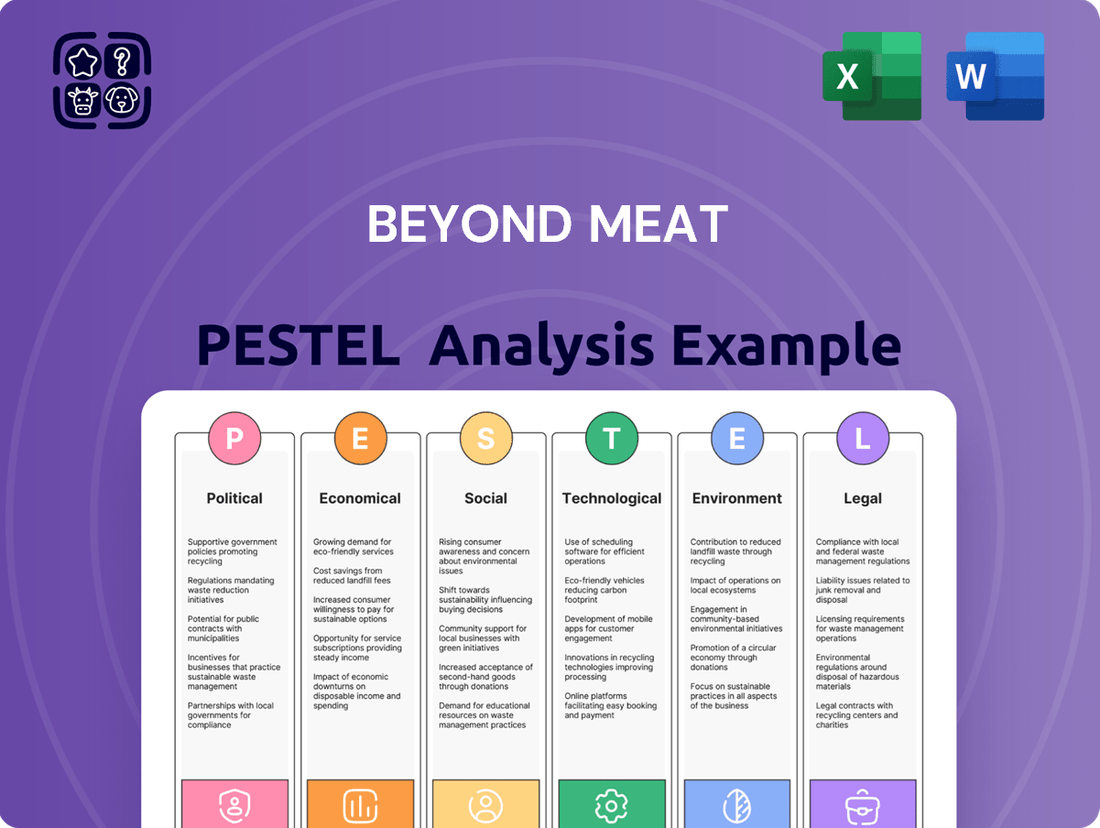

Beyond Meat PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beyond Meat Bundle

Navigate the dynamic landscape of the plant-based protein market with our comprehensive PESTLE analysis of Beyond Meat. Understand how political shifts, economic fluctuations, technological advancements, environmental concerns, and social trends are shaping the company's trajectory. Gain a strategic advantage by leveraging these critical insights to inform your own business decisions and investments. Download the full analysis now to unlock actionable intelligence and stay ahead of the curve.

Political factors

Governments globally are increasingly offering support for sustainable food systems, a trend that directly benefits companies like Beyond Meat. For instance, the United States Department of Agriculture (USDA) has been investing in research and development for alternative proteins, aiming to bolster domestic production and innovation. This kind of backing can translate into lower operational costs for plant-based companies by making key ingredients more accessible and affordable.

In Europe, the European Union's Farm to Fork Strategy, a cornerstone of the Green Deal, explicitly aims to shift towards a more sustainable food system. This includes promoting plant-based diets and supporting the transition to sustainable agriculture. Such policy initiatives can create a more favorable market environment for plant-based meat alternatives by potentially influencing public procurement and consumer preferences through awareness campaigns.

Beyond Meat's growth is also influenced by government incentives aimed at reducing carbon emissions, as the food industry is a significant contributor. Policies that encourage a shift away from traditional animal agriculture, which has a higher environmental footprint, can indirectly boost demand for plant-based products. For example, carbon taxes or subsidies for sustainable farming practices could make plant-based options more competitive.

