Beijing Enterprises Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beijing Enterprises Holdings Bundle

Beijing Enterprises Holdings operates in a dynamic sector where supplier power can significantly impact costs, and the threat of new entrants demands constant innovation. Understanding these pressures is crucial for any stakeholder.

The complete report reveals the real forces shaping Beijing Enterprises Holdings’s industry—from buyer power to the intensity of rivalry. Gain actionable insights to drive smarter decision-making and competitive advantage.

Suppliers Bargaining Power

The bargaining power of suppliers for Beijing Enterprises Holdings Limited is significantly shaped by the concentration of those providing essential inputs like natural gas and advanced environmental technologies. For instance, China's considerable dependence on imported natural gas means international suppliers of LNG and pipeline gas hold substantial sway over pricing and the reliability of supply.

Looking ahead, the anticipated stabilization of wholesale natural gas prices in 2025 could potentially moderate this supplier influence, especially as market reforms continue to evolve within the sector.

In the water and solid waste treatment sectors, the need for cutting-edge technology and specialized equipment is on the rise, driven by substantial infrastructure spending and stricter environmental rules. This situation can give an edge to suppliers offering unique or vital treatment solutions, as their offerings are crucial for Beijing Enterprises Holdings Limited (BEHL) to comply with changing industry benchmarks and enhance its operational capacity.

Beijing Enterprises Holdings, through its brewery operations like Yanjing Brewery, experiences significant bargaining power from its suppliers, particularly for agricultural raw materials such as barley and essential packaging materials. In 2024, the global price of barley saw an upward trend, influenced by weather patterns and geopolitical factors, directly impacting the cost of goods sold for breweries.

This reliance on a concentrated supplier base for key inputs grants these suppliers considerable negotiation leverage. For instance, increases in the cost of aluminum for cans or glass for bottles, which are critical for product presentation and preservation, can directly squeeze profit margins for Yanjing Brewery if these costs cannot be fully passed on to consumers.

Regulatory Environment and State-Owned Suppliers

Beijing Enterprises Holdings (BEHL) may encounter state-owned or heavily regulated suppliers for essential utility inputs within China's economic landscape. This can shift supplier power dynamics, as pricing and availability may be shaped by national policies and strategic objectives rather than pure market competition, potentially reducing BEHL's bargaining leverage.

This regulatory influence can limit BEHL's ability to negotiate favorable terms, as state-owned entities often operate under different mandates. For instance, in 2023, China's state-owned enterprises accounted for a significant portion of the nation's industrial output, highlighting the pervasive influence of state control on supply chains.

- State-Owned Dominance: The prevalence of state-owned enterprises in China's utility sector can centralize supplier power.

- Policy-Driven Pricing: Government policies and national strategies, rather than market forces, can dictate supplier pricing for critical inputs.

- Limited Negotiation Flexibility: BEHL may face reduced room for negotiation when dealing with suppliers whose operations are intrinsically linked to state economic planning.

Switching Costs for Critical Infrastructure Components

Switching costs for critical infrastructure components are a significant factor in the bargaining power of suppliers for Beijing Enterprises Holdings (BEHL). These costs can be substantial when dealing with specialized pipelines, large-scale treatment plant machinery, or proprietary software essential for network management.

Once BEHL has deeply integrated specific systems or technologies from a particular supplier, the process of changing to a new vendor becomes both disruptive and financially burdensome. This inherent stickiness significantly bolsters the leverage of existing suppliers.

- High Integration Costs: The initial investment and integration effort for specialized infrastructure components create a high barrier to switching.

- Operational Disruption: Changing suppliers for critical systems can lead to temporary shutdowns or reduced operational efficiency, impacting service delivery.

- Proprietary Technology Dependence: Reliance on proprietary software or unique machinery locks BEHL into specific supplier ecosystems, limiting alternatives.

The bargaining power of suppliers for Beijing Enterprises Holdings (BEHL) is substantial, particularly for natural gas, where reliance on international LNG and pipeline gas suppliers grants them significant pricing leverage, a factor amplified by China's import dependency. In 2024, global natural gas prices remained volatile, impacting BEHL's operational costs.

