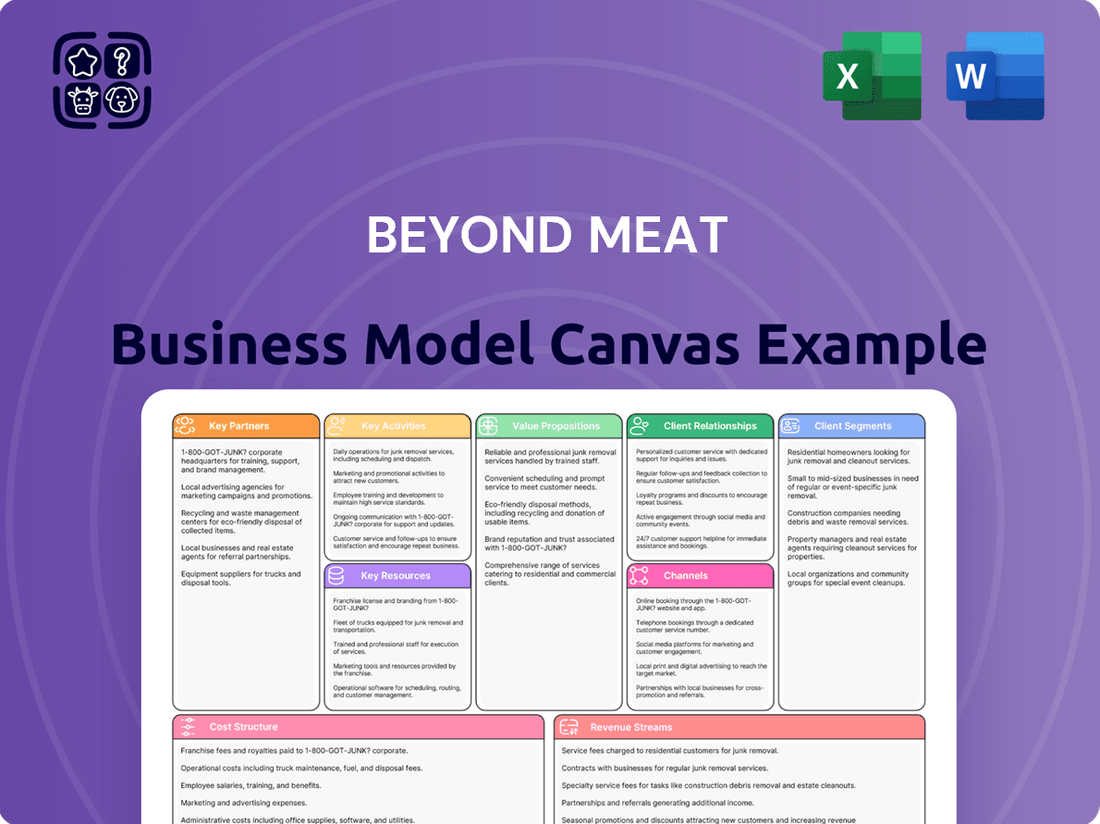

Beyond Meat Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beyond Meat Bundle

Unlock the strategic blueprint behind Beyond Meat's innovative business model. This comprehensive canvas details how they connect with health-conscious consumers and leverage key partnerships to deliver plant-based protein solutions. Discover their unique value proposition and revenue streams.

Ready to dissect Beyond Meat's path to market leadership? Our full Business Model Canvas offers a granular view of their customer relationships, cost structure, and channels, providing actionable insights for aspiring food tech entrepreneurs. Download the complete analysis to gain a competitive edge.

Partnerships

Beyond Meat strategically partners with major quick-service restaurants and foodservice providers worldwide to broaden its market presence. These collaborations are crucial for placing Beyond Meat products on popular menus, significantly boosting brand recognition and making them accessible to consumers outside of traditional grocery stores.

For instance, the company continues its engagement with McDonald's across Europe, with specific promotions observed in Germany. This expansion also extends to the Baltic states, including Lithuania, Latvia, and Estonia, demonstrating a commitment to increasing accessibility in diverse markets.

Beyond Meat's retail distribution agreements with major grocery chains are fundamental to its business model, ensuring broad consumer access. These partnerships are vital for positioning plant-based options alongside traditional meats, normalizing the category. In 2023, Beyond Meat's net revenues were $343.3 million, with retail sales forming a substantial portion of this figure.

Beyond Meat’s success hinges on its ingredient and supply chain partners. Collaborations with suppliers of key plant-based ingredients like peas, brown rice, and mung beans are crucial for ensuring consistent product quality and a reliable supply. These relationships directly impact production efficiency and the cost of goods sold.

Maintaining strong ties with these suppliers is vital. For example, Beyond Meat's reformulated products, launched in 2023 and continuing into 2024, incorporate new ingredients such as avocado oil, red lentils, and fava beans. This necessitates robust and adaptable supply chain relationships to secure these diverse raw materials.

Health and Wellness Organizations

Beyond Meat collaborates with prominent health and wellness organizations to underscore the nutritional advantages of its plant-based offerings. These alliances are crucial for validating the health claims associated with products like the Beyond IV burger, aiming to build significant consumer confidence.

Securing endorsements from respected bodies such as the American Diabetes Association and the American Heart Association provides a powerful health-centric marketing narrative. These partnerships are instrumental in differentiating Beyond Meat in a competitive market, leveraging trust and scientific backing.

- Partnerships for Validation: Beyond Meat actively partners with health organizations to validate the nutritional benefits of its products.

- Key Endorsements: Collaborations include groups like the American Diabetes Association, the American Heart Association, and the Clean Label Project.

- Marketing Advantage: These endorsements bolster consumer trust and enable a strong health-focused marketing message for products like the Beyond IV burger.