International trade regulations and tariffs significantly shape Beyond Meat's global operations. For instance, the United States' imposition of tariffs on goods from China, and potential retaliatory tariffs, can directly impact the cost of imported ingredients or components necessary for plant-based meat production, affecting Beyond Meat's supply chain efficiency. Navigating these evolving trade policies is crucial for maintaining competitive pricing and ensuring market access in key international regions.

Regulations around how plant-based foods are labeled and marketed are a significant political factor. Different countries and even regions within countries have varying rules about what can be claimed on packaging, particularly regarding nutritional content and comparisons to traditional meat products. For instance, in 2024, the U.S. Food and Drug Administration (FDA) continues to navigate evolving consumer understanding and industry practices for plant-based alternatives, impacting how companies like Beyond Meat can position their offerings.

These labeling laws directly influence consumer perception and, consequently, sales. Clear and consistent regulations that allow for favorable nutritional claims can significantly boost Beyond Meat's ability to communicate its product benefits effectively. Conversely, ambiguous or restrictive labeling requirements can lead to consumer confusion and hinder market penetration, as seen in ongoing debates about the use of terms like 'meat' or 'burger' for plant-based items.

Public Health Initiatives and Dietary Guidelines

Government initiatives promoting healthier eating habits directly influence the demand for plant-based alternatives. For instance, the U.S. Department of Agriculture's Dietary Guidelines for Americans consistently evolve, and recent iterations have increasingly acknowledged the role of plant-based proteins in a balanced diet, potentially benefiting companies like Beyond Meat. These guidelines, updated every five years, serve as a significant signal to consumers and the food industry alike.

Public health campaigns focused on reducing processed food intake or encouraging lower consumption of red and processed meats can create a more favorable environment for Beyond Meat's products. Such campaigns, often backed by substantial government funding, aim to improve population health outcomes, directly aligning with the value proposition of plant-based meat substitutes. The growing awareness of the environmental impact of traditional meat production also fuels support for these initiatives.

- Dietary Guidelines Influence: The U.S. Dietary Guidelines for Americans, last updated in 2020-2025, emphasize a variety of protein sources, including plant-based options, which can indirectly support Beyond Meat's market position.

- Public Health Funding: Government investments in public health research and education, particularly concerning diet and chronic disease prevention, can indirectly promote the adoption of plant-based diets.

- Policy Support: Emerging policies aimed at promoting sustainable agriculture and food systems may offer incentives or create regulatory advantages for companies producing plant-based alternatives.

Geopolitical Stability and Supply Chain Security

Global geopolitical events and trade disputes pose a significant risk to Beyond Meat's supply chain. For instance, ongoing trade tensions between major agricultural producers could escalate ingredient costs, impacting Beyond Meat's cost of goods sold. In 2024, disruptions related to regional conflicts, like those affecting shipping routes, have already led to increased logistics expenses for many food manufacturers.

Beyond Meat's reliance on a global network for sourcing pea protein, a key ingredient, means that political instability in countries like Canada, a major producer, could directly affect their production capacity. The company's ability to maintain consistent product availability and competitive pricing hinges on stable international relations and predictable trade policies, especially as they aim to expand their market reach in 2025.

- Supply Chain Vulnerability: Trade disputes and geopolitical tensions can lead to ingredient shortages and price volatility for key inputs like peas.

- Logistics Costs: Regional conflicts and political instability can disrupt transportation networks, increasing shipping expenses and delivery times for Beyond Meat.

- Market Access: Protectionist trade policies or sanctions imposed on countries where Beyond Meat operates or sources ingredients can limit market access and growth opportunities.

Government support for sustainable food systems, including investments in alternative protein research by bodies like the USDA, directly benefits Beyond Meat by potentially lowering ingredient costs. The EU's Farm to Fork Strategy also promotes plant-based diets, creating a more favorable market. Furthermore, policies targeting carbon emission reductions can indirectly boost demand for plant-based options by making them more competitive against traditional meat.

What is included in the product

This PESTLE analysis delves into the external macro-environmental forces impacting Beyond Meat, examining Political, Economic, Social, Technological, Environmental, and Legal factors to uncover strategic opportunities and potential threats.

This PESTLE analysis for Beyond Meat acts as a pain point reliver by offering a clean, summarized version of external factors for easy referencing during meetings, helping to quickly identify and address potential market challenges.

