BHP Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BHP Group Bundle

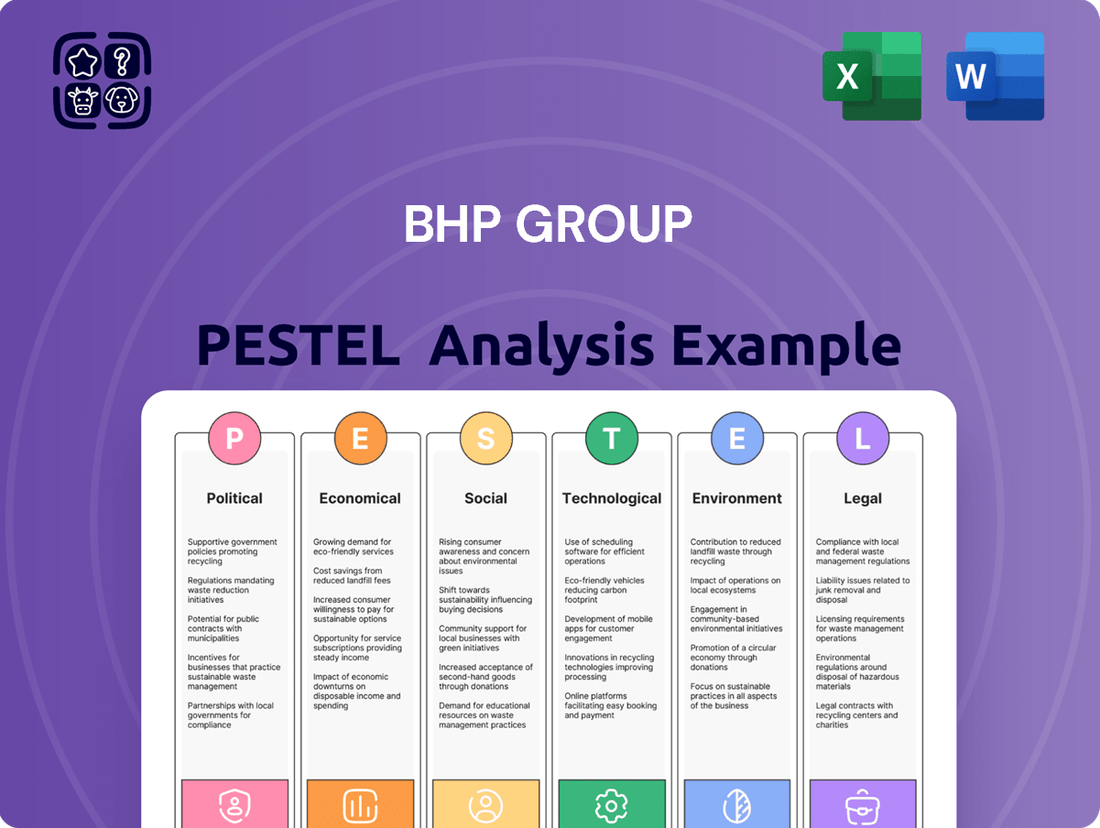

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping BHP Group's strategic landscape. Our PESTLE analysis provides a clear, actionable roadmap for navigating industry shifts and identifying future opportunities. Download the full version to gain a competitive advantage.

Political factors

BHP's global operations are heavily influenced by government policies and regulations concerning resource extraction, taxation, and environmental stewardship. For instance, shifts in royalty rates, as experienced in Queensland, Australia, can directly impact BHP's profitability and strategic investment choices.

The company's ability to attract and sustain new mining investments is closely tied to the presence of stable and competitive tax regimes. In 2023, BHP paid approximately $11.7 billion in taxes and royalties globally, underscoring the significant financial impact of fiscal policies.

Global trade relations and geopolitical stability are paramount for BHP, a company with extensive worldwide operations and a diverse customer base. Trade disputes, such as those that have flared between major economies, can significantly disrupt supply chains and limit access to key markets, impacting commodity demand and prices. For instance, escalating trade tensions in the early 2020s led to increased uncertainty for global commodity markets, a sector BHP is deeply involved in.

The ongoing volatility and policy uncertainty in the international landscape demand that BHP cultivates a resilient business model. This resilience is crucial to navigate potential disruptions, such as sanctions or tariffs, which can affect the movement of raw materials and finished goods. BHP's commitment to diversification across commodities and geographies helps mitigate some of these risks, but the overarching geopolitical climate remains a significant consideration for its strategic planning and operational continuity.

