Bendigo & Adelaide Bank Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bendigo & Adelaide Bank Bundle

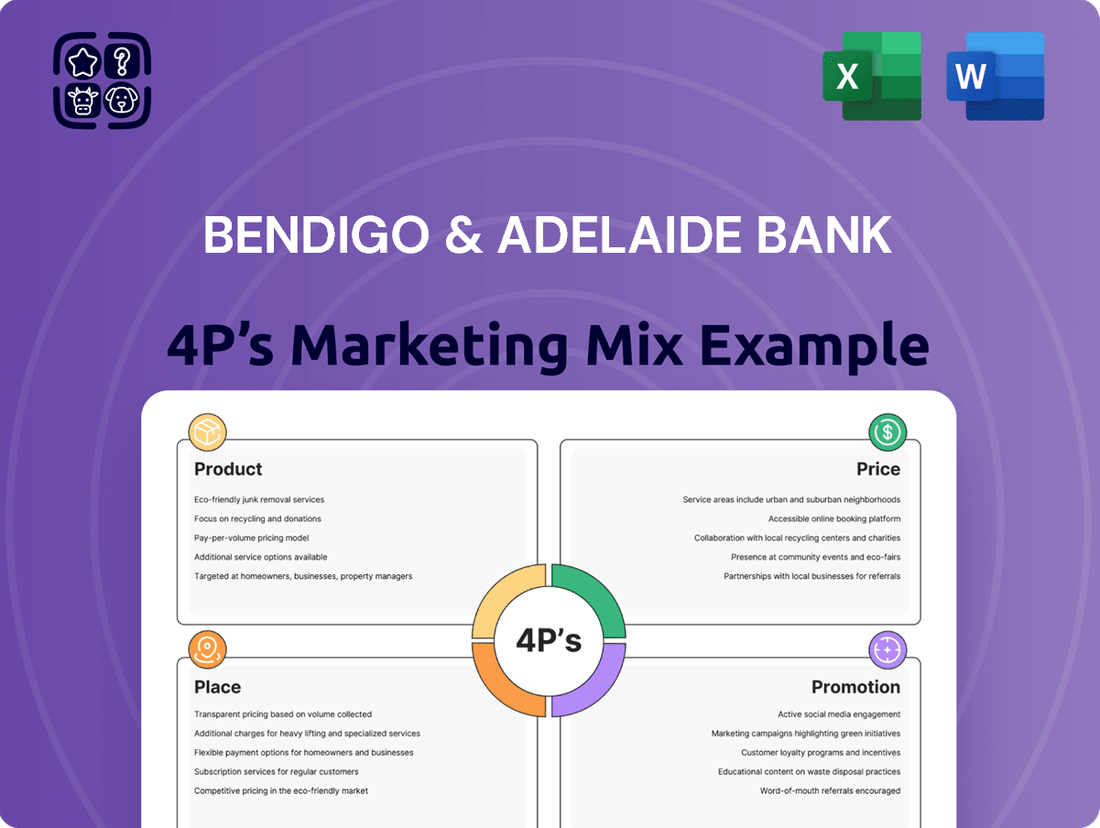

Discover how Bendigo & Adelaide Bank leverages its Product, Price, Place, and Promotion strategies to connect with customers and foster loyalty. This analysis reveals the intricate details behind their market approach.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Bendigo and Adelaide Bank offers a comprehensive suite of business banking solutions, including transaction accounts, savings accounts, and various lending options like business loans and overdrafts. In 2024, they continued to focus on providing tailored financial products to support Australian businesses, from sole traders to larger enterprises.

Their product strategy emphasizes a holistic approach, aiming to be a 'better big bank' by integrating diverse financial services. This includes specialized offerings such as merchant services and international trade finance, designed to meet the evolving needs of their business clientele.

As of the first half of 2024, Bendigo and Adelaide Bank reported a statutory profit after tax of $532 million, demonstrating their capacity to deliver robust financial services. This financial performance underpins their ability to offer competitive and reliable banking products to the business sector.