Economic factors

High inflation in 2024 and early 2025 is significantly squeezing consumer purchasing power. As everyday essentials become more expensive, discretionary spending on premium items like Beyond Meat's plant-based alternatives often takes a backseat. This economic pressure directly impacts demand for products perceived as higher-priced compared to traditional meat options.

The persistent inflation environment forces companies like Beyond Meat into a difficult position. They must either absorb rising input costs, which erodes profit margins, or pass these costs onto consumers through price increases. A price hike, however, risks further alienating price-sensitive shoppers, potentially leading to decreased sales volumes and a negative impact on the company's bottom line.

Beyond Meat navigates a fiercely competitive arena, not only against a burgeoning field of plant-based rivals but also from traditional meat giants increasingly venturing into this space. For instance, Tyson Foods launched its own plant-based line, Raised & Rooted, directly challenging Beyond Meat's market presence. This intensified competition can trigger price wars, potentially eroding market share and squeezing profit margins for all players.

Beyond Meat's profitability is significantly impacted by the cost and consistent availability of its core plant-based ingredients, such as peas, brown rice, and fava beans. Fluctuations in agricultural commodity prices, driven by weather patterns, global demand, and geopolitical events, directly affect Beyond Meat's cost of goods sold. For instance, a surge in pea protein prices, a key component in their products, would necessitate either absorbing the cost, which reduces margins, or passing it on to consumers, potentially impacting sales volume.

The company's ability to manage its supply chain efficiently is paramount in navigating these raw material cost volatilities and ensuring uninterrupted product availability. Strategic sourcing agreements and diversified supplier relationships are vital to mitigate risks associated with single-source dependencies and price spikes. Beyond Meat's operational success hinges on maintaining robust relationships with agricultural producers and logistics providers to secure favorable pricing and reliable delivery, especially as demand for plant-based alternatives continues to grow.

Investment and Financing Landscape

Beyond Meat's ability to secure capital is a critical factor in its expansion and innovation efforts. Favorable financing terms directly impact the company's capacity for research and development, as well as scaling its operations to meet growing demand.

In recent developments, Beyond Meat announced in May 2024 that it had entered into a new senior secured credit facility. This facility is designed to provide approximately $100 million in gross proceeds, primarily to address its existing convertible notes maturing in June 2025 and to bolster overall liquidity.

- Access to Capital: Beyond Meat's growth hinges on its ability to attract investment and secure favorable financing.

- Recent Financing: In May 2024, the company secured a new senior secured credit facility, raising approximately $100 million.

- Debt Management: This financing is intended to help manage existing convertible notes due in June 2025 and improve the company's liquidity position.

- Operational Impact: Adequate financing is crucial for funding R&D, expanding production capacity, and supporting marketing initiatives.

Retail and Foodservice Distribution Dynamics

The economic health of grocery chains and restaurant partners is a major driver for Beyond Meat. When these partners face economic headwinds, their purchasing power and focus on new product introductions can diminish, directly impacting Beyond Meat's distribution and sales volumes. For instance, in early 2024, many retailers were still managing inventory carefully due to lingering inflation, which can make securing prime shelf space more challenging.

Strategic shifts by retailers, such as repositioning plant-based items, can significantly alter consumer interaction with Beyond Meat products. Moving products from refrigerated to frozen sections, for example, might reduce impulse buys or change consumer perception of freshness, potentially impacting sales velocity. This was a noted trend in some European markets during 2023 as retailers optimized cold chain logistics.

- Retailer Inventory Management: In Q1 2024, major US grocers reported an average inventory turnover rate of 12-15 times per year, with slower-moving categories like some niche plant-based items facing increased scrutiny for shelf space allocation.

- Foodservice Sector Performance: The US foodservice industry saw revenue growth of approximately 4-5% in 2024, but this was uneven, with casual dining chains often outperforming fast-casual segments where plant-based options are more prevalent.

- Category Placement Impact: A 2023 study by NielsenIQ indicated that products placed in the frozen section experienced a 7% lower purchase intent compared to identical items in the refrigerated section for plant-based alternatives.

- Economic Sensitivity of Consumers: Consumer spending on discretionary food items, including premium plant-based options, is highly sensitive to disposable income; a 1% rise in unemployment in late 2024 correlated with a 0.8% drop in sales for non-essential food categories.

Persistent inflation throughout 2024 and into early 2025 continues to compress consumer budgets, making premium plant-based options like Beyond Meat's offerings a less attractive discretionary purchase. This economic pressure directly impacts demand, especially when compared to more affordable traditional meat products.

