BHP Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BHP Group Bundle

BHP Group navigates a complex landscape shaped by intense rivalry, significant buyer power, and the ever-present threat of substitutes in the global resources sector. Understanding the subtle interplay of these forces is crucial for strategic advantage.

The complete report reveals the real forces shaping BHP Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

BHP Group typically faces a low bargaining power from suppliers for most of its operational needs, as the market for general mining consumables and services is quite fragmented. This means BHP can often source these items from multiple vendors, keeping prices competitive.

However, the situation shifts when it comes to highly specialized equipment or advanced technologies. For these niche areas, the supplier base can be concentrated, giving those few suppliers more leverage. This is especially true for proprietary mining technologies or large, custom-built machinery that is critical for BHP's specific operational requirements.

For instance, in 2024, the demand for advanced automation and AI-driven solutions in mining continued to grow, with a limited number of providers offering cutting-edge systems. Companies that possess unique intellectual property for these technologies can command higher prices and more favorable terms, directly impacting BHP's procurement costs for such essential, specialized assets.

The availability of alternative suppliers for raw materials and services significantly limits supplier power. For common industrial inputs, BHP Group likely has multiple options, reducing any single supplier's ability to dictate terms. This broad access to inputs is a key factor in managing costs and ensuring operational continuity.

However, certain critical minerals or unique processing chemicals essential for BHP's operations might have a more limited supplier base. In 2024, for instance, the global supply chain for specialized mining equipment and certain rare earth elements remained somewhat constrained, potentially increasing the bargaining power of those few providers. BHP's strategy involves diversifying its supplier base where possible to mitigate this risk.

Switching costs for BHP Group can range significantly. For common raw materials or services, finding alternative suppliers is generally straightforward with minimal disruption, limiting supplier leverage.

However, when BHP relies on specialized equipment, proprietary technology, or suppliers with deeply integrated supply chain solutions, the cost and complexity of switching increase substantially. This can involve considerable investment in new machinery, extensive employee retraining, and potential downtime during the transition, thereby strengthening the bargaining power of those specific suppliers.

Importance of Supplier's Input to BHP's Operations

The bargaining power of suppliers for BHP Group is significantly influenced by the criticality of their inputs to BHP's core mining and processing operations. Suppliers providing essential components for heavy machinery or specialized geological surveying services, crucial for maintaining production levels, naturally hold greater leverage. Without these specialized inputs, BHP's operational continuity would be severely threatened, granting these suppliers considerable power.

Conversely, suppliers of less critical items, such as standard office supplies, wield very little influence over BHP. The distinction lies in the direct impact on production and revenue generation. For instance, in 2023, BHP's capital expenditure on property, plant, and equipment was approximately $10.1 billion, highlighting the significant investment in the machinery and infrastructure that relies on specialized supplier inputs.

- Criticality of Inputs: Suppliers of specialized mining equipment or rare earth minerals essential for processing have high bargaining power due to the direct impact on BHP's production capacity.

- Supplier Concentration: If only a few suppliers can provide a necessary component or service, their bargaining power increases.

- Switching Costs: High costs associated with changing suppliers for specialized equipment or services further empower those suppliers.

- BHP's Procurement Scale: While BHP's massive scale can sometimes give it leverage, the specialized nature of many mining inputs can limit this advantage.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into BHP Group's mining operations is generally low. The immense capital requirements, stringent regulatory hurdles, and the need for highly specialized technical knowledge present substantial barriers to entry for most suppliers looking to undertake large-scale mining activities themselves.

While direct forward integration into core mining is unlikely, some suppliers offering niche processing or specialized logistical services might possess the capabilities to move further up the value chain. This could slightly enhance their bargaining power in specific segments of BHP's supply chain.

- Low Threat of Forward Integration: Suppliers integrating into BHP's core mining operations face significant capital, regulatory, and expertise barriers.