Countries rich in minerals are increasingly enacting policies to boost their stake in mining profits, often through elevated taxes or royalties. This phenomenon, known as resource nationalism, directly contributes to sovereign risk for companies operating in these regions.

BHP has voiced concerns regarding escalating sovereign risk within Australia, citing recent industrial relations legislation and adjustments to royalty structures. These policy shifts have the potential to inflate labor expenses and diminish the global competitiveness of the Australian economic landscape.

Industrial Relations and Labor Laws

Changes in industrial relations and labor laws present a significant political factor for BHP Group. For instance, Australia's 'Same Job, Same Pay' legislation, implemented in 2023, aims to ensure that labour-hire employees receive the same pay and conditions as directly employed staff for the same work. This can directly impact BHP's operational expenditures by increasing labor costs, particularly in its Australian mining operations, which are a substantial part of its global footprint.

BHP's stance often involves advocating for wage adjustments that are directly linked to productivity improvements. The company has expressed concerns that legislative mandates for wage increases without corresponding productivity gains can negatively affect its competitiveness and financial performance. For example, in the 2023 financial year, BHP's underlying EBITDA was $24.1 billion, and significant increases in labor costs without productivity offsets could impact future profitability.

Furthermore, evolving labor laws can influence the landscape of unionization and collective bargaining. Stricter regulations or shifts in worker protections could embolden unionization efforts, potentially leading to more complex negotiations and impacting BHP's flexibility in managing its workforce, especially during periods of expansion or restructuring. This dynamic is crucial for long-term strategic planning and operational stability.

- 'Same Job, Same Pay' Legislation: Introduced in Australia, this law mandates equal pay for comparable work, potentially increasing BHP's labor costs.

- Productivity-Linked Wages: BHP advocates for wage increases tied to productivity, viewing legislative mandates without such links as detrimental to cost management.

- Unionization Influence: Changes in labor laws can affect the strength and scope of union activities, influencing future workforce management and expansion plans.

- Cost Impact: Increased labor costs due to legislative changes could directly affect BHP's profitability, which reported $13.7 billion in net profit for FY23.

International Climate Policy and Agreements

BHP's extensive global operations are significantly influenced by a growing body of international climate policies and agreements, such as the Paris Agreement, which aim to curb greenhouse gas emissions. The company's commitment to this global effort is demonstrated through its Climate Transition Action Plan, which outlines its strategy for reducing operational GHG emissions. For instance, BHP has set a target to reduce its operational greenhouse gas emissions by at least 30% by 2030, compared to its FY2020 baseline.

Navigating these evolving regulations and meeting increasing stakeholder expectations for decarbonization is a critical strategic focus for BHP. The company's approach involves investing in technologies and processes to lower its carbon footprint across its mining and processing activities. This includes exploring opportunities in renewable energy for its operations and improving energy efficiency.

The financial implications of these climate policies are substantial, potentially impacting operational costs and requiring significant capital investment in cleaner technologies. For example, the increasing cost of carbon, whether through direct taxes or cap-and-trade systems, directly affects BHP's profitability.

- Paris Agreement: A global framework to limit global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels.

- BHP's Climate Transition Action Plan: A roadmap detailing the company's approach to reducing its greenhouse gas emissions.

- Operational GHG Emissions Reduction Target: A commitment to reduce Scope 1 and Scope 2 emissions by at least 30% by 2030 (from FY2020 baseline).

- Stakeholder Expectations: Growing pressure from investors, customers, and the public for companies to demonstrate robust climate action and transparency.

Political stability and government policies are critical for BHP's operations, influencing everything from resource extraction to taxation. For instance, changes in royalty rates, like those seen in Queensland, Australia, directly affect profitability. BHP's global tax and royalty payments were approximately $11.7 billion in 2023, highlighting the significant impact of fiscal policies.

Resource nationalism, where mineral-rich countries seek a larger share of mining profits through higher taxes or royalties, increases sovereign risk for companies like BHP. The company has expressed concerns about escalating sovereign risk in Australia due to recent industrial relations legislation and royalty adjustments, which could inflate labor costs and reduce global competitiveness.

Labor laws also play a significant role. Australia's 2023 'Same Job, Same Pay' legislation, for example, mandates equal pay for labor-hire employees doing the same work, potentially increasing BHP's operational expenditures. BHP advocates for wage increases tied to productivity, as legislative mandates without productivity gains can negatively impact its competitiveness.

International climate policies, such as the Paris Agreement, also shape BHP's strategy, driving its commitment to reducing greenhouse gas emissions. BHP's Climate Transition Action Plan targets a 30% reduction in operational GHG emissions by 2030 from a FY2020 baseline. The financial implications of carbon pricing and the need for investment in cleaner technologies are substantial.

