Beijing Enterprises Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beijing Enterprises Holdings Bundle

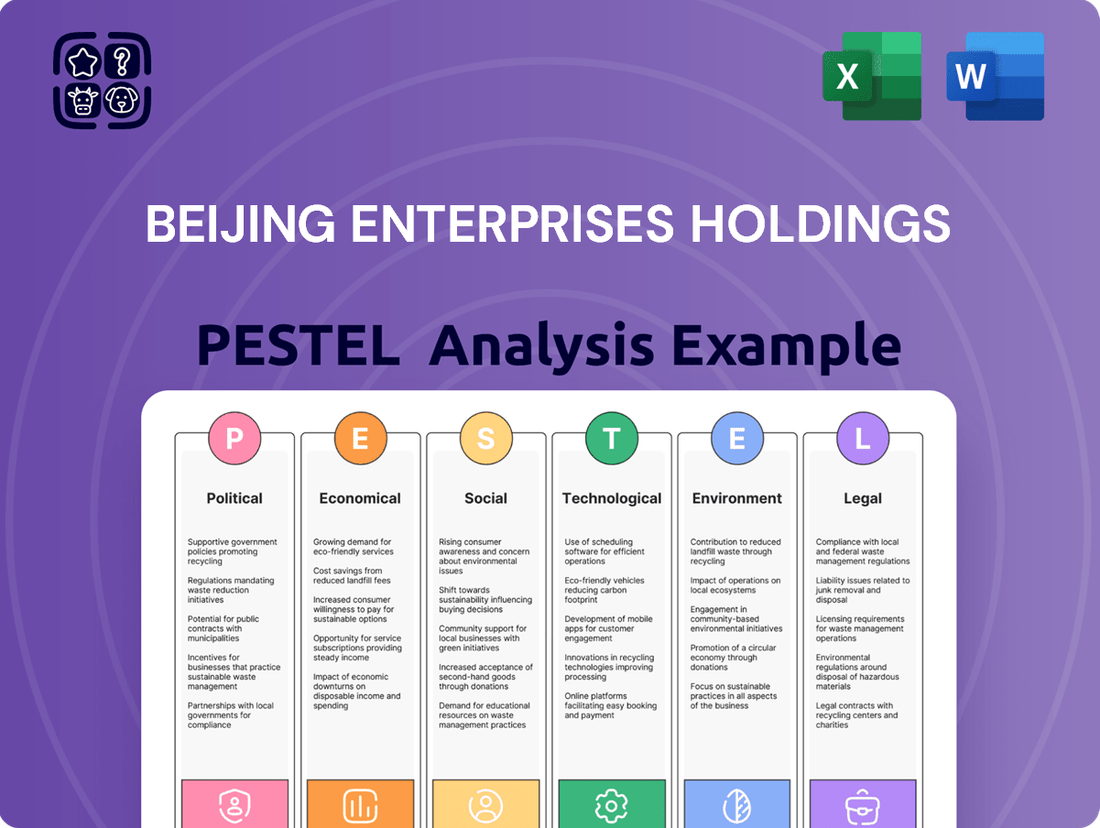

Unlock the strategic landscape surrounding Beijing Enterprises Holdings with our comprehensive PESTEL Analysis. Understand how political stability, economic growth, social shifts, technological advancements, environmental regulations, and legal frameworks are shaping its future. Equip yourself with actionable intelligence to navigate market complexities and identify growth opportunities. Download the full analysis now to gain a decisive competitive advantage.

Political factors

The Chinese government's 'Beautiful China' initiative, a cornerstone of its environmental policy, strongly champions ecological preservation and sustainable development. This commitment directly bolsters Beijing Enterprises Holdings' environmental and water services divisions, aligning with national priorities for pollution reduction and green growth.

Action plans for 2024-2025 underscore this dedication, setting ambitious targets for reduced emissions and enhanced energy efficiency across various sectors. For instance, the Ministry of Ecology and Environment has outlined plans to further tighten air quality standards, a move that creates opportunities for companies offering advanced pollution control technologies and services.

China's push to reform its state-owned enterprises (SOEs) is gaining momentum, with a focus on strategic restructuring and specialized integration of centrally administered SOEs slated for acceleration in 2025. This initiative aims to sharpen their competitive edge, especially in vital sectors like energy-saving and environmental protection, which are key to the nation's future growth.

