Beyond Meat SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beyond Meat Bundle

Beyond Meat's innovative products offer a significant strength in a growing plant-based market, but they also face intense competition and potential supply chain challenges. Understanding these dynamics is crucial for anyone looking to invest or strategize within this sector.

Want the full story behind Beyond Meat's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Beyond Meat boasts significant brand recognition, a crucial asset in the competitive plant-based sector. Its mission to improve human health, combat climate change, conserve resources, and promote animal welfare resonates deeply with a growing consumer base seeking ethical and sustainable options. This clear positioning has helped them capture a notable share of the expanding plant-based market.

Beyond Meat's consistent dedication to product innovation and quality enhancements is a significant strength. The company actively refines its plant-based offerings, focusing on improving taste, texture, and nutritional profiles to better meet consumer expectations.

Recent advancements highlight this commitment, such as the reformulated Beyond IV Burger and Beyond Beef, which now feature avocado oil for reduced saturated fat and incorporate ingredients like red lentils and fava beans for enhanced nutrition. This ongoing product development aims to close the gap with traditional meat products.

Further demonstrating this focus, Beyond Meat launched its Beyond Sun Sausage in 2024, emphasizing wholesome ingredients and appealing new flavor profiles. The company also unveiled a whole-cut mycelium steak filet in 2025, signaling a push into more sophisticated plant-based protein formats.

Beyond Meat's strategic partnerships are a significant strength, enabling broad market penetration. The company has cultivated relationships across both retail and foodservice sectors worldwide. This global reach is crucial for expanding its customer base and increasing brand visibility.

In Q4 2024, Beyond Meat reported increased sales of its chicken products to a major quick-service restaurant (QSR) client in the European Union. Furthermore, active campaigns with McDonald's in Europe underscore the company's success in integrating its products into established food service networks. These collaborations are vital for driving volume and reinforcing market presence.

The multi-year nutrition partnership with the Premier Lacrosse League, commencing in 2025, demonstrates Beyond Meat's capacity to enter diverse markets and align with elite athletic performance. This partnership diversifies its market segments and reinforces its brand image as a provider of plant-based nutrition for active lifestyles.

Improving Gross Margins and Cost Management

Beyond Meat has made notable strides in bolstering its gross margins, a critical indicator of its operational efficiency. The company successfully shifted from negative gross margins to a positive territory in the latter half of 2024. This turnaround is clearly reflected in its financial performance, with gross profit reaching 13.1% in the fourth quarter of 2024 and an even stronger 17.7% in the third quarter of 2024. These figures represent a significant leap forward compared to prior periods.

The company's strategic focus on cost management is a key driver behind this improvement. Beyond Meat is actively engaged in implementing comprehensive cost-cutting initiatives. These measures include a concerted effort to reduce operating expenses across the board and a thorough streamlining of its supply chain operations. The objective is to create a more profitable and sustainable business model, with a clear target of achieving approximately 20% gross margin by 2025.

- Gross Margin Improvement: Beyond Meat achieved positive gross margins in H2 2024, a substantial turnaround from previous negative figures.

- Q4 2024 Performance: The company reported a gross profit of 13.1% in the fourth quarter of 2024.

- Q3 2024 Performance: Gross profit reached 17.7% in the third quarter of 2024, demonstrating strong sequential growth.

- Cost Management Focus: Ongoing efforts to reduce operating expenses and optimize the supply chain are central to enhancing profitability and achieving a 2025 gross margin target of around 20%.

Focus on Health and Nutritional Benefits

Beyond Meat is actively highlighting the health and nutritional advantages of its plant-based offerings, a strategy that resonates with the increasing consumer preference for healthier food choices. This commitment is evident in their product development, which aims to adhere to strict standards set by prominent health organizations.

The company's efforts to position its products as healthier alternatives are gaining traction. For instance, Beyond Sun Sausage has achieved notable certifications:

- American Heart Association's Heart-Check program

- American Diabetes Association's Better Choices for Life program

These certifications are crucial for building consumer trust and dispelling any lingering doubts about the nutritional profile of plant-based meats. By securing these endorsements, Beyond Meat aims to empower consumers to make well-informed decisions, reinforcing the idea that plant-based options can be both delicious and beneficial for their well-being.