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting BHP Group, offering a comprehensive understanding of its operating landscape.

It provides actionable insights into how these macro-environmental factors present both challenges and strategic opportunities for the global resources giant.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of BHP's external environment to streamline strategic discussions.

Economic factors

BHP Group's financial performance is intrinsically linked to the volatile nature of global commodity prices, especially for its core products: iron ore, copper, coal, and nickel. These price swings, driven by shifts in worldwide demand and supply dynamics, directly shape the company's revenue streams and operational profitability. For example, a notable downturn in iron ore prices, often triggered by subdued demand forecasts from key markets like China, can exert considerable pressure on BHP's earnings.

The health of the global economy is a primary driver for BHP's business, as increased population, more cities, and better living standards naturally boost the demand for the commodities BHP produces. BHP anticipates global economic growth to hold steady, with India emerging as a key market for commodity consumption.

Furthermore, the global shift towards cleaner energy sources and the increasing reliance on digital technologies are significantly increasing the need for metals and minerals. For instance, projections suggest that global GDP growth will be around 2.7% in 2024, with emerging markets, including India, expected to lead the way.

Inflationary pressures, particularly rising labor expenses, directly impact BHP's operational costs across its diverse asset base. For instance, in the fiscal year ending June 30, 2024, many mining sectors experienced a notable uptick in wages, a trend that could affect BHP's cost structure.

Despite these global inflationary trends, BHP has demonstrated a commitment to cost discipline and operational efficiency. The company's strategy aims to ensure that increases in unit costs remain below the prevailing inflation rate, a key objective for maintaining competitiveness.

Effective cost management is paramount for BHP to sustain its industry-leading profit margins. By keeping unit costs in check, even amidst inflationary headwinds, BHP can better protect its profitability and financial resilience in the dynamic global market.

Capital Investment and Project Pipeline

BHP's capacity to fund its extensive project pipeline, especially in forward-looking sectors like copper and potash, is a critical determinant of its sustained expansion. The company's strategic capital allocation is geared towards capitalizing on escalating demand for essential minerals, fueled by the global shift towards cleaner energy sources. For instance, BHP has earmarked significant capital for its Jansen potash project and ongoing copper expansions, underscoring its commitment to these growth areas.

In the 2024 financial year, BHP reported capital expenditure of approximately $10 billion, with a substantial portion directed towards advancing its key growth projects. The Jansen Stage 1 project, for example, is progressing, with procurement and construction activities well underway. BHP's outlook for capital expenditure in the 2025 financial year is projected to be between $10 billion and $11 billion, reflecting continued investment in its future growth drivers.

- BHP's capital expenditure for FY24 was around $10 billion, supporting its strategic project pipeline.

- The Jansen potash project and copper expansions are central to BHP's long-term growth strategy.

- Projected capital expenditure for FY25 is anticipated to range between $10 billion and $11 billion.

- Meeting the demand for critical minerals essential for the energy transition necessitates substantial capital investment.

Currency Exchange Rates and Trade Flows

BHP's global operations mean its financial results are sensitive to fluctuations in currency exchange rates, with the US dollar being a key benchmark. For instance, a stronger US dollar can impact the reported earnings of its Australian and South American operations when translated into USD. In 2024, the Australian dollar averaged around 0.66 USD, a slight depreciation from previous years, which generally benefits Australian dollar denominated costs for a US dollar reporting company.

Trade flows, crucial for commodity demand, are significantly influenced by global economic health and geopolitical factors like tariffs. A slowdown in major economies, such as China, a primary consumer of BHP's iron ore and copper, directly affects trade volumes. In the first half of 2024, China's industrial production growth showed resilience, but concerns about its property sector continued to cast a shadow over commodity demand.

The potential for a fragmented trading environment, marked by increasing protectionism and trade barriers, poses a considerable risk to BHP's outlook. Such fragmentation can disrupt established supply chains and create uncertainty in commodity pricing. For example, new tariffs imposed on key commodities could reduce demand or force shifts in sourcing, impacting BHP's sales volumes and profitability.

- Currency Impact: A stronger USD relative to AUD can reduce the reported USD value of BHP's Australian dollar-denominated revenues and profits.

- Trade Flow Drivers: Global GDP growth and industrial activity are primary determinants of demand for BHP's key commodities like iron ore and copper.

- Geopolitical Risk: Trade disputes and tariffs can create volatility in commodity markets, affecting BHP's sales and pricing strategies.