- Niche Integration Potential: Certain specialized service providers may have the capacity to integrate into processing or logistics, slightly increasing their influence.

- Example Scenario: A supplier of specialized ore processing equipment might consider offering integrated processing services, potentially impacting BHP's operational costs if they control critical steps.

BHP Group generally faces low bargaining power from suppliers for common consumables due to a fragmented market, allowing for competitive sourcing. However, for specialized equipment and proprietary technologies, concentrated supplier bases can increase leverage, as seen with advanced automation solutions in 2024.

The availability of alternatives for most inputs limits supplier influence, though constraints in 2024 for certain rare earth elements and specialized mining equipment could empower specific providers. High switching costs for integrated solutions also strengthen supplier power in those instances.

Suppliers of critical inputs, like specialized machinery components, hold significant power due to their direct impact on BHP's production, contrasting with suppliers of less essential items. BHP's 2023 capital expenditure of approximately $10.1 billion on property, plant, and equipment underscores the reliance on these specialized inputs.

| Factor | Impact on BHP | Example (2024) |

|---|---|---|

| Supplier Concentration (Specialized Tech) | High Power | Providers of advanced mining automation systems |

| Availability of Alternatives (General Consumables) | Low Power | Multiple vendors for standard mining supplies |

| Switching Costs (Integrated Solutions) | High Power | Suppliers of proprietary processing technology |

| Criticality of Input (Essential Machinery Parts) | High Power | Manufacturers of core heavy mining equipment components |

