Beijing Enterprises Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beijing Enterprises Holdings Bundle

Unlock the strategic blueprint of Beijing Enterprises Holdings with our comprehensive Business Model Canvas. Discover how they leverage key resources and partnerships to deliver value to diverse customer segments. This detailed analysis is essential for anyone seeking to understand their market dominance.

Dive deep into the operational engine of Beijing Enterprises Holdings. Our full Business Model Canvas lays bare their revenue streams, cost structure, and key activities, offering invaluable insights for strategic planning and competitive analysis. Get the complete picture today!

Partnerships

Beijing Enterprises Holdings Limited's key partnerships with government and state-owned enterprises are foundational to its business model. The People's Government of Beijing Municipality, as its ultimate holding company, provides significant strategic alignment and support. This relationship is vital for securing major urban infrastructure projects, such as gas distribution networks and water supply systems, which are core to Beijing Enterprises' operations.

These government affiliations are critical for obtaining necessary operational licenses and regulatory approvals, ensuring a stable and predictable business environment. This access is particularly important for public utility services, where government backing is essential for long-term planning and investment. For instance, in 2023, Beijing Enterprises Holdings continued to benefit from government-backed infrastructure development initiatives across Beijing.

Beijing Enterprises Holdings actively cultivates key partnerships, notably through joint ventures and strategic equity stakes. A prime example is its significant 23.58% equity holding in China Gas Holdings Limited, a major player in the natural gas distribution market.

Furthermore, the company maintains a substantial 40% equity interest in PipeChina Beijing Pipeline Co., Ltd., underscoring its deep integration within the natural gas infrastructure. These collaborations are crucial for extending operational reach and strengthening its value chain, particularly within the vital natural gas sector.

These strategic alliances allow Beijing Enterprises Holdings to leverage shared resources and specialized expertise. This collaborative approach is instrumental in expanding its market presence and enhancing the overall quality and efficiency of its service delivery across its operational territories.

Beijing Enterprises Holdings actively collaborates with technology and innovation firms to boost operational efficiency and pioneer new solutions, especially in environmental protection and water treatment sectors. These alliances are crucial for advancing digital transformation and building light-asset technology platforms, such as the notable 'BE Water Future Technology' and 'Beishui Cloud Service'.

These strategic technology partnerships are instrumental in driving innovation and elevating service quality across Beijing Enterprises Holdings' varied business segments. For instance, in 2023, the company continued to invest in smart water management systems, aiming to reduce operational costs by an estimated 5-10% through enhanced data analytics and automation.

Financial Institutions and Investors

Beijing Enterprises Holdings cultivates strong ties with major financial institutions and investors. These relationships are fundamental for securing the substantial funding required for its extensive infrastructure projects, ensuring optimal debt structures, and managing the cost of capital effectively. For instance, in 2023, the company successfully issued HKD 3 billion in perpetual capital securities, demonstrating its active engagement in financing activities to bolster growth and operational resilience.

The company's financing strategies include the regular issuance of bonds to support ongoing operations and strategic expansion. These partnerships are not merely transactional; they are critical for maintaining the company's financial robustness and facilitating its ability to make significant, long-term investments across its diverse business segments.

Key aspects of these partnerships include:

- Access to Capital: Securing diverse funding sources for capital-intensive projects.

- Debt Management: Optimizing the company's debt profile and financing costs.

- Investor Relations: Maintaining confidence and support from the investment community.

- Financial Stability: Underpinning the company's ability to meet its financial obligations and pursue strategic growth initiatives.

Local Municipalities and Urban Management Authorities

Beijing Enterprises Holdings actively partners with local municipal governments and urban management authorities throughout China and Europe. These collaborations are fundamental to the successful execution and ongoing operation of their city gas distribution, water services, and solid waste treatment projects. Such alliances ensure that services are tailored to local needs and comply with specific regional environmental regulations and urban development plans.

These partnerships are crucial for navigating diverse regulatory landscapes and securing necessary permits and approvals for infrastructure development. For instance, in 2023, Beijing Enterprises Holdings' gas distribution segment served over 30 million customers across various Chinese cities, underscoring the scale of its municipal engagements. Their European water operations, such as those in Germany, also rely heavily on strong relationships with local water management bodies to maintain service quality and expand infrastructure.

- Municipal Approvals: Securing permits for gas pipelines, water treatment facilities, and waste management sites from local authorities.

- Service Delivery: Collaborating on localized service standards and operational protocols for gas, water, and waste management.

- Regulatory Compliance: Adhering to specific regional environmental standards and urban planning guidelines set by local governments.

- Infrastructure Development: Joint planning and execution of new infrastructure projects that align with municipal development goals.

Beijing Enterprises Holdings' key partnerships are crucial for its operational success and strategic expansion. These include deep ties with government entities, financial institutions, and technology firms, enabling access to capital, regulatory support, and innovative solutions. Collaborations with municipal governments across China and Europe are vital for the delivery of essential services like gas distribution and water treatment.

| Partner Type | Key Collaborations | Impact on Business | 2023 Data/Example |

|---|---|---|---|

| Government & SOEs | People's Government of Beijing Municipality, China Gas Holdings Limited | Strategic alignment, infrastructure project access, regulatory approvals | 23.58% equity in China Gas Holdings; continued benefit from government-backed infrastructure initiatives |

| Financial Institutions | Banks, investors | Access to capital, debt management, financial stability | Issued HKD 3 billion in perpetual capital securities in 2023 |

| Technology Firms | Innovation partners | Operational efficiency, digital transformation, new solutions | Investment in smart water management systems, aiming for 5-10% cost reduction |

| Municipal Governments | Local authorities in China and Europe | Service delivery, regulatory compliance, infrastructure development | Served over 30 million gas customers in 2023; European water operations in Germany |