For its brewery segment, Yanjing Brewery faces strong supplier power in agricultural inputs like barley, with 2024 seeing upward price pressures due to weather and geopolitical events. This cost escalation for raw materials and packaging materials like aluminum and glass directly affects BEHL's profitability.

High switching costs for specialized infrastructure and technology in BEHL's utility and environmental sectors further empower suppliers, as integrating new systems is both costly and disruptive, locking BEHL into existing vendor relationships.

| Input Category | Key Suppliers | Supplier Power Drivers | 2024 Impact/Trend | BEHL Segment Affected |

|---|---|---|---|---|

| Natural Gas | International LNG/Pipeline Suppliers | Import Dependency, Geopolitics | Volatile Pricing, Supply Reliability Concerns | Energy Utilities |

| Barley | Agricultural Cooperatives, Large Farms | Weather Patterns, Global Demand | Upward Price Pressure | Brewery (Yanjing) |

| Packaging Materials (Aluminum, Glass) | Major Material Producers | Commodity Prices, Manufacturing Concentration | Cost Increases, Margin Squeeze | Brewery (Yanjing) |

| Environmental Tech/Machinery | Specialized Equipment Manufacturers | Proprietary Technology, High Integration Costs | Supplier Lock-in, Limited Alternatives | Water & Solid Waste Treatment |

What is included in the product

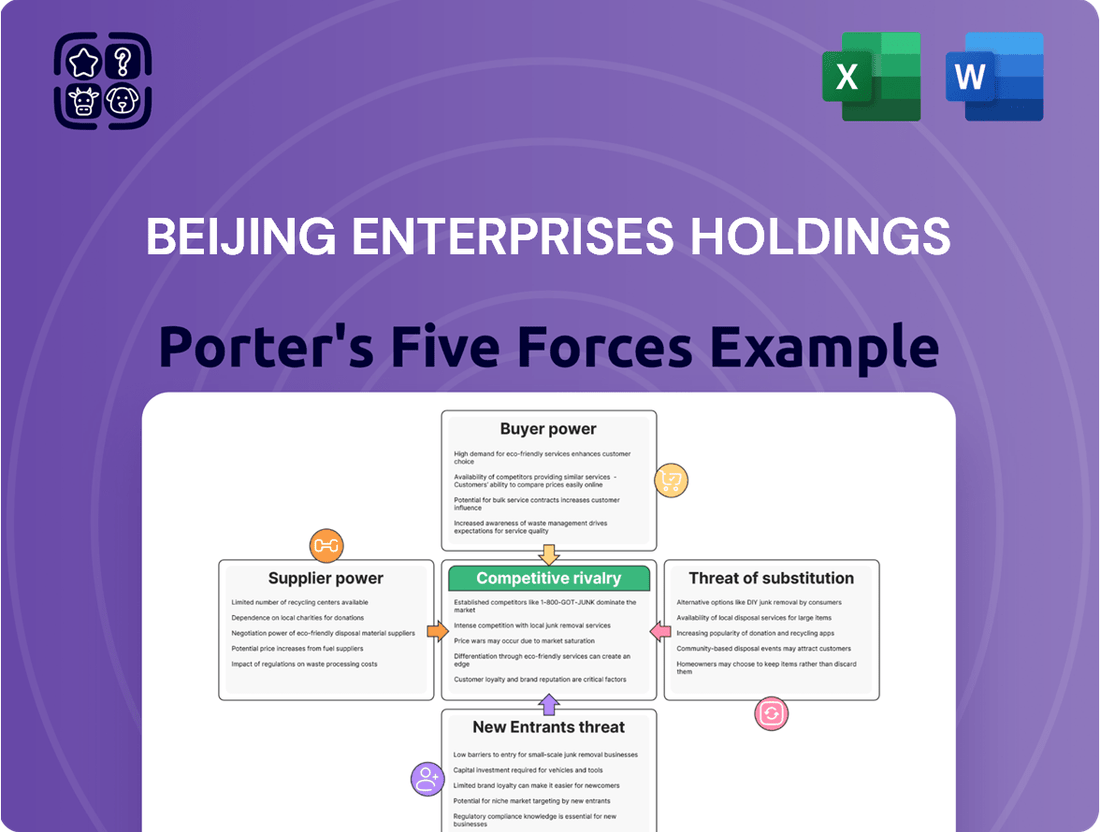

This analysis dissects the competitive landscape for Beijing Enterprises Holdings, examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its business.