What is included in the product

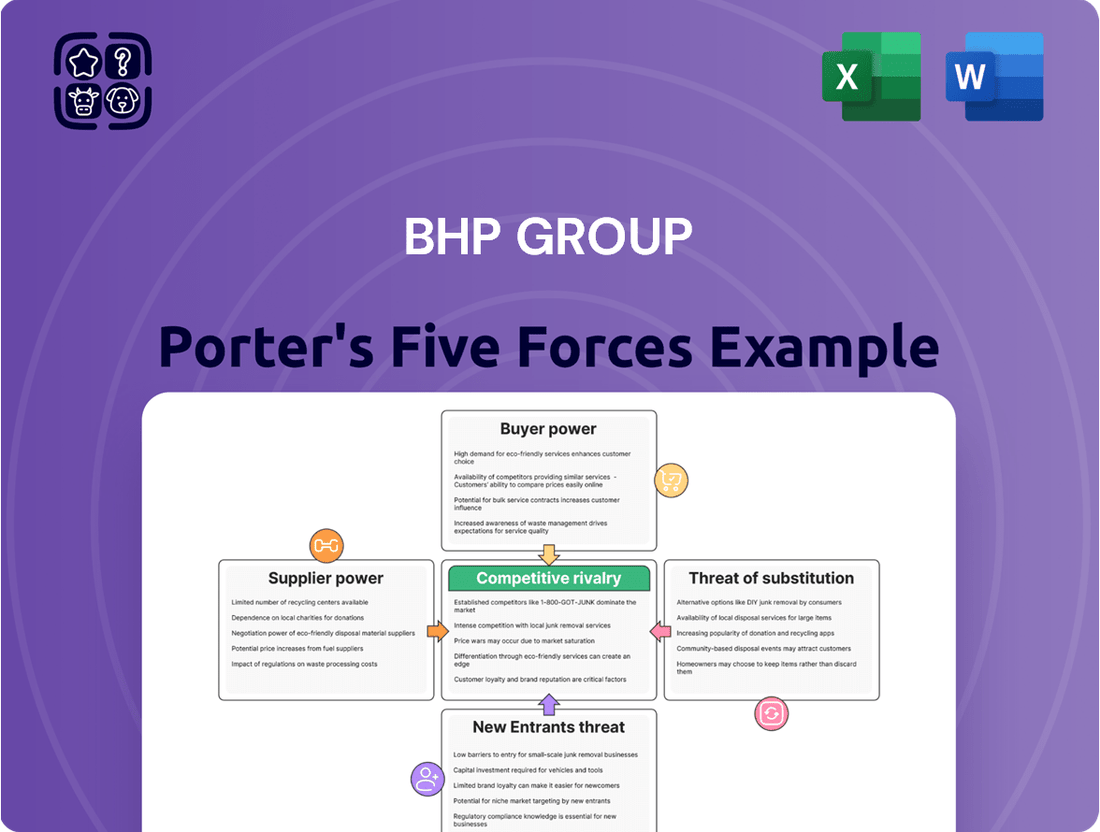

This Porter's Five Forces analysis for BHP Group dissects the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the global resources sector.

Quickly assess competitive intensity across the mining sector, identifying key threats and opportunities for BHP Group.

Customers Bargaining Power

BHP Group's customer base for key commodities like iron ore, copper, and coal can be quite concentrated. For instance, major steel manufacturers in China represent a significant portion of demand for iron ore. This concentration means that a few large industrial buyers can wield considerable power in negotiating prices and contract terms, especially for bulk commodities where standardization is common.

The influence of these concentrated customers is particularly evident in the iron ore market, where China's industrial output and infrastructure spending directly shape global demand and pricing. In 2023, China accounted for approximately 60% of global steel production, underscoring the immense bargaining power held by its steel mills when purchasing raw materials like iron ore from suppliers such as BHP.

Customers making large volume purchases, such as major industrial conglomerates or national entities, hold substantial bargaining power. BHP, selling essential raw materials to global industries, often deals with buyers who procure immense quantities, giving them leverage in price negotiations and contract terms.

For instance, in 2024, major steel manufacturers in China, a primary market for BHP's iron ore, continued to exert significant influence due to their consistent demand for millions of tonnes annually. This scale of purchasing allows these industrial giants to negotiate favorable pricing and delivery schedules, directly impacting BHP's revenue and profit margins.

Switching costs for customers of BHP's commodities are generally low. Many minerals are standardized, meaning buyers can easily find alternative suppliers globally. For instance, in 2024, the iron ore market saw significant price volatility, allowing buyers to shift between producers based on cost advantages.

While long-term contracts can offer some customer loyalty, the inherent fungibility of raw materials like coal and copper means buyers can often switch suppliers without substantial difficulty if better pricing or terms are available. This low switching cost directly impacts BHP's pricing power.

Availability of Substitute Products for Customers

The availability of substitute products for BHP's core commodities can significantly influence customer bargaining power. While direct substitutes for essential materials like iron ore and copper are often limited in current industrial applications, the landscape can shift. Technological advancements or evolving manufacturing processes might introduce viable alternatives, thereby empowering customers with more choices and consequently, greater leverage.

For instance, the growing adoption of lithium iron phosphate (LFP) battery technology in electric vehicles presents a clear example of how substitutes can impact demand for traditional battery materials. This trend could potentially reduce the demand for nickel and cobalt, commodities in which BHP has interests, thereby increasing the bargaining power of EV manufacturers who can opt for LFP alternatives.

- Limited Direct Substitutes: For many of BHP's primary products like iron ore and copper, direct substitutes are not readily available in the short to medium term for their established uses, which generally tempers customer power.

- Emerging Technological Substitutes: Innovations in areas like battery technology (e.g., LFP vs. Nickel-Cobalt) can create indirect substitutes, offering customers alternative pathways and increasing their bargaining leverage.

- Impact on Specific Commodities: The shift towards LFP batteries, for example, could diminish the demand for nickel and cobalt in the EV sector, a key growth market for these metals.

- Future Potential for Substitution: Continued research and development in materials science and industrial processes hold the potential to introduce further substitutes across BHP's product portfolio in the future.

Customer Price Sensitivity

Customer price sensitivity is a significant factor for BHP Group, particularly in its commodity markets. Because products like iron ore and copper are largely standardized, buyers often focus on price as the primary differentiator. This means that even small changes in global commodity prices can directly impact how much customers are willing to pay, pushing them to negotiate harder for lower prices from producers like BHP.