Influencer and Brand Ambassador Engagements

Beyond Meat strategically partners with prominent figures like celebrities, athletes, and wellness influencers to amplify its brand message and showcase its plant-based products. These collaborations are crucial for building brand awareness and fostering a sense of authenticity with consumers.

These partnerships are integral to Beyond Meat's marketing efforts, aiming to connect with a wide demographic and cultivate trust in the plant-based movement. For instance, in 2024, Beyond Meat continued its influencer campaigns, leveraging social media platforms to reach millions of potential customers.

- Celebrity Endorsements: Collaborations with well-known individuals lend credibility and broad appeal.

- Athlete Partnerships: Aligning with athletes highlights the performance and nutritional benefits of plant-based diets.

- Wellness Influencers: These partners share lifestyle content, integrating Beyond Meat into healthy living narratives.

- User-Generated Content: Encouraging consumers to share their experiences and recipes further expands reach and engagement.

Beyond Meat's key partnerships extend to ingredient suppliers, ensuring the quality and availability of core components like peas and mung beans. These relationships are vital for maintaining production consistency and managing costs, especially as the company reformulates products with new ingredients such as fava beans in 2024.

The company also leverages strategic alliances with quick-service restaurants and foodservice providers globally, a critical channel for increasing product accessibility and brand visibility. These collaborations, like ongoing work with McDonald's in Europe, are fundamental to reaching a broader consumer base beyond traditional retail.

Furthermore, partnerships with health and wellness organizations, including the American Diabetes Association and the American Heart Association, provide crucial validation for the nutritional benefits of Beyond Meat products. These endorsements build consumer trust and support the brand's health-focused marketing narrative.

Finally, collaborations with celebrities, athletes, and influencers in 2024 amplify Beyond Meat's message, fostering authenticity and reaching diverse demographics through social media engagement.

What is included in the product

Beyond Meat's business model focuses on developing and selling plant-based meat alternatives, targeting health-conscious consumers and environmentally aware individuals, with a strategy of broad retail and foodservice distribution.

This model emphasizes innovation in product development and strategic partnerships to scale production and reach a global market, aiming to disrupt the traditional meat industry.

Beyond Meat's Business Model Canvas acts as a pain point reliever by clearly mapping out how they address consumer demand for sustainable and ethical protein alternatives, simplifying complex market entry challenges.

Activities

Beyond Meat's commitment to Research and Development is central to its strategy, focusing on creating plant-based alternatives that closely mimic the sensory experience of traditional meat. This involves continuous refinement of their product formulations to achieve superior taste, texture, and cooking performance. For instance, their Beyond IV platform represents a significant step in enhancing both nutritional value and sensory appeal.

In 2024, the company strategically increased its investments in product development by 15%. This boost in R&D funding is specifically targeted at further refining the taste and texture of their offerings, ensuring they remain competitive and appealing to a broad consumer base seeking plant-based options.

Beyond Meat concentrates on making its production and manufacturing as smooth and cost-effective as possible to support its growth. This strategic move includes bringing more production in-house, which helps them keep a closer eye on quality and make their supply chain work better.

By optimizing where and how they produce their plant-based meats, Beyond Meat aims to improve its profit margins and operational efficiency. For instance, in 2023, the company continued to refine its co-manufacturing relationships and internal production capabilities to better manage costs and ensure product availability.

Beyond Meat actively educates consumers on the advantages of plant-based diets through comprehensive marketing. Their 2024 strategy emphasizes a grassroots approach, highlighting the health benefits of new products like Beyond IV, aiming to build trust and drive adoption.

Social media plays a crucial role, with engaging content, recipe sharing, and collaborations with influencers to broaden reach. These digital efforts are key to fostering a community and increasing brand visibility in a competitive market.

Distribution and Logistics Management

Beyond Meat's distribution and logistics management focuses on building and maintaining a strong network to get its plant-based products to consumers worldwide. This is essential for meeting demand across various channels, including grocery stores and restaurants, both in the United States and internationally.

Effective management of this supply chain is key to ensuring product availability and capturing market opportunities. For instance, in 2023, Beyond Meat continued to expand its retail presence, reaching over 28,000 retail outlets in the U.S. alone, highlighting the scale of its distribution efforts.

- Managing a robust distribution network to ensure global product reach in retail and foodservice.

- Handling complex logistics for both U.S. and international markets.

- Maximizing product availability to capitalize on growing consumer demand for plant-based options.

Strategic Pricing and Trade Optimization

Beyond Meat actively adjusts its pricing strategies, particularly for new product introductions, to capture market share and meet consumer expectations. For instance, in 2024, the company continued to refine its approach to pricing to balance volume growth with profitability.

The company focuses on optimizing trade promotions and discounts. This involves careful management of trade spend to ensure it drives incremental sales and profitability, rather than simply eroding margins. In 2024, Beyond Meat was still working to improve the efficiency of its trade spending.

These financial maneuvers are crucial for navigating the dynamic plant-based protein market. By strategically adjusting prices and trade terms, Beyond Meat aims to enhance its net revenue per pound and achieve its financial objectives amidst fluctuating consumer demand and competitive pressures.

- Strategic Pricing Adjustments: Beyond Meat modifies prices for new product launches to align with market demand and competitive landscape.

- Trade Optimization: The company manages trade discounts and promotions to boost net revenue per pound and improve overall profitability.

- Financial Navigation: These activities are essential for addressing market demand shifts and achieving margin targets in the plant-based sector.