Beyond Meat's strong brand recognition in the growing plant-based market is a key differentiator. Its mission-driven approach, focusing on health, climate, and animal welfare, appeals to a broad consumer base. The company's commitment to continuous product innovation, exemplified by reformulated burgers and new sausage and steak offerings in 2024-2025, aims to mimic the taste and texture of traditional meat.

Strategic partnerships across retail and foodservice sectors, including significant Q4 2024 sales increases for chicken products in the EU and ongoing collaborations with McDonald's, expand market reach. A 2025 nutrition partnership with the Premier Lacrosse League further diversifies its market presence and reinforces its brand as a provider of healthy nutrition for active lifestyles.

Beyond Meat has demonstrated significant financial recovery, achieving positive gross margins in the second half of 2024. This turnaround is supported by a focused strategy on cost management and operational efficiency, with gross profit reaching 13.1% in Q4 2024 and 17.7% in Q3 2024. The company targets approximately 20% gross margin by 2025 through expense reduction and supply chain streamlining.

The company is effectively highlighting the health benefits of its products, securing certifications from the American Heart Association and the American Diabetes Association for its Beyond Sun Sausage. These endorsements build consumer trust and position plant-based options as both appealing and beneficial for well-being.

What is included in the product

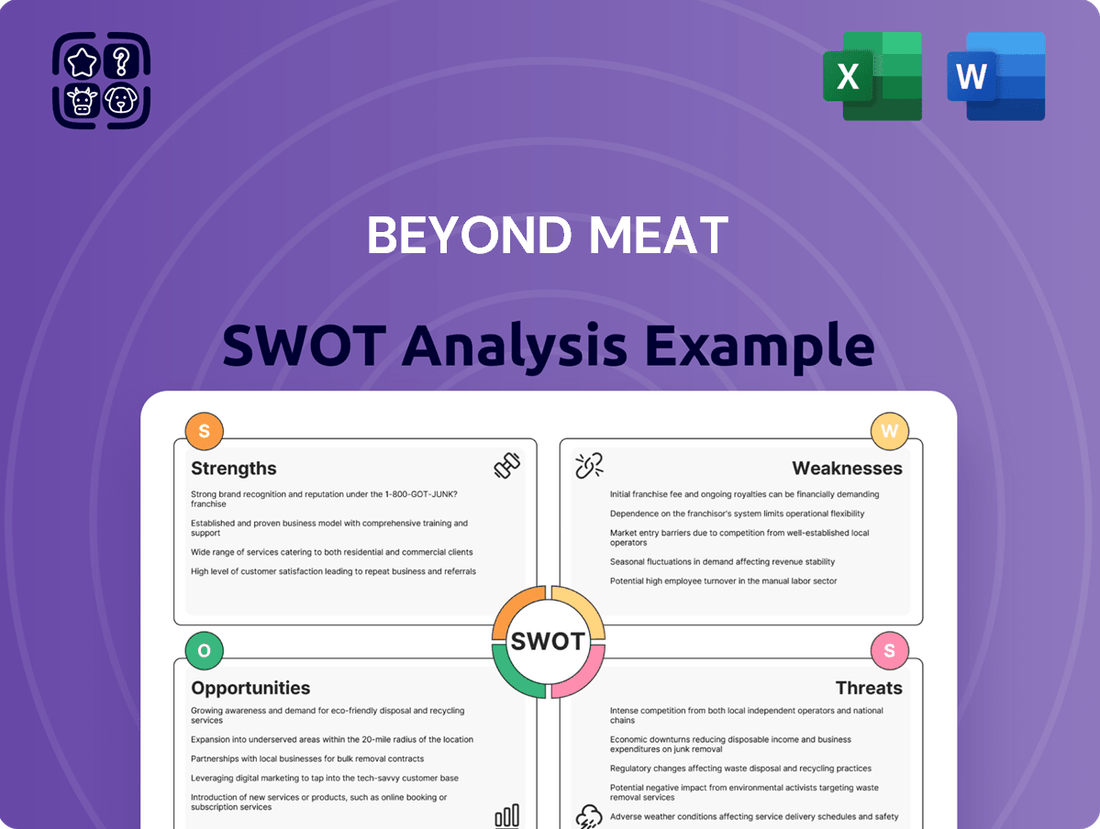

Highlights Beyond Meat's strong brand recognition and product innovation while acknowledging its high production costs and intense market competition.

