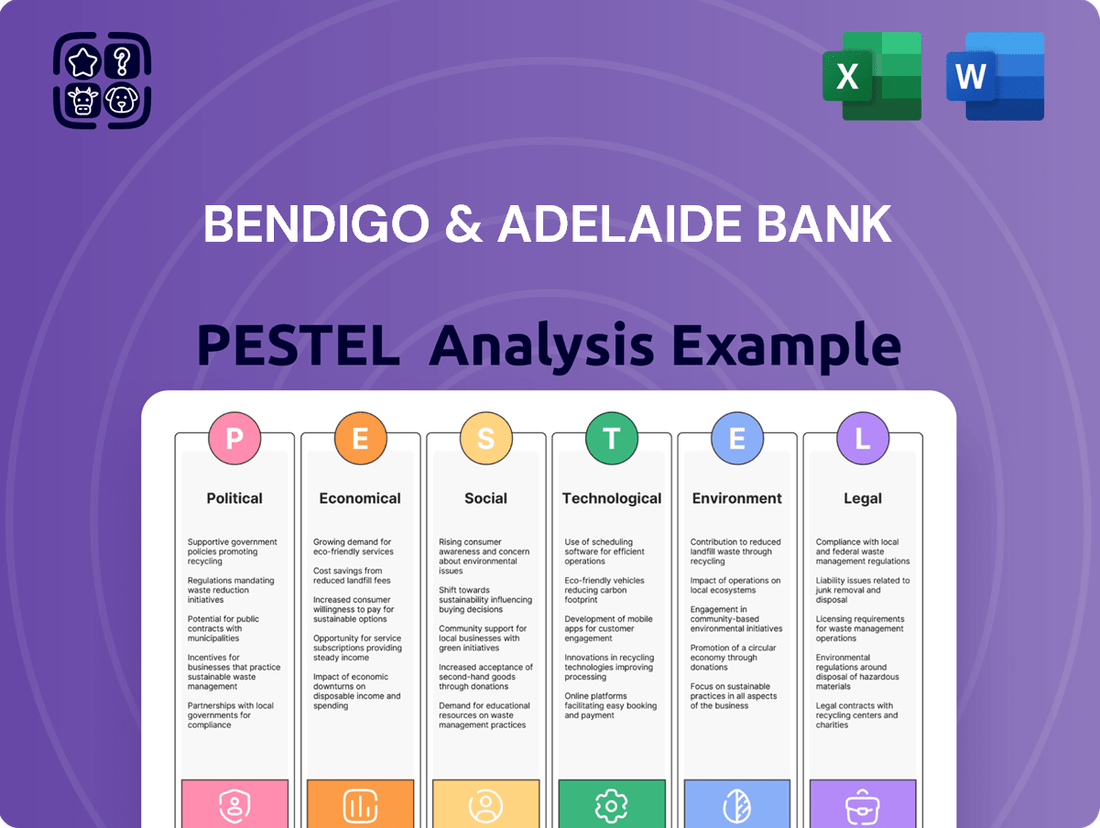

Bendigo & Adelaide Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bendigo & Adelaide Bank Bundle

Gain a strategic advantage with our comprehensive PESTLE analysis of Bendigo & Adelaide Bank. Understand the critical political, economic, social, technological, legal, and environmental factors that are shaping its future. This in-depth report provides actionable intelligence to inform your investment decisions and market strategies. Download the full version now to unlock invaluable insights.

Political factors

The Australian government's intensified focus on the banking sector in 2025 will likely compel institutions like Bendigo and Adelaide Bank to uphold essential services, even if they aren't highly profitable. This heightened oversight is designed to ensure banks actively tackle consumer concerns, including mortgage affordability, the availability of physical branches, and the clarity of fees.

Furthermore, regulators are anticipated to strongly encourage banks to fully implement interest rate reductions announced by the Reserve Bank of Australia (RBA). This push aims to prevent public discontent and preserve customer trust, especially as interest rates have seen significant shifts in recent periods, impacting household budgets across the nation.

The Financial Accountability Regime (FAR) is set to significantly shape Bendigo and Adelaide Bank's operational landscape. Following its rollout for banks, FAR will extend to insurers and superannuation trustees by March 2025, emphasizing enhanced accountability across the financial sector. This means Bendigo and Adelaide Bank must continue to refine its governance and risk management structures to meet these new, stricter requirements.

