Beijing Enterprises Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beijing Enterprises Holdings Bundle

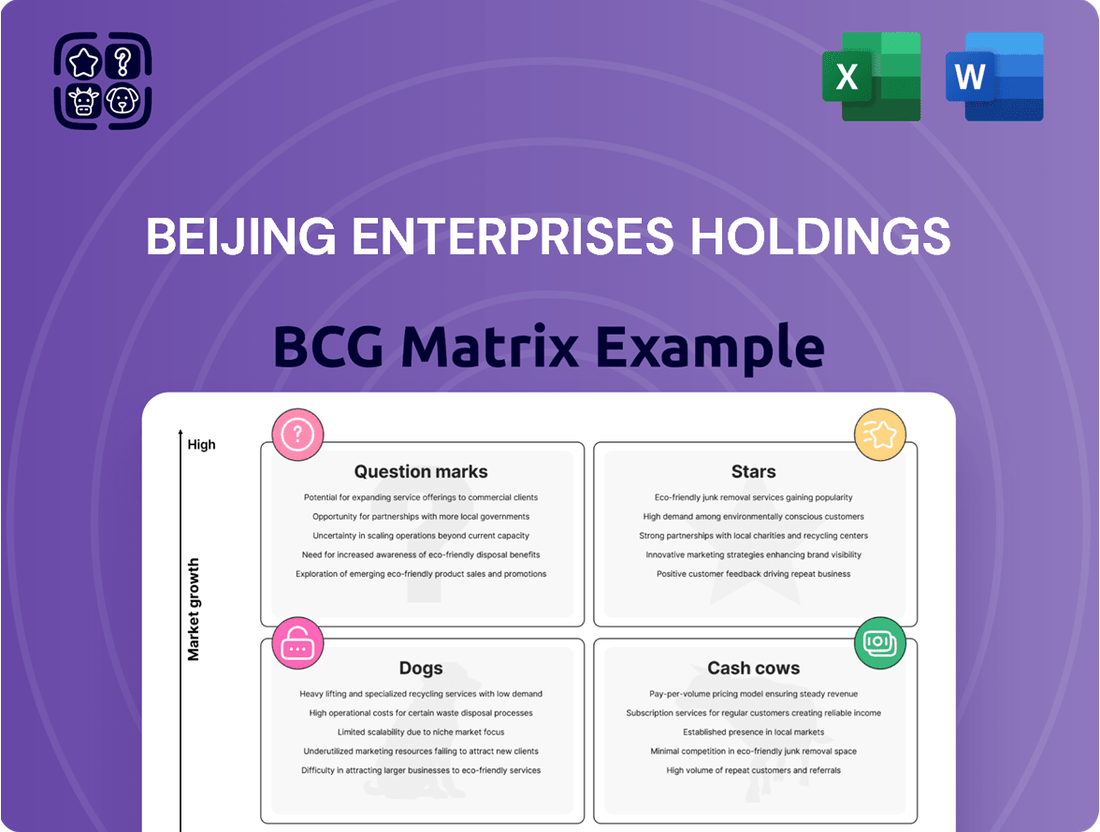

Curious about Beijing Enterprises Holdings' strategic positioning? Our BCG Matrix preview reveals their current market landscape, hinting at their Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full picture; purchase the complete BCG Matrix for actionable insights and a clear roadmap to optimize their portfolio.

Stars

Beijing Enterprises Holdings' (BEHL) waste-to-energy operations in Europe, primarily through its subsidiary EEW Energy from Waste GmbH (EEW GmbH) in Germany, represent a strong performer. EEW GmbH holds the leading market share in Germany's waste-to-energy sector, a mature but essential environmental service.

In 2024, EEW GmbH demonstrated robust growth, treating 4.876 million tons of waste, a 5.8% increase from the previous year, and generating 4.77 billion kWh in energy sales. This consistent expansion in a developed market solidifies its position as a star product within BEHL's portfolio.

