Beyond Meat Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beyond Meat Bundle

Beyond Meat's product portfolio, when viewed through the lens of the BCG Matrix, offers a fascinating glimpse into its market strategy. Understanding whether their plant-based burgers are Stars or Cash Cows, and how their newer innovations fit into the Question Marks or Dogs, is crucial for any investor or competitor.

Dive deeper into Beyond Meat's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Beyond Meat's introduction of the updated Beyond IV platform, featuring the new Beyond Burger and Beyond Beef, signifies a strategic pivot towards enhanced product quality and consumer appeal. This innovation drive centers on improving taste, nutritional profiles, and ingredient transparency, aiming to capture a larger share of the expanding plant-based protein market.

The revamped Beyond Burger and Beyond Beef now utilize avocado oil, a move designed to lower saturated fat content and simplify the ingredient list. This strategic ingredient change is intended to rebuild consumer confidence and boost sales, particularly in a competitive landscape where ingredient perception plays a crucial role. For instance, as of early 2024, the plant-based meat market continues to show resilience, with projections indicating sustained growth through the decade.

The Beyond Steak line, featuring popular flavors like Chimichurri and Korean BBQ-Style, is a standout performer, recognized as one of the fastest-growing and top-selling plant-based meat options available. This success is driven by its appealing nutritional content and the convenience it offers consumers navigating the expanding plant-based market.

Beyond Meat's strategic foodservice partnerships are a cornerstone of its market penetration strategy. Collaborations with major food chains and quick-service restaurants (QSRs) are vital for increasing product availability and integrating plant-based options into mainstream menus. This approach significantly boosts brand visibility and reaches a wider consumer base beyond traditional retail channels.

In 2024, Beyond Meat continued to expand its presence in the foodservice sector, aiming to make its products more accessible. For instance, partnerships with chains like McDonald's (though the McPlant trials have seen varied results and regional availability) and Yum! Brands (including KFC and Pizza Hut) demonstrate a commitment to widespread adoption. These alliances are critical for driving trial and normalizing plant-based eating habits among a broader demographic.

International Expansion (Europe)

Europe represents a significant growth frontier for Beyond Meat, driven by robust consumer appetite for sustainable and plant-based food options. The company is strategically prioritizing this region for its international expansion initiatives, capitalizing on a burgeoning global trend towards flexitarian and vegan lifestyles.

This focus on Europe aligns with increasing consumer awareness regarding the environmental impact of traditional meat production. In 2024, the European plant-based food market was valued at approximately €7.6 billion, with projections indicating continued strong growth. Beyond Meat's presence in key European markets aims to capture a substantial share of this expanding sector.

- Market Share Growth: Beyond Meat aims to increase its market share in Europe, which is expected to contribute significantly to its overall global revenue by 2025.

- Consumer Demand: Surveys in 2024 indicated that over 40% of European consumers are actively reducing their meat consumption, creating a fertile ground for plant-based alternatives.

- Distribution Expansion: The company is expanding its retail and foodservice partnerships across Europe, making its products more accessible to a wider consumer base.

- Product Innovation: Beyond Meat is tailoring its product offerings to European palates and preferences, enhancing consumer appeal and driving sales.

Product Innovation and Health Accreditations

Beyond Meat's dedication to product innovation is evident in its consistent rollout of new plant-based alternatives. This drive to create novel offerings is a key factor in its market positioning.

The company's pursuit of health accreditations, such as the American Heart Association's Heart-Check mark and the American Diabetes Association's Better Choices for Life program, underscores its commitment to health-conscious consumers. These certifications aim to build trust and attract a broader demographic seeking healthier food options.

This strategic focus on health and nutrition can significantly broaden Beyond Meat's appeal beyond traditional vegetarian and vegan markets. By aligning with recognized health organizations, the company can tap into a larger segment of the population prioritizing dietary well-being.

- Product Innovation: Beyond Meat has introduced a range of products including burgers, sausages, and chicken-style tenders.