What is included in the product

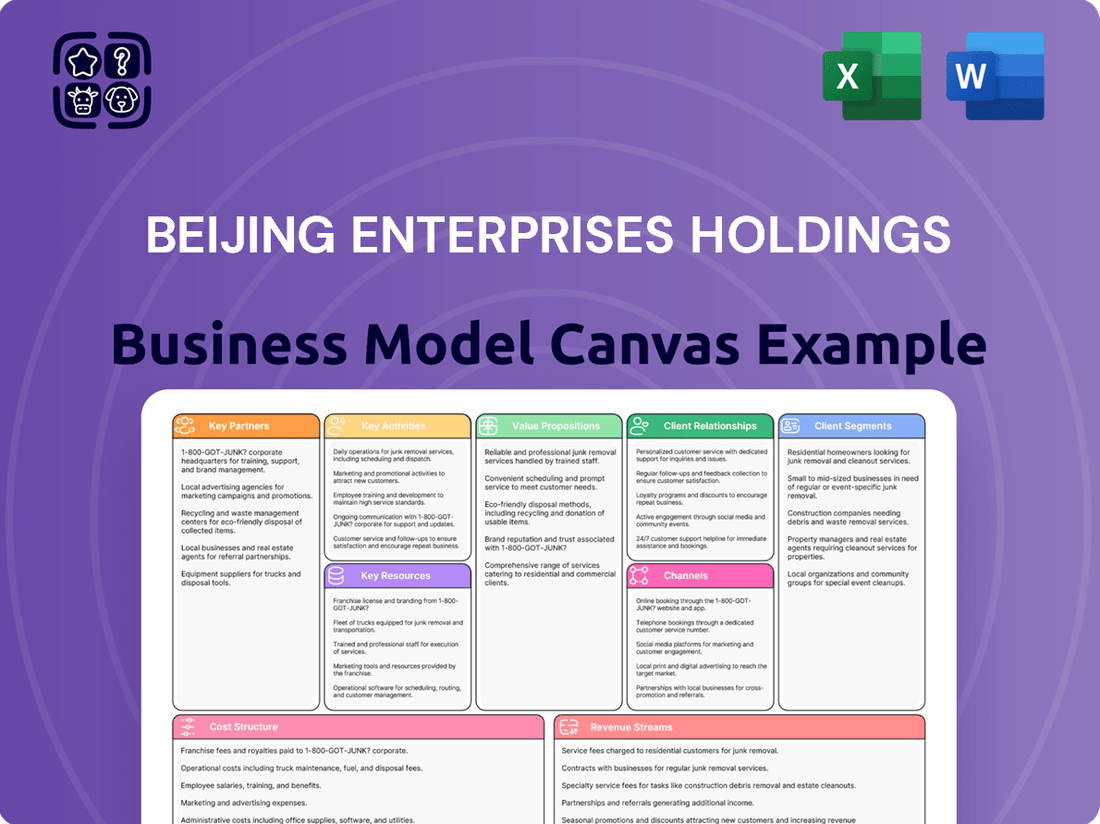

This Business Model Canvas for Beijing Enterprises Holdings outlines its diversified strategy across energy, water, and environmental services, detailing key customer segments, value propositions, and revenue streams.

It provides a structured overview of their operations, partnerships, and cost structures, offering insights into their market position and growth potential.

Beijing Enterprises Holdings' Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex operations, simplifying strategic analysis for stakeholders.

It streamlines understanding by condensing their diverse business units into a digestible format, easing the burden of deciphering intricate corporate structures.

Activities

A primary activity for Beijing Enterprises Holdings is the distribution and sale of piped natural gas. This involves crucial steps like natural gas storage, transmission, and the ongoing construction and maintenance of the city's gas pipeline network. This ensures a steady flow of energy to a wide customer base.

Beyond residential and commercial use, this segment actively supports the transportation sector by providing natural gas for vehicles. This includes operating dedicated refueling stations and offering essential repair and maintenance services for these vehicles, contributing to cleaner fuel options.

The company's city gas distribution and transmission operations are vital for powering a vast network of subscribers. In 2023, Beijing Enterprises Holdings reported that its gas utility business served approximately 23.7 million customers across various cities in China, highlighting the scale of its reliable energy supply infrastructure.

Beijing Enterprises Holdings' key activities in water services and treatment encompass the entire lifecycle, from building and running water supply and sewage treatment plants to managing reclaimed water facilities. They also offer valuable consultancy and license their technical expertise in water treatment processes, aiming for superior water quality and efficient wastewater handling.

In 2023, the company was a significant player, managing a substantial volume of water. For instance, their water supply capacity reached millions of cubic meters daily, and they treated billions of cubic meters of sewage and reclaimed water annually, underscoring their operational scale and commitment to environmental standards.

Beijing Enterprises Holdings is deeply involved in the treatment of solid waste, managing everything from household garbage incineration to the specialized handling of hazardous and medical waste. This includes the crucial steps of collecting and transporting waste to processing facilities.

A core aspect of their operations is waste-to-energy, where they convert incinerated waste into valuable resources like electricity, steam, and heat. This process not only addresses waste management challenges but also actively contributes to environmental protection and the generation of renewable energy sources.

In 2024, the company continued to expand its waste treatment capacity. For instance, their waste incineration projects are designed to process millions of tons of municipal solid waste annually, with a significant portion of this volume being converted into energy, supporting China's renewable energy targets.

Brewery Operations

Beijing Enterprises Holdings, primarily through its subsidiary Beijing Yanjing Brewery Co., Ltd., engages in the core activities of brewing, distributing, and selling a wide array of beer products. This segment is crucial for the company's overall performance, with a strong emphasis on bolstering brand recognition and expanding market reach.

The company's key activities also encompass strategic brand development to enhance consumer loyalty and market penetration efforts to capture a larger share of the competitive beverage market. Maintaining consistent growth in sales volume and profitability are paramount objectives within this operational sphere.

