BHP Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BHP Group Bundle

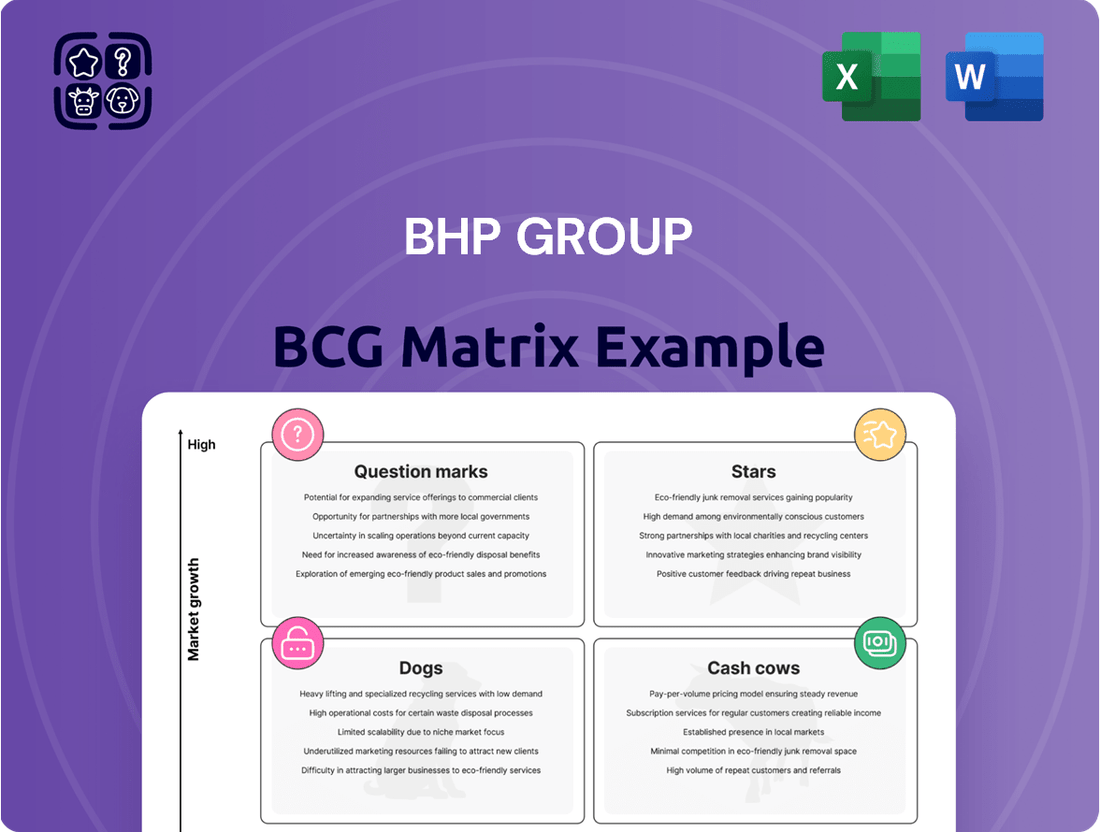

Explore the strategic positioning of BHP Group's diverse portfolio through its BCG Matrix. Understand which of its mining and commodity businesses are Stars, Cash Cows, Dogs, or Question Marks, and how they contribute to the company's overall growth and profitability. Purchase the full BCG Matrix to unlock actionable insights and develop a more robust strategy for resource allocation and future investments.

Stars

BHP Group's copper operations, particularly its Escondida mine, firmly place it as a leading global producer. In fiscal year 2025, BHP achieved a remarkable output exceeding 2 million tonnes of copper, a testament to its significant market share. This performance was bolstered by Escondida setting a 10-year production record, showcasing exceptional operational efficiency and scale.

Copper is a cornerstone of the energy transition, vital for building renewable energy systems, electric vehicles, and modernizing power grids. The demand for this essential metal is soaring.

Projections indicate a substantial increase in copper consumption, with some analyses suggesting a potential deficit of around 6.5 million tonnes by the year 2030. This robust demand forecast firmly places copper in a high-growth category for commodities.

The global push towards electrification, particularly in the automotive sector with electric vehicles (EVs), is a major catalyst for copper demand. By 2024, projections indicated a significant uptick in EV sales, directly translating to increased copper requirements for wiring, batteries, and charging infrastructure. This trend is fundamentally reshaping the market for this essential metal.