Specialized Agribusiness Lending from Bendigo & Adelaide Bank is a key part of their Product strategy, offering tailored financial solutions specifically for the agricultural sector. This focus highlights their commitment to rural and regional Australia, providing products designed to meet the unique needs of farming businesses.

This specialized product offering is supported by the bank's deep understanding of agribusiness, enabling them to provide expert advice and financial products that foster growth. For example, in the 2023 financial year, Bendigo & Adelaide Bank reported a net profit after tax of $1.01 billion, with their rural and regional banking segments playing a crucial role in their overall performance.

Bendigo and Adelaide Bank is heavily investing in digital lending, evidenced by its new Bendigo Lending Platform. This initiative focuses on automating and digitizing the home loan application process, aiming for faster approvals and a smoother customer journey across all its service channels.

The bank's commitment to innovation in lending is a key component of its product strategy, directly addressing customer demand for speed and convenience. This digital transformation is crucial for maintaining competitiveness in the evolving financial services landscape, with similar investments being seen across the Australian banking sector throughout 2024 and into 2025.

Wealth Management and Financial Services

Bendigo and Adelaide Bank extends its offerings beyond core banking to encompass wealth management and a diverse array of financial services, including credit cards. This strategic expansion caters to a wider range of customer needs, from everyday banking to more complex financial planning and investment strategies.

This comprehensive product suite is designed to solidify the bank's position as a preferred financial partner. By providing integrated solutions, they aim to foster deeper customer relationships and capture a greater share of wallet across various financial touchpoints.

As of June 30, 2023, Bendigo and Adelaide Bank reported significant growth in its wealth management segment, with total funds under management reaching $26.4 billion. This demonstrates a strong market acceptance of their expanded financial product offerings.

- Diversified Product Portfolio: Offers wealth management, credit cards, and other financial products alongside traditional banking.

- Broader Customer Reach: Serves a wider spectrum of financial needs for both individuals and businesses.

- Strategic Vision Alignment: Contributes to the bank's goal of becoming a bank of choice by providing comprehensive solutions.

- Growth in Wealth Management: Funds under management in wealth management reached $26.4 billion as of June 30, 2023.

Community-Centric Development

Bendigo and Adelaide Bank's Community Bank model is a standout feature of its product strategy. This model directly reinvests a portion of profits back into the local communities where these branches operate. For instance, in the 2023 financial year, Bendigo and Adelaide Bank reported a cash profit after tax of $973.5 million, with a significant portion of its community bank network's profits channeled back into local initiatives.

This profit-with-purpose philosophy shapes product development by ensuring offerings are tailored to genuine local needs. By fostering deep community connections, the bank can identify and create products that truly resonate, moving beyond generic financial services to provide tangible benefits that support local growth and well-being.

The impact is substantial, creating a virtuous cycle where community support fuels business success, and business success, in turn, further empowers the community. This approach differentiates Bendigo and Adelaide Bank by demonstrating a commitment that extends far beyond mere financial transactions.

- Community Investment: A portion of profits is returned to local communities, fostering local development and engagement.

- Tailored Products: Product development is informed by direct community feedback and needs, ensuring relevance.

- Brand Loyalty: The 'profit-with-purpose' model cultivates strong customer loyalty and a positive brand image.

- Social Impact: The bank actively contributes to social and economic well-being within its operating regions.

Bendigo and Adelaide Bank's product strategy is characterized by its diverse offerings, catering to both individual and business needs with a focus on tailored solutions. Their commitment to innovation, particularly in digital lending, aims to streamline customer experiences and enhance efficiency.

The bank's unique Community Bank model ensures that product development is closely aligned with local community needs, fostering deep engagement and loyalty. This approach, combined with a robust wealth management segment, positions them as a comprehensive financial partner.