For instance, in 2024, the volatility in steel prices, a key driver for iron ore demand, directly influenced steelmakers' purchasing power. When steel prices dipped, customers sought to pass on that cost pressure to their iron ore suppliers. This heightened sensitivity means that producers must remain competitive on price to maintain market share.

- High Price Sensitivity in Commodities: Customers in markets for iron ore, copper, and coal are highly sensitive to price due to product standardization.

- Impact of Raw Material Costs: For many of BHP's customers, the cost of raw materials like iron ore represents a substantial portion of their own production expenses, making them keen negotiators.

- Fluctuations Drive Negotiation: Global commodity price swings in 2024 directly influenced customer demand and their willingness to press for lower prices from suppliers such as BHP.

The bargaining power of BHP Group's customers is substantial, driven by the concentrated nature of their client base, particularly in key markets like China for iron ore. These large industrial buyers, such as major steel manufacturers, procure vast quantities of raw materials annually, granting them significant leverage in price and contract negotiations. For example, in 2024, Chinese steelmakers continued to be a dominant force, influencing global commodity pricing due to their consistent, large-volume purchases, impacting BHP's revenue streams.

Switching costs for customers are generally low, as many of BHP's commodities are standardized and readily available from multiple global suppliers. This fungibility allows buyers to easily shift their procurement to producers offering more favorable terms, a dynamic clearly observed in the iron ore market in 2024 where price volatility enabled buyers to seek cost advantages. Furthermore, while direct substitutes for essential materials like iron ore and copper are limited, emerging technological alternatives, such as LFP batteries in the EV sector, can indirectly empower customers by offering alternative material pathways, potentially impacting demand for commodities like nickel and cobalt.

Customer price sensitivity remains a critical factor. Given the commoditized nature of many of BHP's products, buyers often prioritize price, making them aggressive negotiators, especially when their own product prices fluctuate. In 2024, downturns in steel prices, for instance, directly translated into increased pressure from steelmakers on raw material suppliers like BHP to lower their prices, underscoring the direct link between end-market conditions and customer bargaining power.

| Factor | BHP Group Impact | 2024 Relevance |

|---|---|---|

| Customer Concentration | High (e.g., Chinese steel mills) | Dominant buyers in iron ore market |

| Switching Costs | Low (standardized commodities) | Facilitates buyer flexibility in sourcing |

| Availability of Substitutes | Limited direct, but emerging indirect (e.g., LFP batteries) | Potential future impact on specific metals |

| Price Sensitivity | High (commodity markets) | Directly linked to end-market price fluctuations |

Full Version Awaits

BHP Group Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for BHP Group, revealing the competitive landscape and strategic positioning of this global resources giant. You'll gain insights into the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry among existing competitors, and the threat of substitute products or services. The document you see here is exactly what you’ll be able to download after payment, offering a comprehensive and ready-to-use strategic assessment.

Rivalry Among Competitors

The global mining arena is dominated by a handful of colossal, diversified entities such as Rio Tinto, Glencore, and Vale, interspersed with a multitude of smaller, specialized operators. BHP, standing as one of the world's premier mining corporations, contends with fierce rivalry from these significant competitors, especially within its primary commodity sectors: iron ore and copper.

The mining industry's growth rate is a significant factor influencing competitive rivalry. Global economic expansion and the ongoing energy transition are key drivers of this growth, creating both opportunities and pressures within the sector. For instance, in 2024, the International Monetary Fund projected global growth to be around 3.2%, a figure that directly impacts commodity demand and, consequently, the intensity of competition among mining giants like BHP.

The competitive rivalry within the mining sector, particularly for BHP Group, is significantly shaped by the inherent lack of product differentiation in its core commodities like iron ore, copper, and coal. These are essentially standardized goods, meaning buyers are less concerned with unique product features and more focused on price and dependable delivery. This dynamic naturally fuels intense price competition among major players.