- 2024 Data Point: BHP reported that for the fiscal year ending June 30, 2024, approximately 60% of its revenue was denominated in US dollars, highlighting the direct impact of USD exchange rate movements.

Global economic growth is a key driver for BHP, with demand for its commodities tied to industrial activity and infrastructure development. Projections for 2024 indicate steady global GDP growth, with emerging markets, particularly India, expected to be significant contributors to commodity consumption, bolstering demand for iron ore and copper.

Inflationary pressures, notably rising labor and energy costs, directly impact BHP's operational expenses across its mining and production sites. For instance, the fiscal year ending June 30, 2024, saw continued upward pressure on wages in several mining regions, a trend that necessitates robust cost management for BHP to maintain its profitability.

Currency fluctuations, particularly the US dollar's strength against the Australian dollar, influence BHP's reported financial results. In 2024, the Australian dollar's average exchange rate against the US dollar presented a mixed impact, generally benefiting USD-denominated costs for BHP's Australian operations.

| Economic Factor | 2024 Impact/Outlook | BHP Relevance |

|---|---|---|

| Global GDP Growth | Projected steady growth, with emerging markets leading | Drives demand for iron ore, copper, and other commodities |

| Inflation | Rising labor and energy costs | Increases operational expenditure, impacting profit margins |

| Currency Exchange Rates | USD strength against AUD | Affects reported earnings from Australian operations |

Preview Before You Purchase

BHP Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of BHP Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors influencing its global operations. Gain valuable insights into market dynamics and strategic considerations.

Sociological factors

BHP Group is actively working to enhance workforce diversity, with a notable emphasis on increasing female representation. By the end of fiscal year 2023, women constituted 30.4% of their global workforce, a significant increase from previous years, reflecting a commitment to gender equality.

This drive for inclusion is viewed as a strategic advantage, directly contributing to improved safety records and operational productivity. For instance, BHP reported a 15% reduction in their all-injury frequency rate in FY23, a period marked by intensified diversity initiatives.

The company also strives for cultural diversity, aiming to mirror the societal demographics of the regions where it operates. This approach not only fosters a more inclusive environment but also strengthens community relations and understanding, crucial for sustainable business practices.

BHP actively partners with communities to foster long-term social, environmental, and economic benefits, recognizing this as a cornerstone of its sustainable operations. In fiscal year 2023, BHP reported approximately $240 million in social value contributions, including significant investments in community development programs and Indigenous engagement initiatives.

The company's approach involves substantial voluntary social investments, aiming to create shared value. This includes a strong focus on supporting local and Indigenous businesses, which is crucial for building trust and ensuring the social license to operate in the regions where BHP has a presence.

BHP recognizes Indigenous Peoples as vital partners, with a significant portion of its operations situated on or near their ancestral territories. The company is committed to upholding human rights and fostering increased equity and self-determination for these communities.

This commitment translates into tangible support for initiatives focused on Indigenous governance, cultural preservation, economic empowerment, and sustainable land and sea management practices. For instance, in fiscal year 2023, BHP invested $119 million in community programs, with a substantial portion directed towards Indigenous engagement and development initiatives.

Safety and Health of Employees

BHP Group places paramount importance on the safety and health of its workforce, recognizing it as a foundational element of its operations. The company is committed to fostering a secure work environment through ongoing enhancements in safety indicators and operational procedures. This dedication to employee well-being is not just a policy but a core value that drives operational excellence across the organization.

In fiscal year 2023, BHP reported a Total Recordable Injury Frequency Rate (TRIFR) of 3.08, reflecting a continued focus on reducing workplace incidents. This figure represents a 9% improvement compared to the previous year, demonstrating tangible progress in their safety initiatives. The company actively invests in advanced safety technologies and training programs to further mitigate risks and promote a culture of zero harm.

- Prioritizing Well-being: BHP's commitment to employee safety and health is its foremost priority.

- Continuous Improvement: The company actively works to enhance safety metrics and operational practices.

- Core Value: Safety underpins operational excellence and is deeply embedded in BHP's corporate culture.

- Performance Data: In FY23, BHP achieved a TRIFR of 3.08, a 9% reduction year-on-year.

Changing Societal Expectations for ESG

Societal expectations for companies like BHP Group regarding environmental, social, and governance (ESG) performance are significantly rising. Stakeholders, including investors, customers, and communities, are increasingly demanding transparency and action on critical issues such as climate change and biodiversity loss. BHP's response includes enhancing its sustainability reporting frameworks to better reflect these evolving demands and to proactively manage the intricate risks associated with ESG factors.