- Health Accreditations: The company has sought and obtained marks like the American Heart Association's Heart-Check.

- Market Appeal: These initiatives are designed to attract a wider, health-conscious consumer base.

- Competitive Edge: Focus on health and accreditations differentiates Beyond Meat in the growing plant-based market.

Beyond Meat's Beyond Steak line, particularly its popular flavors, is a clear star in their portfolio. It's experiencing rapid growth and strong sales, positioning it as a leading plant-based option.

This product's success is attributed to its appealing nutritional profile and the convenience it offers consumers. As of early 2024, the plant-based meat market continues its upward trajectory, with Beyond Steak well-positioned to capitalize on this trend.

The company's strategic foodservice partnerships, including those with major chains, are crucial for driving trial and adoption of products like Beyond Steak. These collaborations enhance visibility and accessibility for the brand.

Europe represents a significant growth area, with Beyond Meat expanding its presence and tailoring offerings to local preferences. By 2024, the European plant-based market was valued at approximately €7.6 billion, showcasing substantial opportunity.

| Product Category | Market Position (Early 2024) | Growth Drivers | Strategic Focus |

|---|---|---|---|

| Beyond Steak | Star (High Growth, High Market Share) | Flavor, Nutrition, Convenience, Foodservice Partnerships | Continued Expansion, Product Innovation |

| Beyond Burger/Beef (IV Platform) | Question Mark/Potential Star | Improved Taste, Healthier Ingredients (Avocado Oil), Market Penetration | Rebuilding Consumer Confidence, Retail & Foodservice Push |

| Other Products (Sausages, Tenders) | Cash Cow/Question Mark | Brand Recognition, Diversification | Market Share Defense, Targeted Innovation |