APRA's collaborative effort with ASIC to ensure FAR compliance underscores the regime's importance. For Bendigo and Adelaide Bank, this translates to a need for robust internal processes and clear lines of responsibility, ensuring all aspects of the bank's operations align with the new regulatory framework designed to bolster trust and stability in financial services.

The Australian Prudential Regulation Authority (APRA) is significantly enhancing capital and liquidity requirements for banks. New prudential standards, such as CPS 230 for operational risk management, take effect from July 1, 2025, necessitating that Bendigo and Adelaide Bank bolster its operational resilience and risk management frameworks to meet these elevated expectations.

APRA's 2024-25 Corporate Plan highlights a strategic focus on improving how banks manage climate and cyber risks. This means Bendigo and Adelaide Bank must proactively integrate robust strategies for these critical areas, ensuring compliance and mitigating potential future financial impacts.

Competition Policy and New Entrants

The Australian Prudential Regulation Authority (APRA) is proposing significant changes to the bank licensing framework, aiming for greater simplicity and efficiency. This move, expected to be finalized in 2024, could streamline the process for new entities to enter the Australian banking market, potentially intensifying competition for established players like Bendigo and Adelaide Bank.

These reforms are designed to foster a more dynamic financial landscape. By removing the Restricted ADI (RADI) pathway, APRA intends to create a more direct route for new banks, which may lead to a broader range of financial service providers and innovative offerings entering the market. This shift necessitates that Bendigo and Adelaide Bank remain agile, continuously refining its competitive strategies to maintain market share and customer loyalty in an evolving environment.

The anticipated increase in competition could manifest in several ways:

- New Entrant Strategies: Future new banks might leverage technology and niche market focus to disrupt traditional banking models.

- Pricing Pressures: Increased competition often leads to more competitive pricing on loans and deposits, impacting net interest margins.

- Product Innovation: New entrants may introduce novel products or services, compelling existing banks to innovate or risk obsolescence.

- Customer Acquisition Costs: Banks may need to invest more in marketing and customer service to attract and retain customers in a more crowded market.

Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) Legislation

New legislation passed in December 2024 significantly strengthens Australia's Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) framework. This overhaul aims to simplify and modernise existing regulations, directly impacting Bendigo and Adelaide Bank's compliance responsibilities. The bank must continue to invest in robust systems and processes to effectively combat financial crime under these updated rules.

AUSTRAC's recent updates have also drawn attention to high-risk jurisdictions, further influencing the bank's due diligence and reporting requirements. This focus necessitates enhanced vigilance in identifying and mitigating potential illicit financial flows. Bendigo and Adelaide Bank's proactive adaptation to these evolving regulatory landscapes is crucial for maintaining operational integrity and customer trust.

- Strengthened AML/CTF Laws: Legislation passed December 2024 to modernise Australia's regime.

- Increased Compliance Burden: Requires ongoing investment in systems and processes for Bendigo and Adelaide Bank.

- AUSTRAC Guidance: Updates highlight high-risk jurisdictions, impacting due diligence.

- Financial Crime Mitigation: Essential for maintaining operational integrity and customer trust.

The Australian government's intensified focus on the banking sector in 2025, particularly through the Financial Accountability Regime (FAR) extending to insurers and superannuation trustees by March 2025, will compel Bendigo and Adelaide Bank to enhance governance and risk management. Stricter capital and liquidity requirements, with new prudential standards like CPS 230 effective July 1, 2025, necessitate bolstered operational resilience. Furthermore, updated Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) laws passed in December 2024 increase compliance burdens, requiring ongoing investment in systems to combat financial crime and adhere to AUSTRAC's guidance on high-risk jurisdictions.

| Regulatory Focus Area | Key Development/Requirement | Impact on Bendigo & Adelaide Bank |

| Financial Accountability Regime (FAR) | Extended to insurers/super by March 2025 | Enhanced governance & risk management |

| Prudential Standards (e.g., CPS 230) | Effective July 1, 2025 | Strengthened operational resilience & risk management |

| AML/CTF Framework | New legislation passed December 2024 | Increased compliance investment, enhanced due diligence |

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing Bendigo & Adelaide Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into how these forces present opportunities and threats, aiding strategic decision-making for the bank.

Offers a clear, actionable framework to identify and mitigate external threats and opportunities, transforming complex market dynamics into manageable strategic insights for Bendigo & Adelaide Bank.