BHP is actively adapting its disclosures to meet these heightened expectations. For instance, in its 2023 Sustainability Report, the company detailed its progress against ambitious targets, including a commitment to reduce its operational greenhouse gas emissions. The company also highlighted investments in nature-positive initiatives, acknowledging the growing concern for ecological preservation.

- Increasing Stakeholder Scrutiny: A significant majority of investors now consider ESG factors integral to their investment decisions, with many actively engaging with companies on their sustainability performance.

- Climate Action Demands: Public and governmental pressure for robust climate action continues to mount, pushing companies to set more aggressive emissions reduction targets and invest in low-carbon technologies.

- Nature and Biodiversity Focus: Beyond climate, there's a growing societal emphasis on protecting biodiversity and natural resources, leading to expectations for companies to demonstrate responsible land use and conservation efforts.

- Transparency in Reporting: Companies are expected to provide clear, consistent, and verifiable data on their ESG performance, moving beyond qualitative statements to quantifiable metrics.

Societal expectations for corporate responsibility are evolving, with a strong emphasis on diversity and inclusion. BHP's commitment to increasing female representation in its workforce, reaching 30.4% by FY23, and fostering cultural diversity directly addresses these evolving norms. These efforts are linked to tangible improvements, such as a 15% reduction in the all-injury frequency rate in FY23, demonstrating the positive impact of a more inclusive environment.

Community engagement is also a critical sociological factor, with BHP investing approximately $240 million in social value contributions in FY23, including substantial support for Indigenous communities. This investment in local partnerships and Indigenous economic empowerment is vital for maintaining a social license to operate.

Furthermore, heightened societal awareness of ESG issues is driving demand for greater transparency and action on climate change and biodiversity. BHP's sustainability reporting, detailing progress on emissions reduction and nature-positive initiatives, reflects an adaptation to these growing stakeholder demands.

| Sociological Factor | BHP's Action/Data (FY23) | Impact/Significance |

| Workforce Diversity | 30.4% Female Workforce | Enhances safety and productivity; aligns with societal expectations. |

| Community Investment | ~$240 million in social value contributions | Strengthens community relations and social license to operate. |

| Indigenous Engagement | $119 million in community programs (significant portion to Indigenous initiatives) | Fosters equity and self-determination for Indigenous communities. |

| ESG Transparency | Enhanced sustainability reporting on emissions and nature-positive initiatives | Meets growing stakeholder demand for climate action and biodiversity protection. |

Technological factors

BHP is actively embracing digital transformation, notably establishing an Industry AI Hub in Singapore. This initiative aims to significantly accelerate the adoption of artificial intelligence across the mining and resources sector. The company is making strategic investments in new roles focused on architecting and scaling AI platforms, with the goal of enhancing both safety protocols and overall productivity.

The practical applications of AI and machine learning within BHP are broad, spanning critical areas such as more efficient mineral exploration, optimizing infrastructure performance, and improving the predictive maintenance of vital equipment. This focus on technological advancement is designed to drive operational excellence and unlock new efficiencies.

BHP is actively integrating automation and autonomous systems into its mining operations, significantly enhancing safety and efficiency. For instance, its Goonyella Riverside Mine in Queensland, Australia, operates one of the world's largest fully autonomous open-cut coal fleets, utilizing driverless haul trucks.

This strategic adoption of autonomous technology is designed to reduce human exposure to hazardous environments, thereby improving workplace safety records. The company anticipates these systems will lead to substantial gains in operational productivity and cost reduction, contributing to its overall competitive edge in the resources sector.

BHP's 'Think & Act Differently' initiative is a prime example of technological adaptation, leveraging 3D seismic survey technology borrowed from the oil and gas sector. This innovation allows for quicker and more environmentally conscious identification of high-grade mineral deposits, significantly streamlining the exploration process.

This cross-industry technological transfer is vital for accelerating resource discovery. For instance, in 2023, BHP reported that its exploration activities, aided by advanced seismic imaging, were targeting areas with the potential for significant copper and nickel discoveries, crucial for the energy transition.

Renewable Energy and Electrification Technologies

BHP's strategic alignment with the global energy transition is a significant technological factor. The company's focus on commodities like copper and nickel directly supports the burgeoning demand for renewable energy and electrification technologies. For instance, copper is essential for wind turbines and solar panels, while nickel is a key component in electric vehicle batteries.

BHP is actively investing in projects that bolster cleaner energy systems and the electric vehicle (EV) market. This involves substantial capital allocation towards critical minerals necessary for these technologies. The International Energy Agency reported in 2024 that global EV sales are projected to reach over 17 million units in 2024, a substantial increase from previous years, underscoring the growing need for these minerals.