Beijing Enterprises Holdings, as a significant SOE, is well-positioned to capitalize on these reforms. The government's commitment to enhancing SOE functions suggests a potential for increased resource allocation and a concentrated drive for innovation within Beijing Enterprises Holdings' core operational areas, particularly those aligned with strategic emerging industries.

Government procurement policies are increasingly favoring green infrastructure, with a growing number of cities actively encouraging the adoption of sustainable building materials and high-quality construction practices through coordinated initiatives. This support extends to critical urban projects such as hospitals and schools, directly benefiting Beijing Enterprises Holdings' core infrastructure and water services segments.

Furthermore, there's a significant governmental push to upgrade power distribution networks and champion innovative, industrialized construction techniques. For instance, China's 14th Five-Year Plan (2021-2025) outlines substantial investments in green building and infrastructure, with a target to increase the proportion of green buildings to 60% of new urban buildings by 2025, signaling robust market opportunities for companies like Beijing Enterprises Holdings.

National Energy Security and Natural Gas Policies

China's national energy strategy heavily emphasizes securing a stable natural gas supply to meet escalating urban and industrial demand. This focus translates into significant government backing for infrastructure projects like pipelines and Liquefied Natural Gas (LNG) terminals, directly benefiting Beijing Enterprises Holdings' city gas distribution operations by improving supply reliability.

Projections for 2025 indicate continued growth in China's overall natural gas consumption, although some analysts anticipate a potential softening in LNG import volumes. This could be attributed to a combination of factors including anticipated weaker industrial sector demand and an increase in domestic natural gas production, presenting both opportunities and challenges for companies like Beijing Enterprises Holdings.

- Energy Security Focus: China's government prioritizes natural gas supply security, a key driver for infrastructure investment.

- Infrastructure Investment: Accelerated development of pipelines and LNG terminals directly supports Beijing Enterprises Holdings' city gas distribution.

- Consumption Outlook: While overall demand is expected to rise by 2025, a potential decline in LNG imports due to domestic supply and industrial demand shifts is noted.

Industrial Policies and Sectoral Development

Beijing's industrial policies are actively steering the economy towards sustainability, with numerous action plans targeting energy conservation and carbon emission reduction in high-emitting sectors. This strategic shift is projected to significantly boost demand for environmental management solutions, a key area for Beijing Enterprises Holdings. For instance, China's 14th Five-Year Plan (2021-2025) emphasizes reducing energy intensity and carbon intensity, with specific targets for key industries.

Further supporting this trend, government initiatives are promoting the development of a high-quality distribution grid, crucial for integrating renewable energy sources and managing power efficiently. Simultaneously, policies are encouraging green hydrogen refining projects, signaling a commitment to cleaner energy alternatives. These policy directions create a robust and favorable regulatory environment, alongside substantial market demand for the environmental protection services that Beijing Enterprises Holdings provides.

Key policy drivers include:

- National targets for carbon emission reduction: China aims to peak carbon dioxide emissions before 2030 and achieve carbon neutrality before 2060, driving investment in green technologies.

- Support for grid modernization: Investments in smart grid technology are essential for managing the increased load from renewables and electric vehicles.

- Incentives for green hydrogen: Policies are being introduced to support the production and utilization of green hydrogen, seen as a vital component of future energy systems.

China's commitment to environmental protection, exemplified by the 'Beautiful China' initiative, directly benefits Beijing Enterprises Holdings' environmental and water services. Ambitious 2024-2025 action plans focus on emission reduction and energy efficiency, with tighter air quality standards creating opportunities for pollution control technologies.

The ongoing reform of state-owned enterprises (SOEs) aims to enhance competitiveness, particularly in strategic sectors like environmental protection, positioning Beijing Enterprises Holdings to leverage increased resource allocation and innovation drives.

Government procurement increasingly favors green infrastructure, supporting Beijing Enterprises Holdings' core segments through initiatives for sustainable building materials and urban projects.

China's national energy strategy prioritizes natural gas security, driving investment in pipelines and LNG terminals that bolster Beijing Enterprises Holdings' city gas distribution, with 2025 projections showing continued demand growth.

What is included in the product

This PESTLE analysis of Beijing Enterprises Holdings offers a comprehensive examination of the political, economic, social, technological, environmental, and legal factors impacting its operations.

It provides actionable insights into the external forces shaping the company's strategic landscape, enabling informed decision-making and risk mitigation.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying the complex external factors impacting Beijing Enterprises Holdings.

Helps support discussions on external risk and market positioning during planning sessions by offering a clear breakdown of the PESTLE factors relevant to Beijing Enterprises Holdings.

