BHP Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BHP Group Bundle

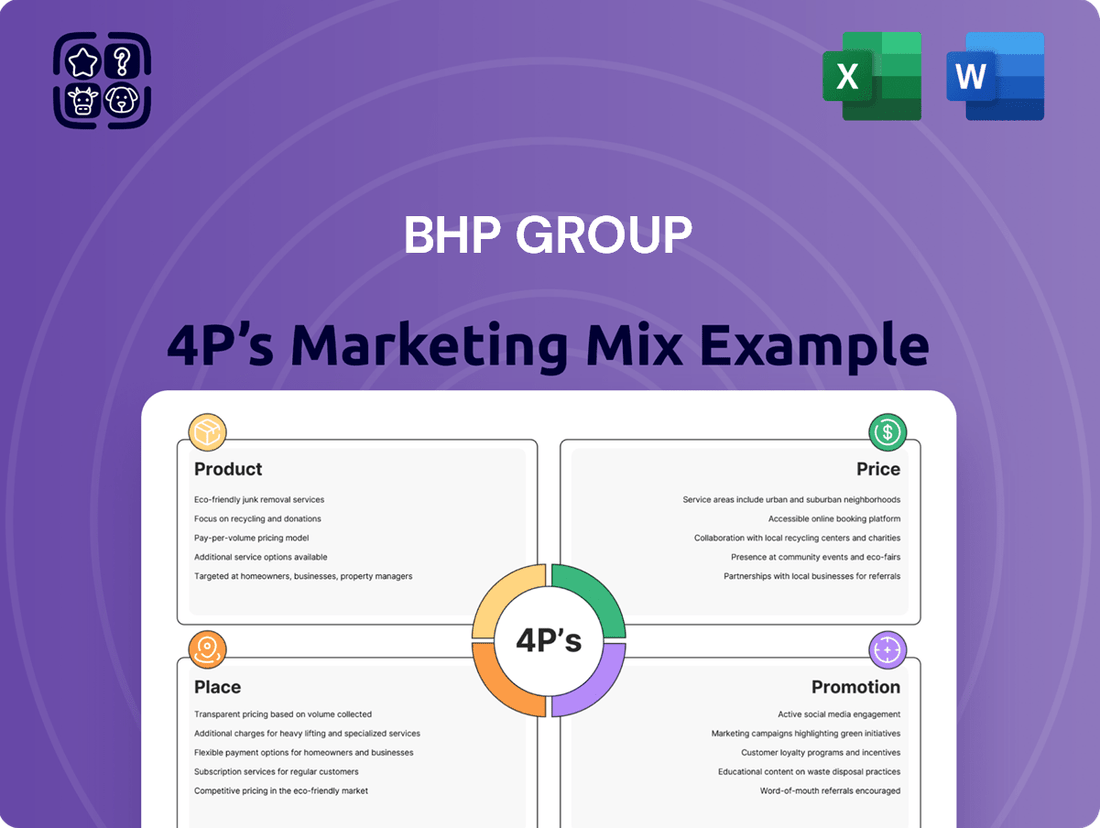

BHP Group's marketing mix is a powerful engine driving its global success, from the essential commodities they offer to their strategic pricing and vast distribution networks. Understanding how they leverage each "P" is key to grasping their market dominance.

Dive deeper into BHP Group's product portfolio, their intricate pricing strategies, their extensive global reach (place), and their impactful promotional activities with our comprehensive 4Ps analysis. This ready-to-use report offers actionable insights for business professionals and students alike.

Save valuable time and gain a strategic edge. Our editable, presentation-ready analysis breaks down each element of BHP Group's marketing mix, providing real-world examples and structured thinking for your own business planning or academic needs.

Product

BHP Group's iron ore product, primarily from its Western Australia Iron Ore (WAIO) operations, is a cornerstone of its business. This key raw material is essential for global steel production, a vital component for infrastructure and manufacturing worldwide.

WAIO consistently demonstrates its strength as a low-cost producer, achieving record volumes. In fiscal year 2025, WAIO's output reached its highest point ever, with the South Flank mine surpassing its nameplate capacity, underscoring BHP's operational efficiency and market leadership in iron ore.

BHP's copper product is central to global trends like electrification and digitalization, making it a crucial commodity. The company's significant asset base ensures a consistent supply of this vital metal.