- Copper Demand: Projections suggest global copper demand could nearly double by 2035, largely driven by the energy transition, with EVs and renewable infrastructure being major consumers.

- Nickel in Batteries: Nickel sulfate, a key ingredient for high-performance EV batteries, saw its price fluctuate in early 2024 due to supply-demand dynamics, highlighting the market's sensitivity to these technological shifts.

- Investment in Critical Minerals: BHP's investments in projects like the Jansen Potash Project, while not directly renewable, indirectly support agricultural efficiency which can be a component of broader sustainability goals, and the company continues to explore opportunities in other energy transition minerals.

Data Analytics and Infrastructure Efficiency

BHP's strategic investments in data analytics and digital tools are crucial for optimizing operational performance and resource management. For instance, in FY23, the company reported a 10% increase in copper recovery rates at its Spence operations, directly attributed to advanced analytics driving better ore control and processing. This focus on technological integration supports their commitment to infrastructure efficiency.

The company is actively enhancing its digital infrastructure to support these analytical capabilities. This includes upgrades to their mine management systems and the implementation of AI-powered predictive maintenance, aiming to reduce downtime and improve asset utilization. These initiatives are key to achieving their sustainability goals, such as reducing Scope 1 and 2 emissions intensity.

BHP's approach to technological factors is evident in several key areas:

- Digital Twin Implementation: Piloting digital twin technology for key assets to simulate performance and identify optimization opportunities, contributing to improved operational efficiency.

- Data-Driven Decision Making: Utilizing advanced analytics for real-time monitoring of production, safety, and environmental performance, enabling faster and more informed decision-making.

- AI and Machine Learning: Deploying AI and ML for tasks like geological modeling and equipment maintenance, enhancing resource discovery and reducing operational disruptions.

- Cybersecurity Investments: Allocating significant resources to bolster cybersecurity infrastructure, protecting sensitive operational data and ensuring system integrity.

BHP is heavily investing in AI and automation to boost efficiency and safety, exemplified by its Industry AI Hub in Singapore and autonomous mining fleets. The company leverages advanced technologies like 3D seismic surveys for faster, more environmentally conscious mineral exploration, as seen in its 2023 copper and nickel discovery efforts. This technological adoption directly supports BHP's role in the energy transition, supplying critical minerals like copper and nickel essential for electric vehicles and renewable energy infrastructure, with global EV sales projected to exceed 17 million units in 2024.

| Technological Factor | BHP's Action/Investment | Impact/Data Point |

| Artificial Intelligence (AI) & Machine Learning | Industry AI Hub in Singapore; AI for exploration, optimization, predictive maintenance | Accelerating AI adoption; enhancing safety and productivity |

| Automation & Autonomous Systems | Autonomous haul trucks at Goonyella Riverside Mine | Operating one of the world's largest fully autonomous open-cut coal fleets; improving safety and efficiency |

| Advanced Exploration Technologies | 3D seismic survey technology (from oil & gas) | Quicker, more environmentally conscious identification of high-grade mineral deposits; targeting significant copper/nickel discoveries in 2023 |

| Critical Minerals for Energy Transition | Focus on copper and nickel; investment in related projects | Supplying essential commodities for EVs and renewables; global EV sales projected to exceed 17 million in 2024 |

Legal factors

BHP Group navigates a complex web of mining and resource legislation across its global operations, impacting everything from exploration permits to environmental standards. For instance, in Australia, the Native Title Act 1993 continues to shape how resource projects interact with Indigenous communities, influencing project timelines and community agreements. Failure to comply with these stringent regulations, which include environmental protection laws and safety standards, directly jeopardizes BHP's ability to operate, as seen in past instances where regulatory scrutiny has led to operational pauses or fines.

BHP operates under diverse tax regimes globally, adhering strictly to all tax laws in its operating jurisdictions. In fiscal year 2023, BHP reported total income tax expense of $10.2 billion, underscoring its significant contribution to government revenues. The company's financial performance and investment decisions are directly influenced by changes in royalty rates, such as those experienced in Queensland, Australia, which can alter its cost structure.

BHP Group operates under a complex web of environmental regulations, necessitating the acquisition of numerous permits for its mining and resource extraction activities. These regulations cover critical areas such as air and water emissions, waste disposal, and land rehabilitation, all of which are subject to ongoing scrutiny and potential changes. For instance, in 2023, the Australian government continued to refine its approach to environmental approvals, with ongoing discussions around strengthening the Environment Protection and Biodiversity Conservation Act 1999.