Simultaneously, the burgeoning growth of artificial intelligence (AI) and its reliance on massive data centers is creating another powerful demand vector for copper. These facilities require substantial amounts of copper for power transmission, cooling systems, and internal connectivity. The sheer scale of AI development means these data centers are becoming increasingly copper-intensive, further bolstering its strategic value.

BHP, as a leading copper producer, is well-positioned to capitalize on these converging trends. The company's 2024 financial reports highlighted robust copper production, underscoring its role in supplying the critical materials needed for this technological transformation. The strategic importance of copper for both green energy transition and digital infrastructure is undeniable, directly impacting BHP's growth trajectory.

Strategic Investments in Copper Expansion

BHP Group's strategic focus on copper positions it strongly within the BCG matrix, likely as a star. The company is making significant investments to boost copper production, aiming to add approximately 540,000 tons annually. This expansion underscores a commitment to capitalizing on the robust demand for copper, driven by electrification and renewable energy trends.

- Copper Production Expansion: BHP plans to increase its copper output by up to 540,000 tons per year.

- Key Projects: The expansion of its Escondida mine is a prime example of this strategic growth.

- Market Opportunity: Copper is a high-growth commodity, essential for green technologies.

- Investment Rationale: These investments reflect confidence in sustained copper demand and pricing.

Favorable Long-Term Market Outlook

Industry experts are optimistic about the long-term prospects for copper, anticipating sustained demand and favorable pricing. This positive outlook stems from a persistent gap between the supply of new copper mines and the rapidly growing consumption needs.

This scenario bodes well for BHP's significant copper holdings, positioning them favorably within the market. For instance, in the fiscal year 2023, BHP's copper production reached 1,760 kt, contributing substantially to their overall revenue.

- Copper Demand Drivers: Electrification of transport and renewable energy infrastructure are key consumption growth areas.

- Supply Constraints: Declining ore grades and the long lead times for new mine development are creating supply challenges.

- Price Projections: Analysts forecast copper prices to remain robust, potentially exceeding $10,000 per tonne in the coming years.

- BHP's Position: BHP's large-scale, low-cost copper operations are well-placed to capitalize on these market dynamics.

BHP's copper assets, particularly its world-class Escondida mine, are undeniably Stars in the BCG matrix. These operations generate substantial revenue and are in a high-growth market due to surging demand for electrification and AI infrastructure. The company's significant investments, like the planned 540,000-ton annual copper output increase, solidify copper's Star status.

Copper's role in the green energy transition and digital advancements ensures continued high demand, positioning BHP's copper segment for sustained growth and market leadership. The company's 2023 copper production of 1,760 kt exemplifies its strong performance in this vital commodity sector.

| Metric | Value (FY2023) | Outlook |

| Copper Production (kt) | 1,760 | Projected increase of 540,000 tons/year |

| Market Growth Drivers | Electrification, AI Data Centers | High and accelerating |

| Price Trend | Robust | Expected to exceed $10,000/tonne |

| BHP's Competitive Advantage | Large-scale, low-cost operations | Well-positioned for demand |

What is included in the product

BHP's BCG Matrix highlights strategic investment in its high-growth, high-market share assets (Stars) and leverages its established, cash-generating businesses (Cash Cows).

The BHP Group BCG Matrix provides a clear, one-page overview, instantly relieving the pain of complex strategic planning.

Cash Cows

BHP's Western Australian Iron Ore (WAIO) operations are a cornerstone of its portfolio, solidifying its position as a global leader. In FY25, BHP achieved record iron ore production, exceeding its own forecasts and underscoring the consistent high volumes generated by WAIO. This performance reinforces BHP's dominant market share in the iron ore sector.

Iron ore is a bedrock of BHP Group's portfolio, acting as a reliable cash cow. Its essential role in global steel production guarantees consistent demand, translating into substantial and stable revenue streams for the company. This commodity underpins much of BHP's financial strength.

Despite occasional market fluctuations and concerns about oversupply, BHP's iron ore operations are characterized by impressive volume and high operational efficiency. These factors are crucial in maintaining robust cash flow generation, even amidst challenging market conditions. For instance, in the fiscal year 2023, BHP's Petroleum division, which includes iron ore, reported underlying earnings of $14.7 billion, showcasing the segment's significant contribution.

BHP's high-quality metallurgical coal portfolio is a prime example of a Cash Cow within its BCG Matrix. The company concentrates on producing premium steelmaking coals, crucial for industries such as construction and automotive manufacturing worldwide. This strategic focus on specialized products ensures a consistent and robust demand within its specific market segment, thereby generating dependable earnings for BHP.

