Beijing Enterprises Holdings Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beijing Enterprises Holdings Bundle

Beijing Enterprises Holdings strategically leverages its diverse product portfolio, from essential utilities to consumer goods, to meet a wide range of market needs. Its pricing strategies are carefully calibrated to ensure competitiveness while reflecting the value proposition of its offerings.

Discover how Beijing Enterprises Holdings’s distribution channels ensure widespread accessibility and how their promotional efforts build brand loyalty. Ready to unlock a complete, actionable understanding of their marketing success?

Go beyond this snapshot and gain access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Beijing Enterprises Holdings Limited (BEHL) provides a diverse range of essential utility services, forming a cornerstone of its marketing mix. These offerings are critical for urban development and daily life, ensuring a stable demand base.

Key services include the distribution and sale of piped natural gas, a vital energy source for millions. In 2023, BEHL's gas utility segment reported revenue of HK$64.4 billion, reflecting its significant market penetration.

The company also offers comprehensive water services, covering sewage treatment and the supply of reclaimed water. This segment is crucial for environmental sustainability and public health, with water utility revenue reaching HK$13.9 billion in the same year.

Furthermore, BEHL operates robust solid waste treatment solutions, including advanced waste-to-energy facilities. This segment addresses environmental challenges and contributes to renewable energy generation, with solid waste treatment revenue at HK$4.2 billion for 2023.

Beijing Enterprises Holdings offers comprehensive environmental management solutions, a key part of its product strategy. This includes advanced technologies for solid waste treatment, such as household waste incineration with power generation capabilities. In 2023, the company processed approximately 10 million tons of household waste, highlighting its significant scale in this area.

Beyond household waste, their expertise extends to the crucial sectors of hazardous and medical waste treatment, alongside specialized sludge treatment. These services are vital for public health and environmental safety, contributing to resource recycling and pollution control. The company's commitment to these areas is underscored by its ongoing investments in upgrading treatment facilities.

Beijing Enterprises Holdings Limited (BEHL) commands a comprehensive natural gas value chain, encompassing upstream resource acquisition, midstream transportation infrastructure, and downstream market distribution. This integrated model allows for robust control and optimization across all stages of natural gas provision.

The company's operations extend to critical areas like natural gas storage, ensuring supply stability, and extensive transmission networks. BEHL is also heavily involved in the sales of natural gas, the construction and management of city gas pipelines, and pioneering the development of new energy technologies, demonstrating a commitment to innovation and future growth.

For instance, in 2023, BEHL's natural gas sales volume reached approximately 27.3 billion cubic meters, a testament to its significant market presence and operational capacity. This extensive network and diversified service offering solidify its position as a key player in the energy sector.

Water Resource Management Innovations

Beijing Enterprises Holdings, through its subsidiary Beijing Enterprises Water Group Limited (BEWG), is a leader in water resource management innovations. Their approach encompasses water recycling and ecological protection, demonstrating a commitment to sustainable water solutions.

BEWG's comprehensive strategy integrates every stage of the water cycle, from industrial investment and design to construction, operation, and technical services. This end-to-end management ensures efficient and high-quality water supply and advanced sewage treatment processes.

The company's focus on innovation is evident in its operational achievements. For instance, BEWG managed approximately 1.7 billion cubic meters of wastewater treatment in 2023, a significant volume underscoring their capacity and reach in water resource management.

- Integrated Water Cycle Management: BEWG's model covers investment, design, construction, operation, and technical services for water supply and sewage treatment.

- Water Ecology Protection: The company actively engages in initiatives aimed at safeguarding and restoring water ecosystems.

- Resource Recycling: BEWG prioritizes water recycling technologies to promote efficient use and reduce reliance on fresh water sources.

- Operational Scale: In 2023, BEWG treated an estimated 1.7 billion cubic meters of wastewater, highlighting their substantial operational footprint.

Brewery s

Beijing Enterprises Holdings (BEHL) actively participates in the consumer product market through its brewery segment, primarily driven by Beijing Yanjing Brewery Co., Ltd. This division is dedicated to manufacturing, distributing, and marketing a diverse portfolio of beer products, with a clear objective to regain its position as an industry frontrunner.

