Bendigo & Adelaide Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bendigo & Adelaide Bank Bundle

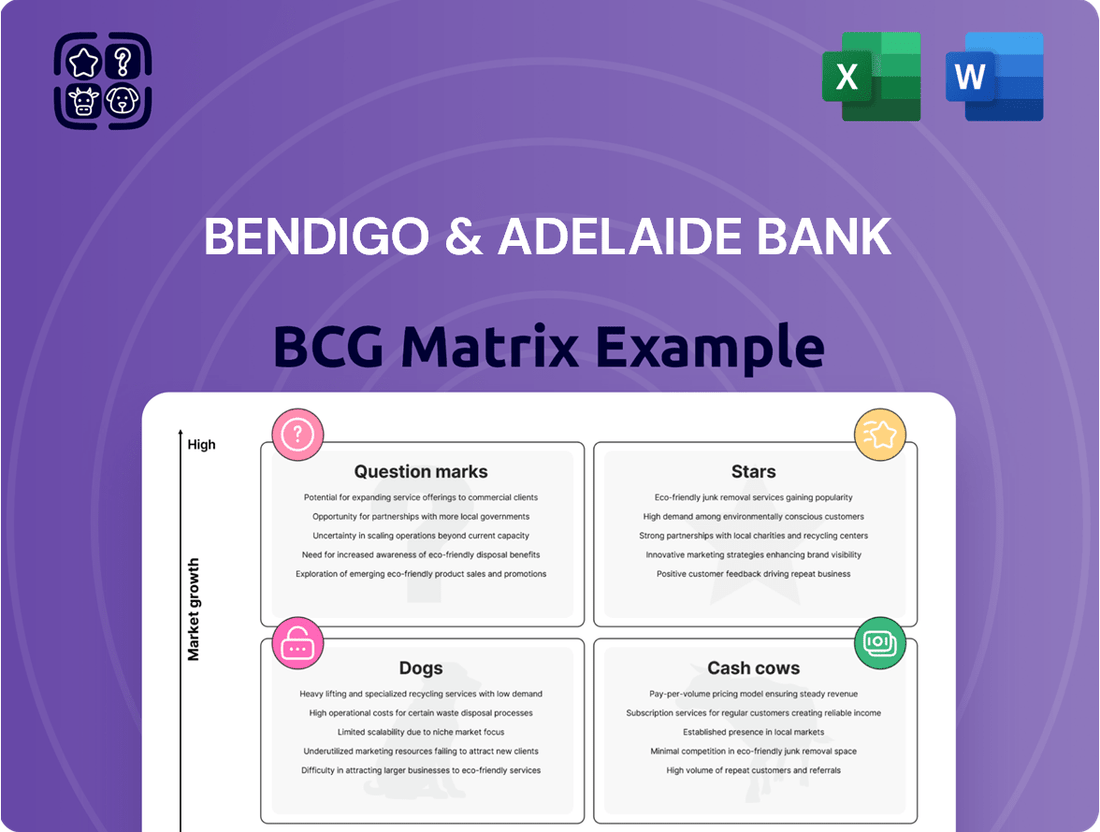

Curious about Bendigo & Adelaide Bank's strategic product positioning? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the full picture – purchase the complete report for detailed quadrant analysis and actionable insights to drive your investment decisions.

Stars

Up, Bendigo and Adelaide Bank's digital banking arm, is a star performer in the BCG matrix. Its customer base surged by 29% in FY24, reaching over 1 million users, with a 13.2% half-on-half increase. This robust growth highlights its strong position in the expanding digital banking landscape.

The bank's commitment to Up is evident in its substantial investments, fueling further expansion in deposits and home loans. Deposits saw a 37% year-on-year jump to over $2.1 billion, while home loans climbed to $1.2 billion, underscoring Up's potential for sustained market leadership.

The Bendigo Lending Platform, a key initiative for Bendigo & Adelaide Bank, is a star in the BCG Matrix, driving impressive growth in the mortgage sector. Its successful implementation has streamlined home loan processing, achieving industry-leading efficiency and turnaround times. This technological advancement is directly fueling the bank's strong performance in home lending, which outpaced the broader market significantly in the first half of FY25, growing at double the system rate.