Beijing Enterprises Holdings' domestic solid waste treatment (waste-to-energy) segment, primarily driven by Beijing Enterprises Environment Group Limited and Beijing Enterprises Holdings Environment Technology Co., Ltd., demonstrated robust performance in 2024. The segment's domestic treatment volume saw a healthy increase of 4.4% year-on-year, reaching 7.353 million tons. This growth, coupled with a 2.6% rise in on-grid power generation to 2,280 GWH, highlights the segment's expanding operational capacity and market penetration.

The operationalization of new facilities, such as those in Beihai and Zhangjiagang, has significantly contributed to this expansion. This segment is strategically positioned within a dynamic market characterized by China's increasingly stringent environmental regulations and ongoing urbanization trends. These factors create a favorable environment for waste-to-energy solutions, solidifying the segment's status as a star performer within the BCG matrix.

Beijing Gas, a cornerstone of Beijing Enterprises Holdings (BEHL), stands as a dominant force in city gas distribution. In the first half of 2024, it expanded its reach by adding around 54,000 new household customers and 1,726 public sector clients within Beijing, showcasing robust market penetration. The company also processed over 1 million tons of LNG at its Tianjin Nangang facility, underscoring its operational scale and market leadership. Supported by favorable government policies in 2024 aimed at revitalizing the gas sector, Beijing Gas is well-positioned for continued expansion.

Water Services (BE Water Group)

Beijing Enterprises Water Group Limited (BE Water) stands out as a leader in China's water sector, holding its top position for an impressive 14 consecutive years.

As of June 30, 2024, the company's extensive network included 1,457 water plants with a combined design capacity of 44 million tons per day, underscoring its significant market presence.

Despite a modest dip in revenue and profit in early 2024, the future outlook for China's water and wastewater treatment market is robust, with an anticipated 6.7% compound annual growth rate from 2025 to 2031, driven by urbanization and government initiatives.

This combination of sustained market dominance and a favorable growth trajectory firmly places BE Water in the Star category of the BCG Matrix.

- Market Leadership: Maintained top position in China's water industry for 14 consecutive years.

- Operational Scale: Participated in 1,457 water plants with 44 million tons/day design capacity as of June 30, 2024.

- Market Growth Potential: China's water and wastewater treatment market projected to grow at a CAGR of 6.7% (2025-2031).

- Growth Drivers: Urban population expansion and government investments fuel market growth.

Premium Beer Segment (Yanjing Brewery)

The premium beer segment, represented by Yanjing Brewery within Beijing Enterprises Holdings Limited (BEHL), shines as a star in the BCG matrix. Despite a general volume decline in China's beer market, consumers are increasingly opting for premium products. Yanjing Brewery's performance underscores this trend, achieving a record net profit surpassing RMB1 billion in 2024, fueled by consistent double-digit growth.

This robust growth in the premium segment, even amidst broader market headwinds, highlights Yanjing Brewery's strategic positioning. The company's ongoing efforts to strengthen its distribution channels and adapt to changing consumer tastes are key drivers of its star status.

- Market Trend: Growing consumer preference for premiumization in China's beer market.

- Yanjing Brewery Performance: Achieved record net profit exceeding RMB1 billion in 2024.

- Growth Driver: Continuous double-digit growth within the premium beer segment.

- Strategic Advantage: Enhanced distribution networks and adaptability to evolving consumer preferences.

Beijing Enterprises Holdings' (BEHL) waste-to-energy operations in Europe, primarily through its subsidiary EEW Energy from Waste GmbH (EEW GmbH) in Germany, represent a strong performer. EEW GmbH holds the leading market share in Germany's waste-to-energy sector, a mature but essential environmental service. In 2024, EEW GmbH demonstrated robust growth, treating 4.876 million tons of waste, a 5.8% increase from the previous year, and generating 4.77 billion kWh in energy sales. This consistent expansion in a developed market solidifies its position as a star product within BEHL's portfolio.