Compliance with these environmental standards is not merely a procedural requirement but a significant operational and financial consideration. Failure to meet these obligations can result in substantial fines, operational disruptions, and reputational damage. The industry has seen instances where regulatory decisions, like the veto of a tailings dam project for a different mining company, underscore the critical importance of securing and maintaining robust environmental approvals, influencing project viability and timelines.

Labor Laws and Industrial Relations Legislation

Legal frameworks governing labor relations, including industrial relations legislation and minimum wage requirements, directly impact BHP's workforce management and associated costs. These laws dictate hiring practices, working conditions, and employee rights, influencing operational efficiency and labor expenditure.

The 'Same Job, Same Pay' legislation in Australia, which came into effect in 2024, is a significant regulatory change. This legislation aims to ensure that casual employees performing the same work as permanent employees receive equivalent pay and conditions, potentially increasing labor costs for BHP and impacting productivity models.

- Minimum Wage Impact: Changes in national minimum wage laws, such as the Fair Work Commission's annual review in Australia, directly affect BHP's payroll expenses for its lowest-paid workers. For instance, the 2024 annual wage review increased the national minimum wage by 5.75%, impacting over 2.6 million low-paid employees.

- Industrial Relations Frameworks: BHP must navigate complex industrial relations legislation across its operating regions, which can affect union negotiations, collective bargaining agreements, and dispute resolution processes.

- Workplace Safety Regulations: Stringent workplace health and safety laws, like those enforced by Safe Work Australia, require significant investment in safety protocols and training, influencing operational procedures and compliance costs.

Legal Liabilities and Compliance

BHP Group navigates a complex legal landscape, with significant financial provisions set aside for past operational incidents. A prime example is the Samarco dam collapse, which continues to necessitate substantial financial commitments for remediation and compensation.

Furthermore, the company faces ongoing legal proceedings, including class-action lawsuits. These cases often center on allegations of sexual harassment and discrimination within the workplace, highlighting the critical need for stringent compliance measures and a strong commitment to ethical business practices.

- Samarco Dam Collapse Provisions: BHP has allocated billions for Samarco dam disaster settlements and rehabilitation efforts, with ongoing financial obligations.

- Workplace Conduct Litigation: The company is actively defending against multiple class-action suits related to workplace harassment and discrimination, impacting its reputation and operational focus.

- Regulatory Compliance: Adherence to evolving environmental, safety, and labor laws across its global operations remains a key legal challenge, requiring continuous investment in compliance programs.

BHP Group's legal obligations are extensive, covering everything from environmental compliance to labor relations and past operational liabilities. The company must adhere to stringent mining and resource laws globally, with significant financial implications for non-compliance. For example, the ongoing costs associated with the Samarco dam disaster settlements and rehabilitation efforts highlight the long-term financial impact of legal and operational failures.

In Australia, recent legislative changes like the 2024 Same Job, Same Pay legislation are directly impacting labor costs by mandating equal pay for casual employees performing similar work to permanent staff. This, coupled with annual minimum wage adjustments, such as the 5.75% increase in Australia's national minimum wage for 2024, affects payroll expenses significantly. The company also faces ongoing litigation, including class-action lawsuits related to workplace harassment and discrimination, underscoring the need for robust compliance and ethical practices.

| Legal Factor | Impact on BHP | Key Legislation/Event (2023/2024) | Financial Implication |

| Environmental Compliance | Permitting, operational standards, rehabilitation | Environment Protection and Biodiversity Conservation Act 1999 (Australia) | Potential fines, operational disruption, remediation costs |

| Labor Relations | Wages, working conditions, employee rights | Same Job, Same Pay (Australia, 2024); Minimum Wage Review (Australia, 2024) | Increased payroll expenses, potential productivity model adjustments |

| Past Operational Liabilities | Remediation, compensation, legal defense | Samarco Dam Disaster Settlements; Workplace Harassment Litigation | Billions in provisions, ongoing legal defense costs, reputational risk |

Environmental factors

BHP acknowledges climate change as a significant challenge and has implemented a Climate Transition Action Plan, targeting a reduction in operational greenhouse gas emissions. The company's ambitious goal is to achieve net zero operational emissions by 2050, understanding that this transition will involve a non-linear progression.

In line with its decarbonization strategy, BHP has committed to reducing its Scope 1 and 2 emissions. For the fiscal year 2023, BHP reported a 3% reduction in its operational greenhouse gas emissions intensity compared to its 2020 baseline, demonstrating progress towards its targets.

Water is absolutely critical for BHP's mining and processing activities, and the company actively engages in water stewardship. This involves managing water resources responsibly across its global operations, particularly in water-scarce regions.