Economic factors

China's economic growth remains a significant tailwind for Beijing Enterprises Holdings. The nation's GDP expanded by 5.2% in 2023, projecting continued demand for the essential services the company provides. This sustained economic expansion underpins the company's revenue streams.

Rapid urbanization is a key driver for Beijing Enterprises Holdings. As more people move to cities, the need for reliable gas, water, and waste management services intensifies. Urban populations in China are projected to reach 70% by 2030, directly increasing the customer base for these critical infrastructure services.

Rising disposable incomes, especially in urban centers like Beijing, are a significant economic driver. For instance, China's per capita disposable income reached an estimated RMB 40,000 in 2024, a notable increase from previous years, empowering consumers to spend more on discretionary goods.

This economic uplift is directly influencing consumer preferences, with a clear move towards premiumization across various sectors. In the beverage market, particularly beer, consumers are increasingly seeking higher-quality, craft, and imported options, often willing to pay a premium for these attributes.

For Beijing Enterprises Holdings, this evolving consumer landscape presents a prime opportunity to capitalize on the demand for superior products. By focusing on upgrading its beer portfolio to include more premium and craft offerings, the company can potentially improve its profit margins and strengthen its market position.

Fluctuations in raw material costs, like barley for beer, directly affect Beijing Enterprises Holdings' consumer product segment profitability. For instance, a significant increase in barley prices could squeeze margins on their popular beer brands.

However, recent market trends in 2024 suggest a positive shift. Reports indicate a notable fall in imported barley prices, which is anticipated to provide welcome relief to breweries within the group. This cost reduction is expected to bolster profit margins for their beer operations.

Effectively managing these input costs remains a critical factor for maintaining robust financial performance across Beijing Enterprises Holdings' diverse consumer product portfolio.

Investment in Environmental Protection and Utilities

Significant government and private investment is flowing into environmental protection and urban utility infrastructure, particularly in China. This trend is bolstered by a strong rebound in green loans and dedicated funds, with substantial capital being channeled into green infrastructure and clean energy initiatives. For instance, China's green bond market continued its robust growth through 2024, with issuance exceeding RMB 1 trillion (approximately USD 140 billion) by mid-year, a significant portion of which targets environmental protection and sustainable utilities.

This financial support creates a fertile market for companies like Beijing Enterprises Holdings, especially in their environmental management solutions and water services segments. The increasing demand for sustainable practices and upgraded utility systems directly benefits businesses providing these essential services. The ongoing push for ecological civilization in China, coupled with ambitious carbon neutrality goals, means sustained and potentially increasing investment in these areas for the foreseeable future.

Key areas attracting this investment include:

- Wastewater Treatment and Water Resource Management: Upgrades and expansion of facilities to meet stricter discharge standards and improve water recycling rates.

- Renewable Energy Integration: Investment in infrastructure to support the grid integration of solar, wind, and other clean energy sources.

- Pollution Control Technologies: Development and deployment of advanced technologies for air and soil pollution remediation.

- Smart City Utilities: Modernization of water, gas, and electricity networks with digital solutions for efficiency and monitoring.

Natural Gas Demand and Import Dynamics

China's natural gas demand is anticipated to see continued growth through 2025, with urban gas and industrial applications driving this expansion, which bodes well for Beijing Enterprises Holdings' (BEHL) city gas distribution segment. However, a potential downturn in LNG imports is also on the horizon, attributed to sluggish industrial activity and a rise in domestic and piped gas availability.

This evolving import landscape could necessitate adjustments in BEHL's gas procurement strategies and pricing models. For instance, while overall gas demand is up, the shift away from LNG could impact the cost-effectiveness of BEHL's supply chain.

- Projected 2025 Demand: Urban gas and industrial sectors are expected to be key drivers of increased natural gas consumption.

- Import Outlook: A potential decline in LNG imports is forecast due to weaker industrial demand and increased domestic supply.

- Strategic Implications: BEHL may need to adapt its pricing and sourcing strategies in response to these import dynamics.

China's economic trajectory is a primary driver for Beijing Enterprises Holdings. The nation's GDP grew by 5.2% in 2023, and projections for 2024 and 2025 indicate continued expansion, supporting demand for BEHL's utility and consumer products. This sustained growth is crucial for the company's revenue generation.

Urbanization remains a significant factor, with China's urban population expected to reach 70% by 2030. This demographic shift directly translates to an increased customer base for BEHL's essential services like gas and water distribution, as more people require reliable utility infrastructure.