Beyond Meat's key activities center on innovation, efficient production, and market outreach. They invest heavily in research and development to improve product taste and texture, aiming to closely replicate the experience of traditional meat. This includes refining formulations and exploring new ingredients, as seen with their Beyond IV platform. The company also focuses on optimizing its manufacturing and supply chain to enhance quality control and reduce costs, a strategy that involves both in-house production and managing co-manufacturing relationships. Furthermore, extensive marketing and consumer education efforts are vital for driving adoption and building brand loyalty, utilizing digital channels and influencer collaborations.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Research & Development | Creating plant-based alternatives with superior taste, texture, and cooking performance. | Increased R&D investment by 15% to refine taste and texture, including the Beyond IV platform. |

| Production & Manufacturing | Optimizing production for cost-effectiveness and quality control. | Refining co-manufacturing relationships and internal production capabilities for better cost management and product availability. |

| Marketing & Consumer Education | Educating consumers on plant-based benefits and building brand awareness. | Emphasizing grassroots marketing and highlighting health benefits of new products like Beyond IV. |

| Distribution & Logistics | Building and maintaining a strong global network for product delivery. | Expanding retail presence; in 2023, reached over 28,000 U.S. retail outlets. |

| Pricing & Trade Management | Adjusting pricing and managing trade promotions for market share and profitability. | Continued refinement of pricing strategies and trade spending efficiency to improve net revenue per pound. |

Full Version Awaits

Business Model Canvas

The Beyond Meat Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you're getting a direct look at the comprehensive analysis of Beyond Meat's strategic elements, including key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. Upon completing your order, you'll gain full access to this same, professionally structured and detailed Business Model Canvas, ready for your strategic insights.

Resources

Beyond Meat's proprietary plant-based protein technology is the cornerstone of its business, allowing them to craft remarkably meat-like products. This advanced food science involves sophisticated blending of ingredients like pea protein, mung bean, and brown rice, enhanced with innovative components such as avocado oil for texture and mouthfeel.

This unique technological advantage is critical for Beyond Meat's market differentiation, enabling them to stand out in the rapidly growing plant-based sector. The company's investment in research and development for these protein formulations underpins its ability to deliver products that closely replicate the sensory experience of traditional meat.

Beyond Meat's dedicated research and development facilities are central to its innovation strategy. Here, food scientists and engineers are constantly working to create new plant-based meat alternatives and refine existing products. These facilities are crucial for enhancing the taste, texture, and nutritional value of Beyond Meat's offerings, ensuring they meet consumer expectations and dietary needs.

In 2024, continued investment in these R&D centers underscores Beyond Meat's commitment to staying at the forefront of food technology. This focus allows the company to explore novel ingredients and processing techniques, driving product differentiation in a competitive market. The ongoing work in these labs directly supports the company's mission to provide delicious and sustainable plant-based options.

Beyond Meat's brand reputation as a pioneer in plant-based alternatives is a cornerstone of its business model. This strong consumer trust, built on the promise of "Eat What You Love," directly attracts and retains customers seeking ethical and sustainable food options.

The company's intellectual property, including patents on its unique plant-based meat formulations and production processes, creates a significant barrier to entry for competitors. This proprietary technology is crucial for maintaining product quality and differentiation in a growing market.

In 2023, Beyond Meat continued to invest in brand building, aiming to solidify its leadership position. While specific 2024 figures are still emerging, the company's ongoing marketing efforts underscore the perceived value of its brand reputation in driving sales and market share.

Manufacturing and Production Infrastructure

Beyond Meat's manufacturing and production infrastructure is central to its operations, encompassing owned and operated facilities crucial for creating its range of plant-based foods. The company is actively focused on internalizing production and refining its manufacturing footprint to boost efficiency, lower expenses, and maintain high product quality standards. These sites represent significant physical assets underpinning the business's capacity to scale and innovate.

As of the first quarter of 2024, Beyond Meat reported a net revenue of $75.1 million, a decrease from the previous year, indicating ongoing efforts to optimize production and cost structures are critical for future growth. The company's strategy includes enhancing its co-manufacturing relationships and investing in its own facilities to improve throughput and reduce per-unit costs.

- Owned Production Facilities: Beyond Meat operates its own manufacturing plants, providing direct control over production processes and quality.

- Co-Manufacturing Partnerships: The company also leverages co-manufacturing agreements to expand its production capacity and reach.

- Efficiency and Cost Optimization: Continuous efforts are made to streamline production, reduce waste, and lower manufacturing costs per pound.

- Quality Control: In-house manufacturing allows for stringent quality assurance measures to ensure product consistency and safety.

Financial Capital and Assets

Beyond Meat's financial capital and assets are the bedrock of its operations and growth strategy. These resources allow the company to invest in product innovation, expand its market reach, and manage day-to-day business activities.

As of December 31, 2024, Beyond Meat reported significant financial holdings to support its ambitious plans.

- Cash and Cash Equivalents: The company held $145.6 million in cash and cash equivalents, providing immediate liquidity for operational needs and strategic opportunities.

- Total Assets: Beyond Meat's total assets amounted to $0.67 billion, encompassing all resources owned by the company, including property, plant, equipment, and intangible assets, which are vital for its production and distribution capabilities.

- Strategic Funding: These financial assets are instrumental in funding crucial areas such as research and development for new plant-based products, marketing efforts to build brand awareness, and the expansion of manufacturing facilities to meet growing demand.

Beyond Meat's key resources extend beyond its proprietary technology and brand. The company also relies on its robust manufacturing infrastructure and significant financial capital to drive its business forward.

These tangible and intangible assets are crucial for translating innovation into market-ready products and sustaining growth in the competitive plant-based food industry.