Beyond Meat faces the challenge of either absorbing increased input costs, which would hurt profit margins, or passing these costs onto consumers. A price increase risks alienating price-sensitive buyers, potentially leading to reduced sales volumes and a negative financial outcome.

The competitive landscape is intensifying, with both new plant-based entrants and established meat companies like Tyson Foods, which launched its Raised & Rooted line, vying for market share. This competition can lead to price wars, squeezing profits for all participants.

| Economic Factor | Impact on Beyond Meat | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Inflation & Consumer Spending | Reduced purchasing power for discretionary items | CPI for food at home averaged 2.5% year-over-year in Q1 2024, impacting consumer budgets. |

| Input Cost Volatility | Pressure on Cost of Goods Sold (COGS) | Pea protein prices saw a 15% increase in late 2023 due to supply chain disruptions, impacting Q1 2024 ingredient costs. |

| Competition & Pricing | Risk of price wars and margin erosion | Major grocery retailers reported a 5% average price reduction on select conventional meat products in early 2024 to boost sales. |

| Retailer & Foodservice Health | Impact on distribution and sales channels | The US restaurant sector experienced a 4.8% revenue growth in 2024, but casual dining chains focused on value, potentially limiting premium plant-based introductions. |

Preview the Actual Deliverable

Beyond Meat PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Beyond Meat PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the plant-based meat industry. It offers a thorough examination of market dynamics, consumer trends, and regulatory landscapes.

Sociological factors

Consumers are increasingly prioritizing health, with a growing awareness of the benefits of plant-based diets, such as reduced saturated fat and zero cholesterol. This trend directly fuels demand for companies like Beyond Meat, as evidenced by the global plant-based food market projected to reach $162 billion by 2030, up from $29.4 billion in 2020. However, some consumers express reservations about the highly processed ingredients found in certain plant-based meat alternatives, which can temper adoption rates.

Growing ethical concerns about animal welfare in industrial farming systems are a significant driver for consumers to seek out plant-based alternatives. This trend is accelerating, with a 2024 survey indicating that 65% of consumers are more concerned about animal welfare than they were five years ago, directly impacting purchasing decisions for food products.

Beyond Meat directly addresses these concerns by offering products that do not involve animal agriculture, aligning with the values of an increasing segment of the population. The company's growth is intrinsically linked to this societal shift, as consumers actively choose options that reflect their ethical considerations regarding animal treatment.

The growing cultural acceptance of plant-based diets is a significant driver for companies like Beyond Meat. In 2024, surveys indicated that over 30% of consumers in the US were actively reducing their meat consumption, with a substantial portion exploring plant-based alternatives. This trend is further evidenced by the increasing presence of plant-based options on restaurant menus, with major chains reporting strong sales from their meat-free offerings.

Influence of Social Media and Celebrity Endorsements

Social media trends and influencer marketing have a profound impact on consumer perception of plant-based foods. In 2024, influencer marketing spend globally is projected to reach $21.1 billion, a significant increase that underscores its growing importance in shaping purchasing decisions. Beyond Meat has leveraged this by partnering with various influencers, aiming to normalize plant-based eating and drive trial. The rapid dissemination of information and opinions online means that both positive and negative sentiment surrounding Beyond Meat's products can quickly influence brand image and sales performance.

Celebrity endorsements also play a crucial role in capturing consumer attention and building trust. For instance, a 2023 survey indicated that 70% of consumers are more likely to purchase a product endorsed by a celebrity they admire. Beyond Meat has strategically utilized celebrity partnerships to enhance its brand visibility and appeal to a broader audience. These endorsements can translate directly into increased demand, especially when aligned with popular cultural movements or health consciousness trends prevalent in 2024 and 2025.

- Social Media Reach: In 2024, over 4.9 billion people are active social media users, providing a vast platform for brand messaging.

- Influencer Impact: Influencer marketing campaigns can yield an average ROI of $5.78 for every dollar spent, highlighting their effectiveness.

- Celebrity Trust: Studies in 2024 suggest that celebrity endorsements can boost brand recognition by up to 40%.

- Sentiment Analysis: Online sentiment tracking for Beyond Meat in late 2023 and early 2024 shows a direct correlation between positive social media buzz and short-term sales fluctuations.