In 2024, BHP's Queensland coal operations, a key part of its metallurgical coal business, continued to be a significant contributor to its financial performance. For the fiscal year ending June 30, 2024, BHP reported strong operational results from its coal segment, underscoring the stable demand and pricing power of its high-quality metallurgical coal. This segment reliably generates substantial cash flow, supporting the company's overall financial health and ability to invest in other growth areas.

Operational Resilience in Mature Markets

BHP's iron ore and metallurgical coal businesses are prime examples of Cash Cows within its portfolio. These operations exhibit remarkable operational resilience, consistently delivering strong production volumes despite external pressures such as adverse weather or market volatility. This stability is a hallmark of mature, highly efficient business units.

These mature assets provide a stable and predictable revenue stream, underpinning BHP's financial strength. For instance, in the fiscal year 2023, BHP's Western Australia Iron Ore operations reported EBITDA of $26.9 billion, showcasing its robust cash-generating capabilities. Similarly, its metallurgical coal segment contributed significantly, with Queensland Coal reporting an EBITDA of $7.9 billion for the same period.

- Iron Ore Resilience: BHP's iron ore operations in Western Australia consistently achieve high production levels, demonstrating their ability to weather operational challenges.

- Metallurgical Coal Strength: The Queensland metallurgical coal business also shows strong operational performance, contributing substantial cash flow.

- Financial Contribution: These segments are key drivers of BHP's overall profitability and cash generation, reflecting their Cash Cow status.

- Mature Market Dominance: Operating in established markets, these units benefit from scale and optimized infrastructure, ensuring sustained cash flows.

Essential for Global Industrial Development

Iron ore and metallurgical coal are the bedrock of global industrial development, particularly for steel production. Their essential nature guarantees consistent demand, solidifying their position as BHP's cash cows.

These commodities are crucial for building everything from skyscrapers to bridges, directly fueling urbanization and infrastructure projects worldwide. This fundamental utility translates into a reliable revenue stream for BHP.

- Iron Ore Demand: Global steel production, heavily reliant on iron ore, is projected to remain robust, supporting infrastructure growth.

- Metallurgical Coal's Role: Essential for coking in steelmaking, metallurgical coal's demand is intrinsically linked to steel output.

- BHP's Market Position: BHP is a leading global producer of both iron ore and metallurgical coal, benefiting from economies of scale and established markets.

- Financial Contribution: In the fiscal year 2023, BHP's iron ore operations generated significant free cash flow, underscoring its cash cow status.

BHP's iron ore and metallurgical coal operations are quintessential Cash Cows. These mature businesses benefit from established markets and efficient operations, consistently generating substantial cash flow. Their critical role in global steel production ensures sustained demand, making them reliable profit engines for the company.

| Segment | FY23 EBITDA (USD Billion) | FY24 Operational Highlights | Cash Flow Contribution |

|---|---|---|---|

| Iron Ore (WAIO) | 26.9 | Record production achieved, exceeding forecasts | Significant free cash flow generation |

| Metallurgical Coal (Queensland) | 7.9 | Strong operational results, stable demand and pricing | Substantial and dependable earnings |

Preview = Final Product

BHP Group BCG Matrix

The BHP Group BCG Matrix preview you are viewing is the precise, fully editable document you will receive immediately after purchase. This comprehensive analysis, meticulously crafted by industry experts, will be delivered directly to you without any watermarks or demo content, ensuring you get a ready-to-use strategic tool for immediate application.

Dogs

BHP Group's decision to temporarily suspend its Western Australia nickel operations, including the West Musgrave nickel project, places these assets firmly in the question mark category of the BCG Matrix. This strategic move acknowledges the current unfavorable market conditions, characterized by a significant global oversupply of nickel, which directly impacts profitability and future growth prospects.

The global nickel market has been significantly impacted by an oversupply, largely stemming from increased production in Indonesia. This surge in supply, particularly of lower-cost nickel pig iron and mixed hydroxide precipitate, has driven down prices considerably. For instance, the London Metal Exchange (LME) nickel price saw a dramatic drop, trading around $16,000 per tonne in early 2024, a stark contrast to its peaks in 2022.

This price environment has directly affected BHP Group's Australian nickel operations. The company announced in February 2024 that it would be placing its nickel assets in Western Australia on care and maintenance, citing the challenging market conditions. These assets, which previously contributed to BHP's portfolio, are now uneconomical to run due to the depressed nickel prices, a direct consequence of the global oversupply.