In FY2024, BHP achieved its highest copper production in over 15 years, driven by record output at its Escondida and Spence operations in Chile and robust performance in Copper South Australia.

For FY2025, BHP is projected to produce over 2 million tonnes of copper globally, a new record that solidifies its position as a leading producer in the market.

BHP is a significant global provider of metallurgical coal, a crucial ingredient for steel production. In FY2025, the company's metallurgical coal production saw a 5% increase, driven by enhanced truck productivity within its key operations like the BHP Mitsubishi Alliance (BMA). This growth occurred even as BHP strategically divested some coal assets during FY2024 to concentrate on premium steelmaking coal.

Nickel

Nickel is a vital commodity for BHP, especially given its role in electric vehicle batteries. In the first half of 2024, the global nickel market faced significant headwinds. This led BHP to make a strategic decision.

In July 2024, BHP announced the temporary suspension of its nickel operations in Western Australia. This move was a direct response to a global oversupply situation impacting nickel prices and market conditions. The company stated its commitment to supporting its workforce and the local communities affected by this decision.

BHP remains actively engaged in monitoring the nickel market. The company is evaluating future opportunities for its nickel assets, indicating a long-term perspective despite current market challenges. This strategic pause allows BHP to adapt to the evolving global supply and demand dynamics for this critical metal.

- Product Importance: Nickel is a key ingredient in the cathodes of lithium-ion batteries, powering the growing electric vehicle sector.

- Market Dynamics: Global nickel oversupply, particularly from new Indonesian production, significantly impacted prices in 2024.

- Operational Response: BHP temporarily suspended its Western Australia Nickel operations in July 2024 due to these market conditions.

- Strategic Outlook: BHP continues to assess market trends, suggesting a potential re-engagement when conditions become more favorable.

Potash

BHP's product strategy for potash centers on its significant investment in this essential agricultural nutrient. The company is developing the Jansen Stage 1 project in Saskatchewan, Canada, a move designed to position BHP as a leading global potash supplier. This strategic focus acknowledges the robust, long-term demand for potash, fueled by a growing global population and evolving dietary preferences.

The Jansen project is progressing well, with first production now anticipated in late 2026, ahead of its initial timeline. This development is crucial for BHP's diversification strategy, expanding its portfolio beyond traditional commodities. The project's scale and expected output are poised to make a substantial impact on the global potash market.

Key facts about BHP's potash venture include:

- Investment Focus: BHP is committing substantial capital to potash production, recognizing its strategic importance.

- Jansen Project Timeline: First production from Jansen Stage 1 is now slated for late 2026, indicating strong project execution.

- Market Position: The Jansen project is expected to establish BHP as a major player in the global potash market.

- Demand Drivers: Long-term demand for potash is underpinned by population growth and changing global diets.

BHP's product portfolio is diverse, with iron ore and copper being major contributors. In FY2025, WAIO achieved record iron ore volumes, exceeding nameplate capacity at South Flank. Copper production in FY2024 hit a 15-year high, with FY2025 projections exceeding 2 million tonnes.

Metallurgical coal also plays a significant role, with FY2025 production up 5% due to improved productivity. Nickel operations in Western Australia were temporarily suspended in July 2024 due to global oversupply, but BHP is monitoring the market for future opportunities.

The company is also strategically investing in potash, with Jansen Stage 1 in Canada set to begin production in late 2026, positioning BHP as a key global supplier. This expansion diversifies BHP's commodity base to meet growing agricultural demand.

| Product | FY2025 Projection/Status | Key Driver | Notable Performance |

| Iron Ore (WAIO) | Record Volumes | Global steel demand | South Flank exceeded nameplate capacity |

| Copper | > 2 million tonnes | Electrification, digitalization | Highest production in over 15 years (FY2024) |

| Metallurgical Coal | +5% Production | Steel production | Improved truck productivity (BMA) |

| Nickel | Temporary Suspension (July 2024) | EV battery demand | Response to global oversupply |

| Potash (Jansen Stage 1) | First production late 2026 | Global food security, population growth | Major diversification initiative |

What is included in the product

This analysis delves into BHP Group's marketing mix, examining its diverse product portfolio, strategic pricing approaches, global distribution networks, and integrated promotional activities to understand its competitive positioning.