Instantly visualize the competitive landscape for Beijing Enterprises Holdings, highlighting key pressures from rivals and new entrants to inform strategic adjustments.

Customers Bargaining Power

Beijing Enterprises Holdings' (BEHL) utility services, such as piped gas and water distribution, cater to millions of residential and commercial clients. This sheer volume of individual customers means that each client, on their own, has minimal influence over pricing or service terms. In 2023, BEHL reported serving over 20 million gas customers across its operational regions, highlighting the fragmented nature of its customer base.

The essential nature of these utility services, combined with often exclusive operating rights or limited competition within specific geographic territories, further diminishes the bargaining power of individual customers. For instance, in many of its key markets, BEHL operates under government-regulated tariffs, which are set through a public process, not through direct negotiation with individual consumers. This regulatory framework inherently caps the leverage any single customer can exert.

Municipal governments and large industrial clients, especially in water and waste treatment, hold considerable sway over Beijing Enterprises Holdings (BEHL). These major customers procure vast volumes of services, giving them significant leverage in contract negotiations. Their ability to influence long-term agreements and the inherent governmental oversight on utility pricing and service standards empower them to dictate terms and service quality expectations.

In the competitive beer landscape, consumers and distributors hold significant sway. With a plethora of domestic and international brands readily available, customers face minimal switching costs, directly impacting Yanjing Brewery's pricing power and profitability.

Regulatory Control over Utility Tariffs

The bargaining power of customers for Beijing Enterprises Holdings (BEHL) is significantly influenced by regulatory control over utility tariffs in China. Pricing for essential services like gas and water is not solely determined by market forces but requires government approval, effectively channeling customer influence through policy.

This regulatory oversight means that while BEHL benefits from revenue stability, customer tariffs are managed by bodies that consider public interest. This indirect exercise of power through government policy limits BEHL's ability to unilaterally adjust prices based on demand alone.

- Government Approval: Tariffs for Beijing Gas Group and Beijing Water Group, BEHL's key subsidiaries, are subject to approval by provincial and municipal price bureaus.

- Revenue Stability: Regulated pricing provides a predictable revenue stream, insulating BEHL from extreme price volatility that might occur in less regulated markets.

- Limited Pricing Flexibility: BEHL cannot freely set prices to maximize profit; adjustments are tied to regulatory cycles and economic conditions deemed acceptable by authorities.

Demand for Integrated Solutions and Service Quality

Customers, particularly industrial and municipal clients, are increasingly seeking integrated environmental management and infrastructure solutions. This demand elevates their bargaining power, as they can leverage their need for comprehensive services across the value chain to push Beijing Enterprises Holdings (BEHL) towards more holistic and efficient offerings. For instance, in 2024, a significant trend saw major municipalities consolidating waste management and water treatment contracts, favoring providers capable of end-to-end service delivery. This shift means clients can negotiate better terms by bundling multiple service requirements, thereby influencing BEHL's pricing and service customization.

- Demand for integrated solutions: Clients are looking for single providers to manage multiple environmental and infrastructure needs, from waste disposal to water purification.

- Service quality expectations: High standards in operational efficiency, reliability, and environmental compliance are critical for securing and retaining large contracts.

- Consolidation of contracts: Municipalities and large industrial players are increasingly consolidating their service providers, increasing the leverage of these major customers.

- Negotiating power: The ability to offer bundled services allows customers to negotiate more favorable pricing and contract terms with BEHL.

While individual residential customers have minimal bargaining power due to the essential nature of utilities and regulated pricing, large industrial and municipal clients exert significant influence. These major consumers can negotiate favorable terms by bundling services and leveraging their substantial volume requirements.

In 2024, the trend of municipalities consolidating environmental service contracts further amplified the bargaining power of these key clients. This allows them to demand integrated solutions and better pricing from providers like Beijing Enterprises Holdings (BEHL).

| Customer Segment | Bargaining Power Level | Key Influencing Factors |

|---|---|---|

| Residential Customers | Low | Large volume of individual users, regulated tariffs |

| Industrial & Municipal Clients | High | High volume procurement, demand for integrated solutions, contract consolidation |

Preview Before You Purchase

Beijing Enterprises Holdings Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Beijing Enterprises Holdings, providing a detailed examination of industry competitiveness. The document you see here is the exact, fully formatted report you will receive immediately after purchase, offering actionable insights without any placeholders or alterations. You're looking at the actual document; once your purchase is complete, you’ll gain instant access to this exact file, ready for your strategic planning needs.