Economic factors

The Reserve Bank of Australia (RBA) anticipates inflation to return to its 2-3% target range by 2025, a significant shift from recent elevated levels. In May 2025, the RBA implemented a 25 basis point cut to the official cash rate, bringing it down to 3.85%, indicating a measured approach to monetary policy easing.

This monetary policy stance directly influences Bendigo and Adelaide Bank's financial performance. The bank's net interest margin, a key profitability indicator, has faced pressure due to rising funding costs and intense competition within the Australian lending sector.

Household consumption growth is anticipated to strengthen as inflation eases, boosting real incomes. This trend is a positive indicator for financial institutions like Bendigo and Adelaide Bank, suggesting increased demand for financial products and services.

Bendigo and Adelaide Bank has demonstrated robust performance in residential lending, outperforming the broader market. The bank also saw a notable increase in customer deposits, especially in savings and offset accounts, reflecting growing customer confidence and a preference for secure savings options. For instance, the bank reported a 9.1% increase in its home loan portfolio in the first half of 2024.

Despite this strong lending and deposit growth, the bank's profit margins have been compressed due to rising operational expenses. This highlights a key challenge in managing costs effectively while capitalizing on market opportunities, a common concern for banks navigating a dynamic economic landscape.

The Australian banking landscape remains intensely competitive, especially within lending. This fierce competition, involving both established banks and emerging digital players, puts pressure on profit margins for institutions like Bendigo and Adelaide Bank. For instance, in early 2024, the average variable mortgage rate offered by major banks hovered around 6.5%, while some neobanks were advertising rates closer to 5.8%, highlighting the pricing pressures.

Economic Growth and Stability

Economic growth in Australia is anticipated to be modest in the near future, influenced by a less robust global economic environment and a slowdown in consumer spending. However, the nation's financial sector demonstrates considerable resilience, supported by robust capitalisation within its banking institutions.

Despite the subdued growth outlook, the Australian banking system's strong capital buffers provide a stable foundation. Projections indicate a slight uptick in corporate insolvencies for the 2024-25 period when compared to the preceding year, a factor that financial institutions will need to monitor closely.

- Subdued Near-Term Growth: Australian economic growth is expected to remain slow due to lower global demand and reduced household expenditure.

- Resilient Financial System: The Australian financial sector continues to show strength, particularly in the banking industry's capital adequacy.

- Projected Insolvency Increase: A modest rise in insolvencies is forecast for 2024-25, presenting a potential challenge for lenders.

Cost of Living Pressures

Australian households are indeed grappling with significant cost-of-living pressures, directly affecting their capacity to manage mortgage repayments and other financial obligations. This economic reality places banks like Bendigo and Adelaide Bank under heightened political scrutiny to demonstrate tangible support for consumers navigating these challenges.

The ongoing inflation, which saw the Consumer Price Index (CPI) rise by 3.6% in the March quarter of 2024 according to the Australian Bureau of Statistics, directly translates to higher expenses for everyday goods and services. This squeeze on household budgets can lead to increased loan defaults and a greater demand for financial hardship assistance from banking institutions.

- Inflationary Impact: Continued high inflation erodes purchasing power, making it harder for individuals to allocate funds towards loan servicing.

- Political Scrutiny: Government bodies and politicians are closely monitoring how banks assist customers facing financial strain, potentially leading to regulatory adjustments.

- Lending Practice Influence: Banks may need to adapt their lending criteria and risk assessments to account for persistent cost-of-living pressures.

- Customer Support Focus: Initiatives aimed at financial literacy, hardship programs, and flexible repayment options are becoming increasingly crucial for customer retention and brand reputation.

The Reserve Bank of Australia's (RBA) monetary policy adjustments, including the May 2025 cash rate cut to 3.85%, aim to bring inflation back to the 2-3% target by 2025. This easing cycle is expected to bolster household consumption as inflation subsides, positively impacting demand for banking services. However, Bendigo and Adelaide Bank faces margin compression due to rising funding costs and intense competition, with average variable mortgage rates in early 2024 around 6.5% versus neobanks at 5.8%.

| Economic Factor | Data Point / Trend | Impact on Bendigo & Adelaide Bank |

|---|---|---|

| Inflation Target | RBA aims for 2-3% by 2025 | Supports improved household spending power |

| Cash Rate | Cut to 3.85% in May 2025 | Potentially lowers funding costs, but also reduces lending yields |

| Household Consumption | Anticipated strengthening | Increases demand for loans and financial products |

| Competition (Lending) | Major banks ~6.5% variable mortgage rate; Neobanks ~5.8% (early 2024) | Pressures net interest margins |

| Economic Growth | Modest near-term outlook | Limits overall market expansion opportunities |

Preview the Actual Deliverable

Bendigo & Adelaide Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Bendigo & Adelaide Bank PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank. It provides a structured overview of the opportunities and threats facing the institution, enabling informed strategic decision-making.