What is included in the product

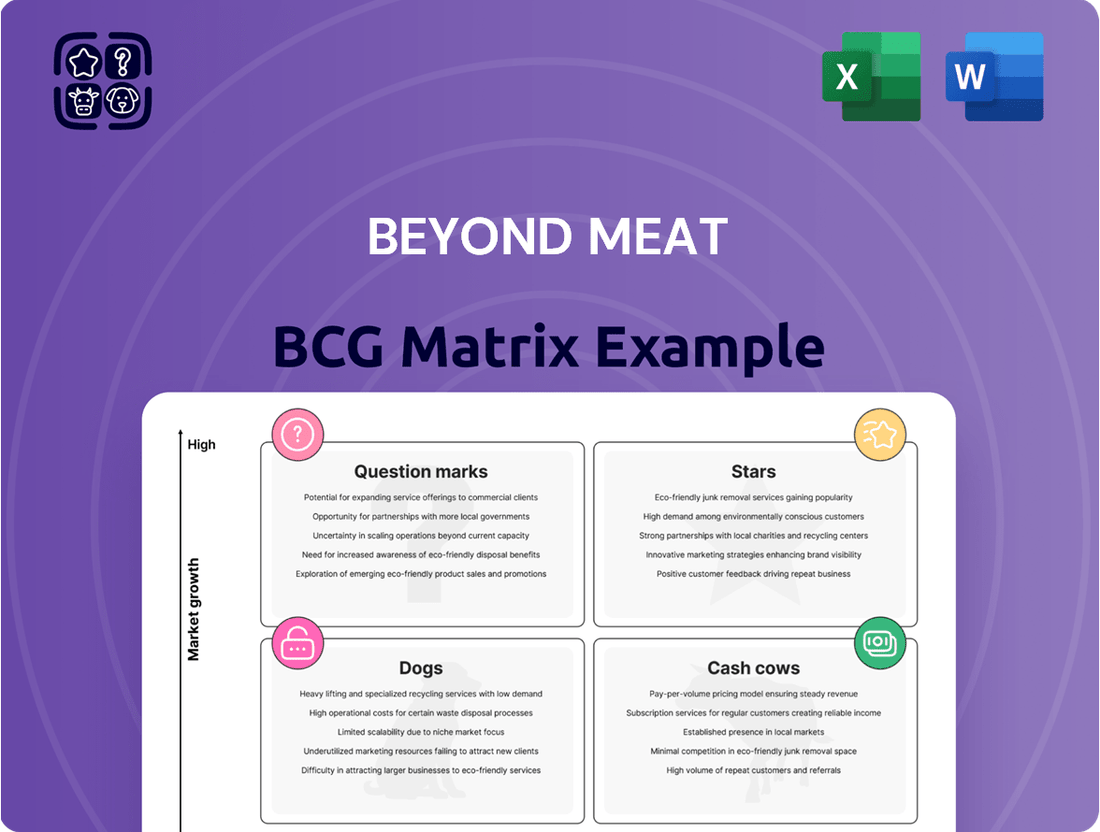

Beyond Meat's BCG Matrix analyzes its product portfolio, categorizing plant-based meats as Stars, Cash Cows, Question Marks, or Dogs to guide strategic investment decisions.

This Beyond Meat BCG Matrix offers a clear, one-page overview, alleviating the pain of complex portfolio analysis for busy executives.

Cash Cows

The original Beyond Burger, despite increased competition, benefits from its early mover advantage, securing a substantial presence in major retail chains. This established footprint in supermarkets and hypermarkets translates to ongoing sales, even as market dynamics shift. For instance, in early 2024, Beyond Meat reported that its plant-based burgers were available in over 30,000 retail locations across the U.S., underscoring its wide reach.

Beyond Sausage, much like the flagship Beyond Burger, has secured a substantial retail footprint, making it a familiar sight in grocery stores. This widespread availability in frozen sections and supermarkets globally signals a steady consumer interest in plant-based sausage alternatives.

The core plant-based burger patties segment is a significant contributor to Beyond Meat's portfolio, holding a substantial portion of the overall plant-based meat market. As of recent market analyses, this segment commands over 45% of the plant-based meat market share, indicating a strong consumer preference for these products.

Despite facing increased competition and evolving market dynamics, Beyond Meat's foundational burger offerings continue to generate a stable revenue stream. This is largely due to their established brand recognition and the enduring demand for plant-based alternatives in the burger category.

Existing Retail Distribution Network

Beyond Meat's existing retail distribution network acts as a significant cash cow. Their established relationships with major supermarkets and grocery chains worldwide ensure broad product availability, leading to consistent sales volume and reliable cash flow generation.

This extensive network, a result of years of building partnerships, is crucial for maintaining market presence and capturing consumer demand for plant-based alternatives. For instance, by 2023, Beyond Meat products were available in over 28,000 retail locations globally, a testament to the strength of this distribution asset.

- Global Retail Presence: Beyond Meat products are stocked in thousands of retail outlets across North America, Europe, and Asia.

- Consistent Sales Driver: The widespread availability ensures a steady stream of revenue, supporting ongoing operations and investments.

- Brand Accessibility: This broad distribution makes Beyond Meat's products easily accessible to a large consumer base, reinforcing its market position.

Frozen Plant-Based Meat Segment

The frozen plant-based meat segment represented a significant 39% of the market by storage type in 2024, making it the largest contributor. This strong showing indicates robust consumer demand for convenience and extended shelf life, advantages that Beyond Meat's frozen offerings are well-positioned to leverage. The stability within this segment suggests a reliable revenue stream for the company.

- Largest Market Share: The frozen segment held 39% of the market in 2024.

- Consumer Preference: Frozen products appeal due to convenience and longer shelf life.

- Stability for Beyond Meat: Beyond Meat's frozen products likely benefit from consistent sales within this dominant segment.

Beyond Meat's established retail distribution network, particularly for its core burger and sausage products, acts as a significant cash cow. This extensive reach, secured through years of building partnerships, ensures consistent sales volume and reliable cash flow. By early 2024, Beyond Meat products were available in over 30,000 retail locations in the U.S. alone, demonstrating their broad accessibility.