For instance, in 2024, the global iron ore market saw prices fluctuate, with major producers like BHP, Rio Tinto, and Vale competing fiercely on cost efficiency to maintain market share. Similarly, copper producers contend with global benchmarks, where the primary competitive edge often comes down to operational excellence and the ability to produce at a lower cost per tonne.

Exit Barriers

The mining sector, including operations like those of BHP Group, is characterized by substantial exit barriers. These include immense sunk costs in specialized, long-lived assets, such as mines and processing facilities, which are difficult to repurpose or sell. For instance, the initial capital expenditure for a new mine can run into billions of dollars.

Environmental remediation obligations also represent a significant cost that must be addressed upon closure, often involving extensive land rehabilitation and long-term monitoring. These costs can amount to hundreds of millions of dollars per site, making abandonment financially unviable. Furthermore, long-term contracts with suppliers and customers create ongoing commitments that are costly to break.

These high exit barriers mean that companies are often compelled to continue production even when market conditions are unfavorable, such as during periods of low commodity prices. This persistence keeps capacity in the market, thereby intensifying competitive rivalry among existing players.

- High Capital Investment: BHP's significant investments in assets like the Olympic Dam mine, which requires substantial ongoing capital for maintenance and expansion, create a strong disincentive to exit.

- Environmental Remediation: Post-mining rehabilitation costs, estimated to be in the hundreds of millions for large-scale operations, act as a major barrier to exiting a particular mining site.

- Contractual Obligations: Long-term supply agreements for raw materials or offtake agreements for produced commodities create financial penalties for early termination, locking companies into operations.

- Specialized Assets: Mining equipment and infrastructure are highly specialized and have limited alternative uses, making their resale value low and contributing to the difficulty of exiting.

Strategic Objectives of Competitors

Competitors within the mining sector, including giants like Rio Tinto and Vale, often prioritize market share expansion and cost leadership. For instance, in 2024, many diversified miners focused on optimizing operations to reduce their all-in sustaining costs (AISC), a key metric for profitability. This pursuit of efficiency directly fuels competitive actions, such as increased capital expenditure on new technologies or streamlining existing production processes.

These rivals frequently pursue similar strategic objectives, which inevitably leads to intensified competition. We see this play out through aggressive pricing strategies, particularly in commodity markets sensitive to supply and demand fluctuations. Furthermore, a surge in production volumes or strategic mergers and acquisitions (M&A) are common tactics employed to secure a stronger competitive position and gain a crucial edge in the global marketplace.

- Market Share Ambitions: Competitors aim to capture a larger portion of the global commodity market, driving aggressive production and sales strategies.

- Cost Leadership Drive: Many rivals focus on reducing operational costs to offer more competitive pricing, impacting overall market dynamics.

- Diversification Strategies: Some competitors are actively exploring diversification into new commodities or value-added products to mitigate risk and unlock new revenue streams.

- M&A Activity: The pursuit of scale and synergy often leads to mergers and acquisitions, reshaping the competitive landscape.

The competitive rivalry for BHP Group is intense, primarily due to the commodity nature of its core products like iron ore and copper. Major players such as Rio Tinto, Glencore, and Vale are constantly vying for market share, often through cost leadership and operational efficiency. For example, in 2024, the pursuit of lower all-in sustaining costs (AISC) was a common strategic objective among these diversified miners, directly influencing competitive actions and pricing strategies.

The lack of product differentiation in these essential commodities means that price and reliable delivery are paramount. This forces companies like BHP to focus heavily on optimizing their production processes and supply chains to remain competitive. The global economic outlook, with projected growth around 3.2% in 2024 according to the IMF, directly impacts demand and escalates this rivalry as companies seek to capitalize on market opportunities.