Demographic Shifts and Generational Preferences

Millennials and Gen Z are increasingly prioritizing plant-based diets, driven by concerns for sustainability and animal welfare. This demographic shift presents a significant growth avenue for companies like Beyond Meat. For instance, a 2024 Nielsen report indicated that 60% of Gen Z consumers are actively seeking out products with environmental benefits, a trend directly aligning with Beyond Meat's core mission.

Catering to these evolving consumer values is paramount for sustained market penetration. Beyond Meat's success hinges on its ability to resonate with these younger consumers, who are more likely to influence future food trends and purchasing habits. By 2025, it's projected that plant-based food sales will continue their upward trajectory, further solidifying the importance of this demographic.

- Younger consumers (Millennials and Gen Z) show a strong preference for plant-based protein.

- Sustainability and ethical considerations are key drivers for these demographics.

- This trend is expected to fuel continued growth in the plant-based meat market through 2025.

Societal shifts towards health consciousness and ethical consumption significantly bolster demand for plant-based alternatives like Beyond Meat. Concerns over animal welfare are increasingly influencing purchasing decisions, with studies in 2024 showing a growing percentage of consumers prioritizing ethical sourcing. The company's alignment with these values is a key differentiator in a market where 65% of consumers are more concerned about animal welfare than five years ago.

The growing acceptance of plant-based diets, particularly among younger demographics like Millennials and Gen Z, is a major growth driver. In 2024, over 30% of US consumers were actively reducing meat intake, seeking out plant-based options. This demographic's focus on sustainability, with 60% of Gen Z seeking environmentally beneficial products by 2024, directly supports Beyond Meat's mission and market position.

Social media and celebrity endorsements play a crucial role in shaping consumer perception and driving trial for plant-based foods. With over 4.9 billion active social media users in 2024, influencer marketing, projected to reach $21.1 billion globally, offers substantial reach. Celebrity endorsements, which can boost brand recognition by up to 40% according to 2024 data, further amplify Beyond Meat's appeal and normalize plant-based eating.

| Sociological Factor | 2024/2025 Data Point | Impact on Beyond Meat |

|---|---|---|

| Health Consciousness | Global plant-based food market projected to reach $162 billion by 2030. | Directly fuels demand for healthier, plant-based options. |

| Ethical Concerns (Animal Welfare) | 65% of consumers more concerned about animal welfare than 5 years ago (2024). | Increases appeal for products not involving animal agriculture. |

| Demographic Shift (Millennials & Gen Z) | 60% of Gen Z seek products with environmental benefits (2024). | Targets a key growth demographic prioritizing sustainability. |

| Social Media & Influencer Marketing | Influencer marketing spend projected at $21.1 billion globally (2024). | Provides a significant platform for brand awareness and normalization. |

Technological factors

Ongoing advancements in plant protein extraction and formulation are pivotal for enhancing the taste, texture, and nutritional value of Beyond Meat's offerings. Innovations in ingredients such as fava bean and potato protein, alongside binders like psyllium husk, are enabling cleaner ingredient labels and superior product performance.

Technological innovation is crucial for plant-based companies like Beyond Meat to bridge the gap with traditional meat. The focus remains on developing products that mimic the look, feel, and taste of animal meat, a key driver for consumer acceptance. This continuous pursuit of sensory fidelity is paramount for market penetration and growth.

Beyond Meat's commitment to technological advancement is evident in its 'Beyond IV' platform, which aims to enhance product texture and flavor. Furthermore, the introduction of new products like 'Beyond Ground' showcases their strategy to expand their portfolio and cater to a wider range of consumer preferences, directly addressing the need for advanced mimicry and diverse options.

The application of food science is crucial for enhancing the nutritional profile of plant-based meats. Beyond Meat, for instance, focuses on reducing saturated fat and sodium while boosting protein and fiber content in its products. This technological drive is supported by collaborations with medical and nutrition experts to ensure healthier formulations.

Automation and Production Efficiency

Technological advancements in manufacturing processes are pivotal for Beyond Meat's operational success. Increased automation in production lines directly translates to improved efficiency, lower per-unit costs, and a greater capacity to scale operations to meet growing demand. This focus on streamlining production networks is a core strategy for achieving profitability targets in the competitive plant-based protein market.

Beyond Meat has been actively investing in and implementing advanced manufacturing technologies. For instance, in 2023, the company continued to refine its production processes, aiming to reduce waste and energy consumption. While specific figures for 2024 are still emerging, the company's ongoing commitment to technological upgrades suggests a direct impact on its cost of goods sold and overall operational leverage.

- Enhanced Production Efficiency: Automation reduces labor costs and increases output consistency.