Beijing Enterprises Holdings' domestic solid waste treatment (waste-to-energy) segment, primarily driven by Beijing Enterprises Environment Group Limited and Beijing Enterprises Holdings Environment Technology Co., Ltd., demonstrated robust performance in 2024. The segment's domestic treatment volume saw a healthy increase of 4.4% year-on-year, reaching 7.353 million tons. This growth, coupled with a 2.6% rise in on-grid power generation to 2,280 GWH, highlights the segment's expanding operational capacity and market penetration. The operationalization of new facilities, such as those in Beihai and Zhangjiagang, has significantly contributed to this expansion, solidifying the segment's status as a star performer.

Beijing Gas, a cornerstone of Beijing Enterprises Holdings (BEHL), stands as a dominant force in city gas distribution. In the first half of 2024, it expanded its reach by adding around 54,000 new household customers and 1,726 public sector clients within Beijing, showcasing robust market penetration. The company also processed over 1 million tons of LNG at its Tianjin Nangang facility, underscoring its operational scale and market leadership. Supported by favorable government policies in 2024 aimed at revitalizing the gas sector, Beijing Gas is well-positioned for continued expansion.

Beijing Enterprises Water Group Limited (BE Water) stands out as a leader in China's water sector, holding its top position for an impressive 14 consecutive years. As of June 30, 2024, the company's extensive network included 1,457 water plants with a combined design capacity of 44 million tons per day, underscoring its significant market presence. Despite a modest dip in revenue and profit in early 2024, the future outlook for China's water and wastewater treatment market is robust, with an anticipated 6.7% compound annual growth rate from 2025 to 2031, driven by urbanization and government initiatives. This combination of sustained market dominance and a favorable growth trajectory firmly places BE Water in the Star category of the BCG Matrix.

The premium beer segment, represented by Yanjing Brewery within Beijing Enterprises Holdings Limited (BEHL), shines as a star in the BCG matrix. Despite a general volume decline in China's beer market, consumers are increasingly opting for premium products. Yanjing Brewery's performance underscores this trend, achieving a record net profit surpassing RMB1 billion in 2024, fueled by consistent double-digit growth. This robust growth in the premium segment, even amidst broader market headwinds, highlights Yanjing Brewery's strategic positioning.

| BEHL Segment | 2024 Performance Highlights | Market Position | BCG Category |

| EEW Energy from Waste (Europe) | Treated 4.876 million tons of waste (+5.8% YoY); Generated 4.77 billion kWh energy sales. | Leading market share in Germany. | Star |

| Domestic Solid Waste Treatment (China) | Treated 7.353 million tons (+4.4% YoY); On-grid power generation 2,280 GWH (+2.6% YoY). | Expanding operational capacity and market penetration. | Star |

| Beijing Gas | Added ~54,000 new household customers; processed over 1 million tons of LNG. | Dominant force in city gas distribution. | Star |

| Beijing Enterprises Water Group (BE Water) | 14 consecutive years as China's water sector leader; 1,457 water plants (44 million tons/day capacity). | Top position in China's water industry. | Star |

| Yanjing Brewery (Premium Beer) | Record net profit > RMB1 billion; double-digit growth in premium segment. | Strong performance driven by premiumization trend. | Star |

What is included in the product

Beijing Enterprises Holdings' BCG Matrix offers a tailored analysis of its product portfolio, highlighting which units to invest in, hold, or divest.

A clear BCG Matrix visually identifies underperforming units, relieving the pain of resource misallocation.

Cash Cows

Beijing Enterprises Holdings' city gas distribution in Beijing is a classic Cash Cow. This segment, primarily operated by Beijing Gas, benefits from a dominant market position in a mature sector. Despite a slight revenue dip of 2.9% in the first half of 2024, the business consistently delivers strong profits before tax, underscoring its stability.

The established infrastructure and essential nature of gas distribution mean lower reinvestment needs for growth or promotion. This allows the Beijing city gas operations to be a reliable source of substantial cash flow for the broader group, supporting other ventures.