BHP Group's Australian nickel operations are currently a significant drag on profitability, reporting an underlying EBITDA loss of approximately $300 million for the financial year ending June 30, 2024. This figure highlights that these assets are consuming capital rather than generating positive cash flow.

Review for Potential Divestment

BHP Group is currently evaluating its nickel operations, with a potential divestment on the table. This move positions the nickel business within the BCG Matrix's 'Dogs' quadrant, a category typically characterized by low market share and low growth, making divestiture a strategic consideration.

In 2023, BHP's Western Australia nickel operations faced significant challenges, contributing to a substantial write-down. For instance, the company recorded an impairment of $2.5 billion in the first half of fiscal year 2024 related to these assets, highlighting their underperformance and the rationale behind the strategic review.

- Nickel Business Review: BHP is actively assessing the future of its nickel assets, including the possibility of selling them.

- BCG Matrix Classification: The nickel business is considered a 'Dog' due to its low market share and growth prospects, suggesting divestment as a viable strategy.

- Financial Performance Impact: The underperformance of the nickel division led to a significant impairment charge of $2.5 billion in H1 FY24 for BHP's Western Australia nickel operations.

- Strategic Rationale: Divesting underperforming assets like the nickel business allows BHP to reallocate capital to more profitable and growth-oriented ventures.

High-Cost Operations in a Competitive Landscape

BHP's Western Australian nickel operations face significant headwinds due to their high-cost structure when compared to emerging, more cost-effective nickel sources, notably from Indonesia. This disparity creates a competitive disadvantage, impacting profitability and leading to their classification as a 'Dog' within the BCG matrix.

The Indonesian nickel industry, benefiting from lower energy costs and advanced processing techniques, is increasingly supplying the global market with competitive pricing. This influx of lower-cost material puts pressure on established, higher-cost producers like BHP's WA operations.

- High Cost Structure: BHP's Western Australian nickel operations are characterized by elevated production costs, making it difficult to compete with newer, lower-cost entrants.

- Competitive Pressure: The increasing supply of nickel from Indonesia, often produced at a lower cost, directly challenges the profitability of BHP's existing assets.

- Profitability Challenges: The combination of high operating expenses and market price pressures makes these operations a significant concern for sustained profitability.

BHP's Western Australian nickel assets are firmly in the 'Dog' category of the BCG matrix. This classification stems from their low market share and negative growth prospects, exacerbated by a high-cost structure that struggles to compete with lower-cost global producers, particularly from Indonesia.

The financial performance reflects this challenging position, with the operations reporting an approximate $300 million EBITDA loss for the fiscal year ending June 30, 2024. This underperformance led to a significant impairment charge of $2.5 billion in the first half of fiscal year 2024, underscoring the strategic decision to review or divest these assets.

The global nickel market dynamics, marked by an oversupply and depressed prices around $16,000 per tonne for LME nickel in early 2024, further solidify the 'Dog' status. These factors make the operations uneconomical and a drag on capital, prompting BHP to consider divestment as a means to reallocate resources to more profitable ventures.

BHP's nickel business is a clear 'Dog' due to its low market share and negative growth outlook, compounded by a high-cost base. The company recorded a substantial $2.5 billion impairment in H1 FY24 for these Western Australian assets, reflecting their underperformance and the challenging market conditions driven by global oversupply, particularly from Indonesia.

| BCG Category | BHP's Nickel Operations (WA) |

| Market Share | Low |

| Market Growth | Low/Negative |

| Profitability (FY24) | EBITDA Loss: ~$300M |

| Impairment (H1 FY24) | $2.5 Billion |

| Key Challenge | High Cost Structure vs. Indonesian Supply |

Question Marks

The Jansen Potash Project, with 63% completion and first production slated for late 2026, represents a significant investment for BHP Group. This venture positions potash as a new growth area for the company, which currently holds a minor share in this market. Given its substantial capital outlay and future market potential, Jansen would likely be classified as a Question Mark in the BCG Matrix.

BHP's Potash business is positioned to capitalize on the critical role of fertilizers in addressing global food security. The demand for potash is directly linked to the need for increased agricultural output to feed a growing world population, which is projected to reach nearly 10 billion by 2050. This makes the potash market a significant growth area.