In the first half of 2024, the bank reported a statutory profit after tax of $532 million, highlighting its financial strength to support these varied product initiatives and investments. Their agribusiness lending, a key specialized product, continues to be a significant contributor, reflecting their commitment to regional Australia.

| Product Area | Key Offerings | 2023/2024 Data Point | Strategic Focus |

|---|---|---|---|

| Business Banking | Transaction accounts, savings accounts, business loans, overdrafts, merchant services, international trade finance | Statutory profit after tax H1 2024: $532 million | Tailored solutions for all business sizes |

| Agribusiness Lending | Specialized financial solutions for the agricultural sector | Significant contributor to overall performance (2023) | Support for rural and regional Australia |

| Digital Lending | Bendigo Lending Platform for automated home loan applications | Ongoing investment in digitisation (2024-2025) | Faster approvals and improved customer journey |

| Wealth Management | Investment services, financial planning | Funds under management: $26.4 billion (June 30, 2023) | Expanding financial services beyond core banking |

What is included in the product

This analysis provides a comprehensive breakdown of Bendigo & Adelaide Bank's marketing strategies, examining their Product offerings, Pricing structures, Place (distribution) channels, and Promotion activities.

It offers a deep dive into how Bendigo & Adelaide Bank leverages the 4Ps to position itself within the competitive banking landscape, providing actionable insights for strategic decision-making.

Provides a clear, actionable framework to address customer pain points by optimizing Bendigo & Adelaide Bank's product, price, place, and promotion strategies.

Place

Bendigo and Adelaide Bank leverages its extensive branch network, a cornerstone of its Community Bank model, which stands as the fourth largest in Australia. This model ensures these community-led branches act as vital distribution channels, offering essential face-to-face banking services. As of the 2023 financial year, the bank reported 323 Community Bank branches, highlighting their significant presence and commitment to local engagement.

Bendigo and Adelaide Bank places a strong emphasis on its digital platforms, notably with its highly successful digital bank, Up. This focus is central to their 'digital by design, human when it matters' strategy, aiming for seamless customer experiences.

These digital channels are vital for attracting new customers and growing deposits. For instance, Up reported over 700,000 customers by June 2024, demonstrating significant customer acquisition through its digital-first approach.

The bank leverages these platforms to offer convenient access to a wide range of banking services, reinforcing their commitment to digital innovation and customer engagement in an increasingly online financial landscape.

Bendigo and Adelaide Bank actively utilizes third-party channels and broker networks to expand its market presence, especially for crucial lending products like home loans. This strategic approach allows the bank to connect with a broader spectrum of potential borrowers it might not otherwise reach.

By partnering with a diverse array of mortgage brokers and engaging with digital mortgage platforms, Bendigo and Adelaide Bank significantly amplifies its lending volumes. For instance, in the fiscal year 2023, the bank reported a substantial portion of its retail mortgage originations flowing through its broker channels, demonstrating the critical role these networks play in its distribution strategy.

Strategic System Consolidation

Bendigo and Adelaide Bank's strategic system consolidation is a key element of its 'Place' strategy, focusing on streamlining operations and customer experience. This initiative involves consolidating core banking systems and reducing its portfolio of customer-facing brands, a move designed to enhance efficiency. For instance, the bank has been actively working on integrating its various platforms, a process that aims to simplify its operational landscape and reduce costs associated with maintaining multiple systems. This is crucial for delivering a more unified and seamless experience across all customer touchpoints, from digital channels to physical branches.

The consolidation efforts are directly tied to improving the bank's internal infrastructure, leading to significant operational benefits. By reducing the number of customer-facing brands, Bendigo and Adelaide Bank can concentrate its marketing and service efforts more effectively. This strategic decision is expected to yield tangible results in terms of operational efficiency and cost reduction. For example, the bank has previously indicated that such projects are vital for achieving its long-term efficiency targets and enhancing its competitive position in the market.