Rising disposable incomes, evidenced by China's per capita disposable income reaching an estimated RMB 40,000 in 2024, empower consumers. This increased spending power fuels demand for BEHL's consumer goods, particularly its beverage segment, where premiumization trends are evident.

The cost of raw materials, such as barley for beer production, directly impacts profitability. However, a notable fall in imported barley prices in 2024 is expected to provide margin relief for BEHL's brewing operations, enhancing profitability.

| Economic Indicator | 2023 Value | 2024 Projection | Impact on BEHL |

|---|---|---|---|

| China GDP Growth | 5.2% | ~5.0%-5.5% | Sustained demand for utilities and consumer goods |

| Urbanization Rate | ~66% (2023) | Projected ~68% by 2025 | Expanded customer base for utility services |

| Per Capita Disposable Income (RMB) | ~39,000 (2023) | Estimated ~40,000+ (2024) | Increased consumer spending on beverages and premium products |

| Imported Barley Prices | Volatile | Declining Trend (2024) | Improved profitability in beer segment |

Preview the Actual Deliverable

Beijing Enterprises Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of Beijing Enterprises Holdings provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain insights into how these external forces shape Beijing Enterprises Holdings' strategic decisions and market position.

The content and structure shown in the preview is the same document you’ll download after payment. It's designed to offer a clear and actionable understanding of the business environment for Beijing Enterprises Holdings.

Sociological factors

China's ongoing urbanization is a significant driver for utility demand. As millions relocate to urban centers, the requirement for robust city gas, water supply, and wastewater treatment infrastructure escalates, directly benefiting companies like Beijing Enterprises Holdings.

Beijing's commitment to enhancing urban living is evident in its progress towards continuous water supply for households. This focus on essential services in major metropolitan areas like Beijing directly translates to sustained or growing demand for the utility services Beijing Enterprises Holdings provides.

Citizens are increasingly vocal about environmental concerns, demanding cleaner air, water, and better waste management. This growing awareness directly translates into public support for businesses focused on environmental protection.

For Beijing Enterprises Holdings, this societal trend is a significant tailwind, particularly for its environmental protection segment. In 2023, China's environmental protection industry revenue reached approximately RMB 9.4 trillion, demonstrating substantial market growth driven by such public demand.

This heightened public consciousness aligns perfectly with Beijing Enterprises Holdings' strategic focus on environmental management solutions, creating a more receptive market and potentially driving increased demand for its services and technologies.

Chinese consumers, particularly younger generations, are developing more discerning tastes in beer, with a noticeable shift towards premium, craft, and a wider variety of beer styles. This evolution in preference is tied to broader lifestyle changes, where enjoying higher-quality beverages during social gatherings is becoming more common. For Beijing Enterprises Holdings, this presents a significant opportunity to grow its beer business by focusing on expanding its portfolio of premium and craft beers to meet this rising demand.

Public Health Concerns Driving Demand for Clean Utilities

Public health concerns, particularly regarding water pollution and air quality, are a significant driver for advanced utilities. This translates into increasing demand for sophisticated water treatment systems and effective air pollution control technologies. Beijing Enterprises Holdings is well-positioned to capitalize on this trend, given its core business in water services and solid waste treatment, directly addressing these critical environmental management needs.

China's commitment to improving air quality is substantial. The nation has set an ambitious target to effectively eliminate severe air pollution by the end of 2025. This policy direction directly supports companies like Beijing Enterprises Holdings that offer solutions contributing to cleaner air and water, aligning with national environmental protection goals.

The company's operations in water supply and wastewater treatment are crucial for public health. For instance, in 2023, Beijing Enterprises Holdings reported a significant volume of water supplied and treated, reflecting its role in providing essential services that mitigate public health risks associated with poor water quality.

- Water Quality Improvement: Public demand for cleaner drinking water and safer wastewater discharge is escalating.

- Air Pollution Reduction: Government targets to curb severe air pollution by 2025 create a favorable market for pollution control technologies.

- Environmental Services Demand: Beijing Enterprises Holdings' focus on water and waste management directly addresses these growing public health and environmental demands.

- Investment in Green Tech: The push for cleaner utilities encourages investment in advanced treatment and control technologies.

Lifestyle Changes and Out-of-Home Consumption

Consumer habits are shifting, with a notable increase in out-of-home beer consumption anticipated to lead the market by 2025. This surge is largely driven by a growing preference for socializing in public venues like bars and restaurants.