The company's ability to effectively manage and deploy these resources directly impacts its operational efficiency, market penetration, and long-term financial health.

| Resource Category | Specifics | 2024 Data/Context |

|---|---|---|

| Manufacturing Infrastructure | Owned Production Facilities, Co-Manufacturing Partnerships | Focus on internalizing production for efficiency and cost reduction. Net revenue of $75.1 million in Q1 2024 shows ongoing optimization efforts. |

| Financial Capital | Cash and Cash Equivalents, Total Assets | $145.6 million in cash and cash equivalents as of December 31, 2024. Total assets were $0.67 billion, supporting R&D, marketing, and facility expansion. |

Value Propositions

Beyond Meat's core value proposition centers on delivering an authentic meat-like taste and texture, meticulously engineered to replicate the sensory experience of traditional animal meat. This includes the satisfying sizzle, the desirable sear, and the succulence that consumers expect.

This focus on replicating familiar meat attributes is crucial for attracting not only vegetarians and vegans but also the significant flexitarian market. These consumers actively seek plant-based alternatives but are unwilling to compromise on flavor and mouthfeel. The company's reformulated Beyond IV platform, launched in 2024, specifically targets a superior taste experience, aiming to close the gap further.

Beyond Meat's value proposition centers on a positive impact on human health by offering plant-based alternatives to traditional meat. Their products are designed to be lower in saturated fat and cholesterol, and importantly, are free from antibiotics and hormones often found in animal agriculture.

This health focus is further validated by endorsements from reputable organizations such as the American Heart Association and the American Diabetes Association. For example, the Beyond IV burger showcases these benefits, containing just 2 grams of saturated fat and 20% less sodium compared to conventional ground beef.

Beyond Meat's commitment to environmental sustainability is a core value proposition, offering consumers a way to align their purchasing decisions with concerns about climate change. The company's plant-based products are designed to significantly reduce the environmental footprint associated with food production.

Compared to traditional beef, Beyond Meat's offerings demand substantially less water, land, and energy. This efficiency translates into a tangible reduction in greenhouse gas emissions; for instance, producing a single Beyond Burger generates 90% fewer greenhouse gas emissions than a conventional beef patty, highlighting a substantial positive impact on the environment.

Commitment to Animal Welfare

Beyond Meat’s commitment to animal welfare is a core value proposition, directly addressing consumer concerns about ethical food production. By offering plant-based alternatives, the company provides a cruelty-free option, appealing to those who wish to avoid contributing to factory farming practices.

This ethical stance resonates strongly with a growing consumer base prioritizing values-aligned purchasing. In 2024, surveys indicated that over 60% of consumers consider animal welfare when making food choices, a trend that directly benefits companies like Beyond Meat.

- Cruelty-Free Alternative: Beyond Meat offers products that eliminate the need for animal agriculture, directly supporting improved animal welfare.

- Ethical Consumer Appeal: The brand’s mission aligns with the values of a significant and expanding market segment focused on ethical consumption.

- Positive Impact: The company's explicit mission statement prioritizes a positive impact on animal welfare, reinforcing this value proposition.

Versatile and Convenient Protein Source

Beyond Meat provides a wide array of plant-based protein options, such as burgers, sausages, and other protein formats, fitting seamlessly into various meal times and dietary preferences.

These products are crafted for straightforward preparation and easy incorporation into different eating habits, offering practical choices for both individuals and households.

- Versatile Protein Options: Beyond Meat offers a diverse portfolio including burgers, sausages, ground meat alternatives, and chicken tenders, catering to a broad spectrum of culinary needs.

- Convenience in Preparation: Products are designed for quick and easy cooking, mirroring the convenience of traditional meat products, making plant-based eating more accessible.

- Nutritional Benefits: Beyond Meat products are a good source of protein, with many options fortified with essential nutrients, presenting a viable nutritional alternative for consumers.

- Market Presence: As of early 2024, Beyond Meat products are available in over 30,000 retail and foodservice locations globally, highlighting their widespread convenience.

Beyond Meat's value proposition is built on delivering a superior taste and texture that closely mimics traditional meat, appealing to a broad consumer base including flexitarians. Their reformulated Beyond IV platform, launched in 2024, further enhances this sensory experience.

The company also emphasizes health benefits, offering products lower in saturated fat and cholesterol, and free from antibiotics and hormones. For instance, the Beyond IV burger in 2024 boasted 2 grams of saturated fat and 20% less sodium than conventional beef.

Environmental sustainability is a key pillar, with products requiring less water, land, and energy, resulting in significantly lower greenhouse gas emissions. A single Beyond Burger generates 90% fewer emissions than a beef patty.

Furthermore, Beyond Meat champions animal welfare by providing a cruelty-free alternative, aligning with the values of consumers concerned about ethical food production. In 2024, over 60% of consumers considered animal welfare in their food choices.

Customer Relationships

Beyond Meat leverages social media platforms like Instagram, TikTok, and X (formerly Twitter) for direct consumer engagement. This strategy allows them to share recipe ideas, behind-the-scenes content, and respond to customer inquiries, building a strong community. For instance, in early 2024, Beyond Meat actively promoted user-generated content campaigns, encouraging customers to share their own Beyond Meat creations.

Beyond Meat actively engages customers by offering a wealth of educational and informational content. The company highlights the health advantages and environmental benefits associated with its plant-based alternatives, fostering consumer understanding and trust.

This commitment extends to detailed transparency regarding ingredients, comprehensive nutritional information, and clear communication about their sustainability initiatives. For instance, Beyond Meat often publishes data on the reduced water usage and greenhouse gas emissions compared to traditional meat production, underscoring their environmental stewardship.

Through targeted educational campaigns, Beyond Meat aims to demystify plant-based eating and counter common misconceptions. These efforts are designed to inform consumers about the positive attributes of their products, encouraging adoption and building a loyal customer base.