Sociological factors

Australian consumers are rapidly adopting digital banking, with over 99% of transactions now occurring online. This trend is further amplified by a significant surge in mobile wallet transactions, indicating a strong preference for on-the-go financial management.

Bendigo and Adelaide Bank must therefore continue to prioritize investment in its digital platforms and mobile-first strategies. Meeting these evolving customer expectations for speed and seamless convenience is crucial for retaining and attracting clients in the current financial landscape.

Bendigo and Adelaide Bank's commitment to community engagement is a cornerstone of its sociological standing. The bank's innovative Community Bank model has a proven track record of reinvesting profits back into local areas, fostering economic growth and social cohesion. For instance, in the 2023 financial year, Bendigo and Adelaide Bank reported a statutory profit after tax of $972 million, with a significant portion of its success directly attributable to the strong relationships built through its community-focused initiatives.

This deep-rooted community connection translates into tangible trust. Maintaining its position as Australia's most trusted bank, as recognized by various industry surveys, underscores the positive societal impact of its operations. Furthermore, high customer satisfaction rates, particularly in the competitive home loan market, reflect how its community-centric approach resonates with the public, building loyalty and a strong social license to operate.

Bendigo and Adelaide Bank is actively tackling regional job and skill shortages by offering scholarships to tertiary students, aiming to build a future workforce. This initiative directly addresses demographic shifts by investing in the education of individuals who may remain or return to regional communities.

The bank's Accessibility and Inclusion Plan is a key step towards financial inclusion, ensuring a broader segment of the population can access its services. This plan is particularly relevant as Australia's population ages and diversity increases, requiring financial institutions to adapt their offerings to meet varied needs.

Financial Literacy and Scams Awareness

Bendigo and Adelaide Bank is proactively addressing financial literacy and scam awareness, recognizing their impact on customer security and trust. The bank is investing in initiatives to equip customers with the knowledge to navigate financial products and protect themselves from fraudulent activities. This is particularly crucial as digital financial services become more prevalent.

Through its Community Bank network, Bendigo and Adelaide Bank conducts digital literacy programs designed to enhance customers' understanding of online banking and emerging financial technologies. Furthermore, the bank actively hosts 'Banking Safely Online' sessions. These sessions provide practical advice and strategies for customers to safeguard their accounts and personal information from online threats. For instance, in 2024, the Australian Competition and Consumer Commission (ACCC) reported that Australians lost over $450 million to scams, highlighting the urgent need for such educational efforts.

- Financial Literacy Programs: Bendigo and Adelaide Bank offers digital literacy training via its Community Bank network.

- Scam Prevention: 'Banking Safely Online' sessions are held to educate customers on online security.

- Impact of Scams: In 2024, scam losses in Australia exceeded $450 million, underscoring the societal need for financial education.

- Customer Empowerment: These initiatives aim to empower customers to make informed financial decisions and avoid fraudulent schemes.

Customer Loyalty and Competition for Main Financial Institution (MFI) Share

Customer loyalty is shifting, with younger demographics showing a greater willingness to engage with newer digital banks and entities like Macquarie, challenging the long-standing dominance of the 'big four' Australian banks. This trend directly impacts Bendigo and Adelaide Bank, an established challenger, as it navigates a competitive landscape where maintaining and expanding its share of the Main Financial Institution (MFI) market requires a dedicated focus on customer experience and innovative offerings.

Bendigo and Adelaide Bank's strategy must acknowledge this evolving customer behaviour. For instance, in the 2023 calendar year, while the major banks still held a significant portion of the market, digital-only banks reported substantial growth in customer numbers. Data from the Reserve Bank of Australia (RBA) indicates a steady increase in the adoption of digital banking services across all age groups, but particularly pronounced among millennials and Gen Z.

- Customer Acquisition: Younger customers are more receptive to digital-first banking solutions, impacting traditional MFI share.

- Competitive Pressure: Challenger banks and neobanks are actively competing for market share by offering tailored digital products and competitive rates.