Offers a clear breakdown of Beyond Meat's competitive landscape, highlighting opportunities to leverage strengths and address weaknesses in the plant-based market.

Weaknesses

Beyond Meat products often come with a higher price tag than traditional meat. For instance, in early 2024, Beyond Meat's burgers could cost significantly more per pound than ground beef, a difference that becomes even more pronounced during periods of economic strain or inflation. This premium pricing can be a major hurdle for consumers who are mindful of their grocery bills, pushing them towards more budget-friendly alternatives.

This price sensitivity is a significant barrier to widespread adoption. Many consumers have cited the cost as a primary reason for not purchasing plant-based options more frequently. As of late 2023 and into 2024, with inflation impacting household budgets, the price gap between Beyond Meat and conventional meat is a key factor limiting market penetration and slowing down the growth trajectory for the company.

Beyond Meat has faced significant headwinds with declining sales volumes, especially in the crucial U.S. retail and foodservice sectors. This trend continued into early 2025, with Q1 net revenues dropping 9% year-over-year and volumes sold declining by 11%.

Despite some modest revenue growth in the latter half of 2024 (Q3 and Q4), the broader plant-based meat market in the U.S. saw a 7% contraction in 2024. This indicates a challenging demand environment that directly impacts Beyond Meat's top-line performance and revenue consistency.

Beyond Meat continues to grapple with significant financial headwinds, demonstrating persistent net losses that hinder its path to sustained profitability. The company reported a net loss of $26.6 million in the third quarter of 2024, followed by a $52.9 million loss in the first quarter of 2025. These figures highlight an ongoing struggle, with the company losing approximately 45 cents from every dollar of sales on an operating basis throughout 2024.

Negative Consumer Perception of Processed Plant-Based Foods

Despite Beyond Meat's emphasis on health, a significant portion of consumers remains skeptical about the nutritional value of processed plant-based alternatives. Concerns often center on the presence of additives, high sodium content, and the overall "processed" nature of the products, even when marketed as healthier options. This perception is a significant hurdle, impacting consumer trust and potentially limiting market penetration.

This negative perception is exacerbated by ongoing public discourse and, at times, misinformation campaigns that question the healthfulness of these items. For instance, a 2024 survey indicated that 35% of consumers who actively avoid plant-based meat alternatives cited "too processed" as their primary reason. This sentiment directly affects brand perception and can erode consumer loyalty, a critical factor in the competitive food industry.

- Consumer Skepticism: A notable segment of consumers views Beyond Meat products as overly processed, despite marketing claims.

- Nutritional Concerns: Worries about additives and sodium levels contribute to a negative perception of the products' health benefits.

- Impact on Trust: Misinformation and public debate can damage brand trust and diminish consumer loyalty among health-conscious individuals.

Significant Debt Burden and Liquidity Concerns

Beyond Meat faces a considerable financial challenge with its substantial debt. As of December 31, 2024, the company reported $1.1 billion in total outstanding debt, largely comprised of convertible notes due in early 2027. This significant debt load raises concerns about the company's ability to meet its repayment obligations.

While a $100 million debt financing arrangement in early 2025 offered a temporary liquidity boost, the financial outlook remains tight. Market observers suggest that further capital infusions will likely be necessary. Such future capital raises could potentially lead to substantial dilution for current shareholders, impacting the value of their existing holdings.

- Debt Maturity: Convertible notes totaling $1.1 billion mature in early 2027.

- Liquidity Injection: Secured $100 million in debt financing in early 2025.

- Future Capital Needs: Analysts anticipate the necessity for additional capital raises.