The frozen plant-based meat segment, which Beyond Meat's products are a part of, represented 39% of the market by storage type in 2024, making it the largest segment. This stability within a dominant market category underscores the consistent revenue generation potential for Beyond Meat's frozen offerings.

This widespread availability and strong presence in the frozen segment contribute to a stable revenue stream, supporting ongoing operations and strategic investments. The brand's accessibility across numerous retail outlets reinforces its market position and consumer demand.

| Product Category | Market Share (2024 Estimate) | Key Cash Cow Attribute | Supporting Data |

| Beyond Burger (Core Patties) | 45% of Plant-Based Meat Market | Established Brand Recognition & Retail Footprint | Available in 30,000+ U.S. retail locations (early 2024) |

| Beyond Sausage | Significant Retail Presence | Widespread Availability & Consumer Familiarity | Global retail availability in major chains |

| Frozen Plant-Based Meats | 39% of Market by Storage Type | Dominant Segment Appeal (Convenience, Shelf Life) | Largest market segment by storage type |

Full Transparency, Always

Beyond Meat BCG Matrix

The Beyond Meat BCG Matrix preview you're seeing is the exact, fully formatted document you'll receive upon purchase, offering a clear strategic overview of their product portfolio without any watermarks or demo content. This comprehensive analysis is ready for immediate use in your business planning, providing actionable insights into Beyond Meat's market position and growth potential. You can confidently expect the same level of detail and professional design in the downloadable file, enabling you to effectively evaluate their products as Stars, Cash Cows, Question Marks, or Dogs. This is your direct link to a professionally crafted strategic tool, empowering you to make informed decisions about Beyond Meat's future.

Dogs

Beyond Meat's decision to suspend operations in China by the end of Q2 2025, coupled with a significant workforce reduction, strongly suggests its products are considered Dogs in the BCG Matrix for that market. This move implies a low market share and dim growth prospects, signaling a strategic divestment from the region.

Beyond Meat's certain ground beef products are experiencing declining sales volume, particularly in the U.S. retail market during the first quarter of 2025. This downturn indicates a struggle against weak consumer demand within the plant-based ground beef category and a loss of market share to competitors. For example, the company reported a significant drop in sales for these specific items, contributing to the overall volume decrease.

Older formulations of Beyond Meat products, predating the Beyond IV platform, could be categorized as dogs in the BCG matrix. The company's strategic focus and substantial investment have clearly shifted towards these newer, enhanced versions.

Consequently, these legacy products likely experience diminished consumer demand. It's probable that Beyond Meat is either phasing them out entirely or offering them at significant discounts to clear existing inventory.

Less Popular or Niche Product SKUs

Beyond Meat’s broad product range might contain certain Stock Keeping Units (SKUs) that haven't captured substantial market interest or share. These specialized items, characterized by low sales volume and constrained growth prospects, would align with the 'dog' quadrant of the BCG Matrix.

The company's strategic emphasis on operational efficiency indicates a potential divestment or reduction in focus on these underperforming product lines. For instance, while Beyond Meat reported a net revenue of $248.4 million for the first quarter of 2024, a decline from $270.5 million in the same period of 2023, the company is likely analyzing individual SKU performance to optimize its portfolio.

- Niche Product Performance: Specific plant-based meat SKUs with limited consumer adoption.

- Low Market Share: Products that have failed to establish a significant presence against competitors or consumer preferences.

- Limited Growth Potential: SKUs unlikely to see substantial sales increases in the near future.

- Portfolio Optimization: Beyond Meat's ongoing efforts to streamline its offerings by potentially phasing out or reducing support for these less popular items.

Products with High Production Costs and Low Profitability

Products with high production costs and low profitability are categorized as Dogs in the BCG Matrix. For Beyond Meat, this could include specific product lines where the cost of ingredients, manufacturing, and distribution consistently outweighs the revenue generated, leading to minimal or negative gross margins. Identifying these underperforming items is crucial for strategic portfolio management.