Rivalry Among Competitors

The Chinese beer market is incredibly competitive, with a crowded field of both local breweries and global giants battling for consumer attention. This intense rivalry means companies must constantly innovate and market effectively to stand out.

Despite some players like Yanjing Brewery seeing strong performance, with a record net profit in 2023 and outperforming the industry's growth, the broader market outlook presents challenges. Projections suggest a decline in beer volumes for 2025, which will likely heat up competition further, potentially leading to price adjustments and increased spending on advertising.

In the city gas and water sectors, Beijing Enterprises Holdings often operates within a framework of localized, regulated competition. This means that within specific service territories, the company frequently enjoys a monopolistic or dominant position, limiting direct head-to-head rivalry. However, competition can still surface during competitive bidding processes for new infrastructure projects, concession renewals, or when expanding into previously unserved geographic areas.

The solid waste treatment and environmental protection sectors in China are experiencing robust growth, attracting substantial investment and intensifying competitive rivalry. This dynamism means companies like Beijing Enterprises Holdings Limited (BEHL) face a market where new technologies and emerging players are constantly entering.

Despite BEHL's established presence and numerous operational projects, the market's expansion and the influx of innovation necessitate continuous adaptation. To maintain its leadership, BEHL must prioritize ongoing innovation and operational efficiency improvements in response to this evolving competitive landscape.

Diversified Portfolio and Cross-Sector Rivalry

Beijing Enterprises Holdings Limited (BEHL) operates in a multifaceted competitive environment due to its diversified portfolio spanning gas, water, waste management, and beer. This broad operational scope means BEHL encounters distinct competitive pressures in each sector, demanding tailored strategies to counter specialized rivals. For instance, in the gas distribution market, competition might arise from other utility providers or emerging alternative energy sources, while the water sector faces challenges from municipal authorities and other infrastructure companies.

This diversification, while a strength in risk mitigation, necessitates a keen understanding of varied competitive dynamics. BEHL must maintain robust, sector-specific strategies to effectively compete against highly focused players in each of its core businesses. The company's 2023 performance, for example, showed varied segment contributions, with its gas segment remaining a significant revenue driver, yet facing evolving market conditions and regulatory landscapes that impact competitive intensity.

- Gas Distribution: Competition from alternative energy sources and other infrastructure providers.

- Water and Wastewater: Rivalry from municipal entities and other utility operators.

- Waste Management: Competition from private waste disposal firms and evolving recycling technologies.

- Beer Segment: Intense competition from both domestic and international brewing giants, with market share often influenced by brand loyalty and distribution networks.

Government Policies and Market Consolidation

Government policies significantly shape competitive rivalry in the urban pipeline gas sector. Initiatives aimed at large-scale integration, like those seen in China's push for consolidation, can reduce the number of independent operators.

For example, in 2024, Beijing Enterprises Holdings, a major player, continues to navigate a landscape where government directives encourage mergers and acquisitions to create more efficient, larger entities. This consolidation intensifies competition among the remaining dominant players, who must now focus on scale and operational efficiency to thrive.

Stringent environmental regulations also play a crucial role. Compliance often requires substantial investment, favoring larger companies with greater financial capacity. This can further drive consolidation as smaller, less capitalized firms struggle to meet new standards, ultimately altering the competitive intensity among the larger, more compliant businesses.

- Government Integration Initiatives: Policies promoting the consolidation of urban pipeline gas networks aim to create economies of scale and improve operational efficiency.

- Environmental Regulations: Stricter environmental standards necessitate significant capital investment, potentially disadvantaging smaller competitors and favoring larger, more established firms.

- Intensified Competition Among Larger Players: Market consolidation, driven by policy, leads to fewer, but larger, competitors who engage in more intense rivalry focused on efficiency and market share.

- Impact on Beijing Enterprises Holdings: The company must adapt to these policy-driven shifts, leveraging its scale to meet regulatory demands and compete effectively in a consolidating market.