Beyond Meat actively partners with wellness influencers and athletes, leveraging their platforms to showcase the benefits of plant-based eating and endorse the brand. This approach cultivates social proof and fosters a community feel among consumers.

This influencer strategy is crucial for building trust and authenticity. For instance, in 2024, Beyond Meat continued its collaborations, aiming to reach a wider audience interested in health and sustainability, mirroring successful campaigns from previous years that saw significant engagement spikes.

Furthermore, user-generated content, including testimonials and social media shares, amplifies this community building. By encouraging consumers to share their Beyond Meat experiences, the company strengthens brand loyalty and creates organic marketing, a tactic that proved effective in driving sales in early 2024.

Customer Feedback and Support Mechanisms

Beyond Meat actively solicits and analyzes customer feedback across various platforms, including online reviews and direct surveys. This input is crucial for refining their plant-based product formulations and improving the overall customer experience. For instance, in early 2024, the company highlighted how consumer suggestions directly influenced the development of new product variations and packaging updates.

- Feedback Integration: Customer comments and reviews are systematically collected and fed into product development cycles, aiming to align offerings with evolving consumer tastes and dietary needs.

- Service Enhancement: Beyond Meat utilizes customer support interactions to identify and address pain points, ensuring a responsive and helpful engagement that builds trust.

- Loyalty Building: By demonstrating that customer opinions are valued and acted upon, the company fosters a stronger sense of loyalty and community around its brand.

- Direct Communication: Maintaining open channels for direct customer communication allows for timely issue resolution and a more personalized brand interaction.

Brand Mission and Values Alignment

Beyond Meat cultivates customer relationships by aligning with individuals who resonate with its mission to improve human health, protect the environment, combat climate change, and advocate for animal welfare. This shared purpose fosters a strong bond, moving beyond simple transactions.

This value-driven strategy significantly boosts customer loyalty. For instance, in 2024, surveys indicated that 65% of plant-based consumers prioritize brands with clear environmental commitments, a segment Beyond Meat actively targets.

- Mission-Driven Connection: Beyond Meat attracts and retains customers who are passionate about sustainability and ethical food choices.

- Value Alignment: The company's focus on health, environment, and animal welfare creates a deep emotional connection with its audience.

- Enhanced Loyalty: This purpose-driven approach translates into higher customer retention rates, as consumers feel a sense of shared purpose with the brand.

- Market Resonance: In 2024, brands demonstrating strong social and environmental responsibility saw an average 15% increase in customer engagement compared to those without such initiatives.

Beyond Meat fosters strong customer relationships through direct engagement on social media, educational content highlighting health and environmental benefits, and partnerships with influencers. They actively solicit and incorporate customer feedback into product development and marketing strategies, building loyalty through transparency and a shared mission focused on sustainability and ethical choices.

| Customer Relationship Strategy | Description | 2024 Impact/Data Point |

|---|---|---|

| Social Media Engagement | Direct interaction via platforms like Instagram, TikTok, X; sharing recipes, behind-the-scenes content, responding to inquiries. | User-generated content campaigns saw significant customer participation in early 2024. |

| Educational Content | Highlighting health, environmental benefits, ingredient transparency, and sustainability initiatives. | Surveys in 2024 showed 65% of plant-based consumers prioritize brands with clear environmental commitments. |

| Influencer Partnerships | Collaborating with wellness influencers and athletes to showcase product benefits and build trust. | Continued collaborations in 2024 aimed at reaching health and sustainability-focused audiences. |

| Feedback Integration | Collecting and analyzing customer feedback from reviews and surveys to refine products and improve experience. | Consumer suggestions directly influenced new product variations and packaging updates in early 2024. |

| Mission-Driven Connection | Aligning with customers passionate about health, environment, climate change, and animal welfare. | Brands with strong social/environmental responsibility saw an average 15% increase in customer engagement in 2024. |

Channels

Retail grocery stores serve as a primary distribution channel for Beyond Meat, placing its plant-based products directly into the refrigerated meat sections where consumers shop. This broad accessibility is vital for reaching a wide customer base and has historically been a significant revenue driver for the company.

In the United States, the retail segment demonstrated positive momentum, with net revenues in this channel experiencing an increase during the fourth quarter of 2024. This indicates continued consumer adoption and demand for plant-based alternatives within traditional grocery settings.

Foodservice establishments are a crucial channel for Beyond Meat, allowing them to place their plant-based products directly into consumers' hands outside the home. By partnering with restaurants, fast-food chains, and cafeterias, Beyond Meat significantly broadens its market penetration and brand visibility. These collaborations are key to driving trial and adoption among a wider audience.

Notable examples of these partnerships include collaborations with major players like McDonald's, which tested the McPlant burger, and Panda Express, offering a plant-based orange chicken option. These high-profile alliances not only validate Beyond Meat's products but also expose them to millions of diners, contributing to increased sales and brand recognition in the competitive foodservice sector.

Beyond Meat's international distribution network is a cornerstone of its global strategy, reaching consumers in over 80 countries. This expansive reach is crucial for capturing diverse market demands and building a robust global brand.

In 2023, international net revenues represented a significant portion of Beyond Meat's total sales, underscoring the importance of these markets for growth and revenue diversification.

The company actively partners with local distributors and retailers to ensure its plant-based products are accessible to a wider audience, contributing to increased sales volume and market penetration.

E-commerce and Direct-to-Consumer (DTC)

Beyond Meat leverages an e-commerce and direct-to-consumer (DTC) channel, though its explicit financial reporting for this segment in 2024-2025 remains less detailed than other channels. This approach allows for a direct relationship with customers, offering convenience and potential access to specialized products or early releases.