High exit barriers, including massive sunk costs in specialized assets and significant environmental remediation obligations, lock companies into the market. This persistence, even during unfavorable periods, intensifies competition among the remaining players. Strategic moves like mergers, acquisitions, and aggressive production expansion are common tactics used to gain an edge.

In 2024, the iron ore market, a key area for BHP, saw significant competition among its top rivals, with a focus on cost efficiency to maintain market dominance. Similarly, copper producers competed based on global benchmarks, where operational excellence and cost per tonne were critical differentiators.

SSubstitutes Threaten

The threat of substitutes for BHP's primary commodities, like iron ore and copper, is currently relatively low for their core applications. However, the landscape is evolving. For instance, in the electric vehicle sector, the increasing adoption of lithium iron phosphate (LFP) batteries, which require less cobalt and nickel, directly impacts demand for these metals, a trend that gained significant traction in 2024.

Technological advancements are a significant threat of substitutes for BHP Group. Innovations in areas like renewable energy storage, for instance, could lessen the demand for traditional battery metals like copper and nickel, which BHP mines. For example, advancements in solid-state battery technology, expected to gain traction through the late 2020s and into 2030, could reduce the need for the cobalt and nickel currently used in many lithium-ion batteries.

Furthermore, the development of advanced materials or more efficient manufacturing processes could reduce the overall quantity of raw materials required for various industries. This means that even if demand for end products remains, the underlying need for BHP's commodities might decrease due to material substitution or process optimization. Consider the push for lighter, stronger materials in the automotive sector, which could decrease the steel required per vehicle, impacting iron ore demand.

Shifts in consumer preferences toward sustainability can significantly impact demand for raw materials. For instance, by 2024, the global market for recycled plastics was projected to reach over $50 billion, indicating a growing preference for alternatives to virgin materials.

Changes in industry standards, such as those promoting circular economy principles, can also act as a substitute. This might involve increased use of refurbished components or materials derived from waste streams, thereby reducing the need for newly mined resources.

These evolving consumer tastes and regulatory shifts can indirectly substitute traditional mining outputs by fostering innovation in material science and recycling technologies, potentially altering the competitive landscape for companies like BHP.

Price-Performance Trade-off of Substitutes

The price-performance trade-off of substitutes directly impacts BHP's commodity sales. If alternatives like advanced plastics or composites offer similar or better performance for construction or manufacturing at a lower cost than steel or aluminum, demand for BHP's products could wane. For instance, the increasing use of lightweight aluminum alloys in the automotive sector, driven by fuel efficiency mandates, presents a direct substitute threat to steel, a key BHP product.

The economic viability of these substitutes is paramount. In 2024, the fluctuating prices of raw materials for BHP's core products, coupled with the development of more cost-effective production methods for substitutes, could shift the competitive landscape. For example, advancements in 3D printing materials might offer customized solutions that reduce the need for traditional bulk commodities.

- Cost Competitiveness: Substitutes that can match or exceed the performance of BHP's commodities at a lower price point pose a significant threat.

- Performance Enhancements: Innovations in substitute materials offering superior durability, weight, or other key attributes can erode demand for traditional commodities.

- Technological Advancements: Emerging technologies in material science and manufacturing can create new, more attractive alternatives to BHP's offerings.

- Market Adoption Rates: The speed at which industries adopt these substitute materials, influenced by factors like capital investment and regulatory changes, will determine the pace of the threat.

Regulatory and Environmental Pressures

Increasing regulatory and environmental pressures, particularly concerning carbon footprints and resource efficiency, are a significant threat to BHP Group. For instance, stricter emissions standards globally can make newly mined materials less competitive compared to recycled alternatives or products made with lower-carbon inputs. This external push accelerates the adoption of substitutes, directly impacting the demand for BHP's primary commodities.

