BHP Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BHP Group Bundle

BHP Group, a global mining giant, navigates a landscape of immense opportunities and significant challenges. While its vast resources and diversified portfolio present clear strengths, understanding the nuances of its market position, potential threats, and strategic growth avenues is crucial for informed decision-making.

Want the full story behind BHP's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

BHP Group maintains a robust and diversified asset base, featuring world-class, long-life operations in essential commodities like iron ore, copper, and metallurgical coal. This strategic mix offers significant resilience against fluctuations in individual commodity prices, ensuring a stable foundation for its business.

The company's deliberate emphasis on 'future-facing commodities,' such as copper and potash, positions it favorably to capitalize on long-term global demand drivers like electrification and decarbonization. For instance, in the fiscal year 2023, BHP's copper production reached 1.7 million tonnes, underscoring its significant presence in this growth sector.

BHP's operational prowess is a significant strength, consistently hitting production highs. For instance, in FY2024, they achieved record output in iron ore and copper, a trend expected to continue into FY2025. This consistent performance underscores their ability to maximize output from their existing asset base.

A key driver of this strength is their unwavering commitment to cost leadership, particularly evident in their Western Australia Iron Ore (WAIO) operations. WAIO remains the world's lowest-cost major iron ore producer, a testament to their disciplined cost management and relentless pursuit of operational efficiencies. This cost advantage directly translates into superior margins and a reliable stream of cash flow, even in fluctuating market conditions.

BHP Group demonstrates robust financial health, consistently reporting strong performance metrics. This financial strength underpins its ability to return value to shareholders via dividends, which for the fiscal year ending June 30, 2023, amounted to $3.7 billion in ordinary dividends, while simultaneously funding strategic growth initiatives.

The company's disciplined approach to capital allocation is a key strength. BHP is strategically investing in future-facing commodities, such as copper and potash, with projects like the Jansen potash project in Canada representing significant long-term growth potential, aligning with anticipated global demand shifts.

This solid financial footing provides BHP with the resilience to weather market fluctuations and the capacity to pursue substantial development opportunities, ensuring its competitive position in the global resources sector.

Commitment to Sustainability and Decarbonization

BHP's commitment to sustainability is a significant strength, clearly demonstrated by its comprehensive Climate Transition Action Plan (CTAP) for 2024. This plan details the company's strategic approach, specific commitments, and ambitious targets for reducing greenhouse gas (GHG) emissions throughout its operations and extended value chain.

The company is making tangible progress towards its goal of achieving at least a 30% reduction in operational GHG emissions by fiscal year 2030. This is primarily being driven by substantial investments in renewable energy through power purchase agreements and ongoing electrification initiatives across its sites.

This dedication to sustainable and responsible resource development not only aligns BHP with critical global efforts to combat climate change but also significantly strengthens its social license to operate.

- Climate Transition Action Plan (CTAP) for 2024: Outlines strategy, commitments, and targets for GHG emission reduction.

- Operational GHG Reduction Target: On track to meet at least a 30% reduction by FY2030.

- Key Investment Areas: Renewable energy power purchase agreements and operational electrification projects.

- Enhanced Social License: Alignment with global climate action bolsters community and stakeholder trust.

Advanced Technology Adoption and Innovation

BHP is making significant strides in adopting advanced technologies. The company is actively integrating automation, artificial intelligence (AI), and sophisticated data analytics across its operations. This focus is designed to streamline extraction, bolster safety protocols, and reduce overall operational expenses.

The strategic goal for BHP is to transform into a fully integrated and highly automated mining entity by 2025. This ambitious target hinges on leveraging technology to drive gains in efficiency, boost productivity, and effectively manage operational risks. These technological investments are vital for ensuring the long-term viability and competitiveness of BHP in a rapidly changing mining landscape.

- Automation: BHP is deploying autonomous haul trucks and drills, particularly at its major iron ore operations in Western Australia. For instance, the Jimblebar mine is a key site for this technology.

- Data Analytics: The company utilizes advanced analytics to optimize ore processing, predict equipment failures, and improve resource allocation, leading to more efficient operations.

- AI Integration: AI is being explored for applications such as geological modeling and real-time decision-making to enhance exploration and extraction success rates.