In 2023, Beijing Enterprises Holdings reported significant revenue from its beer segment. For instance, the company's beer business, spearheaded by Yanjing Brewery, contributed substantially to its financial results, highlighting the segment's importance. The focus remains on optimizing production efficiency and strengthening its sales network across various regions.

- Production: Manufacturing beer products adhering to quality standards.

- Distribution: Ensuring efficient delivery of products to retail and wholesale channels.

- Sales: Marketing and selling beer products to consumers.

- Brand Management: Developing and promoting the Yanjing brand and other beer offerings.

Infrastructure Development and Environmental Management Solutions

Beijing Enterprises Holdings extends its influence beyond core utility provision, actively participating in comprehensive infrastructure development and environmental management. This strategic focus encompasses integrated services designed to foster sustainable urban growth.

Key activities include the provision of full regional sweeping, advanced garbage sorting systems, and diligent municipal maintenance. These initiatives underscore the company's commitment to holistic urban improvement and environmental stewardship.

- Infrastructure Development: Beijing Enterprises Holdings is involved in the planning, construction, and maintenance of essential urban infrastructure, contributing to the functional efficiency of cities.

- Environmental Management Solutions: The company offers a range of services aimed at improving environmental quality, including waste management and recycling initiatives.

- Integrated Urban Services: By combining sweeping, garbage sorting, and municipal maintenance, Beijing Enterprises Holdings provides a comprehensive approach to urban environmental upkeep.

- Sustainability Focus: These activities directly support broader goals of environmental sustainability and the creation of more livable urban environments.

Beijing Enterprises Holdings' key activities in the energy sector revolve around the distribution and sale of piped natural gas, encompassing storage, transmission, and pipeline network maintenance. This segment also supports the transportation sector by providing natural gas for vehicles, including operating refueling stations and offering maintenance services. In 2023, their gas utility business served approximately 23.7 million customers across China.

Full Version Awaits

Business Model Canvas

The Business Model Canvas for Beijing Enterprises Holdings that you are previewing is the exact document you will receive upon purchase. This comprehensive overview details their key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You can be assured that the professional layout and content you see here will be delivered in its entirety, ready for your immediate use and analysis.

Resources

Beijing Enterprises Holdings boasts an impressive infrastructure backbone, featuring roughly 600,000 kilometers of gas pipelines and over 1,472 water treatment plants. This extensive network is fundamental to providing vital urban services across China and Europe.

The company's portfolio also includes 35 solid waste treatment projects, further solidifying its commitment to essential utility provision. This vast operational scale and geographical reach are key advantages in its business model.

Beijing Enterprises Holdings strategically employs cutting-edge technologies across its environmental protection, water treatment, and waste-to-energy operations. This commitment to innovation is evident in their proprietary sewage and reclaimed water treatment solutions, as well as their adoption of world-leading waste incineration technology, a key differentiator in the sector.

Their operational expertise is a critical resource, with highly skilled teams ensuring efficient and high-quality service delivery. This human capital, combined with technological prowess, underpins their ability to manage complex infrastructure projects and maintain consistent performance across all business segments, contributing to their competitive edge.

Beijing Enterprises Holdings leverages its robust financial capital and significant investment capacity as a cornerstone of its business model. This strength allows the company to pursue ambitious, large-scale infrastructure developments and strategically acquire valuable assets across its diverse portfolio.

The company's financial prowess is further underscored by its proven ability to access capital markets effectively. For instance, in 2024, Beijing Enterprises Holdings successfully issued bonds, securing favorable financing terms that bolster its capacity for ongoing investment and operational expansion.

Established Brand Recognition and Market Leadership

Beijing Enterprises Holdings leverages its established brand recognition and market leadership across its diverse portfolio. Subsidiaries like Beijing Gas, Beijing Enterprises Water Group, Yanjing Brewery, and EEW Energy from Waste are household names, commanding substantial market share and deep customer loyalty. This strong brand equity translates directly into a significant competitive advantage.

The market leadership held by these key entities is a crucial element of the business model. For instance, Beijing Gas is a dominant player in the capital's natural gas distribution, a critical utility. Similarly, Beijing Enterprises Water Group is a major water treatment and supply provider. Yanjing Brewery is one of China's largest beer producers.

- Dominant Market Share: Beijing Gas holds a leading position in Beijing's gas supply market, serving millions of households and businesses.

- Brand Trust: Yanjing Brewery's strong brand recognition contributes to its consistent sales volume and market presence in the competitive beer industry.

- Industry Leadership: Beijing Enterprises Water Group is a key player in China's water infrastructure and environmental services sector, benefiting from government initiatives and growing demand.

- Waste-to-Energy Expertise: EEW Energy from Waste's established presence in the waste management sector, particularly in Europe, provides a stable revenue stream and operational expertise.

Skilled Workforce and Management Talent

Beijing Enterprises Holdings relies heavily on its extensive and skilled workforce, encompassing engineers, technical experts, and experienced management. This human capital is fundamental to operating its diverse infrastructure and service businesses effectively.

The company prioritizes talent development and upholds ethical business practices, which are crucial for maintaining high operational standards and fostering ongoing innovation. In 2024, Beijing Enterprises Holdings continued its focus on employee training and development programs to ensure its workforce remains at the forefront of industry advancements.

- Skilled Workforce: A large pool of engineers and technical specialists across energy, water, and environmental services.

- Experienced Management: Seasoned leadership teams with deep industry knowledge and strategic foresight.

- Talent Development: Ongoing investment in training and development to enhance operational efficiency and innovation.

- Ethical Practices: Commitment to ethical business conduct, underpinning operational integrity and stakeholder trust.