Beijing Enterprises Holdings' water distribution services, primarily through BE Water, are firmly positioned as a cash cow within its BCG Matrix. This segment operates in a mature market where demand for piped water is consistently high, reflecting its essential nature and stable customer base.

Despite a slight revenue dip in the first half of 2024, BE Water's robust infrastructure, boasting a vast network of water plants, and its unwavering commitment to high water quality compliance, ensure a predictable and substantial cash flow. This stability is a hallmark of a cash cow, providing reliable financial contributions.

The strategic emphasis on operational efficiency and prudent asset management further solidifies BE Water's cash cow status. These efforts translate into sustained profitability and consistent cash generation, underpinning Beijing Enterprises Holdings' overall financial resilience and capacity for investment in other strategic areas.

Beijing Enterprises Holdings Limited's (BEHL) existing domestic solid waste treatment facilities, primarily focused on incineration and power generation, are firmly positioned as Cash Cows within its BCG Matrix. These operations are characterized by their maturity and established revenue generation, benefiting from consistent waste volumes and reliable on-grid power sales, which translate into predictable and stable cash flows.

In 2023, BEHL reported that its waste-to-energy segment contributed significantly to its overall performance. For instance, the company's waste processing capacity reached approximately 26,000 tons per day across its various facilities. This consistent operational output underscores the stable nature of these assets, providing a dependable source of income.

Traditional Beer Products (Yanjing Brewery)

Yanjing Brewery's traditional beer products are firmly positioned as cash cows within Beijing Enterprises Holdings' BCG matrix. These offerings dominate a mature segment of the Chinese beer market, leveraging strong brand loyalty and extensive distribution networks to generate consistent, high-volume sales. Despite a slower growth trajectory compared to premium segments, their reliable revenue stream is a cornerstone of the company's financial stability.

The profitability of these cash cow products is further bolstered by Yanjing Brewery's ongoing commitment to operational efficiency and cost management in its production facilities. For instance, in 2023, the company reported a notable increase in its gross profit margin, partly attributable to streamlined manufacturing processes.

- Market Share: Traditional Yanjing beer products likely maintain a significant share in China's mass-market beer segment.

- Revenue Generation: These products provide a substantial and stable revenue base, despite slower market growth.

- Profitability: Focus on cost reduction and operational efficiency enhances the cash-generating capability of these established brands.

- Financial Contribution: In 2023, Beijing Enterprises Holdings saw overall revenue growth, with the beer segment playing a key role, indicating the continued strength of its traditional offerings.

Natural Gas Transmission Business

Beijing Enterprises Holdings' natural gas transmission business is a classic cash cow. It operates within a mature market characterized by low growth but enjoys a significant market share due to its extensive infrastructure. This segment is a consistent profit generator, offering stable and predictable cash flows to the Group.

The operational focus here is on maintaining efficiency rather than aggressive expansion or promotion, which is typical for a cash cow. For instance, in 2023, Beijing Enterprises Holdings reported that its gas utility segment, which includes transmission, contributed significantly to its overall revenue.

- High Market Share: Operates in a mature, low-growth market with established infrastructure.

- Consistent Profitability: Provides reliable and predictable cash flows.

- Low Investment Needs: Requires minimal promotional spending, focusing on operational efficiency.

- 2023 Performance: The gas utility segment showed robust performance, underscoring its cash-generating capabilities.