BHP's diversified portfolio, anchored by high-quality, long-life assets in iron ore, copper, and metallurgical coal, provides significant resilience against commodity price volatility. The company's strategic pivot towards future-facing commodities like copper and potash, exemplified by its significant copper production of 1.7 million tonnes in FY2023, positions it for sustained long-term growth driven by global decarbonization trends.

Operational excellence is a hallmark, with record production achieved in iron ore and copper in FY2024, a trend expected to continue into FY2025. This consistent performance is underpinned by a relentless focus on cost leadership, particularly at its Western Australia Iron Ore operations, which remain the world's lowest-cost major producer, ensuring robust margins and cash flow.

The company's financial strength is robust, enabling consistent shareholder returns, with $3.7 billion in ordinary dividends paid in FY2023, alongside strategic investments in growth projects like the Jansen potash development. This financial discipline allows BHP to navigate market fluctuations and pursue future opportunities effectively.

BHP's commitment to sustainability, detailed in its 2024 Climate Transition Action Plan, targets at least a 30% reduction in operational GHG emissions by FY2030 through investments in renewable energy and electrification, strengthening its social license to operate.

The integration of advanced technologies, including automation, AI, and data analytics, is transforming BHP's operations, aiming for full automation by 2025 to enhance efficiency, safety, and competitiveness.

| Metric | FY2023 Value | FY2024 Projection/Status | Key Driver |

| Copper Production | 1.7 million tonnes | Expected growth | Demand for electrification |

| Operational GHG Emissions Reduction Target | N/A | At least 30% by FY2030 | Climate Transition Action Plan |

| Ordinary Dividends Paid | $3.7 billion | Continued shareholder returns | Financial strength |

| Western Australia Iron Ore Cost Position | World's lowest-cost major producer | Maintained | Operational efficiency |

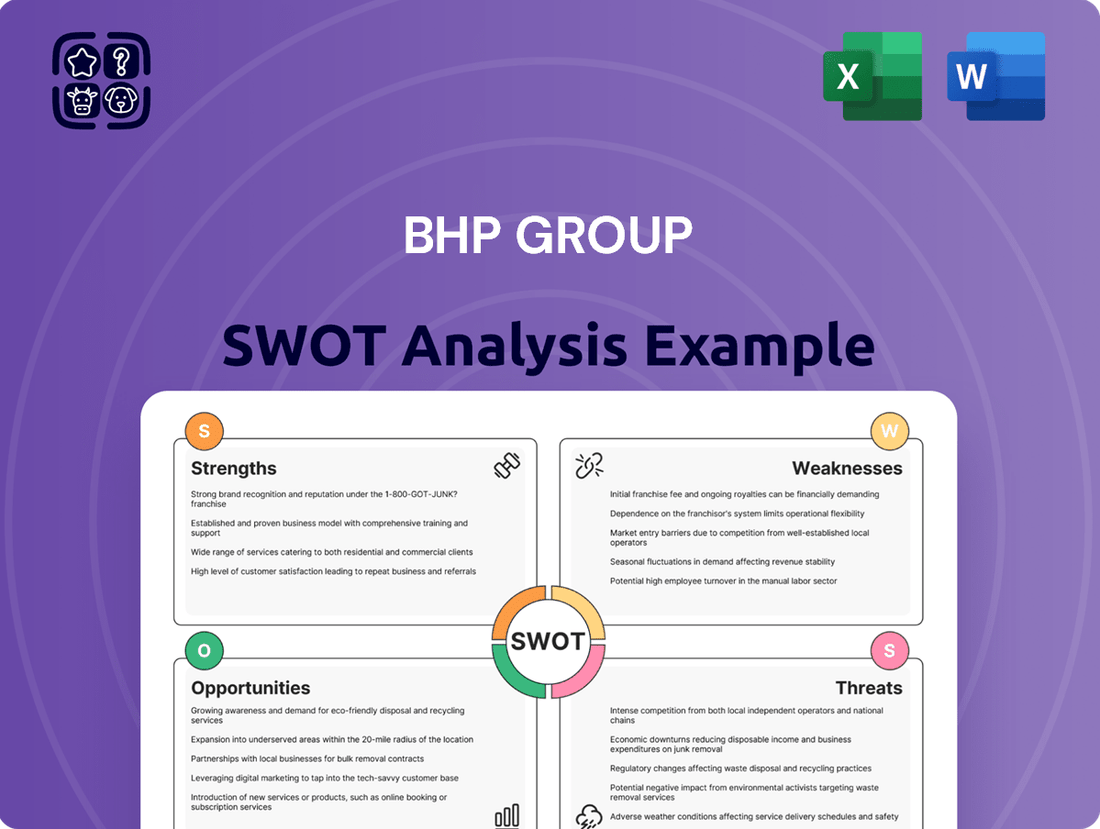

What is included in the product

Delivers a strategic overview of BHP Group’s internal and external business factors, highlighting its strong market position and operational efficiencies alongside potential challenges in commodity price volatility and regulatory environments.