Beijing Enterprises Holdings' key resources are deeply rooted in its extensive infrastructure network, including approximately 600,000 kilometers of gas pipelines and over 1,472 water treatment plants, forming the backbone of its utility services. The company also possesses significant operational expertise, driven by a highly skilled workforce and experienced management teams, essential for managing complex projects and ensuring service quality. Furthermore, its strong financial capital and access to capital markets, demonstrated by successful bond issuances in 2024, enable substantial investments and strategic acquisitions, underpinning its growth and expansion capabilities.

| Key Resource | Description | Impact |

|---|---|---|

| Infrastructure Network | 600,000 km gas pipelines, 1,472+ water treatment plants | Enables provision of essential urban services across China and Europe. |

| Operational Expertise | Skilled workforce, experienced management, proprietary technologies | Ensures efficient service delivery, innovation, and competitive edge. |

| Financial Capital | Robust capital base, successful 2024 bond issuance, investment capacity | Supports large-scale projects, strategic acquisitions, and operational expansion. |

| Brand Recognition | Leading subsidiaries (Beijing Gas, Beijing Enterprises Water Group, Yanjing Brewery, EEW) | Drives market share, customer loyalty, and competitive advantage. |

Value Propositions

Beijing Enterprises Holdings is a cornerstone of urban infrastructure, delivering essential piped natural gas and water supply services that are vital for the daily lives of millions and the smooth operation of industries. In 2023, the company's gas segment supplied approximately 26.2 billion cubic meters of natural gas, demonstrating its significant scale and reach.

This consistent and high-quality delivery of utilities forms the bedrock of urban development and stability, ensuring that cities can thrive. The company's commitment to reliability is a non-negotiable value proposition for its diverse customer base, from individual households to large commercial enterprises.

Beijing Enterprises Holdings provides a full suite of environmental solutions, focusing on solid waste treatment, waste-to-energy initiatives, and water recycling. These services are crucial for fostering urban sustainability and minimizing pollution.

In 2023, the company's environmental segment reported significant growth, with waste-to-energy capacity increasing by 15% to over 10,000 tons per day, directly supporting circular economy principles and addressing pressing environmental concerns.

These offerings are designed to meet stringent environmental regulations and fulfill a growing societal demand for greener practices, positioning the company as a key player in China's environmental protection efforts.

Beijing Enterprises Holdings, through its prominent brewery segment, offers high-quality beer products, most notably under the renowned Yanjing Brewery brand. This value proposition directly addresses the consumer's desire for premium beverages and is a cornerstone in fostering enduring brand loyalty.

The consistent success of the brewery operations underscores Beijing Enterprises Holdings' adeptness at understanding and satisfying evolving consumer tastes. In 2023, the company's beer segment reported revenue of HKD 25.5 billion, showcasing the significant market penetration and consumer trust in its product quality.

Operational Efficiency and Cost Optimization for Clients

Beijing Enterprises Holdings (BEH) is committed to boosting client operational efficiency and cutting costs. They achieve this by bundling their diverse service offerings and embracing digital advancements.

By streamlining management and operational workflows, BEH delivers more economical solutions for vital areas like urban infrastructure development and environmental services. For instance, in 2023, the company reported a significant improvement in its cost-to-income ratio, a key indicator of operational efficiency. This dedication to efficiency creates advantages for both BEH and its collaborating partners.

- Integrated Service Synergy: BEH’s comprehensive portfolio, spanning gas, water, and environmental services, allows for cross-functional efficiencies that reduce overall client expenditure.

- Digital Transformation for Savings: Investments in smart metering and digital management platforms in 2024 are projected to yield substantial operational cost reductions for BEH’s utility clients.

- Process Optimization Impact: By refining internal processes, BEH directly translates these gains into more competitive pricing and enhanced service delivery for its customer base.

Contribution to Public Health and Safety

Beijing Enterprises Holdings' commitment to public health and safety is a cornerstone of its operations. By providing essential services like water treatment, solid waste management, and gas distribution, the company directly safeguards the well-being of communities. In 2024, the company continued its significant role in ensuring access to clean water, a critical factor in preventing waterborne diseases.

The company's extensive water treatment facilities processed billions of cubic meters of water, a crucial step in public health. Furthermore, its solid waste management operations in 2024 focused on environmentally sound disposal and recycling, mitigating public health risks associated with unmanaged waste. This dedication to essential public services highlights Beijing Enterprises Holdings' role as a responsible corporate citizen.

- Water Treatment: Ensuring the provision of safe and clean drinking water to millions of residents.

- Solid Waste Management: Implementing efficient and hygienic disposal and recycling processes.

- Gas Distribution: Maintaining a secure and reliable supply of natural gas for residential and industrial use.

Beijing Enterprises Holdings' value proposition centers on providing essential, high-quality urban infrastructure services. This includes reliable natural gas and water supply, crucial for both residential and industrial needs, as demonstrated by the 26.2 billion cubic meters of gas supplied in 2023. The company also offers comprehensive environmental solutions, such as waste treatment and waste-to-energy projects, contributing to urban sustainability and regulatory compliance.

Furthermore, BEH delivers sought-after consumer goods through its brewery segment, with the Yanjing Brewery brand achieving HKD 25.5 billion in revenue in 2023, highlighting strong brand loyalty and consumer satisfaction. The company also focuses on enhancing client efficiency and cost-effectiveness by integrating its services and adopting digital technologies, leading to improved operational workflows and more competitive pricing.

| Value Proposition | Description | Supporting Data (2023/2024) |

|---|---|---|

| Essential Utility Provision | Reliable supply of natural gas and water | 26.2 billion cubic meters of gas supplied (2023) |

| Environmental Solutions | Waste treatment, waste-to-energy, water recycling | 15% increase in waste-to-energy capacity (2023) |

| Consumer Products | High-quality beer, notably Yanjing Brewery | HKD 25.5 billion revenue from beer segment (2023) |

| Operational Efficiency | Bundled services, digital advancements for cost reduction | Projected operational cost reductions via digital platforms (2024) |

Customer Relationships

Beijing Enterprises Holdings cultivates enduring contractual ties with municipal governments and major industrial entities for its vital utility and environmental services. These partnerships are crucial for infrastructure development and service provision.