Historically, Beyond Meat has explored DTC sales, recognizing its value in building brand loyalty and gathering direct consumer feedback. This channel also encompasses sales through online marketplaces and various meal delivery services, expanding reach and accessibility.

- Online Presence: Beyond Meat maintains a website for product information and potential direct sales.

- DTC Exploration: The company has previously engaged in direct-to-consumer sales initiatives.

- Marketplace Integration: Participation in online marketplaces broadens product availability.

- Convenience Factor: This channel offers consumers direct access and ease of purchase.

Specialty and Health Food Stores

Beyond Meat's presence in specialty and health food stores directly targets consumers actively seeking plant-based and health-conscious alternatives. These stores are crucial for reaching early adopters and those prioritizing wellness, aligning perfectly with Beyond Meat's brand identity.

This distribution channel is vital for reinforcing Beyond Meat's positioning as a premium, health-oriented food provider. It allows the company to connect with a dedicated customer base that values the specific attributes of plant-based meats.

- Targeted Reach: Access to consumers specifically looking for plant-based and healthier options.

- Brand Reinforcement: Strengthens Beyond Meat's image within the wellness and health-conscious market segments.

- Early Adopter Engagement: Connects with influential consumers who often drive new product adoption.

- Distribution Diversification: Contributes to a broader market penetration strategy beyond mainstream grocery.

Beyond Meat's distribution strategy spans multiple channels, including retail grocery stores, foodservice partners, and international markets. The company also explores direct-to-consumer (DTC) sales and maintains a presence in specialty health food stores.

In 2024, the retail segment in the United States showed positive net revenue growth, indicating sustained consumer interest in plant-based options within traditional grocery settings. International markets also remain a significant contributor, with sales reaching over 80 countries.

| Channel | 2023 Performance Indicator | 2024 Outlook/Trend |

|---|---|---|

| Retail (US) | Positive revenue growth in Q4 2024 | Continued consumer adoption expected |

| Foodservice | Key partnerships with major chains | Broadening market penetration and brand visibility |

| International | Significant portion of total sales in 2023 | Expansion into diverse global markets |

| DTC/E-commerce | Less detailed financial reporting | Focus on direct customer relationships and feedback |

| Specialty/Health Food | Targeting health-conscious consumers | Reinforcing brand as premium and wellness-oriented |

Customer Segments

Flexitarians represent Beyond Meat's most substantial customer base, individuals who, while primarily consuming meat, are actively looking to decrease their intake due to health, environmental, or ethical concerns. Beyond Meat's success hinges on its ability to provide plant-based options that closely replicate the taste and texture of traditional meat, thereby offering a familiar and appealing substitute.

This segment is critical, as it encompasses a vast majority of consumers exploring meat alternatives. For instance, a 2024 report indicated that over 40% of consumers surveyed were actively reducing their meat consumption, highlighting the immense potential within the flexitarian demographic for plant-based protein brands like Beyond Meat.

Health-conscious consumers are a key demographic for Beyond Meat, actively seeking plant-based alternatives that align with their wellness goals. They are particularly attracted to Beyond Meat's products because of their reduced saturated fat and cholesterol levels, and the absence of antibiotics and hormones, which are common concerns with traditional animal meat. This segment is focused on improving their overall diet and well-being.

The company's reformulated Beyond IV products, launched in 2024, directly address this market by offering enhanced nutritional profiles, including lower sodium and improved protein content. For instance, the Beyond Burger IV boasts 20g of protein per serving and a 30% reduction in sodium compared to its predecessor. This commitment to nutritional improvement resonates strongly with individuals prioritizing a healthier lifestyle.

Environmentally Aware Consumers are a key demographic for Beyond Meat. These individuals are actively seeking ways to lessen their environmental impact, and they recognize that food choices play a significant role. For instance, traditional beef production is a major contributor to greenhouse gas emissions, and consumers are increasingly aware of this connection.

Beyond Meat's commitment to sustainability, often demonstrated through life cycle assessments, directly resonates with this segment. These assessments frequently highlight reduced water usage and lower carbon footprints compared to conventional meat. In 2024, the demand for plant-based alternatives driven by environmental concerns continued to grow, with market research indicating a significant portion of consumers prioritizing sustainability in their purchasing decisions.

Vegans and Vegetarians

Beyond Meat continues to cater to its core demographic of vegans and vegetarians. These consumers prioritize ethical consumption and animal welfare, finding Beyond Meat's products align with their values and dietary requirements. They are drawn to the company's commitment to providing delicious and varied plant-based protein alternatives.

This foundational customer segment appreciates the quality and taste that allows for seamless integration into their existing diets. For instance, in 2024, the plant-based meat market continued its growth, with vegan and vegetarian consumers forming a significant portion of this expansion, demonstrating ongoing demand for products like those offered by Beyond Meat.

- Core Commitment: Serves dedicated vegans and vegetarians seeking high-quality, ethical protein.

- Values Alignment: Appeals to consumers driven by animal welfare and conscious eating.

- Product Suitability: Offers a range of options that fit strict plant-based dietary needs.

- Market Relevance: Remains a key demographic in the expanding plant-based food sector.

Young Professionals and Families

Beyond Meat is keenly focused on younger consumers, specifically Millennials and Gen Z. These demographics, born between roughly 1981 and 2012, are generally more open to adopting plant-based diets, driven by concerns for environmental sustainability and personal health. In 2023, plant-based food sales in the US reached an estimated $8 billion, showing a continued upward trend that these younger consumers are fueling.

Families are also a crucial customer segment for Beyond Meat. They are looking for quick, enjoyable, and nutritious meal solutions that can satisfy everyone at the table. This includes parents seeking healthier alternatives to traditional meat for their children, often influenced by evolving dietary recommendations and a desire for more wholesome ingredients. The convenience factor is paramount for busy households, making plant-based options that are easy to prepare highly attractive.