Beyond Meat's financial reports in 2023 and early 2024 have highlighted efforts to improve gross margins, which stood at approximately 14.7% in the third quarter of 2023. This figure, while showing improvement from earlier periods, still indicates that some products may be struggling to achieve substantial profitability, especially after accounting for all associated costs.

The company's strategy to reduce operating expenses and streamline production processes is a direct response to the challenges posed by products with high cost structures. The goal is to either make these products more profitable or to consider their removal from the market if a turnaround is not feasible.

- High Production Costs: Beyond Meat has faced challenges with the cost of plant-based ingredients and scaling production efficiently, impacting the profitability of certain items.

- Low Gross Margins: In Q3 2023, Beyond Meat reported a gross margin of 14.7%. Products falling significantly below this average, or even incurring losses, would be classified as Dogs.

- Strategic Review: The company's ongoing focus on cost reduction and portfolio optimization suggests a need to address any products that consistently drain resources without contributing positively to the bottom line.

- Potential Divestment: Products identified as Dogs might be candidates for discontinuation or significant reformulation to improve their economic viability.

Certain older Beyond Meat product formulations, especially those predating the improved Beyond IV platform, are likely classified as Dogs. These products face diminished consumer interest and are probably being phased out or heavily discounted to clear inventory. For instance, the company's strategic shift and investment clearly favor newer, enhanced versions, leaving legacy products with limited growth potential.

Specific Stock Keeping Units (SKUs) within Beyond Meat's broad portfolio may also fall into the Dog category if they have failed to gain significant market traction or share. These niche items, characterized by low sales volumes and minimal growth prospects, are prime candidates for portfolio optimization. The company's emphasis on operational efficiency and cost reduction suggests a potential divestment or reduced focus on these underperforming product lines.

Products with high production costs and low profitability are inherently Dogs. For Beyond Meat, this could involve product lines where ingredient, manufacturing, and distribution expenses consistently exceed revenue, resulting in minimal or negative gross margins. Identifying these items is critical for effective portfolio management, especially as the company strives to improve overall financial performance.

Beyond Meat's Q3 2023 gross margin was approximately 14.7%. Products performing significantly below this average, or even operating at a loss, would be classified as Dogs. The company's ongoing efforts to reduce operating expenses and streamline production are direct responses to the challenges posed by high-cost products, aiming to either boost profitability or consider market removal.

| Product Category | Market Share | Growth Potential | Profitability | BCG Classification |

| Legacy Formulations | Low | Low | Low/Negative | Dog |

| Underperforming SKUs | Low | Low | Low | Dog |

| High-Cost Products | Variable | Low | Low/Negative | Dog |

Question Marks

Beyond Steak Filet, a recent innovation from Beyond Meat, utilizes mycelium, the root structure of mushrooms, to create a whole-cut plant-based steak. This product is positioned in the high-growth potential category of the BCG matrix, often referred to as a 'Star' or 'Question Mark' depending on its market share trajectory.

Its novelty and focus on replicating the texture and experience of traditional steak give it significant growth prospects, tapping into a growing consumer demand for plant-based alternatives that don't compromise on sensory attributes. Early restaurant launches in 2024 are a key indicator of this strategy.

However, as a relatively new entrant, Beyond Steak Filet likely holds a low market share. Its success hinges on consumer acceptance, scalability of production, and competitive pricing, making its future market position uncertain and thus placing it firmly in the 'Question Mark' quadrant of the BCG matrix for now.

The Beyond Smash Burger represents Beyond Meat's strategic move into a different consumer preference segment within the plant-based burger market. This thinner patty is designed to provide a distinct taste and cooking experience compared to its flagship Beyond Burger, aiming to capture a broader audience. Its recent introduction means its position in the BCG matrix is still fluid, likely falling into the question mark category as its market traction is yet to be fully established.