The global fertilizer market, a key indicator for potash demand, was valued at approximately USD 240 billion in 2023 and is expected to grow at a compound annual growth rate of around 4-5% through 2030. Factors like the need for sustainable land use and improved crop yields further bolster the long-term prospects for potash producers like BHP.

BHP Group's current position in the global potash market can be characterized as having a low market share. This is primarily because its Jansen Potash project, a significant future contributor, is still in the development and ramp-up phase and not yet operating at full capacity. For instance, in fiscal year 2023, BHP's potash production was nil as the Jansen project was under construction and progressing towards its initial production target in the second half of calendar year 2026.

This low current market share aligns with the characteristics of a 'Question Mark' in the Boston Consulting Group (BCG) matrix. Question Marks represent business units or products with low market share in high-growth industries. While the global potash market is expected to grow, driven by increasing food demand and declining arable land, BHP's participation is nascent.

As of early 2024, the Jansen project is advancing, with construction nearing completion. The company has invested billions into this venture, aiming to become a significant global player once operational. The success of Jansen will be crucial in shifting BHP's position within the potash market, potentially transforming it from a Question Mark to a Star, assuming continued market growth and successful execution.

Requires Significant Capital Investment for Future Growth

The Jansen project, a key component of BHP's future growth strategy, demands a significant capital outlay. In 2024, BHP continued to invest heavily in its development, with the total project cost estimated to be around $10 billion USD. This substantial expenditure is essential for establishing BHP's position in the potash market and unlocking its long-term potential.

- Jansen Project Capital Expenditure: Estimated at approximately $10 billion USD as of 2024.

- Strategic Importance: Crucial for BHP's entry and expansion in the global potash market.

- Cash Consumption: Development phase requires significant cash outflow, impacting short-term cash flows.

- Future Growth Driver: Investment is foundational for realizing future revenue and market share in potash.

Potential to Become a Future Star Asset

BHP's Jansen potash project in Saskatchewan is positioned to become a future star asset. The global potash market is experiencing robust growth, driven by increasing demand for fertilizers to feed a growing world population. By 2024, the market is projected to see continued expansion, with prices showing resilience.

The Jansen project, a significant, long-life asset, represents a substantial strategic investment for BHP. Once it achieves full production capacity, estimated to be around 4.5 million tonnes per annum in its initial phase, it's expected to capture a significant share of this expanding market. This scale and longevity are key factors in its potential star status.

- Market Growth: The global fertilizer market, including potash, is forecast to grow at a compound annual growth rate (CAGR) of approximately 3-4% through 2025, driven by agricultural intensification.

- Jansen's Scale: BHP's Jansen project is designed as a multi-stage development, with the first phase alone representing a significant addition to global potash supply.

- Strategic Importance: Potash offers diversification for BHP, moving beyond its traditional iron ore and copper dominance into a sector with strong underlying demand fundamentals.

- Long-Term Value: The long-life nature of the Jansen asset means it can contribute to BHP's earnings and cash flow for decades, solidifying its potential as a cornerstone of the portfolio.

The Jansen Potash Project, still in its development phase with first production anticipated in late 2026, embodies the characteristics of a Question Mark in BHP's BCG Matrix. This classification stems from its position in a high-growth potash market, where BHP currently holds a negligible share due to the project's nascent operational status.

The substantial capital expenditure, estimated at around $10 billion USD for the Jansen project as of 2024, highlights the significant investment required to establish BHP's presence in this burgeoning market. This cash-intensive development phase means the venture consumes considerable resources without generating commensurate returns yet, a hallmark of Question Marks.

BHP's strategic intent is to transform Jansen from a Question Mark into a Star by successfully executing its development and ramp-up. The project's future success hinges on capturing a significant portion of the expanding global potash market, driven by food security needs and agricultural productivity growth.

The global fertilizer market, a proxy for potash demand, was valued at approximately USD 240 billion in 2023 and is projected to grow at a CAGR of 4-5% through 2030. This robust market growth provides the high-growth environment essential for a Question Mark to potentially evolve into a Star.

| BCG Category | BHP's Potash Business (Jansen Project) | Market Growth | BHP's Market Share | Strategic Implication |

| Question Mark | High Investment, Nascent Operations | High (Fertilizer Market CAGR 4-5%) | Low (Nil in FY23, growing post-2026) | Requires significant capital, high risk/reward |

BCG Matrix Data Sources

Our BHP Group BCG Matrix is informed by a robust blend of internal financial disclosures, extensive market research reports, and industry-specific growth forecasts to provide a comprehensive strategic overview.