Offers a clear, actionable framework to navigate BHP's complex global operations and market volatility.

Weaknesses

BHP Group's significant reliance on key commodities like iron ore and metallurgical coal means its profitability is directly tied to global price swings. For instance, the company reported a notable drop in its underlying attributable profit for the six months ending December 31, 2024, largely driven by softer prices for these essential commodities.

This exposure to commodity price volatility creates inherent uncertainty in revenue generation and can lead to unpredictable impacts on earnings and, consequently, shareholder returns. Navigating these market fluctuations remains a persistent challenge for BHP.

BHP's Western Australian nickel operations have been hit hard, leading to a multi-billion dollar impairment charge and a temporary shutdown. This significant financial hit, reported in early 2024, underscores the difficulties faced by the company in this segment.

The primary culprits behind this downturn are the aggressive pricing from lower-cost Indonesian nickel producers and a general oversupply in the global market. These external factors have severely impacted the profitability and viability of BHP's nickel assets.

These challenges highlight a key weakness for BHP: the susceptibility of certain commodity divisions to intense global competition and volatile market prices, as evidenced by the substantial write-downs impacting their financial performance.

BHP's global footprint exposes it to significant geopolitical and regulatory risks. For example, the substantial royalty regime in Queensland, Australia, has acted as a deterrent for new coal expansion projects, impacting potential growth avenues.

The ongoing legal ramifications and increased financial provisions stemming from the 2015 Samarco dam disaster in Brazil continue to weigh on BHP's financial stability and public image. As of early 2024, the company has allocated billions towards remediation and compensation efforts.

Furthermore, trade tensions and unpredictable policy changes in key markets like China and the United States create uncertainty for commodity demand, directly affecting BHP's sales volumes and pricing strategies.

Dependency on Chinese Demand

BHP's significant reliance on China for its commodity sales, especially iron ore, presents a considerable weakness. In 2023, China was the destination for over 70% of the seaborne iron ore market, a substantial portion of which directly or indirectly benefits BHP. This concentration means any downturn in the Chinese economy, particularly within its struggling property sector, directly impacts BHP's revenue streams.

The ongoing economic headwinds in China, coupled with a potential long-term shift away from infrastructure-heavy growth towards a consumption-led model, create structural uncertainty for iron ore demand. This structural challenge means that the high demand levels seen in previous years may not be sustainable, posing a risk to BHP's sales volumes and pricing power.

This strong dependence on a single major market, China, inherently creates concentration risk for BHP. Fluctuations in Chinese economic performance, policy shifts, or trade relations can disproportionately affect the company's financial results, making it vulnerable to external shocks originating from this key customer base.

- Concentration Risk: Over 70% of seaborne iron ore demand originates from China, a key market for BHP.

- Economic Vulnerability: China's property sector weakness and economic slowdown directly threaten iron ore demand.

- Structural Shift: A potential move from infrastructure to consumption-led growth in China could structurally reduce iron ore needs.

- Policy Sensitivity: BHP's performance is highly susceptible to Chinese government economic policies and trade decisions.

Significant Capital Expenditure and Project Delays

BHP's aggressive expansion plans, especially in copper and the burgeoning potash market, demand massive capital outlays. These substantial investments, while crucial for future revenue streams, are inherently susceptible to budget blowouts and missed deadlines. For instance, the Jansen Stage 1 potash project has experienced an upward revision in its projected capital expenditure, alongside a return to its initial production timeline.

These large-scale undertakings, essential for long-term growth, are not without their risks. The company's commitment to transitioning its Australian operations to electric haul trucks and rail has encountered setbacks, consequently affecting its decarbonization targets.

- Jansen Potash Project: Jansen Stage 1 capital expenditure estimate increased, with a reversion to the original production schedule.