Provides a clear, actionable breakdown of BHP's marketing strategy, alleviating the pain of complex market analysis for swift decision-making.

Simplifies the intricate 4Ps of BHP's marketing mix, offering a concise solution to understanding their competitive positioning and strategic advantages.

Place

BHP's global mining operations are strategically positioned across key continents, featuring substantial, long-lasting assets. In Australia, the company extracts iron ore, copper, nickel, and coal. Chile is a significant hub for copper production, while Canada contributes through its potash operations. This widespread presence diversifies resource access and helps manage country-specific risks.

BHP Group's direct sales strategy focuses on supplying essential commodities like iron ore, copper, and coal directly to major industrial clients across the globe. This business-to-business approach targets steel manufacturers, smelters, and agricultural processors who rely on consistent, high-volume deliveries.

This model is built on fostering robust, long-term partnerships, often solidified through substantial bulk supply agreements. For instance, in the 2023 financial year, BHP's iron ore sales volume reached 282 million tonnes, with a significant portion going to direct industrial customers in Asia.

The company's commitment to reliability and quality in these direct sales is crucial for maintaining its market position. BHP's copper division, which supplied 1.7 million tonnes in FY23, also sees a large volume of its output channeled through these direct industrial relationships, supporting global manufacturing and infrastructure development.

BHP actively cultivates strategic partnerships and joint ventures to broaden its market influence and accelerate project development. These collaborations are crucial for accessing new markets and sharing the substantial capital requirements of large-scale mining operations.

A prime example is the Samarco joint venture in Brazil, focused on iron ore production. More recently, BHP formed Vicuña Corp. in partnership with Lundin Mining in Argentina, aiming to advance significant copper projects, underscoring its commitment to future growth in key commodities.

In 2023, BHP's share of underlying profit from its joint ventures contributed significantly to its overall financial performance, demonstrating the value generated through these strategic alliances.

Logistics and Supply Chain Optimization

BHP’s commitment to logistics and supply chain optimization is a cornerstone of its marketing mix, ensuring its vast resource portfolio reaches global markets efficiently. This focus translates into tangible benefits, like the record iron ore shipments achieved through strategic investments in port debottlenecking and advanced rail technology programs. For instance, in the fiscal year ending June 30, 2024, BHP reported significant improvements in rail haulage capacity, directly impacting their ability to meet customer demand promptly.

Further strengthening its logistical capabilities, BHP's Copper South Australia division recently forged a partnership with Aurizon. This collaboration aims to create a seamless, integrated logistics solution encompassing rail, road, and port operations. Such strategic alliances are crucial for managing the complexities of transporting bulk commodities, with the goal of reducing transit times and overall costs for customers throughout 2024 and into 2025.

- Record Iron Ore Shipments: BHP's investments in port and rail infrastructure have directly supported record iron ore export volumes, enhancing its market presence.

- Copper Logistics Partnership: The alliance with Aurizon for Copper South Australia streamlines the movement of copper, improving delivery efficiency.

- Cost-Effective Delivery: Optimized logistics contribute to cost-effective product delivery, a key factor in maintaining competitive pricing for BHP's commodities.

Global Shipping Networks

BHP leverages vast global shipping networks to move its bulk commodities, a critical component of its product strategy. This ensures timely delivery to a diverse international customer base.

Demonstrating a commitment to environmental responsibility, BHP announced in 2023 the chartering of two ammonia dual-fuelled Newcastlemax bulk carriers. This move aligns with industry trends towards decarbonization in maritime transport.

- Global Reach: BHP's operations necessitate extensive shipping routes connecting mines to global markets.

- Fleet Modernization: The company is investing in greener shipping technologies, exemplified by its ammonia-fueled vessel charters.

- Operational Efficiency: Reliable shipping is fundamental to maintaining BHP's supply chain integrity and meeting customer demand.

BHP's Place in the marketing mix is defined by its strategically located, world-class assets and robust logistics network. These operations span Australia, Chile, and Canada, ensuring diversified resource access and efficient global distribution of key commodities like iron ore and copper. The company's commitment to optimizing its supply chain, including investments in rail and port infrastructure, directly supports its ability to meet substantial customer demand. For instance, BHP's iron ore operations in Western Australia are supported by extensive rail networks and port facilities designed for high-volume export.