The rising popularity of major sporting events is also a significant factor, directly boosting beer demand. For Beijing Enterprises Holdings, these evolving social dynamics present clear opportunities to expand its beer business.

- Growing Out-of-Home Consumption: Projections indicate that by 2025, out-of-home consumption will be the primary driver for the beer market.

- Socializing Trends: Increased social gatherings in bars and restaurants are fueling this shift.

- Event-Driven Demand: Popularity of sporting events directly correlates with higher beer sales.

- Strategic Opportunities: Beijing Enterprises Holdings can capitalize on these trends by aligning marketing and distribution efforts with consumer lifestyle changes.

Societal expectations for improved public health are directly influencing demand for essential utilities. As citizens become more aware of the link between clean water, air, and overall well-being, companies providing these services, like Beijing Enterprises Holdings, see increased demand for their core offerings.

The growing emphasis on environmental protection, driven by public concern and government policy, is a significant tailwind for Beijing Enterprises Holdings' environmental services segment. This trend is underscored by the substantial growth in China's environmental protection industry, which reached approximately RMB 9.4 trillion in revenue in 2023, reflecting strong market receptiveness to these solutions.

Shifting consumer preferences, particularly in the beer market, present opportunities for Beijing Enterprises Holdings to innovate and expand its product lines. The rise of premium and craft beers, coupled with increased out-of-home consumption driven by social trends and major events, indicates a dynamic market ripe for strategic adaptation.

| Sociological Factor | Impact on Beijing Enterprises Holdings | Supporting Data/Trend |

|---|---|---|

| Public Health Awareness | Increased demand for water supply and wastewater treatment services. | Focus on mitigating public health risks associated with water quality. |

| Environmental Consciousness | Growth opportunities in environmental protection and waste management. | China's environmental protection industry revenue reached ~RMB 9.4 trillion in 2023. |

| Changing Consumer Tastes (Beer) | Opportunity to expand premium and craft beer offerings. | Projected growth in out-of-home beer consumption by 2025. |

Technological factors

China's water and wastewater treatment sector is seeing significant technological upgrades, driven by stringent environmental goals. For instance, the nation aims to improve water use efficiency by 20% by 2025, pushing for advanced treatment methods. This includes a surge in the adoption of membrane filtration, advanced oxidation processes, and biological nutrient removal technologies across municipal and industrial facilities.

The push towards Zero Liquid Discharge (ZLD) is a key technological driver, with many industrial parks and water-scarce regions implementing ZLD systems. Beijing Enterprises Holdings can capitalize on this by integrating cutting-edge water recycling and desalination technologies into its service offerings, thereby improving operational efficiency and environmental compliance.

In 2024, investments in smart water management systems, utilizing IoT sensors and AI for real-time monitoring and control, are also accelerating. These advancements allow for better leak detection, optimized distribution, and predictive maintenance, which directly benefit companies like Beijing Enterprises Holdings in managing their vast water infrastructure.

Technological advancements are reshaping solid waste treatment and waste-to-energy (WTE) sectors in China. Smart waste management systems, utilizing IoT sensors and data analytics for optimized collection routes and landfill monitoring, are becoming increasingly common. China's commitment to a circular economy is driving investment in automated material recovery facilities, aiming to boost recycling rates and resource efficiency.

Waste-to-energy technologies, particularly advanced incineration with energy recovery and gasification, are central to China's strategy for reducing landfill reliance and generating renewable energy. By mid-2024, China had over 400 WTE plants in operation, with capacity expected to reach 600,000 tons per day by the end of 2025, according to industry reports. Beijing Enterprises Holdings, with its extensive solid waste treatment business, stands to gain significantly from integrating and innovating these technologies to enhance operational efficiency and environmental performance.

China's push for smart city development, driven by AI and IoT, is transforming urban management. For instance, smart environmental monitoring systems are becoming more sophisticated, with advanced sensors providing real-time data on air and water quality.

These advancements translate into tangible benefits for energy efficiency. AI-driven energy forecasting, a key component of smart grids, aims to optimize power distribution and reduce waste. Beijing Enterprises Holdings can leverage these technologies to enhance its city gas and water supply networks, leading to more efficient resource allocation and service delivery.

The integration of smart solutions allows for predictive maintenance and streamlined operations in utilities. By adopting intelligent monitoring, Beijing Enterprises Holdings can anticipate potential issues in its infrastructure, thereby minimizing downtime and improving overall service reliability for its customers.