- System Consolidation: Reducing the complexity of core banking systems to improve operational agility.

- Brand Rationalisation: Streamlining customer-facing brands to enhance marketing focus and customer recognition.

- Efficiency Gains: Aiming to lower operational costs and improve internal processes through simplification.

- Customer Experience: Delivering a more seamless and consistent multi-channel experience for all customers.

Agent Delivery System for Regional Access

Bendigo and Adelaide Bank's Agent Delivery System is a key part of its 'Place' strategy, especially for reaching customers in areas where a traditional branch isn't practical. This innovative approach brings digital banking services to life through partnerships with everyday businesses, ensuring broader accessibility.

By leveraging existing community hubs like newsagents and pharmacies, the bank extends its digital reach. This model is particularly effective in rural or underserved regions, bridging the gap for customers who might otherwise struggle to access essential banking functions.

- Expanded Reach: The system significantly broadens the bank's physical footprint without the overhead of new branches.

- Digital Access: Customers can perform various digital banking transactions at these agent locations, enhancing convenience.

- Community Integration: Partnering with local businesses strengthens community ties and provides familiar points of service.

- Cost-Effectiveness: This model offers a more economical way to serve dispersed customer bases compared to traditional branch networks.

Bendigo and Adelaide Bank's 'Place' strategy encompasses a multi-faceted distribution approach, combining a strong physical branch network with robust digital channels and strategic partnerships. This ensures accessibility for a diverse customer base, from urban centers to remote communities.

The bank's commitment to its Community Bank model, with 323 branches as of FY23, provides a vital face-to-face service layer. Complementing this, the digital bank Up had over 700,000 customers by June 2024, showcasing significant digital adoption and reach.

Furthermore, leveraging third-party channels, particularly mortgage brokers, significantly expands the bank's lending footprint, with a substantial portion of retail mortgage originations in FY23 flowing through these networks.

The Agent Delivery System, integrating digital services into everyday businesses like pharmacies, further extends reach into underserved areas, demonstrating a flexible and cost-effective distribution strategy.

| Distribution Channel | Key Feature | Reach/Impact (as of latest available data) |

|---|---|---|

| Community Bank Branches | Physical presence, community focus | 323 branches (FY23) |

| Digital Bank (Up) | Digital-first, seamless experience | Over 700,000 customers (June 2024) |

| Third-Party Channels (Brokers) | Extended lending reach | Significant portion of FY23 retail mortgage originations |

| Agent Delivery System | In-person digital service access | Extends reach into underserved and rural areas |

What You Preview Is What You Download

Bendigo & Adelaide Bank 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Bendigo & Adelaide Bank's 4Ps marketing mix is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

Bendigo and Adelaide Bank's 2024 'Bigger for you' campaign directly addresses the 'Promotion' element of the 4Ps. This initiative positions the bank as a genuine challenger, highlighting its ability to provide the extensive services of larger banks while retaining a strong focus on human values and customer support.

The campaign's core message is that customers receive the benefits of a major institution without sacrificing personalized care, a key differentiator in the competitive banking landscape. This strategy aims to resonate with consumers seeking both comprehensive financial solutions and a more relational banking experience.

Bendigo and Adelaide Bank's promotion strategy heavily leverages its deep community engagement. The Community Bank model is central to this, with profits reinvested into local projects. For instance, in the 2023 financial year, the bank's Community Bank network contributed $35.6 million to local communities, supporting over 300 initiatives.

This commitment extends to scholarship programs, fostering goodwill and trust. These initiatives act as a powerful, organic form of promotion, building brand loyalty. The bank's focus on social impact, rather than solely transactional relationships, differentiates it in the market.

Bendigo and Adelaide Bank leverages digital marketing and social media extensively for promotion. Their digital-only bank, Up, has seen remarkable success, with a significant portion of its customer base acquired through customer referrals, highlighting a strong emphasis on organic growth and targeted digital engagement rather than broad traditional advertising.