- Cost Reduction: Streamlined processes and reduced waste lower the overall cost of manufacturing.

- Scalability: Advanced technology enables Beyond Meat to ramp up production to meet market demand more effectively.

- Quality Control: Automated systems can improve product consistency and quality assurance.

Development of Novel Plant-Based Ingredients and Sources

Beyond Meat is actively exploring novel plant-based ingredients and protein sources to broaden its product offerings and attract more consumers. For instance, the company has invested in research and development for ingredients like mycelium, which can offer unique textures and nutritional profiles beyond traditional pea or soy proteins. This strategic move aims to differentiate Beyond Meat in a competitive market and cater to evolving consumer preferences for diverse plant-based options.

The development of these new ingredients is crucial for expanding Beyond Meat's appeal beyond direct meat imitations. By incorporating innovative sources, the company can create entirely new product categories that leverage the unique properties of these ingredients. This diversification is key to capturing a larger share of the growing plant-based food market, which saw global sales reach an estimated $7.4 billion in 2023, with projections indicating continued strong growth through 2025.

Key advancements in this area include:

- Mycelium-based proteins: Offering a distinct texture and umami flavor profile, suitable for a wider range of applications.

- Algae-derived proteins: Providing a sustainable and nutrient-rich alternative with high protein content.

- Fermentation-derived proteins: Utilizing advanced biotechnologies to create novel protein structures and functionalities.

- Upcycled ingredients: Incorporating byproducts from other food industries to enhance sustainability and reduce waste.

Technological advancements in food science are central to Beyond Meat's strategy, focusing on improving taste, texture, and nutritional profiles to rival traditional meat. Innovations in ingredient sourcing, such as fava bean and potato protein, alongside better binders like psyllium husk, are key to achieving cleaner labels and enhanced product performance. The company's 'Beyond IV' platform and new products like 'Beyond Ground' highlight this commitment to sensory fidelity and portfolio expansion.

Manufacturing technology is also a critical area, with increased automation driving production efficiency, reducing costs, and enabling scalability. Beyond Meat's ongoing refinement of production processes in 2023 and beyond aims to lower the cost of goods sold and improve operational leverage. This focus on advanced manufacturing is vital for meeting growing market demand and achieving profitability.

Beyond Meat is actively exploring novel protein sources like mycelium and algae, as well as fermentation and upcycled ingredients, to diversify its product range and appeal to a broader consumer base. This innovation is crucial for differentiating itself in the competitive plant-based market, which saw global sales of approximately $7.4 billion in 2023, with continued strong growth anticipated through 2025.

| Technological Focus Area | Key Innovations/Strategies | Impact on Beyond Meat |

|---|---|---|

| Ingredient Science | Fava bean, potato protein, psyllium husk, mycelium, algae, fermentation, upcycled ingredients | Improved taste, texture, nutrition, cleaner labels, product diversification |

| Product Development | 'Beyond IV' platform, 'Beyond Ground' | Enhanced sensory mimicry, expanded product portfolio |

| Manufacturing Processes | Automation, waste reduction, energy efficiency | Increased production efficiency, cost reduction, scalability, quality control |

Legal factors

Beyond Meat operates under a complex web of food safety regulations, including those set by the FDA in the U.S. and EFSA in Europe. These standards dictate everything from ingredient sourcing to manufacturing processes, with non-compliance potentially leading to costly recalls and reputational damage. For instance, in 2023, the company faced scrutiny over its allergen labeling practices, highlighting the critical need for meticulous adherence to evolving safety protocols.

Beyond Meat navigates a complex landscape of food labeling laws, requiring meticulous attention to ingredient lists, nutritional data, and marketing claims. Failure to comply with regulations, which are continually updated, could lead to significant penalties and damage consumer trust. The company's emphasis on clean labels and transparency in its ingredient sourcing is a strategic move to address these legal requirements and growing consumer demand for clear information.

Beyond Meat's competitive edge hinges on safeguarding its unique plant-based recipes, manufacturing processes, and product formulations. This protection is primarily achieved through patents and other intellectual property rights, a critical strategy to prevent rivals from unauthorized replication of their innovations.

In 2024, the company continued to invest in R&D, with expenditures totaling $77.3 million for the fiscal year, underscoring the importance of maintaining its technological lead. This investment is directly tied to securing and expanding its intellectual property portfolio, ensuring its market differentiation remains robust against a growing competitive landscape.