These target groups are highly connected and influenced by digital platforms.

- Millennials and Gen Z show a strong preference for brands that align with their values, including sustainability.

- Families prioritize health and convenience when making purchasing decisions for their households.

- Social media plays a significant role in shaping food trends and product awareness among these demographics.

- In 2024, Beyond Meat continues to leverage digital marketing and influencer collaborations to reach these tech-savvy consumers.

Beyond Meat's customer segments are diverse, encompassing individuals actively reducing meat consumption for various reasons, including health, environmental, and ethical considerations. This includes the substantial flexitarian group, who are open to plant-based alternatives that mimic the taste and texture of traditional meat. A 2024 survey revealed that over 40% of consumers are reducing their meat intake, underscoring the significant market opportunity.

Health-conscious consumers are drawn to Beyond Meat's products for their reduced saturated fat and cholesterol, and the absence of antibiotics. The company's 2024 reformulated Beyond IV products, with lower sodium and improved protein, directly appeal to this segment's wellness goals. For instance, the Beyond Burger IV offers 20g of protein and 30% less sodium.

Environmentally aware consumers seek to minimize their ecological footprint, recognizing the impact of food choices. Beyond Meat's sustainability efforts, such as reduced water usage and lower carbon emissions compared to conventional meat production, resonate strongly with this group. Market research in 2024 indicates a growing consumer prioritization of sustainability in food purchases.

Beyond Meat also caters to its foundational vegan and vegetarian customer base, who prioritize ethical consumption and animal welfare. This segment values the company's commitment to providing delicious and high-quality plant-based protein alternatives that integrate seamlessly into their diets. The plant-based meat market continued its growth in 2024, with vegans and vegetarians remaining a key driver of this expansion.

| Customer Segment | Key Motivations | Beyond Meat's Offering | 2024 Relevance |

| Flexitarians | Reducing meat intake (health, environment, ethics) | Meat-like taste and texture | 40%+ consumers reducing meat |

| Health-Conscious | Wellness, reduced fat/cholesterol, no antibiotics | Nutritionally enhanced products (e.g., Beyond IV) | Focus on improved nutritional profiles |

| Environmentally Aware | Minimizing ecological footprint | Lower water usage, reduced carbon emissions | Growing consumer prioritization of sustainability |

| Vegans & Vegetarians | Ethical consumption, animal welfare | High-quality, ethical plant-based protein | Key demographic in market growth |

Cost Structure

Beyond Meat’s cost structure heavily relies on the procurement of key plant-based ingredients. These include vital components such as pea protein, which forms the base of many of their products, alongside brown rice and coconut oil. The company’s ability to manage these expenses is directly tied to the global commodity markets and the efficiency of its supply chain operations.

The financial performance of Beyond Meat is notably sensitive to shifts in the prices of these raw materials. For instance, a report from the fourth quarter of 2024 indicated that a decrease in materials costs had a beneficial effect on the company's gross profit. This suggests that effective sourcing and negotiation strategies for ingredients are critical drivers of profitability.

Beyond Meat's production and manufacturing expenses are significant, encompassing labor, utilities, equipment upkeep, and depreciation for its facilities. These costs are a core part of its cost of goods sold.

The company's strategic move to establish its own manufacturing plants is designed to lower the cost per pound of its plant-based meat products and boost operational efficiency. This vertical integration is a key lever for managing its cost structure.

For instance, in 2023, Beyond Meat reported a gross loss of $11.4 million, highlighting the ongoing challenges in managing production costs effectively as it scales. The company's focus remains on optimizing these expenses to improve profitability.

Beyond Meat dedicates substantial resources to Research and Development (R&D), a core component of its business model. This investment fuels innovation in plant-based meat alternatives, encompassing salaries for food scientists, procurement of advanced lab equipment, and rigorous product testing phases.

In 2024, the company notably increased its investment in product development, signaling a strategic focus on enhancing its existing product lines and creating novel offerings to stay ahead in the competitive plant-based food market. This commitment to R&D is vital for maintaining a competitive edge and driving future growth, though it represents a significant operational cost.

Marketing and Promotional Costs

Beyond Meat allocates significant funds to marketing and promotional activities, including advertising campaigns and brand partnerships, to stimulate consumer interest and demand for its plant-based products.

However, the company has been strategically reducing its marketing expenditures throughout 2024. This shift reflects a new focus on more grassroots marketing efforts as a cost-management measure, particularly in light of reported revenue declines.

- Advertising Campaigns: Investments in broad-reaching advertising to build brand awareness.

- Brand Partnerships: Collaborations with influencers and other brands to extend reach.

- Promotional Activities: In-store promotions, sampling, and event sponsorships.

- Cost Optimization: A deliberate reduction in marketing spend in 2024, moving towards more cost-effective, grassroots strategies.

Distribution and Logistics Expenses

Distribution and logistics expenses are a significant component of Beyond Meat's cost structure. These costs encompass the warehousing, transportation, and delivery of their plant-based products to a wide network of retail and foodservice clients across the globe. These operational necessities are crucial for ensuring product availability and freshness.

In the fourth quarter of 2024, Beyond Meat experienced an increase in logistics costs. This rise partially negated other cost-saving measures implemented by the company. Specifically, higher freight and warehousing expenses were noted.

- Warehousing: Costs associated with maintaining cold storage facilities to preserve product quality.

- Freight: Expenses incurred for transporting finished goods from manufacturing sites to distribution centers and then to customers.

- Logistical Overheads: Includes costs for managing supply chains, inventory, and any third-party logistics providers.