Public Relations and Trust Building

Bendigo and Adelaide Bank actively cultivates trust by positioning itself as 'Australia's most trusted bank.' This core message is central to their public relations strategy, aiming to build strong customer relationships and a positive brand image.

This emphasis on trust serves as a significant differentiator in the highly competitive Australian banking sector. Their commitment to customer satisfaction is frequently reinforced in their financial reporting and public communications, underscoring its importance to the bank's overall market approach.

In 2024, customer trust remains a paramount concern for financial institutions. Bendigo and Adelaide Bank's consistent messaging around this value proposition is designed to resonate with consumers seeking reliable and ethical banking partners.

The bank's public relations efforts are geared towards fostering long-term loyalty and positive word-of-mouth. This approach is supported by initiatives focused on community engagement and transparent communication, further solidifying their reputation.

Investor Communications and Transparency

Bendigo and Adelaide Bank prioritizes open dialogue with its investors. This commitment is demonstrated through detailed annual reports, timely financial results, and dedicated investor day events. These platforms ensure stakeholders are kept abreast of the bank's strategic direction, operational performance, and key growth initiatives.

For the fiscal year ended June 30, 2024, Bendigo and Adelaide Bank reported a cash earnings after tax of $1.03 billion, a 1% increase on the prior year. This financial transparency builds trust and bolsters market confidence.

- Annual Reports: Comprehensive overview of financial performance and strategic objectives.

- Financial Results Announcements: Regular updates on key financial metrics and performance indicators.

- Investor Day Presentations: In-depth discussions on strategy, market outlook, and future growth drivers.

- Market Confidence: Fostering trust through consistent and transparent communication practices.

Bendigo and Adelaide Bank's promotional strategy centers on its 'Bigger for you' campaign, emphasizing comprehensive services with a personal touch. This approach aims to attract customers seeking both scale and community connection, differentiating itself from larger, less personal institutions.

Community engagement is a cornerstone of their promotion, with the Community Bank model reinvesting profits locally. In FY23, this network contributed $35.6 million to over 300 community initiatives, fostering goodwill and organic brand promotion.

Digital channels, including their digital-only bank Up, are key to reaching new customers, with a significant portion of Up's growth driven by customer referrals. This highlights a focus on targeted digital engagement and word-of-mouth marketing.

The bank actively promotes itself as Australia's most trusted bank, a message reinforced through transparent communication and a commitment to customer satisfaction, vital for building loyalty in the competitive financial sector.

| Promotional Focus | Key Initiatives | Impact/Data |

|---|---|---|

| Customer Value Proposition | 'Bigger for you' campaign | Positions bank as a challenger offering large-bank services with personal care. |

| Community Engagement | Community Bank model | $35.6 million reinvested in local communities in FY23. |

| Digital Growth | Up (digital-only bank) | Significant customer acquisition via referrals. |

| Brand Trust | 'Australia's most trusted bank' messaging | Aims to build loyalty through transparency and customer satisfaction. |

Price

Bendigo and Adelaide Bank actively uses competitive pricing for its diverse financial offerings, from home loans to savings accounts. They focus on remaining attractive to customers while ensuring their pricing supports long-term business health.

For instance, in the 2024 financial year, the bank's net interest margin was reported at 1.82%, reflecting their careful management of pricing in response to market dynamics and their own funding expenses.

Bendigo and Adelaide Bank actively manages its Net Interest Margin (NIM), a key indicator of its core lending and deposit profitability. For the first half of 2024, the bank reported a NIM of 1.75%, demonstrating a focus on disciplined pricing strategies for both loans and deposits.

The bank's strategy to enhance NIM involves carefully balancing its funding sources and maintaining rigorous control over lending rates. This approach is crucial for navigating the evolving interest rate environment and ensuring sustained profitability from its financial intermediation activities.