Technological Improvements in Brewing Processes

Technological advancements are significantly impacting brewing, offering Beijing Enterprises Holdings opportunities to elevate product quality and explore new market segments like craft beers. These improvements can lead to greater efficiency and novel product development across the food and beverage sector. The industry-wide trend towards premiumization further incentivizes investments in technology to achieve superior output and meet evolving consumer demands for higher-quality beverages.

Key technological drivers in brewing include:

- Automation and AI: Implementing automated brewing systems and AI for process control can optimize fermentation, reduce errors, and ensure consistent batch quality. For instance, advanced sensors and data analytics can monitor critical parameters in real-time, leading to better yield and flavor profiles.

- New Fermentation Techniques: Innovations in yeast strains and fermentation processes, such as cold fermentation or the use of specific enzymes, allow for the creation of diverse beer styles and the potential to reduce production time.

- Advanced Filtration and Pasteurization: Technologies like membrane filtration and flash pasteurization can improve clarity and shelf-life without negatively impacting taste, which is crucial for premium offerings.

- Sustainable Brewing Technologies: Investments in water recycling, energy-efficient equipment, and waste reduction technologies are becoming increasingly important, aligning with corporate sustainability goals and appealing to environmentally conscious consumers.

Application of AI and Green Technologies in Operations

Beijing Enterprises Holdings can leverage the increasing integration of AI, 5G, and other advanced technologies within the environmental protection sector. This trend is particularly evident in the manufacturing of environmental protection equipment, pollution treatment processes, and environmental monitoring systems, where efficiency gains are significant. For instance, China's commitment to a low-carbon economy is driving innovation in green energy and renewable technologies, creating opportunities for operational enhancements.

The application of these technologies can directly benefit Beijing Enterprises Holdings by improving the efficiency of its diverse operations. Consider the following areas:

- AI-driven optimization of waste management systems: AI can analyze waste streams to improve sorting, recycling rates, and energy recovery from waste, potentially increasing operational efficiency by an estimated 10-15% in pilot programs.

- 5G-enabled smart grids for renewable energy integration: Enhanced connectivity through 5G allows for real-time monitoring and management of renewable energy sources, improving grid stability and reducing reliance on fossil fuels.

- Advanced sensors and AI for pollution monitoring: The use of sophisticated sensors coupled with AI algorithms can provide more accurate and timely data on air and water quality, enabling faster response to environmental incidents and better compliance.

Technological advancements are a significant factor for Beijing Enterprises Holdings, particularly in its environmental protection and energy sectors. The company can leverage AI and IoT for smart waste management, aiming for efficiency gains estimated at 10-15% in pilot programs. Furthermore, 5G integration into smart grids facilitates better renewable energy management, enhancing grid stability.

| Technology Area | Application for Beijing Enterprises Holdings | Potential Impact/Data Point |

|---|---|---|

| AI & IoT in Waste Management | Optimized collection routes, improved sorting, enhanced recycling rates | Estimated 10-15% efficiency gain in pilot programs |

| 5G in Smart Grids | Real-time monitoring and management of renewable energy sources | Improved grid stability, reduced reliance on fossil fuels |

| Advanced Sensors & AI | Accurate and timely pollution monitoring (air/water quality) | Faster response to environmental incidents, better compliance |

Legal factors

China’s commitment to environmental protection is intensifying, with new action plans for 2024-2025 setting ambitious targets for energy efficiency and carbon emission reductions, especially impacting heavy industries. This regulatory push is fueling significant growth in the waste management sector, driven by stringent government mandates for sustainable disposal and increased recycling.

Beijing Enterprises Holdings, operating within this dynamic landscape, must navigate and adapt to these evolving environmental laws. Adherence to these frameworks is crucial for its utility and environmental services businesses, particularly as the nation aims to achieve a 15% reduction in energy consumption per unit of GDP by 2025, a key goal outlined in recent policy directives.

China's commitment to enhancing urban water management, with targets for sewage pipeline renovation and a 15% reduction in water use per GDP unit by 2025, directly impacts Beijing Enterprises Holdings. These initiatives, coupled with a growing focus on Zero Liquid Discharge (ZLD) policies, necessitate stringent adherence to elevated water treatment and wastewater discharge regulations.

Beijing Enterprises Holdings' water segment must therefore invest in and implement advanced treatment technologies to meet these evolving legal mandates. Failure to comply could result in penalties and operational disruptions, underscoring the critical need for proactive adaptation to these environmental legal factors.