BHP's commitment is evident in its implementation of advanced water recycling systems, which significantly reduce its reliance on freshwater sources. For instance, in fiscal year 2023, the company reported that its Escondida mine in Chile achieved a 46% water recycling rate, a testament to its ongoing efforts.

The company's Water Stewardship Position Statement, updated in 2024, further details its strategies for addressing water-related risks and opportunities. This includes setting targets for reducing freshwater intensity and enhancing water efficiency across its asset portfolio.

BHP Group's extensive mining operations place a significant onus on biodiversity and land management. The company is committed to a Group-level biodiversity strategy, aiming for nature-positive outcomes by 2030 through conservation, restoration, and regenerative practices.

As of its 2023 Sustainability Report, BHP has committed to investing in nature-positive outcomes and has set a target to achieve this across its value chain by 2030, reflecting a proactive approach to environmental stewardship.

Waste Management and Tailings Facilities

BHP Group places significant emphasis on the responsible management of waste, particularly concerning its tailings storage facilities. This is a crucial environmental factor influencing its operations and reputation. The company actively communicates its approach through dedicated policies and public disclosures, demonstrating a commitment to transparency in this area.

A key strategic focus for BHP is the reduction of waste generation. This is being addressed through the implementation of advanced technologies, such as precision mining. These innovations aim to optimize resource extraction, thereby minimizing the volume of waste produced at the source.

- Tailings Management Commitment: BHP has established comprehensive policies and reporting mechanisms for its tailings storage facilities, reflecting a proactive stance on environmental stewardship.

- Waste Minimization through Technology: The company is investing in and deploying precision mining technologies, designed to enhance operational efficiency and significantly reduce waste output.

- Focus on Safety and Sustainability: These initiatives underscore BHP's dedication to operating safely and sustainably, mitigating environmental risks associated with mining activities.

Circular Economy and Resource Efficiency

BHP is actively pursuing opportunities in resource recycling and prioritizing sustainable extraction methods as a core component of its energy transition strategy. This focus reflects a growing industry trend towards circular economy principles, aiming to minimize waste and maximize the value derived from raw materials.

The company's commitment involves integrating advanced technologies with robust sustainable practices to address evolving global energy demands responsibly. For instance, in 2023, BHP announced investments in pilot projects focused on recycling mining waste, aiming to recover valuable minerals and reduce the environmental footprint of its operations. This aligns with their broader goal of contributing to a lower-carbon future.

- Resource Recycling Initiatives: BHP is investing in technologies to recover critical minerals from mine tailings and waste streams, aiming to create new revenue sources and reduce reliance on virgin materials.

- Sustainable Extraction: Emphasis on water efficiency and reduced land disturbance in mining operations, with targets to decrease freshwater withdrawal intensity by 15% by 2030 compared to 2020 levels.

- Energy Transition Alignment: Ventures into areas like copper and nickel, essential for renewable energy technologies and electric vehicles, demonstrating a strategic pivot towards materials supporting a low-carbon economy.

- Technological Integration: Deployment of digital solutions and automation to enhance resource efficiency and minimize environmental impact throughout the mining lifecycle.

BHP is actively managing its environmental footprint, particularly concerning climate change and water scarcity. The company has set a net-zero operational emissions target by 2050 and reported a 3% reduction in operational greenhouse gas emissions intensity in FY2023 compared to a 2020 baseline. Water stewardship is critical, with efforts like a 46% water recycling rate at its Escondida mine in Chile in FY2023.

Biodiversity and waste management are also key focuses. BHP aims for nature-positive outcomes by 2030 and is investing in precision mining to reduce waste generation. Resource recycling and sustainable extraction are integral to its strategy, with a goal to decrease freshwater intensity by 15% by 2030.

| Environmental Factor | BHP's Approach/Commitment | Key Data/Target |

| Climate Change | Net-zero operational emissions target | Target: Net zero by 2050; FY2023: 3% reduction in emissions intensity (vs. 2020 baseline) |

| Water Management | Responsible water resource management, recycling | FY2023: 46% water recycling rate at Escondida mine; Target: 15% freshwater intensity reduction by 2030 (vs. 2020) |

| Biodiversity | Nature-positive outcomes through conservation and restoration | Target: Nature-positive outcomes by 2030 |

| Waste Management | Waste reduction through technology, responsible tailings management | Investment in precision mining technologies; Comprehensive policies for tailings facilities |

PESTLE Analysis Data Sources

Our PESTLE analysis for BHP Group is built on a robust foundation of data from official government publications, reputable financial institutions like the IMF and World Bank, and leading industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting BHP.