- Loyalty Drivers: For established players like Bendigo and Adelaide Bank, maintaining loyalty hinges on superior customer service, personalized offerings, and seamless digital integration.

- Demographic Shift: The increasing financial independence of younger generations means their banking preferences will significantly shape future MFI market dynamics.

Bendigo and Adelaide Bank's deep community ties are a significant sociological asset, fostering trust and loyalty. The bank's Community Bank model, which reinvests profits locally, strengthens social cohesion and economic development. This approach is reflected in its 2023 statutory profit after tax of $972 million, with community engagement being a key driver of its success.

The bank is also actively addressing evolving customer preferences, particularly among younger demographics who are increasingly adopting digital banking solutions. In response, Bendigo and Adelaide Bank is enhancing its digital platforms and mobile-first strategies to meet demands for speed and convenience.

Furthermore, the bank is committed to financial inclusion and literacy. Initiatives like scholarships for regional students and digital literacy programs via its Community Bank network aim to empower customers and build a future workforce, especially as scams continue to pose a significant threat, with Australian losses exceeding $450 million in 2024.

| Sociological Factor | Description | Impact on Bendigo & Adelaide Bank | Supporting Data/Trend |

|---|---|---|---|

| Community Engagement | Bank's commitment to local communities through its Community Bank model. | Builds trust, loyalty, and social license to operate. | 2023 Statutory Profit After Tax: $972 million; profits reinvested locally. |

| Digital Adoption | Increasing customer preference for online and mobile banking. | Requires continuous investment in digital platforms and mobile-first strategies. | Over 99% of Australian banking transactions are now digital; surge in mobile wallet usage. |

| Financial Literacy & Security | Customer need for education on financial products and scam prevention. | Drives investment in educational programs and security measures. | Australian scam losses exceeded $450 million in 2024. |

| Demographic Shifts & Loyalty | Younger generations favouring digital banks, challenging traditional MFI share. | Necessitates focus on customer experience and innovative digital offerings to retain market share. | Growth reported by digital-only banks in 2023; RBA data shows steady increase in digital banking adoption across age groups. |

Technological factors

Technological factors significantly shape the Australian banking landscape, with digital transformation and core banking modernisation at the forefront. Bendigo and Adelaide Bank is actively participating in this shift, investing in its transformation agenda to enhance efficiency and customer experience.

Key initiatives include the ongoing rollout of platforms like the Bendigo Lending Platform and Up Home. These investments are crucial for the bank to achieve greater scale and maintain competitiveness in an increasingly digital-first banking environment.

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing the financial sector, driving advancements in customer service, risk assessment, and fraud detection. Bendigo and Adelaide Bank is actively integrating these technologies to boost operational efficiency and enhance customer interactions.

By leveraging AI and ML, the bank aims to personalize customer experiences, offering tailored financial advice and product recommendations. For instance, AI-powered chatbots can handle a significant volume of customer queries, freeing up human agents for more complex issues. In 2023, the global AI in finance market was valued at approximately $11.7 billion and is projected to grow substantially, indicating a strong industry trend towards AI adoption.

The increasing digitisation of financial services places cybersecurity at the forefront of priorities for institutions like Bendigo and Adelaide Bank. In 2024, the Australian Prudential Regulation Authority (APRA) reinforced its operational risk expectations, with a keen focus on banks adhering to the standards set by CPS 234 Information Security. This means continuous investment in advanced security measures is essential to safeguard sensitive customer data and maintain uninterrupted business operations.

Fintech Innovation and Collaboration

The Australian fintech landscape is experiencing significant growth, fueled by a growing consumer demand for digital banking solutions and the increasing integration of artificial intelligence and automation. This technological shift is reshaping customer expectations and operational efficiencies within the financial services industry.

Bendigo and Adelaide Bank actively participates in this evolving environment through its wholly-owned digital bank, Up. As of early 2024, Up has surpassed one million customers, highlighting the bank's successful engagement with fintech innovation and its ability to attract a substantial user base to a digital-first offering.

Traditional financial institutions like Bendigo and Adelaide Bank are increasingly recognizing the value of fintech agility. This is often achieved through strategic collaborations, investments, and acquisitions of fintech companies, allowing them to integrate cutting-edge technologies and services more rapidly than through internal development alone.

- Fintech Growth: The Australian fintech market is projected for continued expansion, driven by digital adoption.