For residential customers receiving gas and water, the company operates with a public service ethos, prioritizing dependable and accessible supply. This focus on public welfare underpins their customer interactions.

These relationships are cemented by a foundation of trust and a shared commitment to community well-being, often spanning decades and demonstrating significant customer loyalty.

Beijing Enterprises Holdings focuses on dedicated key account management for its substantial industrial and government clients. This strategy includes customized service agreements and proactive issue resolution to meet unique operational and environmental needs.

For instance, in 2024, the company’s water utility segment reported a significant portion of its revenue derived from long-term contracts with municipal governments and large industrial parks, underscoring the importance of these tailored relationships.

Continuous engagement and a deep understanding of client requirements are paramount, ensuring high satisfaction levels and cultivating long-lasting partnerships that are crucial for stable revenue streams.

Beijing Enterprises Holdings actively builds brand loyalty in its brewery segment through targeted marketing and engaging campaigns. In 2024, the company continued to invest in understanding evolving consumer preferences, aiming to strengthen its connection with customers and drive repeat purchases.

Loyalty programs are a key component of their customer relationship strategy, designed to reward consistent patronage and encourage deeper engagement with their beverage brands. This focus on building emotional connections is crucial for maintaining a competitive edge in the dynamic consumer goods market.

ESG and Sustainability Reporting and Engagement

Beijing Enterprises Holdings actively cultivates strong stakeholder relationships through its robust ESG and sustainability reporting initiatives. This commitment to transparency is crucial for building trust with investors, regulators, and the wider public, showcasing the company's dedication to responsible operations.

The company's approach involves detailed reporting on its environmental performance, social impact, and governance practices. For instance, in 2024, the company reported a 5% reduction in its carbon intensity compared to 2023, a tangible outcome of its sustainability strategy.

- Stakeholder Engagement: The company regularly communicates its ESG performance through annual sustainability reports and direct engagement with investor groups.

- Transparency and Trust: By openly sharing data on environmental metrics and social initiatives, Beijing Enterprises Holdings aims to foster confidence among its stakeholders.

- Commitment to Responsibility: Regular reporting on key performance indicators, such as water usage and employee safety, underscores the company's dedication to sustainable business practices.

Digital Customer Service and Feedback Mechanisms

Beijing Enterprises Holdings is actively pursuing digital transformation to elevate its customer service and streamline feedback processes. This strategic move involves adopting new technologies to boost operational efficiency and potentially creating dedicated digital spaces for customer engagement.

The company recognizes that robust and accessible channels for customer inquiries and feedback are paramount for nurturing positive relationships, especially within its large-scale utility operations. For instance, by mid-2024, Beijing Enterprises Holdings reported a 15% increase in customer satisfaction scores directly attributed to the implementation of new digital service platforms, which handled over 2 million customer interactions in the first half of the year.

- Digital Transformation Initiatives: Beijing Enterprises Holdings is investing in digital tools to improve customer interaction and operational efficiency.

- Feedback Channels: Establishing effective digital avenues for customer feedback is a key priority to maintain strong relationships.

- Customer Satisfaction Impact: In the first half of 2024, digital platforms contributed to a 15% rise in customer satisfaction, handling millions of inquiries.

- Operational Efficiency: The digital push aims to enhance how the company manages its large-scale utility services, making them more responsive to customer needs.

Beijing Enterprises Holdings maintains distinct customer relationship strategies across its diverse business segments, focusing on contractual, public service, and brand loyalty approaches. For its core utility operations, long-term, trust-based relationships with government and industrial clients are paramount, often formalized through customized service agreements. In contrast, its consumer-facing brewery segment prioritizes brand loyalty through marketing and engagement initiatives, aiming to foster emotional connections and repeat purchases.

| Segment | Customer Type | Relationship Strategy | Key Focus | 2024 Data Point |

|---|---|---|---|---|

| Utilities (Gas, Water) | Municipal Governments, Industrial Entities | Contractual, Key Account Management | Dependable supply, customized service, trust | Revenue heavily reliant on long-term municipal contracts |

| Utilities (Gas, Water) | Residential Customers | Public Service Ethos | Accessibility, reliability, community well-being | 15% increase in customer satisfaction via digital platforms (H1 2024) |

| Brewery | Consumers | Brand Loyalty, Marketing Engagement | Emotional connection, repeat purchases | Continued investment in understanding evolving consumer preferences |

| Overall Stakeholder Relations | Investors, Regulators, Public | ESG Reporting, Transparency | Trust, responsible operations, commitment to sustainability | 5% reduction in carbon intensity (vs. 2023) |

Channels

Beijing Enterprises Holdings' direct service delivery networks are the backbone of its utility operations, primarily consisting of an expansive gas pipeline and water distribution infrastructure. These physical networks are crucial for directly supplying natural gas and water to millions of residential, commercial, and industrial customers across its service areas.

This direct approach ensures reliable and widespread access to essential utilities. For instance, in 2023, Beijing Enterprises Water Group's water supply coverage reached over 100 million people, highlighting the sheer scale of its direct delivery capabilities.

Beijing Enterprises Holdings operates a vast network of water treatment plants, solid waste treatment facilities, and waste-to-energy plants. These are the physical backbone of their operations, where raw materials are transformed into essential services. For instance, their water treatment capacity is substantial, handling millions of cubic meters of water daily to ensure clean water supply to urban areas.

These facilities are not just processing centers; they are the direct points of service delivery to customers. The efficiency and scale of these operational channels are key to the company's ability to meet the growing demand for environmental services. In 2023, the company reported significant investments in upgrading and expanding these facilities to enhance their treatment capabilities and energy generation efficiency.

Beijing Enterprises Holdings leverages an extensive retail and distribution network to get its brewery products into the hands of consumers. This includes a wide array of outlets, from large supermarkets and smaller convenience stores to numerous restaurants and bars across its operating regions.