The brewery operations are a key component of BEHL's broader strategy, aiming to leverage brand strength and market presence. In 2023, the Chinese beer market saw significant activity, with domestic brands like Yanjing competing fiercely. Despite challenges, BEHL's brewery segment is focused on innovation and market penetration to achieve its leadership aspirations.

- Product Range: Beijing Yanjing Brewery offers a variety of beer types, catering to different consumer preferences.

- Distribution Network: A robust distribution system ensures wide availability across key markets.

- Market Strategy: Focus on brand building and product quality to enhance competitiveness.

- Industry Ambition: The company is actively working to re-establish itself as a leader in the Chinese brewery industry.

Beijing Enterprises Holdings Limited (BEHL) offers a diversified product portfolio centered on essential utilities and consumer goods. Their core offerings include natural gas distribution, water treatment, and solid waste management, alongside a significant presence in the beer market through Beijing Yanjing Brewery. This multi-faceted approach caters to fundamental societal needs and consumer demands.

The company's natural gas segment is a major revenue driver, with sales volumes reaching approximately 27.3 billion cubic meters in 2023. This highlights the extensive reach and critical role of their energy distribution network. Similarly, their water services are substantial, with Beijing Enterprises Water Group (BEWG) treating around 1.7 billion cubic meters of wastewater in 2023, underscoring their contribution to environmental sustainability.

In the solid waste sector, BEHL processed approximately 10 million tons of household waste in 2023, demonstrating a strong commitment to environmental solutions and resource management. The brewery segment, while facing market competition, aims to leverage its brand and distribution to regain industry leadership, offering a range of beer products to consumers.

| Product Segment | Key Offering | 2023 Data Point | Significance |

| Natural Gas Utility | Piped Natural Gas Distribution | 27.3 billion cubic meters (sales volume) | Essential energy source, significant market penetration |

| Water Services | Wastewater Treatment | 1.7 billion cubic meters (treated volume) | Environmental sustainability, public health |

| Solid Waste Treatment | Household Waste Incineration | 10 million tons (processed volume) | Environmental solutions, renewable energy |

| Brewery | Beer Manufacturing & Distribution | Focus on market leadership and brand strength | Consumer goods, market competition |