Competitive rivalry within Beijing Enterprises Holdings' diverse portfolio is shaped by sector-specific dynamics and overarching market trends. In the beer segment, intense competition from both domestic and international players, including significant players like Tsingtao Brewery and Anheuser-Busch InBev, necessitates continuous innovation and aggressive marketing. For instance, Yanjing Brewery's record net profit in 2023 highlights the potential for strong performance even amidst this rivalry, though overall market volume projections for 2025 suggest heightened competition ahead.

The company's utility segments, like gas and water distribution, often experience more localized competition, frequently dominated by municipal entities or regulated monopolies. However, competition can emerge during bidding for new projects or concession renewals. Meanwhile, the solid waste treatment sector is rapidly expanding, attracting new entrants and advanced technologies, forcing BEHL to prioritize innovation and efficiency to maintain its competitive edge against a growing field of specialized firms.

| Segment | Key Competitors | Competitive Dynamics |

| Beer | Tsingtao Brewery, Anheuser-Busch InBev, Carlsberg | Intense rivalry, brand loyalty, distribution networks, price competition. Yanjing Brewery's 2023 performance indicates potential for strong individual player success. |

| Gas Distribution | Other utility providers, alternative energy sources | Localized, often regulated; competition arises in project bidding and concessions. Government consolidation initiatives in 2024 are intensifying rivalry among larger entities. |

| Water and Wastewater | Municipal entities, other infrastructure companies | Primarily regulated, with competition focused on service territories and project bids. |

| Solid Waste Treatment | Private waste disposal firms, emerging technology providers | Rapidly growing market, high investment, intense rivalry driven by new technologies and players. |

SSubstitutes Threaten

The threat of substitutes for natural gas is a significant consideration for Beijing Enterprises Holdings Limited (BEHL). In industrial and residential sectors, electricity, liquefied petroleum gas (LPG), and other fossil fuels like coal and oil present viable alternatives. For instance, in 2024, China's continued investment in expanding its renewable energy capacity, particularly solar and wind power, aims to displace a portion of fossil fuel consumption, indirectly impacting natural gas demand.

While government mandates often favor natural gas for its cleaner burning properties, especially in urban areas to combat air pollution, the long-term trajectory of energy policy is increasingly geared towards decarbonization. Advancements in battery storage and grid modernization are making electricity a more competitive and reliable substitute, especially for heating and industrial processes. Furthermore, ongoing improvements in energy efficiency across all sectors mean that overall energy demand may grow slower than anticipated, further pressuring natural gas consumption.

While Beijing Enterprises Holdings Limited (BEHL) provides essential piped water infrastructure, consumers have readily available substitutes for drinking water. Bottled water and residential water treatment systems represent significant alternatives, particularly as consumer awareness around water quality grows and disposable incomes rise in China. For instance, the bottled water market in China saw substantial growth, with sales reaching billions of dollars annually in recent years, indicating a strong consumer preference for perceived higher quality or convenience.

These substitutes, however, do not entirely replace the fundamental need for BEHL's core service: the provision of piped water for daily use beyond drinking, such as sanitation and cooking. While consumers might opt for bottled water for consumption, the infrastructure for these other essential uses remains indispensable. The increasing disposable income, which reached over 40,000 yuan per capita in China by the end of 2023, further fuels the demand for these premium or alternative water solutions.

The threat of substitutes for solid waste treatment, particularly landfilling, is significantly decreasing. China's commitment to a circular economy and aggressive recycling goals, alongside the rapid development of waste-to-energy (WTE) facilities, is actively phasing out traditional landfilling.

By 2023, China had over 400 WTE plants in operation, demonstrating a clear shift away from landfills. This expansion means fewer municipalities are relying on landfills as the primary waste disposal method, weakening their position as a viable substitute for advanced treatment solutions.

Diverse Beverage Choices Beyond Beer

The brewery segment, including Beijing Enterprises Holdings, faces a substantial threat from a vast array of beverage substitutes. Consumers have readily available alternatives such as wine, spirits, and the traditional Chinese spirit, baijiu. For instance, the global wine market was valued at approximately $340 billion in 2023 and is projected to grow, indicating a strong alternative preference.