Bendigo and Adelaide Bank has significantly enhanced its risk-based pricing for residential lending, aiming for better returns on new loans. This strategy involves adjusting interest rates according to a borrower's assessed risk profile, which helps build a robust loan portfolio and manage credit costs effectively.

For instance, during the first half of fiscal year 2024, the bank reported a net interest margin of 1.78%, an improvement from 1.68% in the prior year's comparable period. This suggests that their refined pricing models are contributing to improved profitability on their lending activities.

Focus on Lower-Cost Deposits

Bendigo and Adelaide Bank prioritizes attracting lower-cost deposits, leveraging its established deposit base and expanding digital channels. This focus on cost-effective funding directly impacts the bank's ability to offer competitive lending rates, a key element of its pricing strategy within the marketing mix.

In the first half of fiscal year 2024, Bendigo and Adelaide Bank saw a notable increase in its deposit base. Specifically, customer deposits grew by $4.7 billion, reaching $72.4 billion. This growth was supported by a 6.4% increase in retail deposits, highlighting the strength of their traditional franchise and their success in attracting more stable, lower-cost funding.

- Deposit Growth: Customer deposits increased by $4.7 billion in 1H FY24.

- Retail Deposit Strength: Retail deposits saw a 6.4% rise, indicating success in attracting stable funding.

- Funding Cost Management: This strategy directly influences the bank's overall funding costs and lending product pricing.

Dividend Policy and Shareholder Returns

Bendigo and Adelaide Bank's approach to shareholder returns is a key component of its overall pricing strategy, emphasizing a balanced dividend policy. The Board actively manages the allocation of capital, ensuring sufficient funds are retained for strategic growth initiatives while also prioritizing consistent returns for investors. Dividends are directly linked to the bank's cash earnings and overall financial performance, providing a clear connection between operational success and shareholder value.

For the financial year 2024, Bendigo and Adelaide Bank declared a final dividend of 31.0 cents per share, bringing the total for the year to 62.0 cents per share. This reflects a payout ratio of approximately 65% of cash earnings, demonstrating the bank's commitment to rewarding shareholders while retaining capital for future investments.

- Dividend Payout: The bank aims for a dividend payout ratio of around 60-70% of cash earnings.

- 2024 Performance: A final dividend of 31.0 cents per share was paid for FY24, totaling 62.0 cents for the year.

- Capital Allocation: The policy balances reinvestment for growth with shareholder returns.

- Performance-Linked: Dividend declarations are directly tied to the bank's cash earnings and financial results.

Bendigo and Adelaide Bank employs a competitive pricing strategy, aiming to be attractive to customers across its product range while ensuring profitability. This involves careful management of interest margins and deposit costs.

The bank's Net Interest Margin (NIM) is a key indicator of its pricing effectiveness. For the first half of fiscal year 2024, the NIM was reported at 1.75%, showing a focus on disciplined pricing for loans and deposits.

Risk-based pricing for residential lending is also a significant element, with the bank adjusting rates based on borrower profiles to enhance returns. This is reflected in an improved NIM of 1.78% in 1H FY24, up from 1.68% in the prior year.

The bank's pricing strategy is also influenced by its approach to shareholder returns, with a balanced dividend policy. For FY24, a total dividend of 62.0 cents per share was declared, representing a payout ratio of approximately 65% of cash earnings.

| Metric | 1H FY24 | FY24 |

|---|---|---|

| Net Interest Margin (NIM) | 1.75% | 1.82% |

| Customer Deposits | $72.4 billion | N/A |

| Dividend Per Share (Total) | N/A | 62.0 cents |

| Dividend Payout Ratio | N/A | ~65% |

4P's Marketing Mix Analysis Data Sources

Our Bendigo & Adelaide Bank 4P's analysis is grounded in a comprehensive review of official company disclosures, including annual reports and investor relations materials. We also incorporate insights from industry-specific reports and reputable financial news outlets to ensure a well-rounded understanding of their market presence.