Beijing Enterprises Holdings' city gas distribution, water distribution, and natural gas transmission all operate as strong cash cows. These segments benefit from established infrastructure and essential service demand, leading to stable revenue streams and consistent profitability. For example, in the first half of 2024, while revenue saw slight dips, these core utility businesses continued to generate substantial profits before tax, demonstrating their reliable cash-generating capacity.

| Segment | BCG Status | Key Characteristics | 2023/H1 2024 Data Point |

| City Gas Distribution (Beijing Gas) | Cash Cow | Dominant market position, essential service, mature sector | H1 2024 revenue dip of 2.9%, but strong pre-tax profits |

| Water Distribution (BE Water) | Cash Cow | Mature market, high demand, extensive infrastructure | Consistent cash flow generation despite slight H1 2024 revenue dip |

| Natural Gas Transmission | Cash Cow | Significant market share, mature market, low growth | Gas utility segment contributed significantly to overall revenue in 2023 |

Delivered as Shown

Beijing Enterprises Holdings BCG Matrix

The Beijing Enterprises Holdings BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks or placeholder content, ensuring you get a complete, professional analysis ready for strategic decision-making. The insights and structure presented here are precisely what you'll utilize for your business planning and competitive strategy. You can confidently use this preview as a direct representation of the valuable, unedited document that will be yours to download and implement.

Dogs

Within Beijing Enterprises Holdings' (BEHL) portfolio, underperforming domestic water treatment plants, particularly those experiencing a net decrease in design capacity, can be categorized as Dogs in the BCG Matrix. In 2024, BEHL's water segment saw a significant reduction of 228,026 tons per day in design capacity, a clear indicator of asset rationalization or project expiry.

These divested or underperforming assets likely operated in mature or declining local markets with low market share, fitting the profile of Dogs. Such assets typically require substantial cash to maintain operations or generate minimal returns, making their exit a strategic move to reallocate resources to more promising ventures.

Within Beijing Enterprises Holdings' portfolio, certain low-margin, volume-driven beer segments, particularly those historically strong in western China, are showing signs of weakness. Despite the overall market trend towards premiumization, Yanjing Brewery's performance in these traditional areas suggests these segments are facing challenges.

If these specific mainstream beer offerings possess both a low market share and operate within stagnant or declining segments of the broader Chinese beer market, they would be categorized as dogs in the BCG Matrix. These products are characterized by meager profit margins and contribute little to the company's overall expansion, with 2024 data indicating a continued, albeit slow, contraction in demand for these older, less premium offerings in these specific regions.

Outdated solid waste treatment technologies, failing to adapt to advancements and sustainability mandates, likely fall into the 'dog' category for Beijing Enterprises Holdings. These facilities, characterized by lower efficiency and higher operational costs, struggle to maintain a competitive edge in a market increasingly focused on modern, eco-friendly solutions.

In 2024, the global waste management market is experiencing significant growth, with a strong emphasis on technological innovation. Companies clinging to older methods may find themselves with a shrinking market share and declining profitability, especially as regulatory pressures for cleaner waste processing intensify. For instance, while advanced waste-to-energy plants are seeing increased investment, older incineration methods without modern emission controls are becoming liabilities.

Non-Core, Legacy Investments with Low Returns

Beijing Enterprises Holdings, a vast conglomerate, likely holds certain legacy investments that no longer align with its strategic growth objectives. These non-core assets often operate in mature or declining markets, exhibiting low market share and minimal growth potential. Such holdings can become drains on resources, fitting the profile of 'dogs' in the BCG Matrix, as they consume capital without generating substantial returns.

These 'cash traps' require careful management to avoid hindering the performance of more promising business units. For instance, if a segment of their legacy utilities business, perhaps an older, less efficient power generation plant, is experiencing declining demand and facing increasing regulatory costs, it would fit this category. Such an asset might have generated steady cash flow historically but now presents limited upside and significant operational challenges.

In 2023, Beijing Enterprises Holdings reported a significant portion of its revenue still coming from its traditional businesses, but it also highlighted strategic divestments of non-core assets. While specific figures for individual 'dog' assets are not publicly detailed, the company's overall strategy indicates a move towards optimizing its portfolio. For example, the divestment of a minor stake in a non-strategic manufacturing subsidiary in late 2023 freed up capital that could be reinvested in higher-growth areas.

- Low Market Share: These investments typically hold a small percentage of their respective market.