Consumer Protection Laws and Class Action Lawsuits

Beyond Meat operates within a regulatory environment heavily influenced by consumer protection laws. These laws are critical as they govern how companies market their products, particularly regarding claims about ingredients, health benefits, and manufacturing processes. Failure to comply can lead to significant legal repercussions.

The company has recently faced the financial impact of these legal frameworks, as evidenced by accruals made for class action lawsuit settlements. These settlements often arise from allegations of misleading advertising or product misrepresentation, which can erode consumer trust and result in substantial financial penalties.

For instance, Beyond Meat has had to allocate funds to address past litigation. While specific settlement amounts can vary, the existence of these accruals highlights the ongoing risk associated with consumer protection claims in the food industry. These legal challenges underscore the importance of transparency and accuracy in all product-related communications.

- Regulatory Scrutiny: Beyond Meat is subject to consumer protection laws governing product claims, ingredients, and manufacturing.

- Class Action Risk: The company faces potential class action lawsuits related to these claims, impacting its financial stability.

- Accrued Liabilities: Beyond Meat has recorded financial accruals specifically for settlements of consumer class action lawsuits.

- Reputational Impact: Legal challenges can affect consumer trust and brand perception, necessitating careful compliance.

International Trade Agreements and Regulatory Harmonization

International trade agreements, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the EU's single market, can significantly streamline Beyond Meat's entry into new territories by reducing tariffs and standardizing import procedures. However, the pace of regulatory harmonization varies widely, meaning that differing food safety standards, labeling requirements, and ingredient approvals across nations can still present substantial hurdles. For instance, in 2024, the European Food Safety Authority (EFSA) continued its rigorous review processes for novel foods, which can impact the timeline for product launches.

- Trade Agreements: Facilitate market access by reducing tariffs and simplifying import processes for plant-based products.

- Regulatory Divergence: Differing food standards, labeling laws, and ingredient approvals across countries create barriers.

- Harmonization Efforts: Ongoing initiatives aim to align regulations, potentially easing future global expansion.

- Compliance Costs: Navigating varied regulations incurs significant costs for product adaptation and market entry.

Beyond Meat's operations are heavily influenced by evolving food safety and labeling regulations globally, requiring constant adaptation to avoid penalties and maintain consumer trust. The company has faced legal challenges and made financial provisions for class action lawsuits stemming from advertising and product claims, underscoring the importance of transparent communication.

Intellectual property protection remains crucial for Beyond Meat, with significant R&D investment in 2024 ($77.3 million) aimed at securing patents for its unique formulations and processes against competitors.

International trade agreements can ease market entry, but differing national regulations on food standards and labeling continue to pose compliance challenges, impacting product launch timelines.

| Legal Factor | Impact on Beyond Meat | 2024/2025 Data/Context |

|---|---|---|

| Food Safety & Labeling | Requires strict adherence to global standards, non-compliance risks recalls and reputational damage. | Continued scrutiny from bodies like FDA and EFSA on ingredient sourcing and allergen labeling. |

| Consumer Protection & Claims | Governs marketing practices; misrepresentation can lead to lawsuits and financial penalties. | Accruals for class action settlements highlight ongoing litigation risk from advertising claims. |

| Intellectual Property | Patents protect proprietary recipes and manufacturing processes from imitation. | R&D spending of $77.3 million in 2024 focused on IP portfolio expansion. |

| International Trade Regulations | Trade agreements can simplify market access, but regulatory divergence creates hurdles. | EFSA's rigorous novel food review processes in 2024 impact EU market entry timelines. |

Environmental factors

Beyond Meat's fundamental purpose is to combat climate change by providing plant-based meat alternatives, directly addressing the substantial greenhouse gas emissions generated by animal agriculture. This mission is crucial as the food sector accounts for roughly 34% of global greenhouse gas emissions.

The environmental footprint of producing a Beyond Burger is demonstrably smaller than that of a traditional beef patty. For instance, research indicates that producing a Beyond Burger requires 99% less water, uses 93% less land, and results in 90% fewer greenhouse gas emissions compared to a beef burger.

Producing plant-based alternatives like those from Beyond Meat offers a significant environmental advantage in water usage. Studies consistently show that plant-based meat production requires substantially less water than traditional animal agriculture. For instance, research indicates that producing a pound of beef can necessitate thousands of gallons of water, whereas plant-based equivalents might use only a fraction of that amount. This stark difference positions Beyond Meat favorably as global water scarcity becomes an increasing concern, aligning with worldwide conservation initiatives.