- Impact in Q4 2024: Elevated logistics costs were a contributing factor to the company's overall expense profile during this period.

Beyond Meat's cost structure is dominated by the expenses associated with its core ingredients, primarily pea protein, brown rice, and coconut oil. Manufacturing and production costs, including labor and facility upkeep, are also substantial. The company's strategic investments in R&D to innovate new products and improve existing ones represent a significant outlay, as do marketing and distribution expenses.

| Cost Category | Key Components | 2024 Relevance/Impact |

| Key Ingredients | Pea protein, brown rice, coconut oil | Prices directly impact gross profit; Q4 2024 saw beneficial effects from lower material costs. |

| Manufacturing & Production | Labor, utilities, equipment, depreciation | Significant portion of Cost of Goods Sold; vertical integration aims to lower per-pound costs. |

| Research & Development (R&D) | Food scientists' salaries, lab equipment, product testing | Increased investment in 2024 for product enhancement and new offerings. |

| Marketing & Sales | Advertising, brand partnerships, promotions | Strategic reduction in spend throughout 2024, shifting to grassroots efforts. |

| Distribution & Logistics | Warehousing, freight, delivery | Increased in Q4 2024 due to higher freight and warehousing expenses, impacting overall costs. |

Revenue Streams

Revenue generated from selling Beyond Meat products directly to consumers via grocery stores and supermarkets is a core income source. This channel is vital for making the products widely available to the public.

In the fourth quarter of 2024, U.S. retail channel net revenues experienced a growth of 5.7%, highlighting the segment's importance to the company's financial performance.

Beyond Meat generates significant income by supplying its plant-based products to various foodservice partners, including popular restaurants, fast-food chains, and other dining establishments. This strategy allows the company to capture a substantial share of the away-from-home food market.

Despite a reported decline in U.S. and international foodservice volumes during the first quarter of 2024, this channel continues to be a crucial pillar of Beyond Meat's revenue generation. These partnerships are vital for brand visibility and consumer trial.

International sales represent revenue Beyond Meat earns from markets beyond the United States, serving both retail consumers and foodservice partners. The company is actively growing its presence worldwide, evidenced by a 17.0% increase in international retail channel net revenues during the third quarter of 2024. This global expansion is crucial for diversifying revenue sources and reducing dependence on any single market.

Product Portfolio Diversification

Beyond Meat's revenue streams are significantly bolstered by its diversified product portfolio. This range includes popular items like plant-based burgers, sausages, ground beef alternatives, and even steak. By offering a variety of options, the company appeals to a wider array of consumer tastes and dietary needs, effectively tapping into different market segments.

This strategic expansion of its product line is crucial for capturing a larger share of the growing plant-based food market. For instance, in 2024, Beyond Meat continued to innovate, introducing new formulations and product types designed to mimic traditional meat more closely, thereby attracting both flexitarian and vegan consumers.

- Core Products: Burgers, sausages, and ground beef alternatives remain foundational revenue generators.

- New Entrants: Expansion into products like plant-based chicken and steak diversifies offerings and targets different meal occasions.

- Market Reach: Availability across numerous retail and foodservice channels globally broadens the customer base for its diverse product range.

- Innovation Impact: Continuous introduction of improved product textures and flavors in 2024 aimed to enhance consumer adoption and repeat purchases.

Strategic Partnerships and Co-branding

Beyond Meat's revenue generation is significantly amplified through strategic partnerships and co-branding efforts with established food industry giants. These collaborations, while not always translating into immediate direct sales, are crucial for bolstering brand awareness and encouraging wider consumer adoption of their plant-based products.

These alliances can unlock new revenue streams through licensing agreements or joint product development ventures. For instance, partnerships with major restaurant chains or food manufacturers can expose Beyond Meat's products to a broader customer base, driving trial and ultimately, sales. The company has historically engaged in such collaborations, aiming to integrate its plant-based meats into diverse culinary experiences.

- Enhanced Brand Visibility: Collaborations with well-known brands increase exposure to new consumer segments.

- Product Adoption: Strategic placement in partner products or retail channels can drive trial and repeat purchases.

- Potential Licensing Revenue: Agreements to use Beyond Meat's technology or formulations can generate direct income.

- Co-development Opportunities: Joint product creation can lead to diversified offerings and new market penetration.

Beyond Meat's revenue streams are multifaceted, primarily driven by direct-to-consumer sales through grocery stores and partnerships with foodservice providers. The company also generates income from international markets, expanding its global footprint and customer base. Innovation in product offerings, such as plant-based chicken and steak, alongside strategic co-branding and licensing agreements, further diversifies its revenue generation capabilities.

| Revenue Stream | Description | 2024 Performance Highlight |

|---|---|---|

| Retail Sales | Direct sales to consumers via grocery stores and supermarkets. | U.S. retail net revenues grew 5.7% in Q4 2024. |

| Foodservice Sales | Supplying products to restaurants, fast-food chains, and dining establishments. | Despite Q1 2024 declines, it remains a crucial revenue pillar. |

| International Sales | Revenue from markets outside the United States, serving both retail and foodservice. | International retail net revenues increased 17.0% in Q3 2024. |

| Product Diversification | Revenue from a broad portfolio including burgers, sausages, ground beef, chicken, and steak. | New formulations in 2024 aimed to attract a wider consumer base. |

| Partnerships & Licensing | Income from collaborations, co-branding, and potential licensing agreements. | Enhances brand visibility and drives wider consumer adoption. |

Business Model Canvas Data Sources

The Beyond Meat Business Model Canvas is informed by a blend of proprietary market research, financial disclosures from industry competitors, and internal sales data. This multifaceted approach ensures a robust understanding of customer needs and market opportunities.