Bendigo & Adelaide Bank's Residential Lending (Broker Channel) is a strong performer within its portfolio. The bank has achieved above-system growth in home lending, with a significant portion coming from the broker channel. This success is partly attributed to the implementation of the new Bendigo Lending Platform, which streamlines the application process.

The bank is strategically focused on enhancing its engagement with customers originating through brokers. By digitizing over 200 credit policy rules, Bendigo Bank is improving automation, which in turn supports its ambition to capture a larger share of this competitive market. This focus on digital transformation and broker relationships positions this segment for continued expansion.

Agribusiness Lending

Agribusiness lending demonstrated robust growth, expanding by 7.4% for the full year 2024. This performance was significantly bolstered by capitalizing on opportunities within economically strong states such as Queensland and Western Australia.

Despite a minor contraction in overall business and agribusiness lending towards the end of the half, primarily due to seasonal factors, Bendigo and Adelaide Bank is actively investing in its future. A new origination and customer relationship management platform is being implemented to enhance efficiency and drive growth.

This strategic investment aims to support the agribusiness division's expansion and is targeted to achieve a return to system growth by fiscal year 2026.

- Agribusiness Lending Growth (FY24): 7.4%

- Key Growth Drivers: Economic prosperity in Queensland and Western Australia

- Strategic Investment: New origination and customer relationship management platform

- Targeted Outcome: Return to system growth in FY26

Digital Deposit Channels (EasySaver)

Bendigo & Adelaide Bank's digital deposit channels, exemplified by its EasySaver product, demonstrate significant growth. In 2024, a remarkable 60% of all new EasySaver accounts were opened via the bank's app, highlighting a strong customer preference for digital onboarding. This digital push has translated into substantial gains, with digital deposits for Bendigo experiencing a 38% increase.

This robust digital adoption not only fuels the bank's overall deposit gathering capabilities but also reinforces its financial stability. The increasing digital deposit base directly contributes to a healthy household loan-to-deposit ratio, a key indicator of the bank's ability to fund its lending activities effectively. This success underscores a well-executed strategy for attracting and retaining customer funds within the evolving digital financial landscape.

- Digital Onboarding Dominance: 60% of new EasySaver accounts opened via the app in 2024.

- Digital Deposit Growth: Bendigo's digital deposits grew by 38%.

- Financial Health Indicator: Contributes to a strong household loan-to-deposit ratio.

- Strategic Success: Effective in attracting and retaining funds in a digital-first market.

Up, Bendigo & Adelaide Bank's digital banking arm, is a star performer, boasting a 29% customer base surge in FY24 to over 1 million users. Its substantial investment fuels expansion, with deposits growing 37% year-on-year to $2.1 billion and home loans reaching $1.2 billion, solidifying its market leadership potential.

The Bendigo Lending Platform is a star, driving significant mortgage growth and outperforming the market with double system rate growth in home lending for H1 FY25. Digitizing over 200 credit policy rules enhances automation, supporting its ambition to capture a larger share of the broker channel market.

| Business Unit | BCG Category | FY24 Performance Highlights |

|---|---|---|

| Up (Digital Banking) | Star | 1M+ users, 29% FY24 customer growth, $2.1B deposits (+37% YoY), $1.2B home loans |

| Bendigo Lending Platform | Star | Driving mortgage growth, double system rate growth in H1 FY25 home lending |

What is included in the product

This BCG Matrix overview details Bendigo & Adelaide Bank's product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

The Bendigo & Adelaide Bank BCG Matrix offers a clear, visual overview of business unit performance, simplifying complex strategic decisions.

This easily shareable format alleviates the pain of opaque portfolio management, enabling focused resource allocation.

Cash Cows

The Community Bank Network, a cornerstone of Bendigo & Adelaide Bank's strategy, operates as a powerful cash cow. This unique model consistently delivers substantial profits, with $40.3 million reinvested into communities in FY24 alone, bringing the total since inception to $366 million. This success underscores its role as a stable, high-performing business unit.