- Shareholder Dilution: Future capital raises may significantly dilute existing shareholders.

Beyond Meat's premium pricing strategy remains a significant barrier, with its products often costing considerably more than traditional meat. For example, in early 2024, the price per pound for Beyond Meat burgers was substantially higher than ground beef, a gap that widens during inflationary periods, deterring budget-conscious consumers.

The company's persistent net losses, with a Q3 2024 loss of $26.6 million and a Q1 2025 loss of $52.9 million, highlight ongoing financial struggles. Throughout 2024, the company lost approximately 45 cents for every dollar of sales on an operating basis, underscoring profitability challenges.

Consumer skepticism regarding the nutritional value of processed plant-based alternatives, particularly concerns about additives and sodium, continues to impact brand perception. A 2024 survey revealed that 35% of consumers avoiding these products cited them as "too processed."

Beyond Meat faces a substantial debt burden, with $1.1 billion in outstanding debt as of December 31, 2024, primarily convertible notes maturing in early 2027, raising concerns about repayment capabilities.

Preview the Actual Deliverable

Beyond Meat SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive document offers a professional and structured look at Beyond Meat's strategic position. You'll gain access to all the insights and analysis presented here, ready for your immediate use.

Opportunities

Beyond Meat has a significant opportunity to grow by tapping into international markets where the demand for plant-based foods is already robust. Europe, for example, is a leader in this sector, driven by consumer interest in health and sustainability.

The company saw continued distribution gains and increased demand in international retail and foodservice channels throughout 2024. This momentum in key geographic regions presents a clear pathway for future revenue expansion, especially as more consumers globally adopt plant-based diets.

Beyond Meat has a significant opportunity to broaden its appeal and market share by moving beyond direct meat replication. Exploring categories like plant-based sausages made from ingredients like lentils or chickpeas, as seen with their Beyond Sun Sausage, allows them to cater to different consumer preferences and eating occasions, potentially tapping into a wider audience than just those seeking meat substitutes.

The company's strategic exploration into adjacent plant-based categories, evidenced by trademark filings for 'Beyond Eggs' and 'Beyond Milk', signals a clear intent to diversify its product portfolio. This diversification could unlock new revenue streams and solidify Beyond Meat's position as a broader plant-based food innovator, rather than solely a meat-alternative producer.

The expanding flexitarian consumer base, actively reducing meat intake for health and environmental reasons, represents a significant opportunity for Beyond Meat. This demographic, estimated to grow substantially in the coming years, is actively seeking appealing plant-based alternatives.

By focusing on continued innovation in taste, texture, and nutritional profiles, Beyond Meat can effectively attract and retain these consumers. For instance, by late 2024, a significant portion of consumers in major markets reported increasing their plant-based purchases, driven by these very flexitarian motivations.

Strategic Collaborations and Marketing Campaigns

Forming new strategic partnerships with major food chains, grocery retailers, and complementary organizations is crucial for expanding Beyond Meat's reach and making its products more accessible to a wider consumer base. These collaborations can significantly boost brand visibility and drive trial. For instance, a partnership with a national fast-food chain could introduce Beyond Meat to millions of new customers.

Targeted marketing and educational campaigns are vital for addressing consumer skepticism and highlighting the compelling health and environmental advantages of plant-based eating. By dispelling misinformation and clearly communicating these benefits, Beyond Meat can foster greater consumer acceptance and demand. A successful campaign could focus on the reduced environmental footprint compared to traditional meat production.

- Partnerships: Collaborating with food service providers and retailers to increase product availability and visibility.

- Marketing: Educational campaigns to inform consumers about the benefits of plant-based diets, addressing common misconceptions.

- Consumer Engagement: Events like the Beyond Meat Earth Day Food Festival in 2024 showcase proactive strategies to connect with consumers and promote products.

Investment in Research and Development for Nutritional Advancement

Continued investment in R&D for advanced food technology and nutritional science presents a significant opportunity for Beyond Meat to differentiate its products and cater to evolving consumer demands for healthier options. The company's focus on improving nutritional profiles, exemplified by the recent reformulation of Beyond IV featuring avocado oil and reduced saturated fat, directly addresses this trend.