Furthermore, the rise in health consciousness is fueling demand for non-alcoholic options, including soft drinks and a growing market for non-alcoholic beer itself. The global non-alcoholic beer market reached an estimated $23.4 billion in 2023, showcasing a significant shift in consumer behavior that directly impacts traditional beer sales.

- Widespread Availability: Consumers can easily access a diverse range of alcoholic and non-alcoholic beverages.

- Shifting Consumer Preferences: Health trends and evolving tastes are driving a move towards alternatives like non-alcoholic beer and spirits.

- Market Value of Substitutes: The significant market size of competing beverage categories, such as wine and non-alcoholic beer, highlights the competitive pressure.

Decentralized Infrastructure and Self-Sufficiency Trends

While Beijing Enterprises Holdings primarily serves urban populations, a growing trend towards decentralized infrastructure and self-sufficiency presents a nascent threat. In specific industrial or large-scale commercial settings, entities might explore on-site generation of power or water treatment, reducing reliance on traditional utility providers. For instance, advancements in microgrid technology and renewable energy solutions are making localized energy independence more feasible for large industrial parks or campuses.

This shift could, over the long term, erode the customer base for centralized utilities. While not a significant factor for typical urban residential customers today, substantial technological breakthroughs could enable greater self-reliance. For example, by 2024, the global distributed generation market was projected to reach over $200 billion, indicating a strong growth trajectory for alternative energy solutions.

- Decentralized Infrastructure: Emerging technologies enable localized energy and water solutions.

- Self-Sufficiency Trends: Industrial and commercial entities may seek to reduce dependence on centralized providers.

- Technological Advancements: Innovations in microgrids and renewables are key drivers of this trend.

- Market Growth: The distributed generation market is expanding, indicating increasing adoption of alternative solutions.

The threat of substitutes for natural gas is moderate but growing for Beijing Enterprises Holdings. While electricity and LPG are alternatives, government policy favoring gas for environmental reasons remains strong. However, China's rapid expansion of renewables, with solar and wind capacity increasing significantly by 2024, indirectly pressures natural gas demand.

For BEHL's water services, bottled water and home filtration systems are substitutes, especially with rising incomes in China, exceeding 40,000 yuan per capita by late 2023. Despite this, piped water remains essential for sanitation and cooking, limiting the substitutability for these core functions.

The threat of substitutes for solid waste treatment is low and decreasing. China's focus on waste-to-energy (WTE) plants, with over 400 operational by 2023, actively replaces landfilling, making it a less viable alternative.

The brewery segment faces a high threat from diverse beverage substitutes. The global wine market, valued around $340 billion in 2023, and the non-alcoholic beer market, reaching $23.4 billion in 2023, highlight significant consumer shifts towards alternatives driven by health consciousness and evolving tastes.

Entrants Threaten

The city gas distribution, water services, and solid waste treatment sectors demand massive upfront capital for infrastructure like extensive pipeline networks and treatment plants. For instance, Beijing Enterprises Holdings' gas distribution segment alone involves continuous investment in maintaining and expanding its vast network, with capital expenditures often running into billions of RMB annually. This high financial hurdle makes it exceptionally difficult for new players to enter and compete effectively.

The utility and environmental protection sectors in China are subject to a highly stringent regulatory framework. New entrants must secure numerous complex permits and licenses, often requiring extensive documentation and proof of compliance with rigorous environmental and safety standards. For instance, in 2024, the Ministry of Ecology and Environment continued to emphasize stricter enforcement of pollution control regulations, making it more challenging for new companies to obtain operating permits without a proven track record and substantial investment in compliance technology.

Obtaining government concessions for specific operational regions further solidifies this barrier. These concessions are typically awarded through competitive bidding processes or direct negotiations with government bodies, favoring established players with strong relationships and demonstrated capabilities. The lengthy and often opaque nature of these concession processes can deter potential new entrants, effectively limiting competition and protecting incumbent firms like Beijing Enterprises Holdings.

Beijing Enterprises Holdings Limited (BEHL) benefits from substantial economies of scale, particularly in its gas and water utility operations. This scale translates into lower per-unit costs for production, transportation, and customer service, making it difficult for new entrants to compete on price. For instance, BEHL's extensive gas pipeline network across China, built over years, represents a massive capital investment that new players would need to replicate.