What is included in the product

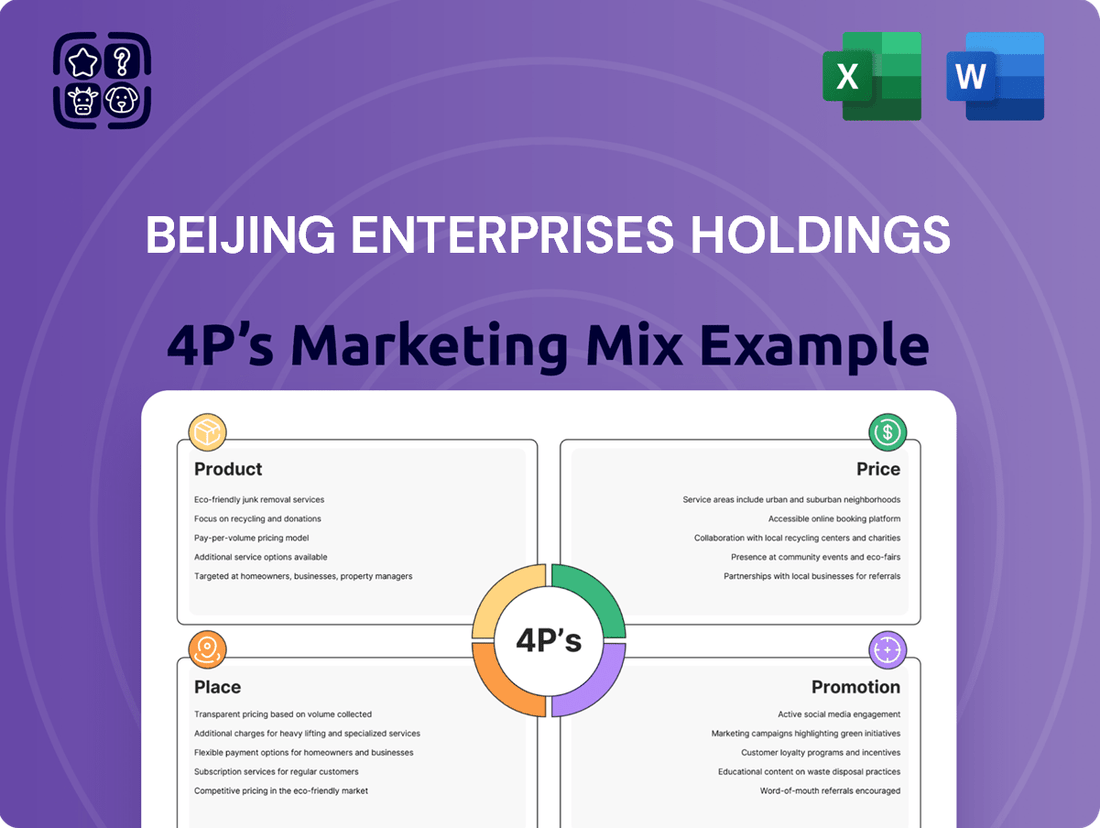

This analysis provides a comprehensive breakdown of Beijing Enterprises Holdings' marketing strategies, examining their Product offerings, Pricing tactics, Place distribution, and Promotion efforts to illuminate their market positioning.

It's designed for professionals seeking a data-driven understanding of Beijing Enterprises Holdings' marketing mix, offering actionable insights for competitive benchmarking and strategic planning.

Simplifies complex marketing strategies into actionable insights, relieving the pain of information overload for busy executives.

Provides a clear, concise overview of Beijing Enterprises Holdings' 4Ps, easing the burden of detailed market analysis for strategic decision-making.

Place

Beijing Enterprises Holdings boasts an extensive gas pipeline network spanning roughly 600,000 kilometers across China. This formidable infrastructure is key to their distribution strategy, allowing them to efficiently deliver natural gas to a massive customer base. As of recent reports, this network serves over 57 million gas subscribers, solidifying their position as a leader in the city gas sector.

Beijing Enterprises Holdings boasts an extensive network of 1,472 water treatment and sewage facilities across China, with a significant design capacity of approximately 44 million tons daily. This vast infrastructure underpins its market presence.

The company's reach extends beyond 20 provinces and major municipalities in Mainland China, demonstrating a strong domestic footprint. Furthermore, its operations span international markets, including Portugal, Singapore, Australia, and Saudi Arabia, highlighting a global diversification strategy.

Beijing Enterprises Holdings (BEHL) actively manages its environmental operations both domestically and internationally. The company operates 18 solid waste treatment projects across Mainland China, demonstrating a strong commitment to addressing environmental challenges within its home market.

Internationally, BEHL has established a significant footprint with 17 solid waste treatment projects, notably through its German subsidiary EEW Energy from Waste GmbH. This European presence, particularly in Germany, allows BEHL to tap into diverse markets and leverage varied regulatory landscapes and technological advancements in waste management.

Established Brewery Distribution Channels

Beijing Enterprises Holdings leverages its robust distribution network for its brewery products, primarily from Beijing Yanjing Brewery, to ensure widespread consumer access. This strategic approach focuses on effective market penetration, aiming to increase the availability of its beer brands and strengthen its competitive standing. For instance, in 2023, Beijing Yanjing Brewery maintained a significant market share in key regions, supported by its extensive sales force and established relationships with wholesalers and retailers across China.

The company's distribution strategy emphasizes reaching diverse consumer segments through various channels:

- Extensive Retail Network: Access to a vast number of supermarkets, convenience stores, and smaller local shops, ensuring product availability in urban and rural areas.

- On-Premise Channels: Strong presence in restaurants, bars, and entertainment venues, catering to social consumption occasions.