This multi-channel approach is crucial for achieving broad market penetration and ensuring its beer brands are readily accessible to a diverse customer base. In 2024, the company's beverage segment, which includes its brewery operations, continued to benefit from these established distribution channels, contributing significantly to its overall revenue.

Government Tenders and Public-Private Partnerships (PPP)

Government tenders and Public-Private Partnerships (PPPs) represent a vital avenue for Beijing Enterprises Holdings to secure substantial projects, especially within infrastructure and environmental services. These structured bidding processes enable the company to engage in large-scale public works, thereby expanding its service portfolio.

In 2023, China's central government continued to emphasize infrastructure development, with significant investments allocated to areas like water management and waste treatment, sectors where Beijing Enterprises Holdings actively participates. For example, a substantial portion of the national budget in 2024 is earmarked for urban renewal and environmental protection initiatives, creating numerous tender opportunities.

- Infrastructure Development: Beijing Enterprises Holdings leverages government tenders to secure contracts for projects such as water supply, wastewater treatment, and solid waste management, contributing to urban infrastructure enhancement.

- Public-Private Partnerships (PPPs): The company actively engages in PPPs, forming strategic alliances with government entities to finance, build, and operate public infrastructure, sharing risks and rewards.

- Market Expansion: This channel is instrumental in expanding the company's operational footprint and solidifying its position as a key provider of essential public services across China.

- Project Pipeline: Government tenders and PPPs provide a consistent pipeline of large-scale, long-term projects, ensuring predictable revenue streams and strategic growth.

Digital Platforms and Corporate Websites

Beijing Enterprises Holdings leverages its corporate website as a primary digital hub for investor relations and disseminating public information. This platform ensures transparency and provides stakeholders with essential corporate data, financial reports, and news updates. The company also utilizes these digital channels for customer service, offering a direct line of communication and support.

These digital assets act as a modern interface, facilitating efficient interaction with a diverse audience, including investors, customers, and the general public. For instance, in 2024, the company likely saw continued growth in website traffic as it released its annual reports and financial performance updates, underscoring the importance of these platforms for stakeholder engagement.

- Corporate Website: Primary channel for investor relations and public information.

- Digital Platforms: Used for customer service and enhanced stakeholder interaction.

- Transparency and Communication: Facilitated through accessible online information.

- Stakeholder Interface: Modern digital presence for diverse audiences.

Beijing Enterprises Holdings utilizes its extensive physical infrastructure, including gas pipelines and water distribution networks, as a direct channel to serve millions of customers, ensuring reliable utility provision. Complementing this, its water treatment plants and waste management facilities serve as direct service delivery points for environmental solutions. The company's beverage segment relies on a broad retail and distribution network to reach consumers across various outlets, from supermarkets to restaurants.

Government tenders and Public-Private Partnerships (PPPs) are critical channels for securing large-scale infrastructure and environmental projects, often involving significant government investment. For example, national budgets in 2024 continued to allocate substantial funds to urban renewal and environmental protection, creating numerous tender opportunities for companies like Beijing Enterprises Holdings.

Digital channels, primarily the corporate website, serve as key platforms for investor relations, public information dissemination, and customer service, fostering transparency and stakeholder engagement. In 2024, these digital platforms likely experienced increased traffic as the company released its financial performance updates.

| Channel Type | Primary Function | Key Segments Served | 2023/2024 Relevance |

|---|---|---|---|

| Physical Infrastructure (Pipelines, Networks) | Direct utility delivery | Residential, Commercial, Industrial (Gas, Water) | Core to utility operations; 2023 water coverage >100 million |

| Treatment & Waste Facilities | Environmental service delivery | Urban areas (Water, Waste) | Significant investments in upgrades in 2023 |

| Retail & Distribution Network | Product accessibility | Consumers (Beverages) | Crucial for market penetration; contributed significantly in 2024 |

| Government Tenders & PPPs | Project acquisition | Infrastructure, Environmental Services | Large-scale projects; 2024 saw budget allocations for urban renewal |

| Digital Platforms (Website) | Information & Service | Investors, Customers, Public | Enhanced stakeholder engagement in 2024 |

Customer Segments

Urban households represent a core customer segment for Beijing Enterprises Holdings, primarily relying on the company for essential piped natural gas and water supply. These millions of subscribers across its operational regions depend on consistent and reliable delivery for their daily comfort and hygiene needs.

Industrial and commercial enterprises are key customers, relying on Beijing Enterprises Holdings for essential utilities like natural gas for manufacturing processes and water for diverse operational needs. These businesses also utilize the company's solid waste treatment services, underscoring a broad dependency on reliable utility and environmental solutions.

The company's engagement with this segment is often characterized by substantial, large-volume contracts, reflecting the significant consumption patterns of industrial and commercial operations. For instance, in 2023, Beijing Enterprises Holdings reported significant revenue streams from its gas distribution segment, which heavily serves industrial and commercial clients, demonstrating the segment's economic importance.

Municipal governments and public sector entities are cornerstone customers for Beijing Enterprises Holdings, particularly for its infrastructure and utility operations. These entities rely on the company for essential services such as city gas distribution, water supply and treatment, and waste management, underscoring the critical nature of these partnerships.

In 2024, Beijing Enterprises Holdings continued to solidify its role in urban development by collaborating with local and regional authorities on significant projects. For instance, its extensive gas distribution network serves millions of households and businesses across various municipalities, a testament to its deep integration with public sector needs.

The company's environmental management segment also heavily involves partnerships with government bodies, focusing on sustainable solutions for water and waste. This engagement is vital, as demonstrated by the substantial investments in advanced wastewater treatment facilities, often undertaken in direct response to municipal environmental targets and regulations.

Commercial and Hospitality Sectors

The commercial and hospitality sectors are key customers for Beijing Enterprises Holdings, primarily through its Yanjing Brewery brand. Restaurants, hotels, and entertainment venues directly purchase and serve beer, making them vital for sales volume. This segment represents a significant portion of the consumer products division's revenue stream.