This model significantly bolsters the bank's deposit-gathering capabilities, offering a cost-effective funding advantage. With an expansive footprint in over 300 Australian communities, the network has secured $20.7 billion in loans and $35 billion in deposits as of June 30, 2024. This deep penetration in a mature market segment highlights its strong and stable cash flow generation.

Bendigo & Adelaide Bank's traditional branch network deposits are a clear Cash Cow. Customer deposits saw a healthy 3.4% increase in FY24 and a robust 5.4% rise in the first half of FY25, with branches being a cornerstone of this growth. This established deposit base offers a reliable and cost-effective funding stream for the bank's operations.

The bank's impressive household loan-to-deposit ratio of 73% underscores the success of its deposit-gathering strategies, encompassing both digital and physical touchpoints. These stable, low-cost deposits are crucial for supporting the bank's lending portfolio and maintaining profitability.

Bendigo and Adelaide Bank's established residential mortgage portfolio, valued at $60.4 billion in FY24, functions as a significant Cash Cow. This substantial asset base generates a consistent and predictable income stream for the bank.

The maturity of this portfolio is further underscored by the bank's strategy of maintaining high levels of fixed-rate mortgages. Additionally, a notable 40% of their home loan customers are currently ahead on their repayments, signaling a stable and reliable cash flow generation.

Wealth Management Services

Bendigo and Adelaide Bank's wealth management services are positioned as a Cash Cow within its BCG Matrix. This segment benefits from a strong, established market presence and contributes steadily to the bank's revenue streams. While recent performance fee growth might have seen a dip, the enduring nature of these services ensures consistent cash generation.

The bank's wealth management offerings provide a diversified income source, leveraging existing customer relationships. In the 2024 financial year, Bendigo and Adelaide Bank reported a net interest margin of 1.62%, indicating the stability of its core lending business, which often underpins wealth management product uptake.

- Established Market Presence: Wealth management is a mature offering for Bendigo and Adelaide Bank, benefiting from long-standing customer trust and a developed infrastructure.

- Steady Revenue Contribution: Despite fluctuations in specific fee types, the segment consistently generates revenue, supporting the bank's overall financial health.

- Diversification Benefit: Wealth management services reduce reliance on traditional banking products, providing a more resilient revenue mix.

- Mature Market Dynamics: Operating in a mature market means predictable cash flows, characteristic of a Cash Cow, even if rapid growth is not the primary driver.

Business Banking (Existing Portfolio)

Bendigo and Adelaide Bank's existing business banking portfolio acts as a strong Cash Cow. This segment offers a stable foundation, consistently contributing to the bank's overall earnings. The mature market for established business lending and services ensures reliable revenue streams.

While the bank is actively investing in new digital platforms to foster future growth in business banking, the current operational base remains a significant contributor. This investment signals a strategic move to enhance efficiency and customer experience within a well-established market segment.

- Stable Revenue Generation: The existing business banking portfolio provides predictable and consistent cash flow, underpinning the bank's financial stability.

- Mature Market Presence: Operations within this segment benefit from a well-understood and established market, allowing for efficient resource allocation and predictable returns.

- Investment for Future Efficiency: Ongoing investment in new platforms aims to streamline operations and improve service delivery within this core business area, ensuring continued competitiveness.

- Contribution to Overall Earnings: This segment plays a crucial role in the bank's overall financial performance, acting as a reliable source of cash generation.

Bendigo & Adelaide Bank's Community Bank Network is a prime example of a Cash Cow. It consistently generates substantial profits, with $40.3 million reinvested into communities in FY24, demonstrating its stable, high-performing nature and deep market penetration.

The bank's traditional branch network deposits also function as a Cash Cow, showing a 3.4% increase in FY24 and a 5.4% rise in the first half of FY25. This established deposit base provides a reliable, cost-effective funding stream, evidenced by a household loan-to-deposit ratio of 73% as of June 30, 2024.

The established residential mortgage portfolio, valued at $60.4 billion in FY24, is a significant Cash Cow, generating consistent income. A notable 40% of home loan customers are ahead on repayments, indicating stable cash flow.