- Decarbonization Efforts: Delays in the adoption of electric haul trucks and rail in Australia are impacting environmental goals.

- Capital Intensity: The mining sector, particularly for new resource development, requires significant upfront investment, posing a financial risk if projects underperform.

BHP's significant reliance on key commodities like iron ore and metallurgical coal exposes it to substantial price volatility, directly impacting profitability. For example, the company's underlying attributable profit for the six months ending December 31, 2024, saw a notable decline due to softer commodity prices.

The company's Western Australian nickel operations have faced severe challenges, including a multi-billion dollar impairment charge and temporary shutdowns in early 2024, largely due to aggressive pricing from Indonesian competitors and global oversupply.

BHP's heavy dependence on China for commodity sales, particularly iron ore where China accounts for over 70% of the seaborne market, creates significant concentration risk. Economic headwinds in China and a potential shift away from infrastructure-led growth pose structural uncertainties for future demand.

Large-scale expansion projects, such as the Jansen Stage 1 potash development, require substantial capital outlays and have faced cost escalations and timeline adjustments, highlighting the financial risks associated with capital-intensive growth strategies.

Preview Before You Purchase

BHP Group SWOT Analysis

This is the same BHP Group SWOT analysis document included in your download. The full content is unlocked after payment, providing a comprehensive overview of the company's strategic positioning.

Opportunities

The global shift towards cleaner energy, coupled with ongoing urbanization and population growth, is creating a robust and sustained demand for commodities essential for this transition. Copper, vital for electrification and renewable energy infrastructure, and potash, crucial for food security in a growing world, are at the forefront of this trend.

BHP is well-positioned to benefit from this burgeoning demand. The company's significant investments in its Jansen potash project, expected to commence production in 2026 with an initial capital expenditure of approximately $5.7 billion, and its ongoing expansion of copper operations, demonstrate a clear strategy to align with these powerful global megatrends.

BHP can leverage AI, automation, and data analytics to boost efficiency and safety. These technologies offer chances for optimized extraction and predictive maintenance, ultimately lowering costs and enhancing productivity.

The company's goal to be a fully integrated, highly automated mining operation by 2025 underscores this strategic direction. This focus on innovation is expected to significantly improve operational performance and environmental outcomes.

BHP's dedication to decarbonization, evidenced by its Climate Transition Action Plan, presents a significant opportunity to bolster its brand image and attract investors prioritizing environmental, social, and governance (ESG) factors. This commitment can translate into a competitive edge in the evolving resource sector.

By channeling investments into renewable energy sources, electrifying its operations, and pioneering lower-emission steelmaking innovations, BHP can shrink its environmental impact. These strategic moves also pave the way for accessing new markets and forging valuable collaborations, as seen in their 2023 investments of approximately $500 million in decarbonization projects.

Exploration and Acquisition of New Resources

BHP Group actively pursues new high-quality Tier 1 copper assets through exploration and strategic early-stage acquisitions. This proactive approach is crucial for securing future supply chains and driving long-term growth in a competitive market. For instance, the formation of Vicuña Corp, a joint venture focused on copper projects in Argentina, demonstrates BHP's commitment to advancing promising new resource opportunities.

Expanding its resource base via exploration and acquisitions is a cornerstone of BHP's strategy. This allows the company to not only meet current demand but also to position itself for sustained success in the evolving global resources landscape. The company's ongoing investment in exploration, particularly in copper-rich regions, underpins its objective of building a robust portfolio of future-facing commodities.

- Exploration Focus: BHP is prioritizing exploration for Tier 1 copper assets globally.

- JV Strategy: The Vicuña Corp joint venture in Argentina highlights their approach to early-stage resource development.

- Growth Driver: Expanding the resource base through these efforts is key to securing long-term supply and future growth.

Leveraging Global Economic Growth Beyond China

While China's significant role in commodity demand persists, BHP Group has a substantial opportunity to tap into the burgeoning growth of other key global economies. India, in particular, is projected to experience robust economic expansion, driving increased demand for steel and related commodities. For instance, India's GDP growth is anticipated to remain strong, with forecasts suggesting it could reach around 6.5% in the fiscal year 2024-2025, a significant driver for infrastructure and manufacturing, both heavily reliant on raw materials like iron ore and copper.