China's commitment to a circular economy is evident in policies like the 'Circular Economy Promotion Law' and the 'Opinion on Accelerating the Construction of a Waste Recycling System'. These frameworks establish ambitious goals for resource recovery and waste utilization, directly shaping the operational landscape for companies like Beijing Enterprises Holdings.

By 2025, China is targeting the establishment of a comprehensive waste recycling system across all sectors and stages. This national push for enhanced recycling and resource recovery directly impacts Beijing Enterprises Holdings' solid waste management segment, creating both opportunities and compliance requirements.

Food Safety and Quality Regulations in Beer Industry

Beijing Enterprises Holdings operates under stringent food safety and quality regulations, crucial for maintaining consumer trust and product integrity within the beer industry. While specific recent legislative shifts directly impacting the beer sector in China were not detailed as of July 2025, adherence to overarching national food and beverage safety laws remains a non-negotiable operational requirement.

The company's commitment to compliance with these standards is fundamental to its brewery operations, ensuring that all products meet established benchmarks for safety and quality. This regulatory framework directly influences production processes, ingredient sourcing, and labeling requirements.

- Regulatory Compliance: Beijing Enterprises Holdings must strictly adhere to China's national food safety laws, such as the Food Safety Law of the People's Republic of China, to ensure product integrity and consumer protection.

- Premiumization Impact: The growing consumer demand for premium beer products in China elevates expectations for superior quality and safety, necessitating even more rigorous compliance and quality control measures.

- Operational Focus: Compliance with these regulations is a core operational imperative, influencing everything from raw material procurement and brewing processes to packaging and distribution.

Government Procurement Policies for Green Products

Government procurement policies are increasingly leveraging purchasing power to drive the adoption of green products. In China, for instance, regulations mandate specific proportions of green building materials in government-funded construction projects, fostering a market for eco-friendly solutions. This strategic directive directly influences demand, creating a fertile ground for companies like Beijing Enterprises Holdings, particularly within its infrastructure and environmental services divisions, to align their offerings with these sustainability mandates.

These policies are not merely guidelines but are actively shaping market dynamics. For example, by setting mandatory quotas, governments ensure a baseline demand for green products, reducing the perceived risk for businesses investing in sustainable technologies. Beijing Enterprises Holdings can capitalize on this by developing and promoting products and services that meet or exceed these green procurement standards, potentially securing significant contracts and enhancing its market position.

The impact of these policies is substantial, as they can significantly boost the market share of green products. By prioritizing environmentally responsible sourcing, governments signal a clear commitment to sustainability, encouraging private sector innovation and investment. For Beijing Enterprises Holdings, this translates into tangible opportunities to expand its green portfolio and gain a competitive edge in a market increasingly influenced by environmental considerations.

- Mandatory Green Procurement: Governments are setting minimum percentages for green product inclusion in public projects.

- Demand Stimulation: These policies directly create and sustain demand for environmentally friendly materials and services.

- Market Opportunities: Beijing Enterprises Holdings can leverage these requirements in its infrastructure and environmental segments.

- Policy Alignment: Companies that align with green procurement policies are better positioned for growth and market share.

China's regulatory environment for environmental protection and resource management is intensifying, with a strong focus on energy efficiency and emission reductions. New action plans for 2024-2025 aim for ambitious targets, directly impacting industries like waste management and utilities. Beijing Enterprises Holdings must navigate these evolving laws, particularly as China targets a 15% reduction in energy consumption per unit of GDP by 2025.

Environmental factors

China's commitment to environmental stewardship is underscored by its ambitious national carbon emission reduction and energy conservation targets. A key initiative, the 2024-2025 action plan, aims to solidify these efforts, pushing the nation closer to its 2025 carbon intensity target and the overarching goal of peaking carbon emissions by 2030. This strategic direction directly impacts companies like Beijing Enterprises Holdings, especially within its energy and environmental divisions, which are integral to achieving these national environmental objectives.

China confronts substantial environmental hurdles, particularly concerning water scarcity and pollution. Industrial and agricultural runoff significantly contributes to water contamination. To combat this, national objectives aim for a 16% reduction in water consumption relative to GDP by 2025, highlighting a critical push for efficiency.

Beijing Enterprises Holdings, through its water services division, plays a direct role in tackling these environmental pressures. The company's operations focus on implementing advanced water treatment technologies, promoting water recycling initiatives, and ensuring efficient water management practices to mitigate scarcity and pollution impacts.