- Limited Growth Prospects: The industries these assets operate in are often mature or declining, offering little room for expansion.

- Capital Drain: They consume resources without generating significant profits or strategic value.

- Portfolio Drag: Their presence can detract from the overall performance and strategic focus of the company.

Segments Impacted by Regional Economic Slowdowns

Specific regional operations within Beijing Enterprises Holdings' diversified portfolio could be categorized as dogs if they are significantly impacted by localized economic slowdowns. For instance, if a particular mainland Chinese province experiences a sharp decline in manufacturing output, affecting Beijing Enterprises' related subsidiaries, this segment might show weak growth.

Consider a scenario where Beijing Enterprises Holdings has a substantial investment in a water treatment facility in a region facing prolonged drought and industrial decline. If this region's economic growth rate dips considerably, say below 2% annually, and the company's market share in that specific water treatment segment remains low, perhaps under 5%, it would likely be classified as a dog.

- Regional Operations Facing Economic Headwinds: Segments heavily reliant on regions experiencing significant economic downturns, such as those impacted by reduced consumer spending or industrial contraction.

- Low Market Share in Stagnant Markets: Operations in markets with minimal growth prospects where Beijing Enterprises Holdings holds a negligible market share, making turnaround efforts less viable.

- Impact of Policy Shifts: Business units affected by adverse changes in local government policies or regulations that stifle growth and profitability in specific geographic areas.

Within Beijing Enterprises Holdings' portfolio, certain underperforming segments, such as older water treatment plants with declining capacity or low-margin beer operations in mature regions, fit the 'dog' category. These assets typically have low market share and limited growth prospects, often consuming capital without generating substantial returns. For example, a reduction in design capacity for specific water treatment facilities in 2024 highlights potential 'dog' assets undergoing rationalization.

| BCG Category | Characteristics | BEHL Segment Examples | 2024 Data/Context |

|---|---|---|---|

| Dogs | Low market share, low growth potential, cash traps | Underperforming water treatment plants, mature regional beer segments, outdated solid waste tech | 228,026 tons/day design capacity reduction in water segment; slow contraction in demand for older beer offerings in specific western China regions. |

Question Marks

Beijing Enterprises Holdings Limited (BEHL) is actively pursuing new environmental technology ventures, aligning with its strong commitment to innovation and green development. This focus is underscored by its recent ESG rating upgrade, reflecting its proactive approach to sustainability and its alignment with China's national climate change strategies. For instance, BEHL's investments in areas like advanced water recycling and novel energy recovery from waste position it to capitalize on growing environmental concerns.

These new ventures, such as specialized hazardous waste treatment solutions, represent high-growth potential opportunities. While currently holding a low market share, their development is crucial for BEHL's long-term strategy. In 2024, the global environmental technology market was projected to reach over $1.5 trillion, with significant growth anticipated in water treatment and waste-to-energy sectors, indicating a fertile ground for BEHL's expansion.

Successfully establishing these ventures will necessitate substantial investment to achieve market traction and transition them into future 'stars' within BEHL's portfolio. The capital expenditure required for research, development, and scaling up these advanced technologies is considerable, but the potential for significant returns as environmental regulations tighten and demand for sustainable solutions increases is substantial.

Beijing Enterprises Holdings Limited (BEHL) might be exploring new domestic gas and water markets within China, areas that are less developed but show significant growth potential. These ventures would likely represent question marks in their BCG matrix, as they require substantial initial investment to build infrastructure and gain market traction. For instance, BEHL's focus on expanding its natural gas pipeline network into less urbanized provinces could be seen as a question mark, aiming to capture future demand.

The company's strategy in these emerging regions would involve significant capital expenditure to establish a foothold, aiming for future profitability by increasing market share. By 2024, China's overall investment in gas infrastructure was projected to continue growing, reflecting the demand for cleaner energy sources, which BEHL aims to capitalize on.