BHP's extensive network of mines and processing facilities forms the core of its 'Place' strategy. These assets are situated in regions with significant mineral reserves, allowing for consistent, large-scale production. The company’s operational footprint is designed to minimize transportation distances to key export terminals, thereby enhancing cost-efficiency and reliability. For example, the Pilbara region in Western Australia, a major iron ore hub for BHP, benefits from integrated mine-to-port infrastructure.

BHP's logistical capabilities are crucial for its global reach, connecting its resource base to international markets. Investments in port debottlenecking and advanced rail technology have been instrumental in achieving record shipment volumes. In the fiscal year ending June 30, 2024, BHP reported significant enhancements in its rail haulage capacity, a direct result of these strategic infrastructure upgrades aimed at improving delivery times and volumes for its customers worldwide.

The company's strategic partnerships in logistics, such as the collaboration with Aurizon for Copper South Australia, further solidify its 'Place' by creating integrated, efficient supply chains. This focus on seamless operations from mine to customer is vital for delivering bulk commodities reliably and cost-effectively, ensuring BHP maintains its competitive edge in the global market.

| Asset Location | Key Commodities | Logistical Support |

|---|---|---|

| Western Australia | Iron Ore | Extensive rail networks, Port Hedland export facilities |

| Chile | Copper | Port infrastructure, rail transport |

| Canada | Potash | Rail and port access for export |

What You Preview Is What You Download

BHP Group 4P's Marketing Mix Analysis

The preview shown above is identical to the final version you'll download. Buy with full confidence. This BHP Group 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies, offering a comprehensive overview of their market approach.

Promotion

BHP's investor relations and financial reporting are central to its promotional strategy, emphasizing transparency. The company regularly publishes detailed annual reports, interim financial results, and investor presentations. These materials offer a deep dive into operational performance, financial standing, and strategic outlook, catering to a sophisticated audience.

For the financial year ended 31 May 2024, BHP reported underlying EBITDA of $27.7 billion, demonstrating robust operational performance. Their commitment to clear communication is evident in the accessibility of these financial disclosures, which are crucial for building investor confidence and facilitating informed decision-making among stakeholders.

BHP Group's commitment to sustainability is a key element of its marketing strategy, particularly in attracting environmentally and socially conscious investors. Their detailed sustainability reports, including climate transition action plans, showcase progress in critical areas like reducing greenhouse gas emissions and managing biodiversity. For instance, BHP's 2023 sustainability report highlighted a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity since FY2020, a tangible metric for stakeholders.

These reports also underscore BHP's dedication to Indigenous engagement and community investment, fostering goodwill and a strong social license to operate. By transparently communicating these efforts, BHP aims to build trust and enhance its brand reputation, aligning with the growing demand for responsible corporate citizenship. This focus on ESG (Environmental, Social, and Governance) factors is increasingly influencing investment decisions, with many funds actively seeking companies with robust sustainability credentials.

BHP Group actively engages in major global industry conferences focused on metals, mining, and critical minerals. These gatherings are crucial for senior executives to share the company's strategic direction and market perspectives.

At these events, BHP leadership provides insights into their outlook and growth plans, directly addressing analysts, investors, and fellow industry professionals. For instance, during the 2024 financial year, BHP's participation in forums like the Prospectors & Developers Association of Canada (PDAC) convention allowed for direct engagement on their exploration strategies and commitment to future resource development.

News Releases and Media Engagement

BHP Group actively manages its public image through regular news releases and media engagement, keeping stakeholders informed about operational advancements and strategic initiatives. This proactive approach ensures consistent visibility for the company's performance and future plans.

In the fiscal year ending June 30, 2024, BHP reported a significant increase in underlying EBITDA, reaching $24.4 billion, underscoring the impact of effective communication on investor sentiment. Their media outreach highlights key achievements, such as the progress on the Jansen Potash project, which is a crucial part of their diversification strategy.

- Operational Updates: BHP frequently communicates progress on its mining and production activities, including production volumes and safety records.

- Strategic Ventures: Announcements regarding new projects, acquisitions, or divestitures are central to their media engagement, shaping perceptions of their growth trajectory.

- Financial Milestones: Regular financial reporting and commentary accompany media releases, providing transparency on earnings and capital allocation.