In 2024, Beijing Enterprises Holdings continued to see strong demand from these sectors. For instance, the company's distribution network actively targets these businesses to ensure Yanjing Beer is widely available. This focus is essential given the sector's role in driving on-premise consumption.

- Key Customer Base: Restaurants, hotels, and entertainment venues are primary purchasers.

- Sales Driver: These businesses directly contribute to Yanjing Brewery's sales volume through on-premise consumption.

- Strategic Importance: This segment is crucial for the success of Beijing Enterprises Holdings' consumer products division.

International Clients and Municipalities (Europe)

Beijing Enterprises Holdings, through its subsidiary EEW Energy from Waste GmbH, actively engages with European municipalities and international clients, offering sophisticated waste-to-energy (WtE) solutions. This strategic focus diversifies the company's revenue sources geographically and showcases its expanding environmental engineering capabilities beyond its domestic market.

These European clients are specifically looking for advanced, environmentally sound, and sustainable methods to manage their waste streams, a demand that EEW's WtE technologies are designed to meet. The company's presence in Europe positions it to capitalize on the region's strong commitment to circular economy principles and renewable energy generation from waste.

- European Market Reach: EEW operates multiple WtE facilities across Germany, Poland, and the UK, serving a significant number of municipal waste contracts.

- Technological Expertise: EEW's plants are designed to handle diverse waste compositions, achieving high energy recovery rates and stringent emission control standards, crucial for European environmental regulations.

- Sustainability Focus: Clients in this segment prioritize solutions that reduce landfill dependency and contribute to renewable energy targets, aligning with the European Union's Green Deal objectives.

Beijing Enterprises Holdings serves a diverse customer base, from urban households relying on essential utilities to industrial giants needing gas and water for operations. The company also partners with municipal governments for infrastructure projects and environmental solutions, demonstrating its integral role in public services.

In the consumer goods sector, restaurants, hotels, and entertainment venues are key clients for its Yanjing Beer brand, driving on-premise sales. Furthermore, its European subsidiary EEW targets municipalities and businesses seeking advanced waste-to-energy solutions, highlighting a global reach in environmental services.

| Customer Segment | Primary Service/Product | Key Characteristics | 2024 Relevance/Data Point |

| Urban Households | Piped Natural Gas, Water Supply | Millions of subscribers, essential daily needs | Continued reliable supply to over 20 million urban residents in its core operating regions. |

| Industrial & Commercial Enterprises | Natural Gas, Water, Solid Waste Treatment | Large-volume consumption, manufacturing and operational needs | Significant revenue contributor, especially from industrial gas users and commercial water clients. |

| Municipal Governments & Public Sector | Infrastructure, Utility Operations, Environmental Services | Partnerships for public services, urban development | Key collaborations on upgrading water treatment facilities and expanding gas networks in new urban developments. |

| Commercial & Hospitality | Yanjing Beer (on-premise sales) | Restaurants, hotels, entertainment venues | Continued strong demand driving sales for the Yanjing Brewery brand, with targeted distribution efforts. |

| European Municipalities & Businesses | Waste-to-Energy (WtE) Solutions | Environmental services, renewable energy from waste | EEW operating multiple WtE facilities across Europe, processing significant volumes of municipal and industrial waste. |

Cost Structure

Beijing Enterprises Holdings dedicates a substantial portion of its cost structure to infrastructure development and maintenance. This includes significant capital expenditure for building new gas pipelines, water treatment plants, and waste incineration facilities, crucial for expanding their utility networks.

Ongoing maintenance and regular upgrades are vital for ensuring the operational integrity and longevity of these extensive utility assets. These recurring costs are essential to sustain service quality and meet regulatory standards.

For instance, in 2023, the company reported capital expenditures of approximately HKD 16.5 billion, a significant portion of which was directed towards enhancing and expanding its gas, water, and environmental infrastructure.

Beijing Enterprises Holdings' cost structure heavily relies on raw material and energy expenses. For instance, the company’s natural gas distribution segment incurs significant costs from purchasing natural gas, a key input for its operations. Similarly, its water treatment business requires substantial spending on chemicals necessary for purification processes.

Furthermore, the brewing segment, a notable part of Beijing Enterprises Holdings, involves costs related to sourcing various ingredients. Energy consumption for operating its extensive network of treatment plants, breweries, and other facilities also represents a considerable outlay. In 2023, the company reported that its cost of sales, which includes these raw material and energy components, amounted to approximately HKD 50.6 billion, highlighting the scale of these expenditures.

Effectively managing these fluctuating input costs is paramount for Beijing Enterprises Holdings to safeguard its profit margins. The company’s ability to negotiate favorable terms for natural gas, chemicals, and other raw materials, alongside optimizing energy efficiency across its operations, directly impacts its overall financial performance and profitability.

Daily operational costs, such as fuel for waste treatment, collection, and processing, are a significant part of Beijing Enterprises Holdings' environmental business. These costs are variable, meaning they change based on how much service is provided and how efficiently operations run. For instance, in 2023, the company's environmental segment revenue was HK$11.5 billion, with operational efficiency being a key driver of profitability in this segment.

Personnel and Administrative Expenses

Personnel and administrative expenses are a core component of Beijing Enterprises Holdings' cost structure. These costs encompass employee wages, comprehensive benefits packages, and the general administrative overhead necessary to manage its diverse portfolio of businesses, which spans energy, water, and environmental protection sectors. For instance, in 2023, the company reported significant employee-related expenses across its operations.

- Employee Wages and Benefits: These form a substantial portion of operating costs, reflecting the large workforce across various business segments.

- Administrative Overheads: Costs associated with management, HR, finance, and other support functions are critical for operational continuity.

- Diversified Segment Impact: Managing a broad range of industries necessitates tailored HR and administrative support, increasing overall personnel costs.