- E-commerce Integration: Growing online sales presence through partnerships with major e-commerce platforms, reaching a younger, digitally-savvy demographic.

- Wholesale Partnerships: Maintaining strong ties with regional distributors who manage logistics and sales to a broad base of smaller retailers.

Strategic Infrastructure Investments

Beijing Enterprises Holdings' strategy is deeply rooted in ongoing, strategic investments in crucial urban infrastructure. This commitment ensures the development and enhancement of vital services like gas pipelines, water treatment, and waste management, directly benefiting a massive customer base with dependable service.

These investments are not just about maintaining current operations but also about future-proofing the company's service delivery capabilities. For instance, in 2023, the company continued its robust capital expenditure program, with significant portions allocated to upgrading and expanding its gas and water networks to meet growing demand and improve operational efficiency.

- Gas Infrastructure: Continued expansion and modernization of the natural gas pipeline network to enhance supply reliability and reach.

- Water Treatment: Investments in advanced water treatment facilities to ensure high-quality water supply and compliance with stringent environmental standards.

- Waste Management: Development of new waste-to-energy plants and optimization of existing facilities to improve recycling rates and energy recovery.

- Technological Integration: Implementing smart technologies and digital solutions across infrastructure assets for better monitoring, control, and predictive maintenance.

Beijing Enterprises Holdings' Place strategy leverages its extensive infrastructure as a primary distribution channel for its core utility services. The company's vast network of gas pipelines, water treatment facilities, and solid waste management plants ensures widespread availability and accessibility across China and internationally. This physical presence is fundamental to serving over 57 million gas subscribers and managing millions of tons of water daily.

| Service Area | Key Infrastructure | Geographic Reach |

|---|---|---|

| Natural Gas | 600,000 km pipeline network | Across China, serving 57 million+ subscribers |

| Water & Sewage | 1,472 treatment facilities | Across 20+ provinces in China |

| Solid Waste Management | 18 projects in Mainland China, 17 internationally | China, Germany, Portugal, Singapore, Australia, Saudi Arabia |

Full Version Awaits

Beijing Enterprises Holdings 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Beijing Enterprises Holdings 4P's Marketing Mix Analysis is fully complete and ready for immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

Beijing Enterprises Holdings prioritizes corporate transparency, a key element of its marketing mix, by actively engaging its investors. The company consistently publishes detailed financial reports, such as its interim results for the six months ended June 30, 2024, which reported a profit attributable to equity holders of HK$3,937 million. This commitment ensures stakeholders have a clear understanding of the company's financial health and operational progress.

Investor relations are central to this transparency strategy. Beijing Enterprises Holdings regularly disseminates company announcements and presentations, offering insights into its strategic direction and performance. For instance, their investor day presentations in 2024 likely covered updates on their energy and environmental businesses, crucial for investor confidence.

Beijing Enterprises Holdings actively showcases its dedication to sustainable growth and robust ESG principles via its comprehensive sustainability reports. These reports detail significant initiatives in areas like climate change mitigation and biodiversity preservation, bolstering its reputation and appeal to ethically-minded investors.

Beijing Enterprises Holdings (BEHL) emphasizes its public service role, aligning promotions with its utility and environmental services. This includes community outreach and awareness campaigns focused on sustainability and resource efficiency, reflecting a commitment to urban development.

In 2023, BEHL's environmental segment, for instance, managed over 2.3 million tonnes of waste, showcasing its direct contribution to public well-being and environmental protection through its operational activities.

Industry Leadership Recognition

Beijing Enterprises Water Group Limited (BEWG), a pivotal subsidiary of Beijing Enterprises Holdings, actively leverages its industry leadership for promotional advantage. Its persistent self-portrayal as China's largest integrated water company and its consistent inclusion in the 'Top 10 Influential Enterprises in Water Industry' rankings underscore its market dominance and operational excellence.