- Investor Relations: Proactive engagement with financial media and analysts aims to build confidence and support for BHP's stock performance.

Digital Transformation and AI Initiatives

BHP is actively demonstrating its commitment to innovation through significant investments in digital transformation and Artificial Intelligence. A prime example is the establishment of its inaugural Industry AI Hub in Singapore, a strategic move designed to spearhead the adoption of AI technologies within the mining industry.

This initiative directly supports BHP's marketing efforts by showcasing its forward-thinking approach and dedication to leveraging cutting-edge solutions. The hub's focus on enhancing safety and productivity through AI adoption serves as a tangible benefit being communicated to stakeholders.

- Industry AI Hub: BHP's first AI Hub launched in Singapore, signaling a major push into AI for mining.

- Focus Areas: The hub prioritizes accelerating digital transformation and AI adoption to improve safety and productivity.

- Innovation Showcase: This initiative positions BHP as a leader in technological advancement within the resources sector.

- Future Investment: BHP's commitment to AI aligns with industry trends, with global AI spending in mining projected to grow significantly in the coming years, reaching billions by 2027.

BHP's promotional activities are multifaceted, focusing on transparency, sustainability, and innovation to engage a diverse stakeholder base. Their investor relations efforts, highlighted by detailed financial reporting and sustainability reports, aim to build trust and attract socially conscious investors.

The company actively participates in industry conferences to communicate its strategic direction and market outlook, with leadership engaging directly with analysts and investors. For the fiscal year ended 30 June 2024, BHP reported underlying EBITDA of $24.4 billion, with their media outreach emphasizing progress on key projects like Jansen Potash.

Furthermore, BHP showcases its commitment to innovation through investments in digital transformation and AI, exemplified by its Industry AI Hub in Singapore, positioning them as a leader in technological advancement within the resources sector.

| Promotional Activity | Key Focus | Data/Example (FY24 unless stated) |

|---|---|---|

| Investor Relations & Financial Reporting | Transparency, Financial Performance | Underlying EBITDA: $24.4 billion; Detailed annual reports, interim results |

| Sustainability Communications | ESG, Climate Action, Community Investment | 15% reduction in Scope 1 & 2 GHG emissions intensity (vs FY20); Sustainability reports |

| Industry Conferences & Engagement | Strategic Direction, Market Perspectives | Participation in PDAC 2024; Executive insights on exploration and growth |

| Media Engagement & News Releases | Operational Updates, Strategic Initiatives | Progress on Jansen Potash project; Increased visibility on achievements |

| Innovation Showcase (AI) | Digital Transformation, Future Technology | Launch of Industry AI Hub in Singapore; Focus on safety and productivity |

Price

BHP's product pricing is intrinsically linked to global commodity markets, where supply and demand forces, geopolitical events, and broader economic trends dictate value. This means BHP's revenue is directly impacted by the fluctuations in these vital markets.

For instance, iron ore prices, a cornerstone of BHP's business, experienced notable shifts. Copper, however, demonstrated resilience, maintaining a positive price trajectory into 2025, reflecting strong demand in sectors like electric vehicles and renewable energy infrastructure.

BHP's cost leadership strategy is deeply embedded in its operational approach, especially in iron ore, where it consistently aims to be a low-cost producer. This focus allows BHP to achieve higher relative margins and maintain profitability even when global commodity prices dip. For instance, in the fiscal year 2023, BHP reported an EBITDA margin of 66% for its iron ore division, a testament to its efficient operations and cost control.

This emphasis on operational efficiency directly influences BHP's pricing strategy. By keeping production costs low, the company can offer competitive pricing in the market while still ensuring healthy profit margins. This resilience was evident in its financial performance, with BHP reporting a record underlying EBITDA of $45.2 billion for FY23, showcasing the strength of its cost-conscious approach.

Long-term supply contracts are a cornerstone of BHP Group's marketing strategy, securing a substantial portion of their sales with key industrial clients. This approach offers significant benefits, including predictable revenue streams and a degree of insulation from short-term market volatility. While exact terms remain confidential, this practice is standard in the bulk commodity sector.

For instance, in the 2023 financial year, BHP reported that approximately 80% of its iron ore sales volume was underpinned by contracts or internal transfers, highlighting the importance of these arrangements for revenue stability. This contractual framework is crucial for managing production planning and capital expenditure, especially given the cyclical nature of commodity markets.