The craft beer and specialty brew market in China is experiencing a significant upswing, presenting a high-growth opportunity even though it currently represents a modest portion of the total beer consumption. For Yanjing Brewery, aggressive expansion into this segment with new product lines positions these offerings as question marks within the BCG matrix. They possess considerable growth potential but are starting with a low market share.

Capturing a meaningful share of this developing market necessitates considerable investment in marketing and distribution infrastructure. For instance, by late 2024, the overall Chinese beer market was valued at over $70 billion, with craft beer estimated to be growing at a compound annual growth rate (CAGR) exceeding 15%, significantly outpacing the mainstream market's growth.

Digitalization and Smart Infrastructure Solutions

Beijing Enterprises Holdings (BEHL) is actively pursuing digitalization and smart infrastructure solutions, particularly in water management. This strategic push aligns with China's broader urbanization trends and the increasing demand for efficient urban services. These emerging digital technologies represent a high-growth potential market, though BEHL's current market share in these relatively new areas may be limited, positioning them as potential stars in the BCG matrix. For instance, the smart water market in China was projected to reach approximately $5.5 billion by 2025, indicating substantial growth opportunities.

- Smart Water Management: BEHL's investment in IoT sensors and data analytics for water networks aims to reduce leakage and improve operational efficiency, a key driver in China's water sector.

- Digital Waste Systems: The company is exploring smart waste collection and recycling technologies, responding to environmental concerns and the need for optimized urban sanitation.

- Urban Service Enhancement: These digital solutions are designed to enhance the overall quality and responsiveness of urban services, a critical focus for Chinese municipalities.

- Investment Requirement: Significant capital expenditure is anticipated to develop and scale these digital capabilities, reflecting the high investment needs typical of nascent technologies.

International Expansion in Environmental Business beyond Europe

Beijing Enterprises Holdings Limited (BEHL) faces a classic BCG Matrix scenario with its environmental business, particularly when considering expansion beyond its successful European base, notably through EEW GmbH. Venturing into new international markets outside of Europe represents a significant "question mark" for BEHL's environmental segment.

These new geographical markets are often characterized by their growth potential, but BEHL would likely enter them with a relatively low market share initially. This requires substantial investment in capital and strategic planning to build a competitive foothold. For instance, emerging markets in Asia or Africa, while showing increasing environmental awareness and regulatory push, are often fragmented and dominated by local players or established global competitors.

Consider the global environmental services market, projected to reach over $2.5 trillion by 2025, with significant growth anticipated in regions beyond Europe. However, BEHL's penetration in these new territories would start from a low base, demanding considerable resources. For example, entering the waste management sector in Southeast Asia might involve navigating complex regulatory landscapes and establishing new infrastructure, a stark contrast to the more mature European market where EEW GmbH operates.

- New Market Entry Costs: Significant capital expenditure is needed for infrastructure development and market penetration in new regions.

- Low Initial Market Share: BEHL would start with a small percentage of the market in these expansion territories.

- Competitive Landscape: Emerging markets may have entrenched local competitors or other international players already established.

- Strategic Investment Required: Success hinges on tailored strategies for each new market, including partnerships and localized operations.

Question marks in BEHL's BCG matrix represent ventures with high growth potential but low current market share. These are often new initiatives requiring significant investment to gain traction. For example, BEHL's expansion into less urbanized domestic gas and water markets, or its development of smart water management systems, fit this category. These areas are poised for growth, but require substantial capital expenditure to build infrastructure and capture market share, aiming to become future stars.

| Venture Area | Market Growth | BEHL Market Share | Investment Need | BCG Category |

| New Domestic Gas/Water Markets | High | Low | High | Question Mark |

| Smart Water Management | High | Low | High | Question Mark |

| Craft Beer Expansion (Yanjing) | High | Low | High | Question Mark |

| New International Environmental Markets | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our Beijing Enterprises Holdings BCG Matrix leverages official company filings, robust market research, and industry growth forecasts to provide a clear strategic overview.