The established distribution networks are a formidable barrier. BEHL's long-standing relationships with municipalities and its comprehensive infrastructure for delivering gas and water to millions of customers are not easily replicated. Building a comparable network would require immense capital expenditure and significant time to gain regulatory approvals and market access, effectively deterring many potential new competitors.

Government Support and Policy Alignment

Beijing Enterprises Holdings (BEHL), as a key provider of essential urban infrastructure in China, benefits significantly from government support and alignment with national policies. This backing creates a substantial barrier for potential new entrants, particularly foreign or independent companies, who struggle to gain the same level of regulatory favor or access to resources. For instance, China's 14th Five-Year Plan (2021-2025) emphasizes sustainable urban development and energy security, sectors where BEHL is heavily invested, suggesting continued policy support.

The strategic importance of BEHL's operations, such as water supply and gas distribution, means the government is unlikely to allow new, unproven entities to easily disrupt these critical services. This inherent protection, coupled with the capital-intensive nature of infrastructure development, further deters new entrants. In 2023, China continued its focus on infrastructure investment, with significant allocations towards water conservancy and environmental protection projects, areas directly relevant to BEHL's business lines.

- Government backing provides preferential access to permits and licenses.

- Alignment with national development plans offers a competitive edge.

- High capital requirements for infrastructure projects deter new players.

- Strategic importance of urban services limits disruptive competition.

Brand Recognition and Market Access in Brewery Segment

While the threat of new entrants in the brewery segment is not as high as in utilities, it still presents significant challenges for newcomers. Established brands, such as Yanjing Brewery, benefit from strong brand recognition built over years of operation. This recognition translates into consumer loyalty and a preference for familiar products.

Gaining market access is another substantial hurdle. Existing breweries possess extensive distribution networks, ensuring their products are readily available in retail outlets across various regions. New entrants would require considerable investment in marketing and sales to build comparable distribution channels and secure shelf space against entrenched competitors.

Furthermore, deep-seated relationships with retailers and a nuanced understanding of consumer preferences are critical for success. New breweries must not only offer a quality product but also develop effective strategies to penetrate these established networks and capture consumer attention. For instance, in 2023, the Chinese beer market saw a volume of over 45 million kiloliters, with major players like Yanjing holding significant market share, indicating the scale of competition.

- Brand Loyalty: Established brands like Yanjing Brewery have cultivated strong consumer loyalty.

- Distribution Networks: Existing players command extensive and efficient distribution channels.

- Marketing Investment: New entrants need substantial capital for marketing to build brand awareness.

- Retailer Relationships: Access to retail space is often secured through long-standing partnerships.

The threat of new entrants for Beijing Enterprises Holdings' core utility businesses, such as gas and water distribution, is significantly low. This is largely due to the immense capital required for infrastructure development, stringent regulatory hurdles, and the necessity of obtaining government concessions. For example, the sheer scale of investment needed for pipeline networks means only well-capitalized entities can even consider entry.

Furthermore, established players like BEHL benefit from existing distribution networks and strong relationships with local governments, which are difficult for newcomers to replicate. The strategic importance of these services also means governments are cautious about allowing new, unproven companies to enter. In 2023, China continued its focus on infrastructure development, reinforcing the advantage of incumbents.

| Barrier | Description | Impact on New Entrants |

| Capital Requirements | Massive upfront investment for infrastructure (pipelines, treatment plants). | Very High Deterrent |

| Regulatory Framework | Complex permits, licenses, and strict environmental/safety standards. | High Deterrent |

| Government Concessions | Exclusive operating rights awarded through lengthy processes. | High Deterrent |

| Economies of Scale | Lower per-unit costs for established, large-scale operations. | High Deterrent |

| Distribution Networks | Extensive, established infrastructure and customer reach. | Very High Deterrent |

| Government Support | Alignment with national policies and preferential treatment. | High Deterrent |

Porter's Five Forces Analysis Data Sources

Our analysis of Beijing Enterprises Holdings' competitive landscape is built upon a foundation of publicly available financial statements, annual reports, and investor presentations. We also incorporate data from reputable industry research firms and market intelligence platforms to capture current market trends and competitor activities.