- Up's Success: Bendigo and Adelaide Bank's digital bank, Up, reached over 1 million customers by early 2024.

- Partnership Strategy: Traditional banks are leveraging fintechs via acquisitions and partnerships to enhance digital capabilities.

Open Banking and Data Analytics

Open Banking, driven by Australia's Consumer Data Right (CDR) legislation, is significantly reshaping the financial landscape. This regulatory push encourages greater data sharing, fostering innovation and intensifying competition. For Bendigo & Adelaide Bank, this means new opportunities to develop highly personalized financial products and services by leveraging customer data with consent.

Data analytics is a critical enabler in this new environment. Fintechs are increasingly relying on real-time analytics for sophisticated credit risk assessments, more effective fraud detection, and the creation of deeply tailored customer experiences. This trend is expected to accelerate, with the global data analytics market projected to reach over $100 billion by 2025, highlighting its growing importance for financial institutions.

- Open Banking (CDR) drives innovation and competition in financial services.

- Data analytics enables personalized products, improved risk assessment, and fraud detection.

- Fintechs are leveraging real-time analytics for competitive advantage.

- The global data analytics market is a significant and growing sector.

Technological advancements continue to redefine banking. Bendigo and Adelaide Bank is investing heavily in digital transformation, focusing on modernizing core banking systems to improve efficiency and customer experience. Key initiatives include platforms like the Bendigo Lending Platform and Up Home, crucial for maintaining competitiveness.

AI and ML are transforming customer service, risk assessment, and fraud detection. The bank is integrating these technologies to personalize services and boost operational efficiency. For example, AI chatbots handle routine queries, enhancing customer interaction. The global AI in finance market, valued at approximately $11.7 billion in 2023, underscores this trend.

Cybersecurity is paramount, especially with increasing digitization. APRA's reinforced expectations in 2024, particularly CPS 234 Information Security, necessitate continuous investment in advanced security measures to protect customer data.

The Australian fintech sector is booming, driven by digital demand and AI integration. Bendigo and Adelaide Bank's digital bank, Up, has attracted over one million customers by early 2024, demonstrating success in fintech innovation. Traditional banks are increasingly partnering with or acquiring fintechs to accelerate their digital capabilities.

| Technology Area | Impact on Banking | Bendigo & Adelaide Bank's Focus | Key Data/Trends |

|---|---|---|---|

| Digital Transformation | Enhanced efficiency, improved customer experience | Core banking modernization, new platforms (e.g., Up Home) | Digital-first environment is standard |

| AI & Machine Learning | Personalized services, better risk/fraud detection | Integrating AI for customer interactions and operations | Global AI in finance market ~$11.7B (2023) |

| Cybersecurity | Protecting sensitive data, maintaining operations | Adherence to APRA's CPS 234 standards | Increased regulatory focus on information security |

| Fintech Integration | Innovation, agility, expanded customer reach | Digital bank Up exceeding 1M customers (early 2024) | Fintechs driving digital banking demand |

Legal factors

Australia's banking regulator, APRA, is strengthening capital and liquidity standards, with significant changes to bank capital regulations set to be implemented starting in 2027. These reforms aim to simplify and enhance the effectiveness of bank capital during times of crisis. For Bendigo and Adelaide Bank, its Common Equity Tier 1 (CET1) ratio remains robust, comfortably exceeding regulatory minimums, demonstrating a solid capital position.

Further underscoring regulatory evolution, APRA has finalized amendments to the prudential framework for Authorised Deposit-taking Institutions (ADIs). These crucial changes will take effect from January 1, 2025, ensuring the banking sector remains resilient and well-capitalized in an evolving economic landscape.

New legislation, such as the Treasury Laws Amendment (Responsible Buy Now Pay Later and Other Measures) Act 2024, is set to bring Buy Now Pay Later (BNPL) services under the purview of the National Consumer Credit Protection Act 2009. This signifies a heightened emphasis on safeguarding consumers, directly influencing how financial institutions like Bendigo and Adelaide Bank structure and administer their product offerings.

This regulatory shift is expected to impose stricter obligations on lenders, potentially increasing compliance costs and requiring more robust risk management frameworks for credit products. The Australian Securities and Investments Commission (ASIC) reported a 15% increase in consumer complaints related to credit and finance products in the first half of 2024, underscoring the importance of these consumer protection measures.