Bendigo and Adelaide Bank's wealth management services are also a Cash Cow, benefiting from a strong market presence and diversified revenue streams. While specific fee growth may fluctuate, the segment ensures consistent cash generation, contributing to overall financial health.

The existing business banking portfolio acts as another strong Cash Cow, providing a stable foundation and consistent earnings. Despite investments in new digital platforms, this mature segment ensures reliable revenue streams.

| Business Unit | BCG Matrix Classification | Key Financial Indicator (FY24 unless otherwise stated) | Supporting Data Point |

| Community Bank Network | Cash Cow | $40.3 million reinvested in communities (FY24) | $35 billion in deposits (June 30, 2024) |

| Traditional Branch Deposits | Cash Cow | 3.4% deposit growth (FY24) | 73% household loan-to-deposit ratio (June 30, 2024) |

| Residential Mortgage Portfolio | Cash Cow | $60.4 billion portfolio value (FY24) | 40% of customers ahead on repayments |

| Wealth Management Services | Cash Cow | Net interest margin of 1.62% (FY24) | Diversified income source |

| Existing Business Banking | Cash Cow | Stable revenue contribution | Mature market presence |

What You See Is What You Get

Bendigo & Adelaide Bank BCG Matrix

The Bendigo & Adelaide Bank BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase, containing no watermarks or demo content. This comprehensive analysis, crafted by industry experts, offers a clear strategic overview of Bendigo & Adelaide Bank's business units, ready for immediate application in your business planning. You'll gain access to the complete, editable BCG Matrix, enabling you to integrate its insights directly into your presentations or strategic discussions without any further modifications. This is the actual, professionally designed document that will be yours to download, providing actionable intelligence for informed decision-making regarding the bank's portfolio.

Dogs

Bendigo and Adelaide Bank has strategically pruned its portfolio by exiting non-core partnerships and divesting underperforming assets. For instance, the bank terminated its relationship agreement with Elders and sold its stake in Homesafe Solutions. These moves reflect a deliberate effort to streamline operations and focus resources on areas with greater growth potential.

Bendigo and Adelaide Bank's legacy IT applications and systems are a prime example of their ongoing transformation efforts. The bank is actively working to reduce its vast IT application landscape, with a goal of consolidating into a single core banking system by FY26. This ambitious project highlights the challenges posed by outdated technology.

The migration away from legacy relational databases and systems indicates these older technologies are proving to be resource-intensive and inefficient. In the current financial technology landscape, these systems likely hold a very low market share for modern banking solutions, positioning them as candidates for divestment or substantial modernization to avoid becoming a drag on performance.

Bendigo and Adelaide Bank's decision to retire the Adelaide Bank brand for new lending from June 2024 signifies a strategic shift. This move, transitioning all brokers to the Bendigo Bank branded home loans, suggests the Adelaide Bank brand was likely a lower-performing asset within the bank's portfolio.

This strategic consolidation likely aims to streamline operations and concentrate resources on the more dominant Bendigo Bank brand. For the fiscal year 2023, Bendigo and Adelaide Bank reported a cash earnings of $532 million, indicating a solid financial foundation from which to execute such brand rationalization strategies.

Certain Alliance Bank Customers

The migration of certain Alliance Bank customers to Bendigo & Adelaide Bank's core banking platform signifies a strategic consolidation. This move suggests that the Alliance Bank customer base, or parts of it, may have been operating on a less integrated or perhaps underperforming model relative to the bank's broader objectives. The retirement of the older model points to a drive for greater efficiency and a unified customer experience.

This strategic realignment positions the Alliance Bank customer segment within the BCG Matrix. Given the migration and platform retirement, these customers might be viewed as a potential 'Dog' if their contribution to revenue or growth has been limited, or if the cost of maintaining their separate systems outweighed the benefits. Bendigo & Adelaide Bank reported a net profit after tax of $1.01 billion for the 2024 financial year, highlighting the overall strength of the consolidated entity.

- Customer Migration: Transitioning Alliance Bank customers to the core platform aims to streamline operations.