Governments worldwide are implementing policies aimed at decarbonization. In 2024, the European Union continued to strengthen its Emissions Trading System (ETS), potentially increasing the cost of carbon-intensive production for materials like steel, which relies heavily on iron ore and metallurgical coal supplied by companies like BHP. This creates a more favorable environment for substitutes that offer lower embedded carbon.

- Regulatory Push: Growing government mandates for emissions reductions and sustainable sourcing directly favor substitute materials.

- Environmental Incentives: Policies promoting resource efficiency and circular economy principles make recycled or alternative inputs more attractive.

- Market Shift: These pressures can lead to a faster-than-expected shift in consumer and industrial demand away from virgin, carbon-intensive commodities.

- Cost Competitiveness: As regulatory costs rise for traditional materials, substitutes can become more economically viable, intensifying competitive pressure.

The threat of substitutes for BHP's core commodities remains a dynamic factor, with technological advancements and evolving consumer preferences driving innovation. While direct substitutes for essential materials like iron ore in steel production are limited, alternative materials in specific applications, such as aluminum in automotive manufacturing, continue to present a challenge. For instance, by 2024, the automotive industry's increasing focus on lightweighting for fuel efficiency saw continued adoption of aluminum, impacting steel demand.

The economic viability of substitutes is crucial. In 2024, fluctuating commodity prices for BHP's products, alongside advancements in the cost-effective production of alternatives like advanced composites or recycled materials, could shift market dynamics. For example, improvements in 3D printing technologies offered more tailored solutions, potentially reducing the need for bulk raw materials.

Regulatory pressures also play a significant role, with global decarbonization efforts favoring lower-carbon alternatives. Stricter emissions standards in 2024, like those within the EU's Emissions Trading System, made carbon-intensive production less competitive, thereby boosting the appeal of recycled or sustainably sourced materials.

| Substitute Material | Primary BHP Commodity | Key Application | 2024 Market Trend/Impact |

|---|---|---|---|

| Aluminum Alloys | Iron Ore (for Steel) | Automotive Body Panels | Increased adoption for lightweighting and fuel efficiency. |

| Advanced Composites | Steel, Aluminum | Aerospace, Automotive Components | Growing use due to high strength-to-weight ratio, impacting demand for metals. |

| Recycled Plastics/Metals | Virgin Plastics, Metals | Packaging, Construction | Rising demand driven by sustainability initiatives and cost-effectiveness. |

| Lithium Iron Phosphate (LFP) Batteries | Nickel, Cobalt | Electric Vehicles | Growing market share reducing demand for traditional battery metals. |

Entrants Threaten

The mining sector, including operations like those of BHP Group, demands colossal capital outlays. Think billions of dollars just to get a new mine off the ground, covering everything from finding the ore to building the roads and processing plants. For instance, developing a new major copper mine can easily cost upwards of $5 billion.

This sheer scale of investment creates a formidable barrier for potential new competitors. BHP's established, large-scale operations, often spanning decades and vast resource deposits, represent a significant advantage. It’s not just about having the money; it’s about deploying it effectively across complex, long-term projects, a feat that is incredibly challenging for smaller, less capitalized entities to replicate.

Economies of scale are a significant barrier for new entrants in the mining sector, where established giants like BHP Group operate. BHP's vast operations in iron ore, for instance, allow for highly efficient extraction and processing, leading to lower per-unit costs that are difficult for newcomers to replicate. In 2023, BHP's iron ore production reached 281 million tonnes, a scale that inherently drives down costs and makes it challenging for smaller, less capitalized firms to compete on price.

BHP Group's established global supply chains and deep-seated relationships with major industrial clients present a significant barrier to new entrants. These existing networks are crucial for efficient product delivery and market penetration.

Securing comparable access to these vital distribution channels would require substantial investment and time for any new competitor. For instance, in 2023, BHP's extensive logistics infrastructure facilitated the movement of millions of tonnes of commodities, underscoring the scale of the challenge for newcomers.