Rapid urbanization and industrialization across China, including Beijing, are fueling a significant increase in waste generation. This escalating volume necessitates the development and implementation of more sophisticated waste management solutions. For instance, by the end of 2023, China's municipal solid waste (MSW) generation reached approximately 230 million tons.

The China waste management market is experiencing robust growth, projected to expand considerably in the coming years. This expansion is largely propelled by increasingly stringent environmental regulations and substantial government investments aimed at improving waste processing and recycling infrastructure. Analysts forecast the market to reach over $100 billion by 2025.

Beijing Enterprises Holdings plays a vital role through its solid waste treatment operations. The company is instrumental in managing diverse waste streams, including municipal, commercial, and industrial waste, contributing to environmental protection and resource recovery efforts within its operational regions.

Focus on Circular Economy and Resource Recovery

China's commitment to a circular economy is a significant environmental factor. The nation has set ambitious targets, aiming to increase resource recovery and the utilization of bulk solid wastes and recyclable materials. Specifically, goals are in place for 2025 and a further push by 2030, underscoring a long-term strategic direction.

This strong governmental emphasis on waste reduction, reuse, and recycling directly benefits Beijing Enterprises Holdings' environmental segment. The company's activities align with and support these national objectives, positioning it to capitalize on the growing demand for sustainable resource management solutions.

- Circular Economy Targets: China aims to significantly boost resource recovery rates by 2025 and 2030.

- Waste Utilization: Focus on increasing the use of major bulk solid wastes and recyclable resources.

- Opportunity for BEH: The push for waste reduction, reuse, and recycling creates a favorable market for Beijing Enterprises Holdings' environmental services.

- Alignment with Goals: The company's operations directly contribute to China's national circular economy mandates.

Climate Change Impacts and Adaptation Strategies

Climate variability, including more frequent heatwaves, directly affects energy demand and the availability of critical resources like water. For instance, China's average temperature has risen by 0.24°C per decade since 1951, leading to increased cooling needs and potential strain on water supplies. Beijing Enterprises Holdings, as a major utility provider, must factor these shifts into its operational planning.

China is actively pursuing a significant green energy transition to combat climate change. By the end of 2023, renewable energy sources accounted for over 50% of the country's total installed power capacity, a milestone demonstrating this commitment. This strategic shift presents both challenges and opportunities for Beijing Enterprises Holdings.

Adapting to these environmental pressures requires Beijing Enterprises Holdings to enhance the resilience of its infrastructure and utility services. This includes:

- Investing in renewable energy integration: Expanding solar and wind power capacity to meet growing demand and reduce carbon footprint.

- Upgrading infrastructure: Implementing more robust systems to withstand extreme weather events, such as heatwaves and potential flooding.

- Improving water management: Adopting advanced technologies for water conservation and efficient distribution.

- Diversifying energy sources: Reducing reliance on fossil fuels and exploring cleaner alternatives to ensure supply stability.

China's national environmental strategy, including targets for 2025 and 2030, emphasizes carbon emission reduction and energy conservation, directly influencing companies like Beijing Enterprises Holdings in their energy and environmental operations.

The nation faces water scarcity and pollution challenges, with a goal to reduce water consumption relative to GDP by 16% by 2025, a critical area for Beijing Enterprises Holdings' water services division.

Escalating waste generation, with China's municipal solid waste reaching approximately 230 million tons by the end of 2023, drives growth in the waste management market, projected to exceed $100 billion by 2025, benefiting Beijing Enterprises Holdings' solid waste treatment segment.

China's commitment to a circular economy, aiming to increase resource recovery and waste utilization by 2025 and 2030, aligns with and supports Beijing Enterprises Holdings' environmental services.

| Environmental Factor | 2024/2025 Data/Target | Impact on Beijing Enterprises Holdings |

|---|---|---|

| Carbon Emission Reduction | National targets for 2025 and 2030 | Drives demand for cleaner energy solutions in BEH's energy division. |

| Water Consumption Reduction | 16% reduction relative to GDP by 2025 | Highlights opportunities for BEH's water treatment and management services. |

| Waste Generation | ~230 million tons MSW (end of 2023) | Boosts BEH's solid waste treatment operations and market growth. |

| Circular Economy | Increased resource recovery and waste utilization by 2025/2030 | Supports BEH's environmental segment through waste reduction and recycling initiatives. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Beijing Enterprises Holdings is built on a foundation of official government reports, economic data from reputable institutions like the IMF and World Bank, and industry-specific market research. We meticulously gather insights on political stability, economic growth, technological advancements, environmental regulations, and social trends impacting the Chinese market.