As a new entrant, the Beyond Smash's market share is still being cultivated, and its future growth trajectory is uncertain. Beyond Meat's success with this product will depend heavily on how effectively it resonates with consumers seeking a smash-burger style option and how well it differentiates itself from existing plant-based and traditional burger offerings. The company will need to invest in marketing and potentially adjust its strategy based on early adoption rates and competitive responses.

The Beyond Burger Jalapeño, a recent spicy addition to Beyond Meat's product line, targets consumers with a preference for heat. Its market penetration will be crucial in defining its position within the company's portfolio, potentially classifying it as a question mark if it fails to gain substantial traction.

As of early 2024, Beyond Meat has faced ongoing challenges in achieving profitability and expanding market share against established meat alternatives and traditional meat products. The success of specialized products like the Jalapeño variant will be a key indicator of Beyond Meat's ability to diversify and appeal to broader consumer tastes, directly impacting its BCG matrix classification.

Future 'Beyond' Branded Products (beyond meat alternatives)

Beyond Meat is strategically evolving, aiming to become a comprehensive plant-based protein powerhouse rather than solely a meat alternative provider. This signifies a move into broader categories, potentially including post-workout protein supplements or innovative products like lentil sausages. These represent nascent ventures with the potential for significant growth, though their market share is currently unproven.

This strategic pivot positions Beyond Meat to capture emerging opportunities within the expansive plant-based food sector. For instance, the global plant-based protein market was valued at approximately $40.2 billion in 2023 and is projected to reach $119.1 billion by 2030, growing at a CAGR of 16.7%. This expansion into diverse product lines like protein powders or novel plant-based meats taps into this robust market growth.

- Diversification into New Plant-Based Categories

- Focus on High-Growth Potential Ventures

- Strategic Shift from Meat Alternatives to Broader Protein Solutions

- Targeting Nascent Markets with Uncertain but Promising Share

Products in Emerging International Markets

Beyond Meat's presence in emerging international markets, beyond its established European footprint, presents significant 'question mark' opportunities. These regions, while currently having a limited Beyond Meat presence, are witnessing a rapid acceleration in the plant-based food trend, indicating high growth potential.

These markets demand substantial investment to build brand awareness, establish distribution networks, and adapt product offerings to local tastes. For instance, while specific 2024 data for Beyond Meat's penetration in all emerging markets isn't publicly detailed, the global plant-based market is projected to reach $162 billion by 2030, with emerging economies expected to be key drivers of this growth.

- High Growth Potential: Emerging markets are showing a strong upward trajectory in plant-based consumption, driven by increasing health consciousness and environmental awareness.

- Significant Investment Required: Establishing a foothold in these markets necessitates considerable capital for marketing, localization, and supply chain development.

- Untapped Market Share: Beyond Meat has a relatively low market share in many of these regions, offering a substantial opportunity to capture new customers.

- Strategic Focus: Identifying and prioritizing these markets is crucial for long-term global expansion and diversification.

Question Marks in Beyond Meat's portfolio represent new products or market entries with high growth potential but currently low market share. These ventures require significant investment to gain traction and establish a competitive position. Their future success is uncertain, making them prime candidates for the Question Mark quadrant of the BCG matrix.

Beyond Meat's expansion into emerging international markets, like parts of Asia and Latin America, exemplifies this. While these regions show strong growth in plant-based consumption, Beyond Meat's current market share is minimal, necessitating substantial investment in brand building and distribution. The global plant-based food market is projected to reach $162 billion by 2030, with emerging economies playing a crucial role.

| Product/Market | Category | Growth Potential | Market Share | Investment Need |

| Beyond Steak Filet | Question Mark | High | Low | High |

| Beyond Smash Burger | Question Mark | High | Low | High |

| Emerging International Markets | Question Mark | High | Low | High |

BCG Matrix Data Sources

Our BCG Matrix for Beyond Meat is informed by a blend of financial disclosures, market growth data, and industry expert analysis to accurately position its product portfolio.