This strategic emphasis on 'clean' and nutrient-dense ingredients is crucial for attracting the growing segment of health-conscious consumers. By enhancing its product offerings through innovation in nutritional science, Beyond Meat can solidify its competitive advantage in the plant-based meat market.

- Beyond Meat's R&D spending in 2023 was $79.9 million, indicating a commitment to innovation.

- The plant-based food market is projected to reach $165 billion by 2030, highlighting the growth potential for nutritionally advanced products.

- Consumer surveys in 2024 show that 65% of plant-based consumers prioritize health benefits when making purchasing decisions.

Beyond Meat can capitalize on the expanding global demand for plant-based alternatives, particularly in regions like Europe where consumer adoption is strong. The company's international distribution gains in 2024 demonstrate this growing market acceptance.

Diversifying its product line beyond direct meat replication into categories like plant-based sausages and exploring items like 'Beyond Eggs' and 'Beyond Milk' opens up new consumer segments and revenue streams. This strategic expansion positions Beyond Meat as a broader plant-based food innovator.

The increasing number of flexitarian consumers, who are reducing meat consumption for health and environmental reasons, presents a significant growth opportunity. By continuing to innovate on taste and nutrition, as seen with the Beyond IV reformulation, the company can effectively attract and retain this key demographic.

Strategic partnerships with major food chains and retailers are crucial for enhancing product accessibility and brand visibility. Furthermore, targeted marketing campaigns that highlight the health and environmental benefits of plant-based eating can help overcome consumer skepticism and drive demand.

| Opportunity Area | Key Action | Supporting Data/Trend (2024/2025 Focus) |

|---|---|---|

| International Expansion | Leverage existing distribution gains and growing consumer interest in plant-based diets globally. | Continued growth in European markets; increased demand in international retail and foodservice channels. |

| Product Diversification | Expand into new plant-based categories beyond meat replication. | Trademark filings for 'Beyond Eggs' and 'Beyond Milk'; success of Beyond Sun Sausage. |

| Flexitarian Consumer Growth | Attract and retain consumers reducing meat intake through improved taste and nutrition. | Growing flexitarian demographic; 65% of plant-based consumers prioritize health benefits (2024 surveys). |

| Strategic Partnerships & Marketing | Increase accessibility and consumer awareness through collaborations and education. | Partnerships with major food chains; educational campaigns on health/environmental benefits. |

| R&D and Innovation | Enhance product offerings with advanced food technology and nutritional science. | Beyond Meat's $79.9 million R&D spending in 2023; reformulation of Beyond IV with avocado oil. |

Threats

The plant-based meat arena is getting crowded, with both nimble startups and big-name food companies jumping in. This surge of new players, including giants like Nestlé and Tyson Foods alongside rivals like Impossible Foods, is really heating up the competition.

Beyond Meat is feeling the heat as these competitors battle for consumer attention and shelf space, directly challenging Beyond Meat’s market leadership. This intense rivalry often translates into price wars, potentially squeezing profit margins and making it harder for Beyond Meat to grow its market share effectively.

Despite the broader interest in plant-based eating, the market for highly processed meat alternatives has seen a slowdown. In 2024, U.S. retail sales for these products actually decreased by 7%, with unit volumes falling by 11%. This indicates a shift away from the initial surge in demand for these specific types of products.

Consumers are increasingly prioritizing simpler, less processed food options. There's growing skepticism regarding the taste and perceived health benefits of 'fake meat', which directly impacts the appeal of products like those offered by Beyond Meat. This preference for whole foods presents a challenge to the core product category.

Beyond Meat faces significant threats from evolving regulatory landscapes, particularly concerning food labeling and health claims for plant-based products. Changes in these regulations could necessitate costly marketing adjustments and limit how the company communicates product benefits.

The company is also vulnerable to negative public perception fueled by ongoing debates and what it describes as misinformation campaigns regarding the nutritional value and processing of its offerings. This can erode consumer trust and directly impact sales volumes.