This strategic positioning as an industry leader directly enhances its brand perception, fostering trust and signaling reliability to stakeholders. For instance, in 2023, BEWG reported a substantial revenue of RMB 26.8 billion, a testament to its scale and operational capacity, further validating its leadership claims.

- Market Leader Status: Consistently recognized as China's largest integrated water services provider.

- Industry Influence: Frequently ranked among the top 10 most influential enterprises in the water sector.

- Brand Credibility: Leadership recognition builds trust and signals expertise to customers and investors.

- Operational Scale: Financial performance, such as its 2023 revenue of RMB 26.8 billion, supports its leading market position.

Brand Building for Brewery Segment

Beijing Yanjing Brewery is heavily invested in brand building for its brewery segment, aiming to elevate its market presence. A key strategy involves accelerating the development of 'U8' into a million-ton bulk single product. This focus is designed to significantly boost product recognition and stimulate consumer demand.

This brand-building push is a core component of Beijing Enterprises Holdings' marketing mix. By concentrating on a flagship product like 'U8', the company seeks to create a stronger brand identity and capture a larger market share. This initiative is part of a broader marketing upgrade strategy to enhance competitiveness within the brewery sector.

- Brand Focus: Beijing Yanjing Brewery prioritizes brand building and marketing upgrades for its brewery operations.

- Flagship Product Strategy: Acceleration of 'U8' to become a million-ton bulk single product is a central initiative.

- Objective: The goal is to enhance product recognition and drive increased consumer demand.

Beijing Enterprises Holdings leverages its market leadership and commitment to sustainability as key promotional tools. The company's consistent recognition as China's largest integrated water company, exemplified by Beijing Enterprises Water Group's 2023 revenue of RMB 26.8 billion, builds significant brand credibility. Furthermore, its active promotion of ESG principles, as seen in its sustainability reports, appeals to a growing segment of ethically-minded investors and consumers.

The brewery segment, Beijing Yanjing Brewery, focuses on enhancing brand recognition through strategic product development, aiming to make its 'U8' brand a million-ton bulk single product. This targeted approach aims to boost consumer demand and market share within the competitive beverage industry.

Beijing Enterprises Holdings also emphasizes its public service role through community outreach and awareness campaigns, particularly in sustainability and resource efficiency. Its environmental segment's management of over 2.3 million tonnes of waste in 2023 highlights its direct contribution to public well-being and environmental protection, reinforcing its image as a responsible corporate citizen.

Price

Regulated pricing for essential utilities like natural gas and water is a cornerstone of Beijing Enterprises Holdings' strategy. In 2023, the company navigated these regulations, which aim to balance affordability for consumers with the need for sustainable operations. For instance, the average gas retail price in Beijing remained stable, reflecting government policy to keep energy costs manageable for households and businesses.

Beijing Enterprises Holdings likely employs value-based pricing for its environmental solutions, particularly for specialized services such as hazardous waste treatment and waste-to-energy. This strategy aligns the price with the significant environmental benefits and operational efficiencies delivered to clients, such as reduced pollution and compliance with stringent regulations.

The pricing reflects the advanced technology and high-quality, sustainable nature of their offerings. For instance, in 2023, the company's environmental segment revenue grew by 12.5%, indicating strong market demand and the perceived value of their advanced solutions in addressing critical environmental challenges.

Beijing Enterprises Holdings, through its Yanjing Brewery, navigates a fiercely competitive consumer market. This means pricing decisions are directly shaped by what consumers are willing to pay, what rivals are charging, and how Yanjing positions itself against them. The strategy aims for pricing that not only attracts customers but also fuels both market share expansion and healthy profits.

In 2023, the Chinese beer market saw intense competition, with major players like Tsingtao and Snow holding significant market share. Yanjing's pricing must therefore be carefully calibrated to offer value. For instance, while specific 2024/2025 pricing data for Yanjing isn't publicly available yet, industry analysis from late 2023 indicated that premium domestic lagers often retailed between 5-15 RMB per bottle, with value-oriented options available below 5 RMB.