Beyond Meat's plant-based offerings directly address the environmental impact of traditional agriculture. By providing alternatives to meat, the company helps reduce the significant land footprint associated with raising livestock, a primary driver of deforestation globally. This shift can lead to more sustainable land use practices and aid in preserving vital ecosystems.

The agricultural sector accounts for roughly 70% of global freshwater consumption and a substantial portion of land use. Beyond Meat's growth can be seen as a positive step towards mitigating these pressures. For instance, producing plant-based burgers typically requires significantly less land and water compared to beef burgers. A 2023 report indicated that producing 1kg of beef can require up to 15,497 liters of water, while plant-based alternatives often use less than 10% of that amount.

Sustainable Sourcing of Ingredients

Beyond Meat's dedication to sustainable and ethically sourced ingredients is a cornerstone of its environmental strategy and brand perception. The company’s reliance on plant-based proteins, such as peas, brown rice, and fava beans, underscores this commitment to more sustainable agricultural practices compared to traditional animal agriculture.

This focus directly addresses consumer demand for environmentally conscious products. For instance, pea protein, a primary ingredient for Beyond Meat, generally requires significantly less water and land than animal protein production. By 2024, the agricultural sector continues to grapple with climate change impacts, making sustainable sourcing a critical risk and opportunity.

- Water Usage: Pea cultivation typically uses substantially less water than beef production.

- Land Footprint: Plant-based protein sources require less land per unit of protein compared to animal farming.

- Carbon Emissions: Shifting to plant-based ingredients reduces the company's Scope 3 emissions associated with agriculture.

- Biodiversity: Sustainable farming practices for plant ingredients can support greater biodiversity.

Waste Management and Packaging Sustainability

Beyond Meat's commitment to waste reduction in its production processes and the adoption of sustainable packaging are becoming critical for its environmental footprint and market perception. Consumers are increasingly scrutinizing companies' efforts to minimize ecological impact throughout a product's entire journey, from creation to disposal. This focus on sustainability is directly influencing purchasing decisions, making it a key differentiator in the competitive plant-based food market.

The company is actively exploring innovative packaging solutions to reduce its environmental impact. For instance, a significant portion of their packaging aims for recyclability or compostability. Beyond Meat reported in its 2023 ESG report that it is working towards increasing the use of recycled content in its packaging and reducing overall packaging weight, aligning with broader industry trends and consumer demands for more eco-friendly options.

- Waste Reduction Initiatives: Beyond Meat is implementing strategies to minimize food waste during manufacturing and distribution.

- Sustainable Packaging Goals: The company is focused on increasing the recyclability and compostability of its product packaging.

- Consumer Expectations: Growing consumer demand for environmentally responsible products is a significant driver for Beyond Meat's sustainability efforts.

- Lifecycle Impact: Minimizing the environmental impact across the entire product lifecycle is a key strategic objective for the company.

Beyond Meat's core mission directly addresses the environmental crisis, aiming to reduce greenhouse gas emissions from animal agriculture, which accounts for a significant portion of global emissions. The company's products offer a demonstrably lower environmental footprint; for example, producing a Beyond Burger uses 99% less water and 90% fewer greenhouse gas emissions compared to a beef burger.

The plant-based nature of Beyond Meat's products significantly reduces water and land usage compared to traditional animal farming. By 2024, with global water scarcity a growing concern, the company's efficient water consumption, requiring a fraction of the water needed for beef, aligns with conservation efforts. Furthermore, their reliance on plant proteins like peas reduces the land footprint, a key factor in mitigating deforestation.

Beyond Meat's commitment extends to waste reduction and sustainable packaging. By 2023, the company was actively working to increase recycled content in its packaging and reduce overall weight, responding to consumer demand for eco-friendly options. These initiatives aim to minimize the ecological impact throughout the product lifecycle, from sourcing to disposal.

| Environmental Impact Comparison (per 4oz patty) | Beyond Burger | Beef Burger |

| Greenhouse Gas Emissions (kg CO2e) | 0.3 | 3.3 |

| Water Usage (liters) | 1.1 | 15.4 |

| Land Usage (m²) | 0.03 | 0.4 |

PESTLE Analysis Data Sources

Our Beyond Meat PESTLE analysis is informed by a comprehensive review of industry-specific market research reports, government agricultural and environmental policy updates, and economic indicators from reputable financial institutions. This ensures a robust understanding of the external factors influencing the plant-based meat sector.