- Platform Retirement: The discontinuation of the older model indicates a move towards a unified banking infrastructure.

- Strategic Alignment: This consolidation suggests a focus on enhancing efficiency and potentially divesting or re-evaluating underperforming segments.

- Financial Context: Bendigo & Adelaide Bank's 2024 financial performance provides a backdrop for these strategic decisions.

Underperforming Micro-Business Segments

Bendigo and Adelaide Bank's focus on establishing a Business Direct team and investing in new platforms for micro-businesses suggests that some existing segments within this category may have been underperforming. This strategic shift, aimed at addressing key customer pain points, implies that previous approaches to servicing these smaller businesses were not yielding optimal results or market share. The bank's investment signals a recognition that growth in these areas was stagnant, necessitating significant intervention.

This strategic pivot indicates that certain micro-business segments within the bank's portfolio likely operated as Dogs in the BCG Matrix. For instance, while the broader Australian small business lending market saw growth, specific niches within micro-businesses may not have kept pace. In 2024, the Australian Bureau of Statistics reported that businesses with fewer than 20 employees, which largely encompass the micro-business sector, faced ongoing challenges with access to finance and digital adoption, potentially limiting their growth trajectory and market share for institutions not adequately catering to their evolving needs.

- Underperforming Segments: The bank's investment in new platforms and teams for micro-businesses points to a need to revitalize previously underperforming or low-growth segments.

- Addressing Pain Points: The focus on customer pain points suggests existing servicing models for micro-businesses were not meeting customer expectations or market demands effectively.

- Market Share Stagnation: The initiative implies that these specific micro-business segments had low market share or were experiencing stagnant growth, requiring strategic intervention.

- Need for Strategic Intervention: The establishment of dedicated teams and new technology highlights the bank's recognition that significant strategic adjustments were necessary to improve performance in these areas.

The retirement of the Adelaide Bank brand for new lending from June 2024 suggests this was a low-performing asset, fitting the 'Dog' category in the BCG Matrix. This strategic move, consolidating brokers under the Bendigo Bank brand, aimed to streamline operations and focus resources on more profitable areas. Bendigo and Adelaide Bank's 2023 cash earnings of $532 million provided the financial strength to support such portfolio rationalization.

Similarly, the bank's investment in new platforms and teams for micro-businesses indicates that certain segments within this category were likely underperforming Dogs. The Australian Bureau of Statistics noted in 2024 that micro-businesses often face challenges with finance access, which could limit their growth and market share for banks not adequately serving them.

| Segment | BCG Category Indication | Rationale | Financial Context (FY23) |

|---|---|---|---|

| Adelaide Bank Brand (New Lending) | Dog | Divested due to low performance, consolidating into Bendigo Bank brand. | Cash Earnings: $532 million |

| Certain Micro-Business Segments | Dog | New investment suggests previous underperformance or low growth, requiring strategic intervention. | Focus on improving service for segments facing finance access challenges (ABS, 2024). |

Question Marks

Bendigo and Adelaide Bank's strategic expansion into digital mortgages through partnerships with entities like Qantas Money Home Loans, Tiimely, and NRMA Insurance positions these ventures as potential stars in its BCG matrix. These collaborations tap into a rapidly expanding digital mortgage sector, indicating high future growth prospects.

Currently, these new digital mortgage channels represent a nascent but promising segment for the bank. While their market share is still developing, the significant investment required highlights the bank's commitment to nurturing these relationships and assessing their long-term potential within the evolving digital lending landscape.

Bendigo and Adelaide Bank's Foundation Financial Inclusion Action Plan 2024-2025, launched in late 2023, emphasizes fair access and digital inclusion. These programs, while vital for community engagement and building long-term loyalty, are likely to be in the 'question mark' category of the BCG matrix.

The immediate financial returns from these social impact initiatives may be modest. For instance, a 2024 report highlighted that while digital literacy programs improve customer engagement, direct revenue uplift is often indirect and takes time to materialize, requiring ongoing investment to assess their potential for future growth.