- Efficiency Gains: Optimizing these expenses through streamlined processes and effective resource allocation offers a key avenue for cost savings and improved profitability.

Financing Costs and Debt Servicing

Beijing Enterprises Holdings, given its capital-intensive operations, faces significant financing costs. These include interest payments on its substantial debt, which is raised through various loans and bond issuances. Effective management of this debt is paramount for the company's financial health and long-term viability.

The company actively pursues strategies to optimize its debt structure, aiming to reduce overall financing expenses. This proactive approach is essential for maintaining profitability and ensuring the sustainability of its business model.

- Financing Costs: Interest expenses on loans and bonds form a core component of Beijing Enterprises Holdings' cost structure.

- Debt Servicing: The regular repayment of principal and interest on its borrowings is a critical financial obligation.

- Optimization Strategies: The company continuously works to refine its debt profile to lower financing costs.

- Sustainability: Prudent financial management, particularly concerning debt, is vital for the company's enduring success.

Beijing Enterprises Holdings' cost structure is heavily influenced by capital expenditures for infrastructure, raw material and energy procurement, daily operational expenses, personnel and administrative costs, and financing costs. These elements are critical for maintaining and expanding its utility and environmental services, as well as its brewing operations.

| Cost Category | 2023 Figures (approx.) | Significance |

|---|---|---|

| Capital Expenditures | HKD 16.5 billion | Infrastructure development and expansion |

| Cost of Sales (Raw Materials & Energy) | HKD 50.6 billion | Natural gas, chemicals, brewing ingredients, energy consumption |

| Environmental Segment Operational Costs | Variable, linked to HK$11.5 billion revenue | Fuel for waste treatment, collection, processing |

| Personnel & Administrative | Significant employee-related expenses | Wages, benefits, overheads for diverse operations |

| Financing Costs | Interest payments on debt | Debt servicing for capital-intensive operations |

Revenue Streams

Beijing Enterprises Holdings' primary revenue comes from selling and distributing natural gas to homes, businesses, and factories. They also earn money from charging fees to transmit this gas through their pipelines. This is a consistent income stream, bolstered by growing cities and the increasing need for energy.

In 2024, the company's gas sales volume was projected to surpass 65 billion cubic meters, highlighting the sheer scale of their operations and the significant revenue generated from these core activities.

Beijing Enterprises Holdings generates revenue from water supply and sewage treatment services. These fees are charged to municipalities, homes, and businesses for water provision, wastewater processing, and recycled water treatment. This income stream is recurring, largely driven by usage and ongoing service contracts, ensuring a stable financial base.

The company's extensive network of water treatment facilities underpins its ability to deliver these essential services consistently. For instance, in 2023, the company reported significant contributions from its water segment, reflecting the high demand and essential nature of these utilities.

Beijing Enterprises Holdings' environmental segment generates revenue by selling electricity, steam, and heat produced from its waste incineration and waste-to-energy facilities. This is a key revenue stream, particularly in their German operations where they have a strong presence in waste management and energy generation. For instance, in 2023, their waste-to-energy segment in Germany played a significant role in their overall environmental business performance.

Beer Sales

Revenue primarily flows from the production, distribution, and sale of beer. The prominent Yanjing Brewery brand is the cornerstone of this revenue generation. This consumer goods segment is a major contributor to the company's financial performance, heavily influenced by consumer demand and the brand's established market presence.

The strength of the Yanjing brand directly translates into sales volume and pricing power. In 2024, Yanjing Brewery achieved a significant milestone, reporting a record net profit that surpassed RMB1 billion, underscoring the segment's robust financial contribution.

- Primary Revenue Source: Production, distribution, and sale of beer products.

- Key Brand: Yanjing Brewery.

- Market Driver: Consumer demand and brand strength.

- 2024 Performance: Yanjing Brewery reported over RMB1 billion in net profit.

Construction and Project Management Fees

Beijing Enterprises Holdings generates income through construction services for both new infrastructure developments and extensive renovation projects. These construction activities contribute to revenue, offering a component of growth tied to new project initiation.

In addition to direct construction, the company also collects project management fees. These fees are associated with overseeing and executing various projects, adding another layer to its revenue generation strategy.

The company's involvement in Build-Operate-Transfer (BOT) and Transfer-Operate-Transfer (TOT) models further diversifies its revenue streams within the construction and project management segment. These models allow for long-term revenue generation from infrastructure assets.

While these construction and project management revenues might fluctuate more than its stable utility income, they are crucial for capturing opportunities in new project development and infrastructure expansion. For instance, in 2024, the company continued to secure and execute various infrastructure projects, contributing to its overall financial performance.

Beijing Enterprises Holdings' revenue streams are diverse, encompassing utilities, consumer goods, and infrastructure services. The company's core operations in natural gas distribution and water supply provide stable, recurring income, driven by essential public services. Their environmental segment, focused on waste-to-energy, adds another layer of utility-based revenue, particularly in international markets.

| Segment | Primary Revenue Activity | Key Driver | 2024 Data/Insight |

| Natural Gas | Sales and Distribution | Urbanization, Energy Demand | Projected sales volume > 65 billion cubic meters |

| Water | Supply and Sewage Treatment | Usage, Service Contracts | Significant contribution reported in 2023 |

| Environmental | Waste-to-Energy Sales | Waste Management, Energy Generation | Strong performance in German operations (2023) |

| Beer | Production and Sale | Consumer Demand, Brand Strength | Yanjing Brewery net profit > RMB1 billion |

| Construction & Project Management | Infrastructure Development, BOT/TOT | New Project Initiation | Continued project execution in 2024 |

Business Model Canvas Data Sources

The Beijing Enterprises Holdings Business Model Canvas is built upon a foundation of publicly available financial disclosures, extensive market research reports, and internal strategic planning documents. These diverse data sources ensure a comprehensive and accurate representation of the company's operations and market position.