Optimized Capital Structure and Financing Costs

Beijing Enterprises Holdings (BEHL) strategically manages its capital structure to minimize financing costs, a crucial element that indirectly supports competitive pricing for its diverse range of services. By actively seeking out and securing debt at favorable interest rates, the company aims to reduce its overall cost of capital, thereby enhancing its ability to maintain stable and attractive pricing for consumers.

Recent financial maneuvers by BEHL demonstrate this commitment. For instance, the company successfully issued bonds in the recent past, securing funds at competitive rates. This proactive approach to debt management directly translates into lower interest expenses, which in turn helps to insulate its service pricing from significant upward pressure.

- Optimized Debt Issuance: BEHL's recent bond issuances have targeted competitive interest rates, aiming to lower overall financing expenses.

- Impact on Operational Costs: Reduced financing costs contribute to lower operational expenses, providing flexibility in service pricing.

- Financial Stability: A well-managed capital structure enhances financial stability, supporting consistent service delivery and pricing.

Dividend Policy Reflecting Financial Stability

Beijing Enterprises Holdings’ consistent dividend policy, including its proposed final dividend for 2024 payable in 2025, underscores its robust financial stability. For instance, the company announced a final dividend of HK$0.48 per share for the year ended December 31, 2023, payable in May 2024, demonstrating a pattern of shareholder returns. This financial health directly bolsters investor confidence, indirectly supporting pricing strategies by signaling long-term viability and the capacity for ongoing investment in service quality and infrastructure.

The company's commitment to a stable dividend payout, such as the proposed HK$0.48 final dividend for 2023, serves as a tangible indicator of its financial resilience. This stability is crucial for pricing, as it reassures customers and stakeholders of Beijing Enterprises Holdings’ enduring operational capacity and its ability to reinvest in enhancing its services and infrastructure, thereby justifying premium pricing or maintaining competitive advantages.

Key aspects of their dividend policy include:

- Consistent Payouts: A history of regular dividend payments, reflecting stable earnings.

- Future Commitments: Proposed final dividends for 2024, expected to be paid in 2025, signal ongoing financial strength.

- Investor Confidence: The policy builds trust, supporting the company's market position and pricing power.

- Reinvestment Capacity: Demonstrated financial stability allows for continued investment in service improvements and infrastructure development.

Beijing Enterprises Holdings' pricing strategy for its core utility businesses, such as natural gas and water, is heavily influenced by government regulations. These regulations aim to ensure affordability for consumers while allowing for sustainable operations. For instance, the company's gas retail pricing in Beijing remained stable throughout 2023, aligning with policy to manage household energy costs.

In its environmental solutions segment, Beijing Enterprises Holdings likely adopts value-based pricing. This approach ties the price of services like hazardous waste treatment and waste-to-energy to the significant environmental benefits and operational efficiencies they provide to clients. The 12.5% revenue growth in this segment in 2023 suggests that customers perceive substantial value in these advanced solutions.

For its Yanjing Brewery, pricing is a dynamic response to a competitive market. The company must consider consumer willingness to pay, competitor pricing, and its own brand positioning to achieve both market share and profitability. Industry data from late 2023 indicated that domestic premium lagers typically ranged from 5 to 15 RMB per bottle, with value options available below 5 RMB.

| Segment | Pricing Strategy | Key Considerations | 2023 Data/Insights |

|---|---|---|---|

| Utilities (Gas, Water) | Regulated Pricing | Affordability, Sustainable Operations | Stable average gas retail price in Beijing |

| Environmental Solutions | Value-Based Pricing | Environmental Benefits, Operational Efficiencies | 12.5% revenue growth in environmental segment |

| Consumer Goods (Yanjing Beer) | Competitive Pricing | Consumer Willingness to Pay, Competitor Pricing, Brand Positioning | Industry pricing for premium lagers: 5-15 RMB/bottle |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Beijing Enterprises Holdings is meticulously constructed using official company disclosures, including annual reports and investor presentations. We also leverage industry-specific market research and competitive intelligence to provide a comprehensive view of their product offerings, pricing strategies, distribution networks, and promotional activities.