Southeast Asian nations also present a compelling growth narrative. These economies are undergoing rapid industrialization and urbanization, creating a rising need for construction materials and manufactured goods. BHP can strategically position itself to capitalize on this expansion, diversifying its customer base and reducing its exposure to any single market's economic fluctuations. This diversification is crucial for long-term stability and sustained revenue streams.

- India's projected GDP growth of approximately 6.5% for FY2024-2025 fuels demand for BHP's core products.

- Southeast Asia's ongoing industrialization and urbanization create new markets for steel and metals.

- Diversifying beyond China mitigates risks associated with market concentration.

- Adapting to evolving global trade flows opens new avenues for commodity demand.

BHP is strategically positioned to capitalize on the global energy transition, with copper and potash demand expected to surge. The company's substantial investments in its Jansen potash project, slated for production start in 2026, and its ongoing copper asset expansions directly align with these powerful megatrends.

Leveraging advanced technologies like AI and automation offers a significant opportunity to enhance operational efficiency and safety, potentially lowering costs and boosting productivity. BHP's goal of becoming a fully automated mining operation by 2025 highlights this forward-looking approach.

BHP's commitment to decarbonization, supported by its Climate Transition Action Plan and approximately $500 million invested in 2023 decarbonization projects, can strengthen its brand and attract ESG-focused investors, providing a competitive advantage.

The company is actively pursuing growth by exploring and acquiring new Tier 1 copper assets, such as through the Vicuña Corp joint venture in Argentina, to secure future supply chains and drive long-term value.

Beyond China, BHP can tap into the growing economies of India, with its projected 6.5% GDP growth for FY2024-2025, and Southeast Asia's industrializing markets, diversifying its customer base and mitigating single-market risks.

| Opportunity Area | Key Driver | BHP's Action/Positioning | Relevant Data/Example |

|---|---|---|---|

| Energy Transition | Demand for copper and potash | Jansen potash project (2026 start), copper asset expansion | Copper vital for electrification; Jansen CAPEX ~$5.7B |

| Technological Advancement | AI, automation, data analytics | Goal for fully automated operations by 2025 | Improved efficiency, safety, and predictive maintenance |

| Decarbonization & ESG | Investor focus on sustainability | Climate Transition Action Plan, ESG investments | ~$500M invested in decarbonization projects (2023) |

| Resource Expansion | Securing future supply | Exploration for Tier 1 copper assets, JV strategy | Vicuña Corp JV for copper projects in Argentina |

| Market Diversification | Growth in emerging economies | Focus on India and Southeast Asia | India FY2024-2025 GDP growth ~6.5% |

Threats

A slowdown in global economic growth, especially in key markets like China, presents a substantial risk to commodity demand and pricing for BHP. For instance, China's GDP growth, while still robust, has shown signs of moderation, impacting its massive appetite for raw materials. This economic deceleration directly threatens BHP's revenue streams by potentially lowering the volume and price of its exported commodities.

Geopolitical instability, including policy uncertainty in major economies like the United States and increasing trade fragmentation globally, adds another layer of threat. These factors can disrupt supply chains, create market volatility, and dampen overall demand for BHP's products. The potential for protectionist policies or trade disputes could significantly hinder international trade flows, impacting BHP's ability to access markets and realize optimal pricing.

These macro-economic headwinds can translate directly into reduced profitability for BHP. For example, a significant downturn in global industrial production, driven by economic slowdown and geopolitical tensions, would likely lead to lower demand for iron ore and metallurgical coal, BHP's flagship commodities. This could pressure margins and impact the company's financial performance in the short to medium term.

BHP Group contends with significant competitive pressures across its core commodity segments. For instance, its nickel division has been particularly affected by an oversupply situation driven by low-cost producers, impacting profitability.

Looking ahead, the iron ore market is also projected to experience a growing surplus. Analysts anticipate that supply could outstrip demand through 2025, creating a challenging pricing environment for major producers like BHP.

This heightened competition and potential oversupply directly threaten to suppress commodity prices. Consequently, BHP's profit margins could face considerable downward pressure, requiring strategic adjustments to maintain financial performance.

Evolving environmental regulations and increasing pressure for stricter climate policies present a significant threat to mining operations like BHP's. These changes can translate into higher compliance costs and operational restrictions, impacting project feasibility and profitability.

