day-to-day functioning and compliance of a global industrial services provider.

| Cost Category | Description | 2023 Impact/Focus |

|---|---|---|

| Personnel & Labor | Salaries, benefits, training for over 30,000 employees | Key driver of operational costs; focus on productivity |

| Materials & Equipment | Raw materials, components, specialized machinery | Strategic sourcing for competitive pricing; critical for project profitability |

| Operational & Project Delivery | On-site management, logistics, safety, quality assurance | Direct expenses for project execution; efficiency impacts financial results |

| Research & Development | New technologies, digital applications, sustainable solutions | Supports innovation and long-term growth; R&D spending in 2023 focused on AI and carbon capture |

| Administrative & Overhead | Corporate governance, IT, marketing, legal | Streamlining structures to enhance efficiency; €429 million in 2023 |

| Depreciation & Amortization | Reduction in value of tangible and intangible assets | Reflects asset utilization and investment decisions |

| Financing Costs | Interest on debt and borrowing arrangements | Linked to capital structure and debt financing |

| Other Operating Expenses | Insurance, IT maintenance, professional fees | Essential for daily operations and compliance |

Revenue Streams

Bilfinger SE generates substantial revenue through its Engineering & Maintenance Services, offering a full spectrum of support for industrial facilities and infrastructure. This encompasses everything from routine upkeep to complex upgrades and specialized technical assistance.

Key revenue drivers within this segment include long-term maintenance contracts, which provide a stable income stream, alongside project-based work like plant modifications and scheduled turnarounds. These services are crucial for ensuring the operational efficiency and longevity of client assets.

In 2024, Bilfinger reported that its Services segment, which heavily features these engineering and maintenance offerings, achieved a revenue of approximately €3.4 billion. This highlights the segment's critical role in the company's financial performance, demonstrating its importance as a core business activity.

Bilfinger SE's revenue increasingly stems from sophisticated technology solutions, particularly in environmental tech and digital applications. This includes vital services like carbon capture and energy efficiency improvements, reflecting strong demand for sustainable solutions.

Digital applications, such as AI-driven predictive maintenance, are also significant revenue drivers. For instance, in 2024, Bilfinger reported a substantial increase in its order intake for digital services, demonstrating the growing market acceptance and financial impact of these advanced offerings.

Bilfinger SE generates significant income from its project-based and consulting services. This includes the comprehensive execution of large-scale industrial projects, encompassing everything from initial consulting and design to the actual manufacturing and assembly of new facilities or expansions.

These complex, often bespoke projects typically involve milestone-based payments, providing a steady flow of revenue as key stages are completed. For instance, the company secured a major contract in 2024 for the construction of a new chemical plant, with payments tied to project milestones.

Furthermore, Bilfinger's consulting services play a crucial role in generating early-stage revenue and fostering strong client relationships. These advisory engagements often precede larger project commitments, allowing Bilfinger to establish expertise and trust with potential clients.

Long-Term Contracts and Framework Agreements

Bilfinger SE secures a significant portion of its revenue through long-term contracts and framework agreements, offering a predictable and stable income base. These arrangements are crucial for maintaining consistent financial performance and allow for strategic resource allocation.

These agreements, often spanning several years, provide recurring revenue streams, insulating the company from short-term market fluctuations. For instance, Bilfinger’s work on gas transport networks and chemical plants exemplifies the nature of these substantial, ongoing projects.

- Recurring Revenue: Long-term contracts generate stable, predictable income, reducing revenue volatility.

- Client Relationships: Framework agreements foster deep, ongoing partnerships with major industrial clients.

- Project Examples: Engagements include maintenance and expansion services for critical infrastructure like gas pipelines and chemical processing facilities.

- Financial Stability: These contracts contribute significantly to Bilfinger's overall financial resilience and planning capabilities.

Acquisition-Driven Revenue Growth

Bilfinger SE pursues revenue growth not only through its core operations but also by strategically acquiring companies. These acquisitions are designed to bring in new service capabilities and expand its customer reach, directly boosting the company's top-line figures. For instance, during 2024, Bilfinger continued to assess and execute targeted acquisitions to strengthen its market position.

These inorganic growth initiatives are crucial for integrating new service portfolios and broadening Bilfinger's presence in important geographical markets and industry sectors. By adding acquired businesses, the company effectively increases its market share and diversifies its revenue base. This strategy complements the growth achieved through organic expansion, creating a more robust and resilient revenue stream.

- Strategic Acquisitions: Bilfinger integrates new service capabilities and customer bases through targeted acquisitions.

- Top-Line Contribution: Acquired businesses directly contribute to revenue growth and enhance market share.

- Synergistic Integration: Acquisitions expand Bilfinger's presence in key regions and sectors, complementing organic growth.

Bilfinger SE's revenue streams are diverse, encompassing services, projects, and strategic acquisitions. The company leverages its expertise in engineering and maintenance, alongside a growing portfolio of technology solutions, to serve a broad industrial client base.

Long-term contracts and framework agreements provide a stable foundation, while project-based work and consulting engagements contribute significantly to revenue. Strategic acquisitions further bolster the company's top-line growth by expanding service offerings and market reach.

In 2024, Bilfinger's Services segment, a core revenue generator, achieved approximately €3.4 billion, underscoring the importance of its maintenance and operational support for industrial facilities.

| Revenue Stream | Description | 2024 Relevance |

|---|---|---|

| Engineering & Maintenance Services | Routine upkeep, complex upgrades, and technical assistance for industrial facilities. | Core business; Services segment revenue ~€3.4 billion. |

| Technology Solutions | Environmental tech (e.g., carbon capture) and digital applications (e.g., AI predictive maintenance). | Growing demand; significant increase in digital services order intake. |

| Project Execution & Consulting | Large-scale industrial projects from design to assembly, with milestone-based payments. | Key contracts secured in 2024 for new plant construction. |

| Long-Term Contracts & Framework Agreements | Recurring revenue from multi-year agreements for infrastructure maintenance and expansion. | Provides stable income for gas transport networks and chemical plants. |

| Strategic Acquisitions | Acquiring companies to gain new service capabilities and expand customer reach. | Continued assessment and execution of targeted acquisitions in 2024. |

Business Model Canvas Data Sources

The Bilfinger SE Business Model Canvas is informed by a comprehensive blend of internal financial reports, market intelligence gathered from industry analysis, and strategic insights derived from operational performance data. These diverse sources ensure a robust and accurate representation of the company's strategic framework.