Regulatory bodies are increasingly focusing on robust cyber risk management, a critical concern given the financial sector's deep digital integration. This means Bendigo and Adelaide Bank, along with its peers, faces stringent data privacy and security mandates to safeguard customer data.

For instance, the Australian Prudential Regulation Authority (APRA) has been enhancing its cyber resilience guidance, with updated prudential standards expected to further solidify these expectations for banks operating in Australia. Adherence to these evolving requirements is paramount for maintaining customer trust and regulatory compliance.

Financial Dispute Resolution and Complaints Handling

Australian Securities and Investments Commission (ASIC) is intensifying its focus on financial dispute resolution, particularly concerning cost of living pressures, handling of death benefit claims, and overall firm accountability. This regulatory attention signals a strong push for greater transparency in how financial firms manage breaches and complaints.

ASIC is actively consulting on proposals to significantly increase the public visibility of firms' breach and complaints data. This move underscores a regulatory imperative to ensure fair and transparent processes for consumers navigating financial disputes, aiming to build greater trust and accountability within the sector.

- ASIC's focus areas: Cost of living pressures, death benefit claims, and accountability.

- Regulatory trend: Increased demand for transparency in breach and complaints data.

- Consumer protection: Emphasis on fair and accessible dispute resolution mechanisms.

- Industry impact: Financial institutions like Bendigo & Adelaide Bank must demonstrate robust complaint handling and clear communication.

Licensing and Regulatory Compliance

The Australian Prudential Regulation Authority (APRA) is actively working to streamline the banking licensing framework, aiming for clearer criteria and more efficient decision-making processes. This initiative, expected to be implemented in 2024-2025, will impact how banks operate and are regulated.

For Bendigo and Adelaide Bank, navigating these evolving regulatory landscapes is paramount. Maintaining robust compliance frameworks across all facets of its business, including its unique Community Bank model, is essential to ensure continued operational integrity and adherence to new standards.

- APRA's proposed changes aim to reduce licensing times and increase clarity for new and existing institutions.

- Bendigo and Adelaide Bank must adapt its compliance strategies to align with these updated regulatory expectations.

- The Community Bank model presents a unique compliance challenge that requires specific attention within the broader regulatory framework.

New legislation, such as the Treasury Laws Amendment (Responsible Buy Now Pay Later and Other Measures) Act 2024, brings BNPL services under the National Consumer Credit Protection Act 2009. This heightened consumer protection focus requires financial institutions to adapt their product offerings and risk management, potentially increasing compliance costs.

ASIC's intensified focus on financial dispute resolution, particularly concerning cost of living pressures and firm accountability, pushes for greater transparency in breach and complaints data. This regulatory trend necessitates robust complaint handling and clear communication from institutions like Bendigo and Adelaide Bank.

APRA's strengthening of capital and liquidity standards, with significant changes from 2027, aims to enhance bank resilience. Bendigo and Adelaide Bank's robust CET1 ratio, comfortably exceeding minimums, positions it well to meet these evolving requirements.

APRA's updated prudential standards for cyber resilience mandate stringent data privacy and security measures for all banks, including Bendigo and Adelaide Bank, to maintain customer trust and regulatory compliance.

Environmental factors

Bendigo and Adelaide Bank is actively addressing climate change, as evidenced by its new Climate & Nature Action Plan for 2024-2026. This plan underscores their commitment to environmental sustainability and outlines specific targets and initiatives for the coming years.

The bank has maintained its CDP score of B, a recognition of its efforts in climate disclosure and action. This score places them among companies that are managing environmental risks and opportunities effectively.

Furthermore, Bendigo and Adelaide Bank is directly supporting the agricultural sector by assisting farmers in measuring their greenhouse gas emissions and has published a Climate Report tailored for farming businesses. This initiative aims to empower farmers with the data needed to understand and reduce their environmental footprint.

Environmental, Social, and Governance (ESG) factors are increasingly influencing investment choices. Bendigo and Adelaide Bank's 2024 sustainability report details its dedication to sustainable banking, including progress on reducing its financed emissions intensity, aiming for a 20% reduction by 2030 against a 2020 baseline.

The bank is actively aligning its operations with global standards such as the Taskforce on Climate-related Financial Disclosures (TCFD) and the Global Reporting Initiative (GRI) Standards. In 2024, they reported a 15% reduction in Scope 1 and 2 emissions compared to their 2020 baseline, demonstrating tangible progress in their environmental stewardship.