While BHP is actively pursuing decarbonization, the upcoming phases of operational emissions reduction are anticipated to be more complex and demand substantial capital investment. For instance, the company has identified that reducing Scope 1 and 2 emissions from its own operations will be more challenging than its initial Scope 3 targets.

Furthermore, shifts in mining tax regimes, such as the recently implemented Chilean mining tax, can directly affect BHP's earnings and cash flow. These fiscal policy changes introduce an element of uncertainty into long-term financial planning and investment decisions.

Supply Chain Disruptions and Operational Risks

BHP's extensive global operations are inherently vulnerable to a range of operational risks. These include the impacts of extreme weather events, complex geological conditions, and potential labor disputes, all of which can directly affect production levels and efficiency. For instance, in the 2023 financial year, BHP reported that heavy wet weather and geotechnical issues in Queensland significantly impacted its steelmaking coal output.

Furthermore, the company faces considerable threats from supply chain disruptions. Geopolitical instability and trade tensions, which have been prominent in recent years, can impede the timely delivery of essential inputs and finished products. This not only creates logistical challenges but also leads to increased operating expenses and potential delays in meeting customer demand.

- Operational Risks: Exposure to extreme weather, geological challenges, and labor issues impacting production.

- Supply Chain Vulnerability: Geopolitical tensions and global events can disrupt product delivery and increase costs.

- Impact on Coal Production: Heavy wet weather and geotechnical problems have previously curtailed steelmaking coal output, as seen in FY23.

- Increased Operating Costs: Disruptions directly translate to higher expenses for raw materials, logistics, and production processes.

Substitution Risk and Technological Disruption

The global push towards a net-zero economy poses a significant substitution risk for some of BHP's core commodities, especially metallurgical coal. As steel production increasingly explores alternatives like hydrogen-based processes, demand for traditional coking coal could decline. For instance, by 2030, the International Energy Agency projects a substantial increase in green steel production capacity, potentially impacting coal volumes.

Technological disruption is a constant threat, and BHP's ability to adapt to evolving customer needs is crucial. While BHP is actively investing in future-facing technologies, the speed at which new materials or production methods are adopted by industries like automotive and construction could outpace its transition efforts, affecting demand for its established product lines.

- Substitution Risk: The transition to a net-zero economy threatens commodities like metallurgical coal, with hydrogen-based steelmaking emerging as a key alternative.

- Technological Disruption: Rapid advancements in materials science and production processes could reduce reliance on BHP's traditional offerings.

- Pace of Adoption: The speed at which customer industries adopt new technologies will directly influence demand for BHP's products.

BHP faces significant threats from a global economic slowdown, particularly in China, which could dampen commodity demand and prices. Geopolitical instability and trade fragmentation also pose risks by disrupting supply chains and creating market volatility. Furthermore, evolving environmental regulations and the push for decarbonization present challenges, potentially increasing compliance costs and impacting operations.

Competitive pressures, such as oversupply in nickel due to low-cost producers, and projected surpluses in iron ore through 2025, threaten to suppress commodity prices and squeeze BHP's profit margins. The company is also vulnerable to operational risks like extreme weather and supply chain disruptions, which can affect production and increase costs, as evidenced by FY23 impacts on steelmaking coal output.

The transition to a net-zero economy introduces substitution risks, especially for metallurgical coal, as green steel production gains traction. Technological disruption is another concern, with the pace of adoption of new materials and production methods in customer industries potentially impacting demand for BHP's traditional products.

| Threat Category | Specific Example/Impact | Data/Statistic |

| Economic Slowdown | Reduced demand and pricing for commodities | China's GDP growth moderation impacts raw material appetite. |

| Geopolitical Instability | Supply chain disruption, market volatility | Trade fragmentation and policy uncertainty increase risk. |

| Environmental Regulations | Higher compliance costs, operational restrictions | Scope 1 & 2 emission reductions are more complex and capital-intensive. |

| Competitive Pressures | Price suppression, margin pressure | Projected iron ore surplus through 2025. |

| Operational Risks | Production curtailment, increased costs | FY23 steelmaking coal output impacted by weather and geotechnical issues. |

| Substitution Risk | Declining demand for certain commodities | Green steel production capacity growth by 2030 could impact coal volumes. |

SWOT Analysis Data Sources

This BHP Group SWOT analysis is constructed using a comprehensive blend of data, including their official financial statements, extensive market research reports, and insights from industry experts and analysts to provide a robust strategic overview.