Bendigo & Adelaide Bank's strategic move to integrate its lending platform into mobile lender and branch channels positions this initiative as a Question Mark within the BCG Matrix. While the core platform is a Star, the success of its rollout into these established, yet potentially slower-to-adapt, channels hinges on significant investment and adoption. The bank is betting on this expansion to unlock new avenues for growth and market share.

This expansion is particularly interesting given the evolving retail banking landscape. In 2024, digital adoption continues to surge, with many customers preferring mobile interactions. However, branches still hold significant value for complex transactions and customer relationships. Bendigo & Adelaide Bank's investment in these new channels aims to bridge this gap, targeting a potential increase in lending volume and customer acquisition.

AI and Cloud Transformation Initiatives

Bendigo and Adelaide Bank's significant investments in AI and cloud transformation position these initiatives as Stars within their strategic framework. The bank's goal to migrate 50% of critical workloads to the cloud by the end of 2024 underscores a commitment to modernizing infrastructure. Furthermore, the application of AI to streamline legacy systems signals a proactive approach to enhancing operational efficiency and customer experience.

These AI and cloud efforts are characterized by high growth potential within the banking sector, yet their ultimate impact on market share and profitability remains an evolving narrative. This places them in a category requiring substantial capital and strategic focus to mature into sustainable competitive advantages.

- Cloud Migration Target: 50% of critical workloads by end of 2024.

- AI Application: Modernization of legacy banking applications.

- Strategic Positioning: High-growth, investment-intensive initiatives with unrealized full potential.

- Objective: Convert current investment into long-term competitive advantages.

Growth in Business and Agribusiness (B&A) via New Platforms

Bendigo and Adelaide Bank's Business and Agribusiness (B&A) division is undergoing a significant transformation, marked by substantial investments in new digital platforms. These platforms are designed to streamline origination processes and enhance customer relationship management, aiming to reignite system growth by the financial year 2026.

This strategic push acknowledges the highly competitive landscape of the B&A sector. The bank's current market share in this segment may not fully reflect its potential, making the successful deployment and adoption of these new technologies crucial for achieving meaningful market share gains.

- Platform Investment: Bendigo and Adelaide Bank is investing in a new origination and customer relationship management platform for its Business and Agribusiness division.

- Growth Target: The objective is to achieve 'system growth' within this division by the financial year 2026.

- Market Context: This initiative is a response to a competitive market where increasing market share is a key objective.

- Success Metric: The success of these platforms will be measured by their ability to drive significant market share gains.

Bendigo and Adelaide Bank's investments in social impact initiatives, such as its Financial Inclusion Action Plan, represent Question Marks. These programs, while crucial for community well-being and long-term brand building, often require significant upfront investment with uncertain, indirect financial returns in the short to medium term.

The 2024-2025 Financial Inclusion Action Plan, launched in late 2023, aims to foster digital inclusion and fair access to financial services. While these efforts are vital for social responsibility and customer loyalty, their direct contribution to immediate revenue growth is not guaranteed, necessitating careful monitoring of their potential to develop into future cash cows.

The bank's strategic move to integrate its lending platform across mobile lender and branch channels also falls into the Question Mark category. This initiative requires substantial investment and faces the challenge of adoption in potentially slower-adapting channels, aiming to unlock future growth and market share.

The success of these Question Mark initiatives is contingent on the bank's ability to nurture them through continued investment and strategic management, ultimately aiming to convert them into Stars or Cash Cows in the future.

| Initiative | BCG Category | Rationale | Investment Focus | Potential Outcome |

|---|---|---|---|---|

| Financial Inclusion Action Plan (2024-2025) | Question Mark | High social impact, uncertain direct financial returns. | Community engagement, brand loyalty. | Potential for long-term customer loyalty, indirect revenue growth. |

| Lending Platform Integration (Mobile/Branch) | Question Mark | Requires significant investment, adoption challenges in traditional channels. | Channel optimization, customer acquisition. | Potential to increase lending volume and market share. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including Bendigo & Adelaide Bank's annual reports, market share data, and industry growth forecasts, to accurately position each business unit.