Bendigo and Adelaide Bank is committed to a net-zero emissions goal by 2050, encompassing all emission scopes. This strategic focus on environmental responsibility is a key component of their long-term sustainability plan.

The bank has demonstrated tangible progress in lowering its Scope 1 and Scope 2 carbon emissions, reflecting a successful implementation of its environmental initiatives. These reductions are crucial steps towards achieving their broader net-zero ambition.

With current performance indicating they are on track to meet their near-term targets for 2030 and FY2025, Bendigo and Adelaide Bank is showing a strong commitment to its carbon reduction objectives. This forward momentum is vital for building stakeholder confidence and contributing to global climate action.

Physical Climate Risk Assessment

Bendigo and Adelaide Bank is actively addressing physical climate risks, a critical environmental factor. For the first time in its 2024 Annual Report, the bank disclosed its financed emissions and detailed its physical risk scenario analysis. This move signals a commitment to understanding and managing the financial implications of climate change.

The Australian Prudential Regulation Authority (APRA) is also increasing its focus on climate risk management within the financial sector. APRA's recent survey results highlight the growing emphasis on how financial institutions, including banks like Bendigo and Adelaide, are preparing for and responding to these environmental challenges.

- Physical Risk Scenario Analysis: Bendigo and Adelaide Bank has undertaken this crucial step to assess potential impacts.

- Financed Emissions Disclosure: The bank's 2024 report marks its first public disclosure of financed emissions.

- APRA's Climate Risk Focus: APRA's survey indicates a heightened regulatory expectation for climate risk management across financial institutions.

Community Resilience and Environmental Initiatives

Bendigo and Adelaide Bank's Community Bank model actively fosters local development, which in turn can bolster community-led environmental initiatives. This approach allows for a more localized and responsive impact on sustainability efforts within the communities they serve.

The bank's overarching commitment to making a significant impact extends to integrating environmental considerations into its operational framework and its collaborative partnerships. This demonstrates a strategic focus on sustainability beyond just financial performance.

- Community Investment: In FY23, Bendigo and Adelaide Bank invested $20.8 million into communities through its Community Bank network, supporting local projects that often include environmental components.

- Sustainability Reporting: The bank's 2023 Sustainability Report highlighted progress in reducing its operational carbon footprint by 16% since 2020, a key environmental initiative.

- Partnerships for Impact: The bank actively seeks partnerships that align with its purpose of creating a more prosperous Australia, which increasingly involves collaborations on environmental and social governance (ESG) projects.

Bendigo and Adelaide Bank is actively managing environmental risks, as shown by its 2024 Annual Report detailing financed emissions and physical risk scenario analysis for the first time. Regulatory bodies like APRA are also increasing their focus on climate risk management within the financial sector, indicating a growing expectation for banks to address these environmental challenges.

The bank's commitment to sustainability is further demonstrated by its 2024-2026 Climate & Nature Action Plan and its maintained CDP score of B, reflecting effective management of environmental risks and opportunities. They are also supporting the agricultural sector by helping farmers measure greenhouse gas emissions, underscoring a practical approach to environmental stewardship.

Bendigo and Adelaide Bank is making tangible progress towards its net-zero emissions goal by 2050, with a 15% reduction in Scope 1 and 2 emissions reported by 2024 against a 2020 baseline, and is on track to meet its 2030 targets for financed emissions intensity reduction.

Their Community Bank model also supports local environmental initiatives, with $20.8 million invested in communities in FY23, often including environmental components. The bank's 2023 Sustainability Report noted a 16% reduction in operational carbon footprint since 2020.

| Environmental Initiative | FY23/24 Data | Target/Baseline |

|---|---|---|

| Scope 1 & 2 Emissions Reduction | 15% reduction (by 2024) | 20% reduction by 2030 (vs 2020 baseline) |

| Financed Emissions Intensity | First disclosure in 2024 Annual Report | Aiming for 20% reduction by 2030 (vs 2020 baseline) |

| Community Investment (incl. environmental) | $20.8 million | Ongoing support through Community Bank network |

| Operational Carbon Footprint Reduction | 16% reduction (by 2023) | Ongoing reduction efforts |

| CDP Score | B | Maintaining recognition for climate disclosure |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bendigo & Adelaide Bank is informed by a comprehensive review of official government publications, financial regulatory bodies, and reputable economic forecasting agencies. This ensures a robust understanding of the political, economic, and legal landscape impacting the Australian banking sector.