Emerging consumer concerns about ultra-processed foods add another layer of threat, as Beyond Meat's products are often categorized as such, potentially alienating a segment of health-conscious consumers. For instance, in early 2024, reports continued to highlight consumer apprehension about ingredient lists in plant-based alternatives.

Economic Uncertainties and Consumer Price Sensitivity

Broader macroeconomic concerns and reduced consumer confidence, particularly in 2024 and projected into 2025, pose a significant threat to Beyond Meat's sales. With inflation persisting, consumers are increasingly price-sensitive, often prioritizing essential spending over premium food purchases. This makes them less inclined to pay a premium for plant-based alternatives when more affordable options are available.

Beyond Meat's products typically carry a higher price point compared to traditional meat. In an economic climate marked by uncertainty and rising living costs, this price gap becomes a substantial barrier to widespread adoption. For instance, by early 2024, the average price of Beyond Meat's products remained notably higher than conventional beef or chicken, a disparity that consumers are more likely to scrutinize during economic downturns.

- Economic Headwinds: Persistent inflation and potential recessionary pressures in key markets (e.g., US, Europe) continue to dampen consumer discretionary spending through 2024 and into 2025.

- Price Premium: Beyond Meat products often retail at a 20-50% premium compared to conventional meat, a gap that widens consumer hesitation during inflationary periods.

- Consumer Confidence: Declining consumer confidence indices, reported by various economic bodies throughout 2024, indicate a reduced willingness to spend on non-essential or premium food items.

- Shifting Priorities: In a cost-conscious environment, consumers are more likely to trade down to cheaper protein sources, impacting demand for plant-based alternatives like Beyond Meat.

Supply Chain Volatility and Raw Material Cost Fluctuations

Beyond Meat faces significant threats from supply chain volatility and fluctuating raw material costs, directly impacting its production expenses and overall profitability. The prices of key ingredients like pea protein, coconut oil, and canola oil are subject to market forces, directly influencing the company's cost of goods sold. For instance, disruptions in agricultural output or global trade can lead to sharp price increases for these essential components, squeezing Beyond Meat's margins and potentially forcing price adjustments that could affect consumer demand.

The company's reliance on specific agricultural inputs makes it susceptible to weather patterns, geopolitical events, and global commodity market trends. For example, a poor harvest of peas in a key growing region could significantly elevate pea protein prices, a primary ingredient in Beyond Meat's products. Efficiently managing these cost fluctuations is paramount for maintaining competitive pricing against both traditional meat products and other plant-based alternatives, ensuring the company's ability to sustain healthy profit margins in a dynamic market.

- Pea Protein Costs: Beyond Meat's primary protein source, pea protein, experienced price volatility in 2023, with some reports indicating an increase of up to 20% for certain suppliers due to increased demand and supply chain pressures.

- Coconut Oil and Canola Oil Prices: Global commodity markets saw fluctuations in edible oils throughout 2023 and early 2024, driven by factors like weather events affecting crop yields and geopolitical tensions impacting trade routes.

- Impact on Margins: A sustained increase in raw material costs without a corresponding ability to pass these costs onto consumers can directly erode Beyond Meat's gross profit margins, which were reported to be in the low teens for recent quarters.

- Competitive Pricing Pressure: The need to maintain competitive pricing against conventional meat and other plant-based options means Beyond Meat has limited flexibility to absorb significant cost increases, making supply chain and raw material cost management a critical strategic imperative.

The plant-based meat market is increasingly saturated, with both established food giants and emerging startups intensifying competition. This crowded landscape puts pressure on Beyond Meat to maintain its market position and can lead to price wars, potentially impacting profitability. The slowdown in the highly processed meat alternative sector, evidenced by a 7% decrease in U.S. retail sales in 2024, highlights a shift in consumer preference towards less processed options, posing a significant challenge to Beyond Meat's core product offerings.

SWOT Analysis Data Sources

This analysis is built on a foundation of robust data, including Beyond Meat's official financial filings, comprehensive market research reports, and expert industry commentary to provide a well-rounded perspective.