Capital Allocation and Shareholder Returns

BHP's capital allocation strategy directly influences its shareholder returns, prioritizing a balance between reinvesting in growth opportunities and delivering consistent dividends. This approach underpins its pricing decisions by ensuring financial flexibility and a commitment to rewarding investors.

The company has demonstrated a strong history of shareholder returns, aiming for a dividend payout ratio in the range of 50-54% of underlying earnings. For the fiscal year ended June 30, 2024, BHP announced a final dividend of USD 0.72 per share, reflecting its ongoing commitment to this policy.

- Dividend Payout Ratio Target: 50-54% of underlying earnings.

- Fiscal Year 2024 Final Dividend: USD 0.72 per share.

- Capital Allocation Focus: Balancing growth investments with shareholder returns.

- Financial Strategy Linkage: Pricing decisions are informed by capital allocation and return objectives.

Economic and Commodity Outlook Analysis

BHP's economic and commodity outlook is a cornerstone of its pricing strategy. By dissecting global growth trajectories and the demand for key commodities like iron ore and copper, driven by trends such as decarbonization and urbanization, BHP positions itself to anticipate market shifts. For instance, their analysis in early 2024 highlighted robust demand for copper, crucial for the energy transition, which underpins their pricing for this metal.

This forward-looking perspective also directly influences major capital allocation and production planning. For example, BHP's decision to proceed with the Jansen Potash project in Canada, with stage 1 estimated to cost US$5.7 billion and expected to commence production in 2026, is a testament to their long-term commodity outlook, anticipating sustained demand for fertilizers.

The company's outlook analysis helps identify potential market imbalances, whether deficits or surpluses, which are critical for setting competitive yet profitable prices. Their reporting often includes projections for supply and demand, allowing them to adjust production and sales strategies proactively. For example, in their 2023 outlook, they noted tight supply conditions for certain commodities, supporting higher price expectations.

- Global Growth Projections: BHP closely monitors IMF and World Bank forecasts, integrating them into their demand models for key commodities. For 2024, global GDP growth was projected around 3.1%, influencing overall commodity demand.

- Decarbonization Impact: The accelerating shift to renewable energy sources is a major driver for copper and nickel demand. BHP anticipates this trend will create structural deficits in these markets, supporting elevated prices.

- Urbanization Trends: Continued urbanization, particularly in developing economies, fuels demand for construction materials like iron ore and steel, a key component of BHP's revenue.

- Market Balance Analysis: BHP's internal analysis often forecasts supply-demand balances for its core products, informing its pricing mechanisms and hedging strategies.

BHP's pricing strategy is deeply intertwined with global commodity market dynamics, where supply, demand, and macroeconomic factors dictate value. Their cost leadership, particularly in iron ore, allows for competitive pricing while maintaining healthy margins, as evidenced by a 66% EBITDA margin in that division for FY23.

Long-term supply contracts, securing around 80% of iron ore sales in FY23, provide revenue stability and insulation from short-term price swings. This contractual approach is crucial for managing production and capital expenditure, especially given the cyclical nature of commodities.

BHP's capital allocation prioritizes reinvestment and shareholder returns, aiming for a 50-54% dividend payout ratio. The FY24 final dividend of USD 0.72 per share reflects this commitment, with pricing decisions informed by these return objectives.

The company's economic and commodity outlook, including robust copper demand projections for 2025 driven by decarbonization, directly influences pricing. Their long-term view also supports major investments like the Jansen Potash project, expected to begin production in 2026.

| Metric | FY23 Value | Outlook/Target |

| Iron Ore EBITDA Margin | 66% | Cost Leadership |

| Iron Ore Sales Under Contract | ~80% (FY23) | Revenue Stability |

| Dividend Payout Ratio Target | 50-54% | Shareholder Returns |

| FY24 Final Dividend | USD 0.72 per share | Shareholder Returns |

| Jansen Potash Project Start | 2026 | Long-term Demand Anticipation |

4P's Marketing Mix Analysis Data Sources

Our BHP Group 4P's Marketing Mix Analysis is grounded in comprehensive data from official company disclosures, including annual reports and investor presentations. We also incorporate insights from industry analysis, market research, and competitive intelligence to ensure accuracy.