Government Policy and Regulation

Government policy and regulation act as a substantial barrier to entry in the mining sector, directly impacting BHP Group. The industry is subject to rigorous environmental, social, and governance (ESG) standards, complex permitting procedures, and specific taxation regimes. These requirements necessitate significant upfront investment and expertise, making it challenging for newcomers to establish operations.

For instance, in 2024, many jurisdictions continued to strengthen their ESG reporting mandates for mining companies. This includes detailed disclosures on water usage, carbon emissions, and community engagement. New entrants must demonstrate compliance with these evolving standards from the outset, adding to the cost and complexity of market entry.

- Stringent ESG Requirements: New entrants must meet evolving environmental and social governance standards, which can involve substantial capital expenditure for compliance.

- Complex Permitting Processes: Obtaining mining licenses and operational permits often involves lengthy and intricate bureaucratic procedures, delaying or deterring new competitors.

- Taxation Policies: Resource-rich nations frequently impose specific mining taxes and royalties, which can significantly impact the profitability and attractiveness of the sector for new investors.

- Regulatory Uncertainty: Changes in government policy or the introduction of new regulations can create an unpredictable operating environment, discouraging potential new entrants.

Access to Raw Materials and Technology

The threat of new entrants into the mining sector, particularly for a company like BHP Group, is significantly mitigated by the substantial barriers related to accessing raw materials and technology. Securing high-quality, economically viable mineral deposits is a finite challenge, and these prime resources are often already controlled by established major players. This existing control limits the availability of attractive new sites for potential competitors.

Furthermore, companies such as BHP have cultivated proprietary mining technologies and decades of operational expertise. This accumulated know-how forms a formidable barrier for newcomers who lack comparable access to advanced techniques or the necessary operational capabilities. For instance, BHP’s investments in autonomous mining systems and advanced geological surveying tools are not easily replicated by nascent firms.

- Limited Availability of Prime Deposits: High-grade, easily accessible mineral reserves are scarce and often already under the control of established mining giants like BHP.

- High Capital Requirements: The sheer cost of acquiring exploration rights, developing infrastructure, and implementing advanced mining technologies presents a significant financial hurdle for new entrants.

- Proprietary Technology and Expertise: Decades of investment in research and development have resulted in specialized technologies and operational efficiencies that are difficult for new companies to match.

- Regulatory and Environmental Hurdles: Navigating complex permitting processes and meeting stringent environmental standards require significant experience and resources, which new entrants may lack.

The threat of new entrants for BHP Group is considerably low due to immense capital requirements, with new major mine development often exceeding $5 billion. BHP's established economies of scale, demonstrated by its 2023 iron ore production of 281 million tonnes, create cost advantages that are difficult for newcomers to match.

Furthermore, proprietary technology and decades of operational expertise, such as BHP's investments in autonomous mining, act as significant deterrents. The scarcity of prime mineral deposits, often controlled by established players, alongside stringent ESG regulations and complex permitting processes, further solidifies these barriers.

| Barrier Type | Description | Example for BHP Group |

| Capital Requirements | Colossal initial investment needed for exploration, infrastructure, and operations. | New copper mine development can cost over $5 billion. |

| Economies of Scale | Lower per-unit costs achieved through large-scale production. | BHP's 2023 iron ore output of 281 million tonnes drives cost efficiencies. |

| Proprietary Technology & Expertise | Advanced, specialized knowledge and systems developed over time. | Investment in autonomous mining systems and advanced geological tools. |

| Regulatory & Permitting | Complex and lengthy processes for obtaining licenses and meeting ESG standards. | Evolving ESG reporting mandates in 2024 require substantial compliance investment. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for BHP Group is built upon a foundation of comprehensive data, including BHP's annual reports and investor presentations, alongside industry-specific market research from firms like Wood Mackenzie and S&P Global Platts.

We supplement this with data from regulatory filings, commodity price indices, and macroeconomic indicators to provide a robust assessment of competitive forces within the mining and metals sector.